Professional Documents

Culture Documents

FRA Notes

FRA Notes

Uploaded by

Amit Ray0 ratings0% found this document useful (0 votes)

6 views3 pagesThe document discusses the increasing role of whistleblowing and goals of ethics education.

It describes different types of whistleblowers, such as internal, external, and alumni whistleblowers. The Whistleblowers Protection Act of 2011 in India defines whistleblowing and provides protection for whistleblowers.

Goals of ethics education include enhancing knowledge of ethical standards, developing ethical sensitivity and recognition of issues, and improving ethical decision-making skills and commitment to ethical behavior. Ethics education aims to provide skills to identify and resolve ethical issues through learning frameworks that emphasize ethical values.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the increasing role of whistleblowing and goals of ethics education.

It describes different types of whistleblowers, such as internal, external, and alumni whistleblowers. The Whistleblowers Protection Act of 2011 in India defines whistleblowing and provides protection for whistleblowers.

Goals of ethics education include enhancing knowledge of ethical standards, developing ethical sensitivity and recognition of issues, and improving ethical decision-making skills and commitment to ethical behavior. Ethics education aims to provide skills to identify and resolve ethical issues through learning frameworks that emphasize ethical values.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views3 pagesFRA Notes

FRA Notes

Uploaded by

Amit RayThe document discusses the increasing role of whistleblowing and goals of ethics education.

It describes different types of whistleblowers, such as internal, external, and alumni whistleblowers. The Whistleblowers Protection Act of 2011 in India defines whistleblowing and provides protection for whistleblowers.

Goals of ethics education include enhancing knowledge of ethical standards, developing ethical sensitivity and recognition of issues, and improving ethical decision-making skills and commitment to ethical behavior. Ethics education aims to provide skills to identify and resolve ethical issues through learning frameworks that emphasize ethical values.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Dusy

13. THE INCREASING ROLE OF

WHISTLE-BLOWING

8.1 INTRODUCTION

)Meaning : The term whistleblower is derived from the practice of

uldblow their whistles when they noticed the English Policemen, who

commission

hoth law enforcemernt oficers and the general public of

ofa crime. The whistle would alert

danger. Whistle

Suspicions of illegalor improper behaviour to aperson in authority. blowing' means reporting

Types of Whistle Blowers : There are different types of whistle blowers

which are described as

following :

ia) Internal : When whistle blower, while being employed with the

organisation, reports the

WTong conduct or activities of an official or a colluded effort by a group of people in

organisation.

(b)External :When the issues pertaining to the wrong practises or wilful misdeeds are reported

by people who are outside the system - these people can be individuals or in the form of

organisations such as media, public interest groups or any other such agency. Such whistle

blowers are known as external whistle blowers.

(c)Alumni : When the whistleblowing is done by á person who is no more employed by the

organisation but he is acting on the willful wrongdoings he has witnessed during his

employment with the organisation. Such ex-employees can unearth such deliberate

mismanagements with the relevant authorities.

13.2 WHISTLE BLOWING UNDER WHISTLE-BLOWERS PROTECTION ACT, 2011

) Law: In India the Whistle-blowers Protection Act, 2011 was passed by Lok Sabha in 2011,

Rajya Sabha in 2014 and finally enacted after President's assent in 2014.

) Definition: Under the Act, Whistle Blowing' is defined as -An act to establish a mechanism to

receive complaints relating to disclosure on any allegations of corruption or wilful misuse of

power or wilful misuse of discretion against any public servant and to inquire or cause an inquiry

Into such disclosure and to provide adequate safeguards against victimisation of the person making

SilChcomplaint and for matters connected therewith and incidental thereto,"

)Frotection: The Act seeks to protect whistle blowers, i.e. persons making a public interest

servant.

dISclosure related to an act of corruption, misuse ofpower,or criminaloffence by apublic

organization

bsclosure: Any public servant or any other person including a non-governmental

Commission.

ihay make such a disclosure to the Central or State.Vigilance

complaint has to include the identity of the complainant. The Vigilance

entity : Every

except to the head ofthe department

Omission shall not disclose the identity of thecomplainant

(c) Part of risk management to protectthe organisation's long-term wellbeing and reputation.

Who ?

