Professional Documents

Culture Documents

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

Uploaded by

Sundar AbhimanyuCopyright:

Available Formats

You might also like

- Bill French Case SolutionDocument3 pagesBill French Case SolutionMurat Kalender80% (5)

- Microsoft IPO ProspectusDocument52 pagesMicrosoft IPO Prospectusjohnnyg31100% (1)

- Overhead Crane Pre-Op ChecklistDocument2 pagesOverhead Crane Pre-Op ChecklistThompson OgborokpaNo ratings yet

- IT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideDocument26 pagesIT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideKriben Rao100% (1)

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATAnna Hofisi100% (1)

- Economic Programme Committee Report 1948Document10 pagesEconomic Programme Committee Report 1948Pushpendra Kumar100% (1)

- Chapter 3 Introduction To Business TaxationDocument27 pagesChapter 3 Introduction To Business TaxationHazel Jane Esclamada100% (1)

- e20NITSITC3nos13PsgrLiftPattoPanjim PDFDocument109 pagese20NITSITC3nos13PsgrLiftPattoPanjim PDFSharon ShajiNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Chapter 1 MCQsDocument6 pagesChapter 1 MCQsmpatra264No ratings yet

- Tax Revision Plan With Hrs and MarksDocument7 pagesTax Revision Plan With Hrs and MarksKukuNo ratings yet

- MIDC TenderDocumentDocument243 pagesMIDC TenderDocumentSwapnil GawadeNo ratings yet

- November 2020: Gauteng Department of Education Provincial ExaminationDocument8 pagesNovember 2020: Gauteng Department of Education Provincial Examinationmelinencube2002No ratings yet

- Gr9 EMS (English) 2020 Exemplars Possible AnswersDocument8 pagesGr9 EMS (English) 2020 Exemplars Possible AnswersZizipho MakaulaNo ratings yet

- Revision 3 of Specification For Escalator PDFDocument74 pagesRevision 3 of Specification For Escalator PDFAniket PradhanNo ratings yet

- Tariff Order DNHPDCL 2021-22Document172 pagesTariff Order DNHPDCL 2021-22sunilgvoraNo ratings yet

- DMS12012024 10224693835181492Document2 pagesDMS12012024 10224693835181492Senthil MithulNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Exemption Scoring 60 Questions CA CMA CS FINAL MAY NOV 2023Document100 pagesExemption Scoring 60 Questions CA CMA CS FINAL MAY NOV 2023Raghothama Achar RNo ratings yet

- TenderDocument ThaneDocument184 pagesTenderDocument Thaneswanya_kulNo ratings yet

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- One Day Before Exam - N23 NewDocument16 pagesOne Day Before Exam - N23 NewVikash AgarwalNo ratings yet

- Mi SCDocument2 pagesMi SCRam PraveshNo ratings yet

- Detailed Financial Progress Report Feb 2022Document4 pagesDetailed Financial Progress Report Feb 2022anil peralaNo ratings yet

- FinalDocument1,200 pagesFinalRahulNo ratings yet

- Tender DocumentDocument224 pagesTender Documentswanya_kulNo ratings yet

- E-Invoicing Detailed Technical GuidelinesDocument79 pagesE-Invoicing Detailed Technical GuidelinesRCENo ratings yet

- Mar2021 to Jul 2021 (1132)_240614_164517Document4 pagesMar2021 to Jul 2021 (1132)_240614_164517samgeorgemaxNo ratings yet

- Chapter 2 Charge of TaxDocument6 pagesChapter 2 Charge of Taxkatta sumanthNo ratings yet

- FS - InRetail Consumer - 2020Document124 pagesFS - InRetail Consumer - 2020joseacasieteuwuNo ratings yet

- GST Ready Reckoner 2020 - 10062020Document240 pagesGST Ready Reckoner 2020 - 10062020P S AmritNo ratings yet

- Bill of Quantities - SummaryDocument2 pagesBill of Quantities - SummaryPrasenjit DeyNo ratings yet

- 47 Council Meeting FinalDocument38 pages47 Council Meeting FinalAbhishek PareekNo ratings yet

- Kptlfinal 191218100809Document29 pagesKptlfinal 191218100809Manisha PatelNo ratings yet

- Revised Liability - E&T - by - June - 070721Document69 pagesRevised Liability - E&T - by - June - 070721sanjuNo ratings yet

- Bs SML Isuzu q4 2023-24Document8 pagesBs SML Isuzu q4 2023-24Bithal PrasadNo ratings yet

- Chapter 1 Introduction of GSTDocument4 pagesChapter 1 Introduction of GSTjhjhNo ratings yet

- Why WhyDocument12 pagesWhy WhySANJEEV KUMARNo ratings yet

- CA Final 40 Days Revision Program For DT IDTDocument5 pagesCA Final 40 Days Revision Program For DT IDTMala M PrasannaNo ratings yet

- Electricity Company Accounts: Solutions To Assignment ProblemsDocument3 pagesElectricity Company Accounts: Solutions To Assignment ProblemsHemmu sahuNo ratings yet

- RoadDocument11 pagesRoadShafiek IsmailNo ratings yet

- PSPM MODEL 3 AA015/ KMM Session 2019/2020Document7 pagesPSPM MODEL 3 AA015/ KMM Session 2019/2020syahmiafndiNo ratings yet

- Sub Contractor Interim Payment CertificateDocument7 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Inspection Report of Mumbai South GSTDocument105 pagesInspection Report of Mumbai South GSTAvnish KumarNo ratings yet

- Final - Civil Cost WSA (Positive) (LASA)Document165 pagesFinal - Civil Cost WSA (Positive) (LASA)Pankaj SinghNo ratings yet

- Budget Slides - For The FY 22-23Document3 pagesBudget Slides - For The FY 22-23hatc marineNo ratings yet

- FactBookQ12023 VFDocument26 pagesFactBookQ12023 VFprateekpd92sgNo ratings yet

- Dombivali MIDC DTP 2nd CallDocument177 pagesDombivali MIDC DTP 2nd Calldivya jhamtaniNo ratings yet

- Forms For Different Registers and Their Authority (Para Nos)Document4 pagesForms For Different Registers and Their Authority (Para Nos)Vicky Srivastava100% (1)

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- GeneralestpdfviewDocument6 pagesGeneralestpdfviewAsst. Exe. Engr ElamdesomNo ratings yet

- Biil of Quantity (Boq)Document1 pageBiil of Quantity (Boq)ccalosa29No ratings yet

- TenderDocument135 pagesTenderElectrical RadicalNo ratings yet

- 3010182428unit Run Canteen (Urc) Manual PDFDocument206 pages3010182428unit Run Canteen (Urc) Manual PDFShyam Prabhu50% (2)

- New Administrative Building, 1 Floor, A Wing, 16 Greams Road, Chennai - 600006Document12 pagesNew Administrative Building, 1 Floor, A Wing, 16 Greams Road, Chennai - 600006Vinoth Kumar SNo ratings yet

- Ayirakulam and Puliyoor KulamDocument1 pageAyirakulam and Puliyoor KulamnaseebNo ratings yet

- GAOC Option 2Document2 pagesGAOC Option 2Amit PhadatareNo ratings yet

- INDIGO - Investor Presentation - 03-Aug-22 - TickertapeDocument17 pagesINDIGO - Investor Presentation - 03-Aug-22 - TickertapeDot EduNo ratings yet

- Rate Anlysis Drill JumboDocument1 pageRate Anlysis Drill Jumboshubhamtandon01No ratings yet

- BOQ Summary Wardha Arvi (EPC)Document1 pageBOQ Summary Wardha Arvi (EPC)Irfan BiradarNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SCR 202205202021621 28 SCRRPT'Document10 pagesSCR 202205202021621 28 SCRRPT'dhaneshNo ratings yet

- Epl SCT L 0262Document4 pagesEpl SCT L 0262Khan ShahrukhNo ratings yet

- 5G System Design: Architectural and Functional Considerations and Long Term ResearchFrom Everand5G System Design: Architectural and Functional Considerations and Long Term ResearchNo ratings yet

- Propertytax ChecklistDocument1 pagePropertytax ChecklistContinental InfrastructureNo ratings yet

- RTP Cap III Gr-I Dec 2022Document105 pagesRTP Cap III Gr-I Dec 2022मदन कुमार बिस्टNo ratings yet

- Gst-Challan Doctel Jan 2019Document2 pagesGst-Challan Doctel Jan 2019aapka.kapil3758No ratings yet

- Untitled 1Document1,318 pagesUntitled 1Dence Cris RondonNo ratings yet

- Starbuck PPT by Pershing SquareDocument44 pagesStarbuck PPT by Pershing SquareJainam VoraNo ratings yet

- GRP 2 - Digests 2nd ExamDocument28 pagesGRP 2 - Digests 2nd ExamRemus CalicdanNo ratings yet

- Dann Corporation Working Balance Sheet Decemeber 31, 2016Document12 pagesDann Corporation Working Balance Sheet Decemeber 31, 2016Ne BzNo ratings yet

- Fire Code and Assessment and CollectionDocument57 pagesFire Code and Assessment and CollectionWarperlito AndoNo ratings yet

- Description U/S Percentage RemarkDocument7 pagesDescription U/S Percentage Remarkshakhawat HossainNo ratings yet

- NZ Tax IndividualDocument60 pagesNZ Tax IndividualSusana SembranoNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument2 pagesIncome Statement - Annual - As Originally ReportedHoàng HuếNo ratings yet

- Course Details of 'Corporate Tax Computation and Return Filing - A Practical Approach'Document3 pagesCourse Details of 'Corporate Tax Computation and Return Filing - A Practical Approach'Md. MohimanNo ratings yet

- Print 2Document2 pagesPrint 2SwagBeast SKJJNo ratings yet

- PHD Thesis TaxationDocument7 pagesPHD Thesis Taxationafknwride100% (1)

- Alabama Motor Vehicle Bill of Sale: The Parties. JUAN DAVID TRUJILLO FRANCO With A Mailing AddressDocument3 pagesAlabama Motor Vehicle Bill of Sale: The Parties. JUAN DAVID TRUJILLO FRANCO With A Mailing AddressJuan TrujilloNo ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- Detailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateDocument27 pagesDetailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateAnkit SainiNo ratings yet

- Responsibility of Fiscal Policy UPDATEDDocument24 pagesResponsibility of Fiscal Policy UPDATEDFiona RamiNo ratings yet

- Trimmer - Invoice PDFDocument1 pageTrimmer - Invoice PDFsai krishna krishna shasthrulaNo ratings yet

- Summer Internship ReportDocument29 pagesSummer Internship ReportVeshesh SrivastavaNo ratings yet

- Edited SAP MCQsDocument7 pagesEdited SAP MCQssajidaliraza163No ratings yet

- 3 Revision Summary of Income TaxDocument22 pages3 Revision Summary of Income TaxJitendra VernekarNo ratings yet

- RubricDocument3 pagesRubricapi-356375185No ratings yet

- Mahindra and MahindraDocument18 pagesMahindra and Mahindravenkataswamynath channa100% (1)

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27No ratings yet

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

Uploaded by

Sundar AbhimanyuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

ABC Analysis & Important Questions For May June 23 - CA Ramesh Soni

Uploaded by

Sundar AbhimanyuCopyright:

Available Formats

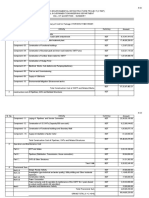

CHARTMASTER’s

ABC Analysis &

Important Q & A list

on

INDIRECT TAX LAWS

(Applicable for CA CS CMA Final May/June 23 attempt)

CA RAMESH SONI

www.rameshsoni.com

Ramesh Soni Classes | Bangalore | 9353619482 | 7483378296

GST

Sl Grade Important Sections/ areas to Question No

Particulars

No. remember/ Focus (Version 9)

C Taxes subsumed & not subsumed 2, 3, 10, 12, 14, 15, 16,

GST:

Cross Empowerment 19, 20

Introduction,

1. Taxes on Various goods & services

Overview &

Article 246A, 269A, 279A

Administration

GSTN & Its functions

A Section 7(1)(c) 3, 6, 8,15, 19, 20, 23,

Section 7(2)(a) & (b) 29, 30, 32, 34

Section 8: Composite & Mixed

2. Supply Supply

Circular on PSLC

Amendments (Check amendment

booklet)

C Section 16 1

Definition of Export of Service

3. Nature of Supply

Circular on short term

accommodation services to SEZ

A Section 9(3), 9(5) 3, 6, 7, 9, 13, 14, 16,17

4. Charge of GST Section 5(3)

Amendments in Section 9(3)

