Professional Documents

Culture Documents

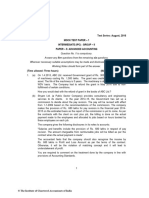

Top 200 FR

Top 200 FR

Uploaded by

jasleenchawla326Copyright:

Available Formats

You might also like

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument7 pagesFinancial Statements For Jollibee Foods CorporationFretelle Rimafranca80% (5)

- Problem 20-4Document5 pagesProblem 20-4Rohail Khan NiaziNo ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- Paper 2 Advanced Financial Management 170737012920240208100249Document25 pagesPaper 2 Advanced Financial Management 170737012920240208100249Pranav CrtNo ratings yet

- Paper14 Strategic Financial ManagementDocument34 pagesPaper14 Strategic Financial ManagementKumar SAPNo ratings yet

- CA Intermediate December 2021 AccountingNew SyllabusDocument27 pagesCA Intermediate December 2021 AccountingNew SyllabusDivyanshu SharmaNo ratings yet

- Accounts Dec21 Suggested Answer InterDocument27 pagesAccounts Dec21 Suggested Answer InterKotadiya RonakNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- CA Inter FM - Nov 2018 Suggested AnswersDocument14 pagesCA Inter FM - Nov 2018 Suggested Answersrisavey693No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- 18555sugg Ans Ipcc grp2 Nov09 Paper5Document24 pages18555sugg Ans Ipcc grp2 Nov09 Paper5NikitaNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Fundamental of Partnership (Part 4)Document11 pagesFundamental of Partnership (Part 4)Sanchit GargNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Advance Accounts TestDocument3 pagesAdvance Accounts Testdivya shahasaneNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Inp 2111 - Accounts - Suggested AnswerDocument14 pagesInp 2111 - Accounts - Suggested AnswerSachin ChourasiyaNo ratings yet

- Financial Instruments - Suggested AnswersDocument10 pagesFinancial Instruments - Suggested Answerspratikdubey9586No ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- Year Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)Document11 pagesYear Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)anon_573519739No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- CA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutesDocument7 pagesCA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutespriyaNo ratings yet

- MS Set2 SP AccDocument14 pagesMS Set2 SP AccJohn JoshyNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- Advance Accounts Suggested Answer May2022Document13 pagesAdvance Accounts Suggested Answer May2022rajuNo ratings yet

- Paper - 1: Financial Reporting: (5 Marks)Document30 pagesPaper - 1: Financial Reporting: (5 Marks)priyanka khakharNo ratings yet

- 75766bos61307-P2 Important ThingsDocument26 pages75766bos61307-P2 Important ThingsVishal AgarwalNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- Musharakah FinancingDocument23 pagesMusharakah FinancingTayyaba TariqNo ratings yet

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- Exercise Topic 1Document3 pagesExercise Topic 1NHI NGUYỄN THỊ YẾNNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Chapter 5 Management of Cash and Chapter - 6 Ratio AnalysisDocument21 pagesChapter 5 Management of Cash and Chapter - 6 Ratio AnalysisAbhishek TiwariNo ratings yet

- Rajdhani College FM Assignment FinalDocument6 pagesRajdhani College FM Assignment Finalayushkorea52629No ratings yet

- MTP 1 Suggested Answers AADocument9 pagesMTP 1 Suggested Answers AAYash RankaNo ratings yet

- Advance 3Document14 pagesAdvance 3pari maheshwariNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Test 2 - Ind As 36 - 105 - QuesDocument4 pagesTest 2 - Ind As 36 - 105 - Quesbhallavishal.socialmediaNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Class 12 Accountancy Practical Sample Paper 3Document1 pageClass 12 Accountancy Practical Sample Paper 3Rahul singh device &techNo ratings yet

- G Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensDocument3 pagesG Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensNidhi ChawdheryNo ratings yet

- FNJ 7417frfinalquestionpaperDocument10 pagesFNJ 7417frfinalquestionpaperKv kNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Financing Decisions - Practice QuestionsDocument3 pagesFinancing Decisions - Practice QuestionsAbrarNo ratings yet

- 2020 70513 Week 4 Cost of Equity CapitalDocument68 pages2020 70513 Week 4 Cost of Equity CapitalBelal HossainNo ratings yet

- Letter of Transmittal: Abdullah Al MasudDocument5 pagesLetter of Transmittal: Abdullah Al Masudরিদোয়ান নূরNo ratings yet

- SIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaDocument38 pagesSIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaFion TayNo ratings yet

- Accounting BasicsDocument4 pagesAccounting BasicsHazel Mae LasayNo ratings yet

- College Accounting Chapters 1-30-15th Edition Price Solutions ManualDocument16 pagesCollege Accounting Chapters 1-30-15th Edition Price Solutions Manualmelissazunigaiwspkcbfnt100% (32)

- COST ANALYSIS - 62 Questions With AnswersDocument6 pagesCOST ANALYSIS - 62 Questions With Answersmehdi everythingNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- FM-II-CH-1 Capital Structure and LeverageDocument14 pagesFM-II-CH-1 Capital Structure and LeverageAschalew Ye Giwen LijiNo ratings yet

- Lecture W3Document39 pagesLecture W3ShuyiNo ratings yet

- Cryptocurrencies Vs Real EstateDocument3 pagesCryptocurrencies Vs Real EstateAnunobi JaneNo ratings yet

- Accounting Theory PDFDocument61 pagesAccounting Theory PDFrabin khatriNo ratings yet

- Enigma SecuritiesDocument14 pagesEnigma SecuritiesJulian OwinoNo ratings yet

- Unit 1: IATA Accreditation For Travel Agencies: Learning Objectives Key Learning PointsDocument15 pagesUnit 1: IATA Accreditation For Travel Agencies: Learning Objectives Key Learning PointsSitakanta AcharyaNo ratings yet

- 1606 - Accounting For Management Model Question PaperDocument4 pages1606 - Accounting For Management Model Question Papersiva86No ratings yet

- Analytical Review ProceduresDocument5 pagesAnalytical Review ProceduresnderitulinetNo ratings yet

- Fin 3320 ProjectDocument13 pagesFin 3320 Projectapi-313630382No ratings yet

- Introduction To Treasury and Funds Management 27-11-2018Document51 pagesIntroduction To Treasury and Funds Management 27-11-2018faisal_sarwar82No ratings yet

- A Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFDocument1 pageA Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFHassan JanNo ratings yet

- 03 - Literature ReviewDocument7 pages03 - Literature ReviewVienna Corrine Q. AbucejoNo ratings yet

- Exercise 5.3 (2023)Document3 pagesExercise 5.3 (2023)Clarisha fritzNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)AREEZA BATOOL M.Sc. Information TechnologyNo ratings yet

- Quiz 2 CGTDocument2 pagesQuiz 2 CGTHector Quillo Ladua Jr.No ratings yet

- Glossary 30 Day Trading BootcampDocument9 pagesGlossary 30 Day Trading Bootcampschizo mailNo ratings yet

- Tulip Mania ScriptDocument7 pagesTulip Mania ScriptafzalkhanNo ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

Top 200 FR

Top 200 FR

Uploaded by

jasleenchawla326Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top 200 FR

Top 200 FR

Uploaded by

jasleenchawla326Copyright:

Available Formats

| Chapter 7: Financial Instruments

(B) Present value of interest [300,000 x 3.17] (4 years cumulative 10% discount 951,000

factor)

Total present value of debt component (A) + (B) 2,821,000

Issue proceeds from convertible debentures 5,000,000

Value of equity component 2,179,000

Journal entry at initial recognition:

Particulars Dr. Amount(₹) Cr. Amount(₹)

Bank A/c Dr. 5,000,000

To 6% debenture A/c (liability component) 2,821,000

To 6% debenture A/c (equity component) 2,179,000

(Being disbursement recorded at fair value)

Question 54 Hedge Accounting (MTP April’21)

Besides construction activity, Buildings & Co. Limited is also engaged in the trading of Copper. On

1st April, 20X1, it had 100 kg of copper costing Rs. 70 per kg - totalling Rs. 7000. The Company has

a scheduled delivery of these 100 kgs of copper to its customer on 30th September, 20X1 at the

rate of USD 100 on that date. To protect itself from decline in currency exchange rate (USD to

Rs.), the entity hedges its position by entering into currency futures contract for equivalent

currency units at Rs. 76 / USD. The future contract mature on 30th September, 20X1. The

management performed an assessment of hedge effectiveness and concluded that the hedging

relationship qualifies for cash flow hedge accounting. The entity determines and documents that

changes in fair value of the currency futures contract will be highly effective in offsetting

variability in cash flow of currency exchange. On 30th September, 20X1, the entity closes out its

currency futures contract. On the same day, it also sells its inventory of copper at USD 100 when

the spot rate is Rs. 72 / USD.

You are required to prepare detailed working and pass necessary journal entries for the sale of

copper and the corresponding hedge instrument taken by the company. Pass the journal entries as

on the initial date (i.e., 1st April 20X1), first quarter end reporting (i.e. 30th June 20X1) and date

of sale of copper and settlement of forward contract (i.e. 30th September 20X1).

Assume the exchange rates as follows and yield @ 6% per annum.

Date Future price for 30th September 20X1 delivery (Rs. / USD)

1 st April, 20X1 76

30th June, 20X1 74

30th September, 20X1 71

Solution

Calculation of discounting factor based on yield @ 6% p.a

Date Spot Rate at Forward Rate for Delivery (Rs. / USD) Discount

indicated date 30th September 20X1 factor @6% p.a on quarter basis

1 st April, 20X1 76 0.971

www.pratikjagati.com 79 CA PRATIK JAGATI

| Chapter 7: Financial Instruments

30th June, 20X1 74 0.985

30th Sep, 20X1 72 71 1

Determination of fair value change 1st April, 20X1 30th June, 20X1 30th Sep, 20X1

A Nominal value in Rs. @ Rs. 76 / USD 7600 7600 7600

B Nominal value in USD (100 kg for USD 100) 100 100 100

C Forward rate for 30th September, 20X1 76 74 71

D Value in Rs. (b x c) 7600 7400 7100

E Difference (a-d) 0 200 500

F Discount factor (as calculated in the above) 0.971 0.985 1

G Fair value (e x f) 0 197 500

H Fair value change for the period 0 197 303*

* 500 – 197= 303

Journal Entries

1st April, 20X1

- No entry as initial fair value is zero -

30th June, 20X1

Future Contract Dr 197

To Cash Flow Hedge Reserve (Other Equity)-OCI 197

(Being Change in Fair Value of Hedging Instrument recognised in

OCI accumulated in a separate component in Equity)

30th Sep,2021

Future Contract Dr 303

To Cash Flow Hedge Reserve (Other Equity)-OCI 303

(Being change in fair value of the hedging instrument recognised in

OCI)

30th Sep,2021

Bank/Trade Receivable Dr 7,200

To Revenue from Contracts with Customers 7,200

(Being sale of 100 kgs. of copper for USD 100 recognised at spot

rate of Rs. 72 for USD 1)

30th Sep, 2021

Cash Flow Hedge Reserve (Other Equity) – OCI Dr 500

To Revenue from Contracts with Customers 500

(Being fair value change in forward contract reclassified to

profit and loss and recognised in the line item affected by the

hedge item)

30th Sep,2021

Bank/Cash Dr 500

To Future Contract 500

www.pratikjagati.com 80 CA PRATIK JAGATI

| Chapter 15: Ind AS 115

Question 125(RTP May’19/ MTP Oct’19/ MTP Oct’20) (10 Marks)

KK Ltd. runs a departmental store which awards 10 points for every purchase of ₹ 500 which can be

discounted by the customers for further shopping with the same merchant. Unutilised points will

lapse on expiry of two years from the date of credit. Value of each point is ₹ 0.50. During the

accounting period 2019-2020, the entity awarded 1,00,00,000 points to various customers of which

18,00,000 points remained undiscounted. The management expects only 80% will be discounted in

future of which normally 60-70% are redeemed during the next year.

