Professional Documents

Culture Documents

Audit Report June 30 2021

Audit Report June 30 2021

Uploaded by

Dagnachew Tsegaye0 ratings0% found this document useful (0 votes)

8 views29 pagesOriginal Title

Audit report June 30 2021

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

8 views29 pagesAudit Report June 30 2021

Audit Report June 30 2021

Uploaded by

Dagnachew TsegayeCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

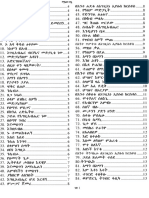

You are on page 1of 29

I

ETHIOPIAN ECONOMICS ASSOCIATION (EEA)

T AUDITOR'S REPORT AND

ATEMENTS:

AS AT AND FOR THE YEAR ENDED JUNE 30, 2021

"AYE GEDLU MEBRATE

CERTIFIED AUDIT FIRM

DFCHE PHODNLAFOPLADAPRPES PHL PLAT OR RACE

MUM

Queen Bl

#° Floor, Room No.401

‘Addis Ababa

CUARTERED CERTIFIED ACCOENEANTS (UK)

AND AUTHORIZED AUDITORS (E11)

Un

2.0.BOX 14848

Tel. O11 154 0634

Mobile 093 001 4496

E-mail: ugedtu7@gumal.coms migedu(ayahoo.com

Ethiopian Eeonomie Association

Cont

As of June 30, 2021

Contents

M

agement, Professional Advisors, and Registered Office

Statement of Management Responsibility

Auditors Opinion

Statement of Financial Position

Statement of Financial Perforn

nee

Statement of Changes in Net Assets

Statement of Cash

General Background

Signi

Notes to the Adoption of IPSAS

ant Accounting Policies

Note to the Financial Statements

page

Ethiopian Economies Associ

Management, Professi

As of June 30, 207

rs, Registered Office

Organization

Ethiopian Economies Association

Registered office:~ Addis Ababa, Ethiopia:

Registration: Registe for Civil Society Organization Rey

‘Address:- Yeka Sub City, Woreda 11, House No , New

‘Velephone +251 116453200 email: info@

stration No 1373

Executive Management

Name ma Position

Prof. Mengistu Ketemia Chief Executive Officer

Dr, Degeye Goshu Director, Research and Policy Analyisis

Dr. Semench Bessie Director, Comm. & Partenership [2020/2021

[Ato Woubeshet Amerga Director, Admin & Finance [2020/2021

fAwo Demirew Getachew Research Project Coordinator 020/2021

Independent Auditors

‘Tesfaye Gedlu Mebrate

Certified Audit

Chartered Certified Accountants [UK]

Authhorized Auditors [ETH]

P.O.BOX 14848

Addis Ababa, Ethiopia

Bankers

Commercial Bank of Ethiopia

Hiibret Bank SC

Bank of Abyssinia

ncial Statements

Statement of Management Responsibility for F

The management

representations contained in the financial statements for the years ended June 30, 2021, This

financial statement is prepared in accordance with International Public Sector Accountis

Standards (IPSAS) based on the requirements of IPSAS and reflect amounts that are based on the

best estimates and informed judgment of management with an appropriate consideration to

materiality. As IPSAS standards are basically designed for public sectors, some of IPSAS.

standards may not be applicable to EEA and hence, applied IPSAS sta

this report. In addition, other national laws that are applicable to the organization is consider

the preparation of the financial statements

thiopian Economic Association is responsible for all information and

rds are only covered in

In this regard, management maintains a system of accounting and reporting which provides for the

necessary intern

are safeguarded against unauthorized use or disposition and liabilities are recognized.

controls to ensure that transaetions are properly authorized andl recorded, assets

Name Wubeshet Amerga

Position Director, Adpfinjpfration & Finance

Signature Signature a

Date Date OCHRE,

m E ne

“AY Econonncs

a nas

TNE ISM BNd-t

Tesfaye Gedlu Mebrate

PtaAhcat ALE LCEE

Certified Audit Firm

Chartered Certified Accountant (UK) Authorized Auditor (ETH)

Independent Auditor's Repo

‘To Ethiopian Economies Associ

Opinion

We have audited the accompanying financial statements of Ethiopian Economies Association set out on

pages 7 10.9 which comprise the statement of financial postion as at 30th June 2021, the Statement of

Financial Performance, Statement of ehange

the ended, and notes to the financial statements, including a summary of significant accounting policies.

in net assets and the Cash flowa statement for the year

In our opinion, the financial statements give a true and fair view ofthe financial position of the organization

as at 30th June 2021 and of its financial performance and its cash flows for the year then ended in

accordance with International Public Sector Accounting St

andar,

Basis of Opinion

‘We conducted our audit in aceordance with International Standards on Auditing (IS/\). Our responsibilities

under those standards are further described in the Auditors’ Responsibiliti

statements section of our report, We are independent of the ory

International Ethics Standards Board for Accountants’ Code of Eth

(IESBA Code), together with other ethical requirements that are relevant to our audit of the financial

statements in Ethiopia, and we have fulfilled our other ethical responsibilities in accordance with these

requirements, We belie wwe have obtained is sufficient and appropri

provide a basis for our opinion,

for the audit of Financial

ization in accordance with the

for Professional Accountants

¢ that the audit eviden eto

Management Responsibility for the Financial Statements

Management is responsible for the preparation of fina

Intern:

