Professional Documents

Culture Documents

Gail & Brad

Gail & Brad

Uploaded by

Abid AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gail & Brad

Gail & Brad

Uploaded by

Abid AliCopyright:

Available Formats

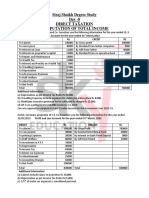

PG 48,

Part (a):

Sale Of Simpson’s Building

Disposal Proceeds 140,000

(Cost) Cost to A Ltd (75000)

Indexation Allowance (75000 * 0.162) - Note 1 (12150)

Chargeable Gain 52850

(Corporation Tax @ 19%) (10041)

Dividend paid to A Ltd 140000 - 10041 129959

Sale Of Shares in A Ltd:

Disposal Proceeds 250000

Total Cash Available for Gail 379959

Part (b):

Payment by Bonus:

Bonus is a cash benefit and hence class 1 employee NIC, class 1 employer NIC and income tax will be

paid on the bonus amount.

Bonus 379959

Class 1 Employee NIC (379959 * 3.25%) (12349)

Class 1 Employer NIC (379959 * 15.05%) (57184)

Corporate tax saving (57184 * 19%) 10865

Income Tax Liability (379959 * 45%) (170981)

Post tax cash receipt 150310

Gail is an additional rate taxpayer and hence all of the nil rate band, basic rate band and higher rate band

have been utilized for income tax and NIC purpose.

Payment By Dividend:

Dividend 379959

Income tax liability (2000 * 0%) 0

(377959 * 39.35%) (148727)

Post Tax payment Cash Receipt 231232

Part (d)(i):

1. Lifetime gifts to individuals come under Potentially exempt transfers and are not chargeable

during lifetime.

2. If the donor dies 3 years after the time of lifetime gift, taper relief is available which reduces the

death tax on lifetime gift.

3. If the donor dies 7 years after the date of lifetime gift, it gets fully exempt from death tax.

4. There in annual exempt amount of 3000 per year for gifts falling under IHT. This annual exempt

amount will reduce the amount of chargeable transfer.

5. The value of gift gets locked at the time of gift. Future tax such as death tax will be at the locked

value.

6. If there is a decrease in value, fall in value relief is available.

7. Small gift exemption is available upto the gift value of 250 per donne per year

Part (d)(ii):

Brad and his wife have a total shareholding of 7,500 shares amounting to 75% holding of Omnium Ltd

since both brad and his wife are related parties.

Value of Brad’s shareholding before gift (3000 * 290) 870,000

Value of Brad’s shareholding after gift (1500 * 240) (360,000)

Value Of gift 510,000

Annual Exemption (2 years) (6,000)

PET 504,000

The value of reduction in Brad’s estate is 735,000.

Omnium is an unquoted business and qualifies for business property relief as follows:

1. Unquoted business property

2. Brad has owned the shares for more than 2 years

3. The donne should hold the business until the donor’s death.

4. In changing business scenario, the donne should 2 out of 5 years in business.

If BPR applies and holding conditions are satisfied by both donor and donne, no lifetime tax or death tax

will be payable on the amount of BPR.

If Gail sells the shares of Omnium Ltd, the total amount of gift will become chargeable as there were no

BPR in first place. Furthermore, if Brad dies within 3 years of gift date, whole of the PET amount will get

chargeable at 40%. However, if brad dies within 3 to 7 years of gift, the death tax will be reduced by

taper relief and will get exempt if Brad dies after 7 years.

You might also like

- Shoppers Stop ProjectDocument69 pagesShoppers Stop ProjectDibyendu Das57% (7)

- Just Dial Appointment - Letter PDFDocument4 pagesJust Dial Appointment - Letter PDFOmkar sahu100% (1)

- Case Study On WidgetsDocument4 pagesCase Study On Widgetsmasum1234100% (1)

- Project ManagementDocument60 pagesProject ManagementAfshin100% (67)

- Sri Lanka Insurance Corporation LTD.: Task 01Document11 pagesSri Lanka Insurance Corporation LTD.: Task 01Saman PathirathnaNo ratings yet

- Appointment Letter PDFDocument4 pagesAppointment Letter PDFKhushu ParmarNo ratings yet

- 06 Task PerformanceDocument2 pages06 Task PerformanceKatherine Borja67% (3)

- Sap MRP: Is Carried Out in Five StepsDocument2 pagesSap MRP: Is Carried Out in Five Stepssunil khallalNo ratings yet

