Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsEQUITY - Focused Funds For APR - JUNE 2020-1

EQUITY - Focused Funds For APR - JUNE 2020-1

Uploaded by

Raj PatilThis document provides performance data for various mutual funds across different categories like large cap, mid cap, small cap, hybrid, and thematic funds for periods of 1 month, 3 months, 1 year, 3 years and 5 years. It also lists the assets under management for each fund and parameters for fund selection like evaluating the fund management team, fund ranking, portfolio review, philosophy matching, and ratio evaluation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Reborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)Document515 pagesReborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)julian vegaNo ratings yet

- Performance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Document1 pagePerformance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Jazib SoofiNo ratings yet

- Yamaha Fazer-Fzh150 CatalogueDocument55 pagesYamaha Fazer-Fzh150 CatalogueAnonymous KoA00wXXD69% (13)

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- Equity Mutual Funds Best Equity Mutual Funds Mutual Fund RankingDocument3 pagesEquity Mutual Funds Best Equity Mutual Funds Mutual Fund Rankingneerajmca12No ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- Equity FundsDocument2 pagesEquity FundsMahesh SainiNo ratings yet

- Kenanga Today-230321 (Kenanga)Document5 pagesKenanga Today-230321 (Kenanga)hl lowNo ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- Kenanga Today - 230322 (Kenanga)Document5 pagesKenanga Today - 230322 (Kenanga)hl lowNo ratings yet

- MF Comparison ChartDocument2 pagesMF Comparison ChartBinayKPNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- ATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.Document4 pagesATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.JBPS Capital ManagementNo ratings yet

- Factsheet Al Amal) June 2010Document1 pageFactsheet Al Amal) June 2010sureniimbNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Corpus Yield & Maturity Expenses & LoadsDocument1 pageCorpus Yield & Maturity Expenses & Loadsaadhil1992No ratings yet

- Investuotoju asociacija-LMacijauskasDocument29 pagesInvestuotoju asociacija-LMacijauskasSynergyFinanceNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Document6 pages.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- San Lam Stratus FundsDocument2 pagesSan Lam Stratus FundsTiso Blackstar GroupNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- Case Assignment v01Document10 pagesCase Assignment v01Memo NerNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Fund Comparison With PeersDocument22 pagesFund Comparison With PeersArmstrong CapitalNo ratings yet

- Debt FuAndsDocument1 pageDebt FuAndsyogeshNo ratings yet

- Tài liệu không có tiêu đềDocument24 pagesTài liệu không có tiêu đềVũ Minh HoàngNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- Sanlam Stratus Funds - July 30 2020Document2 pagesSanlam Stratus Funds - July 30 2020Lisle Daverin BlythNo ratings yet

- Daily - March 7-8, 2011Document1 pageDaily - March 7-8, 2011JC CalaycayNo ratings yet

- G-Mint 50Document1 pageG-Mint 50hackavatarNo ratings yet

- Macy's, Inc. Financial HealthDocument2 pagesMacy's, Inc. Financial Healthjoia.dej1234No ratings yet

- Nse Market Report: Week Ended July 30, 2020Document1 pageNse Market Report: Week Ended July 30, 2020Vaite JamesNo ratings yet

- Equity - AutoDocument7 pagesEquity - Automsmanish29No ratings yet

- Daily Market Commentary: Tuesday, 23 June 2020Document1 pageDaily Market Commentary: Tuesday, 23 June 2020TerryNo ratings yet

- Kenanga Today 240116 KenangaDocument6 pagesKenanga Today 240116 KenangaChee TonyNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Document4 pagesSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanNo ratings yet

- Informe SBS Asset ManagementDocument32 pagesInforme SBS Asset ManagementyaninaNo ratings yet

- Top Performing Mutual Funds (Trailing Returns)Document2 pagesTop Performing Mutual Funds (Trailing Returns)Anand VermaNo ratings yet

- Sapa Mentari 121023Document6 pagesSapa Mentari 121023Diense ZhangNo ratings yet

- Care Home - Management AccountsDocument9 pagesCare Home - Management AccountscoolmanzNo ratings yet

- June 3, 2011: Market OverviewDocument10 pagesJune 3, 2011: Market OverviewValuEngine.comNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Nse Market Report: August 3, 2020Document1 pageNse Market Report: August 3, 2020Vaite JamesNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- Roche Group Financial DataDocument43 pagesRoche Group Financial DataDryTvMusicNo ratings yet

- Quadro Diário de Rentabilidade: GestoresDocument6 pagesQuadro Diário de Rentabilidade: GestoresGabriela DinizNo ratings yet