{al statements that give you in accordance with the

jonal Public Sector Accounting Standards and for such internal controls as Manage

are necessary to enable the preparation of financial statements that are free rom material misstatem

whether due to fraud or error

¢ determing

In preparing the financial statements, management is responsible for assessing

continue as a going concem, disclosing , as applicable, matters related to

Auditor's responsibility for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatements, whehter due (o fraud or error, aud 10 issue

includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an

audit conducted in accordance with ISA will

Misstatements can arise from fraud or error and are considered material if, individually o in aggregate,

n auditor's report that

Iways dotect a material misstatement when it exists

they could reasonably be expected to influence the economic decisions oF users taken on the basis of

of these financial statements.

SA, we exet

As part of an audit in accordance with

professiosl sceptickism throughout the audit, We also:

i) Identify and assess the risks of material misstatement of the Finaneal statement, due to fraud

or error, design procedures responsive to the risks, and obtain audit evidence that is sufficient

approp

resulting from fraud is higher than for one resulting from error, as fraud may involve collusion,

forgery, intentional omissions, misrepres ternal control

ii) Obtain an understanding of internal control relevant to the audit procedures that are appropriate

in the circumstances, but not for the purpose of expressin,

the organization's internal control

Evaluate the appropriateness accounting polic

estimates and related disclosures made by management,

iv) conclude on the appropriateness of the mane

k of not detecting a material misstatement

we to provide a basis for our opinion, The r

entations, or the override of

ntei

an opinion on the effectiveness of

xed and the reasonablness oF'aecounting

ment use of th

ing concern basis of accounting

and based on the audit evidence obtained, whether a material uncertainty exists related to events

‘or conditions that may cast significant doubt on the organization's ability to continue as @ going

concer, If we conclude that a material uncertainty exists, we are required to draw attention in

our auditor's report to the related disteosure: nts or, fsuch disclosure

adequate, to modify our opinion. Our conclusions are based on the audit evidence obtained

upto the date of our auditor's report. However, future events or conditons may’ cause the

organization to cease to continue as a going concern.

the fina

¥) Evaluate the overall presentation, structure and eont

of the financial statements, ineluding the

disclosu transactions and events

cs and whether the financial statements represent the under

ina manner that achieve fair presentation.

We communicate with 1

of the audit and significant deficiencies in internal control that we identify through our audit

at re

urding, among other matters, the planned scope and timing

We also provide those charged with management with a statement that we have complied with the

relevant ethical requirements regarding independence, and to communicate with them all relationsh

and other matters that may reasonably be thought to bear on our independence, and where applica

related safeguards,

5)

Tesfaye Gedlu Mebrate

Certified Audit Firm

Statements of Financial Performace

For the Year Ended June 30,2021

Income

Donation

Other Income

Expenditures

Program Expenditures

Administrative Expenditures

Excess (Deficit) of Income over Expenditure

Note

49

4.10

2024

2020

59,199,962.77 23,923,660.00

7,512,427.74 4,907,872.00.

66,712,390. 28,831,532.00

36,317.420.59 10,346,456.80

8,678,171.01 3,650,065.38

44,995,591.60, 13,996,522.18

21,716,798.91 14,835,009.82

Statements of Financial Position

As

ye 30, 2021

Note

Assets

Non Current Assets

Property, Plant and Equipment 4a 829,108 28.406.233

Investment in IGA, S63

Right co Use Assos 42 0

28,400,667, 28,746,801

Current Assets

Detvors 43 76.969 $98,398

(Cash snd Bank Balances

‘Total assets

[Not Asset / Equity

Fund Balance 6.391.262 4,760,349.

‘Total equity / net assets 6331.20 4,760,389)

Non-Current Liabilities

Lease payables = 351,048

Employee Benefits 342 3.263.016 1,383,320

aa. 06 176368

Current Liabilities

Creditors as 93.191 302,008

“Tax Payables 46 622,363 384,518

Employee Benefts- Annual leave 340 1.206 279.250

Deferred Revenue 0

1507.21

4.770467

71101729

27,030

Prof Mengisin Ketema

Chief Execmive Officer

Ato Woubeshet Amerger

Director, Administration & Finance

Ethiopian Economics Association

atements of Changes in Equity / Net Assets

For the years ent ne 30, 2021

Fund Balance (IPSAS) as of June 30,2019

Excess of Revenue over Expenditure

Fixed Assets fund balance Adjustment

Prior year adjustment

Fund Balance (IPSAS) as of June 30, 2020

Fund Balance as of July 1, 2020

Prior year adjustment

Excess of Income over expenditure

Fund Balance as of June 30, 2021

31,953,040.71

14,835,009.82

(1,666,321.00)

(361,378.00)

44,760,.351,53

44, 760,351.53

(145,888.02)

