Professional Documents

Culture Documents

AT-01 (Practice and Regulation of The Profession)

AT-01 (Practice and Regulation of The Profession)

Uploaded by

Soremn Potatohead0 ratings0% found this document useful (0 votes)

24 views7 pages1. The document discusses the practice and regulation of the accounting profession in the Philippines based on the Philippine Accountancy Act of 2004 (RA 9298) and its implementing rules and regulations (IRR).

2. It covers the objectives of RA 9298 which are the standardization and regulation of accounting education, the examination for registration of certified public accountants, and the supervision, control, and regulation of the practice of accountancy.

3. It also discusses the Professional Regulatory Board of Accountancy (PRBOA), qualifications for the CPA licensure exam, scope of practice, continuing professional development requirements, and other organizations related to the accounting profession.

Original Description:

Original Title

AT-01 (Practice and Regulation of the Profession)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document discusses the practice and regulation of the accounting profession in the Philippines based on the Philippine Accountancy Act of 2004 (RA 9298) and its implementing rules and regulations (IRR).

2. It covers the objectives of RA 9298 which are the standardization and regulation of accounting education, the examination for registration of certified public accountants, and the supervision, control, and regulation of the practice of accountancy.

3. It also discusses the Professional Regulatory Board of Accountancy (PRBOA), qualifications for the CPA licensure exam, scope of practice, continuing professional development requirements, and other organizations related to the accounting profession.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

24 views7 pagesAT-01 (Practice and Regulation of The Profession)

AT-01 (Practice and Regulation of The Profession)

Uploaded by

Soremn Potatohead1. The document discusses the practice and regulation of the accounting profession in the Philippines based on the Philippine Accountancy Act of 2004 (RA 9298) and its implementing rules and regulations (IRR).

2. It covers the objectives of RA 9298 which are the standardization and regulation of accounting education, the examination for registration of certified public accountants, and the supervision, control, and regulation of the practice of accountancy.

3. It also discusses the Professional Regulatory Board of Accountancy (PRBOA), qualifications for the CPA licensure exam, scope of practice, continuing professional development requirements, and other organizations related to the accounting profession.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

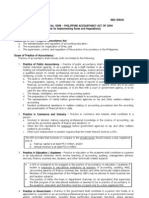

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 46 October 2023 CPA Licensure Examination AT- 01

AUDITING (Auditing Theory) J. IRENEO E. ARAÑAS F. TUGAS C. ALLAUIGAN

PRACTICE AND REGULATION OF THE PROFESSION

PRBOA Resolution No. 16 Series of 2021 “Resolution to Make an Official Representation with the

Office of the President of the Philippines for the Signing of a Presidential Proclamation Declaring the

Period March 17, 2022 to March 17, 2023 as the Centenary Year of the Accountancy Profession and

the Board of Accountancy and the Adoption of the Centennial Logo and Theme for Its Year-long

Anniversary Celebration”

The Philippine Accountancy Act of 2004 (RA 9298)

Objective 1: the standardization and regulation of accounting education

▪ The creation of Education Technical Council (Section 9 [B] of the IRR of RA 9298)

▪ The Philippine Institute of Certified Public Accountants (PICPA) as member of the International

Federation of Accountants (IFAC) is expected to comply with the Statement of Membership

Obligations (SMOs).

▪ One of the regulators is the Commission on Higher Education (CHED)

Objective 2: the examination for registration of certified public accountants

▪ The Professional Regulatory Board of Accountancy (PRBOA)

o Composition of PRBOA

o Qualifications of Members of the Professional Regulatory Board

✓ Must be a natural-born citizen and a resident of the Philippines

✓ Must be a duly registered Certified Public Accountant with a least ten (10) years

of work experience in any scope of practice of accountancy

✓ Must be of good moral character and must not have been convicted of crimes

involving moral turpitude

✓ Must not have any pecuniary interest, directly or indirectly, in any school,

college, university or institution conferring an academic degree necessary for

admission to the practice of accountancy or where review classes in preparation

for the licensure examination are being offered or conducted, nor shall he/she

be a member of the faculty or administration thereof at the time of his/her

appointment to the Board

✓ Must not be a Director or Officer of the AIPO (or PICPA) at the time of

appointment

o Powers and Functions of the Board

o Grounds for Suspension or Removal of Members of the Board

▪ Qualifications of Applicants of Examinations

✓ is a Filipino citizen

✓ is of good moral character

✓ is a holder of the degree of Bachelor of Science in Accountancy conferred by a

school, college, academy or institute duly recognized and/or accredited by the

CHED or other authorized government offices

✓ has not been convicted of any criminal offense involving moral turpitude

▪ Scope of Examination

▪ Rating in the Licensure Examination

▪ Failing Candidates to Take Refresher Course

▪ Oath, Issuance of Certificates of Registration, and Professional Identification Card

Objective 3: the supervision, control, and regulation of the practice of accountancy in the Philippines

▪ The entire Rule IV (Practice of Accountancy) of the IRR of RA 9298

▪ The entire Rule V (Penal and Final Provisions) of the IRR of RA 9298

▪ All the annexes of the IRR of RA 9298

▪ Practice sectors are public practice, commerce and industry, government, and

academe/education.

