Professional Documents

Culture Documents

Washingtonpost - Newsweek Interactive, LLC

Washingtonpost - Newsweek Interactive, LLC

Uploaded by

pocut.rayshaCopyright:

Available Formats

You might also like

- DOA - Aquantus Vicero Deutsche DBS (40+2+2) - Draft v4 (7541)Document20 pagesDOA - Aquantus Vicero Deutsche DBS (40+2+2) - Draft v4 (7541)MH Hashim100% (6)

- GROUP 6 SWOT Analysis of SHOPEE CompanyDocument4 pagesGROUP 6 SWOT Analysis of SHOPEE CompanyTry Zega100% (1)

- Broad Shifts in MarketingDocument3 pagesBroad Shifts in MarketingNIHAR RANJAN MishraNo ratings yet

- Developing Countries and The Global Financial System: C H A P T e RDocument17 pagesDeveloping Countries and The Global Financial System: C H A P T e RAsniNo ratings yet

- Presented By: Investment and Portfolio AnalysisDocument22 pagesPresented By: Investment and Portfolio Analysis8537814No ratings yet

- Economic Risk of GlobalizationDocument4 pagesEconomic Risk of Globalizationfarhad5685390535No ratings yet

- Exchange Rate and Capital Account Management For Developing CountriesDocument10 pagesExchange Rate and Capital Account Management For Developing CountriesJace BezzitNo ratings yet

- Financial Markets PDFDocument44 pagesFinancial Markets PDFNitin SakpalNo ratings yet

- Emerging Markets - Risk, Reward and Covid - Financial TimesDocument10 pagesEmerging Markets - Risk, Reward and Covid - Financial TimesAditi PuthranNo ratings yet

- The Case Against Capital Controls: Financial Flows, Crises, and The Flip Side of The Free-Trade Argument, Cato Policy Analysis No. 403Document20 pagesThe Case Against Capital Controls: Financial Flows, Crises, and The Flip Side of The Free-Trade Argument, Cato Policy Analysis No. 403Cato Institute100% (1)

- If - Mba 4Document72 pagesIf - Mba 4mansisharma8301No ratings yet

- Palgrave Macmillan Journals International Monetary FundDocument45 pagesPalgrave Macmillan Journals International Monetary FundRamiro Gimenez GarciaNo ratings yet

- Libéralisation Du Compte CapitalDocument4 pagesLibéralisation Du Compte Capitalelyka.paintingNo ratings yet

- Financial MarketsDocument44 pagesFinancial MarketsOxfamNo ratings yet

- Indian Accountancy ProfessionDocument8 pagesIndian Accountancy ProfessionIshan GroverNo ratings yet

- Cheep CapitalDocument3 pagesCheep CapitalshiprathereNo ratings yet

- New International Economic OrderDocument20 pagesNew International Economic Orderrazz_22100% (1)

- Strategic Factors Affecting Foreign Direct Investment DecisionsDocument2 pagesStrategic Factors Affecting Foreign Direct Investment DecisionsSharma GokhoolNo ratings yet

- Impact of GlobalizationDocument66 pagesImpact of GlobalizationPriyanka SoniNo ratings yet

- Discussion Papers in EconomicsDocument39 pagesDiscussion Papers in EconomicsBryson MannNo ratings yet

- Many Shades of GreenbackDocument1 pageMany Shades of GreenbacknaikNo ratings yet

- Resume Ekonomi Moneter 2Document3 pagesResume Ekonomi Moneter 2nurjannah_hadaitaNo ratings yet

- Globalization: How It Affects International TradeDocument5 pagesGlobalization: How It Affects International TradeDuke SucgangNo ratings yet

- Toc Aff v.1Document13 pagesToc Aff v.1Sully MrkvaNo ratings yet

- APRIL 2019 International Finance Question PaperDocument9 pagesAPRIL 2019 International Finance Question PaperApruva BelapurkarNo ratings yet

- Elucidate The Importance of International Finanace in This Era of GlobalisationDocument15 pagesElucidate The Importance of International Finanace in This Era of GlobalisationAnsariMohammedShoaibNo ratings yet

- Kapur IMFCureCurse 1998Document17 pagesKapur IMFCureCurse 1998salmazeus87No ratings yet

- Lessons From The South African ExperienceDocument15 pagesLessons From The South African ExperienceEmir TermeNo ratings yet

- Globalization of Financial MarketsDocument6 pagesGlobalization of Financial MarketsAlinaasirNo ratings yet

- Índices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Document13 pagesÍndices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Marc SaundersNo ratings yet

- Quick DollarDocument40 pagesQuick DollarANKIT_XXNo ratings yet

- Presspb20102 enDocument2 pagesPresspb20102 enZerohedgeNo ratings yet

- Lecture General Overview of IfDocument18 pagesLecture General Overview of IfMinney EddyNo ratings yet

- Financial Dependence and GrowthDocument3 pagesFinancial Dependence and GrowthutsavNo ratings yet

- Factiva 20190909 2242Document2 pagesFactiva 20190909 2242Jiajun YangNo ratings yet

- Global Financial SystemDocument16 pagesGlobal Financial SystemahmadmudasirNo ratings yet

- Decoupling A Fresh PerspectiveDocument3 pagesDecoupling A Fresh PerspectiveSovid GuptaNo ratings yet

- The Effect of Capital Flight On Nigerian EconomyDocument127 pagesThe Effect of Capital Flight On Nigerian EconomyAdewole Aliu OlusolaNo ratings yet

- Currency WarsDocument10 pagesCurrency WarsEscobar AlbertoNo ratings yet

- Every Central Bank For ItselfDocument17 pagesEvery Central Bank For Itselfrichardck61No ratings yet

