Professional Documents

Culture Documents

Arindam 2023

Arindam 2023

Uploaded by

Anupam DasCopyright:

Available Formats

You might also like

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Document7 pagesChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarNo ratings yet

- Obn - Gwox - Issue 34 (March 2021)Document1 pageObn - Gwox - Issue 34 (March 2021)Nate TobikNo ratings yet

- TheoryofacctsexamDocument7 pagesTheoryofacctsexammarvin barlisoNo ratings yet

- Payroll - With Payslip ActivityDocument17 pagesPayroll - With Payslip Activitylheamaecayabyab4No ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationMarirose Sheena DomingoNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Income Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CDocument6 pagesIncome Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CkannanchammyNo ratings yet

- Little Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanDocument4 pagesLittle Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanYogesh DeshmukhNo ratings yet

- Shubha KDocument1 pageShubha Kjyothi sNo ratings yet

- Advance Tax ExampleDocument2 pagesAdvance Tax ExampleRitsikaGurramNo ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Financial Income StatementDocument1 pageFinancial Income StatementLei Angielin DurwinNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- Tax Calculation SheetDocument2 pagesTax Calculation Sheetpallab2110No ratings yet

- Krishna Radha Ram EnterpriseDocument3 pagesKrishna Radha Ram EnterpriseAvijit MistriNo ratings yet

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Document5 pagesComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Faculty of Business and Management Introduction To Corporate Finance FIN 430Document10 pagesFaculty of Business and Management Introduction To Corporate Finance FIN 430Luqmanaien UitmNo ratings yet

- Pre F.chap.5 NewDocument9 pagesPre F.chap.5 NewVee Gabiana GoNo ratings yet

- CAT Exam 3 - 2018 Answer KeyDocument32 pagesCAT Exam 3 - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Rosas Payroll CalculatorDocument15 pagesRosas Payroll Calculatoracctg2012No ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- Sample Exam - 2018 Answer KeyDocument23 pagesSample Exam - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MaynikitachaudharyworldNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- M-1 - Unit-2A ADVANCE PAYMENT OF TAXDocument4 pagesM-1 - Unit-2A ADVANCE PAYMENT OF TAXAnanya SahooNo ratings yet

- One97 Communications Limited: Earnings DeductionsDocument2 pagesOne97 Communications Limited: Earnings Deductionsrusingh932No ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Salary Certificate For EmployeesDocument3 pagesSalary Certificate For EmployeesCherukuri Viswanadha ChettyNo ratings yet

- Income StatementDocument2 pagesIncome Statementapi-383676233% (3)

- Salary Variance Report: Psno Employee NameDocument1 pageSalary Variance Report: Psno Employee NameAkhil MohammadNo ratings yet

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- TEAM C ActivityDocument7 pagesTEAM C ActivityPatrick MedinaNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- ASSIGNMENTDocument15 pagesASSIGNMENTKeith Joshua Gabiason100% (1)

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Financial AspectDocument13 pagesFinancial AspectGElla BarRete ReQuilloNo ratings yet

- Illustrative Problem PayrollDocument23 pagesIllustrative Problem PayrollSophia VistanNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Ayisha PayDocument3 pagesAyisha Paycontact.fidbankNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- I JT Statement For F.Y 2022-23Document7 pagesI JT Statement For F.Y 2022-23Sasidhar KatariNo ratings yet

- Payslip For: APR-2022: Louis Berger SASDocument1 pagePayslip For: APR-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Paystub 202311Document1 pagePaystub 202311Gss ChaitanyaNo ratings yet

- PDFReportsDocument2 pagesPDFReportspathakakash036No ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Suggested Answer On Tax Planning and Compliance Nov-Dec, 2023Document18 pagesSuggested Answer On Tax Planning and Compliance Nov-Dec, 2023Erfan KhanNo ratings yet

- Project-3 Cash ManagementDocument7 pagesProject-3 Cash ManagementAnkur TomarNo ratings yet

- Current Liabilities & PayrollDocument12 pagesCurrent Liabilities & PayrollMesele AdemeNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisRenz BrionesNo ratings yet

- Infrastructure Tax Credits Final RevisedDocument8 pagesInfrastructure Tax Credits Final RevisedomolakanyeNo ratings yet