- 20th July, 2020Document8 pages20th July, 2020samuel debebeNo ratings yet

- Rights IssueDocument18 pagesRights Issuemuthum44499335No ratings yet

- Data Dampak Ekonomi COVID-19 - Sum - SendDocument52 pagesData Dampak Ekonomi COVID-19 - Sum - SendQA ARNANo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Lean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareFrom EverandLean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareRating: 5 out of 5 stars5/5 (2)

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- Piyush ReportDocument22 pagesPiyush ReportRaj PatilNo ratings yet

- Amber & Company: A Reliable Company of WaterproofingDocument20 pagesAmber & Company: A Reliable Company of WaterproofingRaj PatilNo ratings yet

- Scanned by CamscannerDocument13 pagesScanned by CamscannerRaj PatilNo ratings yet

- Basel NormsDocument9 pagesBasel NormsRaj PatilNo ratings yet

- Master of Management Studies MMSDocument20 pagesMaster of Management Studies MMSRaj PatilNo ratings yet

- 2ND and 3RD Drug StudyDocument16 pages2ND and 3RD Drug Study황춘히No ratings yet

- Veg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipesDocument22 pagesVeg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipespmaNo ratings yet

- Student-Flute-2.0 Leaflet ENDocument1 pageStudent-Flute-2.0 Leaflet ENkaa007No ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- 211-Article Text-399-1-10-20180522 PDFDocument42 pages211-Article Text-399-1-10-20180522 PDFAlex KanathNo ratings yet

- Analyzing IoT Data in Python Chapter1Document27 pagesAnalyzing IoT Data in Python Chapter1FgpeqwNo ratings yet

- (Oral Ana) Molars Gen CharacteristicsDocument24 pages(Oral Ana) Molars Gen CharacteristicsVT Superticioso Facto - TampusNo ratings yet

- BTS Power ManagementDocument21 pagesBTS Power ManagementSam FicherNo ratings yet

- May Benson CermakDocument7 pagesMay Benson CermakTamiris AlvesNo ratings yet

- Module For Questioned Document ExaminationDocument13 pagesModule For Questioned Document ExaminationMark Jayson Pampag Muyco100% (1)

- Introduction To SipDocument2 pagesIntroduction To Sipriyasharma040596No ratings yet

- PSI Framework Components - EnglishDocument20 pagesPSI Framework Components - Englishalejandrosag0% (1)

- Impact of The New Malaysian IFSA 2013 Regulation On Takaful and ReTakaful OperatorsDocument3 pagesImpact of The New Malaysian IFSA 2013 Regulation On Takaful and ReTakaful OperatorsDilawar AheerNo ratings yet

- Lesson 2Document16 pagesLesson 2Vusani NeguyuniNo ratings yet

- Fumihiko Maki and His Theory of Collective Form - A Study On Its PDocument278 pagesFumihiko Maki and His Theory of Collective Form - A Study On Its PemiliosasofNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration) WarningDocument5 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration) WarningRana Tauqeer HaiderNo ratings yet

- 2 Grade English ReaderDocument176 pages2 Grade English ReaderaniteshsannigrahiNo ratings yet

- Solid State MCQ & CsaDocument10 pagesSolid State MCQ & Csashivansh upadhyay100% (1)

- Ibm - R61i Vga ShareDocument100 pagesIbm - R61i Vga Shareحسن علي نوفلNo ratings yet

- He Va Grass Roller 63 82 Spare PartsDocument48 pagesHe Va Grass Roller 63 82 Spare PartstotcsabNo ratings yet

- Gen Bio 1 Le Week 1 - Quarter 2Document7 pagesGen Bio 1 Le Week 1 - Quarter 2Cassy Joy Rellama100% (1)

- 15ec74 MMC Course ModulesDocument2 pages15ec74 MMC Course Modulesragavendra4No ratings yet

- Domino Server Tasks and Console CommandsDocument26 pagesDomino Server Tasks and Console Commandsvc_nishank8890No ratings yet

- Chronic Suppurative Otitis MediaDocument37 pagesChronic Suppurative Otitis Media43 Mohamed RazikNo ratings yet

- Method Statement Ceiling RemovalDocument7 pagesMethod Statement Ceiling RemovalSimpol MathNo ratings yet

- Module 2 - Lesson Plan ComponentsDocument5 pagesModule 2 - Lesson Plan ComponentsMay Myoe KhinNo ratings yet

EQUITY - Focused Funds For APR - JUNE 2020-1

EQUITY - Focused Funds For APR - JUNE 2020-1

Uploaded by

Raj Patil0 ratings0% found this document useful (0 votes)

4 views2 pagesThis document provides performance data for various mutual funds across different categories like large cap, mid cap, small cap, hybrid, and thematic funds for periods of 1 month, 3 months, 1 year, 3 years and 5 years. It also lists the assets under management for each fund and parameters for fund selection like evaluating the fund management team, fund ranking, portfolio review, philosophy matching, and ratio evaluation.