- Gabriel Palma - Why Corporations in Developing Countries Are Likely To BeDocument24 pagesGabriel Palma - Why Corporations in Developing Countries Are Likely To BeMario Matus GonzálezNo ratings yet

- Introduction To Global Finance With Electronic 1 BankingDocument4 pagesIntroduction To Global Finance With Electronic 1 Bankingcharlenealvarez59No ratings yet

- Financial Management in A Global PerspectiveDocument6 pagesFinancial Management in A Global PerspectiveRaj AnwarNo ratings yet

- What Are The Recent Developments in Global Financial MarketsDocument6 pagesWhat Are The Recent Developments in Global Financial MarketsHari KrishnanNo ratings yet

- 305-Int Fin-NotesDocument6 pages305-Int Fin-NotesRutik PatilNo ratings yet

- Importance of International FinanceDocument4 pagesImportance of International FinanceNandini Jagan29% (7)

- Izbor Tekstova Iz The Economist 15 OktobarDocument11 pagesIzbor Tekstova Iz The Economist 15 OktobarNiksa KosuticNo ratings yet

- 9781557756350Document18 pages9781557756350Robert RoblesNo ratings yet

- 2839 Financial Globalization Chapter May30Document45 pages2839 Financial Globalization Chapter May30indiaholicNo ratings yet

- SPCFLCF36B29BDocument5 pagesSPCFLCF36B29BRao TvaraNo ratings yet

- The Financial Crisis and The Developing WorldDocument4 pagesThe Financial Crisis and The Developing WorldmustafeezNo ratings yet

- LKJH4A33C7AFFDocument12 pagesLKJH4A33C7AFFRao TvaraNo ratings yet

- Mod2 Global EconomyDocument36 pagesMod2 Global Economyclaire yowsNo ratings yet

- Ifm Assignment: - Babitha P Mba-B (121823602050)Document4 pagesIfm Assignment: - Babitha P Mba-B (121823602050)Hanuman PotluriNo ratings yet

- What Is GlobalizationDocument22 pagesWhat Is GlobalizationPrashant SharmaNo ratings yet

- 2021-7 Cleary Progress and ImprovementDocument26 pages2021-7 Cleary Progress and ImprovementSean ClearyNo ratings yet

- Globalization in Financial EnvironmentDocument3 pagesGlobalization in Financial EnvironmentabdakbarNo ratings yet

- Structural Adjustment - A Major Cause of PovertyDocument10 pagesStructural Adjustment - A Major Cause of PovertyBert M DronaNo ratings yet

- Multinational Finance Solutions Chapter 1Document3 pagesMultinational Finance Solutions Chapter 1fifi_yaoNo ratings yet

- Global Marketing: By: Aastha Uppal Aishani Vij Apoorwa Middha Avantika Gupta Deviyani Bhasin Nitiz Kaila Sneha KumarDocument73 pagesGlobal Marketing: By: Aastha Uppal Aishani Vij Apoorwa Middha Avantika Gupta Deviyani Bhasin Nitiz Kaila Sneha KumarDeepika AjayanNo ratings yet

- The Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichFrom EverandThe Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichNo ratings yet

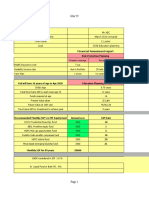

- Invested Capital Profit Annual NET RORDocument7 pagesInvested Capital Profit Annual NET RORAnjo VasquezNo ratings yet

- DLP ElementsofstoryDocument33 pagesDLP ElementsofstoryKathlen Aiyanna Salvan BuhatNo ratings yet

- DescrepaniesDocument21 pagesDescrepaniesHoward boiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shashikant ChaturvediNo ratings yet

- W91Document4 pagesW91Patrick LongNo ratings yet

- Saudi Arabia Real Estate Market ReviewDocument4 pagesSaudi Arabia Real Estate Market ReviewDIVENIRENo ratings yet

- Economics of Social Issues 21E 21St Edition Charles A Register Full ChapterDocument51 pagesEconomics of Social Issues 21E 21St Edition Charles A Register Full Chapterjoseph.velazquez944100% (7)

- LG 2Document1 pageLG 2darrenNo ratings yet

- 1-Price Ceiling Examples Effectiveness (Short Run vs. Long Run) 2 - Price Floor Examples Effectiveness 3 - Price Setting ExamplesDocument6 pages1-Price Ceiling Examples Effectiveness (Short Run vs. Long Run) 2 - Price Floor Examples Effectiveness 3 - Price Setting ExamplesFioighlg BuhewofNo ratings yet

- ABCDE Consulting Inc.: Articles of Incorporation ofDocument5 pagesABCDE Consulting Inc.: Articles of Incorporation ofAl Cheeno AnonuevoNo ratings yet

- Vitting - Format.Document12 pagesVitting - Format.rbn_7225No ratings yet

- Directors Loan and Tax ImplicationsDocument2 pagesDirectors Loan and Tax ImplicationsMary SmithNo ratings yet

- Topic 1 Introduction To Quality: Learning ObjectivesDocument6 pagesTopic 1 Introduction To Quality: Learning ObjectivesSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- Dummy PortfolioDocument4 pagesDummy PortfolioManik KainthNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationKyla DizonNo ratings yet

- UntitledDocument420 pagesUntitledCristian MarinNo ratings yet

- Entrep DLP 6Document2 pagesEntrep DLP 6Jemel GepigaNo ratings yet

- UntitledDocument2 pagesUntitledRuss FajardoNo ratings yet

- BHN, HV, HRB and HRC Hardness Conversion Chart - Upmold LimitedDocument6 pagesBHN, HV, HRB and HRC Hardness Conversion Chart - Upmold Limitednikunjsingh04No ratings yet

- Micro4 - Price Floor and Ceilings - 2021Document35 pagesMicro4 - Price Floor and Ceilings - 2021Divya Deepika BobbiliNo ratings yet

