Professional Documents

Culture Documents

Performance Analysis of Palmal Group of Industries

Performance Analysis of Palmal Group of Industries

Uploaded by

yatin6648Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance Analysis of Palmal Group of Industries

Performance Analysis of Palmal Group of Industries

Uploaded by

yatin6648Copyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/362452336

An Internship Report On an analysis of Financial Performance Of Palmal group

of Industries

Preprint · August 2022

DOI: 10.13140/RG.2.2.19477.81126

CITATIONS READS

0 8,000

1 author:

Shoriful Islam

Daffodil International University

9 PUBLICATIONS 0 CITATIONS

SEE PROFILE

All content following this page was uploaded by Shoriful Islam on 03 August 2022.

The user has requested enhancement of the downloaded file.

An Internship Report

On an analysis of Financial Performance

Of

Palmal group of Industries

SUPERVISED BY:

Mohammad Shibli Shahriar

Associate Professor

Department of Business Administration

Daffodil International University, Bangladesh

PREPARED BY:

Shoriful Islam

ID No: 211-14-3314

MBA Major in Finance

Department of Business Administration

Daffodil International University

Submission Date

Letter of Transmittal

i ©Daffodil International University

Date:

Mohammad Shibli Shahriar

Associate Professor

Department of Business Administration

Daffodil International University Bangladesh

Subject: Submission of Internship Report on “Financial Performance Analysis of “Palmal

Group of Industries”.

Dear Sir

I am delighted to submit my Internship Report on Financial Performance Analysis of "Palmal

Group of Industries". Following the guidelines provided by you and the company, I have tried

my best to complete this report.

I am confident that the internship program has greatly enhanced both my practical experience

and theoretical knowledge. So, I hope you would be kind enough to accept my report.

Sincerely Yours.

___________

Name: Shoriful Islam

ID No. 211-14-3314

Batch: 58th

MBA (Major in Finance)

Daffodil International University

ii ©Daffodil International University

Certificate of Approval

I am pleased to certify that the Internship report on “Financial Performance Analysis of

Palmal Group of Industries”. A study conducted by Shoriful Islam bearing ID No. 211-14-

3314 MBA Program, Department of Business Administration has been approved for defense.

Shoriful Islam is currently working with palmal group of industries under department of stock lot

holding position as internal Audit Executive and placement at Asulia Bongobondhu road has

been confirmed by the central management. Shoriful Islam prepared this report under my

supervision.

______________

Mohammad Shibli Shahriar

Associate Professor

Department of Business Administration

Faculty of Business & Entrepreneurship

Daffodil International University

iii ©Daffodil International University

Executive Summary

This report will give a clear idea of its financial performance. Specifically, this report focuses on

what financial analysis is and how liquidity and profitability analysis are used which closely

monitor and evaluate during working hours at Asulia Land Project (ALP) Bongo bondhu road

of Palmal Group of Industries.

iv ©Daffodil International University

Table of Contents

Letter of Transmittal ...................................................................................................................................... i

Certificate of Approval ................................................................................................................................ iii

Executive Summary ..................................................................................................................................... iv

CHAPTER ONE ............................................................................................................................................... 1

INTRODUCTION ............................................................................................................................................. 1

1.1Introduction .......................................................................................................................................... 1

1.2Origin of the report: ............................................................................................................................. 1

1.3 Objectives of the Study ....................................................................................................................... 2

1.6Limitations: .......................................................................................................................................... 4

Chapter Two .................................................................................................................................................. 5

The Organizational Profile PALMAL GROUP OF INUSTRIES ...................................................................... 5

CHAPTER THREE ............................................................................................................................................ 6

Financial Performance Analysis Of Palmal Group of Industries.................................................................... 6

3.1RATIO OF THE REPORT ......................................................................................................................... 7

3.2.1Net Profit Margin .......................................................................................................................... 8

3.2.2Return on Assets (ROA)................................................................................................................. 9

3.2.3Return on Equity (ROE) ............................................................................................................... 11

3.3.1Current ratio ............................................................................................................................... 12

3.4Analyzing Activity Ratio...................................................................................................................... 14

3.4.1Total Asset Turnover Ratio.......................................................................................................... 14

3.5 Analyzing solvency Ratio ................................................................................................................... 16

