Professional Documents

Culture Documents

Transaction Statement1700677173

Transaction Statement1700677173

Uploaded by

Madhav LungareCopyright:

Available Formats

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- Transaction Statement1703726923Document2 pagesTransaction Statement1703726923dipuhansda6300No ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Welcome To Central Record Keeping AgencyDocument2 pagesWelcome To Central Record Keeping AgencyAbhishek SenguptaNo ratings yet

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- Transaction Statement1656568636Document2 pagesTransaction Statement1656568636Gulzar Ali QadriNo ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- Transaction Statement1673011931Document1 pageTransaction Statement1673011931SAMIR KUMARNo ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- EPF ECR Sep 19Document119 pagesEPF ECR Sep 19kushalthareja7777No ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- JajulabandaDocument1 pageJajulabandab9042192No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Jajulabanda FTODocument1 pageJajulabanda FTOb9042192No ratings yet

- Central Recordkeeping AgencyDocument11 pagesCentral Recordkeeping AgencyRudra GourNo ratings yet

- Accounting Forms October To December 2023Document7 pagesAccounting Forms October To December 2023Lorna MamaweNo ratings yet

- Master DataDocument2 pagesMaster Datarajubhai.kabcoNo ratings yet

- ST22 231660Document2 pagesST22 231660Spandan Kumar DasNo ratings yet

- Statement of Account For The PeriodDocument1 pageStatement of Account For The PeriodBiswa Ranjan NayakNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Unpaid and Unclaimed Dividend 2015-16Document43 pagesUnpaid and Unclaimed Dividend 2015-16mritunjay.kumarNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document2 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)SOMIL DHOKENo ratings yet

- Epf Ecr Oct-19 PDFDocument2 pagesEpf Ecr Oct-19 PDFSOMIL DHOKENo ratings yet

- 2023t1allDocument5 pages2023t1allsriharisreeramNo ratings yet

- ST22 231572Document1 pageST22 231572Spandan Kumar DasNo ratings yet

- 2024 01 30 10 52 09dec 23 - 411016Document11 pages2024 01 30 10 52 09dec 23 - 411016balalntecc1968No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- Jan - 18 - Staff SalaryDocument21 pagesJan - 18 - Staff Salarym.kannaiyanNo ratings yet

- Epf Ecr Nov-19 PDFDocument2 pagesEpf Ecr Nov-19 PDFSOMIL DHOKENo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- Ayan Sharma Gas BillDocument1 pageAyan Sharma Gas BillRahul ShuklaNo ratings yet

- Ajit BhartiDocument1 pageAjit BhartiNirajThakurNo ratings yet

- LDLDH0010628000 39900763 1578904821430 2020011351021430501Document70 pagesLDLDH0010628000 39900763 1578904821430 2020011351021430501vishalNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- Invoice #227634: PT. Cloud Hosting IndonesiaDocument1 pageInvoice #227634: PT. Cloud Hosting IndonesianonoNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- Apr-21 560008Document7 pagesApr-21 5600086fm9bnjtr5No ratings yet

- वववगवगDocument7 pagesवववगवगDeva RathodNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- ST22 231407Document2 pagesST22 231407Spandan Kumar DasNo ratings yet

- Runaya Refining LLP: Wor KsDocument2 pagesRunaya Refining LLP: Wor KsDeepak MallikNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Venkatesh HaNo ratings yet

- Unclaimed Dividend FY2009 10Document185 pagesUnclaimed Dividend FY2009 10harsh bangurNo ratings yet

- Foreign Income t1135Document6 pagesForeign Income t1135api-457375876No ratings yet

- The Pragmatic FrameworkDocument1 pageThe Pragmatic FrameworkZNo ratings yet

- The Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityDocument15 pagesThe Efficiency of Financial Ratios Analysis To Evaluate Company'S Profitabilityfaizal1229No ratings yet

- IIN0341 - Mapeo de Procesos 3Document12 pagesIIN0341 - Mapeo de Procesos 3Cristhian Javier100% (1)

- Topic 3 - A191 - The Recording ProcessDocument30 pagesTopic 3 - A191 - The Recording ProcessCarmenn LouNo ratings yet

- William Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageDocument1 pageWilliam Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageNokowire TVNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgageLab LeeNo ratings yet

- COC - Annual Report Template - July 2019Document36 pagesCOC - Annual Report Template - July 2019Gabriel BuzziNo ratings yet

- Biological Assets - NotesDocument1 pageBiological Assets - NotesJessel Ann MontecilloNo ratings yet

- Spandana Sphoorty Financial PDFDocument4 pagesSpandana Sphoorty Financial PDFdarshanmadeNo ratings yet

- Settlement Agreement (30 04 10) - FinalDocument45 pagesSettlement Agreement (30 04 10) - FinalShida RejabNo ratings yet

- PriyaDocument2 pagesPriyaPriya Sangharsh NavadaNo ratings yet

- Agriculture Fruit Farm Business PlanDocument25 pagesAgriculture Fruit Farm Business PlanRakib_234No ratings yet

- Asset Based LendingDocument2 pagesAsset Based LendingBarno NicholusNo ratings yet

- Question Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsDocument64 pagesQuestion Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsRISHIKA KHURANA100% (2)

- BLL13 - Types of Negotiable InstrumentsDocument8 pagesBLL13 - Types of Negotiable Instrumentssvm kishoreNo ratings yet

- This Study Resource Was: InvestmentsDocument5 pagesThis Study Resource Was: InvestmentsMs Vampire100% (1)

- Aristotle PG College: Indiabulls Securities LTDDocument15 pagesAristotle PG College: Indiabulls Securities LTDMohmmedKhayyumNo ratings yet

- Proof of Claim: Official Form 410Document4 pagesProof of Claim: Official Form 410ABC Action NewsNo ratings yet

- Principles of Banking: Scheduled & Non-Scheduled BanksDocument3 pagesPrinciples of Banking: Scheduled & Non-Scheduled Bankscitystandard collegeNo ratings yet

- Including Administration ChargesDocument162 pagesIncluding Administration ChargesmayoorNo ratings yet

- Housing Construction Project of Social Interest Quintana Villa Phase and Phase No 2 No 3Document17 pagesHousing Construction Project of Social Interest Quintana Villa Phase and Phase No 2 No 3Luis Enrique Villada GNo ratings yet

- Industry Analysis of Ceat Lt1Document9 pagesIndustry Analysis of Ceat Lt1santosh panditNo ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Nikita Pashine - Investment OpportuinitesDocument44 pagesNikita Pashine - Investment OpportuinitesprashantNo ratings yet

- Bankura Sammilani College: Admission Group - 2020Document1 pageBankura Sammilani College: Admission Group - 2020Parthiva SinhaNo ratings yet

- A Mohammad Ismail CVDocument6 pagesA Mohammad Ismail CVSaber Khan HaidaryNo ratings yet

- AA Accounts Part ADocument4 pagesAA Accounts Part Arajan shukla100% (2)

- Jurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Document19 pagesJurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Hanny Tri MeilindaNo ratings yet

- Chamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesDocument30 pagesChamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesUmarNo ratings yet

Transaction Statement1700677173

Transaction Statement1700677173

Uploaded by

Madhav LungareOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Statement1700677173

Transaction Statement1700677173

Uploaded by

Madhav LungareCopyright:

Available Formats

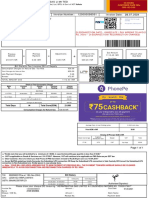

NPS Transaction Statement

01-Apr-2023 to 22-Nov-2023

Statement Generation Date:November 22, 2023 11:49 PM

NPS Transaction Statement-ATAL PENSION YOJANA (APY)

PRAN 500290655999 Registration Date 23-Jul-2020

Subscriber Name SHRI MADHAVMANCHAKRAOLUNGARE PRAN Migration Date Not Applicable

GATE NO 435 BANKARVASTI MOSHIGATE NO 435

BANKARVASTI MOSHI Saving Bank A/C No. 587802010024317

Address PUNE

MAHARASHTRA-412105 APY-SP Bank Reg. no. 7001912

INDIA

APY-SP Bank Name UNION BANK OF INDIA

IRA Status IRA compliant

M-11, 2nd FLOOR, MIDDLE CIRCLECONNAUGHT CIRCUS, NEW

APY-SP Bank Address

Mobile Number 8888983023 DELHI, 110001

APY-SP Bank Branch Reg. No. NPS100180F

Email ID MADHAVLUNGARE9@GMAIL.COM

APY-SP Bank Branch Name ALANDI-UNION BANK OF INDIA

Date Of Birth 07-Sep-1989

APY-SP Bank Branch Address MAE Campus, Alandi, , Pune, 412105

Marital Status Married

Pension Amount Selected 1,000

Spouse Name RSHIKA

Periodicity of Contribution Monthly

Nominee Name RSHIKA MADHAV LUNGARE

Percentage 100%

Summary

The total contribution to your pension account till November 22,2023 was Rs.4,816.00

Value of your Holding (investments) as on November 22,2023 was Rs. 5,253.49

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

18-Apr-2023 By APY Contribution for APRIL 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

11-May-2023 By APY Contribution for MAY 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

16-Jun-2023 By APY Contribution for JUNE 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

14-Jul-2023 By APY Contribution for JULY 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

17-Aug-2023 By APY Contribution for AUGUST 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

14-Sep-2023 By APY Contribution for SEPTEMBER 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

12-Oct-2023 By APY Contribution for OCTOBER 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

15-Nov-2023 By APY Contribution for NOVEMBER 2023 UNION BANK OF INDIA (7001912), 116.00 0.00 116.00

Billing Summary

Perticulars Amount

Summary of Billing during the statement period (17.61)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement

1.The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

2.The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for a

period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory

social security scheme & who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half

yearly basis in a Financial Year once subscriber has made the entire contribution for six months.

3.The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

4.The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank branch.

In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any

discrepancy, you must contact your APY bank branch immediately.

5.Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government

securities and upto 15% will be invested in equity).

6.For transactions with the remarks 'To Unit Redemption', the cost of units redeemed are adjusted against the total contribution in the Investment Details

section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

7."Cost of Withdrawal" is the cost of units for the particular transaction and is calculated on a First-In-First-Out (FIFO) basis. For calculating the

'Returns based on Inflows', the actual redemption value corresponding to the units redeemed has been considered. Further, 'Total Withdrawal' in the

Investment Summary section includes actual redemption value of Withdrawal.

8.The amount shown in the field 'Pension Amount Selected' is the guaranteed pension that will be received (irrespective of present value of your

holding), if you continue to contribute till 60 years of age.

9.Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed

payments. The overdue interest for delayed contributions would be as shown below: Overdue interest for delayed contribution:Rs. 1 per month for contribution for every Rs. 100, or part

Overdue interest

thereof, for each delayed monthly payment. Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest

amount collected will remain as part of the pension corpus of the subscriber.

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- Transaction Statement1703726923Document2 pagesTransaction Statement1703726923dipuhansda6300No ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Welcome To Central Record Keeping AgencyDocument2 pagesWelcome To Central Record Keeping AgencyAbhishek SenguptaNo ratings yet

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- Transaction Statement1656568636Document2 pagesTransaction Statement1656568636Gulzar Ali QadriNo ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- Transaction Statement1673011931Document1 pageTransaction Statement1673011931SAMIR KUMARNo ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- EPF ECR Sep 19Document119 pagesEPF ECR Sep 19kushalthareja7777No ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- JajulabandaDocument1 pageJajulabandab9042192No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Jajulabanda FTODocument1 pageJajulabanda FTOb9042192No ratings yet

- Central Recordkeeping AgencyDocument11 pagesCentral Recordkeeping AgencyRudra GourNo ratings yet

- Accounting Forms October To December 2023Document7 pagesAccounting Forms October To December 2023Lorna MamaweNo ratings yet

- Master DataDocument2 pagesMaster Datarajubhai.kabcoNo ratings yet

- ST22 231660Document2 pagesST22 231660Spandan Kumar DasNo ratings yet

- Statement of Account For The PeriodDocument1 pageStatement of Account For The PeriodBiswa Ranjan NayakNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Unpaid and Unclaimed Dividend 2015-16Document43 pagesUnpaid and Unclaimed Dividend 2015-16mritunjay.kumarNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document2 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)SOMIL DHOKENo ratings yet

- Epf Ecr Oct-19 PDFDocument2 pagesEpf Ecr Oct-19 PDFSOMIL DHOKENo ratings yet

- 2023t1allDocument5 pages2023t1allsriharisreeramNo ratings yet

- ST22 231572Document1 pageST22 231572Spandan Kumar DasNo ratings yet

- 2024 01 30 10 52 09dec 23 - 411016Document11 pages2024 01 30 10 52 09dec 23 - 411016balalntecc1968No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- Jan - 18 - Staff SalaryDocument21 pagesJan - 18 - Staff Salarym.kannaiyanNo ratings yet

- Epf Ecr Nov-19 PDFDocument2 pagesEpf Ecr Nov-19 PDFSOMIL DHOKENo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- Ayan Sharma Gas BillDocument1 pageAyan Sharma Gas BillRahul ShuklaNo ratings yet

- Ajit BhartiDocument1 pageAjit BhartiNirajThakurNo ratings yet

- LDLDH0010628000 39900763 1578904821430 2020011351021430501Document70 pagesLDLDH0010628000 39900763 1578904821430 2020011351021430501vishalNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- Invoice #227634: PT. Cloud Hosting IndonesiaDocument1 pageInvoice #227634: PT. Cloud Hosting IndonesianonoNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- Apr-21 560008Document7 pagesApr-21 5600086fm9bnjtr5No ratings yet

- वववगवगDocument7 pagesवववगवगDeva RathodNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- ST22 231407Document2 pagesST22 231407Spandan Kumar DasNo ratings yet

- Runaya Refining LLP: Wor KsDocument2 pagesRunaya Refining LLP: Wor KsDeepak MallikNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Venkatesh HaNo ratings yet

- Unclaimed Dividend FY2009 10Document185 pagesUnclaimed Dividend FY2009 10harsh bangurNo ratings yet

- Foreign Income t1135Document6 pagesForeign Income t1135api-457375876No ratings yet

- The Pragmatic FrameworkDocument1 pageThe Pragmatic FrameworkZNo ratings yet

- The Efficiency of Financial Ratios Analysis To Evaluate Company'S ProfitabilityDocument15 pagesThe Efficiency of Financial Ratios Analysis To Evaluate Company'S Profitabilityfaizal1229No ratings yet

- IIN0341 - Mapeo de Procesos 3Document12 pagesIIN0341 - Mapeo de Procesos 3Cristhian Javier100% (1)

- Topic 3 - A191 - The Recording ProcessDocument30 pagesTopic 3 - A191 - The Recording ProcessCarmenn LouNo ratings yet

- William Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageDocument1 pageWilliam Carroll - JAFP 1.8 Paycheck Calculations Student Activity PageNokowire TVNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgageLab LeeNo ratings yet

- COC - Annual Report Template - July 2019Document36 pagesCOC - Annual Report Template - July 2019Gabriel BuzziNo ratings yet

- Biological Assets - NotesDocument1 pageBiological Assets - NotesJessel Ann MontecilloNo ratings yet

- Spandana Sphoorty Financial PDFDocument4 pagesSpandana Sphoorty Financial PDFdarshanmadeNo ratings yet

- Settlement Agreement (30 04 10) - FinalDocument45 pagesSettlement Agreement (30 04 10) - FinalShida RejabNo ratings yet

- PriyaDocument2 pagesPriyaPriya Sangharsh NavadaNo ratings yet

- Agriculture Fruit Farm Business PlanDocument25 pagesAgriculture Fruit Farm Business PlanRakib_234No ratings yet

- Asset Based LendingDocument2 pagesAsset Based LendingBarno NicholusNo ratings yet

- Question Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsDocument64 pagesQuestion Bank of Multiple-Choice Questions 2021-22 Class Xii EconomicsRISHIKA KHURANA100% (2)

- BLL13 - Types of Negotiable InstrumentsDocument8 pagesBLL13 - Types of Negotiable Instrumentssvm kishoreNo ratings yet

- This Study Resource Was: InvestmentsDocument5 pagesThis Study Resource Was: InvestmentsMs Vampire100% (1)

- Aristotle PG College: Indiabulls Securities LTDDocument15 pagesAristotle PG College: Indiabulls Securities LTDMohmmedKhayyumNo ratings yet

- Proof of Claim: Official Form 410Document4 pagesProof of Claim: Official Form 410ABC Action NewsNo ratings yet

- Principles of Banking: Scheduled & Non-Scheduled BanksDocument3 pagesPrinciples of Banking: Scheduled & Non-Scheduled Bankscitystandard collegeNo ratings yet

- Including Administration ChargesDocument162 pagesIncluding Administration ChargesmayoorNo ratings yet

- Housing Construction Project of Social Interest Quintana Villa Phase and Phase No 2 No 3Document17 pagesHousing Construction Project of Social Interest Quintana Villa Phase and Phase No 2 No 3Luis Enrique Villada GNo ratings yet

- Industry Analysis of Ceat Lt1Document9 pagesIndustry Analysis of Ceat Lt1santosh panditNo ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Nikita Pashine - Investment OpportuinitesDocument44 pagesNikita Pashine - Investment OpportuinitesprashantNo ratings yet

- Bankura Sammilani College: Admission Group - 2020Document1 pageBankura Sammilani College: Admission Group - 2020Parthiva SinhaNo ratings yet

- A Mohammad Ismail CVDocument6 pagesA Mohammad Ismail CVSaber Khan HaidaryNo ratings yet

- AA Accounts Part ADocument4 pagesAA Accounts Part Arajan shukla100% (2)

- Jurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Document19 pagesJurnal Riset Sains Manajemen: Volume 3, Nomor 1, 2019Hanny Tri MeilindaNo ratings yet

- Chamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesDocument30 pagesChamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesUmarNo ratings yet