- APT Satellite (1045 HK) Time To Revisit PDFDocument7 pagesAPT Satellite (1045 HK) Time To Revisit PDFJocelynNo ratings yet

- Bill of Sale (Motorcycle)Document2 pagesBill of Sale (Motorcycle)bradley omariNo ratings yet

- Iata Passenger Glossary of TermsDocument199 pagesIata Passenger Glossary of Termschan dannyNo ratings yet

- 8 Taxation of NRDocument8 pages8 Taxation of NRchandrakantchainani606No ratings yet

- 7-Year Asset Class Real Return Forecasts : As of January 31, 2021Document1 page7-Year Asset Class Real Return Forecasts : As of January 31, 2021Ericko Marvin KweknotoNo ratings yet

- 2.07 Social Problems and Solutions ChartDocument4 pages2.07 Social Problems and Solutions ChartAubrey HovanNo ratings yet

Washingtonpost - Newsweek Interactive, LLC

Washingtonpost - Newsweek Interactive, LLC

Uploaded by

pocut.rayshaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washingtonpost - Newsweek Interactive, LLC

Washingtonpost - Newsweek Interactive, LLC

Uploaded by

pocut.rayshaCopyright:

Available Formats

Washingtonpost.

Newsweek Interactive, LLC

The International Financial System

Author(s): Zanny Minton Beddoes

Source: Foreign Policy, No. 116 (Autumn, 1999), pp. 16-27

Published by: Washingtonpost.Newsweek Interactive, LLC

Stable URL: http://www.jstor.org/stable/1149641 .

Accessed: 14/06/2014 07:01

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Washingtonpost.Newsweek Interactive, LLC is collaborating with JSTOR to digitize, preserve and extend

access to Foreign Policy.

http://www.jstor.org

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

THE INTERNATION

FINANCIALSYSTEM

The recent spate of crises in

emerging markets around the world

has shattered the consensus over

the benefits of unfettered capital

A flows and prompted calls for a

VI 'I new global financial architecture.

However, a closer examination of

the causes underlying the world's

financial woes suggests the need

not for a radical restructuring, but

for some commonsense repairs.

byZannyMintonBeddoes

There Is a Global Market for Capital

Not really. Although huge amountsof money move aroundthe

world almost instantaneously-grosstradingon foreignexchange

marketsis now worthabout$1.5 trilliona day,whereasin the mid-

1980sit amountedto less than $200 billion-a singleglobalmarket

for capitalhas not emerged.Some countriesdo not take in private

foreigncapitalat all. There are at least 13 nations,mostlyin sub-

SaharanAfrica,whoseonly sourceof outsidefinanceis foreignaid.

Forall the furorover"emerging markets," only 18 developingcoun-

trieshave regularaccessto privatecapital.

Evenif morecountrieshadaccessto foreignsourcesof privatecap-

ital, it wouldnot meanthata unifiedglobalcapitalmarketexisted.If

thereweresucha market,then hugefundsfromcountrieswithample

savingswouldflow to profitableinvestmentopportunitiesabroad.

Moreover,pricesof equivalentassetswouldtend to be roughlythe

samein differentcountries.

ZANNY MINTON BEDDOESis Washington

economics fortheEconomist.

correspondent

16 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

MintonBeddoes

Neitherof thosetwoexpectationsbearsanyrelationto reality.First,

althoughthe overallamountsof moneythatmoveinternationally are

enormous,the net amountsthatgo fromone countryto another-and

staythere-are muchsmaller.Evenin richcountries,mostsavingand

investmentarestilldoneat home.And althoughprivatecapitalflows

havesurgedfrom$50 billionin 1990to $152billionin 1998,emerging

economieshave,on average,beenableto financeonly 10 percentof

theirtotalinvestmentwithforeigncapitalduringthe 1990s.

Second,contraryto textbooktheory,the pricesof similarassetsare

not the same in differentcountries.Consider,for example, the

returnson comparativelysafe assets, such as governmentbonds.

Amongwealthycountries,governmentbondswhoseyieldsare cal-

culatedin a commoncurrencydo not provideidenticalreturns.This

slight discrepancyin returnsoccursbecauseinvestorsworryabout

unforeseenchanges in the exchange rate, as well as the risk of

default,while tradingin foreigncurrencies.In developingcountries,

these risksareeven higher,so the pricesof "equivalent"assetsvary

enormously. Although markets areindeedbecoming moreintegrated-

due to innovationsin technology,the removalof capitalcontrols,

and the increasein the internationalscopeof investors-we arefar

froma trulyglobalcapitalmarket.

Allowing the Free Movement of Capital in and

out of a Country Stimulates Economic Growth

Probably.Until recently,the conventionalwisdomamongpolicy-

makerswasthatdevelopingcountrieswerewell advisedto followthe

exampleof rich countriesand eliminatecapitalcontrols.Economic

theorysuggestsseveralreasonswhy free capitalflows are good for

economicgrowth.First,justas freetradeallowsfor a moreefficient

allocationof goods,free capitalflows enablesavingsto be sent to

theirmostproductiveusesregardless of geography

orpoliticalbound-

aries.This argumentsuggestscapital shouldflow from developed

countriesto developingones, as developedcountriesshouldhave

higher savings while developing countries should have more prof-

itable investment opportunities.

Second, capital mobility allows a country to insure itself against

sudden drops in export revenues or other financial shocks from

abroad.If, for example, Mexico were to sufferfrom a temporarydrop

FALL 1999 17

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

ThinkAgain

in oil prices,it could borrowabroadinsteadof drasticallycutting

consumptionat home. Third, foreign capital flows, particularly

direct investment, allow a countryto importforeign technology

and expertise,therebyacceleratingits economic growth.