▪ The creation of Auditing and Assurance Standard Council (AASC), Financial Reporting and

Standards Council (FRSC), Quality Review Committee (QRC), and CPE Council

Scope of Practice

Organizations (Regulatory, Government, and Professional) Related to the Profession

RA 10912: Continuing Professional Development Act of 2016

▪ International Education Standard (IES) 7

▪ PRC and PRBOA resolutions and issuances

Managing Public Accounting Practice and Other Considerations

▪ PRBOA accreditation

▪ Audit fees and billing

Page 1 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

1. Which of the following statements regarding PRBOA Resolution No. 16 Series of 2021 is/are

CORRECT?

A. November 17, 2023 will mark the 100th anniversary of the establishment of the

accountancy profession in the Philippines and the creation of the Board of Accountancy.

B. The pre-centenary activities of the Centenary Year of the Accountancy Profession and the

Board of Accountancy were officially launched on November 17, 2021.

C. The centennial theme is “Celebrating the Past, Transforming the Present, and Shaping the

Future.”

D. All of the statements are correct.

2. Why should CPAs in the Philippines adhere to the SMOs of the International Federation of

Accountants (IFAC)?

A. because of globalization and ASEAN integration

B. because the Philippine Institute of Certified Public Accountants (PICPA) is a member-

professional organization of IFAC

C. because it is required by the Code of Ethics

D. because it is required by the CPD Act of 2016

3. Which of the following is/are included among the fundamental objectives of the Statement of

Membership Obligations (SMOs)?

A. to provide clear benchmarks to current IFAC member bodies only.

B. to support the adoption and implementation of international standards and other

pronouncements issued by the International Auditing and Assurance Standards Board

(IAASB), International Accounting Education Standards Board (IAESB), International

Ethics Standards Board for Accountants (IESBA), International Public Sector Accounting

Standards Board (IPSASB), and International Accounting Standards Board (IASB).

C. Both A and B

D. Neither A nor B

4. This SMO is issued by the IFAC Board and sets out requirements for IFAC member bodies with

respect to international standards issued by the International Accounting Education Standards

Board (IAESB), an independent standard-setting body supported by IFAC.

A. SMO 1 – Quality Assurance

B. SMO 2 – International Education Standards for Professional Accountants and Other

Pronouncements Issued by the IAESB

C. SMO 4 – IESBA Code of Ethics for Professional Accountants

D. SMO 6 – Investigation and Discipline

5. Emma Jean, a Filipino certified public accountant (CPA), is an accounting teacher in a higher

education institution in Davao City. She plans to become an ASEAN Chartered Professional

Accountant (ACPA). For this purpose, which of the following is/are among the requirements?

I. NBI clearance

II. Photocopies of CPD certificates of credit units earned

III. Certificate for ACPA Registration from nACPAE since she is a CPA in the education sector

IV. Registration Fee of ₱1,500

A. I only C. IV only

B. I, II, and IV only D. I, II, III and IV

6. The receipt and processing of ASEAN Chartered Professional Accountant (ACPA) applications is

under the jurisdiction of which PRC division?

A. Professional Regulatory Boards (PRBs) Secretariat Division.

B. Continuing Professional Development Division.

C. Professional Registry Division.

D. International Affairs Division.

7. Which of the following statements about the Philippine Accountancy Act of 2004 is LEAST LIKELY

CORRECT?

A. It shall provide for and govern the standardization and regulation of accounting education

and the examination for registration of certified public accountants.

B. It shall provide for and govern the supervision, control, and regulation of the practice of

Filipino professional accountants in the Philippines and abroad.

C. It is aligned with the policy of the State to recognize accountants in nation building and

development.

D. It aims to develop and nurture professional accountants whose standards of practice and

service shall be excellent, qualitative, world class, and globally competitive.

Page 2 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

8. A person is deemed to be in practice of the accounting profession in commerce and industry when

he/she:

A. Holds, or is appointed to a position in an accounting professional group in government or

in a government-owned and/or controlled corporation, where decision-making requires

professional knowledge in the science of accounting.

B. Is involved in decision-making requiring professional knowledge in the science of

accounting, as well as the accounting aspects of finance and taxation, or is employed in a

position that requires a CPA.

C. Is in an educational institution which involves teaching of accounting, auditing,

management advisory services, accounting aspect of finance, business law, taxation, and

other technically-related subjects.

D. Holds out himself/herself as one skilled in the knowledge, science and practice of

accounting, and as someone qualified to render professional services as a CPA.

9. According to the IRR of RA 9298, the following can teach business law:

CPAs Members of the IBP

A. Yes Yes

B. Yes No

C. No Yes

D. No No

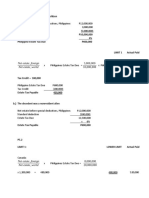

10. The following first-time candidates had these CPALE ratings:

Examinees CPALE Ratings

Subject Subject Subject Subject Subject Subject

1 2 3 4 5 6

Berlin 90 88 95 74 74 64

Manila 87 68 65 75 81 76

Nairobi 94 71 61 73 86 84

Rio 89 78 64 74 85 82

Tokyo 81 89 73 65 65 77

Statement 1: Only two candidates failed.

Statement 2: One candidate had to retake only one subject.

Statement 3: Two candidates would receive conditional credits.

Statement 4: Only two candidates passed.

A. Only one statement is correct. C. Only three statements are correct.

B. Only two statements are correct. D. All statements are correct.

11. Any candidate who fails in _____ complete CPA Board Examinations shall be disqualified from

taking another set of examinations unless he/she submits evidence to the satisfaction of the BOA

that he/she enrolled in and completed at least _____ of subjects given in the licensure

examination.

A. 3, 15 units per year for a total of 60 units C. 2, 15 units/year, total of 60 units

B. 2, 24 units D. 3, 24 units

12. Any candidate who fails in two (2) complete CPA Board Examinations shall be disqualified from

taking another set of examinations unless he/she submits certificate of completion of refresher

course to the satisfaction of the PRBOA that he/she enrolled in and completed at least twenty-four

(24) units of subjects given in the licensure examination. Such a certificate shall be valid for ___

years from the date of completion.

A. One C. Three

B. Two D. Four

13. The PRBOA, subject to the approval of the PRC, may revise or exclude any of the subjects and

their syllabi, and add new ones as the need arises, provided that the change shall not be more

often than:

A. Every two years. C. Every four years.

B. Every three years. D. Every five years.

14. Evaluate the following statements:

I. In a year, the Professional Regulatory Board of Accountancy (PRBOA) ordinarily administers

three (3) CPA licensure examinations in the Philippines.

II. As of the most recent update, a professional identification card has a validity of five (5)

years.

A. True, True C. False, True

B. True, False D. False, False

Page 3 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

15. A certificate under seal, bearing a registration number, issued to an individual, by the PRC, upon

recommendation by the Board of Accountancy, signifying that the individual has complied with all

the legal and procedural requirements for such issuance, including, in appropriate cases, having

successfully passed the CPA licensure examinations.

A. Certificate of registration. C. Certificate of identification.

B. Certificate of accreditation. D. Certificate of quality review.

16. The Continuing Professional Development (CPD) programs for accountancy shall have these

objectives:

A B C D

• To raise and maintain the professional’s capability for

delivering professional services Yes Yes No Yes

• To attain and maintain the minimum standards and

quality in the practice of the profession No Yes Yes No

• To make the profession financially rewarding Yes No Yes No

17. CPD competence areas include:

A. technical skills. C. professional values, ethics, and attitudes.

B. professional competence. D. All of the above.

18. With reference to membership to IFAC, aspiring professional accountants are required to complete

practical experience by the end of initial professional development as compliance to:

A. International Education Standard (IES) 3

B. International Education Standard (IES) 5

C. International Education Standard (IES) 6

D. International Education Standard (IES) 7

19. Per PRBOA Resolution 254 Series of 2017, which of the following statements is INCORRECT?

A. The following can be a CPD provider: sole proprietor, partnership, corporation, government

institutions, and foreign entities.

B. Members of PRBOA are disqualified to be a CPD provider during their incumbency.

C. Application for CPD program accreditation should be filed 60 days before the offering of

the program.

D. The CPD monitor should submit the monitoring report to PRC within 15 working days after

the conduct of the program.

20. With respect to the most recent IRR (PRC Resolution 1146 Series of 2019) for CPD Law, which of

the following statements is INCORRECT?

A. The new provisions would take effect by March 1, 2019.

B. It would refer to CPD Law of 2016.

C. 15 CPD credit units would be required for the renewal of the PRC ID.

D. 120 CPD credit units would be required for the accreditation of CPAs in government.

21. What is the minimum number of CPD credit units that a registered professional accountant in public

practice should accumulate for accreditation within the three-year period starting 2019?

A. 15 credit units C. 100 credit units

B. 45 credit units D. 120 credit units

22. Which of the following is NOT a ground for the suspension or revocation of certificate of registration

and professional identification card?

A. Possession of an unsound mind

B. Practice in more than one field of accountancy

C. Conviction of a criminal offense involving moral turpitude

D. Unprofessional or unethical conduct, malpractice, or violation of RA 9298.

23. The punishment, upon conviction, for any person who has violated any of the provisions of the

Accountancy Act of 2004, or any of its Implementing Rules and Regulations as promulgated by the

Board of Accountancy:

A. A fine of not less than fifty thousand pesos (₱50,000.00) and imprisonment for a period

not exceeding two (2) years.