Original Description:

EQUITY - Focused Funds For APR - JUNE 2020-1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides performance data for various mutual funds across different categories like large cap, mid cap, small cap, hybrid, and thematic funds for periods of 1 month, 3 months, 1 year, 3 years and 5 years. It also lists the assets under management for each fund and parameters for fund selection like evaluating the fund management team, fund ranking, portfolio review, philosophy matching, and ratio evaluation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesEQUITY - Focused Funds For APR - JUNE 2020-1

EQUITY - Focused Funds For APR - JUNE 2020-1

Uploaded by

Raj PatilThis document provides performance data for various mutual funds across different categories like large cap, mid cap, small cap, hybrid, and thematic funds for periods of 1 month, 3 months, 1 year, 3 years and 5 years. It also lists the assets under management for each fund and parameters for fund selection like evaluating the fund management team, fund ranking, portfolio review, philosophy matching, and ratio evaluation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

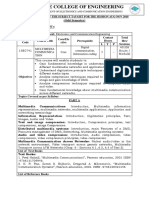

Focused Funds for April - June 2020

LARGE CAP AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Mirae Asset Large Cap 15,347 3.38% -22.67% -13.84% 0.47% 6.05%

Axis Bluechip 12,717 0.90% -19.99% -2.99% 7.17% 7.41%

LARGE & MID CAP AUM (in Cr.) 1M 3M 1Y 3Y 5Y

DSP Equity Opportunities 4,439 3.86% -23.54% -11.23% -2.23% 5.24%

Principal Emerging Bluechip 1,822 4.57% -22.19% -9.54% -2.25% 5.85%

Sundaram Large & Mid Cap Fund 1,013 1.91% -27.67% -16.03% -1.61% 4.53%

MULTI CAP AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Kotak Standard Multicap 26,049 4.40% -23.28% -13.40% -0.97% 5.79%

DSP Equity Fund 3,151 2.80% -23.80% -5.97% 0.44% 5.64%

Axis Multicap Fund 5,592 0.85% -19.75% -2.90% - -

MID CAP AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Kotak Emerging Equity 5,912 4.25% -26.66% -12.24% -4.34% 4.94%

AXIS MIDCAP 5,098 3.10% -17.25% 1.67% 6.78% 7.18%

DSP Mid Cap 6,488 5.50% -19.50% -4.99% -2.11% 7.30%

SMALL CAP AUM (in Cr.) 1M 3M 1Y 3Y 5Y

SBI Small Cap 3,280 2.38% -23.83% -11.15% 0.57% 7.97%

Axis Small Cap 2,169 2.06% -26.87% -4.12% 1.52% 6.56%

HYBRID EQUITY AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Mirae Asset Hybrid Fund 3,314 3.80% -15.38% -6.67% 2.69% -

Principal Hybrid equity Fund 1,088 2.76% -16.29% -11.57% 0.12% 5.94%

Moderate Balanced Funds AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Kotak Balanced Advantage Fund 3,600 3.90% -12.88% -3.36% - -

Principal Balanced Advantage 144 2.23% -5.61% -4.19% 1.39% 3.62

EQUITY LINKED SAVING SCHEME AUM (in Cr.) 1M 3M 1Y 3Y 5Y

MIRAE ASSET TAX SAVER 3,184 4.19% -21.76% -10.07% 1.87% -

PRINCIPAL TAX PLAN 344 3.43% -21.53% -16.10% -3.94% 4.01%

Axis Long Term Equity 19632 2.22% -22.63% -5.05% 3.85% 6.01%

FOCUSED 25-30 STOCKS FUNDS AUM (in Cr.) 1M 3M 1Y 3Y 5Y

AXIS Focused 25 9,493 3.25% -23.99% -6.10% 2.84% 7.79%

SBI Focused Equity 7,968 1.02% -21.93% -8.14% 4.59% 7.54%

Thematic Fund AUM (in Cr.) 1M 3M 1Y 3Y 5Y

Sundaram Services Fund 1,010 4.24% -27.08% -7.33% - -

Mosl Nasdaq 100 Fof 402 10.51% 2.07% 29.84% - -

* Time periods greater than 1 Year are annualised

** Only SIP's Allowed

## Returns as on 13-05-2020

Parameters for Fund Selection:-

1) Evaluating Fund Management Team

2) Fund Ranking

3) Portfolio Review

4) Philosophy Matching

5) Multiple Ratios Evaluation

You might also like

- Reborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)Document515 pagesReborn Apocalypse (A LitRPGWuxia Story) (Volume 1) (Kerr L.M.)julian vegaNo ratings yet

- Performance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Document1 pagePerformance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Jazib SoofiNo ratings yet

- Yamaha Fazer-Fzh150 CatalogueDocument55 pagesYamaha Fazer-Fzh150 CatalogueAnonymous KoA00wXXD69% (13)

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- Equity Mutual Funds Best Equity Mutual Funds Mutual Fund RankingDocument3 pagesEquity Mutual Funds Best Equity Mutual Funds Mutual Fund Rankingneerajmca12No ratings yet

- Pms Performance 30 JUNE 2019: Large Cap OrientedDocument3 pagesPms Performance 30 JUNE 2019: Large Cap Orientedmaheshtech76No ratings yet

- Equity FundsDocument2 pagesEquity FundsMahesh SainiNo ratings yet

- Kenanga Today-230321 (Kenanga)Document5 pagesKenanga Today-230321 (Kenanga)hl lowNo ratings yet

- March-PMS-Performance-Newsletter (PMS AIF World)Document5 pagesMarch-PMS-Performance-Newsletter (PMS AIF World)maheshtech76No ratings yet

- Kenanga Today - 230322 (Kenanga)Document5 pagesKenanga Today - 230322 (Kenanga)hl lowNo ratings yet

- MF Comparison ChartDocument2 pagesMF Comparison ChartBinayKPNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- ATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.Document4 pagesATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.JBPS Capital ManagementNo ratings yet

- Factsheet Al Amal) June 2010Document1 pageFactsheet Al Amal) June 2010sureniimbNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Corpus Yield & Maturity Expenses & LoadsDocument1 pageCorpus Yield & Maturity Expenses & Loadsaadhil1992No ratings yet

- Investuotoju asociacija-LMacijauskasDocument29 pagesInvestuotoju asociacija-LMacijauskasSynergyFinanceNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Document6 pages.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- San Lam Stratus FundsDocument2 pagesSan Lam Stratus FundsTiso Blackstar GroupNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- Case Assignment v01Document10 pagesCase Assignment v01Memo NerNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Fund Comparison With PeersDocument22 pagesFund Comparison With PeersArmstrong CapitalNo ratings yet

- Debt FuAndsDocument1 pageDebt FuAndsyogeshNo ratings yet

- Tài liệu không có tiêu đềDocument24 pagesTài liệu không có tiêu đềVũ Minh HoàngNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- Sanlam Stratus Funds - July 30 2020Document2 pagesSanlam Stratus Funds - July 30 2020Lisle Daverin BlythNo ratings yet

- Daily - March 7-8, 2011Document1 pageDaily - March 7-8, 2011JC CalaycayNo ratings yet

- G-Mint 50Document1 pageG-Mint 50hackavatarNo ratings yet

- Macy's, Inc. Financial HealthDocument2 pagesMacy's, Inc. Financial Healthjoia.dej1234No ratings yet

- Nse Market Report: Week Ended July 30, 2020Document1 pageNse Market Report: Week Ended July 30, 2020Vaite JamesNo ratings yet

- Equity - AutoDocument7 pagesEquity - Automsmanish29No ratings yet

- Daily Market Commentary: Tuesday, 23 June 2020Document1 pageDaily Market Commentary: Tuesday, 23 June 2020TerryNo ratings yet

- Kenanga Today 240116 KenangaDocument6 pagesKenanga Today 240116 KenangaChee TonyNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Document4 pagesSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanNo ratings yet

- Informe SBS Asset ManagementDocument32 pagesInforme SBS Asset ManagementyaninaNo ratings yet

- Top Performing Mutual Funds (Trailing Returns)Document2 pagesTop Performing Mutual Funds (Trailing Returns)Anand VermaNo ratings yet

- Sapa Mentari 121023Document6 pagesSapa Mentari 121023Diense ZhangNo ratings yet

- Care Home - Management AccountsDocument9 pagesCare Home - Management AccountscoolmanzNo ratings yet

- June 3, 2011: Market OverviewDocument10 pagesJune 3, 2011: Market OverviewValuEngine.comNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Nse Market Report: August 3, 2020Document1 pageNse Market Report: August 3, 2020Vaite JamesNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- Roche Group Financial DataDocument43 pagesRoche Group Financial DataDryTvMusicNo ratings yet

- Quadro Diário de Rentabilidade: GestoresDocument6 pagesQuadro Diário de Rentabilidade: GestoresGabriela DinizNo ratings yet

- 20th July, 2020Document8 pages20th July, 2020samuel debebeNo ratings yet

- Rights IssueDocument18 pagesRights Issuemuthum44499335No ratings yet

- Data Dampak Ekonomi COVID-19 - Sum - SendDocument52 pagesData Dampak Ekonomi COVID-19 - Sum - SendQA ARNANo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Lean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareFrom EverandLean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareRating: 5 out of 5 stars5/5 (2)

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- Piyush ReportDocument22 pagesPiyush ReportRaj PatilNo ratings yet

- Amber & Company: A Reliable Company of WaterproofingDocument20 pagesAmber & Company: A Reliable Company of WaterproofingRaj PatilNo ratings yet

- Scanned by CamscannerDocument13 pagesScanned by CamscannerRaj PatilNo ratings yet

- Basel NormsDocument9 pagesBasel NormsRaj PatilNo ratings yet

- Master of Management Studies MMSDocument20 pagesMaster of Management Studies MMSRaj PatilNo ratings yet

- 2ND and 3RD Drug StudyDocument16 pages2ND and 3RD Drug Study황춘히No ratings yet

- Veg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipesDocument22 pagesVeg Roll Recipe - Frankie Recipe For Kids - Swasthi's RecipespmaNo ratings yet

- Student-Flute-2.0 Leaflet ENDocument1 pageStudent-Flute-2.0 Leaflet ENkaa007No ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- 211-Article Text-399-1-10-20180522 PDFDocument42 pages211-Article Text-399-1-10-20180522 PDFAlex KanathNo ratings yet

- Analyzing IoT Data in Python Chapter1Document27 pagesAnalyzing IoT Data in Python Chapter1FgpeqwNo ratings yet

- (Oral Ana) Molars Gen CharacteristicsDocument24 pages(Oral Ana) Molars Gen CharacteristicsVT Superticioso Facto - TampusNo ratings yet

- BTS Power ManagementDocument21 pagesBTS Power ManagementSam FicherNo ratings yet

- May Benson CermakDocument7 pagesMay Benson CermakTamiris AlvesNo ratings yet

- Module For Questioned Document ExaminationDocument13 pagesModule For Questioned Document ExaminationMark Jayson Pampag Muyco100% (1)

- Introduction To SipDocument2 pagesIntroduction To Sipriyasharma040596No ratings yet

- PSI Framework Components - EnglishDocument20 pagesPSI Framework Components - Englishalejandrosag0% (1)

- Impact of The New Malaysian IFSA 2013 Regulation On Takaful and ReTakaful OperatorsDocument3 pagesImpact of The New Malaysian IFSA 2013 Regulation On Takaful and ReTakaful OperatorsDilawar AheerNo ratings yet

- Lesson 2Document16 pagesLesson 2Vusani NeguyuniNo ratings yet

- Fumihiko Maki and His Theory of Collective Form - A Study On Its PDocument278 pagesFumihiko Maki and His Theory of Collective Form - A Study On Its PemiliosasofNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration) WarningDocument5 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration) WarningRana Tauqeer HaiderNo ratings yet

- 2 Grade English ReaderDocument176 pages2 Grade English ReaderaniteshsannigrahiNo ratings yet

- Solid State MCQ & CsaDocument10 pagesSolid State MCQ & Csashivansh upadhyay100% (1)

- Ibm - R61i Vga ShareDocument100 pagesIbm - R61i Vga Shareحسن علي نوفلNo ratings yet

- He Va Grass Roller 63 82 Spare PartsDocument48 pagesHe Va Grass Roller 63 82 Spare PartstotcsabNo ratings yet

- Gen Bio 1 Le Week 1 - Quarter 2Document7 pagesGen Bio 1 Le Week 1 - Quarter 2Cassy Joy Rellama100% (1)

- 15ec74 MMC Course ModulesDocument2 pages15ec74 MMC Course Modulesragavendra4No ratings yet

- Domino Server Tasks and Console CommandsDocument26 pagesDomino Server Tasks and Console Commandsvc_nishank8890No ratings yet

- Chronic Suppurative Otitis MediaDocument37 pagesChronic Suppurative Otitis Media43 Mohamed RazikNo ratings yet

- Method Statement Ceiling RemovalDocument7 pagesMethod Statement Ceiling RemovalSimpol MathNo ratings yet

- Module 2 - Lesson Plan ComponentsDocument5 pagesModule 2 - Lesson Plan ComponentsMay Myoe KhinNo ratings yet