Professional Documents

Culture Documents

5 A&b

5 A&b

Uploaded by

Inderpaal SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 A&b

5 A&b

Uploaded by

Inderpaal SinghCopyright:

Available Formats

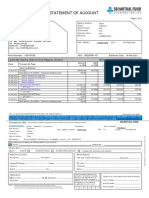

Account Statement

Page 1 of 3

investor.line@mutualfunds.hsbc.co.in 1800 200 2434 / 1800 4190 200 assetmanagement.hsbc.com/in

Folio Number : 4631292 / 16 Statement Date : 03-Nov-2023

R Kanakavalli (First Holder) Total Units : 0.00

Investment Overview

Total Valuation : INR Total Valuation : INR

Mode of Holding : Anyone or Survivor

Old No 33 New No 12 Tax Status : Individual

Natumuthu Kumarappa Street Nmk Street 2 nd Unit Holder : K Raghunathan

Mylapore 3 rd Unit Holder : None

Chennai - 600004

Nominee : OPTED OUT

Tamil Nadu

India

Off : - Res : 9380633036

Mobile : XXXXXXXXX3036 Guardian :-

EMAIL : XXXXXXXXXXXXXnaka@gmail.com POA :-

CAN : N/A Statement Preference : By Email

IDCW Option : Pay IDCW

INVESTOR TYPE PAN PAN VERIFIED KYC COMPLIANT CKYC-KIN FATCA/UBO SUPPLEMENTARY PAN AADHAR

KYC LINKING STATUS

Complied/Not

First Holder AVDPK***** Yes Yes Not Provided Complied Successful

applicable

Complied/Not

Second Holder AGZPR***** Yes Yes Not Provided Complied Successful

applicable

HSBC Midcap Fund - Regular IDCW# (Formerly known as L&T Midcap Fund - NAV as on 02/11/2023 : INR 57.0983

IDCW# )

ISIN - INF917K01239

EISC-CCSHAKTI-16.6.0-031123130152(I)-A16605--1042

Date Transaction Type Amount Price NAV Number of Balance

(INR) (INR) (INR) Units Units

Opening Balance as on 23/08/2019 0.000

23/08/2019 Purchase 80,000.00 37.370 37.3700 2,140.755 2,140.755

23/08/2019 ***IDCW Payout @ Rs.2.87757809 per unit*** 6,160.19 37.3700

26/08/2020 ***IDCW Payout @ Rs.1.50 per unit*** 3,211.13 39.9600

26/08/2021 ***IDCW Payout @ Rs.3.50 per unit*** 6,743.64 55.0900

*** TDS on Cumulative IDCW *** 749.00

26/08/2022 ***IDCW Payout @ Rs.3.75 per unit*** 7,224.83 54.2400

*** TDS on Cumulative IDCW *** 803.00

26/05/2023 ***Registration of Nominee Rejected***

25/08/2023 ***IDCW Payout @ Rs.5.00 per unit*** 9,633.78 59.6460

*** TDS on Cumulative IDCW *** 1,070.00

19/09/2023 ***Change of Contacts***

22/09/2023 Redemption - ELECTRONIC PAYMENT - CITIN23427948893 , less (120,372.17) 56.2294 56.2294 (2,140.755) 0.000

STT

*** STT Paid *** (1.20)

23/09/2023 ***Address Updated from KRA Data***

Unit Balance : 0.00 Cost Value : INR 0.00

Market Value as on 02/11/2023 : INR 0.00 Available Units for Redemption : 0.000

IDCW for the period : 32,973.57 IDCW since inception : 32,973.57 Units under Lien : 0.000 Payout Mode : Electronic

Bank Details : SB XXXXXXXXXXX6799 / Indian Overseas Bank / CHENNAI-EAST MADA STREET / Chennai IFSC Code : IOBA0001083

MICR Code : 600020057 Your Broker/Dealer is : ARN-137779 / Revathi Sub-Broker (ARN Code) : -

EUIN : E232917 Sub-Broker Code : -

Exit Load :If the units redeemed or switched out are upto 10% of the units purchased or switched in (the limit) within 1 year from the date of allotment Nil. If units redeemed or switched out are

over and above the limit within 1 year from the date of allotment 1%. If units are redeemed or switched out on or after 1 year from the date of allotment Nil. A switch-out or a withdrawal under

SWP may also attract an Exit Load like any Redemption.No Exit load will be chargeable in case of switches made between different options of the Scheme.No Exit load will be chargeable in

case of Units allotted on account of dividend reinvestments, if any.

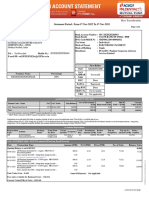

HSBC Small Cap Fund - Regular IDCW# (Formerly known as L&T Emerging

Businesses Fund IDCW # ) NAV as on 02/11/2023 : INR 36.3672

ISIN - INF917K01QB9

Date Transaction Type Amount Price NAV Number of Balance

(INR) (INR) (INR) Units Units

Opening Balance as on 08/06/2018 0.000

08/06/2018 Purchase 100,000.00 22.598 22.5980 4,425.170 4,425.170

09/06/2018 ***Address Updated from KRA Data***

26/10/2018 ***IDCW Payout @ Rs.1.32811296 per unit*** 5,877.13 19.7680

#IDCW - Income Distribution cum Capital Withdrawal

... continued on next page

Page 2 of 3

HSBC Small Cap Fund - Regular IDCW# (Formerly known as L&T Emerging

Businesses Fund IDCW # ) NAV as on 02/11/2023 : INR 36.3672

ISIN - INF917K01QB9

Date Transaction Type Amount Price NAV Number of Balance

(INR) (INR) (INR) Units Units

Opening Balance as on 08/06/2018 0.000

23/10/2019 ***IDCW Payout @ Rs.1.06249037 per unit*** 4,701.70 17.4510

22/10/2021 ***IDCW Payout @ Rs.1.50 per unit*** 5,973.76 31.2030

*** TDS on Cumulative IDCW *** 664.00

21/10/2022 ***IDCW Payout @ Rs.1.85 per unit*** 7,367.56 32.3730

*** TDS on Cumulative IDCW *** 819.00

25/05/2023 ***IDCW Payout @ Rs.3.00 per unit*** 11,947.51 33.4612

*** TDS on Cumulative IDCW *** 1,328.00

22/09/2023 Redemption - ELECTRONIC PAYMENT - CITIN23427948853 , less (160,997.58) 36.383 36.3826 (4,425.170) 0.000

STT

*** STT Paid *** (1.61)

Unit Balance : 0.00 Cost Value : INR 0.00

Market Value as on 02/11/2023 : INR 0.00 Available Units for Redemption : 0.000

IDCW for the period : 35,867.66 IDCW since inception : 35,867.66 Units under Lien : 0.000 Payout Mode : Electronic

Bank Details : SB XXXXXXXXXXX6799 / Indian Overseas Bank / CHENNAI-EAST MADA STREET / Chennai IFSC Code : IOBA0001083

MICR Code : 600020057 Your Broker/Dealer is : ARN-137779 / Revathi Sub-Broker (ARN Code) : -

EUIN : E232917 Sub-Broker Code : -

Exit Load :If the units redeemed or switched out are upto 10% of the units purchased or switched in (the limit) within 1 year from the date of allotment Nil. If units redeemed or switched out are

over and above the limit within 1 year from the date of allotment 1%. If units are redeemed or switched out on or after 1 year from the date of allotment Nil. A switch-out or a withdrawal under

EISC-CCSHAKTI-16.6.0-031123130152(I)-A16605--1042

SWP may also attract an Exit Load like any Redemption.No Exit load will be chargeable in case of switches made between different options of the Scheme.No Exit load will be chargeable in

case of Units allotted on account of dividend reinvestments, if any.

#IDCW - Income Distribution cum Capital Withdrawal

... continued on next page

To locate your nearest Investor Service Centre of AMC / CAMS please visit the Contact Us section www.assetmanagement.hsbc.co.in/en/mutual-funds or www.camsonline.com

Folio Number : 4631292 / 16

Particulars PAN No KYC Compliant Last Transacted

: ARN-137779/Revathi

R Kanakavalli (First Holder) AVDPK***** Yes Broker Code

Sub-Broker (ARN Code) :

Mode of Holding : Anyone or Survivor EUIN : E232917

Scheme HSBC Plan :

^Sub-Option Growth Reinvestment Payout of IDCW ^IDCW Frequency Daily Weekly Fortnightly Monthly Quarterly Semi-Annual Annual

of IDCW

ADDITIONAL PURCHASE REQUEST Cheque/Transfer

Cheque/Transfer

Date Date

I / We would like to purchase Units of the above mentioned Scheme for Rs. (amount in figures) transferred via RTGS or Funds Transfer or

Cheque/DD No. Drawn on bank A/c. No.

To your Bank A/c. No. A/c. Type Current Savings NRO NRE FCNR Others

SWITCH REQUEST (From scheme as above) Please check exit load, if applicable.

I / We wish to switch All Units OR No. of Units OR Amount Rs.

To Scheme HSBC Plan Option

^Sub-Option Growth Reinvestment Payout of IDCW ^IDCW Frequency Daily Weekly Fortnightly Monthly Quarterly Semi-Annual Annual

of IDCW

Sole / First Unitholder Guardian Second Unitholder Third Unitholder

PAN (Mandatory)

Documents attached to avoid Third Party Payment Rejection where applicable: Third Party Declarations Bank Certificate for Pre-funded Instruments.

^ In case the option(s) offered are not ticked or incorrectly ticked, the default option(s) will be applicable as per SID and SAI.

In case the Additional Purchase amount is Rs. 10,000 or more and your Distributor has opted to receive Transaction Charges Rs. 100/- will be deducted from the purchase amount and paid to the Distributor. Units will be

issued against the balance amount invested . I / We have read and understood the terms and contents of the Scheme Information Documents including addenda, Key Information Memorandum and load structure (s) of the

respective Scheme (s) and Statement of Additional Information of HSBC Mutual Fund. I / We hereby apply to the Trustee of HSBC Mutual Fund for allotment of Units of the Scheme(s) of HSBC Mutual Fund, as

indicated and agree to abide by the terms, conditions, rules and regulations of the relevant Scheme(s). I / We have not received nor been induced by any rebate or gifts, directly or indirectly, in making this investment. The

ARN Holder has disclosed to me / us all the commissions (in the form of trail commission or any other mode ), payable to him / them for the different competing schemes of various Mutual Funds from amongst whcih the

Scheme is being recommended to me / us. I / We hereby confirm that I / We have not been offered / communicated any indicative portfolio and / or any indicative yield by HSBC Mutual Fund / HSBC Asset

Management Company Limited / its distributor for this investment. I / We am / are authorised to undertake this transaction.

X X X

SIGNATURE(S) First Account Holder / Regd. POA Holder Second Account Holder / Regd. POA Holder Third Account Holder / Regd. POA Holder

In case of joint holding, the request should be signed by all the unitholders

... continued on next page

Page 3 of 3

IMPORTANT INSTRUCTIONS 12. Please note that certain critical information will be obtained from the KRA database and

overwritten in AMC records. Eg: Address, DOB and where email and mobile number is not

1. Please fill in details in English and in BLOCK CAPITALS in Black or Blue ink. available in the folio.

13. Any non-financial or static details change request received with a financial transaction will be

2. If you have filled both side of the transaction slip, it is mandatory to sign both sides, failing

rejected. In such cases, only the financial transaction will be processed. For e.g. incase of a

which only the signed side will be processed.

redemption transaction, the same will be processed and the proceeds shall be credited to the

3. PAN and KYC are mandatory for all investors, POA holders and Guardians. registered bank account without considering the change of bank details received along with such

redemption request.

4. Completed Transaction Slip should be submitted to HSBC or CAMS Investor Service Centres. 14. In order to avoid any instances of mis-selling, please provide the EUIN of the Sub-Broker

Please visit our website www.assetmanagement.hsbc.co.in for an updated list of Official Points code/Main ARN code as applicable in case if your transaction is advisory in nature. In case of

of Acceptance of HSBC Mutual Fund. Please visit www.camsonline.com for an updated list of execution mode, please provide the declaration.

CAMS.

15. In case of Direct Application, please write as "Direct" against Broker Code.Any correction of the

5. This Account Statement is record of your transaction in the Units of the Scheme(s) of HSBC code requires authentication. Any corrections in the request to be counter-signed by the unit

Mutual Fund. This is a non-transferable document. The unit balance shown overleaf is subject to holder(s).

realisation of cheque, fulfilment of regulatory requirements, fulfilment of requirements of the

scheme related documents / Addendum(s) and furnishing necessary information to the 16. Please refer to the SID/SAI/KIM for details on Transaction Charges, Third Party validation,

satisfaction of the Mutual Fund. Kindly quote your Folio No. and Plan / Scheme name in all Stamp Duty Charges.

future correspondence. 17. Redemption request:

a. Please specify scheme details and the amount /number of units you wish to redeem . If

6. All cheques and bank drafts must be drawn in the name of Scheme as specified in the Scheme your redemption request specifies both amount and units for redemption, then the

related documents and crossed "Account Payee Only". A separate cheque / bank draft / fund amount will be considered.

transfer letter must accompany each Application. All purchase are subject to realisation of

instruments. b. In case an investor has purchased Units on more than one Business Day (either under

the Initial Offer Period or through subsequent purchases) the Units purchased first will

7. Any request must be signed by all joint holders in case mode of operation as specified by the be deemed to have been redeemed first i.e. on a First-In-First-O ut basis.

unitholder(s) is joint.

8. For details and risk factors applicable to the scheme / Plans, Please refer to the scheme related c. A redemption will be processed only for the amount which has been realized. If the

documents. Investors are deemed to have read and understood the terms and conditions of the balance in the scheme/plan/option after taking into account the redemption is below

scheme related documents and addenda of the scheme in which they are transacting, as of the the minimum redemption size (either in amount or in units whichever is less), the

date of the transaction. entire balance would be redeemed and paid out.

9. Please verify the details mentioned on this statement . In case of any discrepancy you

d. To safeguard investors against fraudulent action on their investments, where

may write to enq_o@camsonline.com or investor.line@hsbc.co.in or contact us at the

redemption request is received together with a request for change of address and / or

number mentioned below . Contents of this statement will be considered correct, if no

change in bank details. the AMC may release the payment only after completing

discrepancy is reported within 30 days of receipt of this statement.

necessary additional checks.

18. Switch Request:

10. HSBC Mutual Fund is not responsible for errors or delay in processing your request due to the a. Please specify the exact source, target scheme names for the switch and

errors in the information provided. All transaction processing is subject to final verification.

amount/number of units you wish to switch.

EISC-CCSHAKTI-16.6.0-031123130152(I)-A16605--1042

11. The Proof of address AND PAN Card (OR Any other Proof of Identity for PAN exempt cases b. If your switch request specifies both amount and units, then the amount will be

only). Copies of all documents submitted should be self-attested & accompanied by originals for considered.

verification (OR) they should be attested by a KYD complied distributor or personnel/entities

authorized for attesting as per KYC guidelines. All KYC comliant folios/clients are requested to c. f the balance in the source scheme / plan / option, after taking into account the switch

submit change of address request along with the Supporting documents as outlined under is below the minimum redemption size (either in amount or in units whichever is less),

uniform KYC guidelines. the entire balance in the source scheme will be switched to the target scheme

Contact us at SMS your request to HSBC Mutual Fund

Contact us at our following customer service toll free numbers or write an email to: Latest NAV : Send SMS as HSBCMF NAV <Scheme Code> to 56767

investor.line@m utualfunds.hsbc.co.in Example:

Example: HSBCMF NAV CAMS

F03 O VAL 123456

Investor & Online related queries : 1800-4190-200 / 1800-200-2434 Valuation Service : Send SMS as HSBCMF VAL <folio_number> to 56767

Example: HSBCMF VAL 123456

Investor (Dialing from abroad) : +91 44 39923900

Annual Report :

Useful Links for self service options For Electronic Copy: Send SMS as HSBCMFARE <folio_number> to 567678080

To Invest online or Update your Bank details or Nominee : Example: HSBCMFARE 123456

v isit: https://invest.assetmanagement.hsbc.co.in For Physical Copy: Send SMS as HSBCMFARP <folio_number> to 567678080

Use our 24 x 7 Chatbot : “ASKME” for any queries or service request : Example: HSBCMFARP 123456

v isit: https://invest.assetmanagement.hsbc.co.in

Half Yearly Portfolio:

To update your Personal details like PAN & Email ID : For Electronic Copy: Send SMS as HSBCMFHPE <folio_number> to 567678080

v isit: https://new.camsonline.com

Example: HSBCMFHPE 123456

Join us on WhatsApp For Physical Copy: Send SMS as HSBCMFHPP <folio_number> to 567678080

W hatsApp @ 9326929294 for financial and non-financial transactions, Account statement, Example: HSBCMFHPP 123456

etc.

SMS charges applicable as per the rates fixed for such services by your mobile phone

Missed Call Service operator.

You can give a missed call to 9212900020 to get the total valuation via SMS and a statement

on your registered email ID

To locate your nearest Investor Service Centre of AMC / CAMS please visit the Contact Us section www.assetmanagement.hsbc.co.in/en/mutual-funds or www.camsonline.com

Folio Number : 4631292 / 16

Particulars PAN No KYC Compliant

Last Transacted

AVDPK***** Yes

: ARN-137779/Revathi

R Kanakavalli (First Holder) Broker Code

Sub-Broker (ARN Code) :

Mode of Holding : Anyone or Survivor EUIN : E232917

Folio No.

REDEMPTION REQUEST Please check exit load, if applicable.

I / We would like to redeem from the below mentioned Scheme

All Units OR No. of Units OR Amount Rs. (in words) Rs.

Scheme HSBC Plan

Option ^Sub-Option Growth Reinvestment of IDCW Payout of IDCW

^IDCW Frequency Daily Weekly Fortnightly Monthly Quarterly Semi-Annual Annual

^ In case the option(s) offered are not ticked or incorrectly ticked, the default option(s) will be applicable as per SID and SAI.

For investors who have registered for Multiple Bank Accounts facility in the above folio. (Please strike off this section if not used)

The redemption should be processed into the following bank account as per the payout mechanism indicated by me / us. (This bank account has already been registered in the folio)

Name of the Bank: Account No. : Account Type :

Important Note : If the bank account mentioned above is different from those already registered in your folio OR if the bank account details are not filled above, the redemption will be processed into the “Default”

bank account registered for the aforesaid folio. HSBC Mutual Fund or HSBC Asset Management Company Ltd. will not be liable for any loss arising to the unitholder(s) due to the credit of redemption proceeds into any

of the bank accounts registered with us for the aforesaid folio.

I / We have read and understood the contents of the Scheme Information Document and Statement of Additional Information. Key Information Memorandum, Addendums and Instructions issued of respective Scheme

(s) of HSBC Mutual Fund. I / We hereby apply to the Trustee of HSBC Mutual Fund for units of the Scheme(s) and agree to abide by the terms and conditions, rules and regulations of the relevant Scheme(s). I / We

have neither received nor been induced by any rebate or gifts, directly or indirectly in making this investment.

X X X

SIGNATURE(S) First Account Holder / Regd. POA Holder Second Account Holder / Regd. POA Holder Third Account Holder / Regd. POA Holder

In case of joint holding, the request should be signed by all the unitholders

You might also like

- Act Constitutiv in EnglezaDocument10 pagesAct Constitutiv in EnglezaFlori OpreaNo ratings yet

- From 05-MAR-2021 To 05-MAR-2021: Non-TransferableDocument3 pagesFrom 05-MAR-2021 To 05-MAR-2021: Non-TransferableNeha100% (1)

- Deed of Absolute Sale - DRAFTDocument4 pagesDeed of Absolute Sale - DRAFTXyryn Tablisma100% (1)

- Account Statement: Folio Number: 10169457Document2 pagesAccount Statement: Folio Number: 10169457ashishNo ratings yet

- Venugopal Invesco PDFDocument2 pagesVenugopal Invesco PDFV. Manohar LallNo ratings yet

- Account Statement: Folio No.: 11323206 / 73Document2 pagesAccount Statement: Folio No.: 11323206 / 73Inderpaal SinghNo ratings yet

- Acctstmt P 11713974Document1 pageAcctstmt P 11713974nisha goyalNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- Statement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Document4 pagesStatement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Kirti Kant SrivastavaNo ratings yet

- G S BhadaniDocument2 pagesG S Bhadanigayamansukh25No ratings yet

- Account Statement: Folio No.: 11323308 / 58Document2 pagesAccount Statement: Folio No.: 11323308 / 58Inderpaal SinghNo ratings yet

- Account Statement (From 12-JAN-2023 To 12-JAN-2023)Document2 pagesAccount Statement (From 12-JAN-2023 To 12-JAN-2023)shekhy123No ratings yet

- Acctstmt LDocument3 pagesAcctstmt LIshwaryaNo ratings yet

- Portfolio Summary: Investor Details Holding Information Hunaid Ali HitawalaDocument3 pagesPortfolio Summary: Investor Details Holding Information Hunaid Ali Hitawalaanshu bohra0% (1)

- MB137076624R7Document4 pagesMB137076624R7SiddharthNo ratings yet

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementJyoti PandeyNo ratings yet

- Acctstmt LDocument4 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Account Statement: Savita Shivagouda PatilDocument3 pagesAccount Statement: Savita Shivagouda Patilsia kamathNo ratings yet

- Account Statement: Folio Number: 1037065705Document2 pagesAccount Statement: Folio Number: 1037065705Abhishek JoshiNo ratings yet

- Abmf ElssDocument4 pagesAbmf ElssnirajNo ratings yet

- Non-Transferable: Page 1 of 2Document2 pagesNon-Transferable: Page 1 of 2Nawal KishoreNo ratings yet

- MLL0 Lssh2vlousbhxid-0u3eofddwwx5nvsrgjbduyDocument3 pagesMLL0 Lssh2vlousbhxid-0u3eofddwwx5nvsrgjbduyRahul ChoudharyNo ratings yet

- Axis Mutual Fund PDFDocument2 pagesAxis Mutual Fund PDFSunil Koricherla100% (1)

- Acctstmt B 1043752493EmailAcctStmtDocument2 pagesAcctstmt B 1043752493EmailAcctStmtSujata DeshpandeNo ratings yet

- Statement of Account: From 19-DEC-2022 To 19-DEC-2023Document3 pagesStatement of Account: From 19-DEC-2022 To 19-DEC-2023naysarNo ratings yet

- Acctstmt FDocument3 pagesAcctstmt FAbhay SinghNo ratings yet

- Account StatementDocument2 pagesAccount Statementsia kamathNo ratings yet

- Acctstmt HDocument3 pagesAcctstmt Hrekha nairNo ratings yet

- Acctstmt LDocument11 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- AxisDocument2 pagesAxisMukeshChoudharyNo ratings yet