3.5.1Debt to Equity Ratio .................................................................................................................... 16

3.5.2Times interest earned ................................................................................................................. 18

v ©Daffodil International University

Chapter Four ............................................................................................................................................... 19

Findings, Recommendations and Conclusions............................................................................................ 19

4.1 Findings of the Study......................................................................................................................... 20

4.2Recomentations ................................................................................................................................. 21

4.3Conclusion .......................................................................................................................................... 21

4.4 Reference & Bibliography ............................................................................................................. 21

vi ©Daffodil International University

CHAPTER ONE

INTRODUCTION

1.1Introduction

Palmal Group of Industries is the leading and pioneer readymade manufacturing garments

company in Bangladesh. It is a leading supplier to customers by delivering socially, ethically and

sustainable manufactured quality products with on time delivery using a highly efficient, Eco-

friendly and vertically integrated manufacturing process. This study I will try to find out their

financial performance in stock lot department as I am responsible for this section

1.2Origin of the report:

This report was prepared as required under the MBA program Daffodil International University.

This is a golden opportunity to me for working with one of the most renowned and leading

manufacturing group company in the country – Palmal Group Of industries. I am currently

working with palmal group as permanent employee and I am placed on Asulia land project

(ALP) Bongobondhu road Asulia Dhaka Bangladesh and prepared a report to evaluate the

financial performances in stock lot department of Palmal group.

1 ©Daffodil International University

1.3 Objectives of the Study

Evaluate the financial performance of Palmal Group Of industries is main objective of the study

Specific objectives

1. To analyze the financial operations of Palmal Group of Industries

2. To evaluate those operations of Palmal Group of Industries

3. To identify some problems of Palmal Group of Industries

4. To make some suggestions to overcome the problems

2 ©Daffodil International University

1.5Methodology of the Study

primary secondary

sources sources

• Face to face

• Monthly reports of Stock

conversation lot

with the officer and

buyer

Daily diary

(containing my

• Practical desk activities of

work practical

orientation in)

maintained by

me

• Direct

observations

• Memos & Circulars

3 ©Daffodil International University

1.6Limitations:

To prepare a report requires different aspects and experiences. However I have encountered

some obstacles to prepare a complete and perfect report. Below are some of the obstacles

that have impeded my work

Time Limitation: There was very little time for details about a giant organization such

as Palmal Group Of Industries.

Inadequate Data: The lack of available information about export and import business

activities of Palmal group of industries made it difficult to collect the required

information.

Lack of Record: Greater research was not possible due to restrictions by the

organization. Inadequacy of sufficient written documentation to conduct a comprehensive

study of the required. In many cases up-to-date information was not available.

Lack of experiences: Lack of experience has served as a barrier to the rhythmic

exploration of the subject. Being a member of the organization; I couldn't express

anything sensitive issues.

4 ©Daffodil International University

Chapter Two

The Organizational Profile PALMAL

GROUP OF INUSTRIES

The Palmal Group of Industries, one of the promising RMG manufacturing enterprises, made its

debut in 1984 as the sole venture of the late engineer. Mr. Nurul Haque Sikder, Former and

Founding Chairman and Managing Director of the Group.

Late Engg. Mr. N.H. Sikder appointed his beloved son Mr. Nafis Sikder as Managing Director in

2001. Since then Mr. Nafis Sikder has been the Honorary Managing Director of the Group and

under his dynamic leadership the Group has been running smoothly. The company's business

growth over the last seventeen years has been extremely high and significant.

At this stage palmal group of industries have managed more than 25000 permanent employees

and operating more than 30 individual factories alongside 60 units working together under

central management without facing any conflict, needless to say that palmal group of industries

have contributed to national economy for long time.

5 ©Daffodil International University

CHAPTER THREE

Financial Performance Analysis Of Palmal

Group of Industries

6 ©Daffodil International University

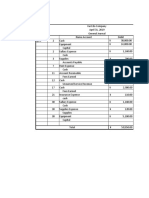

3.1RATIO OF THE REPORT

1.Net Profit Margin

Profitability Ratio 2.Return on Assets

3.Return on Equity

Liquidity Ratio 1.Current Ratio

1.Total Assets Turnover

Activity Ratio

1.Debt-Equity Ratio

Solvency Ratio 2.Times interest earned

7 ©Daffodil International University

3.2.1Net Profit Margin

Net profit margin is equal to the percentage of income or profit makes as a percentage of income.

