Professional Documents

Culture Documents

Fa6 Sem5 Cbcgs Baf Commerce Nov19

Fa6 Sem5 Cbcgs Baf Commerce Nov19

Uploaded by

sacos16074Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fa6 Sem5 Cbcgs Baf Commerce Nov19

Fa6 Sem5 Cbcgs Baf Commerce Nov19

Uploaded by

sacos16074Copyright:

Available Formats

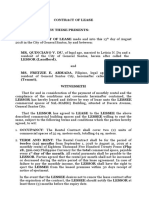

Paper / Subject Code: 44802 / Financial Accounting - VI

TVe ft?/.sern y l ro-u -t ? ,,

t't''l'":'i

Duration: 2 %lFrrs, -":',1t"- tylarKs:-/5

Please check whether you have got the right queslion'paper,

Note: (a) All questions are compulsory and carry f5:mirrctffi

(b) Working notes should form part of your

4nq*9"'r:.1,, -

(c) Figures to the right indicate full ma1llg....',:., ." ,,.,,,; r,

(d) Use of simple calculator is allowed;,;i_',:.;.,i,;'i;,,,:.,,: ,;;,:.:'

Q 1) Fill in the blanks with the correct alternative (Any 8) I0gl

l. Interest payable on deposits which is accrued but not due is shown under

a. Deposits b. Advances c. Other liabilities d. Contingent I,iuUititier

2. A -

assets would be one, r.vhich has remained NPA for a period less than or equal to

twelve months.

m

a. Substandard b. Standard c. Loss d. Doubtful

- total number olschedules to an insurance company's financial statements in India

The

4.

a. l0 b. 15

Insurance business is controlled by _.

a. Insurance Act 1938

d. All of the above

c,20

.co

b. Insurance Rules 1939

d:25

C.lBQ

:', ..'t ';"'

Regulation 2002

ra

..::

5. agency regulates and supervises NBFCs. 1..,

a. Finance Ministry b. SEBI c, RBI d.Respective State Government

6. NBFCs are required to accept public deposit for a maximum period of

nd

a. 36;months b.48 months .c..50.mciliths d.120 months

7. The most important element in valuation of goodwill is

a. Type of business b. Efficiency of owner c. Future maintainable profit

d. Place and location of business.

ke

a. 7 partners ' b. 50 partners c. 2 partners ' d.3 partners

9, Following can become the partner in LLP_.

QP

Q. Coqrpany incorporated in India b. LLP incorporated outside India

c.' Individual resident outside India d. All ofthe above

10. Following are the factors affecting goodwill except

a. Nature of business b. Efficiency of management c.Technical know how

d. Location of the customers

Q I B) State whether the following statements are true or false. (Any 7) t07l

1. Sub Broking companies must be registered with RBL

2. Morlgage Guarantee Companies have not been notified as Non Banking Financial Companies.

3. Premium shall be recognised when the income is received.

4. Company incorporated outside India can become a Paftner in a LLp.

5. Curent account balances are shown by the banks as demand deposit.

75847 Page 1 of6

EE3BC0983D326D t t 4F 8|2BDFD2 I 480 8 8

Visit www.qpkendra.com for more question paper

Paper / Subject Code: 44802 / Financial Accounting - VI

6. Discount received by the bank is shown under the schedule of interest earnid.

7. All nationalized Banks are governed by the Banking Regulation Act. :

8. Fair market value of shares is an average of yield ,ulr" Ino intrinsic value.

9. Goodwill is excess of sales value of business over n.t ur"fts oi;,nm;,,;..'atr'..i

10. s.unll#t-ed.;',1,", -i, "rrr:.: ..:-.:-),

LLP should have minimum two parrners where as m4r'imi+n.*ufrlinili';j;''.r,. ..:

,

:... : !

;..:'.

..:'i !:: ..., ..

:;' ::..'." : ' ;;1,...r. q:.,;;r..'- ' '. ) .:i.: :,' :"1

.'. ..!. ...i . \,

,. :l

".;;;:-,.:ti

Q 2) The following figures have been obtained from thsb-6.oli3'.of.theB+nkLtd,,forth,py,,i ,"rAAg

^'.lj

31tt March,2019: -..r.,..".i ,t,'f i,-;.-';;' -;':,r't',:: ..'l'.r,r..: lfil

Interest eamed 5,000

Discount earned . ;;U;6 ,

I sus L^vrrorrSv .: :: : 5yv,

. :. ..