The Company has approached your firm with the following queries and has asked you to suggest the

accounting treatment (Journal Entries) under the applicable Ind AS for these award points:

a) How should the recognition be done for the sale of goods worth ₹ 10,00,000 on a particular

day?

b) How should the redemption transaction be recorded in the year 2019-2020? The Company

has requested you to present the sale of goods and redemption as independent transaction.

Total sales of the entity is₹ 5,000 lakhs.

c) How much of the deferred revenue should be recognized at the year-end (2019-2020)

because of the estimation that only 80% of the outstanding points will be redeemed?

d) In the next year 2020-2021, 60% of the outstanding points were discounted. Balance 40%

of the outstanding points of 2019-2020 still remained outstanding. How much of the deferred

revenue should the merchant recognize in the year 2020-2021 and what will be the amount

of balance deferred revenue?

e) How much revenue will the merchant recognized in the year 2021-2022, if 3,00,000 points

are redeemed in the year 2021-2022?

Solution:

a) Points earned on ₹ 10,00,000 @ 10 points on every ₹ 500 = [(10,00,000 / 500) x 10] = 20,000

points.

Value of points = 20,000 points x ₹ 0.5 each point = ₹ 10,000

Revenue recognized for sale of ₹ 9,90,099 [10,00,000 x (10,00,000/10,10,000)]

goods

Revenue for points deferred ₹ 9,901 [10,00,000x (10,000/10,10,000)]

Journal Entry

Bank A/c Dr 10,00,000

To Sales A/c 9,90,099

To Liability under Customer Loyalty Programme 9,901

b) Points earned on ₹ 50,00,00,000 @ 10 points on every ₹ 500

= [(50,00,00,000/500) x 10] = 1,00,00,000 points.

Value of points = 1,00,00,000 points x ₹ 0.5 each point = ₹ 50,00,000

Revenue recognized for sale of goods

= ₹ 49,50,49,505 [50,00,00,000 x (50,00,00,000/50,50,00,000)] Revenue for points

= ₹ 49,50,495 [50,00,00,000 x (50,00,000/ 50,50,00,000)]

Journal Entry in the year 2019

Bank A/c Dr 50,00,00,000

To Sales A/c 49,50,49,505

To Liability under Customer Loyalty Programme 49,50,495

www.pratikjagati.com 205 CA PRATIK JAGATI

| Chapter 15: Ind AS 115

(On sale of Goods)

Liability under Customer Loyalty Programme Dr 42,11,002

To Sales A/c 42,11,002

(On redemption of (100 lakhs -18 lakhs) points)

Revenue for points to be recognized

Undiscounted points estimated to be recognized next year 18,00,000 x 80% = 14,40,000 points

Total points to be redeemed within 2 years = [(1,00,00,000-18,00,000) + 14,40,000] = 96,40,000

Revenue to be recognised with respect to discounted point = 49,50,495 x

(82,00,000/96,40,000) = 42,11,002

c) Revenue to be deferred with respect to undiscounted point in 2019-2020 = 49,50,495 –

42,11,002 = 7,39,493

d) In 2020-2021, KK Ltd. would recognize revenue for discounting of 60% of outstanding points as

follows: Outstanding points = 18,00,000 x 60% = 10,80,000 points

Total points discounted till date = 82,00,000 + 10,80,000 = 92,80,000 points

Revenue to be recognized in the year 2020-2021

= [{49,50,495 x (92,80,000 / 96,40,000)} 42,11,002] = ₹ 5,54,620.

Liability under Customer Loyalty Programme Dr ₹ 5,54,620

To Sales A/c ₹ 5,54,620

(On redemption of further 10,80,000 points)

The Liability under Customer Loyalty programme at the end of the year 2020-2021 will be ₹

7,39,493 – ₹ 5,54,620 = ₹ 1,84,873.

e) In the year 2021-2022, the merchant will recognize the balance revenue of ₹ 1,84,873

irrespective of the points redeemed as this is the last year for redeeming the points. Journal

entry will be as follows:

Liability under Customer Loyalty Programme Dr ₹1,84,873

To Sales A/c ₹1,84,873

(On redemption of balance points)

www.pratikjagati.com 206 CA PRATIK JAGATI

You might also like

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument7 pagesFinancial Statements For Jollibee Foods CorporationFretelle Rimafranca80% (5)

- Problem 20-4Document5 pagesProblem 20-4Rohail Khan NiaziNo ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- Paper 2 Advanced Financial Management 170737012920240208100249Document25 pagesPaper 2 Advanced Financial Management 170737012920240208100249Pranav CrtNo ratings yet

- Paper14 Strategic Financial ManagementDocument34 pagesPaper14 Strategic Financial ManagementKumar SAPNo ratings yet

- CA Intermediate December 2021 AccountingNew SyllabusDocument27 pagesCA Intermediate December 2021 AccountingNew SyllabusDivyanshu SharmaNo ratings yet

- Accounts Dec21 Suggested Answer InterDocument27 pagesAccounts Dec21 Suggested Answer InterKotadiya RonakNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- CA Inter FM - Nov 2018 Suggested AnswersDocument14 pagesCA Inter FM - Nov 2018 Suggested Answersrisavey693No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- 18555sugg Ans Ipcc grp2 Nov09 Paper5Document24 pages18555sugg Ans Ipcc grp2 Nov09 Paper5NikitaNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Fundamental of Partnership (Part 4)Document11 pagesFundamental of Partnership (Part 4)Sanchit GargNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Advance Accounts TestDocument3 pagesAdvance Accounts Testdivya shahasaneNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Inp 2111 - Accounts - Suggested AnswerDocument14 pagesInp 2111 - Accounts - Suggested AnswerSachin ChourasiyaNo ratings yet

- Financial Instruments - Suggested AnswersDocument10 pagesFinancial Instruments - Suggested Answerspratikdubey9586No ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- Year Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)Document11 pagesYear Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)anon_573519739No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- CA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutesDocument7 pagesCA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutespriyaNo ratings yet

- MS Set2 SP AccDocument14 pagesMS Set2 SP AccJohn JoshyNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- Advance Accounts Suggested Answer May2022Document13 pagesAdvance Accounts Suggested Answer May2022rajuNo ratings yet

- Paper - 1: Financial Reporting: (5 Marks)Document30 pagesPaper - 1: Financial Reporting: (5 Marks)priyanka khakharNo ratings yet

- 75766bos61307-P2 Important ThingsDocument26 pages75766bos61307-P2 Important ThingsVishal AgarwalNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- Musharakah FinancingDocument23 pagesMusharakah FinancingTayyaba TariqNo ratings yet

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- Exercise Topic 1Document3 pagesExercise Topic 1NHI NGUYỄN THỊ YẾNNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Chapter 5 Management of Cash and Chapter - 6 Ratio AnalysisDocument21 pagesChapter 5 Management of Cash and Chapter - 6 Ratio AnalysisAbhishek TiwariNo ratings yet

- Rajdhani College FM Assignment FinalDocument6 pagesRajdhani College FM Assignment Finalayushkorea52629No ratings yet

- MTP 1 Suggested Answers AADocument9 pagesMTP 1 Suggested Answers AAYash RankaNo ratings yet

