Professional Documents

Culture Documents

Comparison of IPR, PPP & IFE Theories

Comparison of IPR, PPP & IFE Theories

Uploaded by

Technical networkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison of IPR, PPP & IFE Theories

Comparison of IPR, PPP & IFE Theories

Uploaded by

Technical networkCopyright:

Available Formats

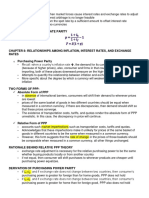

Comparison of IPR, PPP and IFE Theories

Theory Key Variables of Theory Summary of Theory

Interest Rate Forward rate premium Interest The forward rate of one currency

Party (IRP) (or Discount differential with respect to another will

contain a premium (or discount)

that is determined by the

differential in interest rates

between the two countries. As a

result, covered interest arbitrage

will provide a return that is no

higher than a domestic return.

Purchasing Percentage change in Inflation rate The spot rate of one currency with

Power spot exchange rate differential respect to another will change in

Parity (PPP) reaction to the differential in

inflation rates between the two

countries. Consequently, the

purchasing power for consumers

when purchasing goods in their

own country will be similar to

their purchasing power when

importing goods from the foreign

country.

International Percentage Interest rate The spot rate of one currency with

Fisher change in spot differential respect to another will change in

Effect (IFE) exchange rate accordance with the differential in

interest rates between the two

countries Consequently, the return

on uncovered foreign money

market securities will, on an

average, be no higher than the

return on domestic money market

securities from the perspective of

investors in the

home country.

You might also like

- Risk ManagementDocument12 pagesRisk ManagementAhmed RazaNo ratings yet

- Let Export Copy: Indian Customs Edi SystemDocument6 pagesLet Export Copy: Indian Customs Edi Systemsanjiiva8531No ratings yet

- 67847bos54415-Cp9 (1) ExportDocument1 page67847bos54415-Cp9 (1) ExportreadorplaydigitalNo ratings yet

- Theories of Exchange RateDocument11 pagesTheories of Exchange RateNiharika Satyadev Jaiswal100% (1)

- Fishers EffectDocument14 pagesFishers EffectKiran NayakNo ratings yet

- Adinda Salma Nadhira - 2010532019 - Mind MapDocument2 pagesAdinda Salma Nadhira - 2010532019 - Mind MapadindaNo ratings yet

- IRP PPP IFE - PDF Version 1Document1 pageIRP PPP IFE - PDF Version 1সাবরিন সুলতানাNo ratings yet

- FINALS - Global FinDocument11 pagesFINALS - Global Fincara0925100% (1)

- Locational Arbitrage:: Rabea Rashed Mansoor - 20311562Document2 pagesLocational Arbitrage:: Rabea Rashed Mansoor - 20311562Rabea Rashed Al SabahiNo ratings yet

- Theories of Foreign Exchange Rate Movement and International Parity ConditionsDocument10 pagesTheories of Foreign Exchange Rate Movement and International Parity ConditionsSaravanakrishnan VNo ratings yet

- IFM - Lecture 2.9 - IRP-PPP-IFE - IFE TheoryDocument23 pagesIFM - Lecture 2.9 - IRP-PPP-IFE - IFE TheoryKancherla Bhaskara RaoNo ratings yet

- 25444sm SFM Finalnewvol2 cp12Document72 pages25444sm SFM Finalnewvol2 cp12h.b. akshayaNo ratings yet

- International Financial ManagementDocument29 pagesInternational Financial ManagementVikrant SinghNo ratings yet

- Guía Comercialización Week 9Document2 pagesGuía Comercialización Week 9fermoto20No ratings yet

- Chapter 3 Foreign Exchange and Its SignificanceDocument16 pagesChapter 3 Foreign Exchange and Its SignificanceRach BNo ratings yet

- Group 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGDocument37 pagesGroup 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGadindaNo ratings yet

- Lesson 4 - c8Document32 pagesLesson 4 - c8TRANG LÊ THỊ HẠNHNo ratings yet

- Chapte R: International Financial ManagementDocument24 pagesChapte R: International Financial ManagementNiket GuptaNo ratings yet

- ITSLecture 20Document28 pagesITSLecture 20Shivam KumarNo ratings yet

- AhmedDocument17 pagesAhmedmoizmeingNo ratings yet

- International Economics Second Mid TermDocument3 pagesInternational Economics Second Mid TermLili MártaNo ratings yet

- Finance Exam 2 Cheat Sheet: by ViaDocument2 pagesFinance Exam 2 Cheat Sheet: by ViaKimondo KingNo ratings yet