The recentspateof emerging-market crises,however,has cracked

this consensus.Manyemergingeconomiesthat have freedthe entry

andexit of foreigncapitalhaveundergonespectacular financialcrises

accompaniedby huge economic costs. Private capitalmarketsseem

to dryup justwhenan emergingmarketgetshit by an outsideshock,

suchas a collapsein oil pricesor an increasein worldinterestrates.

Overall,economistshave been unableto find any statisticalrela-

tionshipbetweencapitalflowsandeconomicgrowth.

Criticsof open capitalregimeshave been quickto jumpon these

developmentsas proofthat the goal of freeingcapitalflowsis mis-

conceived.Theyarguethatthe risksinvolvedin capitalmobilityout-

weighthe benefitsfordevelopingcountries.The truthprobablylies

somewherein the middle.Recentcrisesshowthat premature capital

liberalizationis mosthazardouswhencountries'banksareundercap-

italizedand poorlysupervised.These crises,however,do not prove

the follyof the wholeidea.

Emerging-Market Crashes Are More

Frequent and Severe Than Ever Before

Not really.Even the most casualreaderof newspaperheadlines

knowsthat manydevelopingcountries-Brazil,Indonesia,Mexico,

Russia,South Korea,and Thailand-have faceddramaticcurrency

crisesin recent years.But a casualnewspaperreader15 yearsago

couldhaveverywellreachedthe sameconclusion.Currencycrisesin

emergingeconomiesarenothingnew.Duringthe 1980sdebt crisis,

manydevelopingcountrieswerehit hardas foreigncapitalstopped

flowing in and startedfleeing out. Between 1979 and 1983, for

instance,13 countrieslostforeigncapitalworth,on net, morethan3

percentof grossdomesticproduct(GDP)withinone year.Bythe same

measure,14 countriesexperiencedseriouscapital flight between

1994 and 1998. The picture is more nuanced when examined in

terms of regional developments. In Asia, the number of such crises

has shot up in the late 1990s, while Latin America, in fact, has seen

fewer crises in the 1990s than in the 1980s.

18 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

MintonBeddoes

Gaugingthe severityof a currencycrisis dependson how it is

measured.Judgingby how much capitalfled, Latin Americasaw

worsecrisesin the 1980sthan in the 1990s.Argentina,forexample,

lost foreign capital worth an enormous20 percent of GDPin

1982-83, comparedwith a reversalof 4 percentof GDPin 1995. In

Asia,however,the late 1990shavebroughtfarworsecrisesthanany-

thing experiencedearlier.Thailandsuffereda reversalof capital

flowswortha whopping26 percentof GDPbetween1996 and 1997.

Judgingby their impacton economicoutput,the recent financial

criseshave been broaderthan previousones. They have affecteda

greatershareof globalGDP.Theyhave alsocausedsubstantialreces-

sions, though it seems that economic recoveryis occurringmore

quicklythan it did duringthe 1980sdebtcrisis.

Financial Crises Spread Because Investors Panic

Not always. One of the most perniciouscharacteristics of today's

financialturmoilhas been the virulencewith which it has spread

fromone countryto another.Thailand'sdecisionin July1997to float

its currency,the baht, led to a pan-Asiancrisiswithin a coupleof

months.The causesof this"contagion" arehardto understand. Many

peopleblamepanicamonginvestors.Scaredandirrationalinvestors,

the argumentgoes,pull theirmoneyout of all emergingmarkets.

Infact,investorsmightbebehaving in a perfectly

rational manner. They

for be

might, instance, reevaluating theirinvestments in the lightof new

exchangerates.The economicprospects of somecountries worsenwhen

theirtradingpartners devalue.Thatwascertainlythe casein Southeast

Asia,wheremassivedevaluation in somecountries reducedthe competi-

tivenessof others.OnceThailand's bahthadcollapsedin July1997,for

instance,the relativecompetitiveness of Indonesia,Malaysia, and the

Philippinesworsened sharply.Investorsmight alsohave been rational

in

theirdecisionto sell,iftheyfearedeveryone elsewassellingtoo.Moreover,

firms'internalcomputer modelsthataredesignedspecifically to manage

riskmightpromotecontagion: Thesemodelssuggest, forinstance,thatif

investorslostmoneyon Russianbonds,theyshouldrebalance theirover-

all portfolioby selling equivalentassetsin other emergingmarkets(say

Brazilianbonds).Such argumentsmakeperfectsensewhen appliedat the

level of the individualinvestor.However,collectivelythey createan irra-

tionaloutcome,causingwell-managedcountriesto sufferfinancialcrises.

FALL 1999 19

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

Think

Again

Some Words to Invest By

Arbitrage:The processof driving aggressive financial strategies

prices of related assets, or the that are prohibitedto mutual

sameassetsin differentmarkets, funds.

towardconsistencybypurchasing

assetswhencheapin one market Lenderof LastResort:

and selling them when dear in Traditionally, anentity,government,

another. or national central bank that

extendscreditto an illiquid,but

Bail In: When the privatesector uninsured, financialinstitutionto

is encouraged-throughpressure preventits failure.Morerecently,

tactics or the placement of there have been proposalsfor

conditionson officialsupport- governments or multilateral

to participatewith its own funds institutionsto playa similarrole

in providingfinancialrelieffor a forsovereignborrowers.

troubleddebtor.

Long-TermCapitalFlows: The

BailOut:Whenloansorgrantsare movementof capital from one

provided-usually bya government, countryto anotherwitha maturity

centralbank,and/ormultilateral that is longer than one year.

(suchastheInternational Examples include direct

institution

Monetary Fund)-to helpa nation, investmentsin fixed assetssuch

company,or individualremain as manufacturingplants and

solvent. long-termportfolioinvestments

in stocksandbonds.