- Axis Statement Fy 2020 - 2021Document3 pagesAxis Statement Fy 2020 - 2021ok okNo ratings yet

- Sbi PDFDocument5 pagesSbi PDFshweta pundirNo ratings yet

- Account Statement: Your Portfolio SummaryDocument3 pagesAccount Statement: Your Portfolio SummaryAnonymous CbpO95CNo ratings yet

- Portfolio 1700228693331Document3 pagesPortfolio 1700228693331Sumeet SoniNo ratings yet

- Account Statement: Non-TransferableDocument2 pagesAccount Statement: Non-Transferablemaakabhawan26No ratings yet

- 2021051722026094G76520650937278BMB137076625R7Document2 pages2021051722026094G76520650937278BMB137076625R7SiddharthNo ratings yet

- Sbi MF SipDocument2 pagesSbi MF Sipstuti1987No ratings yet

- Account Statement: Folio Number: 1019974653Document2 pagesAccount Statement: Folio Number: 1019974653Jay JaniNo ratings yet

- Saktipada Kayal All SoaDocument10 pagesSaktipada Kayal All Soabmfkolkata56No ratings yet

- Account Statement: Page 1 of 3Document3 pagesAccount Statement: Page 1 of 3achyut kumarNo ratings yet

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDocument3 pagesStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitKumar ManojNo ratings yet

- Mb1w9vgei25cx Xv2cwuyqiscokjclzyeupbrnlqcwoDocument3 pagesMb1w9vgei25cx Xv2cwuyqiscokjclzyeupbrnlqcwoRatan SinhaNo ratings yet

- Acctstmt LDocument4 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Account StatementDocument3 pagesAccount StatementKoushik MukherjeeNo ratings yet

- 1922Document2 pages1922imran khanNo ratings yet

- Account StatementDocument3 pagesAccount Statementvenkatesh kilariNo ratings yet

- Folio No. 9104 4783 646: Account SummaryDocument2 pagesFolio No. 9104 4783 646: Account SummarySaurabh BansalNo ratings yet

- Acctstmt B 1017529778Document2 pagesAcctstmt B 1017529778kc wardhaNo ratings yet

- Kubqz76sw8bjstc4 Nhnph1hspew5wqtb4vdaazozjsDocument3 pagesKubqz76sw8bjstc4 Nhnph1hspew5wqtb4vdaazozjsSURAKSHA PATELNo ratings yet

- Account StatementDocument2 pagesAccount Statementmca2k15.manitNo ratings yet

- Account Statement: Folio Number: 1038047310Document2 pagesAccount Statement: Folio Number: 1038047310Rajat RK KumarNo ratings yet

- Aditya Birla Mutual Fund Statement 19-20Document2 pagesAditya Birla Mutual Fund Statement 19-20Kiran DandileNo ratings yet

- MF AccountStatement-unlockedDocument2 pagesMF AccountStatement-unlockedRahul SonawaneNo ratings yet

- Account StatementDocument2 pagesAccount Statementsia kamathNo ratings yet

- Acctstmt LDocument2 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Mutual FundsDocument14 pagesMutual FundsSiddharthNo ratings yet

- Siddharth Canara 17733213733Document3 pagesSiddharth Canara 17733213733SiddharthNo ratings yet

- Sbi STATEMENTDocument7 pagesSbi STATEMENTlalitNo ratings yet

- Folio No. 9075 4601 351: Account SummaryDocument2 pagesFolio No. 9075 4601 351: Account SummaryspeedenquiryNo ratings yet

- Mutual Funds (Icici)Document1 pageMutual Funds (Icici)Adil KhanNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- Circular 64 - KG I Sibling Admissions For The AY 2024-25Document2 pagesCircular 64 - KG I Sibling Admissions For The AY 2024-25Inderpaal SinghNo ratings yet

- Statement 108301000006799Document3 pagesStatement 108301000006799Inderpaal SinghNo ratings yet

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementInderpaal SinghNo ratings yet

- Pulido v. People Digest v.2Document2 pagesPulido v. People Digest v.2Riann Bilbao100% (2)

- CJ 1010Document8 pagesCJ 1010api-537166164No ratings yet

- Mocomi TimePass The Magazine - Issue 72Document12 pagesMocomi TimePass The Magazine - Issue 72Mocomi KidsNo ratings yet

- Virtues and Credo of An ArchitectDocument9 pagesVirtues and Credo of An ArchitectRenee ObligarNo ratings yet

- Boluba Testimony of ElderDocument3 pagesBoluba Testimony of ElderEulo LagudasNo ratings yet

- Gas LawDocument1 pageGas Lawaira sharidaNo ratings yet

- Demand Letter - SampleDocument1 pageDemand Letter - SampleAina SolisNo ratings yet

- Payment FormDocument4 pagesPayment FormRodel Rivera VelascoNo ratings yet

- 45 - Moreno v. BernabeDocument5 pages45 - Moreno v. BernabePatricia DizonNo ratings yet

- OCA Circular No. 74-2024Document4 pagesOCA Circular No. 74-2024tpr1nc3ss6No ratings yet

- Federal Judge Consolidates Norfolk Southern Lawsuits, Names Co-Lead CounselsDocument23 pagesFederal Judge Consolidates Norfolk Southern Lawsuits, Names Co-Lead CounselsBenjamin DuerNo ratings yet

- Article 9 Advising of Credits and Amendments: K. M. Lutfor Rahman CDCS PresentationDocument45 pagesArticle 9 Advising of Credits and Amendments: K. M. Lutfor Rahman CDCS PresentationMohammodMosaddakShovonNo ratings yet

- A. Wassmer vs. Velez - G.R. No.l-20089Document3 pagesA. Wassmer vs. Velez - G.R. No.l-20089Bint MananNo ratings yet

- G.R. No. 115844 PDFDocument11 pagesG.R. No. 115844 PDFJeunice VillanuevaNo ratings yet

- Vested and Contingent Interest - Analysis As To The Title in The PropertyDocument42 pagesVested and Contingent Interest - Analysis As To The Title in The PropertyManikantan sNo ratings yet

- Iphone Xs 256gbDocument3 pagesIphone Xs 256gbGSM Fixer53No ratings yet

- Evidence Feb 16 Assignment (Provisions + Digests)Document17 pagesEvidence Feb 16 Assignment (Provisions + Digests)Victoria EscobalNo ratings yet

- HardshipDocument3 pagesHardship_clintonNo ratings yet

- Chapter 3: Legal, Ethical, and Professional Issues in Information SecurityDocument6 pagesChapter 3: Legal, Ethical, and Professional Issues in Information SecurityAnonymousNo ratings yet

- Agana Vs LagmanDocument1 pageAgana Vs LagmanAbdul-Hayya DitongcopunNo ratings yet

- CHERRY BLOSSOM LTD V MATIKOLA N and ORS 2020 SCJ 2Document10 pagesCHERRY BLOSSOM LTD V MATIKOLA N and ORS 2020 SCJ 2GirishNo ratings yet

- Driver Management SOPDocument5 pagesDriver Management SOPHari Krishnan100% (2)

- DO 045 s2019Document2 pagesDO 045 s2019ruzsi07No ratings yet

- 001 Ient v. Tullett PrebonDocument26 pages001 Ient v. Tullett PrebonAxel MendozaNo ratings yet

- Deed of SaleDocument2 pagesDeed of SaleBoss LeighNo ratings yet

- Partnership Act 1932Document10 pagesPartnership Act 1932Meer SalarNo ratings yet

- CPL 1.0 License - EnglishDocument7 pagesCPL 1.0 License - EnglishMartin Mendieta loraNo ratings yet

- Business Taxation QuizDocument5 pagesBusiness Taxation QuizWerpa PetmaluNo ratings yet