Net profit margin is the ratio of net profit to earnings of a company.

Net Profit Margin=Net profit after tax/operating income

Net Profit Margin

Year 2017 2018 2019 2020

Percentage of 28% 29% 32% 35%

Ratio

Source:annual report of Palmal Group of Industries

Graphical Presentation:

28%

35%

29%

32%

2017 2018 2019 2020

8 ©Daffodil International University

Figure 3.1 Net Profit Margins

Interpretation: Net profit margin increased by year to year from 2017 to 2019, indicating that the

operating results were improving. In this figure it seen that company had a net profit margin of 35% in

2020 which show very decent operating results of the company

3.2.2Return on Assets (ROA)

Return on assets (ROA) is a ratio that measures a company's earnings before interest and tax

(EBIT), compared to a company's total net asset.

Return on Asset (ROA) =Net Profit after tax/Total Asset

Return on Total Asset

Year 2017 2018 2019 2020

Percentage of 1.43% 1.90% 1.43% 1.08%

ratio

Source: annual report of Palmal Group of Industries

9 ©Daffodil International University

Graphical presentation

1.90%

1.43% 1.43%

1.08%

2017 2018 2019 2020

Figure 3.2Return on asset

Interpretation: From the graph it is shown that the return on assets increased slightly from

2017 to 2018 and it decreased somewhat in 2019 and 2020, it was 1.43% and 1.08%

respectively. According to the graph in 2017, assets were the highest on return. This represent

that the year make the most revenue

10 ©Daffodil International University

3.2.3Return on Equity (ROE)

Return on Equity (ROE) considered how more effectively a company using their resources to

generate more profit

Return on Equity=Net Profit after Tax/ Shareholders equity

Return on Equity

Year 2017 2018 2019 2020

Percentage of 12.74% 15.96% 12.27% 9.63%

ratio

Source: annual report of Palmal Group of Industries

Graphical presentation

18

12.27%

16

14 15.96% 9.63%

12

9.63

10

8

6

4

2

0

2017 2018 2019 2020

Figure: 3.3Return on Equity

Interpretation:

In the 1st two years, company having 12.74% to 15.96% return on equity and the highest value had

shown in 2017 and lowest value had shown in 2019, which was not good.

11 ©Daffodil International University

3.3.1Current ratio

Current ratio measures that a firm's ability to pay short-term liabilities with its current assets. The

current ratio play vital role for measuring company liquidity because there are short-term

liabilities within the next year.

Current Ratio=Current Asset/Current Liabilities

Current Ratio

Year 2017 2018 2019 2020

1.1:1 1.2:1 1.01:1 1.08:1

Source: annual report of Palmal Group of Industries

Graphical Presentation

12 ©Daffodil International University

1.25

1.2 1.2

1.15

1.1 1.1

1.08

1.05

1.01

1

0.95

0.9

2017 2018 2019 2020

Figure3.4 Current ratio

Interpretation: A current ratio of 1.2 to 2 is considered as the norm. If the ratio is less than 1,

it can be difficult for a firm to pay current liabilities. If the ratio is greater than 1 which indicates

to a company that it is able to cover its entire short-term obligation. Here we can see that the

current ratio of palmal group is 1.1: 1 in 2017, 1.2: 1 in 2018, 1.01: 1 in 2019 and 1.08:1 in 2020.

This indicates that the palmal group current liquidity. The position is not bad.

13 ©Daffodil International University

3.4Analyzing Activity Ratio

Activity ratios are a category of financial ratios that measure a firm's ability to convert cash or

sales into its balance sheet.

3.4.1Total Asset Turnover Ratio.

Total asset turnover is the financial efficiency ratio that measures a company's ability to use its

assets to increase sales.

Total asset turnover=Operating Income/Total asset

Total asset turnover Ratio

Year 2017 2018 2019 2020

Times 7.7 7.3 7.1 9.7

Source: annual report of Palmal Group of Industries

14 ©Daffodil International University

Graphical presentation

12

9.7

0

10

7.7

0

8 7.3

0 7.1

0

0

2017 2018 2019 2020

Figure: 3.5 Total asset turnover

Interpretation: The graph provides information about total asset turnover ratio of company

between 2017 to 2020.we know highest turnover is more efficient for the company. So according

that statement we can see that in the year of 2020 hold the highest total asset turnover which is

9.7times and in the year of 2019 hold the least total asset turnover which is 7.1times that not

good for the company.