Derivatives: Financial instru-

mentswhosevaluedependson the Moral Hazard:The impactthat

value of underlyinginvestments, insurance,whetherit is implicit

indices,orassets.Futuresandstock or explicit (includinglender-of-

optionsaretwo commontypesof last-resortactivity),mayhave in

derivatives. increasingthe risks (or hazard)

that investorsmay undertakein

Due Diligence: The processof lendingstrategies.

byinvestors-

research---performed

into the details of a potential Short-Term CapitalFlows:

investment. The movement of capitalfromone

country to another with a less

HedgeFunds:Largely unregulated than one-yearmaturity. Examples

andprivately managedinvestment includeshort-term loansandliquid

funds that are permittedto use investments in stockmarkets.

20 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

MintonBeddoes

Bad Banking Causes Most FinancialCrises

Absolutely.Moreoftenthannot, recentfinancialcriseshavebeentrig-

geredby externalfinancialshocksthat are amplifiedby failedfixed

exchangerateregimes: Countries attemptto defendtheirexchangerates

bysellingoffmoreandmoreforeignreserves, promptingwidespread spec-

ulationof animminentcurrency devaluation,andleadingin turnto even

morecapitalflight.However,the rootcauseof thesecrisesis usuallya

weakbankingsystem.In manydevelopingcountries,undercapitalized

andbadlysupervised banksborrowed toomuchshort-term moneyabroad

andlentit to dubiousprojectsathome.Theysuffered fromcurrency mis-

matches(banksborrowed in dollarsandlentin localcurrency, convinced

thatexchangerateswouldstaystable)andmaturity mismatches (inThai-

for

land, instance, some banks were on

borrowing the30-daymarketand

lendingfor multiyear construction projects).Cronyismandcorruption

madetheseweakbankseven weakeras theymadeloansto veryrisky,

unworthy projectsownedbytheirshareholders andmanagers.

Foreignbanksalso beartheirshareof the blame.Convincedthat

governments wouldbailout insolventbanksin timesof crisis,interna-

tionallendersmadeextremelyriskyloanswithoutduediligence.They

wereencouraged by faultyinternationalbankingstandards (the "Basle

CapitalAccord")thatfavorshort-term ratherthanlong-termlending

bybanksanddo not discriminate effectivelybetweenassetsof different

risks.Fortunately,

a centralthemeof globalfinancialreformis improving

bankingstandards. is rapidlybeingmadeon thisfront.

Progress

We Need a New "Global FinancialArchitecture"

That dependson what you mean. The frequencyand severityof

recentfinancialcriseshave fueledcallsfor a radicalredesignof the

rulesof globalfinance.PresidentBill Clinton wants to "adaptthe

international

financialarchitecture

to the 21stcentury";Britishprime

ministerTonyBlairwantsa "newBrettonWoodsfora new millenni-

um."Countlessacademicsandpunditshavepublishedpapersandedi-

torialson how to revampthe system.Some want to scrapthe

InternationalMonetaryFund(IMF) altogether;otherswant to createa

global central bank;still others want a globalbankruptcycourt.

Sadly,most of these radicalideas are either ill-advisedor politically

unfeasible(or both). A "new architecture"is thereforehighly unlikely.

FALL 1999 21

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

ThinkAgain

But thereis a lot of interiordecoratinggoingon. Ledby the Group

of Sevencountries, a modestbutusefulagendaof globalreformis taking

shape.It includes the developmentof internationalstandardsof good

behavioron everythingfrominformationprovisionto corporategov-

ernance.The IMFhas a new loanfacilityto help staveoff contagion,

andthereis a growingconsensusamongdecisionmakersthatgreater

emphasisneeds to be placedon internationalfinancialregulation.

The globalfinancialstructuremaynot be completelyremodeledas a

result,but it will certainlybe sprucedup.

Global Financial Reform Must Concentrate on

ControllingCapital Flows

No. Scaredby recentcapitalmarketcrises,severalcommentatorswantto

putthe geniebackin the bottle.Onlybycontrolling capitalflows,they

argue,can developingcountriessurvivethe turbulence of the interna-

tional economy.The most radicalproposalscall for halting,or even

reversing,the wholetrendtowardfreercapitalflows.The lessextreme

approach wouldlimitthe paceandscaleof investments untilfinancial

systemsin emergingeconomieswerein sufficiently goodshapeto cope

withlargeflowsof foreignmoney.Andmoreandmorepeopleagreethat

it is okayforcountriesto discourage highlyvolatileshort-term flowsby

taxingthem.Chile is regarded as the primeexample.Formostof the

1990s,it forcedallcompanies andbanksthatborrowed abroadto deposit

30 percentof theirproceedsin anunremunerated accountat the central

bankfora year(thiswas,in effect,a heftytaxon short-term borrowing).

Ironically,however,Chilesuspended thisrequirement in 1998,justas it

wasbeingheldupasa rolemodel.

Themoreradicalideasaresimplynotviable.Thespeedandcomplexity

of financialtransactions

in theInformation Agemakeit allbutimpossible

fora countryto reinstate

capitalcontrolson a long-termbasis(although, as

has

Malaysia shown,capital outflow controlscan work quiteeffectivelyfor

a while).Slowingdowntheprocess ofcapitalinflowsmakesmoresense,but

it alsomaybehardto enforce. TheCzechRepublic, forinstance,triedand

failedto enforcecontrolson capitalinflows.Evenin Chile,the policy

reducedthe shareof short-termflowsbutdidnot reducethe overalllevelof

capital inflows.And even if the strategydoes work,it comes at a cost:

Interestratesin emergingmarketsstayhigherthan they need to, as local

and internationalcapitalmarketsremainartificially

separated.

22 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

Minton

Beddoes

A Global Capital Market Needs a

Global Central Bank

Soundsright,butit'sunrealistic. Centralbanksplayan important rolein

nationaleconomies.Theyarethe lendersof lastresort.Whena viable

bankor indeedthe entirebankingsystemsuffersa lossof liquidity-say

becausea computer systembreaksdownorbecausepeoplesuddenly panic

and withdrawtheirmoneyen masse-the centralbankcan provide

moneyto stopthe wholesystemfromcollapsing. Advocatesof a global

centralbankmakea similarargument at the international level.They

maintainthatthe worldneedsan organization thatcanprovidelimitless

liquidityto countrieshit by a sudden-andunjustified-lossof market

confidence.Manysuggestthat the IMFshoulddo the job and should

receivea commensurate increasein resources fromitsmember countries.

the

Unfortunately, analogy doesnot quite work. unlike

First, a central

bankthatcanprintmoney,the IMFwillneverhaveaccessto limitless

resources.Consequently, althoughit is the main international crisis

manager, it will always be constrained as a crisislender. Second, the

IMFis a much more politicizedinstitution and, therefore,less

autonomousthanmostnationalcentralbanks.Centralbanksdecide

whetheror not to bail out individualbanksbasedon whetherthese

banksaremerelyilliquidor actuallyinsolvent.Makingthatdistinction

for countriesis much harder.Moreover, it is politicallyunlikelythat

important countries willgounaided, eveniftheyaretechnically insolvent.

Thatwasthecasein Russia,forexample.

Thesedifferences meanthattherisksofmoralhazard-wheninvestors

takeirresponsible risksconfidentthatthe IMFwillbailthemout-rise as

thefund'sreserveincreases. In addition,it is not obviousthatthe IMFis

the best institutionto deal with a trulysystemicproblem,suchas a

globallossof liquidity.Thecentralbanksof the threemajorcurrencies-

the dollar,euro,and yen-are farbetterequippedto loosen global

liquidityconditionsthroughcoordinated cutsin interestrates.

The IMFIs More of a Problem Than a Solution

A widespreadbut mistakenclaim. The IMFis probablyas unpopularas

it has ever been in its 50-yearhistory.Criticismsabout its handling of

recent financialcrisesabound.Morefundamentalcritiquessuggestthat

the IMF'svery existence causes,or at least exacerbates,financialcrises.

FALL 1999 23

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

ThinkAgain

Someof the tacticalcriticismsarevalid.The IMFfailedto foresee

the severityof the AsianCrisis(asdidvirtuallyeveryone).As a result,

the fund demandedthat countriestightentheir fiscalpolicies-an

approachthat, with the benefitof hindsight,now seemsexcessively

stringent.Othercriticismsaremorecontroversial. Somepundits,for

instance,claimthat the IMFdemandedtoo maThy structuralreforms

in crisiscountries,therebyworseningthe situation.They arguethat

breakingup SouthKorea'schaebols (largebusinessgroups)ordisman-

tling Indonesia'sexportmonopolieswasnot crucialto solvingthose

countries'currencycrisesandonly addedto the market's uncertainty.

That maybe true,but these reformswerenecessary.Moreover,it is

unlikelythat they wouldhave been implementedonce the senseof

crisiswasover.

The mostviciousdisagreements are aboutmonetarypolicy.From

JosephStiglitz, chief economistat the WorldBank,to JeffreySachs,

an outspokenIMFbasherfromHarvardUniversity,comesthe criti-

cism that the fund demandedexcessivelytight monetarypolicies.

They arguethat by forcingcrisis-afflicted countriesto raise their

interestrates,the IMFdeepenedthe recessions.The IMF,in contrast,

claimsthat lowerinterestrateswouldhave meanteven weakercur-

renciesandevenbiggerdebtproblems forAsiancompaniesandhigher

overallinflation.Althoughthe fundhasproducedstudiesto support

its position,the skepticsremainunconvinced.

Moreprofoundargumentsagainstthe fun&dconcern the risksof

moralhazardit generates.By bailingout countriesin trouble,the

argumentgoes, the IMFinducesrecklessbehavioron the part of

investorsandcountries,as both sidesareconfidentthat theywill be

bailedout if troublehits. Whetherthat criticismis validdependson

whetherbailoutsdo in factcausecrisesandwhetherinvestorsactually

escapescot-free.

Bailouts Are to Blame for International

Economic Crises

No. A casualglance seemsto supportthis view:There have been

plenty of prominent financial crises and plenty of massive bailouts.

Unfortunately,just as the magnitudeof financial crises is easily exag-

gerated,so too is the size of the bailouts. Although many recent IMF

packageshave had big headline numbers,much of the money never

24 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

MintonBeddoes

materialized.Indonesia,for instance,waspromisedover $40 billion

of bail-outmoneyin 1997. So far,less than $15 billionhas actually

been disbursed(althoughthesenumbersareconstantlychanging).It

was promisedby individualgovernmentsthat had no intentionof

actuallyprovidingthe cash.

Moreover,it is hard to arguethat developing-country govern-

mentsreallysufferfrommoralhazard.Do governmentslookforward

to the traumaof a crisis-the hugerecessions,the IMFausteritymea-

sures,and the routinepurgingof financeministers?Farmorelikely

is that short-termistpoliticiansfind it hard to undertaketough

reformsbeforean economiccrisisforcesthem to do so. Investors,

however,are morelikely to base their behavioron the prospectof

bailouts.Anecdotal evidence aboundsthat shows this is exactly

what they were doing in several countries. Investment banks

involvedin Russiangovernmentbonds,for instance,talkedopenly

about a "moral-hazard play."Investorswere betting on a bailout.

Fortunately,the fact that Russiadid not ultimatelyget bailedout-

and that investorslost a lot of money-should help reducethe risks

of moralhazard,at leastfor a while.