B Section 10(1): Eligibility 1, 3, 5, 6, 7, 9, 10, 13,

10(2): Ineligibility 15, 16

5. Composition levy

10(2A)

Amendment

A Computation of ATO 3, 5, 7, 8, 11, 13, 15, 1,

Section 22, 23, 24 18, 25, 26

Section 25(1) read with Rule 10:

Registration Effective date

Rule 10B

Section 25(6B) (6C) (6D)

6. Registration

Section 28 – Core field

amendment

Rule 21A- Suspension

Section 29(1) & (2) read with rule

21

Cover amendments properly

A Charitable & religious activities 1, 5, 6, 10, 14, 15, 19,

Government services 22, 25, 28

Transportation services

Agriculture related services

Exemptions from

7. Healthcare services

GST

Education related services

Miscellaneous Exemptions (in

chart book-only amendments)

Cover all the amendments

A+ VOS – Computation – Section 5, 13, 14, 15, 21, 22,

15(1)(2)(3) 23, 26, 27, 30, 32, 34,

Rule 27, Rule 28, 29 36, 44, 45

8. Value of Supply Rule 32(2) (3) (4) (5)

Rule 33

Circular on EMI, Discounts & Del-

credere agent

Sl Grade Important Sections/ areas to Question No

Particulars

No. remember/ Focus (Version 9)

B Section 31 - complete, 2, 5, 10, 13, 15, 16, 20,

Tax Invoice,

Section 34-Credit note, 25

9. Credit and Debit

E-Invoice & Dynamic QR code

Notes

applicability

C Section 35(1) 1, 2, 9, 10, 11, 18

Records composition dealer need

not maintain?

Accounts and Records to be maintained by -

10.

Records Transporter & Owner operator of

warehouse

Records to be maintained by

Agent

C Rule 138(1) – When is EWB 5, 13, 14, 18, 16

required? Consequence of Non

Issuance of E-way Bill

Computation of Consignment

11. E-way bill value

E-way Bill Validity

When is E-way Bill not required?

Rule 138E: Blocking & Unblocking

of E- way Bill

B Section 12(2), 12(3) 5, 6, 13, 15, 23, 34, 36,

12. Time of Supply Section 13(2), 13(3) 40, 41, 42

Section 14 – rate change

A++ Section 16 read with rule 36 & 37 1, 5, 8, 10, 13, 18, 21,

Rule 42 & 43 33, 34, 36, 39, 44, 47,

Section 17 (5)-Blocked Credit 48

13. Input Tax Credit Section 18(1), (3), (6)

I will recommend covering this

chapter completely (including

amendments)

B Quick revision through Chart 9, 12, 15, 16, 17

14. Job work

book/ YouTube Revisionary

Input service B Quick revision through Chart 1, 6

15.

distributor book/ YouTube Revisionary

A+ Sec 50 & rule 88B: Interest on 5, 10, 12, 13, 14

delayed payment (Very

important)

16. Payment of Tax Rule 86A & Rule 86B

Rule 88A: Manner of Utilisation of

credit (set off of credit)

Amendments (must do)

B Quick revision through Chart book 4, 5, 6, 7, 17

17. TDS and TCS

/YouTube Revisionary

B Quick revision through Chart Book 3, 5, 6, 13, 14, 22, 23

/YouTube Revisionary

18. Returns

Amendments to be covered

properly

C Quick revision/YouTube 1, 3, 16, 18

19. Advance Ruling

Revisionary

20. Assessment B Section 60, 62, 63, 64 3, 4, 8, 10

Sl Grade Important Sections/ areas to Question No

Particulars

No. remember/ Focus (Version 9)

C Quick revision/YouTube 1, 7

21. Audit

Revisionary

Inspection, C Quick revision/YouTube 1, 6, 7, 8, 10, 14

22. Search, Seizure & Revisionary

Arrest

B Time limits for SCN & DO u/s 73 & 1, 2, 5, 8, 15, 16, 19,

74 21, 22, 23, 31, 32

Demands and Section 75, 76, 77 (must do)

23.

Recovery Section 79 - Modes of recovery.

Section 83: Provisional

attachment

B Time limit for filing Appeals 1, 2, 4, 9, 10, 11, 12,

Computation of Pre-deposit 13, 15, 18/19, 21, 22,

amount. 24

Pre-deposit against order u/s

Appeals and 129(3): 25% of the penalty.

24.

Revision Sec 121: Non-Appealable orders

Either Demand & Recovery or

from Appeals & Revision, Question

will come (don’t leave this 2

chapters)

C Quick revision/YouTube 9, 10, 11

Liability to Pay in

25. Revisionary

Certain Cases

Please do: Sec 87, 88, 89, 90, 93.

A • Section 122(1) (1A) & (3), 1, 2, 6, 10, 12, 13, 18,

• Section 125, 126 19, 24

Offences and

26. • Section 129, 130 (very important)

Penalties

• Section 132, 138.

• Must cover amendments

A • Quick revision/YouTube 2, 12, 20, 25, 27, 29,

27. Place of Supply

Revisionary 35, 36, 37

C • OIDAR Provisions 3, 4

Import under

28. • High Seas sale

GST

• Bond to Bond transfer

B • Section 147 – Deemed Exports 6, 7

• Rule 96: withholding & release of

29. Export under GST

refund

• Rule 96B – Recovery of refund

A+ • Please revise the complete 3, 8, 9

chapter through chart/YouTube

revisionary

30. Refunds • Formula for Calculation of

maximum refund u/s 54(3) rule

89(4) & (5).

• All amendments must do.

Miscellaneous C • Quick revision/YouTube 1, 7, 8, 12

31.

Provisions Revisionary

Computation of A+ Must Practice by writing 1, 4, 13, 14, 15, 16, 17,

32. GST liability (Big 18

Questions)

Customs & FTP

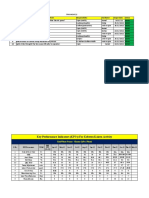

Grade Important Sections/areas to Question No

Sl No. Particulars

remember

B • Sec 13: No duty liability if goods 7, 10, 11, 14, 16,

pilfered 19, 21, 25, 27,

Levy and • Sec 20: Re-importation r/w 30, 31, 32

1. Exemption from notification no 45/2017

Custom duty • Sec 22: Abatement of duty

• Sec 23: Remission of duty

• Case laws

B • Import & Export Procedure (Glance) 2, 3, 4, 7, 8, 10,

• Deferred Payment of Duty (Clear 12, 15

Importation, now pay later)

Exportation and • Section 46: Filing of Bill of Entry:

2.

Transportation of Time limit to present BOE changed.

goods • Specified deposits exempted from

provisions of electronic cash ledger

[Section 51A]

Classification of B • General rules of Interpretation: Rule 8, 9, 10, 13, 14,

3.

Goods 2, Rule 3, Rule 5 & Project imports 16

A+ • Import Valuation - Determination of 7, 8, 18, 24, 30,

Assessable Value & CD 33, 43, 50, 57,

Valuation under

4. • Valuation rules – Rule 4, 5, 8 59, 66, 67, 75,

Customs

• Quickly recall: Relevant date for Rate 79, 80

of duty & Rate of exchange.

A • Section 8B – Safeguard Measures 2, 9, 12, 14, 15,

5. Types of Duties • Section 9A: Anti-dumping duty 17, 20

• 3(7), 3(8A) - Bond to Bond transfer

Baggage, A • Computation of duty on baggage 1, 2, 5, 10, 18,

6. Post or Courier & (important) 20

Stores

Assessment and C • Provisional Assessment & interest in 1, 2, 4, 6,12

7.

Audit case of provisional assessment

A • Section 74 & Section 75 2, 3, 7, 9, 14,

8. Duty Drawback • Section 75A: Interest on DBK 18, 23, 24, 31,

35, 37, 38

C • Quickly revise from YouTube 5, 9, 10, 11, 14,

9. Refund

revisionary 16, 17

Customs (Import A+ • Quickly revise from YouTube 1

of Goods at revisionary

Concessional Rate • Important for exam - cover

10.

of Duty or for completely

Specified End

Use) Rules, 2022

A • Quickly revise from YouTube 1, 2, 10, 13

11. Warehousing

revisionary.

A Advance Authorisation 6, 15, 16, 20, 21,

Similarities & difference between AA 22, 32

& DFIA

Foreign Trade

12. Status holder

Policy

RODTEP Scheme

EPCG Scheme

MEIS

Link for Chapter-wise YouTube Revisionary (includes GST + Customs + FTP)

Hindi: https://www.youtube.com/playlist?list=PLTa3hBcErFfy9I6HTM_XtVyCuD_RQQit6

English: https://www.youtube.com/playlist?list=PL6DyI2GjqVsulApEO4gU7IO1D7dsiklm3

Link for YouTube Amendment video

Hindi: https://www.youtube.com/playlist?list=PLTa3hBcErFfzyeYgBFcR4C4DRwnx2vnum

English: https://www.youtube.com/playlist?list=PL6DyI2GjqVssMWCWLpdv4gxJ_SOLEDc1t

Link for downloading amendment notes

https://rameshsoni.com/free-resources/ Go to CA Final May 23 folder _ Statutory updates for

may June 23

Important Note:

1. Must solve May 23 & Nov 22 RTP

2. Must cover all amendment for May 23 & Nov 22

Very Important notes (for Exam)

Provide proper working notes & Assumptions for answers.

In Case-study MCQs read the questions first and then start reading the case study.

If you remember section number very good, if you don’t then just don’t bother trying to remember

now. Writing a correct section will make your answer impressive but quoting a wrong section can make

you lose marks, so never do that.

Circular & Notification number don’t try to remember, Just use the words “As per the latest circular

issued/as per the notification issued by CBIC”.

For MCQs you can download the “Ramesh Soni classes” mobile app and solve MCQs, the course is priced

at just Re. 1. Its like playing game. Whenever you are tired of studying, play this game.

All the Best Guys, Lets Rock It!!

You might also like

- Bill French Case SolutionDocument3 pagesBill French Case SolutionMurat Kalender80% (5)

- Microsoft IPO ProspectusDocument52 pagesMicrosoft IPO Prospectusjohnnyg31100% (1)

- Overhead Crane Pre-Op ChecklistDocument2 pagesOverhead Crane Pre-Op ChecklistThompson OgborokpaNo ratings yet

- IT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideDocument26 pagesIT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideKriben Rao100% (1)

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATAnna Hofisi100% (1)

- Economic Programme Committee Report 1948Document10 pagesEconomic Programme Committee Report 1948Pushpendra Kumar100% (1)

- Chapter 3 Introduction To Business TaxationDocument27 pagesChapter 3 Introduction To Business TaxationHazel Jane Esclamada100% (1)

- e20NITSITC3nos13PsgrLiftPattoPanjim PDFDocument109 pagese20NITSITC3nos13PsgrLiftPattoPanjim PDFSharon ShajiNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Chapter 1 MCQsDocument6 pagesChapter 1 MCQsmpatra264No ratings yet

- Tax Revision Plan With Hrs and MarksDocument7 pagesTax Revision Plan With Hrs and MarksKukuNo ratings yet

- MIDC TenderDocumentDocument243 pagesMIDC TenderDocumentSwapnil GawadeNo ratings yet

- November 2020: Gauteng Department of Education Provincial ExaminationDocument8 pagesNovember 2020: Gauteng Department of Education Provincial Examinationmelinencube2002No ratings yet

- Gr9 EMS (English) 2020 Exemplars Possible AnswersDocument8 pagesGr9 EMS (English) 2020 Exemplars Possible AnswersZizipho MakaulaNo ratings yet

- Revision 3 of Specification For Escalator PDFDocument74 pagesRevision 3 of Specification For Escalator PDFAniket PradhanNo ratings yet

- Tariff Order DNHPDCL 2021-22Document172 pagesTariff Order DNHPDCL 2021-22sunilgvoraNo ratings yet

- DMS12012024 10224693835181492Document2 pagesDMS12012024 10224693835181492Senthil MithulNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Exemption Scoring 60 Questions CA CMA CS FINAL MAY NOV 2023Document100 pagesExemption Scoring 60 Questions CA CMA CS FINAL MAY NOV 2023Raghothama Achar RNo ratings yet

- TenderDocument ThaneDocument184 pagesTenderDocument Thaneswanya_kulNo ratings yet

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- One Day Before Exam - N23 NewDocument16 pagesOne Day Before Exam - N23 NewVikash AgarwalNo ratings yet

- Mi SCDocument2 pagesMi SCRam PraveshNo ratings yet

- Detailed Financial Progress Report Feb 2022Document4 pagesDetailed Financial Progress Report Feb 2022anil peralaNo ratings yet

- FinalDocument1,200 pagesFinalRahulNo ratings yet

- Tender DocumentDocument224 pagesTender Documentswanya_kulNo ratings yet

- E-Invoicing Detailed Technical GuidelinesDocument79 pagesE-Invoicing Detailed Technical GuidelinesRCENo ratings yet

- Mar2021 to Jul 2021 (1132)_240614_164517Document4 pagesMar2021 to Jul 2021 (1132)_240614_164517samgeorgemaxNo ratings yet

- Chapter 2 Charge of TaxDocument6 pagesChapter 2 Charge of Taxkatta sumanthNo ratings yet

- FS - InRetail Consumer - 2020Document124 pagesFS - InRetail Consumer - 2020joseacasieteuwuNo ratings yet

- GST Ready Reckoner 2020 - 10062020Document240 pagesGST Ready Reckoner 2020 - 10062020P S AmritNo ratings yet

- Bill of Quantities - SummaryDocument2 pagesBill of Quantities - SummaryPrasenjit DeyNo ratings yet

- 47 Council Meeting FinalDocument38 pages47 Council Meeting FinalAbhishek PareekNo ratings yet

- Kptlfinal 191218100809Document29 pagesKptlfinal 191218100809Manisha PatelNo ratings yet

- Revised Liability - E&T - by - June - 070721Document69 pagesRevised Liability - E&T - by - June - 070721sanjuNo ratings yet

- Bs SML Isuzu q4 2023-24Document8 pagesBs SML Isuzu q4 2023-24Bithal PrasadNo ratings yet

- Chapter 1 Introduction of GSTDocument4 pagesChapter 1 Introduction of GSTjhjhNo ratings yet

- Why WhyDocument12 pagesWhy WhySANJEEV KUMARNo ratings yet

- CA Final 40 Days Revision Program For DT IDTDocument5 pagesCA Final 40 Days Revision Program For DT IDTMala M PrasannaNo ratings yet

- Electricity Company Accounts: Solutions To Assignment ProblemsDocument3 pagesElectricity Company Accounts: Solutions To Assignment ProblemsHemmu sahuNo ratings yet

- RoadDocument11 pagesRoadShafiek IsmailNo ratings yet

- PSPM MODEL 3 AA015/ KMM Session 2019/2020Document7 pagesPSPM MODEL 3 AA015/ KMM Session 2019/2020syahmiafndiNo ratings yet

- Sub Contractor Interim Payment CertificateDocument7 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Inspection Report of Mumbai South GSTDocument105 pagesInspection Report of Mumbai South GSTAvnish KumarNo ratings yet

- Final - Civil Cost WSA (Positive) (LASA)Document165 pagesFinal - Civil Cost WSA (Positive) (LASA)Pankaj SinghNo ratings yet

- Budget Slides - For The FY 22-23Document3 pagesBudget Slides - For The FY 22-23hatc marineNo ratings yet

- FactBookQ12023 VFDocument26 pagesFactBookQ12023 VFprateekpd92sgNo ratings yet

- Dombivali MIDC DTP 2nd CallDocument177 pagesDombivali MIDC DTP 2nd Calldivya jhamtaniNo ratings yet

- Forms For Different Registers and Their Authority (Para Nos)Document4 pagesForms For Different Registers and Their Authority (Para Nos)Vicky Srivastava100% (1)

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- GeneralestpdfviewDocument6 pagesGeneralestpdfviewAsst. Exe. Engr ElamdesomNo ratings yet

- Biil of Quantity (Boq)Document1 pageBiil of Quantity (Boq)ccalosa29No ratings yet

- TenderDocument135 pagesTenderElectrical RadicalNo ratings yet

- 3010182428unit Run Canteen (Urc) Manual PDFDocument206 pages3010182428unit Run Canteen (Urc) Manual PDFShyam Prabhu50% (2)

- New Administrative Building, 1 Floor, A Wing, 16 Greams Road, Chennai - 600006Document12 pagesNew Administrative Building, 1 Floor, A Wing, 16 Greams Road, Chennai - 600006Vinoth Kumar SNo ratings yet