- Retirement Benefits - 2023Document6 pagesRetirement Benefits - 2023Given RefilweNo ratings yet

- Just Dial Joining Salary ChartDocument2 pagesJust Dial Joining Salary ChartPritam SamantaNo ratings yet

- ZittiDocument3 pagesZittiAbid AliNo ratings yet

- Ray, ShaniraDocument2 pagesRay, ShaniraAbid AliNo ratings yet

- Quiz 3: Profit Before Taxation - s4 (A) 67,069Document5 pagesQuiz 3: Profit Before Taxation - s4 (A) 67,069fujinlim98No ratings yet

- Chargeable Lifetime Transfers - Calculation of Tax: Basic PrinciplesDocument8 pagesChargeable Lifetime Transfers - Calculation of Tax: Basic PrinciplesAlellie Khay JordanNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Week 8 Tutorial 7Document4 pagesWeek 8 Tutorial 7umstudyNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- Chapter 2 Capsule SessionDocument40 pagesChapter 2 Capsule SessionKshitishNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- AC415 Group 6 Assignment 2022Document3 pagesAC415 Group 6 Assignment 2022portiafadzaiNo ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Solution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheDocument23 pagesSolution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheLucyNo ratings yet

- Scheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Document8 pagesScheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Anonymous ckTjn7RCq8No ratings yet

- Financial Accounting 3a Assignment 2 2022Document9 pagesFinancial Accounting 3a Assignment 2 2022sartynaftalNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- S20 TX SGP Sample AnswersDocument7 pagesS20 TX SGP Sample AnswersKAH MENG KAMNo ratings yet

- Lec 2 After Mid TermDocument11 pagesLec 2 After Mid TermsherygafaarNo ratings yet

- Chapter 8 Ptx1033/Business IncomeDocument9 pagesChapter 8 Ptx1033/Business IncomeNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Digit Private Car Policy: (AKA The Paper You Pull Out When You Get Pulled Over)Document6 pagesDigit Private Car Policy: (AKA The Paper You Pull Out When You Get Pulled Over)subba ramaiah GogineniNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- AFM 3 4表格Document3 pagesAFM 3 4表格mincole17No ratings yet

- CPA Question - CHPT 16 AnswersDocument22 pagesCPA Question - CHPT 16 Answersrohaanali222No ratings yet

- F6ZWE 2015 Jun ADocument8 pagesF6ZWE 2015 Jun APhebieon MukwenhaNo ratings yet

- Uj 35520+SOURCE1+SOURCE1.1Document14 pagesUj 35520+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Homework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnDocument11 pagesHomework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnBryan EngNo ratings yet

- F6 - IPRO - 2021 - Mock 1 - AnswersDocument16 pagesF6 - IPRO - 2021 - Mock 1 - AnswersHussein SeetalNo ratings yet

- Tax Tables 2018 19 - 4Document8 pagesTax Tables 2018 19 - 4Alellie Khay JordanNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- 2021 - A2S2 Solution-OplossingDocument19 pages2021 - A2S2 Solution-OplossingmeghdyckNo ratings yet

- CompressedDocument2 pagesCompressedthiru557No ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Mangerial Remuneration Final!Document4 pagesMangerial Remuneration Final!Yash RajNo ratings yet

- ACC4002H Taxation III 2023 April Test Suggested SolutionDocument3 pagesACC4002H Taxation III 2023 April Test Suggested SolutionJessica albaNo ratings yet

- Income From BusinessDocument8 pagesIncome From BusinessSuyash PrakashNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- CA2 - Question On Taxable Income of A Natural Person MEMODocument5 pagesCA2 - Question On Taxable Income of A Natural Person MEMOYonnyNo ratings yet

- Lease Versus PurchasingDocument10 pagesLease Versus PurchasingnirmalajNo ratings yet

- PRM41 Sec-D D3 AnalysisDocument6 pagesPRM41 Sec-D D3 AnalysisAnushree PareekNo ratings yet

- Term Plan 10000000 Coverage 28yrsDocument2 pagesTerm Plan 10000000 Coverage 28yrsanjan0No ratings yet

- Tax HomeworkDocument4 pagesTax HomeworkMatthew WittNo ratings yet

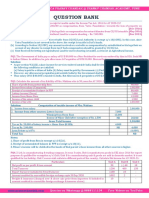

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Term Test 1 (Sol.)Document5 pagesTerm Test 1 (Sol.)iamneonkingNo ratings yet