Who can be a whistleblower?

e are dìfferent types of persons who can be whistleblowers and therefore covered by the policy.

se persons can be broadly classified as internal (employees, contract workers, vendors, etc.) or

enal (customers,members of the public etc.). The policy should clarify if it is strictly meant as an

nalpolicy or whether the policy also covers "outsiders" or third parties.

Who to make the disclosure to?

ohistleblower policy may cover internal and/or external persons to whom disclosure may be

de. Internal persons may include the following

Line manager

CEO/CFO

Head of HR

Head of internal audit

Company secretary or legal counsel

Designated ethics officer

Board audit committee or chairman of audit committee

ternal personsmay include the following:

Company-appointed whistleblower service provider e.g. ethics hotline

Company-appointed external lawyer

Independent, external organisation providing free advice on whistleblowing

Regulatory bodies or equivalent, including the police

Media

FWho is responsible for following up and investigating when a disclosure has been made?

The policy should state that an investigation will ensue after a report has been made. The policy

should provide information of any other persons who will be informed of the disclosure (e.g.

board of directors, HR, etc.) inorder to follow up. The board of directors shouldbe involved in

deciding who should be tasked to lead the investigation.

Ihe policy should undertake to keep the whistleblower informed of the progress and, subject to

egal constraints, the outcome of the investigation. It should also include the caveat that blowing

the whistie does not lessen the guilt or criminal liability of awhistleblower who is involved in

WTOngdoing,although this may be taken into account.

lhere should be a proper process for undertaking investigations of complaints.

Who will provide or ensure protection of the whistleblower?

ensure the welfare of the

POBhcy may specify the appointment of a company representative toinvestigation. It may also

eblower and who will also update the latter on the status of the

ywho a whistleblower can approach if he feels that he has suffered a detriment.

What ?

What are the types of breaches that can be reported?

concerns that could have a large

Poicy should emphasise that it is intended to cover serious normal feedback and grievance

from the

a mpact on the organisation, so that it is differentiatedby the policy could include aetions that:

Savalable to employees. Serious concerns covered

392 indicates that accounting ethics educatios

also

Training: The evidence programs. With limited ethics cOverage in the

Adequate Ethics bave

(4)Need significant way inmost learning accounting professionals will

is not covered in a uniikely that trainer

learning programs, it is corporate

role of member bodies, ethics traininp

business and accounting ethics. Therefore, it is the

sutticient relevant training inensure professional accountants receive adequate

and education providers to

ETHICS EDUCATION

14.2 GOALS OF be identifed

structure in which ethical threats or issues mayethical is sues

Ethicseducation provides a learning and competence to resolve

analysed, so that accountants possess the skills

well-informed decision and take appropriate

and able to make a

Ultimately, accountants must be ethics education include:

responsible actions. Specific goals of expectations of ethical and professional conduct

standards and

Enhance the knowledge of relevant with ethical sensitivity and an

appreciation of

professional responsibility

Develop a sense of

ethical threats.

sharpened ethical decision-making skills.

Improve professional judgement with

Develop a commitment to ethical behaviour.

Let us study these in detail. professional

must understand the relevant ethical and

(1) Knowledge : Professional accountantsknowledge

standards of accounting.Without core of ethical and professional principles, ethical

outcomes are unlikely.

threat or issue when it occurs

(2) Sensitivity : Ethical sensitivity is the ability to recognise an ethical

ethical solution and how each

and being aware of alternative courses of action leading to an

alternative course of action affects the parties concerned. Enhancing ethical sensitivity through

ethics education willenable accountants to more readily identify dificult situations, which they

must then resolve. The ability to make ethical judgements and behave ethically, presupposes the

accountant's ability to recognise an ethical issue when it arises. If professional accountants are

ethically sensitive to the issues they face,then the decision-maker is more likely to use ethical

principles in resolving the dilemma.

(3) Judgement : Professionalaccountants must expand their decision-making frameworks to include

an increased emphasis on ethical values as differentiated from quantitative values. Core ethical

values are an important part of ethicaldecision making. Choosing the rightvalues requires ethics

knowledge, an understanding of the consequences, and ethicalsensitivity. Such knowiedge and

sensitivity can be taught and developed in ethics education programs.

(4)Ethical behaviour :Accounting professionals must not only be adept with the technical aspects

of their responsibilities but they must also be able to deal with situations where

the facts are

ambiguous or stakeholders' interests conflict. Therefore, accountants must not only

ethical issues but they must also be committed to take the action which is recognist

ethically

training provides accountants with the confidence to deal with an ethical conflict. sound. Ethics

on ethical decision-making and behaviour, Without training

their environment. accountants may easily succumb to the demands O

14.3 STAGES INETHICS EDUCATION

Ethics education is a lifelong

and continues throughout one's commitment which begins in the early stages of a

career. The stages in Ethics Education are pre-qualifyng prog

(1)Stage 1- Ethics knowledge :

Ethics education at this foundation stage described as:

fundamental knowledge on matters concerning instils in accounta

education at this stage focuses professional

on the intellectual values, ethics and attitudes. E

accountant or accounting learner understand the basic background which necessary to ensu

is

and the fundamental environment which influences decist

which govern one'stheories and principles of ethics, virtues,

actions. Ethics knowledge provides the and individual moral

intelligence for the learner. social, ethical and developal

emotional

You might also like

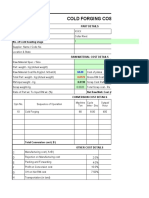

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- Biryani Research PaperDocument11 pagesBiryani Research PaperRaamji Mp100% (1)

- JCB Case StudyDocument9 pagesJCB Case StudyPanma PatelNo ratings yet

- Unit-3 Human Resource Planning ProcessDocument5 pagesUnit-3 Human Resource Planning ProcessSujan Chaudhary100% (1)

- Word FilesDocument5 pagesWord Filesrabia khanNo ratings yet

- Topic 4Document37 pagesTopic 4glenettearizala18No ratings yet

- A Study On Whistle Blowing - InfosysDocument61 pagesA Study On Whistle Blowing - InfosysRajesh BathulaNo ratings yet

- EthicsDocument18 pagesEthicsPrahlad RaiNo ratings yet

- Andika Daffa Elianto - 12010119190124 - UAS Business Ethics - IUPDocument5 pagesAndika Daffa Elianto - 12010119190124 - UAS Business Ethics - IUPAndika Daffa EliantoNo ratings yet

- Whistleblower PolicyDocument7 pagesWhistleblower PolicyAbhijeetNo ratings yet

- Meeting 6Document6 pagesMeeting 6p aloaNo ratings yet

- Professional Ethics: Elaine Capili Christine TeodoroDocument65 pagesProfessional Ethics: Elaine Capili Christine TeodoroJoyce Anne GarduqueNo ratings yet

- Q.3 Ethics AssignmentDocument3 pagesQ.3 Ethics AssignmentShashank VarmaNo ratings yet

- Whisle Blowing 1Document10 pagesWhisle Blowing 1Arun Gireesh100% (1)

- BA4 Notes CimaDocument25 pagesBA4 Notes CimakateNo ratings yet

- Business Ethics (Unit 4)Document8 pagesBusiness Ethics (Unit 4)prabhav1822001No ratings yet

- The Ethico-Legal Framework - CullingsDocument19 pagesThe Ethico-Legal Framework - CullingsAkash PanigrahiNo ratings yet

- SSRN Id2258296 PDFDocument10 pagesSSRN Id2258296 PDFVed VyasNo ratings yet

- SSRN Id2258296 PDFDocument10 pagesSSRN Id2258296 PDFVed VyasNo ratings yet

- A Project On Whistle Blowing (Business Ethics)Document14 pagesA Project On Whistle Blowing (Business Ethics)Kiran moreNo ratings yet

- OHS135 - Module 3 - Ethics For OHS ProfessionalsDocument16 pagesOHS135 - Module 3 - Ethics For OHS ProfessionalsdknausNo ratings yet

- Part 6-1 PDFDocument22 pagesPart 6-1 PDFanvesh MININGNo ratings yet

- Chapter 4 Professional EthicsDocument45 pagesChapter 4 Professional EthicsitsmefxezNo ratings yet

- Toshiba SaudDocument3 pagesToshiba SaudFaiq HashmiNo ratings yet

- Unit 123Document22 pagesUnit 123Khushal GargNo ratings yet

- C10 GovernanceDocument7 pagesC10 GovernanceBernice CheongNo ratings yet

- Group#5 Corruption and Ethics in Global BusinessDocument37 pagesGroup#5 Corruption and Ethics in Global BusinessTricia Angel P. BantigueNo ratings yet

- Whistel Blower PolicyDocument16 pagesWhistel Blower PolicyPoonam SonvaniNo ratings yet

- Assessing and Managing The Risk of ReprisalDocument9 pagesAssessing and Managing The Risk of ReprisalDavid Paul HensonNo ratings yet

- Whistle-Blowing Booklet 2023 IndoDocument32 pagesWhistle-Blowing Booklet 2023 IndoBetta LoverNo ratings yet

- Acc 2214 - Whistle BlowingDocument5 pagesAcc 2214 - Whistle BlowingSunday OcheNo ratings yet

- Ethics Exam SuggasationDocument10 pagesEthics Exam SuggasationFuck YouNo ratings yet

- White Collar SessionalDocument20 pagesWhite Collar SessionalBinit PandeyNo ratings yet

- Wenjun Herminado QuizzzzzDocument3 pagesWenjun Herminado QuizzzzzWenjunNo ratings yet

- Auditing I CH 2Document36 pagesAuditing I CH 2Hussien AdemNo ratings yet

- Building A Culture of CandourDocument44 pagesBuilding A Culture of CandourharliestudieNo ratings yet

- Why Should A Business Be Ethically Sensitive?: The Social Function of BusinessDocument3 pagesWhy Should A Business Be Ethically Sensitive?: The Social Function of BusinessKassandra VenzueloNo ratings yet

- Key Concepts in AccountingDocument9 pagesKey Concepts in AccountingSunday OcheNo ratings yet

- Business Ethics ModuleDocument7 pagesBusiness Ethics ModuleRica Canaba100% (2)

- ترجمة قانونيةDocument40 pagesترجمة قانونيةAhmedNo ratings yet

- Final-Notes BEDocument9 pagesFinal-Notes BEBùi Diễm QuỳnhNo ratings yet

- BE Module 5Document5 pagesBE Module 5Thanmayi VanteruNo ratings yet

- Ethics Chapter 1: The Responsibility of EngineersDocument24 pagesEthics Chapter 1: The Responsibility of EngineersNguyễn QuỳnhNo ratings yet

- Whistle BlowingDocument7 pagesWhistle Blowingsruthi karthiNo ratings yet

- Whistleblowing Policy - V1.4Document5 pagesWhistleblowing Policy - V1.4Zinko ThuNo ratings yet

- Chap 4 Whistle BlowingDocument7 pagesChap 4 Whistle BlowingMyaNo ratings yet

- Topic 2Document7 pagesTopic 2Casio ManikNo ratings yet

- Sample in House Whistle Blowing Training Programme For Cipd Members 2014Document2 pagesSample in House Whistle Blowing Training Programme For Cipd Members 2014Monkey D. LuffyNo ratings yet

- Audit-Professional EthicsDocument5 pagesAudit-Professional EthicsRhn Habib RehmanNo ratings yet

- Whistle BlowingDocument6 pagesWhistle BlowingVinay Ramane50% (4)

- Whistle BlowingDocument24 pagesWhistle BlowingTati Mansur100% (4)

- Whistle Blowing NotesDocument6 pagesWhistle Blowing NotesRathin BanerjeeNo ratings yet

- BMU 08104: Business Ethics: For BMU 08104-III Semester IDocument169 pagesBMU 08104: Business Ethics: For BMU 08104-III Semester Ially jumanneNo ratings yet

- Ethics Unit 3Document14 pagesEthics Unit 3Tarun KumarNo ratings yet

- Policy On Preventing and Addressing RetaliationDocument13 pagesPolicy On Preventing and Addressing RetaliationOmar FilaliNo ratings yet

- Practice Advisory 1210 (1) .A2-2 Rev 4 27 2006Document5 pagesPractice Advisory 1210 (1) .A2-2 Rev 4 27 2006linghongcNo ratings yet

- Chapter 2 NotesDocument7 pagesChapter 2 NotesKrisha Therese PajarilloNo ratings yet

- Code of Conduct and Whistle BlowerDocument17 pagesCode of Conduct and Whistle BlowerSandeep KaurNo ratings yet

- Sartorius Anti-Corruption CodeDocument12 pagesSartorius Anti-Corruption CodeRanjith LMNo ratings yet

- Corporate Law CIA-3Document2 pagesCorporate Law CIA-3Dhruvraj SolankiNo ratings yet

- Les Chapter 03 Part 4 Session 2Document26 pagesLes Chapter 03 Part 4 Session 2Henok AsemahugnNo ratings yet

- Exam 3 NotesDocument20 pagesExam 3 NotesVince Cinco ParconNo ratings yet

- Whistle Blowing Part of CH 13Document9 pagesWhistle Blowing Part of CH 1342MD ASIFUR RAHMAN ASIFNo ratings yet

- The Whistleblowing Program Handbook: A practical guide to running a whistleblowing program in AustraliaFrom EverandThe Whistleblowing Program Handbook: A practical guide to running a whistleblowing program in AustraliaNo ratings yet

- ACC 182 Accounting For Government ExpenditureDocument40 pagesACC 182 Accounting For Government ExpenditureniggerNo ratings yet

- Purdue University Contract With Ibram KendiDocument8 pagesPurdue University Contract With Ibram KendiThe College FixNo ratings yet

- Balance ConfirmationDocument11 pagesBalance Confirmationeastern arteqaNo ratings yet

- Course: Marketing Research: Faculty of International Economic Relations Semester 1, 2021 - 2022Document2 pagesCourse: Marketing Research: Faculty of International Economic Relations Semester 1, 2021 - 2022Thảo NguyễnNo ratings yet

- Masterglenium Ace: Solutions For The Pre-Cast IndustryDocument7 pagesMasterglenium Ace: Solutions For The Pre-Cast IndustryAlanNo ratings yet

- Golden Star Resources Reports ResultsDocument20 pagesGolden Star Resources Reports ResultsFuaad DodooNo ratings yet

- Test Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadDocument56 pagesTest Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadTeresaMoorecsrby100% (45)

- 11 QueuingDocument39 pages11 QueuingArihant patilNo ratings yet

- Group-4 STM28 Scientific-PosterDocument1 pageGroup-4 STM28 Scientific-Postercesxzhoran hahaNo ratings yet

- HO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following DataDocument4 pagesHO-Venn Diagram: Directions For Questions 1 and 5: Answer The Questions On The Basis of The Following Dataankit singhNo ratings yet

- Project CharterDocument9 pagesProject CharterKomal SoomroNo ratings yet

- KEPCO - Consolidated - FY 2018 - FinalDocument175 pagesKEPCO - Consolidated - FY 2018 - FinalJenna GanNo ratings yet

- MGT 162 Group Assignments 25Document20 pagesMGT 162 Group Assignments 25MUHAMMAD FAUZAN ABU BAKARNo ratings yet

- Posco Inv.Document6 pagesPosco Inv.dhawalhemantNo ratings yet

- Odoo v15Document5 pagesOdoo v15t.nominerdene99No ratings yet

- When in Doubt Blame The Accountants Said Mathew Ingram inDocument2 pagesWhen in Doubt Blame The Accountants Said Mathew Ingram inLet's Talk With HassanNo ratings yet

- My IdolDocument1 pageMy IdolSyed FarisNo ratings yet

- Coa M2020-026Document18 pagesCoa M2020-026Justine CastilloNo ratings yet

- MayaSavings SoA 2023OCTDocument17 pagesMayaSavings SoA 2023OCTfitdaddyphNo ratings yet

- Dragoneante of The Inpec: Jhon Jairo Ortiz RodrguezDocument3 pagesDragoneante of The Inpec: Jhon Jairo Ortiz RodrguezJOHN JAIRO ORTIZ RODRIGUEZNo ratings yet

- Project Report FormatDocument8 pagesProject Report FormatBhartiNo ratings yet

- Group B Code of Ethics Caselet 245Document2 pagesGroup B Code of Ethics Caselet 245BSA3Tagum MariletNo ratings yet

- Module 3 Exam - Attempt Review Netacad ITE 6301Document6 pagesModule 3 Exam - Attempt Review Netacad ITE 6301Allen JoshuaNo ratings yet

- Fmda GST RCDocument3 pagesFmda GST RCDipankar BarmanNo ratings yet

- Younity's 3 Year Young Anniv Flash Sale PDFDocument1 pageYounity's 3 Year Young Anniv Flash Sale PDFIvy NinjaNo ratings yet