B. A fine of not less than fifty thousand pesos (₱50,000.00) but not an imprisonment.

C. No fine but an imprisonment for a period not exceeding two (2) years.

D. A fine of not less than fifty thousand pesos (₱50,000.00) or imprisonment for a period not

exceeding two (2) years, or both.

Page 4 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

24. A CPA whose certificate has been revoked:

A. Is required to take the CPA Board Licensure examinations before reinstatement

B. May be reinstated by the PRBOA after the expiration of two (2) years from the date of

revocation

C. Can no longer be reinstated as a Certified Public Accountant

D. Has committed a crime involving moral turpitude

25. Evaluate the following statements:

I. A BSA graduate is NOT allowed to practice public accountancy under his or her own name

immediately upon passing the CPA Board Exams.

II. The certificate of accreditation for CPAs in education is granted only once and remains in

effect until withdrawn, suspended, or revoked in accordance with RA 9298.

A. True, True C. False, True

B. True, False D. False, False

26. Evaluate the following statements:

I. Single practitioners and partnerships for the practice of public accountancy shall be

registered certified public accountants in the Philippines.

II. A certificate of accreditation shall be issued to certified public accountants in public practice

only upon showing, that such registrant has acquired a minimum of three (3) years

meaningful experience in any of the areas of public practice including taxation.

A. True, True C. False, True

B. True, False D. False, False

27. Which of the following functions would usually be performed by a senior (experienced) associate?

A. Signs the audit report.

B. Performs detailed audit procedures.

C. Prepares the audit program and performs more complex audit procedures

D. Tasked with liaison work between partners and other team members

28. The amount of professional fees depend largely on the:

A. Size and capitalization of the company under audit.

B. Amount of profit for the year.

C. Availability of cash.

D. Volume of audit work and degree of competence and responsibilities involved.

29. Under this method of billing a client, billing is done on the basis of actual time spent by the staff

multiplied by the hourly rates agreed upon.

A. Per diem basis C. Flat or fixed fee basis

B. Retainer fee basis D. Maximum fee basis

30. Which of the following cannot be mentioned by an author in publicizing a book in accounting?

A. Name C. Membership in professional organization

B. Qualifications D. Services that the author’s firm provides

31. May a CPA give a brochure to a non-client?

A. No, because this is a violation of the revised rules on advertising

B. Yes, since this is acceptable under the revised rules on advertising

C. No, unless the non-client becomes a client within ten (10) days from receipt of the brochure

D. Yes, if the non-client has made an unsolicited request

32. Subjects or citizens of foreign countries:

A. May be allowed to practice accountancy in the Philippines, regardless of the provisions of

existing laws and international treaty obligations, including mutual recognition agreements

entered into by the Philippine government with other countries.

B. Are not allowed to practice accountancy in the Philippines, unless they take, and pass, the

certified public accountant licensure examination given by the Board of Accountancy

C. May be allowed to practice accountancy in the Philippines, subject to the provisions of

existing laws and international treaty obligations, including mutual recognition agreements

entered into by the Philippine government with other countries.

D. Are never allowed to practice accountancy in the Philippines because they will jeopardize

the interests of Filipino certified public accountants.

Page 5 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

33. RA 9298 provides that temporary or special permits may be issued to Foreign CPAs in the following

situations:

A. A foreign CPA was called for consultation which, in the judgment of the Board of

Accountancy, is essential for the development of the Philippines. The permit restricts the

foreign CPA’s practice to the particular consultation work being performed. No Filipino CPA

was qualified for such consultation.

B. A foreign CPA was engaged to lecture on fields essential to accountancy education in the

Philippines. The permit restricts the CPA to teaching only, and limited public practice

provided such practice is conducted outside class hours.

C. A foreign CPA, an IFRS expert, is engaged for services deemed essential for the

advancement of accountancy in the Philippines which can also be performed by Filipino

CPAs

D. All of the above situations do not justify the issuance of a temporary or special permit.

34. Violations of the IRR shall subject the CPA to fines and penalties as provided for in RA 9298,

including its IRR. Such violations include:

I. Engaging in public accounting practice without first registering with the PRBOA and the

SEC

II. Continuing to engage in the practice of public accountancy after the expiration of the

registration/accreditation

III. Continuing to engage in the practice of public accountancy after suspension, revocation

or withdrawal of registration

IV. Giving any false information, data, statistics, reports or other statement which tend to

mislead, obstruct, or obscure the registration of an Individual CPA, Firm or Partnership of

CPAs under the IRR.