Private Investors Usually Escape Crises Scot-free

Not necessarily.Conventionalwisdomholds that fat cats on Wall

Streethaveemergedtriumphant fromrecentcrises,whilepoorpeople

in developingcountrieshave suffered.A few investorshave escaped

lightly.In 1995,forinstance,peopleholdingMexicantesobonos (dollar-

denominatedgovernmentdebt) were paid off, courtesyof the

IMF-U.S. governmentsupportpackage.But most investorshave

been hit, and hit hard,by the crisesin emergingmarkets.Anyone

who madeloansto Russialost a hugeamountof money.Manybanks

that hadlent to Asianfirms,especiallyin Indonesia,tooka hit. And

anyone who invested in emerging-market equities sufferedhuge

losses-at least in 1998, when virtuallyall emergingmarketsplum-

meted.Forexample,Russia'sstockmarketlost nearly90 percentof

its value.The InternationalFinancialCorporation's compositeindex

of emerging-marketequities fell 24 percent in dollar terms last year.

Although there has been considerablerecovery this year, emerging

markets have still massively underperformedAmerica's stock mar-

ket-hardly a stellar record.

FALL 1999 25

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

ThinkAgain

The Emerging-MarketBoom Was a Bubble That

Has Permanently Burst

Think Again.The hypethatsurrounded investmentin emergingmar-

kets duringthe early1990swas extraordinary. Privatecapital-from

mutualfundsto hedgefundsandprivateinvestors-pouredintodevel-

opingcountriesin searchof high returns.Afterthe recentfinancial

crises,the glamourof emergingeconomieshaswanedandthe investor

basehas contractedsharply.Becausethe currentinvestorbase is so

small,emerging-market assetsareextremelyvolatile.

But it wouldbe a mistaketo concludethat emergingmarketswill

alwaysbe on the margin.In the longrun,the reasonsforinvestingthere

areas attractiveas ever.Emerging marketsarerelativelypoor,withbig

investmentopportunities forthe agingpopulations of the richworldto

earnhighreturns. Startingfrom a low capitalbase,theseeconomieshave

thepotentialforrapidgrowth.Therecentcriseshavebeena wake-up call:

Theyhaveshowntheneedforgoodpolicies,strongfinancialsectors,and

transparency in emergingmarkets. Thesereforms arefarmoreimportant

than a "newglobalarchitecture." Provideddevelopingcountrieskeep

implementing thesereforms,thereis no reasonwhyemergingmarkets

shouldnot becomean ever-growing assetclass.Eventually,

if thisrouteis

we

followed, really willhave a globalcapitalmarket.

WANT TO KNOW MORE?

One problemwith the reformof globalfinanceis thatmuchof what

is writtenon the subjectis arcaneand impenetrableto nonecono-

mists.An importantexception-and a goodintroductory overview-

is BarryEichengreen'sGlobalizingCapital: A History of the

InternationalEconomicSystem (Princeton:PrincetonUniversity

Press, 1996). Eichengreen's latest book, Toward a New

International Financial Architecture: A Practical Post-Asia

Agenda (Washington:Institutefor InternationalEconomics, 1999), is

anequallygoodsummary of thereformdebate.Fora moreskepticalper-

spectiveon free capitalflows,try Dani Rodrik's"The New Global

Economyand DevelopingCountries:MakingOpennessWork,"

OverseasDevelopment CouncilPolicyEssay,no. 24, (Washington:

OverseasDevelopment Council,1999).Foran impassioned-ifuncon-

26 FOREIGN POLICY

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

Minton

Beddoes

vincing-lament, see George Soros'The Crisis of Global Capitalism:

Open Society Endangered (New York:PublicAffairs,1998).

FOREIGNPOLICY magazinehas servedas a forumfor extensivedebate

over how to reformthe internationalfinancialsystemin the wakeof the

recent economic crises.See Robert Wade's"The Fight Over Capital

Flows" (FOREIGN POLICY, Winter1998-99), ClaudeSmadja's"The End

of Complacency"(FOREIGN POLICY, Winter 1998-99), and David

Rothkopf's "The Disinformation Age" (FOREIGN POLICY,Spring1999).

The most comprehensivesourceof topical informationon financial

crises and reformof the internationalfinancial system can be found

online at a Web site maintained by Nouriel Roubini of New York

University. Both the International Monetary Fund and the World

Bank maintain excellent Web sites with specific sections on interna-

tional financial reform.For official reportsand information,the Web

sites of financeministriesand centralbanksfromGroupof Seven coun-

tries areuseful,as is that of the Bank for InternationalSettlements.

Forlinksto theseandotherrelevantWebsites,aswellasa comprehensive

indexof relatedFOREIGNPOLICYarticles,accesswww.foreignpolicy.com.

ii;

Rr??"~-:~i"g~;

_i~E~IY" ,,

.s hr~sx

''

Searching the globe for

:~.:

up-to-the minute coverage

''c' YQ : of international affairs and

~I ;-:--

ii

domestic policy issues?

iiii::

;? ?Y:

~

_i;?i : ::::_:~~_ir-i-

-i?--~

ri:ii~~ii~

Look no further than your desktop...

www.policy.com

On the Internetat www.policy.comand on AOLat keyword:Policy

Policy.comr

lw w r

lcy co

The policy news & information service

Nonpartisan Free Comprehensive

This content downloaded from 195.78.108.147 on Sat, 14 Jun 2014 07:01:06 AM

All use subject to JSTOR Terms and Conditions

You might also like

- DOA - Aquantus Vicero Deutsche DBS (40+2+2) - Draft v4 (7541)Document20 pagesDOA - Aquantus Vicero Deutsche DBS (40+2+2) - Draft v4 (7541)MH Hashim100% (6)

