Professional Documents

Culture Documents

Bi 4258jcbu

Bi 4258jcbu

Uploaded by

rayees khanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bi 4258jcbu

Bi 4258jcbu

Uploaded by

rayees khanCopyright:

Available Formats

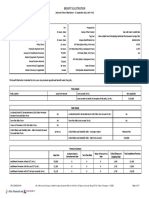

Proposal No:

Name of the Prospect/Policyholder: Mr. Rayees Name of the Product: Max Life Online Savings Plan

Tag Line: A Unit Linked Non Participating Individual Life Insurance Plan

Age & Gender: 36 Years, Male

Policy Option: Variant 2

Name of the Life Assured: Mr. Rayees Unique Identification No: 104L098V05

GST Rate: 18.00%

Age & Gender: 36 Years, Male Max Life State: Haryana

Policyholder Residential State: Haryana

Sum Assured: `12,00,000 Investment Strategy Opted for: NA

Policy Term & Premium Payment Term: 20 Years & 10 Years

Funds opted for along with their risk level

Amount of Installment Premium: `10,000 [Please specify the customer specific fund

Mode of payment of premium: Monthly option): NIFTY Smallcap Quality Index Fund (Risk Rating-Very High) :

100%

How to read and understand this benefit illustration?

This benefit illustration is intended to show what charges are deducted from your premiums and how the unit fund, net of charges and taxes, may grow over the years of the policy term if the fund earns a gross

return of 8% p.a. or 4% p.a. These rates, i.e., 8% p.a. and 4% p.a. are assumed only for the purpose of illustrating the flow of benefits if the returns are at this level. It should not be interpreted that the returns

under the plan are going to be either 8% p.a. or 4% p.a.

Net Yield mentioned corresponds to the gross investment return of 8% p.a., net of all charges but does not consider mortality, morbidity charges, underwriting extra, if any, guarantee charges and cost of riders, if

deducted by cancellation of units. It demonstrates the impact of charges exclusive of taxes on the net yield. Please note that the mortality charges per thousand sum assured in general, increases with age.

The actual returns can vary depending on the performance of the chosen fund, charges towards mortality, morbidity, underwriting extra, cost of riders, etc. The investment risk in this policy is borne by the

policyholder, hence, for more details on terms and conditions please read sales literature carefully.

Part A of this statement presents a summary view of year-by-year charges deducted under the policy, fund value, surrender value and the death benefit, at two assumed rates of return. Part B of this statement

presents a detailed break-up of the charges, and other values.

Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then

these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment

returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual

future investment performance.

Rider Details

Critical Illness and Disability-Secure Rider - Rider Premium Payment Term and Rider Term NA Critical Illness and Disability Rider - Coverage Variant NA

Critical Illness and Disability Rider - Rider Sum Assured NA

Premium Summary

Max Life Critical Illness and Disability-Secure Rider

Base Plan Total Installment Premium

Installment Premium without GST (in Rs.) 10,000 0 10,000

Installment Premium with first year GST (in Rs.) 10,000 0 10,000

Installment Premium with GST 2nd year onwards (in Rs.) 10,000 0 10,000

UIN: 104L098V05 Page 1 of 5

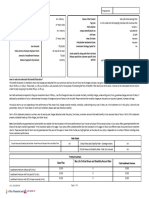

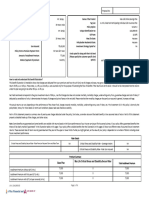

Part A

(Amount in Rupees.)

At 4% p.a. Gross Investment Return At 8% p.a. Gross Investment Return

Commission

Policy Annualized

payable to

Year Premium Mortality, Morbidity Fund at End Surrender Mortality, Fund at End Surrender

Other Charges* GST Death Benefit Other Charges* GST Death Benefit intermediary

Charges of Year Value Morbidity Charges of Year Value

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1 1,20,000 3,502 638 745 1,17,601 1,10,521 12,00,000 3,502 647 747 1,20,047 1,12,967 12,00,000 -

2 1,20,000 3,641 1,837 986 2,38,298 2,32,634 12,00,000 3,641 1,897 997 2,48,000 2,42,336 12,00,000 -

3 1,20,000 3,795 3,068 1,235 3,62,158 3,57,910 12,00,000 3,795 3,229 1,264 3,84,371 3,80,123 12,00,000 -

4 1,20,000 3,960 4,331 1,492 4,89,256 4,86,896 12,00,000 3,960 4,649 1,550 5,29,714 5,27,354 12,00,000 -

5 1,20,000 4,162 5,627 1,762 6,19,638 6,19,638 12,00,000 4,162 6,162 1,858 6,84,586 6,84,586 12,00,000 -

6 1,20,000 4,394 6,956 2,043 7,53,359 7,53,359 12,00,000 4,394 7,774 2,190 8,49,593 8,49,593 12,00,000 -

7 1,20,000 4,619 8,320 2,329 8,90,519 8,90,519 12,00,000 4,619 9,492 2,540 10,25,424 10,25,424 12,00,000 -

8 1,20,000 4,886 9,718 2,629 10,31,164 10,31,164 12,00,000 4,886 11,322 2,917 12,12,756 12,12,756 12,00,000 -

9 1,20,000 5,156 11,152 2,935 11,75,387 11,75,387 12,00,000 5,156 13,272 3,317 14,12,359 14,12,359 12,00,000 -

10 1,20,000 5,506 12,622 3,263 13,23,192 13,23,192 12,60,000 5,506 15,349 3,754 16,24,962 16,24,962 12,60,000 -

11 - 5,977 13,466 3,500 13,52,737 13,52,737 12,60,000 5,977 16,891 4,116 17,26,961 17,26,961 12,60,000 -

12 - 6,400 13,765 3,630 13,82,595 13,82,595 12,60,000 6,400 17,951 4,383 18,35,304 18,35,304 12,60,000 -

13 - 6,863 14,067 3,767 14,12,725 14,12,725 12,60,000 6,863 19,076 4,669 19,50,367 19,50,367 12,60,000 -

14 - 7,306 14,372 3,902 14,43,162 14,43,162 12,60,000 7,306 20,272 4,964 20,72,630 20,72,630 12,60,000 -

15 - 7,712 14,680 4,031 14,73,956 14,73,956 12,60,000 7,712 21,544 5,266 22,02,620 22,02,620 12,60,000 -

16 - 8,065 14,992 4,150 15,05,181 15,05,181 12,60,000 8,065 22,896 5,573 23,40,922 23,40,922 12,60,000 -

17 - 8,328 15,309 4,255 15,36,958 15,36,958 12,60,000 8,328 24,335 5,879 24,88,207 24,88,207 12,60,000 -

18 - 8,818 15,630 4,401 15,69,030 15,69,030 12,60,000 8,818 25,866 6,243 26,44,799 26,44,799 12,60,000 -

19 - 9,671 15,952 4,612 16,00,970 16,00,970 12,60,000 9,671 27,492 6,689 28,10,882 28,10,882 12,60,000 -

20 - 10,611 16,271 4,839 16,32,669 16,32,669 12,60,000 10,611 29,216 7,169 29,86,987 29,86,987 12,60,000 -

*See Part B for details

IN THIS POLICY, THE INVESTMENT RISK IS BORNE BY THE POLICYHOLDER AND THE ABOVE INTEREST RATES ARE ONLY FOR ILLUSTRATIVE PURPOSE.

I ALSO UNDERSTAND THAT WHILST 100% OF MY FIRST YEAR PREMIUM WILL BE INVESTED IN UNIT LINKED INVESTMENT FUNDS THERE ARE CHARGES DURING THE FIRST POLICY

YEAR AS GIVEN IN THE BENEFIT ILLUSTRATION.

UIN: 104L098V05 Page 2 of 5

I, ……………………………………………. (name), have explained the premiums, charges and I, Rayees (name), having received the information with respect to the above, have understood

benefits under the policy fully to the prospect / policyholder. the above statement before entering into the contract.