V. Giving any misrepresentation to the effect that registration was secured in truth when in

fact, it was not secured

VI. Failure or refusal to undergo quality review

A. I, II, III, IV, V, and VI C. I, II, III, IV, and VI

B. I, II, III, IV, and V D. I, II, IV, V, and VI

35. Fill out the table below to summarize pointers on the PRBOA:

Composition 1 Chairman, 6 Members

Nominations 5 PICPA – 3 PRC – 1 President

One (1) complete term 3 Years

Maximum no. of years 12 years

Vice Chairman (term) 1 Year

Two (2) consecutive complete terms 1 Year Lapse

36. The following are qualifications of the members of the Board of Accountancy, EXCEPT:

A. Natural-born citizen and resident of the Philippines.

B. Duly registered CPA with at least five (5) years of work experience in any scope of practice

of accountancy.

C. Good moral character, not convicted of crimes involving moral turpitude.

D. No direct, or indirect pecuniary interest in any school, college, university or institution

conferring the B.S. Accountancy degree or providing CPA Review classes.

37. The following qualifications are common to members of the PRBOA and the applicants for CPALE,

EXCEPT:

A. good moral character. C. Both A and B.

B. natural-born Filipino citizen. D. Neither A nor B.

38. The Accredited Integrated Professional Organization (AIPO) shall submit its nominations for the

PRBOA, with complete documentation, to the Commission

A. Not later than sixty (60) days prior to the expiry of the term of an incumbent chairman or

member.

B. On the date of expiry of the term of an incumbent chairman or member.

C. After the 60th day from the expiry of the term of an incumbent chairman or member.

D. Upon request by the Commission for the submission of nominations.

39. The following are among the powers and functions of the PRBOA, EXCEPT:

A. To prescribe and/or adopt a Code of Ethics for the practice of accountancy

B. To ensure, in coordination with DepEd and CHED that all senior high schools and higher

education institutions offering accountancy-related programs and strand comply with

prescribed policies, standards and requirements

C. To conduct an oversight into the quality of audits of financial statements

D. None of the choices

Page 6 of 7 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

PRACTICE and REGULATION of the PROFESSION AT-01

40. The following are grounds for suspension or removal of members of the PRBOA, EXCEPT:

A. Neglect of duty or incompetence.

B. Violation or tolerance of any violation of RA 9298 and its IRR, or the Code of Ethics and

technical and professional standards of practice for CPAs.

C. Pending case on a crime involving moral turpitude.

D. Manipulation or rigging of the CPA licensure examination results.

41. According to the IRR of RA 9298, this group is tasked to assist the PRC in accepting, evaluating,

and approving applications for accreditation of CPE programs, activities or sources as to their

relevance to the profession and determine the number of CPE credit units to be earned on the

basis of the contents of the programs, activity or source submitted by the CPE providers.

A. PRC Quality Review Committee C. PRC CPE Council

B. PRC Education Technical Council D. PRC CPD Committee

42. The Quality Review Committee (QRC) shall have the following functions:

A. Conduct quality control review on applicants for registration to practice public accountancy

and render a report on such quality review

B. Revoke the certificate of registration and professional ID of an individual CPA, firm, or

partnership of CPAs who have not observed quality control measures.

C. Both A and B

D. Neither A nor B

43. Which of the following is not represented in both AASC and FRSC?

A. SEC C. PRBOA

B. BSP D. BIR

44. Evaluate the following statements:

I. The Philippine Institute of Certified Public Accountants is registered with the SEC as a stock

corporation and recognized by the PRBOA, subject to the approval by the PRC.

II. Membership in PICPA shall be a bar to membership in any other association of certified

public accountants.

A. True, True C. False, True

B. True, False D. False, False

45. Sectoral organizations have been established to promote the interests of groups of professional

accountants. Which of the following is the sectoral organization for CPAs employed under oil and

gas companies?

A. GACPA B. ACPAPP C. ACPACI D. nACPAE

46. The Securities Exchange Commission restrict accredited auditors from providing many non-audit

services to their audit clients. Which of the following is true for SEC-accredited auditors?

I. They are restricted from providing internal audit outsourcing services to audit clients.

II. There is no restriction on providing non-audit services to audit clients.

A. I only C. Both I and II

B. II only D. Neither I nor II

47. Which of the following is a CORRECT qualification of the Chairman and two Commissioners of COA?

A. A naturalized citizen of the Philippines

B. At least forty (40) years of age upon appointment

C. CPAs with no less than five (5) years of auditing experience or members of the Philippine

bar who have been engaged in law practice for at least five (5) years

D. Must not have been candidates for any elective position preceding appointment

48. Evaluate the following statements:

Statement 1: The mission of COA is to ensure accountability for public resources, promote

transparency, and help improve government operations, in partnership with

stakeholders, for the benefit of the Filipino people.

Statement 2: The Commission on Audit can conduct special audits on NGOs upon request by

proper authorities or as determined by the Chairman.

A. Only statement 1 is correct. C. Only statement 2 is correct.

B. Both statements are correct. D. Both statements are incorrect.

- END -

Page 7 of 7 0915-2303213 www.resacpareview.com

You might also like

- Assignment 8Document5 pagesAssignment 8Rakesh KumarNo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- Roque CPA Reviewer Auditing ch2 Final PDFDocument52 pagesRoque CPA Reviewer Auditing ch2 Final PDFSherene Faith Carampatan100% (3)

- Phil. Accountancy Act of 2004Document8 pagesPhil. Accountancy Act of 2004emc2_mcvNo ratings yet

- 80 Byte Population Guide - v15.94Document216 pages80 Byte Population Guide - v15.94HMNo ratings yet

- Quantitative Problems Chapter 3Document5 pagesQuantitative Problems Chapter 3Khadija ShabbirNo ratings yet

- How To Buy Good CC From Shop Like Feshop and UniccDocument24 pagesHow To Buy Good CC From Shop Like Feshop and UniccGlendaNo ratings yet

- At-04 (Practice and Regulation of The Profession)Document6 pagesAt-04 (Practice and Regulation of The Profession)Angela Laine HiponiaNo ratings yet

- 04 Practice & Regulation of The ProfessionDocument7 pages04 Practice & Regulation of The Professionrandomlungs121223No ratings yet

- PH Accountancy Act of 2004 (RA9298) - Code of EthicsDocument8 pagesPH Accountancy Act of 2004 (RA9298) - Code of EthicsHaks MashtiNo ratings yet

- P3 Professional-Practice-Of-AccountancyDocument38 pagesP3 Professional-Practice-Of-AccountancyMa. Elene MagdaraogNo ratings yet

- Poa 2Document3 pagesPoa 2batistillenieNo ratings yet

- Philippine Accountancy Act of 2004Document6 pagesPhilippine Accountancy Act of 2004jeromyNo ratings yet

- Public Accounting ProfessionDocument13 pagesPublic Accounting ProfessionAlex OngNo ratings yet

- Lesson 5Document27 pagesLesson 5Ramon AlpitcheNo ratings yet

- Practice Test 2 - Auditing Theory 2023Document57 pagesPractice Test 2 - Auditing Theory 2023April Rose Sobrevilla DimpoNo ratings yet

- 04 The Professional Practice of AccountingDocument10 pages04 The Professional Practice of AccountingJane DizonNo ratings yet

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- FARAP-4520Document7 pagesFARAP-4520Accounting StuffNo ratings yet

- Public and Professional AccountingDocument5 pagesPublic and Professional Accountingemc2_mcvNo ratings yet

- The Accountancy Profession and Its DevelopmentDocument23 pagesThe Accountancy Profession and Its DevelopmentCharish BonielNo ratings yet

- Public Accounting ProfessionDocument10 pagesPublic Accounting ProfessionJudilyn DealonNo ratings yet

- At Professional Responsibilities and Other Topics With AnswersDocument27 pagesAt Professional Responsibilities and Other Topics With AnswersShielle AzonNo ratings yet

- Repealed PD 692 Known As Revised Accountancy LawDocument8 pagesRepealed PD 692 Known As Revised Accountancy LawLian RamirezNo ratings yet

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocument10 pagesQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNo ratings yet

- 01 Practice and Regulation of The Accountancy ProfessionDocument18 pages01 Practice and Regulation of The Accountancy Professionxara mizpahNo ratings yet

- Audit Assurance MidtermDocument8 pagesAudit Assurance MidtermMohammad Farhan SafwanNo ratings yet

- Accountancy ProfessionDocument94 pagesAccountancy ProfessionMANZANO, Isaiah Keith C.No ratings yet

- IFRS PrelimDocument9 pagesIFRS PrelimChandria SimbulanNo ratings yet

- The Philippine Accountancy Act of 2004Document4 pagesThe Philippine Accountancy Act of 2004Anna ParciaNo ratings yet

- AT 01-Practice-and-Regulation-of-the-Accountancy-ProfessionDocument14 pagesAT 01-Practice-and-Regulation-of-the-Accountancy-ProfessionRhia Mae Pacelo100% (2)

- 1 Introduction To Accounting ProfessionDocument27 pages1 Introduction To Accounting ProfessionJames FloresNo ratings yet

- AT.3501 - The Professional Practice of AccountancyDocument9 pagesAT.3501 - The Professional Practice of AccountancyRINCONADA ReynalynNo ratings yet

- 1ADocument8 pages1APaula Mae DacanayNo ratings yet

- Fundamentals of Accounting 1 (Chapter 1)Document5 pagesFundamentals of Accounting 1 (Chapter 1)eleanor astridNo ratings yet

- REVIEWERDocument14 pagesREVIEWERgrace bruanNo ratings yet

- Answer Key Assignment For Chapter 3Document8 pagesAnswer Key Assignment For Chapter 3John Lester DungcaNo ratings yet

- Learning Objectives: at The End of The Lesson, The Learner Will Be Able ToDocument12 pagesLearning Objectives: at The End of The Lesson, The Learner Will Be Able ToBielan Fabian GrayNo ratings yet

- Module 1 - Fundamentals of Auditing and Assurance ServicesDocument29 pagesModule 1 - Fundamentals of Auditing and Assurance ServicesEnya ViscoNo ratings yet

- AT03 03 The Accountancy Profession PresentationDocument66 pagesAT03 03 The Accountancy Profession Presentationgutlaysophia06No ratings yet

- AT 04 Practice and Regulation of The ProfessionDocument6 pagesAT 04 Practice and Regulation of The ProfessionEira ShaneNo ratings yet

- Report - Ac315Document39 pagesReport - Ac315Lalaine De JesusNo ratings yet

- c3 ReviewerDocument42 pagesc3 Reviewerrandomlungs121223No ratings yet

- Auditing IiiDocument2 pagesAuditing IiiRose Medina BarondaNo ratings yet

- AT 04 Practice - Regulation of The ProfessionDocument6 pagesAT 04 Practice - Regulation of The ProfessionPrincesNo ratings yet

- AT 1.02 Part 1 RA9298Document35 pagesAT 1.02 Part 1 RA9298Alyssa MoralesNo ratings yet

- Welcome To ACT14: Conceptual Framework and Accounting Standards (CFAS)Document55 pagesWelcome To ACT14: Conceptual Framework and Accounting Standards (CFAS)Jashi SiñelNo ratings yet

- Apd 2 NotesDocument3 pagesApd 2 NotesHelios HexNo ratings yet

- Semi Answered Aud TheoryDocument11 pagesSemi Answered Aud TheoryAbdulmajed Unda MimbantasNo ratings yet

- Auditing Theory: Cpa Review School of The Philippines ManilaDocument5 pagesAuditing Theory: Cpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Mercado Marie Angelica 04 JournalDocument4 pagesMercado Marie Angelica 04 Journalacilegna mercadoNo ratings yet

- PRTC - AT1 - The CPA's Professional ResponsibilityDocument4 pagesPRTC - AT1 - The CPA's Professional Responsibilityelle868No ratings yet

- The Professiona Practice of AccountancyDocument22 pagesThe Professiona Practice of AccountancyMiyangNo ratings yet

- Module #03 - The Professional Practice of AccountingDocument6 pagesModule #03 - The Professional Practice of AccountingRhesus UrbanoNo ratings yet

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Z 2Document12 pagesZ 2Helios HexNo ratings yet

- Auditing and AssuranceDocument4 pagesAuditing and AssuranceSalmairah Balty AmoreNo ratings yet

- AI 2 Part 6 QADocument39 pagesAI 2 Part 6 QAJobby JaranillaNo ratings yet

- Regulation of Accountancy ProfessionDocument2 pagesRegulation of Accountancy ProfessionKim TaehyungNo ratings yet

- Ra 9298Document14 pagesRa 9298Errah Jenn CajesNo ratings yet

- Auditing Theory: All of TheseDocument7 pagesAuditing Theory: All of TheseKIM RAGANo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- AT-03 (Introduction To Auditing)Document4 pagesAT-03 (Introduction To Auditing)Soremn PotatoheadNo ratings yet

- AT-04 (Financial Statements Audit Overview)Document5 pagesAT-04 (Financial Statements Audit Overview)Soremn PotatoheadNo ratings yet

- Art. 10667Document16 pagesArt. 10667Soremn PotatoheadNo ratings yet

- AT-05 (Quality Management)Document7 pagesAT-05 (Quality Management)Soremn Potatohead100% (1)

- GROUP 1 Activity 2Document3 pagesGROUP 1 Activity 2Soremn PotatoheadNo ratings yet

- Edith CutieDocument1 pageEdith CutieSoremn PotatoheadNo ratings yet

- REFERENCESDocument9 pagesREFERENCESSoremn PotatoheadNo ratings yet

- Gantt ChartDocument1 pageGantt ChartSoremn PotatoheadNo ratings yet

- Fundamentals of HRM Chapter 1 5Document17 pagesFundamentals of HRM Chapter 1 5Soremn PotatoheadNo ratings yet

- Bape3 Hi Def Engagement LetterDocument8 pagesBape3 Hi Def Engagement LetterSoremn PotatoheadNo ratings yet

- Overview of Cost ManagementDocument1 pageOverview of Cost ManagementSoremn PotatoheadNo ratings yet

- Dalida - Delos Santos Movie ReviewDocument3 pagesDalida - Delos Santos Movie ReviewSoremn PotatoheadNo ratings yet

- Mining ReportDocument2 pagesMining ReportSoremn PotatoheadNo ratings yet

- Capacity PlanningDocument4 pagesCapacity PlanningSoremn PotatoheadNo ratings yet

- Prof Elec ReviewerDocument4 pagesProf Elec ReviewerSoremn PotatoheadNo ratings yet

- RECITATIONDocument3 pagesRECITATIONSoremn PotatoheadNo ratings yet

- RecitationDocument2 pagesRecitationSoremn PotatoheadNo ratings yet

- Recreational Games DALIDADocument2 pagesRecreational Games DALIDASoremn PotatoheadNo ratings yet

- Ia 3 LQSDocument19 pagesIa 3 LQSSoremn PotatoheadNo ratings yet

- MIDTERMDocument14 pagesMIDTERMSoremn PotatoheadNo ratings yet

- Finmarket ReviewerDocument27 pagesFinmarket ReviewerSoremn PotatoheadNo ratings yet

- Q3 Bape6Document4 pagesQ3 Bape6Soremn PotatoheadNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 1Document4 pagesCREDIT TRANSACTION Guaranty Chapter 1Soremn PotatoheadNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 2Document4 pagesCREDIT TRANSACTION Guaranty Chapter 2Soremn PotatoheadNo ratings yet

- RFBT TerminologiesDocument2 pagesRFBT TerminologiesSoremn PotatoheadNo ratings yet

- LQ 2Document19 pagesLQ 2Soremn PotatoheadNo ratings yet

- CAS 101 - Lesson 1 W - ActivitiesDocument11 pagesCAS 101 - Lesson 1 W - ActivitiesSoremn PotatoheadNo ratings yet

- RFBT LQ AgencyDocument6 pagesRFBT LQ AgencySoremn PotatoheadNo ratings yet

- Medieval Arts - Refers To A Period Also Known As The Middle Ages, Which RoughlyDocument12 pagesMedieval Arts - Refers To A Period Also Known As The Middle Ages, Which RoughlySoremn PotatoheadNo ratings yet

- CREDIT TRANSACTION Deposit Chapter 4Document1 pageCREDIT TRANSACTION Deposit Chapter 4Soremn PotatoheadNo ratings yet

- Domestic Markets & Monetary Management Department: ProvisionalDocument1 pageDomestic Markets & Monetary Management Department: ProvisionalIrfan KhanNo ratings yet

- Lesson 3.3: T-AccountsDocument3 pagesLesson 3.3: T-AccountsJamiellaNo ratings yet

- Credit Risk Management in BanksDocument73 pagesCredit Risk Management in BanksNikhil Sattur100% (2)

- Hizon Notes - Negotiable InstrumentsDocument86 pagesHizon Notes - Negotiable Instrumentsdnel13No ratings yet

- Core Banking Systems by Vendor Country - Nationality (A To L)Document4 pagesCore Banking Systems by Vendor Country - Nationality (A To L)dahoune4728No ratings yet

- Meezan Bank Profit Rates 2023Document1 pageMeezan Bank Profit Rates 2023ashfaq huda100% (1)

- Deutsche Bank Compensation PolicyDocument7 pagesDeutsche Bank Compensation PolicySyed Ali AbbasNo ratings yet

- INDEMNITY BOND - Loss of Cheque Book UDocument2 pagesINDEMNITY BOND - Loss of Cheque Book UNeelam SharmaNo ratings yet

- FOREIGN DOLL CORP May 2023 TD StatementDocument4 pagesFOREIGN DOLL CORP May 2023 TD Statementlesly malebrancheNo ratings yet

- Bfi Questions FinalDocument4 pagesBfi Questions FinalChristian RellonNo ratings yet

- Ps Na Bago Sa ECONDocument10 pagesPs Na Bago Sa ECONJonelou CusipagNo ratings yet

- Revenue (BPP)Document6 pagesRevenue (BPP)ram ramNo ratings yet

- PIA3 A InglesDocument17 pagesPIA3 A Inglesmobbcarlos23No ratings yet

- P3 2A AnswerDocument2 pagesP3 2A AnswerMinh NhậtNo ratings yet

- HW On Cash PDFDocument6 pagesHW On Cash PDFMich ClementeNo ratings yet

- Accounting2 Activity1Document2 pagesAccounting2 Activity1devy mar topiaNo ratings yet

- 2022-09-19 Assignment 3 Life Insurance MathsDocument2 pages2022-09-19 Assignment 3 Life Insurance MathshimeshNo ratings yet

- Description: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Document3 pagesDescription: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Suvaid KcNo ratings yet

- Equitas AR20 PDFDocument196 pagesEquitas AR20 PDFpinky gargNo ratings yet

- MSB ATM GuidanceDocument3 pagesMSB ATM GuidanceJay CaplanNo ratings yet

- Reading 47 Fundamentals of Credit AnalysisDocument18 pagesReading 47 Fundamentals of Credit AnalysisNeerajNo ratings yet

- 2022 ICM Part 7Document49 pages2022 ICM Part 7amkamo99No ratings yet

- Sbimf Project ReportDocument66 pagesSbimf Project ReportAman Gupta100% (1)

- Accounting For Merchandising OperationsDocument13 pagesAccounting For Merchandising OperationsAB Cloyd100% (1)

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet