Professional Documents

Culture Documents

Att 1

Att 1

Uploaded by

andynashOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Att 1

Att 1

Uploaded by

andynashCopyright:

Available Formats

The Insolvency Service

Redundancy Payments Service

www.gov.uk/insolvency-service/

redundancy-payments

Mr Andrew Nash

andynash@nmcltd.co.uk

Your ref: LN10309894 - Please quote this in any reply

Date: 10 June 2023

Dear Mr Andrew Nash,

Applying for compensation for loss of notice

You recently applied to the Insolvency Service for money you were owed by your

former employer, NASH MANAGEMENT CONSULTANCY LTD.

When you filled in your application, you told us you wanted to claim compensation

for loss of notice pay (also called payment in lieu of notice).

You can now claim for loss of notice pay.

We cannot pay you compensation for loss of notice pay until you complete this

application.

It's a separate application to the 'Claim for redundancy and other money you're

owed' application that you completed before.

Completing your online claim

We have guidance online about how to claim for loss of notice pay.

Completing an application takes between 10 and 20 minutes. When you start your

application, we’ll ask you for your:

● National Insurance number

● Ten-character claim reference - LN10309894

We’ll also ask you about your circumstances during your notice period. You’ll need

to provide information about:

● any benefits you were entitled to during your notice period

● any income you earned during your notice period

02 - Claim for Notice Pay

Your notice period ran from 18 March 2023 to 9 June 2023.

Information about how notice periods are calculated can be found on GOV.UK.

Processing your application

We expect to make your payment within 6 weeks of receiving your completed

application.

Please do not contact us to check the status of your application until after the 6

weeks have passed.

This will help us deal with everyone's application as quickly as possible.

What we can pay

If your application is successful, we can pay you for each week of your notice

period. Find out more about what we can pay you and the deductions we make on

GOV.UK.

From your payment we deduct:

● tax at the standard rate of 20%

● National Insurance at the standard rate of 12% (if you were made redundant

after 6 April 2018)

● new income-related benefits you were awarded during your notice period

● new income you earned during your notice period

● benefits you could have been awarded during your notice period even if you did

not apply for them (for example Jobseeker’s Allowance or Universal Credit)

If we pay your claim, we'll send you a letter explaining what we've paid you and

any deductions we have made. If we cannot make you a payment, we'll send you a

letter explaining why.

If you cannot complete your claim

If you get an error that states your claim details do not match, email us for further

assistance. We will check your claim details for you.

In the body of your email please include your:

● claim reference number (begins LN)

● National Insurance number

● date of birth

Please make sure you email us from the address you provided in your 'Claim for

redundancy and other money you're owed' application.

You might also like

- Nationstar 122016Document6 pagesNationstar 122016kathy bechtleNo ratings yet

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (2)

- F 9465Document3 pagesF 9465Pat PlanteNo ratings yet

- Your Finance Agreement Arranged Through Right PDFDocument12 pagesYour Finance Agreement Arranged Through Right PDFSchipor Danny MagdaNo ratings yet

- FORBDocument2 pagesFORBjotav11No ratings yet

- Vanquis Credit Card Agreement and Full TermsDocument9 pagesVanquis Credit Card Agreement and Full TermsAnonymous TpBLcskeypNo ratings yet

- PCI - 0000007008 - Nov 2017 - FlexStudentDocument3 pagesPCI - 0000007008 - Nov 2017 - FlexStudentAnonymous uSJazsNo ratings yet

- Direct Debit Form 200010-2259-A4Document2 pagesDirect Debit Form 200010-2259-A4bluffboy55No ratings yet

- SteelfixerDocument15 pagesSteelfixerJohn Albert BaltazarNo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Outcome of Our ReviewDocument1 pageOutcome of Our ReviewEduardo Aguirre ArenasNo ratings yet

- University National Bank ("Bank") Refund Transfer Application and AgreementDocument6 pagesUniversity National Bank ("Bank") Refund Transfer Application and AgreementMètrès Rosie-Rose AimableNo ratings yet

- 5c38-D56e-7566 Provident Compensation Letter 06-04-2022Document5 pages5c38-D56e-7566 Provident Compensation Letter 06-04-2022Ileana Andreea DropNo ratings yet

- Settlement Letter 5798468 2023-01-31Document2 pagesSettlement Letter 5798468 2023-01-31Rajput HareshNo ratings yet

- Acknowledgement of Your Notice of Intent 26 March 2024Document2 pagesAcknowledgement of Your Notice of Intent 26 March 2024olivier lejusNo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- In Rewardscard Most Important Terms and ConditionsDocument4 pagesIn Rewardscard Most Important Terms and ConditionsHichem BarkatiNo ratings yet

- How HMRC Handle Tax Credit OverpaymentsDocument15 pagesHow HMRC Handle Tax Credit OverpaymentsiamchrisliNo ratings yet

- MotorWelcome (SODY14PC01) PDFDocument10 pagesMotorWelcome (SODY14PC01) PDFDimitris ElefsinaNo ratings yet

- Agreement 8400063 PDFDocument2 pagesAgreement 8400063 PDFrussell83No ratings yet

- Ucd367 Le TuanDocument4 pagesUcd367 Le Tuananhtuanle686No ratings yet

- Pass 114232 Mg-DirectdebitDocument2 pagesPass 114232 Mg-DirectdebitJoseph GetachewNo ratings yet

- Agreement 15397696Document2 pagesAgreement 15397696jra87roboNo ratings yet

- Your Direct Debit For Vehicle Tax Has Been Successfully Set Up / RenewedDocument3 pagesYour Direct Debit For Vehicle Tax Has Been Successfully Set Up / RenewedDave AsanteNo ratings yet

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocument4 pagesCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNo ratings yet

- Digismart A4 Iid Rtob Ver 270819Document4 pagesDigismart A4 Iid Rtob Ver 270819Guru PrasadNo ratings yet

- PCC I 20240104Document2 pagesPCC I 20240104gaetanopetiNo ratings yet

- Idfc letterDocument2 pagesIdfc letternagursharief95No ratings yet

- 2022-10-05T11 - 11 - 20 - LoanAgreement - 1123603 3Document9 pages2022-10-05T11 - 11 - 20 - LoanAgreement - 1123603 3Liliana MendozaNo ratings yet

- Benefits InvoiceDocument4 pagesBenefits Invoicesaad.asifhamidNo ratings yet

- Creditcare - Ca Agreement: O/B Finance West IncDocument2 pagesCreditcare - Ca Agreement: O/B Finance West IncRitu Aryan0% (1)

- FedLoanServicing - Direct DepositDocument2 pagesFedLoanServicing - Direct DepositEric Li Cheungtastic100% (1)

- B 1926093Document2 pagesB 1926093damianNo ratings yet

- Bill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Document4 pagesBill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Ashish NaikNo ratings yet

- In Digismart Most Important Terms and ConditionsDocument4 pagesIn Digismart Most Important Terms and Conditionskanagu12No ratings yet

- Curo Canada Corp. ("Cash Money") - and - The Borrower: Payday Loan AgreementDocument6 pagesCuro Canada Corp. ("Cash Money") - and - The Borrower: Payday Loan AgreementJohn SabandoNo ratings yet

- Info: Your Loan Status and Repayment ScheduleDocument3 pagesInfo: Your Loan Status and Repayment ScheduleFrank RoseNo ratings yet

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- VoluntarySurrender HowitWorksDocument4 pagesVoluntarySurrender HowitWorksmkubheka2015No ratings yet

- Loan DocoDocument6 pagesLoan DocopranayusinNo ratings yet

- Umbrella FAQDocument7 pagesUmbrella FAQKusuma NandiniNo ratings yet

- Personal Loan Pre-Approval LetterDocument3 pagesPersonal Loan Pre-Approval LetterJoeLuisAndradeNo ratings yet

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS.)Document5 pagesYour Reliance Communications Bill: Summary of Current Charges Amount (RS.)amritabhosleNo ratings yet

- Acknowledgement Letter Templates #03Document2 pagesAcknowledgement Letter Templates #03Ericka Grace De CastroNo ratings yet

- Agreement 10256805 PDFDocument2 pagesAgreement 10256805 PDF1030sqrpioNo ratings yet

- How Interest Will Be Levied Example OptionDocument2 pagesHow Interest Will Be Levied Example Optionpareen9No ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- Direct Debit Request Service Agreement: DefinitionsDocument5 pagesDirect Debit Request Service Agreement: DefinitionsSujib BarmanNo ratings yet

- UCD367 Habib ShahDocument4 pagesUCD367 Habib Shahnetflix.dumbsNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS.)Document4 pagesYour Reliance Bill: Summary of Current Charges Amount (RS.)Mohd Farman SajidNo ratings yet

- Legal Department Delhi Shashi Bhushan KumarDocument1 pageLegal Department Delhi Shashi Bhushan Kumarshivamraj780840100% (1)

- Early Release of Super - Human ServicesDocument10 pagesEarly Release of Super - Human ServicesOzDamo2No ratings yet

- Bankruptcy NotesDocument6 pagesBankruptcy NotesDhabitah Adriana100% (1)

- CWSInsurancehasExpired t0023919 08292023Document1 pageCWSInsurancehasExpired t0023919 08292023sunikesh shuklaNo ratings yet

- Lnvjwlap 042301674501Document2 pagesLnvjwlap 042301674501pulapa umamaheswara raoNo ratings yet

- Legal Department Delhi Vindeswar PaswanDocument1 pageLegal Department Delhi Vindeswar Paswanshivamraj780840No ratings yet

- Transunion Credit Report User Guide: South AfricaDocument8 pagesTransunion Credit Report User Guide: South Africasonal10No ratings yet

- 5Document10 pages5John C. LewisNo ratings yet

- Offer Letter - Benjamen AtandaDocument13 pagesOffer Letter - Benjamen Atandaadigunaderonke41No ratings yet

- Lahore Smart CityDocument2 pagesLahore Smart CitychatroomvistaNo ratings yet

- Villegas vs. Hiu ChiongDocument8 pagesVillegas vs. Hiu ChiongPatricia SanchezNo ratings yet

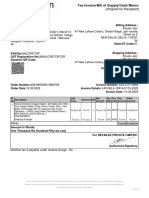

- InvoiceDocument1 pageInvoiceRanjith R (RS)No ratings yet

- Vipin Kumar Senior Software Engineer: Yours Truly, For Mothersonsumi Infotech & Designs LimitedDocument2 pagesVipin Kumar Senior Software Engineer: Yours Truly, For Mothersonsumi Infotech & Designs LimitedVipin MishraNo ratings yet

- MPMDocument18 pagesMPMRaymond Robles DanicoNo ratings yet

- BAAFM P30898 AFR Lecture Slides - TaxationDocument23 pagesBAAFM P30898 AFR Lecture Slides - TaxationGrace TanNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

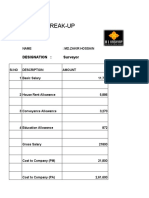

- Salary Break-Up: Designation: SurveyorDocument7 pagesSalary Break-Up: Designation: Surveyorjs_khoar87No ratings yet

- FABM 1 NotesDocument24 pagesFABM 1 Notessam100% (14)

- OBYC v2 15Document131 pagesOBYC v2 15Francisco HerreraNo ratings yet

- Cluster - Rice DSR by Dept of Industries OrissaDocument33 pagesCluster - Rice DSR by Dept of Industries Orissaanyan_666No ratings yet

- SFGHCFDocument2 pagesSFGHCFadsgdtrfNo ratings yet

- Analysis of Financial StatementDocument28 pagesAnalysis of Financial Statementbijay bhandariNo ratings yet

- ABM - FABM11 IIIa 5Document4 pagesABM - FABM11 IIIa 5Kayelle BelinoNo ratings yet

- Kuwait University: Student NameDocument5 pagesKuwait University: Student NameabdalwhabNo ratings yet

- Las Americas ASPIRA v. Christina School District - ComplaintDocument25 pagesLas Americas ASPIRA v. Christina School District - ComplaintKevinOhlandtNo ratings yet

- ChopperDocument1 pageChopperKhushi JainNo ratings yet

- Assessment & AuditDocument24 pagesAssessment & Audit9punitagrawalNo ratings yet

- Itc GSTDocument27 pagesItc GSTShivam GoelNo ratings yet

- Quotation DotZotDocument3 pagesQuotation DotZotGaurav singh BishtNo ratings yet

- Policies and ProceduresDocument23 pagesPolicies and ProceduresMel CowenNo ratings yet

- Lesson 1 - The Nature and Forms of Business OrganizationDocument3 pagesLesson 1 - The Nature and Forms of Business OrganizationJose Emmanuel CalagNo ratings yet

- Private High School Admission Essay ExamplesDocument5 pagesPrivate High School Admission Essay Examplesafibyoabyfffry100% (2)

- General Principles of InterpretationDocument20 pagesGeneral Principles of Interpretationyuili554No ratings yet

- PD 705 As AmendedDocument51 pagesPD 705 As Amendedjun_romeroNo ratings yet

- ITR-3 Indian Income Tax Return: Individual HufDocument45 pagesITR-3 Indian Income Tax Return: Individual HufSyed Faisal AhsanNo ratings yet

- Department of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsDocument20 pagesDepartment of Management Studies BMS Semester 3 Syllabus June 2019 OnwardsAleena Clare ThomasNo ratings yet

- Ebook Concepts in Federal Taxation 2019 26Th Edition Murphy Solutions Manual Full Chapter PDFDocument68 pagesEbook Concepts in Federal Taxation 2019 26Th Edition Murphy Solutions Manual Full Chapter PDFbeckhamquangi9avb100% (14)

- Banking and Finance Practice Test PDFDocument2 pagesBanking and Finance Practice Test PDFVenkata Raman RedrowtuNo ratings yet

- CGI5616P18Document322 pagesCGI5616P18Deepak YadavNo ratings yet