15 ©Daffodil International University

3.5 Analyzing solvency Ratio

The solvency ratio determines the size of a company's after-tax income, not the cash-for-cash

depreciation expense, versus the company's total debt obligation.

3.5.1Debt to Equity Ratio

The debt to Equity Ratio shows the percentage of company financing from the company's

lenders and investors. A higher debt to equity ratio indicates that more credit financing (bank

loan) is used than investor financing (shareholder)

Debt to Equity ratio=Total liabilities/Total equity

Debt to Equity Ratio

Year 2017 2018 2019 2020

times 7.39 7.44 7.69 8.08

Source: annual report of Palmal Group of Industries

16 ©Daffodil International University

Graphical Presentation

8.2

8.08

7.8

7.69

7.6

7.44

7.39

7.4

7.2

7

2017 2018 2019 2020

Figure: 3.6 Debts to Equity Ratio

Interpretation:

Throughout the period, we can see that debt equity ratio of the company increased. The highest

ratio was 8.08 in 2020, while lowest ratio was 7.39 in 2017 in term of times. Palmal group of

industries debt equity ratio is higher than the value so it should be reduced.

17 ©Daffodil International University

3.5.2Times interest earned

The times interest earned ratio, sometimes called the interest coverage ratio, measures the firm’s

ability to make contractual interest payments.

Time Interest Earned Ratio =Earnings before interest & Taxes/Interest

Time Interest Earned Ratio

Years 2017 2018 2019 2020

Times 1.39 1.29 1.37 1.72

Source: annual report of Palmal Group of Industries

1.8 1.72

1.6

1.39 1.37

1.4 1.29

1.2

0.8

0.6

0.4

0.2

0

2017 2018 2019 2020

Figure: 3.7 times interest earn ratio

Interpretation: Times interest earn ratio had fluctuated over the time period.it highest

value accounted in 2020 and least value accounted in 2018 which was 1.29times and 1.72

times consistently.

18 ©Daffodil International University

Chapter Four

Findings, Recommendations and

Conclusions

19 ©Daffodil International University

4.1 Findings of the Study

1. Net Profit Margin of Palmal group of industries was 35% in 2020 which is higher than

2017, 2018 and 2019.

2. Return on Asset (ROA) of Palmal group of industries was 1.90% in 2018 which is higher

than 2017, 2019 and 2020.

3. Return on Equity (ROE) of Palmal group of industries was 15.96% in 2018 which is

higher than 2017, 2019 and 2020.

4. Current Ratio of Palmal group of industries was 1.2:1 in 2018 which is better than 2017,

2019 and 2020.

5. Total Asset Turnover of Palmal group of industries was 7.7 times in 2017 which is higher

than 2018, 2019 and 2020.

6. Debt to Equity Ratio of Palmal group of industries was 8.08 times 2020 which is higher

than 2017, 2018 and 2019.

7. Times Interest Earned Ratio of Palmal group of industries was 1.72 times in 2020 which

is higher than 2017, 2018 and 2019.

20 ©Daffodil International University

4.2Recomentations

The following recommendations can be suggested to resolve the issues outlined above:

1. Palmal group of industries total assets should be increased.

2. Palmal group of industries must generate earnings per share (EPS).

3. Palmal group of industries should be rose up their current assets.

4. Palmal group of industries must reduce their spending.

5. Palmal group of industries has to keep their total assets turnover.

4.3Conclusion

This internship report is part of my MBA course at Daffodil International University and I have

done my best to prepare with some gratitude. The main purpose of this internship course is to

provide the student with a job presentation and to know the scope of organizational attachment.

From a practical standpoint I can boldly declare that from the very first day I truly enjoyed my

internship at this organization. Furthermore, this internship program that is compulsory for my

MBA program is short-lived, but has definitely helped me think more about my career. I have

tried my soul to attach the research report to the relevant information needed in my report.