- Projected Financial StatementsDocument2 pagesProjected Financial StatementsAcademic StuffNo ratings yet

- Mas Drills Weeks 1-7 & DiagnosticDocument56 pagesMas Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Natalie Budgeting AssignmentDocument4 pagesNatalie Budgeting Assignmentnatalie hastingsNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- Income From Other SourcesDocument29 pagesIncome From Other SourcesSatish BhadaniNo ratings yet

- Munir Industry Exemption 2021 FBRDocument2 pagesMunir Industry Exemption 2021 FBRAqeel ZahidNo ratings yet

- Module 4 - The Essence of Financial StatementsDocument31 pagesModule 4 - The Essence of Financial StatementsBellela DumpNo ratings yet

- Income Tax Law & PracticeDocument29 pagesIncome Tax Law & PracticeMohanNo ratings yet

- F A P - R A: Inancial Nalysis and Lanning Atio NalysisDocument70 pagesF A P - R A: Inancial Nalysis and Lanning Atio NalysissajedulNo ratings yet

- Assignment 1.1 Prepare and Describe A Succession ScenarioDocument2 pagesAssignment 1.1 Prepare and Describe A Succession Scenariomikheal beyberNo ratings yet

- Assignment Bank Reconciliation and Payroll New 1Document5 pagesAssignment Bank Reconciliation and Payroll New 1Dagnachew WeldegebrielNo ratings yet

- TX ZWE Examinable Documents 2021Document3 pagesTX ZWE Examinable Documents 2021Tawanda Tatenda HerbertNo ratings yet

- Income Tax - FootnotesDocument3 pagesIncome Tax - FootnotesNichelle De RamaNo ratings yet

- Tax 101 Reviewer For Business and Transfer TaxDocument34 pagesTax 101 Reviewer For Business and Transfer TaxVeronika BlairNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Acc 202Document5 pagesAcc 202Moana BrownNo ratings yet

- Personal Financial StatementDocument1 pagePersonal Financial StatementsureshNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Tutorial 6 (Week 7) QUESTIONDocument7 pagesTutorial 6 (Week 7) QUESTIONJahmesNo ratings yet

- Employment IncomeDocument2 pagesEmployment IncomeFarhanah AfendiNo ratings yet

- Test Bank Business TaxationDocument28 pagesTest Bank Business TaxationKrezza Amor MabanNo ratings yet

- Corporate Tax Research Paper TopicsDocument4 pagesCorporate Tax Research Paper Topicsjrcrefvhf100% (1)

Arindam 2023

Arindam 2023

Uploaded by

Anupam DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arindam 2023

Arindam 2023

Uploaded by

Anupam DasCopyright:

Available Formats

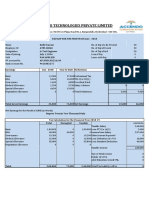

SAHEBERHAT PURNANANDA HIGH SCHOOL

Salary Received and Tax Calculation for the year 2022-2023 I. Tax Rule : Old

Name ARINDAM SARKAR Level : P.A.N CXXPS9563C

D.A H.R.A Additional Gross

Basic M. A. Remuneration

G.P.F P. Tax I. Tax Net Salary

Salary Month @ 3% @ 12% Amount

Mar, 22 49000 1470 5880 500 56850 4000 200 52650

April, 22 49000 1470 5880 500 56850 4000 200 52650

May, 22 49000 1470 5880 500 56850 4000 200 52650

June, 22 49000 1470 5880 500 56850 4000 200 52650

July, 22 50500 1515 6060 500 58575 4000 200 54375

August, 22 50500 1515 6060 500 58575 4000 200 54375

Sep, 22 50500 1515 6060 500 58575 4000 200 54375

Oct, 22 50500 1515 6060 500 58575 4000 200 54375

Nov, 22 50500 1515 6060 500 58575 4000 200 54375

Dec, 22 50500 1515 6060 500 58575 4000 200 54375

Jan, 23 50500 1515 6060 500 58575 4000 200 54375

Feb, 23 50500 1515 6060 500 58575 4000 200 54375

Total = 600000 18000 72000 6000 0 696000 48000 2400 0 645600

Salary Received during F.Y 2022-2023 = 696000.00 Table-1 : Income From Other Sources = 7500.00