Interest paid ..",14,000,-

m

Salaries and Wages

oararlssalluwAges :: I ., . 420

42C

Directors fees :

Telegrams

.co

Postage and LZ2

Printing and Stationary

LossonSaleofAssets.:...,'.,1i'.-...,....]..

ra

Staiionery ;;)

ffitHil"r"rtr ,.-. . ", .-o'.' 't--

;-'t'" 16

niioni , ...,,,..,

nd

l. The Profit and Loss account had.a balance of Rs. 10,00,000 on lstApril, 2017.

2. An advance of Rs. 5,68,000 has become doubtful ura ii it expected that only 50yo of the

amount due can be recovered from the security.

ke

3. The provision for tax be made at 35o/a.

4. A dividend of Rs 2,00,000 is proposed by the board of directors.

Prepare Profit & Loss Account of the Bank Ltd. for the year ending 31.t March, 2019.

QP

.t..:,. ,,,:..:,.1:' , .:.,....-,t OR

Q 2) From the following balances, prepare Balance Sheet of Prateeth Bank Ltd. as on 3l rt March,

2019.

tlsl

,Particulars Dr. (Rs Lakhs) Cr (Rs Lakhs)

Share Capital 10.00

Reserve Fund

16.00

tlrp{pe$ositsl 40.00

Savings Deposits 60.00

Current Accounts 220.00

Nlofiey..at e4ll and.Sho.rtl notice 2.00

'Billd.,4iS0qunted.and purchased

9.00

Investments at Cost:

75847 Page} of 6

EE3BC0983D 326D t I 4F 8L2BDFD2 I 4808 8

Visit www.qpkendra.com for more question paper

Paper/ Subject Code: 44802 / Financial Accounting - VI

.Ja' .l': .X\ j.

a"

ij, .-

lfl

- ..

;..

: a..-;:,

,4,

.-,:

_-1j

..,.j,.4,

).1:. :

- Cenhal and State Government 100.00.

- GovernmentSecurities 4.00 ,: : ::.,-

Bullion- 24,-00

Reserves for Building . ' l;:,' ,;.'a' .' l , r.' ,, r ' :": l. .- 1o.oo

Premises at cost r.100.0O

Addition to Premises '20;00,

Depreciation Fund on Premises ,:,'80,0'0,:i

. r:" "' - il-.:':.' 1

Cash with RBI 33J0 '.i:,.'1 ::,: :',t.-l'.-. .:i' .:..:

CaSh with SBI 12.00 'r 'i:.

l'.::,:,',.,!,.i ..r

:ir.:

Unclaimed Dividend 1.50

Unexpired Discount 0.50

Loans and Advances :1,00.00:

Branch Adjustment .,, 57,00".' -:./.. ,..::'

.....:',' , ..!'., :.ll' . -'

r"r .. :"

Silver 2.00

Advance payme4t of Tax :'!":"' '':t:,=ii 1,00 l'r;.1, 1''-.:' ',;'

Interest Accrued on Investment lI

m

.':2i'50

Non-Banking Assets '.'0;50. i...',,.'..r'

Borrowed from Banks 2.00

.co

Bills Payables i :.f ...! 1 r. t, \ ')

,.:., ..,,..,,: t-r"r ,1.",4_ 20.00

Profit and Loss Account (Profit for the year 2. i 0) 4.00

Dividend fluctuation fund,"1,.,:r:il ;.:llil ' l",l ,:, .i ':. ., \ l.)

4.00

i

:- 468.00 468.00

Ihebankhadbillsforcol1ectiontp.i.its.cg,qituentSR5.Q,00,00]0.anm

ra

was a claim of Rs. 2,00,q0O ig.ain$t th; iiank,bul ngJ acknowf"aAii.m; debt. The liabilities for bilts

discounted was Rs. 32,00U iiibitltieg for forward eichange .onou.t was Rs. 10,00,000. The Directors

decided to transfer 20Yoto statutory reserves & reserves Rs. 2,000 for unexpired discounts.

nd

r:'.,1-.:! .. ,. r.ilr . : _.'" ..1.. .'...ri'...,t

Q 3) A,Genbr$,fisy.:ins9..Qr9qrn'1Ay*ubrni*ltie.fo.$a'*i+.ijrlrormation for the year ended

h,20,L9.; . .'' ' ::, ,r'1 '-'

' ',i

'.,' .' .' 1

ke

Direct Business Reinsurance

(Rs) (Rs)

$emiurii rqqciv€d 75,25,000 8,25,000

4,90,000

cfaih;bdiit, 4diingr,fu' y,e{;41

QP

49.70.000 5,10.000

Claim payable:

-

1" aprit. 2ols 6,85,000 95,000

- 3l'tM4Ich,2019 -rl 7.38.000 70,000

Claims rgceived 3,95,000

- April, 2018

1$

75,000

,'.' il,t:lMaiah. '2oI g 1,25,000

Expen e$:of Management 2,90.000

,re"oinmiss.i6n: ,

1,60.000 1s.000

0n,,ihsruraqi. ., c"e_4ed "

18,000

:a:.:;- . ;:: : ,' '. ''

ps*al.:,: .'.,',:,

Page 3 of6

,''. .'.,;..;'-'1".t;

, " ;;;::. :- '' 'l'

-i' i'r'.,-

EE3BC0983D326Dl l4F8l 2BDFD2 I 48088

Visit www.qpkendra.com for more question paper

Paper / Subject Code: 44802 / Financial Accounting - VI

Q 3) From the following figures taken from the

business, Prepare the Revenue and Profit

Particulars ." J

..Di;(R.s):r' Cr, (BS),.

Fire fund (as on l-4-2018) ,i;

:' ;_,,.1..:'

:;; .r::' ii.,,,. r3.000

Additional Reserve 1.,: ., i,,...;r. .- ,i ..ii."1r'r1i 133,000

Premium :i.

,\ i.2,70.150

m

Claims paid ' ,,6A|?00,

Profit & Loss A/c (Cr) 7,500

Re- insurance Premium 11.200

Claim recovered from Re-ins*brS'..:,' 1,, -'j;fll.l

Commission on Re-insurance ceded

Commission on direct business

Commission on *"-tnrutuoda.$cc'ept9.d..,,..::I

.co ':19:970

6.000

2,100

4.800

Outstanding Premium"',.1':'1-' :',.l: ,{

ra

2.250

Claims intimated but not paid: (1 -4-20 I 8\ 6,000

Expenses on Management' 43,190

Audit fees 3.600

nd

Rates and Taxes 550

Rents 6,750

Income from Investments 15,300

The fol further in also be noted:

ke

legal expenses of Rs.3,600 and Rs. 2,000

10,400.

QP

x current profits to General Reserve.

risk along with an additional reserve

Q 4) Alex and Rex are in partnership sharing Profit and Losses equally. The Trial Balance of the

firm on 3l't March, 2019 was as follows: tls]

Trial Balance as on 3l.t March,20l9

Amount (Rs) Credit Balances Amount (Rs)

Pu-rchase6-'' 25,000 Capital

Debtois 12.000 - Alex 40,000

Opeflins'stock 20,000 - Rex 30.000

:'![sgds:. 5.000 Sales 60,000

.'_ .;-r

,.75847

Page 4 of6

:

EE3BC0983D 326D I I 4F 8|2BDFD2 I 4808 8

Visit www.qpkendra.com for more question paper

Paper / Subject Code: 44802 / Financial Accounting - VI

Salaries 8.000 Creditors 20,000

'; t.::,

Land and Buildine 30,000 l0% Bank Loan .20j0CI

t

Plant and Machinery 25.000 Commission ' ,r'5 01',

Furniture 16.000 Outstandins I 1,500

Advertisement (for 2 years) 6,000 Discount s00

-" :,1!r::1..:-:r a'.1-ll

Bills Receivable 8.000 :.1;",,:'}

Insurance 2,000

Drawings:

- Alex 2,000

-

Rex 3,000

Cash in Hand 5,000;:

Rent 7,000

Power and Fuel 3,000

1.77.000 l.riT,ooo

Adjustments:

m

t.

)

J. Outstanding expenses

4.

5.

Write offRs. 2,000 for

Depreciate Land

From the above Trial

limited.

.co accounts ofLLP

ra

under: [081

nd

Liabilities' rAmount... Assets,.'l Amount

3,00,000

ke

25,000 Equity Shares of Rs.10 Plant 3,00,000

each fully paid

Sefiri eS. mitim ,3;o0rooo 'Furniture 2.00.000

General Reserves .406-0001 Motor Car

QP

50,000

10% Debentures 2.00.000 Stock 2,50,000

.,,Ac,Cotuit!,rpW1blLg .

l i, ;'2,50.000 Debtors 3,s0,000

Cash 50,000

15.00.000 1s.00.000

The Company earned profits (after tax) for the past five years as follows:

Yearended Prolit after Tax (Rs) Income tax rate

3l-3-2015 1,90,000 40%

3t-3-2016 3,38,000 35%

3t-3-2017 3,64,000 35%

3l-3-2018 ,i: 2,601000 35%

3t-3-201,9 4,20,000 30%

7584:l Page 5 of6

EE3BC0983D326D I r 4F8 I 2BDFD2l 48088

Visit www.qpkendra.com for more question paper

Paper / Subject Code: 44802 / Financial Accounting - VI

{_n

You are required to calculate value of Goodwill on

profits.

Q 4 B) The following is the summ arized Balalrce Sheet of Virendra Ltd. as on .t

3 I March, 2019:

-.-a--i--

Liabilities Amount Arnount

50,000 Equity shares of Rs. 20

m

,4,80,000

each fully paid up

Securities Premium A/c 2.00.000 '

2,00,000

General Reserve 4,78,000 Stock ".,,

.co

12.40.000

Profit & Loss A/c 3,14,000 4,12,000

Sundry Creditors 8,18,000 Cash ih Hand 6,000

Provision for Taxation 3.96.000 "Casfi.*Bank 8,69,000

32.06.000 32,06,000

The company transfers 2070 of its'profits,,(after tax) to Generat nese.ve. t tet profits pf

ra

re taxation

for the last three

For the year endedr

For the year

nd

For the year

Machinery

Average Use simple average. Calculate

the (b) Yield value method.

ke

[08]

l07l

QP

llsI

********

.:- r1 ..' .

..:,";; .1r .-.

,.75*4ri ,,.

Page 6 of6

.,," t;' ' '.11;

:. . : .,;.-

EE3BC0983D326D I I 4F8 I 2BDFD2 I 48088

Visit www.qpkendra.com for more question paper

You might also like

- Corporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFDocument35 pagesCorporate Finance 11Th Edition Ross Solutions Manual Full Chapter PDFvernon.amundson153100% (10)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 6Document21 pages2CEXAM Mock Question Licensing Examination Paper 6Tsz Ngong KoNo ratings yet

- CHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISDocument6 pagesCHAPTER 5 (1st Part) - ANNUAL CASH FLOW ANALYSISSandipNo ratings yet

- Jaipur National University, Jaipur: School of Distance Education & Learning Internal Assignment No. 1Document2 pagesJaipur National University, Jaipur: School of Distance Education & Learning Internal Assignment No. 1naren17% (6)

- Stock & Book Debts StatementDocument2 pagesStock & Book Debts Statementalok darakNo ratings yet

- Build Operate Transfer (Bot)Document8 pagesBuild Operate Transfer (Bot)aparnaNo ratings yet

- Tybaf Sem5 Fa-Vi Nov19Document6 pagesTybaf Sem5 Fa-Vi Nov19Hasan ShahNo ratings yet

- Miljane Perdizo - Quiz 2Document2 pagesMiljane Perdizo - Quiz 2Miljane PerdizoNo ratings yet

- Fra Sem5 CBCGS Bbi Commerce Nov19Document6 pagesFra Sem5 CBCGS Bbi Commerce Nov19John SadulaNo ratings yet

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- Module 1 - External Financial Reporting - Balance Sheet and ValuationDocument12 pagesModule 1 - External Financial Reporting - Balance Sheet and ValuationPatricia AtienzaNo ratings yet

- Question Paper Investment Banking and Financial Services - I: January 2002Document17 pagesQuestion Paper Investment Banking and Financial Services - I: January 2002api-27548664No ratings yet

- FAR Dry Run ReviewerDocument5 pagesFAR Dry Run ReviewerJohn Ace MadriagaNo ratings yet

- Chapter 5Document16 pagesChapter 5desi permataNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 4Document6 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 4JordanNo ratings yet

- Past Comdp Question Papers 079Document146 pagesPast Comdp Question Papers 079Oyegbami Olubukonla100% (2)

- 1styr - 1stMT - Intermediate Accounting 1 - 2223Document35 pages1styr - 1stMT - Intermediate Accounting 1 - 2223angelpaulenebeatricemNo ratings yet

- Polytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsDocument12 pagesPolytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsChristine Joyce MagoteNo ratings yet

- A. Mr. Samuel Misa: To Protect The Certificate of Certified Public Accountants Granted by The Republic of The PhilippinesDocument6 pagesA. Mr. Samuel Misa: To Protect The Certificate of Certified Public Accountants Granted by The Republic of The PhilippinesShaira IwayanNo ratings yet

- Paper 13 ICMA Mportant Qns - CA ShivangiDocument43 pagesPaper 13 ICMA Mportant Qns - CA Shivangisivarama marriNo ratings yet

- C. D. A. B. C. It D.: Il', I:TjrDocument1 pageC. D. A. B. C. It D.: Il', I:TjrCPANo ratings yet

- Quiz Capital Budgeting 2018 2019 1st SemDocument6 pagesQuiz Capital Budgeting 2018 2019 1st Semjethro carlobosNo ratings yet

- AAM3781 06 Nor 2019Document5 pagesAAM3781 06 Nor 2019Desmond Basson Jr.No ratings yet

- BFM Memory Based QuestionsDocument8 pagesBFM Memory Based QuestionsSudhakarNo ratings yet

- Theory of Accounts With Answers PDFDocument9 pagesTheory of Accounts With Answers PDFRodNo ratings yet

- JAIIB Genius Week 23 2023Document11 pagesJAIIB Genius Week 23 2023Anand MekalaNo ratings yet

- 11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)Document17 pages11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)nishvanprabhuNo ratings yet

- Tybbi Sem5 FSM Nov19Document2 pagesTybbi Sem5 FSM Nov19parchavinit35No ratings yet

- Finance: Practice QuestionsDocument33 pagesFinance: Practice QuestionsMahtab Chondon100% (1)

- Conceptual Framework and Accounting StandardsDocument11 pagesConceptual Framework and Accounting StandardsAngela TalastasNo ratings yet

- Company Law II (2018)Document4 pagesCompany Law II (2018)Aanika AeryNo ratings yet

- MCQ On Financial ManagementDocument28 pagesMCQ On Financial ManagementibrahimNo ratings yet

- Aud Quiz No.3Document3 pagesAud Quiz No.3Clarice GonzalesNo ratings yet

- MCQ On FMDocument28 pagesMCQ On FMSachin Tikale100% (1)

- Scan 28 Oct 2020Document4 pagesScan 28 Oct 2020devarajangouriNo ratings yet

- Consolidated FAR UC QUESTIONDocument15 pagesConsolidated FAR UC QUESTIONNathalie GetinoNo ratings yet

- The Balance Sheet and Notes To The Financial Statements: HapterDocument38 pagesThe Balance Sheet and Notes To The Financial Statements: Hapterreno100% (1)

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- Understanding Financial Statement: IV. Multiple ChoicesDocument2 pagesUnderstanding Financial Statement: IV. Multiple ChoicesJulrick Cubio Egbus100% (1)

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- MS 34PB2ND-7Document1 pageMS 34PB2ND-7sunshineNo ratings yet

- Sean Gonzales-ACCY41AssignmentDocument3 pagesSean Gonzales-ACCY41AssignmentSean GonzalesNo ratings yet

- Mca - 204 - FM & CFDocument28 pagesMca - 204 - FM & CFjaitripathi26No ratings yet

- Own Mock QualiDocument10 pagesOwn Mock QualiDarwin John SantosNo ratings yet

- MCQ-on-FM WITH SOLDocument28 pagesMCQ-on-FM WITH SOLarmansafi761100% (1)

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- Activity 6B CapStructure FinmaDocument4 pagesActivity 6B CapStructure FinmaDiomela BionganNo ratings yet

- ACCT 575quiz 1 PDFDocument16 pagesACCT 575quiz 1 PDFMelNo ratings yet

- 261 0701Document17 pages261 0701api-27548664No ratings yet

- Mba Ii Sem - FM - QBDocument29 pagesMba Ii Sem - FM - QBMona GhunageNo ratings yet

- Financial Accounting and Reporting - QUIZ 8Document5 pagesFinancial Accounting and Reporting - QUIZ 8JINGLE FULGENCIONo ratings yet

- Consolidated FAR UCDocument28 pagesConsolidated FAR UCNathalie GetinoNo ratings yet

- ACCT 575quiz 3 PDFDocument17 pagesACCT 575quiz 3 PDFMelNo ratings yet

- End - of - Semester Examination Semester SessionDocument6 pagesEnd - of - Semester Examination Semester Sessionkenha2000No ratings yet

- 34 Corporate Accounting F+R CBCS 2015 16 and OnwardsDocument15 pages34 Corporate Accounting F+R CBCS 2015 16 and Onwardspremium info2222No ratings yet

- FAR 1 - Prelim ExamDocument9 pagesFAR 1 - Prelim ExamaprentadoaltheaNo ratings yet

- Test BankDocument16 pagesTest BankMoraga MacaronsingNo ratings yet

- Financial Services QBDocument89 pagesFinancial Services QBVimal RajNo ratings yet

- Advanced Auditing ProblemsDocument4 pagesAdvanced Auditing Problemsshani shanNo ratings yet

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedNo ratings yet

- 2nd Year QuestionnairesDocument7 pages2nd Year QuestionnaireswivadaNo ratings yet

- AcctgDocument14 pagesAcctgLara Lewis AchillesNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- CBS PDRN PrintDocument3 pagesCBS PDRN PrintEloisa PigaNo ratings yet

- Working Capital Management of SBIDocument76 pagesWorking Capital Management of SBIDr Sachin Chitnis M O UPHC AiroliNo ratings yet

- CAF 1 GridDocument5 pagesCAF 1 GridRiot SkinNo ratings yet

- HDFC Bank: PGDM Banking and Financial ServicesDocument4 pagesHDFC Bank: PGDM Banking and Financial ServicesPuneet GargNo ratings yet

- Contract of LeaseDocument6 pagesContract of LeaseAilen Rose PuertasNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesVikram KsNo ratings yet

- Financial Aspects IntroductionDocument5 pagesFinancial Aspects IntroductionSef Getizo Cado67% (3)

- Executive SummaryDocument6 pagesExecutive SummaryRenelyn Rentillosa CabanasNo ratings yet

- Circular Flow of IncomeDocument12 pagesCircular Flow of IncomeDhawal RajNo ratings yet

- Write Up On SJ FinancialDocument2 pagesWrite Up On SJ FinancialArman AliNo ratings yet

- Kapitan Alex Soce 2023Document4 pagesKapitan Alex Soce 2023Guia Marie Diaz BriginoNo ratings yet

- Branding Mishaps: Why Fiat Uno Failed in India?Document4 pagesBranding Mishaps: Why Fiat Uno Failed in India?sahilindia4No ratings yet

- Nefas Silk Poly Technic College: Learning GuideDocument20 pagesNefas Silk Poly Technic College: Learning GuideNigussie BerhanuNo ratings yet

- The Marketing Strategies of IKEA in China Using Tools of PESTEL, Five Forces Model and SWOT AnalysisDocument8 pagesThe Marketing Strategies of IKEA in China Using Tools of PESTEL, Five Forces Model and SWOT AnalysisSamantha SiuNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)Suyash Yadav0% (1)

- Sri Sai Food CourtDocument1 pageSri Sai Food CourtpvrdeveltestNo ratings yet

- Entrepreneurial Finance: Final AssignmentDocument9 pagesEntrepreneurial Finance: Final AssignmentВиолетта КотвицкаяNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversitySagar ModiNo ratings yet

- Problems: Hedged Item - Forecasted TransactionDocument8 pagesProblems: Hedged Item - Forecasted TransactionSheira Mae GuzmanNo ratings yet

- Correcting - Entries (Compatibility Mode)Document6 pagesCorrecting - Entries (Compatibility Mode)MahediNo ratings yet

- Value Streeam Mapping in A Manufacturing CompanyDocument11 pagesValue Streeam Mapping in A Manufacturing CompanyIsrael Urbina LugoNo ratings yet

- RMIT International University Vietnam: Assignment Cover Page (INDIVIDUAL)Document16 pagesRMIT International University Vietnam: Assignment Cover Page (INDIVIDUAL)Tuan MinhNo ratings yet

- MyGov 11th April, 2023 FREE CIRCULATION PDFDocument17 pagesMyGov 11th April, 2023 FREE CIRCULATION PDFGeorge_Watene_4475No ratings yet

- PT Ortu PT Bocah Comprehensive Income RP RPDocument8 pagesPT Ortu PT Bocah Comprehensive Income RP RPNcim PoNo ratings yet

- Pre Board 10th SST Set 2Document8 pagesPre Board 10th SST Set 2harsh jatNo ratings yet