4.4 Reference & Bibliography

1. Monthly reconciliation, Annual report and analysis of daily and monthly challan

2. website https://palmalgarments.com/

3. Practical working experience.

21 ©Daffodil International University

View publication stats

You might also like

- CCDE Study GuideDocument518 pagesCCDE Study Guidesmamedov80100% (5)

- Exam Tests: Latest Exam Questions & Answers Help You To Pass IT Exam Test EasilyDocument7 pagesExam Tests: Latest Exam Questions & Answers Help You To Pass IT Exam Test EasilyAnonymous yahXGrlz850% (2)

- Financial Ratio Annalysis Dharwad Milk Project Report MbaDocument97 pagesFinancial Ratio Annalysis Dharwad Milk Project Report MbaBabasab Patil (Karrisatte)100% (4)

- Financial Analysis & Valuation of Godrej Consumer Product LimitedDocument30 pagesFinancial Analysis & Valuation of Godrej Consumer Product Limitedanshul sinhal100% (1)

- Investment AnalysisDocument31 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Project Report On "Performance of Mutual Funds in Bangladesh"Document42 pagesProject Report On "Performance of Mutual Funds in Bangladesh"Shovan SahaNo ratings yet

- Report On Berger Paints Bangladesh LimitedDocument18 pagesReport On Berger Paints Bangladesh LimitedtabisahshanNo ratings yet

- WACC CalculationDocument17 pagesWACC Calculationrm1912No ratings yet

- WACC CalculationDocument17 pagesWACC Calculationrm1912No ratings yet

- A Project Report On Financial Ratio Annalysis Dharwad Milk Project Report Bec Bagalkot Mba by Babasab Patil (Karisatte)Document97 pagesA Project Report On Financial Ratio Annalysis Dharwad Milk Project Report Bec Bagalkot Mba by Babasab Patil (Karisatte)rajmalaleNo ratings yet

- Ayush - Verma - SIP ReportDocument28 pagesAyush - Verma - SIP ReportKanha MishraNo ratings yet

- 25 File of ReportDocument63 pages25 File of ReportArchit JaiswalNo ratings yet

- A Project ON "Analysis of Financial Statement & Global Automotive Conponents Private Limied"Document96 pagesA Project ON "Analysis of Financial Statement & Global Automotive Conponents Private Limied"Mukul MachalNo ratings yet

- Sip ReportDocument57 pagesSip Reportvijay soniNo ratings yet

- Reliance Industriese LimitedDocument57 pagesReliance Industriese Limitedrunusahu209No ratings yet

- Corporate Bridge Consultancy - SIP ReportDocument12 pagesCorporate Bridge Consultancy - SIP Reportharishmittal20No ratings yet

- Rahul Dissertation ReportDocument37 pagesRahul Dissertation ReportGauravChhokarNo ratings yet

- Internship Report: Oil and Gas Development Corporation LimitedDocument26 pagesInternship Report: Oil and Gas Development Corporation LimitedsohaibNo ratings yet

- Report On Capital StructureDocument89 pagesReport On Capital StructureAbhishek Jain0% (1)

- A Study On Balance Sheet Analysis With Reference To Tirumala Cotton and Agro Products PVT LTDDocument93 pagesA Study On Balance Sheet Analysis With Reference To Tirumala Cotton and Agro Products PVT LTDdurga prasadNo ratings yet

- Zeshan FinanceDocument62 pagesZeshan FinanceDibyanshu AmanNo ratings yet

- Report On "Financial Statement Analysis of Samsung": Submitted ToDocument26 pagesReport On "Financial Statement Analysis of Samsung": Submitted Tojahid.coolNo ratings yet

- Project For MbaDocument66 pagesProject For MbasagarNo ratings yet

- A Project Report On Ratio Analysis 2016Document40 pagesA Project Report On Ratio Analysis 2016Catchy Digital AcademyNo ratings yet

- A Study On Ratio Analysis PDFDocument97 pagesA Study On Ratio Analysis PDFDr Linda Mary SimonNo ratings yet

- Abdul Wali M!!Document72 pagesAbdul Wali M!!Faisal AwanNo ratings yet

- Industry Internship Project Cover Pages (Sample)Document15 pagesIndustry Internship Project Cover Pages (Sample)Jatin KumarNo ratings yet