Place:

Date: 11/21/23 Signature / OTP Confirmation Date / Thumb Impression / Date:11/21/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

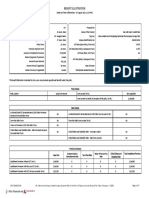

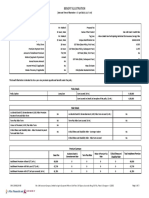

Part B

Gross Yield 8% p.a. Net Yield 6.92% Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 1,20,000 - 1,20,000 3,502 747 - - - - 1,20,166 647 1,20,047 1,12,967 12,00,000

2 1,20,000 - 1,20,000 3,641 997 - - - - 2,48,245 1,897 2,48,000 2,42,336 12,00,000

3 1,20,000 - 1,20,000 3,795 1,264 - - - - 3,84,751 3,229 3,84,371 3,80,123 12,00,000

4 1,20,000 - 1,20,000 3,960 1,550 - - - - 5,30,237 4,649 5,29,714 5,27,354 12,00,000

5 1,20,000 - 1,20,000 4,162 1,858 - - - - 6,85,263 6,162 6,84,586 6,84,586 12,00,000

6 1,20,000 - 1,20,000 4,394 2,190 - - - - 8,50,433 7,774 8,49,593 8,49,593 12,00,000

7 1,20,000 - 1,20,000 4,619 2,540 - - - - 10,26,438 9,492 10,25,424 10,25,424 12,00,000

8 1,20,000 - 1,20,000 4,886 2,917 - - - - 12,13,955 11,322 12,12,756 12,12,756 12,00,000

9 1,20,000 - 1,20,000 5,156 3,317 - - - - 14,13,756 13,272 14,12,359 14,12,359 12,00,000

10 1,20,000 - 1,20,000 5,506 3,754 - - - - 16,26,569 15,349 16,24,962 16,24,962 12,60,000

11 - - - 5,977 4,116 - - - - 17,28,669 16,891 17,26,961 17,26,961 12,60,000

12 - - - 6,400 4,383 - - - - 18,37,119 17,951 18,35,304 18,35,304 12,60,000

13 - - - 6,863 4,669 - - - - 19,52,296 19,076 19,50,367 19,50,367 12,60,000

14 - - - 7,306 4,964 - - - - 20,74,679 20,272 20,72,630 20,72,630 12,60,000

15 - - - 7,712 5,266 - - - - 22,04,798 21,544 22,02,620 22,02,620 12,60,000

16 - - - 8,065 5,573 - - - - 23,43,237 22,896 23,40,922 23,40,922 12,60,000

17 - - - 8,328 5,879 - - - - 24,90,667 24,335 24,88,207 24,88,207 12,60,000

18 - - - 8,818 6,243 - - - - 26,47,414 25,866 26,44,799 26,44,799 12,60,000

19 - - - 9,671 6,689 - - - - 28,13,662 27,492 28,10,882 28,10,882 12,60,000

20 - - - 10,611 7,169 - - - - 29,89,941 29,216 29,86,987 29,86,987 12,60,000

UIN: 104L098V05 Page 3 of 5

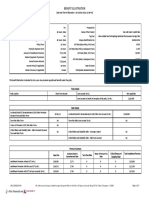

Gross Yield 4% p.a. Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 1,20,000 - 1,20,000 3,502 745 - - - - 1,17,717 638 1,17,601 1,10,521 12,00,000

2 1,20,000 - 1,20,000 3,641 986 - - - - 2,38,533 1,837 2,38,298 2,32,634 12,00,000

3 1,20,000 - 1,20,000 3,795 1,235 - - - - 3,62,516 3,068 3,62,158 3,57,910 12,00,000

4 1,20,000 - 1,20,000 3,960 1,492 - - - - 4,89,740 4,331 4,89,256 4,86,896 12,00,000

5 1,20,000 - 1,20,000 4,162 1,762 - - - - 6,20,250 5,627 6,19,638 6,19,638 12,00,000

6 1,20,000 - 1,20,000 4,394 2,043 - - - - 7,54,104 6,956 7,53,359 7,53,359 12,00,000

7 1,20,000 - 1,20,000 4,619 2,329 - - - - 8,91,399 8,320 8,90,519 8,90,519 12,00,000

8 1,20,000 - 1,20,000 4,886 2,629 - - - - 10,32,184 9,718 10,31,164 10,31,164 12,00,000

9 1,20,000 - 1,20,000 5,156 2,935 - - - - 11,76,549 11,152 11,75,387 11,75,387 12,00,000

10 1,20,000 - 1,20,000 5,506 3,263 - - - - 13,24,500 12,622 13,23,192 13,23,192 12,60,000

11 - - - 5,977 3,500 - - - - 13,54,074 13,466 13,52,737 13,52,737 12,60,000

12 - - - 6,400 3,630 - - - - 13,83,962 13,765 13,82,595 13,82,595 12,60,000

13 - - - 6,863 3,767 - - - - 14,14,122 14,067 14,12,725 14,12,725 12,60,000

14 - - - 7,306 3,902 - - - - 14,44,589 14,372 14,43,162 14,43,162 12,60,000

15 - - - 7,712 4,031 - - - - 14,75,413 14,680 14,73,956 14,73,956 12,60,000

16 - - - 8,065 4,150 - - - - 15,06,670 14,992 15,05,181 15,05,181 12,60,000

17 - - - 8,328 4,255 - - - - 15,38,478 15,309 15,36,958 15,36,958 12,60,000

18 - - - 8,818 4,401 - - - - 15,70,581 15,630 15,69,030 15,69,030 12,60,000

19 - - - 9,671 4,612 - - - - 16,02,553 15,952 16,00,970 16,00,970 12,60,000

20 - - - 10,611 4,839 - - - - 16,34,283 16,271 16,32,669 16,32,669 12,60,000

*There are no charges included in other charges. There are no additions included on Additions to the fund.

Notes: 1. Refer the sales literature for explanation of terms used in this illustration.

2. Fund management charge is based on the specific fund option(s) chosen.

3. In case rider charges are collected explicitly through collection of rider premium, and not by way of cancellation of units, then, such charges are not considered in this illustration. In other cases, rider charges are included in

other charges.

UIN: 104L098V05 Page 4 of 5

I, ……………………………………………. (name), have explained the premiums, charges and I, Rayees (name), having received the information with respect to the above, have understood

benefits under the policy fully to the prospect / policyholder. the above statement before entering into the contract.

Place:

Date: 11/21/23 Signature / OTP Confirmation Date / Thumb Impression / Date:11/21/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L098V05 Page 5 of 5

You might also like

- Rent To Own AgreementDocument13 pagesRent To Own AgreementjohnNo ratings yet

- Manzana Case AnalysisDocument5 pagesManzana Case AnalysisTitah LaksamanaNo ratings yet

- P6 Mind MapDocument9 pagesP6 Mind MapbiduzNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Bi 4299eekbDocument4 pagesBi 4299eekbchigiliseenaNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- Bi 9351xmteDocument7 pagesBi 9351xmtetoptrendingtoday30No ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Bi 0655kgueDocument9 pagesBi 0655kguevanselimNo ratings yet

- Max Life UlipDocument4 pagesMax Life Ulipjagdevwasson761No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- UIN: 104L098V03 Page 1 of 4Document4 pagesUIN: 104L098V03 Page 1 of 4sajeet sahNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001420020721Document6 pagesE SymbiosysFiles Generated OutputSIPDF 10200001420020721Sankalp SrivastavaNo ratings yet

- Illustration Qbxt9qkqiyoe8Document3 pagesIllustration Qbxt9qkqiyoe8mr copy xeroxNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- IllustrationDocument3 pagesIllustrationNiranjan LenkaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit IllustrationDocument4 pagesBenefit IllustrationAbhilash KumarNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- 2 5l:7pay (Deferment)Document3 pages2 5l:7pay (Deferment)sun16darNo ratings yet

- IllustrationDocument3 pagesIllustrationbrijesh.trivedi89No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- 2 5l:10pay (Differemnt)Document3 pages2 5l:10pay (Differemnt)sun16darNo ratings yet

- TNTNDocument4 pagesTNTNsamvil2007No ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- Illustration - 2022-10-11T115742.458Document3 pagesIllustration - 2022-10-11T115742.458BLOODY ASHHERNo ratings yet

- Illustration - 2022-11-03T115112.732Document3 pagesIllustration - 2022-11-03T115112.732BLOODY ASHHERNo ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- FPC010 Application For Providnet Benefits ClaimDocument2 pagesFPC010 Application For Providnet Benefits ClaimFe Pastor100% (1)

- Acces 01 02Document2 pagesAcces 01 02sasirajareddyNo ratings yet

- Osiris Data GuideDocument270 pagesOsiris Data GuideWilliam WijayaNo ratings yet

- Bar Examination Questions in Mercantile Law (2006-2018)Document132 pagesBar Examination Questions in Mercantile Law (2006-2018)hazelpugongNo ratings yet

- C550 Humana Dentral PlanDocument22 pagesC550 Humana Dentral Plananguyen22153319No ratings yet

- Summary WordingDocument5 pagesSummary WordingDaniel JenkinsNo ratings yet

- Insurance ProjectDocument9 pagesInsurance ProjectVineeth ReddyNo ratings yet

- Assignment On Insurance DocumentsDocument8 pagesAssignment On Insurance DocumentsNeha GuleriaNo ratings yet

- Marine Delay in Start-Up PolicyDocument34 pagesMarine Delay in Start-Up PolicyAkash kumar KanuguNo ratings yet

- Contracts Outline - Abuse of The Bargaining ProcessDocument64 pagesContracts Outline - Abuse of The Bargaining ProcessJason HenryNo ratings yet

- Dwnload Full Principles of Economics 12th Edition Case Solutions Manual PDFDocument35 pagesDwnload Full Principles of Economics 12th Edition Case Solutions Manual PDFmcalljenaevippro100% (15)

- Sun Life v. Tan Kit - LOANDocument2 pagesSun Life v. Tan Kit - LOANElca Javier100% (1)

- Aguila CaseDocument10 pagesAguila CaseCris NavarroNo ratings yet

- Association LTD, The Supreme Court Provided That The Articles ofDocument21 pagesAssociation LTD, The Supreme Court Provided That The Articles ofAman BajajNo ratings yet

- HDFC Unit Linked YoungStar Plus II 101L032V01Document40 pagesHDFC Unit Linked YoungStar Plus II 101L032V01Jasnak AdnanNo ratings yet

- 157 28395 EY111 2013 4 2 1 Chap003Document74 pages157 28395 EY111 2013 4 2 1 Chap003JasonNo ratings yet

- 07-12-30 Workshop AttendanceDocument8 pages07-12-30 Workshop Attendancericky_soni32No ratings yet

- Wharton Case Preparation Toolkit: Industry PrimerDocument25 pagesWharton Case Preparation Toolkit: Industry PrimerBailu Xu100% (1)

- Tata AIA Life MahaLife Gold DadDocument1 pageTata AIA Life MahaLife Gold DadMirzaNo ratings yet

- 2016 1098-MORT MORTGAGE 4868 WellsFargoDocument2 pages2016 1098-MORT MORTGAGE 4868 WellsFargoJay EvansNo ratings yet

- Q4 Business LawDocument645 pagesQ4 Business LawSubhashis Chakraborty71% (21)

- Types of InsuranceDocument2 pagesTypes of InsuranceS GaneshNo ratings yet

- LICDocument82 pagesLICTinu Burmi Anand67% (3)

- Article Differences FIDIC - OrgalimeDocument18 pagesArticle Differences FIDIC - OrgalimepapillonnnnNo ratings yet

- Inpatriates To Canada BrochureDocument2 pagesInpatriates To Canada BrochureLorena florez quintanaNo ratings yet

- Yudfjk JKHHDocument33 pagesYudfjk JKHHNoor MahmoodNo ratings yet

- Beneficiary Trust ActDocument17 pagesBeneficiary Trust ActArunaML100% (2)