Add : Bonus = Interest From S/B Account = 7500.00

Add : Arrear =

696000.00

Standard Deduction U/S 16(ia) = 50000.00

Exemption of HRA U/S 10 (13A) =

Less : P. Tax U/S 16(iii) = 2400.00

52400.00

Income Under The Head Salaries = 643600.00

Table-1 : Income From Other Sources = 7500.00

Gross Total Income = 651100.00

Table-2 : Deductions U/S 80C = 124644.00 Table-2 : Deductions U/S 80C = 124644.00

Table-3 : All Other Deductions = 28117.00 Contribution to GPF = 48000.00

Total Deductions = 152761.00 Life Insurance Premium = 16644.00

Net Taxable Income = 498339.00 Postal Life Insurance 45000.00

Child Policy(LIC) 6400.00

Income Tax Computation for the Amount 498339/- Tution Fees 8600.00

Income tax for the amount 250000/- @ 0% = 0.00

Income tax for the amount 248339/- @ 5% = 12416.95

Income tax for the amount 0/- @ 20% = 0.00

Income tax for the amount 0/- @ 30% = 0.00

12416.95

Rebate U/S 87A = 12416.95 Table-3 : All Other Deductions = 28117.00

Income Tax after Rebate = 0.00 U/S 80D: Medical Insurance = 15617.00

Educational Cess @ 4% on 0/- = 0.00 U/S 80TTA: Interest From S/B Account = 7500.00

Relief U/S 89 = 0.00 Preventive health check-up 5000.00

Total Tax for the F.Y 2022-2023 = 0.00

Total T.D.S paid during the F.Y 2022-2023 = 0.00

Balance Tax = NIL

Presented By, Ram Prosad Dawn

Total Tax of ARINDAM SARKAR for the Financial Year 2022-2023 is Rupees Zero Only

Signature:

VISIT : https://www.youtube.com/c/RamDawn

You might also like

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Document7 pagesChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarNo ratings yet

- Obn - Gwox - Issue 34 (March 2021)Document1 pageObn - Gwox - Issue 34 (March 2021)Nate TobikNo ratings yet

- TheoryofacctsexamDocument7 pagesTheoryofacctsexammarvin barlisoNo ratings yet

- Payroll - With Payslip ActivityDocument17 pagesPayroll - With Payslip Activitylheamaecayabyab4No ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationMarirose Sheena DomingoNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Income Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CDocument6 pagesIncome Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CkannanchammyNo ratings yet

- Little Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanDocument4 pagesLittle Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanYogesh DeshmukhNo ratings yet

- Shubha KDocument1 pageShubha Kjyothi sNo ratings yet

- Advance Tax ExampleDocument2 pagesAdvance Tax ExampleRitsikaGurramNo ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Financial Income StatementDocument1 pageFinancial Income StatementLei Angielin DurwinNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- Tax Calculation SheetDocument2 pagesTax Calculation Sheetpallab2110No ratings yet

- Krishna Radha Ram EnterpriseDocument3 pagesKrishna Radha Ram EnterpriseAvijit MistriNo ratings yet

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Document5 pagesComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Faculty of Business and Management Introduction To Corporate Finance FIN 430Document10 pagesFaculty of Business and Management Introduction To Corporate Finance FIN 430Luqmanaien UitmNo ratings yet

- Pre F.chap.5 NewDocument9 pagesPre F.chap.5 NewVee Gabiana GoNo ratings yet

- CAT Exam 3 - 2018 Answer KeyDocument32 pagesCAT Exam 3 - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Rosas Payroll CalculatorDocument15 pagesRosas Payroll Calculatoracctg2012No ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- Sample Exam - 2018 Answer KeyDocument23 pagesSample Exam - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MaynikitachaudharyworldNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- M-1 - Unit-2A ADVANCE PAYMENT OF TAXDocument4 pagesM-1 - Unit-2A ADVANCE PAYMENT OF TAXAnanya SahooNo ratings yet

- One97 Communications Limited: Earnings DeductionsDocument2 pagesOne97 Communications Limited: Earnings Deductionsrusingh932No ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Salary Certificate For EmployeesDocument3 pagesSalary Certificate For EmployeesCherukuri Viswanadha ChettyNo ratings yet

- Income StatementDocument2 pagesIncome Statementapi-383676233% (3)

- Salary Variance Report: Psno Employee NameDocument1 pageSalary Variance Report: Psno Employee NameAkhil MohammadNo ratings yet

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- TEAM C ActivityDocument7 pagesTEAM C ActivityPatrick MedinaNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- ASSIGNMENTDocument15 pagesASSIGNMENTKeith Joshua Gabiason100% (1)

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Financial AspectDocument13 pagesFinancial AspectGElla BarRete ReQuilloNo ratings yet

- Illustrative Problem PayrollDocument23 pagesIllustrative Problem PayrollSophia VistanNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Ayisha PayDocument3 pagesAyisha Paycontact.fidbankNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- I JT Statement For F.Y 2022-23Document7 pagesI JT Statement For F.Y 2022-23Sasidhar KatariNo ratings yet

- Payslip For: APR-2022: Louis Berger SASDocument1 pagePayslip For: APR-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Paystub 202311Document1 pagePaystub 202311Gss ChaitanyaNo ratings yet

- PDFReportsDocument2 pagesPDFReportspathakakash036No ratings yet

- CompDocument3 pagesCompchalukrcNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Suggested Answer On Tax Planning and Compliance Nov-Dec, 2023Document18 pagesSuggested Answer On Tax Planning and Compliance Nov-Dec, 2023Erfan KhanNo ratings yet

- Project-3 Cash ManagementDocument7 pagesProject-3 Cash ManagementAnkur TomarNo ratings yet

- Current Liabilities & PayrollDocument12 pagesCurrent Liabilities & PayrollMesele AdemeNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisRenz BrionesNo ratings yet

- Infrastructure Tax Credits Final RevisedDocument8 pagesInfrastructure Tax Credits Final RevisedomolakanyeNo ratings yet

- Projected Financial StatementsDocument2 pagesProjected Financial StatementsAcademic StuffNo ratings yet

- Mas Drills Weeks 1-7 & DiagnosticDocument56 pagesMas Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Natalie Budgeting AssignmentDocument4 pagesNatalie Budgeting Assignmentnatalie hastingsNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- Income From Other SourcesDocument29 pagesIncome From Other SourcesSatish BhadaniNo ratings yet

- Munir Industry Exemption 2021 FBRDocument2 pagesMunir Industry Exemption 2021 FBRAqeel ZahidNo ratings yet

- Module 4 - The Essence of Financial StatementsDocument31 pagesModule 4 - The Essence of Financial StatementsBellela DumpNo ratings yet

- Income Tax Law & PracticeDocument29 pagesIncome Tax Law & PracticeMohanNo ratings yet

- F A P - R A: Inancial Nalysis and Lanning Atio NalysisDocument70 pagesF A P - R A: Inancial Nalysis and Lanning Atio NalysissajedulNo ratings yet

- Assignment 1.1 Prepare and Describe A Succession ScenarioDocument2 pagesAssignment 1.1 Prepare and Describe A Succession Scenariomikheal beyberNo ratings yet

- Assignment Bank Reconciliation and Payroll New 1Document5 pagesAssignment Bank Reconciliation and Payroll New 1Dagnachew WeldegebrielNo ratings yet

- TX ZWE Examinable Documents 2021Document3 pagesTX ZWE Examinable Documents 2021Tawanda Tatenda HerbertNo ratings yet

- Income Tax - FootnotesDocument3 pagesIncome Tax - FootnotesNichelle De RamaNo ratings yet

- Tax 101 Reviewer For Business and Transfer TaxDocument34 pagesTax 101 Reviewer For Business and Transfer TaxVeronika BlairNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Acc 202Document5 pagesAcc 202Moana BrownNo ratings yet

- Personal Financial StatementDocument1 pagePersonal Financial StatementsureshNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Tutorial 6 (Week 7) QUESTIONDocument7 pagesTutorial 6 (Week 7) QUESTIONJahmesNo ratings yet

- Employment IncomeDocument2 pagesEmployment IncomeFarhanah AfendiNo ratings yet

- Test Bank Business TaxationDocument28 pagesTest Bank Business TaxationKrezza Amor MabanNo ratings yet

- Corporate Tax Research Paper TopicsDocument4 pagesCorporate Tax Research Paper Topicsjrcrefvhf100% (1)