- Please Send Me HackDocument3 pagesPlease Send Me Hackgaurav.verma17No ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- SCIENCEDocument6 pagesSCIENCEAbby NavarroNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Week 9, CT Losses, 2022-23 - TutorDocument32 pagesWeek 9, CT Losses, 2022-23 - Tutorarpita aroraNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Registration No.: Wazir ArifDocument1 pageRegistration No.: Wazir ArifAbid AliNo ratings yet

- 174522Document4 pages174522Abid AliNo ratings yet

- ZittiDocument3 pagesZittiAbid AliNo ratings yet

- Accounting For Creamery and Dairy ProductsDocument15 pagesAccounting For Creamery and Dairy ProductsAbid AliNo ratings yet

- HR Term PaperDocument7 pagesHR Term Paperdazelasif100% (1)

- EU: Quicklime, Slaked Lime and Hydraulic Lime - Market Report. Analysis and Forecast To 2020Document10 pagesEU: Quicklime, Slaked Lime and Hydraulic Lime - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- What Is A StockDocument2 pagesWhat Is A StockDarlene SarcinoNo ratings yet

- Employee Experience For Healthcare WorkersDocument12 pagesEmployee Experience For Healthcare WorkersragcajunNo ratings yet

- 1 - CRG 650 Understanding Business EthicsDocument18 pages1 - CRG 650 Understanding Business Ethicsfirdaus yahyaNo ratings yet

- Manager Financial Reporting Analyst in Toronto Canada Resume Ursula JamesDocument2 pagesManager Financial Reporting Analyst in Toronto Canada Resume Ursula JamesUrsula JamesNo ratings yet

- SELL 4th Edition Ingram LaForge Avila Schwepker Williams Solution ManualDocument26 pagesSELL 4th Edition Ingram LaForge Avila Schwepker Williams Solution Manualjoyce100% (26)

- Supply Chain Metrics That Matter:: A Focus On The Automotive Industry - 2015Document31 pagesSupply Chain Metrics That Matter:: A Focus On The Automotive Industry - 2015KeerthiNo ratings yet

- 4 Assignment 4 PDFDocument2 pages4 Assignment 4 PDFasmelash gideyNo ratings yet

- Fctfllmllhi TT : Preparation Work and Financial Plan Fpi To Cover TheDocument34 pagesFctfllmllhi TT : Preparation Work and Financial Plan Fpi To Cover TheMARIFE PASCUANo ratings yet

- Accounting Information Systems 14th Edition Romney Solutions ManualDocument27 pagesAccounting Information Systems 14th Edition Romney Solutions Manualvaginulegrandly.51163100% (27)

- Polytechnic University of The Philippines College of Accountancy and FinanceDocument1 pagePolytechnic University of The Philippines College of Accountancy and FinanceChin Chin FrancoNo ratings yet

- Assessment and Audit Under GSTDocument19 pagesAssessment and Audit Under GSTSONICK THUKKANINo ratings yet

- Accounting For Governmental and Nonprofit Entities 17th Edition Reck Test BankDocument44 pagesAccounting For Governmental and Nonprofit Entities 17th Edition Reck Test Bankjasonzunigapdonjzbmws100% (31)

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Bethtexas1 3252 Beth Prusinsky#2-ResumeDocument4 pagesBethtexas1 3252 Beth Prusinsky#2-Resumeapi-24881886No ratings yet

- Scheme Information Documents For Common Equity & Balanced SchemesDocument64 pagesScheme Information Documents For Common Equity & Balanced SchemesprajwalbhatNo ratings yet

- How Do I Get Quickbooks Premier Support Number 8444765438 ?Document8 pagesHow Do I Get Quickbooks Premier Support Number 8444765438 ?tanujkashyap2023No ratings yet

- Royal Realty: Business PlanDocument27 pagesRoyal Realty: Business Planapi-444970299No ratings yet

- Starbucks Coffee Company in The 21 CenturyDocument11 pagesStarbucks Coffee Company in The 21 Centurymyra weeNo ratings yet

- Dashboard QGDocument122 pagesDashboard QGRhad EstoqueNo ratings yet

- Business ProposalDocument13 pagesBusiness ProposalVinjay AdvinculaNo ratings yet

- D7265R87992Document4 pagesD7265R87992Roxana IskandarNo ratings yet

- Major Research Project ShivaDocument69 pagesMajor Research Project ShivaThe Lord ShivaNo ratings yet

- Multiple Choice QuestionsDocument82 pagesMultiple Choice QuestionsJohn Rey EnriquezNo ratings yet