21,716,798.91

66,331,202.42

onomies Association

Statements of Cash Flows

Fs 1d June 30,2021

(Cash ows trom operating et

Excess of Income over expedite

Depreciation

Lease Amorisation

Transfer

Prior year adjustment

Working Capital changes

‘Changes in Debtors

Changes in Creditors

‘Change in Tas Liabilities

‘Changes in Deferred Revenue

(Change in Employee B

Change in Employee Benefits vacation

[Net eash provided by operating activities

nefits Severance

Cash fow from Lavesting Activities

Acquisition of properties and equipment

PE Adjusines

Net cash us

investing activities

Cash flow From Finan

Lease Paid

[Net Cash flow from financing ativtes

ng Aetivities

Increase (deere) in cash and cash equivalents

‘Cash and cash equivalents:

‘At bepining of perc

Aven of perio

er

Nate

24,716,79891 Las3s.010

197.903.00, 7818

5.2039

(9,500,000 00)

(145,888.02), 0137),

801,129.48 (76533)

(408,211.70), aly

2578IS.57 20)

(27,030.00), 27.030

Lsr.2604 sa

279236

512,010.38

(7.812.015 00)

306,785.63),

351.01.66) e510

(351,087.60) (25.710)

90747384 13.480.68

mies Association

Notes to the Financial Statements

‘For the Year Ended June 30,2021

1. GENERAL BACKGORUND.

1.1 Introduction

ce with International Public Sector Accounting

30 June 2020.

ndards required for publie

This financial statement is prepared in accorda

Standards (IPSAS) based on the requirements of IPSAS for financial year endin

‘Though IPSAS standards are fully meant for public sector, some of the st

sectors may not applicable to ition, hereinafter referred as BEA and

may not be covered in this report

Ethiopian Feanomies Associa

EEA is a first-time preparer of IPSAS financial statements, The transitio

accounting standard have therefore been covered. AS a first-time adopter of IPSAS, EEA provide full

disclosure in the accounting policies and in the notes to the financial st

use of the transitional provisions.

| provisions of each

ments when it has made

1.2 About EEA

‘The Ethiopian Economic Association (EEA) is a non-profit and independent professional

organization established on 25 November 1991. The association promotes the study of economies in

Ethiopia, promotes economic research and assists in its dissemination and facilitating contact with

Ethiopian and foreign

Policy Research Institute (EEPRI

research and in organizing short term trainings on

Ethiopia's economic development. Key objectives of the association is to contribute to the economic

sonomists. The Association has established, under i, the Ethiopian Economie

in July 2000 as its research wing, ‘The Institute is involved in

ous issues that are of critical importance to

policy formulation capability and broadly to the economic advancement of Ethiopia.

Principal activity of EEA includes

+10 promote the professional interest of its I

+ to promote the study of economies in the country's educational institutions

+ fo promote economic research and assist in the dissemination of the findings of such

Ethiopia:

+ to provide fora for the discussion of economic issues, and

+0 promote professional contacts between Ethiopian economists and those of other

countries.

onomists;

research,

A (80820 5;

ES 1.4,

OS 140.

ne

‘Jey ment

ely MeOr

era

keg 5

Audit

10

The General Assembly is the highest decision-making body with the responsibility of

providing an overall policy framework. An Executive Committee elected by the General

‘Assembly and serving for three years provides leadership. It has a secretariat with employed

staff who manages the day to day activitics of the Association. ‘The Ethiopian Economic

Policy Research Institute, which is a subsidiary of the Association is oreanized under four

research divisions namely, Agriculture and Rural Development Division, rade and Industry

Division, Social and Human Resource Division and Macroeconomic Division. Each division

is staffed with at least one full time senior researcher and one

searcher.

sociation in Africa by 2030.”

envisioned to become a premier economi

on: The mission of EEA is to provide a platform for networking, access to information and

learning; to contribute to a better understanding of the glob:

and investment decision; to offer training

national and local economic

issues; to inform and influence economic policymaki

and foster the advancement of discipline of economics.

Values: Professionalism, integrity, independent inclusiveness, teamwork,

accountability and transparency.

quality, efficiency,

Motto: Professionalism and Economic Thinking for Development!

SV ecuency AF

Ethiopian Economies Association

Notes (o the Financial Statements

For the Year Ended June 30,2021

1.3 Statement of Compliance and Basis of Preparation

adopting IPSAS for the first time in July 1, 2019, eleeted and applied the following transitional prov

ption allowed under IPSAS 33 paragraph 63 to 134 that do not affect fair presentation and complianes

sis of IPSAS.

and ex

with accrual

IPSAS 17, Property, Plant and Equipment

EEA applied the accounting policy under IPSAS for property, plant and equipment on historical cost

IPSAS 39, Employee Benefits

EEA applied the accounting policy under IPSAS 39 for employee benefits. L:mployce benefit labilities are

measured based on the salary at th ied approach projection in line

with the calculation provided under the Ethiopia Labour Law

| of the reporting period with a simpli

New standards and Interpretation not yet adopted

-EA didn't adopt IPSAS 4 - Financial Instruments and IPSAS 42 - Social Benefits, which will be effective

from January 1, 2022. EEA didn’t have complex financial instruments. Its receivables and payables are short

terms and doesn't have other debt and equity instruments and the adoption of PSAS 41 will not have sig

impact. The management of EEA considered [PSAS 42 less applicable to 1PSAS.