- ABC - Foreign Currency TransactionsDocument5 pagesABC - Foreign Currency TransactionsSailah PatakNo ratings yet

- Foreign Exchange Markets: Parvesh AghiDocument49 pagesForeign Exchange Markets: Parvesh AghiParvesh AghiNo ratings yet

- Purchase Power Parity PrintDocument5 pagesPurchase Power Parity PrintTejaliNo ratings yet

- 3 & 4. Foreign Exchange Market and Management of Foreign Exchange RiskDocument56 pages3 & 4. Foreign Exchange Market and Management of Foreign Exchange RiskPanashe MachekepfuNo ratings yet

- International Arbitrage and Interest Rate ParityDocument20 pagesInternational Arbitrage and Interest Rate Parityjahirul munnaNo ratings yet

- Group G IFM PrnstationDocument12 pagesGroup G IFM PrnstationMaryamNo ratings yet

- DocDocument8 pagesDocAhmad RahhalNo ratings yet

- Spot and ForwardDocument11 pagesSpot and ForwardKajal ChaudharyNo ratings yet

- Chapter 14 Short-Term FinancingDocument8 pagesChapter 14 Short-Term FinancingharistheguideNo ratings yet

- FOREX MARKETS Part 3Document31 pagesFOREX MARKETS Part 3Parvesh AghiNo ratings yet

- Midterm FM ReviewerDocument11 pagesMidterm FM ReviewerKristine MartinezNo ratings yet

- Int. Parity ConditionDocument27 pagesInt. Parity Condition杜易航No ratings yet

- Balance of Payment 1Document8 pagesBalance of Payment 1Wanjiku MathuNo ratings yet

- International Financial Management::parity ConditionsDocument47 pagesInternational Financial Management::parity ConditionsABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- Exchange Rate: Outline of DiscussionDocument3 pagesExchange Rate: Outline of DiscussionRiubenNo ratings yet

- (SM) Financial Instruments Unit 5Document15 pages(SM) Financial Instruments Unit 5Mayank GoyalNo ratings yet

- Chapter 08Document38 pagesChapter 08vytpk123No ratings yet

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDocument12 pages(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueMert Can GencNo ratings yet

- BFD Forex & HedgingDocument7 pagesBFD Forex & HedgingAbdul RaufNo ratings yet

- CH 07 - International Arbitrage and IRPDocument31 pagesCH 07 - International Arbitrage and IRPRim RimNo ratings yet

- Parity Theories: Hemchand JDocument20 pagesParity Theories: Hemchand JPrem shuklaNo ratings yet

- 3 Parity ConditionsDocument47 pages3 Parity ConditionsSarthak SharmaNo ratings yet

- Consolidated Products EbrochureDocument64 pagesConsolidated Products EbrochureVincentNo ratings yet

- Assignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)Document6 pagesAssignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)doraemonNo ratings yet

- Foreign Exchange MarketDocument12 pagesForeign Exchange MarketJoksmer MajorNo ratings yet

- Parity RelationshipDocument11 pagesParity Relationshipkenedy simwingaNo ratings yet

- Exchange Rates and The Foreign Exchange MarketDocument19 pagesExchange Rates and The Foreign Exchange MarketSyeda Uzma TauqirNo ratings yet

- Financial Markets Chapter 2 - NotesDocument3 pagesFinancial Markets Chapter 2 - Notesgojo satoruNo ratings yet

- Material Temas 3 y 4 - Tipo de Cambio y Paridad Poder de CompraDocument27 pagesMaterial Temas 3 y 4 - Tipo de Cambio y Paridad Poder de CompraReynerio VilledaNo ratings yet

- Interest Rate ParityDocument3 pagesInterest Rate ParityJayesh DessaiNo ratings yet

- Role of Exchange Rate Markets in An EconomyDocument14 pagesRole of Exchange Rate Markets in An EconomyGohar KhalidNo ratings yet

- Chapter 7 - International Parity Conditions - BlackboardDocument33 pagesChapter 7 - International Parity Conditions - BlackboardCarlosNo ratings yet

- Bond Valuation: by Sarah M. Balisacan, CPADocument13 pagesBond Valuation: by Sarah M. Balisacan, CPAChristine CabonegroNo ratings yet

- 67847bos54415-Cp9 (1) ExportDocument1 page67847bos54415-Cp9 (1) ExportreadorplaydigitalNo ratings yet

- Interest Rate Parity PresentationDocument31 pagesInterest Rate Parity Presentationviki12334No ratings yet

- International Parity ConditionsDocument35 pagesInternational Parity ConditionsRashique Ul LatifNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Tuton Tugas 2 Bahasa Inggris NiagaDocument1 pageTuton Tugas 2 Bahasa Inggris NiagaR RifaiNo ratings yet

- Travel Expense Report1Document1 pageTravel Expense Report1Văn Hoàng PhongNo ratings yet

- 8 Ways World Trade Organization Membership Will Benefit Afghanistan - ChemonicsDocument7 pages8 Ways World Trade Organization Membership Will Benefit Afghanistan - ChemonicsZekria Noori AfghanNo ratings yet

- Selected Questions Chapter 25Document10 pagesSelected Questions Chapter 25Pranta SahaNo ratings yet

- Homework A Chapters 1 ToDocument36 pagesHomework A Chapters 1 TosebasNo ratings yet

- Multinational Finance Solutions Chapter 1Document3 pagesMultinational Finance Solutions Chapter 1fifi_yaoNo ratings yet

- Chapter 7Document26 pagesChapter 7الزنبقة السوداءNo ratings yet

- IGCSE Business Studies Note Chapter 25Document3 pagesIGCSE Business Studies Note Chapter 25emonimtiazNo ratings yet

- Foreign Trade Policy 2009-14: Agneshwar Sen JT - DGFT KolkataDocument28 pagesForeign Trade Policy 2009-14: Agneshwar Sen JT - DGFT KolkatandipdubeyNo ratings yet

- WE - 12 - Exchange Rates and FX MarketsDocument23 pagesWE - 12 - Exchange Rates and FX MarketsKholoud KhaledNo ratings yet

- Lecture 07.WTO - Cross National Cooperationa and AgreementsDocument42 pagesLecture 07.WTO - Cross National Cooperationa and AgreementsBorn HyperNo ratings yet

- BopmDocument9 pagesBopmAreej AslamNo ratings yet

- Chapter 3 - International TradeDocument70 pagesChapter 3 - International TradeHay JirenyaaNo ratings yet

- ASEAN INTEGRATION: Challenges, Implications: Gilberto LlantoDocument19 pagesASEAN INTEGRATION: Challenges, Implications: Gilberto LlantoDeanne GuintoNo ratings yet

- Europe Euro Euro Euro: Different Countries Currencies Country by Continent Currency Name Currency CodeDocument5 pagesEurope Euro Euro Euro: Different Countries Currencies Country by Continent Currency Name Currency Codethejasdk100% (2)

- Smart Trade Abg Din by Ahmadulhadi VER 2Document124 pagesSmart Trade Abg Din by Ahmadulhadi VER 2Joewayder Upat100% (3)

- Why Economic Partnership Agreements Undermines Africa S Regional Integration PDFDocument6 pagesWhy Economic Partnership Agreements Undermines Africa S Regional Integration PDFj.assokoNo ratings yet

- FIN323 - Chapter 1Document12 pagesFIN323 - Chapter 1syahiir syauqiiNo ratings yet

- Tutorial 2 International FinanceDocument2 pagesTutorial 2 International FinanceEmad Uddin ShahidNo ratings yet

- Muayad Hussein Abdulsalam Mohammed AlhetariDocument2 pagesMuayad Hussein Abdulsalam Mohammed AlhetariMuayad Hussein Abdulsalam Mohammed Al HetariNo ratings yet

- TT TTTDocument19 pagesTT TTTdevanNo ratings yet

- CurrencyDocument3 pagesCurrencySarthak ShrivastavaNo ratings yet

- Imports and ExportsDocument8 pagesImports and Exportssuresh yadavNo ratings yet

- Fixed and Flexible Exchange Rate SystemsDocument11 pagesFixed and Flexible Exchange Rate SystemsAliciaNo ratings yet

- Comprehensive Economic Cooperation Agreement India MalaysiaDocument8 pagesComprehensive Economic Cooperation Agreement India MalaysiarahmatillaNo ratings yet

- Guide To Profitable Forex TradingDocument75 pagesGuide To Profitable Forex TradingDenys ShyshkinNo ratings yet

- Multi-Currency Iban Account. Pre-Paid Cards. FXDocument9 pagesMulti-Currency Iban Account. Pre-Paid Cards. FXNaoifle WACHEN IDRISSINo ratings yet

- International Trade & Finance Assignment Anti-Dumping AgreementDocument10 pagesInternational Trade & Finance Assignment Anti-Dumping AgreementShimran ZamanNo ratings yet

- BBFN3323 Mid-TermDocument13 pagesBBFN3323 Mid-TermLIM JEI XEE BACC18B-1No ratings yet