- Fianl ProjectDocument59 pagesFianl ProjectBilal GillaniNo ratings yet

- Butt Ki ReportDocument46 pagesButt Ki ReportToast ToastNo ratings yet

- Amul - Sumit GuptaDocument57 pagesAmul - Sumit Guptadjsumit11No ratings yet

- Report On Valuation of Rangpur Dairy & Food Product LTDDocument31 pagesReport On Valuation of Rangpur Dairy & Food Product LTDFarzana Fariha LimaNo ratings yet

- Financial Statement Analysis of Haldirams Pvt. Ltd.Document53 pagesFinancial Statement Analysis of Haldirams Pvt. Ltd.KRITISH BISWAS100% (1)

- A Project Report On Ratio AnanlysisDocument16 pagesA Project Report On Ratio AnanlysisBinal DesaiNo ratings yet

- BUS526 - Sec 2 - Group 3 - Term PaperDocument13 pagesBUS526 - Sec 2 - Group 3 - Term PaperMd. Asif Iqbal SamiNo ratings yet

- Project Report of Anand Malode 1 (Existing)Document72 pagesProject Report of Anand Malode 1 (Existing)Anand MalodeNo ratings yet

- Summer Internship Report VadilalDocument106 pagesSummer Internship Report VadilalAditya PatelNo ratings yet

- Research Report On Financial Analysis On Ford Motor CoDocument101 pagesResearch Report On Financial Analysis On Ford Motor CoANKIT100% (4)

- Project-Report - Sangam AlmirahDocument59 pagesProject-Report - Sangam Almirahsarfraz alamNo ratings yet

- Working Capital Management - IFFCO - Kalol UnitDocument64 pagesWorking Capital Management - IFFCO - Kalol UnitVijay Kumbhar100% (1)

- The India Cements. LTD.: Project ReportDocument89 pagesThe India Cements. LTD.: Project Reportsyed shaibazNo ratings yet

- Ratio Analysis at Indian Rayon by Rafik Kaat1Document76 pagesRatio Analysis at Indian Rayon by Rafik Kaat1rashmidatta10No ratings yet

- GST Project - Report - MbaDocument95 pagesGST Project - Report - Mbaanjali sikhaNo ratings yet

- Re Vend FinalDocument39 pagesRe Vend FinalTayyab ZahidNo ratings yet

- Internship Report On Audit FirmDocument96 pagesInternship Report On Audit FirmMuhammad SufyanNo ratings yet

- Final FinanceDocument95 pagesFinal FinanceSagar ChauhanNo ratings yet

- C2 - Amg - Skin Cream-4Document80 pagesC2 - Amg - Skin Cream-4TangulNo ratings yet

- Capital BudgeingDocument83 pagesCapital BudgeingNitin PatelNo ratings yet

- Asian Granito Ind LTD, Dalpur (Brijesh)Document73 pagesAsian Granito Ind LTD, Dalpur (Brijesh)Bj fact FactoryNo ratings yet

- Opportunity Analysis For Mergers and Acquisitions in East IndiaDocument31 pagesOpportunity Analysis For Mergers and Acquisitions in East IndiaSloke PoddarNo ratings yet

- Working Capital Management & Comparative Financial Analysis of Indian Oil With Its Major CompetitorsDocument97 pagesWorking Capital Management & Comparative Financial Analysis of Indian Oil With Its Major Competitorsamitstud200185% (20)

- Investment AnalysisDocument57 pagesInvestment AnalysisFarzana Fariha LimaNo ratings yet

- Abdul Aahad BSF1703230Document47 pagesAbdul Aahad BSF1703230Faran Ali /Lecturer / DMASNo ratings yet

- A Summer Project ReportDocument57 pagesA Summer Project Reportanshu276No ratings yet

- 1827 ArticleText 2485 3 10 20221116Document11 pages1827 ArticleText 2485 3 10 20221116bbNo ratings yet

- OIL Project FinalDocument78 pagesOIL Project FinalParshant GuptaNo ratings yet

- Project Report Sem III (Gaurav.N.Kasat)Document66 pagesProject Report Sem III (Gaurav.N.Kasat)gaminghub069ytNo ratings yet

- CPD Report SL AlDocument47 pagesCPD Report SL AlshanuxNo ratings yet

- Final FileDocument69 pagesFinal FileGulshan kumarNo ratings yet

- Project Report....... Narender DagarDocument75 pagesProject Report....... Narender DagarNaren Rajpal DagarNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Ergun 20 Feb 24Document10 pagesErgun 20 Feb 24GuilhermeNo ratings yet

- Accountancy ProfessionDocument5 pagesAccountancy Professionpanda 1No ratings yet

- Passive Income and Capital GainsDocument4 pagesPassive Income and Capital GainsTRISHAANN RUTAQUIONo ratings yet

- Building CompletionDocument1 pageBuilding CompletionOBO pagadianNo ratings yet

- MLQHS - Certification - List of EstablishmentsDocument2 pagesMLQHS - Certification - List of EstablishmentsBplo CaloocanNo ratings yet

- Appendix 37 - Instructions - CBRegDocument1 pageAppendix 37 - Instructions - CBRegabbey89No ratings yet

- Godrej Parkland Estate - First LookDocument21 pagesGodrej Parkland Estate - First LookMayank PalNo ratings yet

- BIR Form No. 2339 - June 2017 ENCSDocument1 pageBIR Form No. 2339 - June 2017 ENCSlegal.intern.maticlawofficeNo ratings yet

- Rationale of Patent ProtectionDocument12 pagesRationale of Patent Protectiondivedeep49No ratings yet

- TOR Supervision Services For Roads Reconstruction PDFDocument17 pagesTOR Supervision Services For Roads Reconstruction PDFSami AjNo ratings yet

- Chapter 4 - MARKETING For MICE ServicesDocument23 pagesChapter 4 - MARKETING For MICE ServicesThe Nguyen Long NhatNo ratings yet

- E-Commerce Website DesignDocument33 pagesE-Commerce Website Designআশরাফুল অ্যাস্ট্রো100% (1)

- HP Culture OrigDocument20 pagesHP Culture Origpeacock yadavNo ratings yet

- Chapter 9 - Dealing With The Competition Multiple Choice QuestionsDocument19 pagesChapter 9 - Dealing With The Competition Multiple Choice QuestionsMutya Neri CruzNo ratings yet

- Chapter 4Document17 pagesChapter 4aurorashiva1No ratings yet

- Bottom and Shell Bom - Up12Document27 pagesBottom and Shell Bom - Up12Karthimeena MeenaNo ratings yet

- Tenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesDocument2 pagesTenders: Tender No. Description Last Date of Buying Date of Submission Tender Price R. O THE NotesAli MustafaNo ratings yet

- Fomblin PFPE Lubes For Vaccum Applications en 220533Document8 pagesFomblin PFPE Lubes For Vaccum Applications en 220533rakaNo ratings yet

- Financial Times Asia June 8 2019 PDFDocument60 pagesFinancial Times Asia June 8 2019 PDFHai AnhNo ratings yet

- Guide On Sales Tax Exemption Under Item Schedule ADocument45 pagesGuide On Sales Tax Exemption Under Item Schedule AJodie LeeNo ratings yet

- Carbon Footprint of Extra Virgin Olive Oil PDFDocument15 pagesCarbon Footprint of Extra Virgin Olive Oil PDFEstefania Ortiz AriasNo ratings yet

- Mid Term ASSIGNMENT ON Strategic MGMTDocument19 pagesMid Term ASSIGNMENT ON Strategic MGMTAsghar Ali100% (1)

- Benefit Structure AnalysisDocument11 pagesBenefit Structure AnalysisSandeep RainaNo ratings yet

- Infrastructure Development Systems IDS-OO-T-O 16: Chapter 1 Bridging The Golden Gate: Outsourcing To A New Public EntityDocument14 pagesInfrastructure Development Systems IDS-OO-T-O 16: Chapter 1 Bridging The Golden Gate: Outsourcing To A New Public EntityÁlvaro GarayNo ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- Partnership Accounting Intended Learning OutcomesDocument15 pagesPartnership Accounting Intended Learning OutcomesMon RamNo ratings yet

- Full Download Test Bank For Technical Communication Twelfth Edition PDF Full ChapterDocument27 pagesFull Download Test Bank For Technical Communication Twelfth Edition PDF Full Chaptergowdie.mornward.b50a100% (26)

- Assessment Item 1 v4.0Document2 pagesAssessment Item 1 v4.0Hardik PanchalNo ratings yet