For the Year Ended June 30, 2021

Ethiopian Eeonomies Association

Notes to the Finaneial Statements

ACCOUNTING POLICIES

2 SUMMARY OF SIGNIFICAN

icies applied in the preparation of these financial statements are set out

The significant a

below. These policies have been consistently applied to all the years presented, unless otherwise

stated.

2.1 Basis of preparation

The financial statements for the period ended 30 June 2021 have been prepared in accordance with

International Public Sector Accounting Standards ("IPSAS") as issued by the International Public

Sector Accounting Standards Board ("IPSASB"). Additional information requited

regulations is included where appropriate

py National

‘The Financial Statements of EEA have been prepared in accordance with and comply with

International Public Sector Accounting Standards (IPSAS). The Financial Stat

Birr (ETB) whieh is also the funa

donors is convereted in to ETB equivalent on the date of receipt by the bank at an exchange rate

yents are presented in

Ethiopi

nal currency. Cash transferred in foregin currency from

prevailing on the date of re

‘years presented.

iting policies have been consistently applied to all the

he financial and Other Comprehensive

ments comprise the Statement of Surplus and Defi

‘The F

in accordance with IPSAS.

incial Statements for the period ended 30 June 2021 are the second for ELA has been prepared

All values are presented without roundit

otherwise indicated.

fen’ rounded to the nearest thousands), except when

reney is Ethiopian Bier (ETB)

IEA’s funetional and reporting cu

‘The Financial Statements provide comparativ

addition, EEA presents an additional Statem

period when there is retrospective application of

‘reclassification of items in financial statements

information in respect of the previous period, In

The financial statements have been prepared on a going concern basis. ‘he management has no doubt

2.3 Key Judgements and Sources of Estimation Uncerta

ty

3, estimates and assumptions that affect the

I statements requires Judgemes

application of policies and reported amounts of assets and liabilities, ineome and expenses. ‘The key

judgements management have made in preparing the financial statements are as follows:

cful life of Property, Plant and Equipment (PPE) based on judgement

tthe condition of the

ind also the start-up estimated useful life of new assets though

EEA estimated the r

of the management taking into ace

threshold for the determination of PPE

the useful life is subject to revision annually, Accounting policy on PPE

sels. AS.a policy BEA set out the

stated under Note 2.11.3,

Key estimates and underlying assumptions are reviewed on an ongoing basis, Revisions to accounting

estimates are recongnised in the period in whieh the estimate is revised, if the revision affeets only that

period, or in the period of the revision and future periods if the revision afleets both the period of

revision and future periods.

2.4 Foreign Curreney Transactions

EEA’s functional and reporting currency is Ethiopian Birr (EB), ELA translate its foreign euereney

accounts into ETB at the prevailing exchage rate on the date of reporting, ‘rhe result yin oF loss on

translation are dealt with the Statement of surplus and deficit.

2.5 Changes in accounting policies and est

The effets of changes in

1s of

counting policy retrospectiv

ing policy are applied prospectively if retrospective application is impractical, the eff

in surplus or deficit

EEA recognizes the effects of changes i

changes in accounting esti

s reflected prospectively by inchudi

2.6

snt versus Non-current classific

EEA presents assets and liabilities in the statement of fi urrent

ication, An asset is current when it is:

rancial position based on current/no

Expected to be realized or intended to sold or consumed in the normal operating. eyele held primarily

for the purpose of the operation

Expected to be realized within twelve months

Cash or cash equivalent unless restricted from being exchanged or w

twelve months after the reporting period.

All other assets are classi

the reporting period, or

ed to seule a liability for at least

as non-current

A liabil

is current when:It is expected to be settled in the normal operating eyete

Itis held primarily for the purpose of the opration.

Itis due to be settled within twelve months after the reporting period, or

‘There is no unconditional right to defer the settlement of the liability for at least twelve m

the reporting period,

all other liabilities as non-current

2.7 Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and cash at bank, high liqquid investments with a

maturity less than 90 days from the date of aquisition and which are readily convertible to known

amounts of eash and are subject 10 insignificant risk of changes in value

2.8 Loan and Receivables

Receivables from exchange transaction are mainly resulted from sales of rental services on credit

Receivables from exchange transactions are recognized initially at fair value and subsequently

measured at amortized cost using the effective interest method, less provision for iinpairment

Receivables from non-exchange transactions comprises as « result of non-irrevocuble pledye received

from a donor.

aif repaid on installment bi

and! deer

Loan disbursed to stalT are recorded as receivabll ses as

‘Advance to contractors and consultants are recorded as receivable when paid and shall be settled

against evidence of delivery of services or goods.

{of receivables is established when there is objective evidence that EEA

due according to the original terms of the receivables.

A provision for impair

will not be able to colk

amo

Inventory is measured at cost upon initial recognition, To the extent that inventory was received

through nonexchange transactions (for no cost or for'a nominal cost), the cost of the inventory is its

fair value at the date of acquisition. Cost is determined using Wieghted Average method

Inventories held for distribution for members and to the public for free are recorded at cost, adjusted

where applicable for any loss of service potential. Anni ied at lower of

cost and Netrealisable value (or replacement cost). When the value of inventories counted at the end of

reporting period are insignificant, EEA does not recognise them.

inventory on hand are

2.10 Other Recei

bles and Current Assets

ged when transaction

Prepayment and deposits are stated at cost (at fair value of consideration exh

occurred) and transferred to the appropriate expenditure account on a monthly basis with the

equivalent value services rendered by the vendor.

transferred to the appropriate expenditu

assignment

EEA assesses at each statement of finaneial position date whether the

financial asset or a group of financial assets is impaired,

21 Property, Pint and Equip

21 Recognition and Measurement

4 impairment

All property, plant and equipment are stated at eost less accumulated depreciation 3

losses. Cost includes expenditure that is direetly attributable to the acquisition of the items, When

significant parts of property, plant and equipment are required to be replaced at intervals, EEA

recognizes such parts as individual assets with specific useful lives and depreciates them accordingly

Likewise, when a major inspection is performed, i the carrying amount of the

plant and equipment as a replacement if the recognition criteria are satisfied, All other repair and

maintenance costs are recognized in surplus or deficit as incurred, Where an asset is aequired in a no

exc

“The materiality threshold for the reco;

is cost is recognized in

\ge transaction for nil or nominal consideration the asset is initially measured al its fair value.

ition of PPEs is ETB 30,000.

rying amount or recognized as

4 separate asse

Subsequent costs are included in the asset's

appropriate, only when itis probable that future economic benefits or service potential associated

with the item will flow to EEA and the cost of the item can be measured reliably. The carrying

amount of a replaced part is derecognized. All repair and maintenance are charged to the statement

ancial performance during the financial period in which it is incurred,

of fi

2.11.2 Dereeognition

{An item of property, plant and equipment is derecognized upon disposal or when ns future economic

benefits are expected from its use or disposal.

2.11.3 Depreciation

Depreciation on assets is charged on a straight-line basis at rates calculated to allocate the cost or

valuation of the asset less any estimated residual value over its

cee | Depreciation | Useful tite in years

Building Straight Line 40

Equipment Sirsight Line 10

10

Fur

ure

[Generator

[Computers and Accessories

[Vehele Straight Line 10

The assets’ residual values and uselul lives are reviewed, snd adjusted if appropriate atthe end of

each reporting period. An a

amount or recoverable service amount if the

recoverable amount or recoverable servie

's carrying amount is written down immediately to its recoverable

18 amount is greater than its estimated

ssets carry!

2.12. Payables under exchange trans

Payables and accruals are fmancial liabilities for goods or services that have been received bl

paid by the reporting date. Payables are recognized initially at fair value and subsequently me

amortized cost using the effective interest method. Payables and accruals are of a short-term na

and are recognized at cost as the effect of discounting is not considered material

2.13 Provisions

A has a present obligation (legal or constructive) as a result of a past event, itis probable that an

outflow of resources embodying economic benefits or service potential will be required to settle the

‘obligation and a reliable estimate ca mount of the obligation. EEA expects some or all

of a provision to be reimbursed, for example, under an is

recognized as a separate asset only wher

bbe made of the a

surance contract, the reimbursement is

bursement is virtually certain,

‘The expense relating to any provision is presented in the statement of financial performance net of any

reimbursement

a le s based on

2.14 Leases ‘The de

the substance of the arrangement and requires,

dependent on the use of a spec

asset

nation of whether an arrangement is _ oF contains a lease

assessment of whether the fulfillment of the

-ment conveys a right to use the

ment

ie asset or assets or whether the arra

EBA asalessee Leases that do not trans

incidental to ownership of the leased items are operating leases. Operating lease payments are

recognized as an expense in the statement of finan

term.

fer to the Company substantially all of the risks and benefits

performance on a straight-line basis over the lease

EE

of ownership of the asset are classified as operating leases. Rental income is recorded as earned based on

the contractual terms of the lease. Initial direct costs incurred in negotiating operatiny

the carrying amount of the leased asset and recognized over the lease term on the same basis as rental

income,

as alessor Leases where the Company does not transtir substantially all of the risk and b

lcases are added to

Ri

{-to-use arrangements Where EEA has signed an agreement for the right-to-use assets without

legal ttle/ownership of the assets, e.g., through donated use granted EEA at no cost, the transaction is @

non-exchange transaction. In this case, an asset and revenue is recognized at the point the

agreement is entered into. Recognition of an asset is contingent upon satisfying criteria or

jon ofan asset, Valuation of the asset will bet of the resource for which the right to

use was acquired at the date of acquisition. The asset is depreciated over the shorter of the asset's. useful

life and the right-to-use term, Revenue is also recognized at the same amount as the asset, except to

the extent that a liability is also recognized.

2S Net Asset /Equity

EA's equity comprises the initial cash and assets received from its member oryaniation

subsequent transfers of eash and assets from the organization and donors as revenue and are

recongnised as revenues in the Statement of Financial Performance. The surplus trom the rf

expenditure will add up to the total

2.16 Revenue

Revenue is recognized to the extent that itis probable that the economic benefits oF service po

flow to BEA and the revenue ean be reliably measured,

Ww (

Revenue from Exehange ‘Transactions / Cot

Revenues from non-es

donors, from local and international charitable organizations and Local and Foreign government

entities are measured at fair value and recognized on obtaining control of th

services and property). However, Ifthe transfer is attached wi

legally enforceable, revenue is recognized to the extent of Ti

recognized to the extent that a present obligation his not bee

jange transactions with entities such as transfers or contribution from private

set (cash, goods,

condition and the conditions are

filled conditions and a liability is,

satistied

Revenue from exchange transactions

ions for LEA includes membership fees; revenue from sales of

ie comprises the fair

Revenue from Exchange Tr

publications, gains/losses on disposal of property, plant and equipment, Rever

value of consideration received or receivab le for the sale of goods and services. Revenue is

shown net of retums and discounts, Revenue is recognized when it ean be rel iably measured, when

the inflow of future economic benefits is probable and when specific eriteria have been met

2.16 Expenditure

BEA expenditure is recognized on accrual basis. Expenditures are classified as program expenditure

and administration expenditures. According to the Organization of Civil Societies Proclamation

1113/2020, EEA’s administration expenditure should not execed above 20% of the total Income for

the reporting period. The classification of expenditure between administration and program is,

provided in the guideline issued by the Ageney for Civil Society Organizations

2.17 Employee Benefits and obligat

EEA has short term employee benefits that includes defined contribution plans, defined contribution

has

plan is a pension. fund plan under which EEA pays fixed contributions in to a separate entity

no legal or constructive obligations to pay further contributions, Obligations for contributions to

defined contribution schemes are recognized a

which the services are rendered by employees.

‘expense in surplus and deficit in the period during,

2.17.1 Pension and Provident fund Short term benefit

PEA\s Pension fund contribution is 11

EEA makes pension fund contribution on behalf of its employ

% on the basic salary of the employees employed in accordnace with Private Organi

Pension Contribution Proclamation (2011). Employees contribute 7% of their basi salary for provident

fund (7% those who are in the Pension Scheme). ‘The Private Organization 1

Proclamation No 715/201 requires a pension contribution is

tions Ei

nployees!

‘and 11% by the emp und

employers respectively to be deposited every month within 30 days from the end of each month, The

is administered by the Private Organization Pension Fund Ageney other

EEA other than the above stated monthly contribution. Ch

EEA

nd there is no an

sase of « provident

pension fi

liability to

_— fund account to employees is granted when employees resig

2.17.2 Vacation or Leave pay_Short term benefit

Unused annual leave are accrued. Employees are entitled to get the equivalent salary for u

leaves up on employment contract termination,

2.17.3 Severance Payable_Long-1

ince pay in aceordanee with Labour Proclamation No

month salary for the

for employ

mployer

acerues future liabilities on sever

1156/2020. ‘The Proclamation requires employers to pay a severance pay of on

first year of services and 1/3 of monthly salary for each additional year of servi

served more than five years or those who have been terminated by the will of the

‘computed the severance payable to the extent of employees service year to the date of reporting based

‘on the salary on the date of reporting taking into account stalf turnover rates. FEA will not pay

severance pay if staf member leave the organization by his own will before the fifth year aniversary of

employment , Due to the lack of reliable data on mortal

rate

y rate, salary growth rate, discount

and other parameters, the management opted a simplified but more reasonable estinration approach for

severance pay comput

inimize its exposure to financial risk. It receive from its intenational donors on

th transfer to partners is made on

of previous advances

hes in its account, C:

EEA maintain some of its eash order to ensure fore

payments on demand.

n curreney

2.18 Related Parti

EEA regards a related party as a person or an entity with the ability to exert control individually oF

jointly, or to exercise significant influence over the entity, or vice versa, Members of key manayement are

regarded as related parties,

‘A established a separate business unit to manage the income

of the realestate business units and other services. The separation of the income generating unit is a result

of EEA board decision to comply with the Civil Society laws of Ethiopia which requires charitable

aivit

ing activities including managment

organization to manage income generating,

accordnace with relevant commercial codes.

ss under a seprate business unit established in

Ethiopian Economics Associati

Notes to the

3 Notes to the Adoption of IPSAS

‘The financial statements for the year ended 30 June 2021 are the second time EEA financial statements

prepared in accordance with IPSAS

Accordingly, EEA has prepared financial statements that comply with IPSAS applicable as at 30 June

2021, together with the comparative period data for the year ended 30 June 2070, us described in the

summary of significant accounting policies.

31

in requirements under

jement of

IPSAS 33 allows certain exemptions from the retrospective application of ce

IPSAS. EEA. didn’t apply exemptions and opted for the preparation of comparative sta

e Revenue and Expenditure.

3.2 Property, Plant and Eq

‘The Management raised the materiality threshold to ETB 30,000. Asa result, the carrying value of

certain PPEs which doesnt mect the threshold are derecognised. he useful life of the assets were

reassessed on the date of IPSAS adoption

3.4 Employee Benefit

q EEA provide for employce benefit in accordance with IPSAS 39. The adoption resulted a Jong term

‘employee benefits of ETB 3.263.046 (Jun 30, 2021). ETB 791,266 recognised as a short term employee

benefit as at June 30, 2021

3.4

Short term Employee Bene!

Short term employee benefit is Annual leave payable, pension payables and other short term staf?

payables which will be settled within 12 months.

20

a ere

Annual Leave payable 279.256

n 3.4.2 Long Term Employee Benefit Payable

Long term employee benefit represents severance pay payable

22 2020

ETB EIB

263,046 1,383,320

Severance Payabale

3.5 Reconciliation of Financial Position as of June 30, 2021

Assets

Non Current Assets

Property, plant

Investement in

Right to Use Assets

id equipment

Current Assets

Debtors

Cash and Bank Balances

‘Total assets.

Lease Payables

Employee Benefits

(Current Laibil

Creditors

‘Tax Payables

Employee Benetits-Annual leave

Defered Revenue

‘Total Liabilities

‘Total Net Assets/Equities &

Ree rama 7

2020

ETB

28,406,233

0

898.398

18,042,327

18,940,725

7,526

14,760,349

44,760,349

351.018

1,383,320

“1734308

302,003,

384,518,

219.

eae

2,927,175

47,687,524

2

dit Fin

stiments

ETB

(27,577,129)

27,571,563

(340,569)

(346,135)

(821,429)

24,581,766

23,760,338

23,414,203

913

0,913

21,

(51,018)

1,879,126

1,528,

(408,212)

237,845

512,010

On

0)

314,613.50

1,843,292

23,414,205

2021

ere

829,104

27,571,563

oO

"28,400,667

76,910

412,624,093,

42,701,063

71,101,729

66,331,262

66,331,262

3,263,046

93,792

622363

791.266

0

15071

4,770,407

T1101,729

Ethiopian Economies Assocaition

Notes to the Financial Statements

For the Year Ended June 30, 2021

4. NOTE TO THE FINANCIAL STATEM

4.1 Property, Plant and Equipment

Balance as of June| Balance as of

30,2020 as per Addition in

vesas | orsvosaus | “ananat "| aspertts

eos a | =

Buiings Terao | Giemsa)

fics Ep 269.50 Wisoo0| emo

Office Furniture 30,000 oer _ 30,000,

Vehicl 2,355,908 z 7,500,000.00, 9,855,908

Generator riess | 700530) :

Compu 7.5 oo | 8365 | nurs

S75H181 | GLITI6820) 7.812.015] _12see8

[Accumulated Depreciation

Buildings 132.717 | (6.432.717 on

Oifce Equipment 269.500) ia 7

‘omiee Furniture 30.00 : 30,000

Vehicle 1,995,323 216K OS

Gencrator sao | 235.110.00) :

‘Computers 380.9985 a ans

9.109.918 | (6,668.127.00) 790s | 2009724

[Book Valute a E

Buildings ED _—

‘Office Equipment — | sie2s.00

Ofte Furniture :

Vehicle ons | mas

Generaior aos | _ ci :

‘Computers 37407 360.205

Tout 2m A235 529,108

Ethiopian Economies Association

Notes to the Financial Statements

For the Year Ended Jume 30, 2021

4.2 Leasehold Land

The Associations obtained a 2011 meter square land at a lease cost of ETB 642,903.29 from Addis Ababa City

Si ity for the lease life of 99 years, starting from June 23, 2003, The lease right

ment is ETB 25,716.13 for a period of 20

ling bank iterest rate, This has been

istration Autho

inistratio

granted with a 20% advance payment of lease price . The annual lease pa

‘years. Interest also shall be paid on the outstanding unpaid lease amount at a pre:

wholly transferred to the IGA unit of the Association,

4.3, Debtors

Debtors includes advances to contractors, partners and staf’ members. The management didn’t forsee any

credit losses in connection with the outstanding balances. Advance to a contract represents a significant

part of the debtors balance. The advance payment shall be transferred to Construct

fonce a payment te is received from the contractor

n in progress account

2021 2020

Staff Debtors 22,170 363,564

Sundry Debtors 19,000 182,922

Withholding Receivables 35,221

VAT Receivables 08 16,691

76,969 898,398

44° Cash and cash equivalents

All cash and bank balances are represented by largely by cash in bank with small amount of petty cash

fund, The cash and cash equivalents balance as of June 30, 2021 as

Cash on Hand : 1,369.00

Cash at Bank 42,624,094 18,040,958

42,624,094 18,042,327

Ethiopian Economies Associaton

Notes to the Financial Statements

For the Year Ended June 30, 2021

4.5 Payables

4.5.1 Creditors

Grant and Contract payables are unrestricted yrant r

to Profit and loss account when spent.

Provident Fund Payable

Sundry payables

Staff Payable

Retention payable

Deposit Payables

4.5.2 Tax Payables

‘Tax payables are witholds from employees incon

collected from vendors to be settled within 30 da

Income ‘Tax Payables

Withholding Tax Payables

Pension Fund Payable

VAT Payable

4.6 Employee Benefits

4.6.1 Short term Employee Benefit p

Short term employee benefit is vacation le

les which will be settled within 12 months.

Annual Leave Payable

4.6.2 Long’Term Employee Benefit Payable

Long term employee benefit represents severance pay payable

Severance Payabale

veived from donors. The balance will be transferred

2020

ETB

82,348

15,102

93 40

68,475 =

404,

93,791

tax and pension contribution and witholding, tax

from the date of collection

2021 2020

ELE E

139,954 177.231

5,613 51,788

177,196 52,996

: 102,503,

ee,

1 payable, pension payables and other short term stall

791,266

2021

1B

3,263,046

4.7 Related Party Transactions

4.7.1 Related Ent

Related party transactions represent transactions with senior management of BEA. The EEA Board of

Directors approved the establishment of an Income Generating Unit, which is fully owned by EEA

which has been established from Ist of July 2020,

4.7.2 : Key Management Personnel

Key management personnel in 2020/21, comprise the Chief Executive Officer, Director, Research and

Policy Analyisis, Director,Communication & Partenership, Research Project Coordinator and Director,

Admin & Finance. The remuneration of key management personnels is. as follows:

4.7.3 Compensation of key management personnel

Salaries

Employee benefits

wement personnel 5 4

74.9.4 Related Party ‘Tr:

‘The IGA unit of the Association has been approved by the Board to operate with its own management

structure and reports its financial statements in accordance with business accounting, principles sicne

July 1,2020. As of the reporting date it has not declared the tax duc and the net result has not been

incorporated in these Financial stauments .

actions

Ethiopian Economics Association

Notes to the Financial Statements

For the Year Ended June 30,2021

48 Revenue

48.1 Grnats

Grants

4.8.2 Other Income

Membership Fee

Sales of publications

Rent

Gain on Sale of assets

Gain on Foreign Exchange

Deferred revenue

Interest Income

Sundry

4.9 Expenditures

4.9.1 Program

Progam service

Salaries and Way

Printing and Publishing

Workshops, Contere

Assembly

Project Expenditures

EEA Chapters

Employee Benefits - Sever

Employee Bene

and General

59,199,963

461

2021,

are

Say

35,949

608.679

6630.48 2,108,269

27.030 :

1766222 16,695

934,902

ont

ene

868,251.00 :

8.137.230

1324145.31

155.146

230,881 1,474,148

23,170,984 4,581,095

500 136,459

1AL9 574,370

6 216,423.00

10,341,217

4.9.2 Administration

Salaries and Wages

Employee Benefits

Printing, Stationeries and supplies

Building maintenance

Repair and Maintenance

Vehicle Running Costs

Bank Charges

Building Tax

‘Advertisement and Promotion

Interest on land lease

‘Travel and Perdiem

Cleaning and San

Subscripti

Professional Fee

Audit Fee

Legal Fee

Staff meeting & training

Uniforms and Outfits

Vehicle donated

Fixed Assets

Computers and Electrical Materials

Miscellaneous.

mployee Benefits

Employee Benefits - annual leave

tation

tion

Severance Pay

57,049

B9,D1

59,715

19410

2,739,010

377415

68,550

16,220

4,674

329,737

148.901

0

17,375

40393

1,863

84,088

19,953

124,118

39,799

Is

328,160

372.914

34,768

22.477

685,120

M1

8,678,171

7

2020

2,595,380.

499,032

223,871

64,887

115,950

223,814

48,961

87,864

2415

11,095

158,190

20,888

4.928

21,308.00

3.243,

182,352

18,228.00

46,477

26,570

o

16,687

110,736.00

23,056

304

4.9.3 Percentage of Program & Ad Exp

In accordance with the civil society proctamation No 1113/2020 civil societies are

required to present its expenditure report by classifying as program and

administration expenditures. tive expenditure should not

exceed 20% of the total Income in the reporting period, Accordingly, EEA program

expenditure is 84% of the total expenditure. Administration Expenditure comprises

16% of the total expenditure.

vil societies’ adm

the year Ended

ne 30, 2021

Expenditure Categories

mage of

Revenue

Program Expenses 36,317.420,59 54.4%

‘Admin Expenses 8,678,171.01 13.0%

449 674%

‘The total revenue of the Association during the year was 66,712391.51

4.10 Contingencies and Commitm

There were no contingent liabilities at the reporting date of 30 June.2021. tn

addition, there were no commitment for capital expenditure in the reporting date.

4.11 Byents after the reporting period

Events subsequent to the reporting date are reflected in the financial statements only

nder consideration and the effe

ial, Major significant event is the transfer of the role of

me generating activities to a newly established business unit of EEA. The event

doesn't result in an adjustment to the

hagement oF

statements,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DocumentDocument1 pageDocumentDagnachew TsegayeNo ratings yet

- FM Manual - EEA-IGA - Final - July 2021Document123 pagesFM Manual - EEA-IGA - Final - July 2021Dagnachew TsegayeNo ratings yet

- AuditDocument2 pagesAuditDagnachew TsegayeNo ratings yet

- Lanen 5e ch13 StudentDocument39 pagesLanen 5e ch13 StudentDagnachew TsegayeNo ratings yet

- Budgetary Planning and ControlDocument25 pagesBudgetary Planning and ControlDagnachew TsegayeNo ratings yet

- Dagnachew Tsegaye Scaned File-5Document1 pageDagnachew Tsegaye Scaned File-5Dagnachew TsegayeNo ratings yet

- 9 2011Document11 pages9 2011Dagnachew TsegayeNo ratings yet

- BXNT - MQT$ LXGZ!XN X!Ys#S KrsèsDocument34 pagesBXNT - MQT$ LXGZ!XN X!Ys#S KrsèsDagnachew TsegayeNo ratings yet