- Advance 3Document14 pagesAdvance 3pari maheshwariNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Test 2 - Ind As 36 - 105 - QuesDocument4 pagesTest 2 - Ind As 36 - 105 - Quesbhallavishal.socialmediaNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Class 12 Accountancy Practical Sample Paper 3Document1 pageClass 12 Accountancy Practical Sample Paper 3Rahul singh device &techNo ratings yet

- G Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensDocument3 pagesG Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensNidhi ChawdheryNo ratings yet

- FNJ 7417frfinalquestionpaperDocument10 pagesFNJ 7417frfinalquestionpaperKv kNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Financing Decisions - Practice QuestionsDocument3 pagesFinancing Decisions - Practice QuestionsAbrarNo ratings yet

- 2020 70513 Week 4 Cost of Equity CapitalDocument68 pages2020 70513 Week 4 Cost of Equity CapitalBelal HossainNo ratings yet

- Letter of Transmittal: Abdullah Al MasudDocument5 pagesLetter of Transmittal: Abdullah Al Masudরিদোয়ান নূরNo ratings yet

- SIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaDocument38 pagesSIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaFion TayNo ratings yet

- Accounting BasicsDocument4 pagesAccounting BasicsHazel Mae LasayNo ratings yet

- College Accounting Chapters 1-30-15th Edition Price Solutions ManualDocument16 pagesCollege Accounting Chapters 1-30-15th Edition Price Solutions Manualmelissazunigaiwspkcbfnt100% (32)

- COST ANALYSIS - 62 Questions With AnswersDocument6 pagesCOST ANALYSIS - 62 Questions With Answersmehdi everythingNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- FM-II-CH-1 Capital Structure and LeverageDocument14 pagesFM-II-CH-1 Capital Structure and LeverageAschalew Ye Giwen LijiNo ratings yet

- Lecture W3Document39 pagesLecture W3ShuyiNo ratings yet

- Cryptocurrencies Vs Real EstateDocument3 pagesCryptocurrencies Vs Real EstateAnunobi JaneNo ratings yet

- Accounting Theory PDFDocument61 pagesAccounting Theory PDFrabin khatriNo ratings yet

- Enigma SecuritiesDocument14 pagesEnigma SecuritiesJulian OwinoNo ratings yet

- Unit 1: IATA Accreditation For Travel Agencies: Learning Objectives Key Learning PointsDocument15 pagesUnit 1: IATA Accreditation For Travel Agencies: Learning Objectives Key Learning PointsSitakanta AcharyaNo ratings yet

- 1606 - Accounting For Management Model Question PaperDocument4 pages1606 - Accounting For Management Model Question Papersiva86No ratings yet

- Analytical Review ProceduresDocument5 pagesAnalytical Review ProceduresnderitulinetNo ratings yet

- Fin 3320 ProjectDocument13 pagesFin 3320 Projectapi-313630382No ratings yet

- Introduction To Treasury and Funds Management 27-11-2018Document51 pagesIntroduction To Treasury and Funds Management 27-11-2018faisal_sarwar82No ratings yet

- A Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFDocument1 pageA Parry Electronics Is A Regional Electronics Wholesaler and Distributor That PDFHassan JanNo ratings yet

- 03 - Literature ReviewDocument7 pages03 - Literature ReviewVienna Corrine Q. AbucejoNo ratings yet

- Exercise 5.3 (2023)Document3 pagesExercise 5.3 (2023)Clarisha fritzNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)AREEZA BATOOL M.Sc. Information TechnologyNo ratings yet

- Quiz 2 CGTDocument2 pagesQuiz 2 CGTHector Quillo Ladua Jr.No ratings yet

- Glossary 30 Day Trading BootcampDocument9 pagesGlossary 30 Day Trading Bootcampschizo mailNo ratings yet

- Tulip Mania ScriptDocument7 pagesTulip Mania ScriptafzalkhanNo ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet