Professional Documents

Culture Documents

Axap App200609183 Email

Axap App200609183 Email

Uploaded by

daikuya21Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axap App200609183 Email

Axap App200609183 Email

Uploaded by

daikuya21Copyright:

Available Formats

Proposal Specially Designed for You

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Age : 1 (Non-smoker)

Hakim

Payor : Mr Mohd Amirul Hakim Bin Abdul Rahim Age : 31 (Non-smoker)

YOUR PLAN(S) AND PREMIUM(S)

PLAN(S) COVER SUM INITIAL REGULAR PREMIUM

UP TO INSURED (MYR)

AGE (MYR)

ANNUAL MONTHLY

- Life 80 80 25,000 160.25 14.02

- Medical Care Plus Rider - Silver 80 - 601.00 52.59

Your Total Initial Premium is 761.25 66.61

Dummy text

Prepared by: NOORUL SAKILA BINTI SAJA KHAN

Agent code: 13132

Tel. No.:

Fax/Email:

Date prepared: 25/06/2020

THE TERMS AND FIGURES SET OUT IN THIS DOCUMENT ARE BY WAY OF ILLUSTRATION ONLY

AND ARE NOT INTENDED TO BE BINDING ON EITHER AXA AFFIN LIFE INSURANCE BERHAD OR

YOU. NEITHER YOU NOR AXA AFFIN LIFE INSURANCE BERHAD IS OBLIGED TO ENTER INTO ANY

CONTRACT ON THE EXACT TERMS SET OUT IN THIS DOCUMENT.

Notes :

• The initial monthly premiums shown above indicate the amounts payable under monthly payment mode and are

provided for Your reference only. All projections of benefits in this proposal are based on annual premiums.

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

TD80N| MEA6|

Page 1 of 10

Life 80

BENEFITS FOR YOU AND YOUR FAMILY

If You pass away

Your family will receive MYR 25,000

YOUR BENEFIT

End of Policy

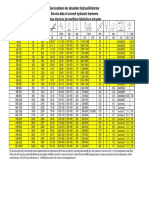

Year Premium Paid Per Year Guaranteed Cash Value

1 160 -

2 160 -

3 160 -

4 160 75

5 160 100

6 160 125

7 160 175

8 160 225

9 160 250

10 160 300

11 160 350

12 160 375

13 160 425

14 160 500

15 160 550

16 160 600

17 160 675

18 160 725

19 160 775

20 160 850

25 160 1,175

30 160 1,650

35 160 2,250

40 160 2,950

45 160 3,750

50 160 4,625

55 160 5,450

60 160 6,225

65 160 6,750

70 160 6,575

75 160 5,200

AGE 50 160 4,450

AGE 55 160 5,300

AGE 60 160 6,075

AGE 65 160 6,700

AGE 70 160 6,700

AGE 75 160 5,250

AGE 80 160 -

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Hakim Date : 25/06/2020

(Non-smoker)

Life 80

PRODUCT NOTES

IMPORTANT

• The information set out below forms part of Your Sales Illustration.

• AXA AFFIN LIFE INSURANCE BERHAD believes it is important that You fully appreciate all the benefits under Your Policy.

• The illustration includes a schedule that shows how the value of Your Policy changes over time.

• You should satisfy Yourself that this plan serves Your needs and that You can afford the premium. If You need clarification, please contact Us or

Your agent.

Plan Description

• Life 80 is a non-participating Regular Premium level term Policy which provides coverage for Death up to age 80.

Premium Paid Per Year

• This is the amount that You pay annually for this Policy.

• The premium payment period is the same as the coverage period. The premium rates are guaranteed throughout the Policy term.

Sum Insured

• This is the amount to be received upon death.

Guaranteed Cash Value

• This is the amount that You will receive if You surrender Your Policy. However, Your Policy may not have a guaranteed minimum cash value on

termination until You have paid premium for four years.

• If You terminate Your Policy in the early years, You may get back less than the amount You have paid in.

Declaration:

I confirm that I have read and understood the information provided in this illustration. My agent has fully explained to me the features

and charges that will be made on this plan.

Applicant's Name : ________________________ Signature : ____________________ Date : ______________

Agent's Name : ________________________ Signature : ____________________ Date : ______________

Prepared by : NOORUL SAKILA BINTI SAJA KHAN Ver 7.14.0 Page 3 of 10

Life 80

SUMMARY OF BENEFITS

Living Benefits: For Yourself

(MYR)

• When the Insured reaches AGE 65

Cash Value of Life 80............................................................................................................. MYR 6,700

• If the Insured requires MEDICAL TREATMENT

Overall Annual Limit ...................................................................................................up to MYR 100,000

(For more details of Your Medical Care Plus Rider, Medical Care Xtra Rider (if any), please refer to the

Product Disclosure Sheet)

Death Benefits: For Your Loved Ones

(MYR)

• If the Insured passes away

Basic Sum Insured of Life 80 ................................................................................................. MYR 25,000

Note

This is a summary only. All the amounts shown in this summary are based on the assumption that no other benefit (if any) has been paid

before. For further information on the basis of the above calculation and the benefit details, please refer to the previous pages for the

relevant plan(s).

THE TERMS AND FIGURES SET OUT IN THIS DOCUMENT ARE BY WAY OF ILLUSTRATION ONLY AND ARE NOT

INTENDED TO BE BINDING ON EITHER AXA AFFIN LIFE INSURANCE BERHAD OR YOU. NEITHER YOU NOR

AXA AFFIN LIFE INSURANCE BERHAD IS OBLIGED TO ENTER INTO ANY CONTRACT ON THE EXACT TERMS

SET OUT IN THIS DOCUMENT.

Note :

• This proposal is an illustration only of the key features of the recommended insurance plans. If Your application is accepted, You

will receive a Policy Contract which will include detailed terms, conditions and exclusions.

• If after purchasing this Policy, You realise that it does not fit Your financial needs, You may cancel Your Policy by returning the

Policy within 15 days from the date of Your receipt of this Policy. The premiums that You have paid (less any medical fee incurred)

will be refunded to You.

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Hakim Date : 25/06/2020

(Non-smoker)

Life 80

PRODUCT DISCLOSURE SHEET

Read this Product Disclosure Sheet and the Proposal Specially Designed For You before You decide to take out this product. Be sure to also

read the general terms and conditions.

1. What is this product about?

This product offers insurance protection up to Age 80. It pays a lump sum death benefit if death occurs during the term of the plan.

2. What is the cover / benefits provided?

This product covers:

• Death - MYR25,000.

Supplementary benefits:

• Medical Care Plus Rider - provides for hospitalisation and surgical expenses up to MYR100,000 annually.

Duration: Premature death or term of the contract: 79 years.

3. How much premium do I have to pay?

The premium that You have to pay and the Policy terms may vary depending on the underwriting requirements of AXA AFFIN Life Insurance Berhad.

• The estimated total premium that You have to pay: MYR66.61 monthly.

• Premium duration: Until Age 80.

• Grace Period: You are given 31 days of grace period after the due date to make Your premium payment.

4. What are the fees, charges and taxes that I have to pay?

Nil.

5. What are some of the key terms and conditions that I should be aware of?

• Importance of disclosure - You must disclose all material facts such as medical condition, and state Your Age correctly.

• Free-look period - You may cancel Your Policy by returning the Policy to Us within 15 days after You have received the Policy. The premiums that

You have paid (less any medical fee incurred) will be refunded to You.

• Implication of switching Policy to another insurer - One of the main disadvantages is if Your current health status is less favourable to the new

insurer, You may be subject to new terms and conditions of the new Policy. You are advised to check with Your insurer before making a final

decision.

Note: This list is non-exhaustive. Please refer to the Policy Contract for the terms and conditions under this Policy.

6. What are the major exclusions under this product?

Your nominee will not receive any money if:

• Death was due to suicide within 1 year from the issue date or any date of reinstatement, whichever is later.

Note: This list is non-exhaustive. Please refer to the Policy Contract for the full list of exclusions under this Policy.

7. Can I cancel my Policy?

You may cancel Your Policy by giving a written notice to AXA AFFIN Life Insurance Berhad. Buying a life Policy is a long-term financial

commitment. If You do not pay Your premiums within the grace period (31 days from the premium payment due date), Your Policy may lapse unless

Your Policy has acquired cash value. The cash value that AXA AFFIN Life Insurance Berhad will pay You when You cancel the Policy before the

maturity period will be much lesser than the total amount of premium that You have paid.

Note: Please refer to non forfeiture provision in the Policy Contract for detail.

8. What do I need to do if there are changes to my contact details?

Please notify Us of any change in Your contact details to ensure that all correspondences reach You in a timely manner.

9. Where can I get further information?

Should You require additional information about life insurance, please refer to the insuranceinfo booklet on 'Life Insurance' available at all Our

branches or You can obtain a copy from Your insurance agent or visit www.insuranceinfo.com.my.

If You have any enquiries, please contact Us at:

AXA AFFIN Life Insurance Berhad

Ground Floor, Chulan Tower

No.3 Jalan Conlay

50450 Kuala Lumpur

Tel: 1 300 88 1616

Fax: 03 2117 6768

E-mail: customer.care@axa-life.com.my

Prepared by : NOORUL SAKILA BINTI SAJA KHAN Ver 7.14.0 Page 5 of 10

Life 80

PRODUCT DISCLOSURE SHEET

10. Other similar types of cover available:

Please ask AXA AFFIN Life Insurance Berhad for other similar types of plans offered.

IMPORTANT NOTE:

BUYING LIFE INSURANCE POLICY IS A LONG-TERM FINANCIAL COMMITMENT. YOU MUST CHOOSE THE TYPE OF POLICY

THAT BEST SUITS YOUR PERSONAL CIRCUMSTANCES. YOU SHOULD READ AND UNDERSTAND THE INSURANCE POLICY AND

DISCUSS WITH THE AGENT OR CONTACT AXA AFFIN LIFE INSURANCE BERHAD DIRECTLY FOR MORE INFORMATION.

This insurance plan is underwritten by AXA AFFIN Life Insurance Berhad 200601003992 (723739-W), a Company licensed under the Financial Services

Act 2013 and regulated by Bank Negara Malaysia.

The information provided in this disclosure sheet is valid as at 25/06/2020.

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Hakim Date : 25/06/2020

(Non-smoker)

Medical Care Plus Rider - Silver

PRODUCT DISCLOSURE SHEET

Read this Product Disclosure Sheet and the Proposal Specially Designed For You before You decide to take out this product. Be sure to also

read the general terms and conditions.

1. What is this product about?

This product pays the benefit for hospitalisation and surgical expenses in accordance with Your chosen plan.

2. What is the cover / benefits provided?

Your chosen Plan: Silver

Duration of coverage is up to Age 80

3. How much premium do I have to pay?

The premium that You have to pay and the plan terms may vary depending on the underwriting requirements of AXA AFFIN Life Insurance Berhad.

• The estimated premium that You have to pay: MYR52.59 monthly.

Prepared by : NOORUL SAKILA BINTI SAJA KHAN Ver 7.14.0 Page 7 of 10

Medical Care Plus Rider - Silver

PRODUCT DISCLOSURE SHEET

Premiums will be charged according to Your attained Age at renewal. Premium rates are not guaranteed and may increase upon renewal. The

Company reserves the right to revise the premium rates by giving You at least 90 days notification if the actual claims experience is worse than

expected. Such changes will be applicable to all Policy owners regardless of their individual claims experience.

4. What are the fees, charges and taxes that I have to pay?

Nil.

5. What are some of the key terms and conditions that I should be aware of?

• Importance of disclosure - all material facts such as medical condition must be disclosed and the Age must be stated correctly.

• Free-look period - You may cancel Your policy by returning the Policy within 15 days from the date of Your receipt of this Policy. The premiums

that You have paid (less any medical fee incurred) will be refunded to You.

• Waiting period - the eligibility for benefit under this supplement will only start 120 days for Specified Illness and 30 days for any other causes from

the commencement of this supplement or reinstatement date, whichever is later, except for Accidental Injuries.

• This plan is renewable at Your option. Unless renewed, the coverage will cease on the expiry date and AXA AFFIN Life Insurance Berhad shall

strictly not be liable for any expenses that take place after the expiry date.

• Implication of switching policy to another insurer - One of the main disadvantages is new term and conditions of the new Policy may be applied if

the current health status is less favourable to the new insurer. It is advisable to check with the insurer before making a final decision.

• If both R&B rate and room category stayed is higher and better than the eligible benefit, You will have to bear the difference in R&B rate and 20%

co-payment of the total Eligible Expenses incurred (excluding R&B rate). However, if the R&B stayed is of the same room category, but with higher

R&B rate, You will have to bear the difference in the R&B.

6. What are the major exclusions under this plan?

Coverage Benefits will not be payable if the Insured's injury results from one or more of the following:

• Pre-existing Illness

• Specified Illnesses occurring during the first 120 days of continuous cover

• Any medical or physical conditions arising within the first 30 days following the Supplement Effective Date or date reinstatement whichever is later

except for Accidental Injuries.

• Plastic/Cosmetic surgery, circumcision, eye examination, glasses and refraction or surgical correction of near sightedness (Radial Keratotomy or

Lasik) or all corrective glasses, contact lenses and intraocular lens (except monofocal intraocular lenses in cataract Surgery) or robotics Surgery that

aid a Surgical procedure) and the use or acquisition of external prosthetic appliances or devices such as artificial limbs, hearing aids, implanted

pacemakers and prescriptions thereof.

• Dental conditions including Dental Treatment or oral surgery except as necessitated by Accidental injuries to sound natural teeth occurring wholly

during the period of insurance.

• Private nursing, rest cures or sanitaria care, illegal drugs, intoxication, sterilisation, venereal Disease and its sequelae, AIDS (Acquired Immune

Deficiency Syndrome) or ARC (AIDS Related Complex) and HIV related Diseases, and any communicable Diseases required quarantine by law.

• Any Treatment or Surgical operation for Congenital abnormalities or deformities including hereditary conditions.

• Pregnancy, pregnancy related condition or its complications, child birth (including Surgical delivery), miscarriage, abortion and prenatal or postnatal

care and Surgical, mechanical or chemical contraceptive methods of birth control or Treatment pertaining to infertility, erectile dysfunction and tests

or Treatment related to impotence or sterilisation.

• Hospitalisation primarily for investigatory purposes, diagnosis, X-ray examination, general physical or medical examinations, not incidental to

Treatment or diagnosis of a covered Disability or any Treatment which is not Medically Necessary and any preventive Treatments, preventive

Medicines or examinations carried out by a Physician, and Treatments specifically for weight reduction or gain.

• Suicide, attempted suicide or intentionally self-inflicted Injury while sane or insane.

• War or any act of war, declared or undeclared, criminal or terrorist activities, active duty in any armed forces, direct participation in strikes, riots and

civil commotion or insurrection.

• Ionising radiation or contamination by radioactivity from any nuclear fuel or nuclear waste from process of nuclear fission or from any nuclear

weapons material.

• Expenses incurred for donation of any body organ by an Insured and costs of acquisition of the organ including all costs incurred by the donor during

organ transplant and its complications.

• Investigation and Treatment of sleep and snoring disorders, hormone replacement therapy and alternative therapy such as Treatment, medical service

or supplies, including but not limited to chiropractic services, acupuncture, acupressure reflexology, bone setting, herbalist Treatment, massage or

aroma therapy or other alternative Treatment.

• Care or Treatment for which payment is not required or to the extent which is payable by any other insurance or indemnity covering the Insured and

Disabilities arising out of duties of employment or profession discovered under a Workman's Compensation Insurance Contract.

• Psychotic, mental or nervous disorders, (including any neuroses and their physiological or psychosomatic manifestations) and any other conditions

classified under the "Diagnostic and Statistical Manual of Mental Disorders (DSM-IV Codes)" as published by American Psychiatric Association.

• Costs/expenses of services of a non-medical nature, such as television, telephones, telex services, radios or similar facilities, admission kit/pack and

other ineligible non-medical items.

• Sickness or Injury arising from racing of any kind (except foot racing), hazardous sports such as but not limited to skydiving, water skiing,

underwater activities requiring breathing apparatus, winter sports, professional sports and illegal activities.

• Private flying other than as a fare-paying passenger in any commercial scheduled airlines licensed to carry passengers over established routes.

• Expenses incurred for sex changes.

• Any Treatment directed towards developmental delays and/or learning disabilities in Insured children.

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Hakim Date : 25/06/2020

(Non-smoker)

Medical Care Plus Rider - Silver

PRODUCT DISCLOSURE SHEET

• Cosmetic (aesthetic) Surgery or Treatment, or any Treatment which relates to or is needed because of previous cosmetic treatment. However, we will

pay for reconstructive surgery if:

(a) It is carried out to restore function or appearance after an Accident or following Surgery for a medical condition, provided that the Insured has

been continuosly covered under the supplement since before the Accident or Surgery happened; and

(b) It is done at a medically appropriate stage after the Accident or Surgery; and

(c) We agree, in writing, to the cost of the treatment in writing before it is done.

• Any Treatment which only offers temporary relief of symptoms on any long term iIllness and Disease rather than dealing with the underlying

medical condition.

• Biological or chemical contamination.

7. Can I cancel my coverage under the plan?

You may cancel Your Policy by giving a written notice to AXA AFFIN Life Insurance Berhad.

8. What do I need to do if there are changes to my contact details?

Please contact AXA AFFIN Life Insurance Berhad if there are any changes in Your contact details to ensure that all correspondences reach You in a

timely manner.

9. Where can I get further information?

Should You require additional information about medical and health insurance, please refer to the insuranceinfo booklet on 'Medical and Health

Insurance', available at all Our branches or You can obtain a copy from Your agent or visit www.insuranceinfo.com.my.

If You have any enquiries, please contact Us at:

AXA AFFIN Life Insurance Berhad

Ground Floor, Chulan Tower

No.3 Jalan Conlay

50450 Kuala Lumpur

Tel: 1 300 88 1616

Fax: 03 2117 6768

E-mail: customer.care@axa-life.com.my

10. Other types of Medical and Health Insurance Cover available.

Please ask AXA AFFIN Life Insurance Berhad for other similar types of plans offered.

IMPORTANT NOTE:

YOU SHOULD SATISFY YOURSELF THAT THIS PLAN WILL BEST SERVE YOUR NEEDS. YOU SHOULD READ AND UNDERSTAND

THE INSURANCE POLICY AND DISCUSS WITH THE AGENT OR CONTACT AXA AFFIN LIFE INSURANCE BERHAD DIRECTLY

FOR MORE INFORMATION.

The information provided in this disclosure sheet is valid as at 25/06/2020.

Prepared by : NOORUL SAKILA BINTI SAJA KHAN Ver 7.14.0 Page 9 of 10

SERVICE GUIDE FOR LIFE INSURANCE

What Services can you expect from our Agent?

Our Company offers life insurance products through our agency force, bank partners, online channel, etc. If you intend to purchase a life insurance

product from our agents, you can enjoy these value-added services.

1. Before you buy a policy

Deal only with registered agents

• You can check the status of the agent via the Life Insurance Association of Malaysia’s (LIAM) website or via Short Message Service (SMS).

• Visit http://www.liam.org.my/index.php/customer-zone/know-your-agent for more details.

Assist you in Choosing the Right Insurance Plan

• Go through with you the Customer Fact Find form to understand your insurance needs and financial goals.

• Recommend suitable insurance plan after assessing your needs.

Explain Product Features

• Explain the product features, benefits payable, exclusions, premiums and charges.

• Provide Product Disclosure Sheet to assist you in making informed decision and to facilitate product comparison.

2. When you Decide to Buy a Policy

Assist you with the Policy Application

• Explain the importance of answering the questions in the proposal form fully and accurately.

• Submit your application for underwriting after you have signed the proposal form and made the premium payment.

• Arrange for medical examination with one of our panel clinics, if required.

• Provide information on making a nomination or appointment of a trustee to ensure policy moneys are received by your beneficiaries in the event of

death.

Explain the Policy Terms and Conditions

• Your policy document will be delivered to you (by hand or via post) within 14 days from the last document received.

• Go through the policy terms and conditions with you to ensure that this is the right plan that you have purchased.

3. During the term of the policy

Continuous Policy Servicing

• Assist in renewal of policy.

• Provide continuous service e.g. policy modifications, change of address and frequency of premium payments. If the agent has left the Company, we

shall appoint a new agent to service you.

Assist you in making a Claim

• Guide you through the standard procedures on how to file an insurance claim.

Customer Website

Please visit our Customer Website at www.axa.com.my for more information

If you are not satisfied with the services of our agent, or require additional support from our Company, you may contact us at 1300 88 1616.

AXA AFFIN Life Insurance Berhad 200601003992 (723739-W)

8th Floor, Chulan Tower, No.3 Jalan Conlay, 50450 Kuala Lumpur. Telephone : +603 2117 6688. Fax : +603 2117 3698.

Proposed Insured : Mr Muhammad Fattah Bin Mohd Amirul Hakim Date : 25/06/2020

(Non-smoker)

You might also like

- Health Insurance Capability ModelDocument8 pagesHealth Insurance Capability ModelCapability Model100% (1)

- NEC Cable Chart Article 310Document2 pagesNEC Cable Chart Article 310SalNo ratings yet

- Proposal Form 906 Aarogya RakshakDocument22 pagesProposal Form 906 Aarogya RakshakBharath Kumar K83% (6)

- Unicharm - Prospectus 2016-2018Document350 pagesUnicharm - Prospectus 2016-2018re faNo ratings yet

- Sofa Dai + Tu May GiatDocument2 pagesSofa Dai + Tu May GiatLý Văn ThọNo ratings yet

- Center: STB STB STBDocument4 pagesCenter: STB STB STBBwabt sathishNo ratings yet

- Pages From 11. FCM WizardDocument3 pagesPages From 11. FCM WizardJon PruittNo ratings yet

- Document 1083870621Document5 pagesDocument 1083870621Okan AladağNo ratings yet

- Database SB, MB, HBDocument1 pageDatabase SB, MB, HBChachou MohamedNo ratings yet

- Ampacity Charts: Wire Size and Amp RatingsDocument1 pageAmpacity Charts: Wire Size and Amp RatingsEsgurdNo ratings yet

- Table 310.15 - Selection Cable - Pages 350-354 PDFDocument5 pagesTable 310.15 - Selection Cable - Pages 350-354 PDFPKT-KCS Nguyễn Xuân LongNo ratings yet

- Tabla 310.15 (B) (16) - Ampacidades PDFDocument1 pageTabla 310.15 (B) (16) - Ampacidades PDFDettagli GuateNo ratings yet

- Royal Garden4 ModelDocument1 pageRoyal Garden4 ModelOtávio MartinsNo ratings yet

- 5 Bushing 6 Pcs #10 O.D120 I.D100 6 PIN 2 PCS: Material Title: CustomerDocument1 page5 Bushing 6 Pcs #10 O.D120 I.D100 6 PIN 2 PCS: Material Title: CustomerRifki AuliaNo ratings yet

- FR00 6.26 3A Faresin ChicoDocument239 pagesFR00 6.26 3A Faresin Chicojuanarielcano84No ratings yet

- HP2521 - Kildare Sofa - 2150 PDFDocument1 pageHP2521 - Kildare Sofa - 2150 PDFmuhammad zia ur rehmanNo ratings yet

- Signs DraftDocument12 pagesSigns DraftNana Kwame Osei AsareNo ratings yet

- CabinetDocument27 pagesCabinetDavid SunNo ratings yet

- A N R S T U V W Y AA AB AC AD AE AF AG SIZE RANGE 150 TO 1500mm Sq. or Dia. (Refer To Both Tables)Document1 pageA N R S T U V W Y AA AB AC AD AE AF AG SIZE RANGE 150 TO 1500mm Sq. or Dia. (Refer To Both Tables)rizkboss8312No ratings yet

- NullDocument4 pagesNullnateNo ratings yet

- Ampacity TableDocument1 pageAmpacity TablehomersssNo ratings yet

- BRAY s40 PDFDocument26 pagesBRAY s40 PDFCristina Mayumi InoueNo ratings yet

- MOSFET and To Determine Its Threshold Voltage and TransconductanceDocument7 pagesMOSFET and To Determine Its Threshold Voltage and TransconductanceHarshith TsNo ratings yet

- Change Torque Chart 11-30-2017Document1 pageChange Torque Chart 11-30-2017Titino AlejandroNo ratings yet

- Kuhinja ModelDocument1 pageKuhinja ModelMarija NikodijevićNo ratings yet

- 4Q23 Earnings Release - EngDocument17 pages4Q23 Earnings Release - EngProtik MazumdarNo ratings yet

- AH EngDocument22 pagesAH EngcoachanzaiNo ratings yet

- Torque Chart Spiral Wound GasketsDocument2 pagesTorque Chart Spiral Wound GasketsMocanu MarianNo ratings yet

- Flexitallic Tabla de TorqueDocument2 pagesFlexitallic Tabla de TorqueWalter100% (1)

- Untitled Spreadsheet-2Document2 pagesUntitled Spreadsheet-2api-398388514No ratings yet

- Torque Spiral Wound GSKT TableDocument2 pagesTorque Spiral Wound GSKT TableCarlos Roberto Tamariz100% (1)

- 310 15B16Document1 page310 15B16HoodmyNo ratings yet

- Case Study On Local Car ManufacturerDocument14 pagesCase Study On Local Car ManufacturerElly TanNo ratings yet

- Selectivity Table: Upstream: iC60N/H/L Curve C Downstream: Ic40, Ic40 N Curves B, C, DDocument1 pageSelectivity Table: Upstream: iC60N/H/L Curve C Downstream: Ic40, Ic40 N Curves B, C, DAsh DustNo ratings yet

- S FSD150 CircpacDocument4 pagesS FSD150 Circpacbillel limaneNo ratings yet

- Speed Vs Thickness (Spin Coating)Document3 pagesSpeed Vs Thickness (Spin Coating)SANGAM SRIKANTHNo ratings yet

- Maximum Torque Settings For Composite FlangesDocument1 pageMaximum Torque Settings For Composite FlangesJulius ContrerasNo ratings yet

- Ficha Tecnica Espirometalicos y Tabla de Torque-1-12-8Document1 pageFicha Tecnica Espirometalicos y Tabla de Torque-1-12-8Luis AlbertoNo ratings yet

- Ssej File No.2Document1 pageSsej File No.2muthu kumarNo ratings yet

- Panel Assy-Wired CG, Overhead Main SectionDocument7 pagesPanel Assy-Wired CG, Overhead Main Sectionsarvesh_ame2011No ratings yet

- GBT-9439-2010-Gray-Cast-Iron-Castings 2Document1 pageGBT-9439-2010-Gray-Cast-Iron-Castings 2Awad SalibNo ratings yet

- How To Select FittingsDocument16 pagesHow To Select FittingsPooja ThaparNo ratings yet

- Electrical/Mechanical Downtilt (Continued)Document3 pagesElectrical/Mechanical Downtilt (Continued)ZteTems OptNo ratings yet

- Chart 03 PDFDocument1 pageChart 03 PDFAlex CariñoNo ratings yet

- Crane Wheels With Slide Bearing DIN 15 074 Without Gear RingDocument2 pagesCrane Wheels With Slide Bearing DIN 15 074 Without Gear RingGilmar MenegottoNo ratings yet

- LU 4 SolutionsDocument3 pagesLU 4 Solutionsbison3216No ratings yet

- UntitledDocument2 pagesUntitledGerin AzharaniNo ratings yet

- 1 Plate Form Ply Cutting-ModelDocument1 page1 Plate Form Ply Cutting-Modelrizal rinaldyNo ratings yet

- Tegangan Penambahan Ifg Dengan Kecepatan 1400 Dan 1200 RPM Tegangan Penurunan Ifg Dengan KecepatanDocument7 pagesTegangan Penambahan Ifg Dengan Kecepatan 1400 Dan 1200 RPM Tegangan Penurunan Ifg Dengan KecepatanRama M. FauziNo ratings yet

- Catalog 4Document7 pagesCatalog 4Ashirvad RathNo ratings yet

- VIP Room - 1 Rest StopDocument1 pageVIP Room - 1 Rest StopSKYLERNo ratings yet

- GBT 9439 2010 Gray Cast Iron CastingsDocument19 pagesGBT 9439 2010 Gray Cast Iron CastingsAwad SalibNo ratings yet

- Torque Chart SWGDocument3 pagesTorque Chart SWGjsanchezNo ratings yet

- Chart 04Document1 pageChart 04aldyNo ratings yet

- Chart 04 PDFDocument1 pageChart 04 PDFrahim Abbas aliNo ratings yet

- 170M 6809Document2 pages170M 6809bernaNo ratings yet

- Room-08 (65th) Cutting ListDocument3 pagesRoom-08 (65th) Cutting ListmuhammadNo ratings yet

- Kolom Pedestal P2: WF 250x125x6x9Document1 pageKolom Pedestal P2: WF 250x125x6x9asriyono ppinfraNo ratings yet

- Kolom Pedestal P2: WF 250x125x6x9Document1 pageKolom Pedestal P2: WF 250x125x6x9asriyono ppinfraNo ratings yet

- Iii Semester, Insurance and Risk Management ModuleDocument10 pagesIii Semester, Insurance and Risk Management ModuleSofi KhanNo ratings yet

- IoT Insurance Observatory To Be Posted ResizedDocument17 pagesIoT Insurance Observatory To Be Posted ResizedMatteoCarboneNo ratings yet

- Answers - Chapter 4Document3 pagesAnswers - Chapter 4Nazlı YumruNo ratings yet

- Underwriting of Securities in India: Submission in The Subject of Corporate Finance LawDocument22 pagesUnderwriting of Securities in India: Submission in The Subject of Corporate Finance Lawakshay kharteNo ratings yet

- Spe 3Document23 pagesSpe 3THAYAL A/L MUNUSAMY MoeNo ratings yet

- Strategic Management: Concepts 3rd Edition Frank Rothaermel Full Chapter PDFDocument24 pagesStrategic Management: Concepts 3rd Edition Frank Rothaermel Full Chapter PDFmesetakhent100% (13)

- IPO ReportDocument36 pagesIPO Reportrobinson_john2005No ratings yet

- Duck Creek - The New Standard in InsuranceDocument22 pagesDuck Creek - The New Standard in InsuranceAlejandro Giraldo M.No ratings yet

- Principles of LawDocument72 pagesPrinciples of LawMakaha Rutendo100% (1)

- Customer Satisfaction Towards Retail Lending of UCO Bank in ChandigarhDocument72 pagesCustomer Satisfaction Towards Retail Lending of UCO Bank in Chandigarhshivkmrchauhan0% (1)

- Financial Markets and Institutions 6th Edition Saunders Solutions Manual 1Document9 pagesFinancial Markets and Institutions 6th Edition Saunders Solutions Manual 1jess100% (39)

- Presentation of ECGC, KolkataDocument30 pagesPresentation of ECGC, Kolkatabharti ashhplayNo ratings yet

- Aviation InsuranceDocument43 pagesAviation Insurancechaitu464No ratings yet

- Money, Capital Market, and Financial InstitutionsDocument42 pagesMoney, Capital Market, and Financial Institutions버니 모지코No ratings yet

- UnderwriterDocument23 pagesUnderwritervarunsingh88No ratings yet

- Insurance Job ResumeDocument8 pagesInsurance Job Resumefupbxmjbf100% (2)

- Antima TybmsDocument32 pagesAntima TybmsAntima ChoubeNo ratings yet

- Prospectus and UnderwriterDocument2 pagesProspectus and UnderwriterCarl MontemayorNo ratings yet

- Freddie Mac May 2017 - Securitization - Investor-PresentationDocument67 pagesFreddie Mac May 2017 - Securitization - Investor-PresentationMarcel GozaliNo ratings yet

- An Assessment of The Performance of Nile Insurance Company S.C PDFDocument75 pagesAn Assessment of The Performance of Nile Insurance Company S.C PDFnigus100% (2)

- Eurotunnel Case Study: Project FinanceDocument8 pagesEurotunnel Case Study: Project FinanceAekansh JainNo ratings yet

- 5-Non-Banking Financial InstitutionsDocument19 pages5-Non-Banking Financial InstitutionsSharleen Joy TuguinayNo ratings yet

- Carter v. BoehmDocument8 pagesCarter v. BoehmTondofarNo ratings yet

- Case Pan Atlantic Insurance Co - LTD v. Pine Top Insurance Co LTD 1995 15.09.41Document6 pagesCase Pan Atlantic Insurance Co - LTD v. Pine Top Insurance Co LTD 1995 15.09.41My Trần HàNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- Merchant BankingDocument27 pagesMerchant Bankingapi-3865133100% (13)

- Assignment Title:: Innovations in Financial Service IndustryDocument9 pagesAssignment Title:: Innovations in Financial Service IndustryKashishNo ratings yet