- Ayirakulam and Puliyoor KulamDocument1 pageAyirakulam and Puliyoor KulamnaseebNo ratings yet

- GAOC Option 2Document2 pagesGAOC Option 2Amit PhadatareNo ratings yet

- INDIGO - Investor Presentation - 03-Aug-22 - TickertapeDocument17 pagesINDIGO - Investor Presentation - 03-Aug-22 - TickertapeDot EduNo ratings yet

- Rate Anlysis Drill JumboDocument1 pageRate Anlysis Drill Jumboshubhamtandon01No ratings yet

- BOQ Summary Wardha Arvi (EPC)Document1 pageBOQ Summary Wardha Arvi (EPC)Irfan BiradarNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SCR 202205202021621 28 SCRRPT'Document10 pagesSCR 202205202021621 28 SCRRPT'dhaneshNo ratings yet

- Epl SCT L 0262Document4 pagesEpl SCT L 0262Khan ShahrukhNo ratings yet

- 5G System Design: Architectural and Functional Considerations and Long Term ResearchFrom Everand5G System Design: Architectural and Functional Considerations and Long Term ResearchNo ratings yet

- Propertytax ChecklistDocument1 pagePropertytax ChecklistContinental InfrastructureNo ratings yet

- RTP Cap III Gr-I Dec 2022Document105 pagesRTP Cap III Gr-I Dec 2022मदन कुमार बिस्टNo ratings yet

- Gst-Challan Doctel Jan 2019Document2 pagesGst-Challan Doctel Jan 2019aapka.kapil3758No ratings yet

- Untitled 1Document1,318 pagesUntitled 1Dence Cris RondonNo ratings yet

- Starbuck PPT by Pershing SquareDocument44 pagesStarbuck PPT by Pershing SquareJainam VoraNo ratings yet

- GRP 2 - Digests 2nd ExamDocument28 pagesGRP 2 - Digests 2nd ExamRemus CalicdanNo ratings yet

- Dann Corporation Working Balance Sheet Decemeber 31, 2016Document12 pagesDann Corporation Working Balance Sheet Decemeber 31, 2016Ne BzNo ratings yet

- Fire Code and Assessment and CollectionDocument57 pagesFire Code and Assessment and CollectionWarperlito AndoNo ratings yet

- Description U/S Percentage RemarkDocument7 pagesDescription U/S Percentage Remarkshakhawat HossainNo ratings yet

- NZ Tax IndividualDocument60 pagesNZ Tax IndividualSusana SembranoNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument2 pagesIncome Statement - Annual - As Originally ReportedHoàng HuếNo ratings yet

- Course Details of 'Corporate Tax Computation and Return Filing - A Practical Approach'Document3 pagesCourse Details of 'Corporate Tax Computation and Return Filing - A Practical Approach'Md. MohimanNo ratings yet

- Print 2Document2 pagesPrint 2SwagBeast SKJJNo ratings yet

- PHD Thesis TaxationDocument7 pagesPHD Thesis Taxationafknwride100% (1)

- Alabama Motor Vehicle Bill of Sale: The Parties. JUAN DAVID TRUJILLO FRANCO With A Mailing AddressDocument3 pagesAlabama Motor Vehicle Bill of Sale: The Parties. JUAN DAVID TRUJILLO FRANCO With A Mailing AddressJuan TrujilloNo ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- Detailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateDocument27 pagesDetailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateAnkit SainiNo ratings yet

- Responsibility of Fiscal Policy UPDATEDDocument24 pagesResponsibility of Fiscal Policy UPDATEDFiona RamiNo ratings yet

- Trimmer - Invoice PDFDocument1 pageTrimmer - Invoice PDFsai krishna krishna shasthrulaNo ratings yet

- Summer Internship ReportDocument29 pagesSummer Internship ReportVeshesh SrivastavaNo ratings yet

- Edited SAP MCQsDocument7 pagesEdited SAP MCQssajidaliraza163No ratings yet

- 3 Revision Summary of Income TaxDocument22 pages3 Revision Summary of Income TaxJitendra VernekarNo ratings yet

- RubricDocument3 pagesRubricapi-356375185No ratings yet

- Mahindra and MahindraDocument18 pagesMahindra and Mahindravenkataswamynath channa100% (1)

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27No ratings yet