- GROUP 6 SWOT Analysis of SHOPEE CompanyDocument4 pagesGROUP 6 SWOT Analysis of SHOPEE CompanyTry Zega100% (1)

- Broad Shifts in MarketingDocument3 pagesBroad Shifts in MarketingNIHAR RANJAN MishraNo ratings yet

- Developing Countries and The Global Financial System: C H A P T e RDocument17 pagesDeveloping Countries and The Global Financial System: C H A P T e RAsniNo ratings yet

- Presented By: Investment and Portfolio AnalysisDocument22 pagesPresented By: Investment and Portfolio Analysis8537814No ratings yet

- Economic Risk of GlobalizationDocument4 pagesEconomic Risk of Globalizationfarhad5685390535No ratings yet

- Exchange Rate and Capital Account Management For Developing CountriesDocument10 pagesExchange Rate and Capital Account Management For Developing CountriesJace BezzitNo ratings yet

- Financial Markets PDFDocument44 pagesFinancial Markets PDFNitin SakpalNo ratings yet

- Emerging Markets - Risk, Reward and Covid - Financial TimesDocument10 pagesEmerging Markets - Risk, Reward and Covid - Financial TimesAditi PuthranNo ratings yet

- The Case Against Capital Controls: Financial Flows, Crises, and The Flip Side of The Free-Trade Argument, Cato Policy Analysis No. 403Document20 pagesThe Case Against Capital Controls: Financial Flows, Crises, and The Flip Side of The Free-Trade Argument, Cato Policy Analysis No. 403Cato Institute100% (1)

- If - Mba 4Document72 pagesIf - Mba 4mansisharma8301No ratings yet

- Palgrave Macmillan Journals International Monetary FundDocument45 pagesPalgrave Macmillan Journals International Monetary FundRamiro Gimenez GarciaNo ratings yet

- Libéralisation Du Compte CapitalDocument4 pagesLibéralisation Du Compte Capitalelyka.paintingNo ratings yet

- Financial MarketsDocument44 pagesFinancial MarketsOxfamNo ratings yet

- Indian Accountancy ProfessionDocument8 pagesIndian Accountancy ProfessionIshan GroverNo ratings yet

- Cheep CapitalDocument3 pagesCheep CapitalshiprathereNo ratings yet

- New International Economic OrderDocument20 pagesNew International Economic Orderrazz_22100% (1)

- Strategic Factors Affecting Foreign Direct Investment DecisionsDocument2 pagesStrategic Factors Affecting Foreign Direct Investment DecisionsSharma GokhoolNo ratings yet

- Impact of GlobalizationDocument66 pagesImpact of GlobalizationPriyanka SoniNo ratings yet

- Discussion Papers in EconomicsDocument39 pagesDiscussion Papers in EconomicsBryson MannNo ratings yet

- Many Shades of GreenbackDocument1 pageMany Shades of GreenbacknaikNo ratings yet

- Resume Ekonomi Moneter 2Document3 pagesResume Ekonomi Moneter 2nurjannah_hadaitaNo ratings yet

- Globalization: How It Affects International TradeDocument5 pagesGlobalization: How It Affects International TradeDuke SucgangNo ratings yet

- Toc Aff v.1Document13 pagesToc Aff v.1Sully MrkvaNo ratings yet

- APRIL 2019 International Finance Question PaperDocument9 pagesAPRIL 2019 International Finance Question PaperApruva BelapurkarNo ratings yet

- Elucidate The Importance of International Finanace in This Era of GlobalisationDocument15 pagesElucidate The Importance of International Finanace in This Era of GlobalisationAnsariMohammedShoaibNo ratings yet

- Kapur IMFCureCurse 1998Document17 pagesKapur IMFCureCurse 1998salmazeus87No ratings yet

- Lessons From The South African ExperienceDocument15 pagesLessons From The South African ExperienceEmir TermeNo ratings yet

- Globalization of Financial MarketsDocument6 pagesGlobalization of Financial MarketsAlinaasirNo ratings yet

- Índices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Document13 pagesÍndices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Marc SaundersNo ratings yet

- Quick DollarDocument40 pagesQuick DollarANKIT_XXNo ratings yet

- Presspb20102 enDocument2 pagesPresspb20102 enZerohedgeNo ratings yet

- Lecture General Overview of IfDocument18 pagesLecture General Overview of IfMinney EddyNo ratings yet

- Financial Dependence and GrowthDocument3 pagesFinancial Dependence and GrowthutsavNo ratings yet

- Factiva 20190909 2242Document2 pagesFactiva 20190909 2242Jiajun YangNo ratings yet

- Global Financial SystemDocument16 pagesGlobal Financial SystemahmadmudasirNo ratings yet

- Decoupling A Fresh PerspectiveDocument3 pagesDecoupling A Fresh PerspectiveSovid GuptaNo ratings yet

- The Effect of Capital Flight On Nigerian EconomyDocument127 pagesThe Effect of Capital Flight On Nigerian EconomyAdewole Aliu OlusolaNo ratings yet

- Currency WarsDocument10 pagesCurrency WarsEscobar AlbertoNo ratings yet

- Every Central Bank For ItselfDocument17 pagesEvery Central Bank For Itselfrichardck61No ratings yet

- Gabriel Palma - Why Corporations in Developing Countries Are Likely To BeDocument24 pagesGabriel Palma - Why Corporations in Developing Countries Are Likely To BeMario Matus GonzálezNo ratings yet

- Introduction To Global Finance With Electronic 1 BankingDocument4 pagesIntroduction To Global Finance With Electronic 1 Bankingcharlenealvarez59No ratings yet

- Financial Management in A Global PerspectiveDocument6 pagesFinancial Management in A Global PerspectiveRaj AnwarNo ratings yet

- What Are The Recent Developments in Global Financial MarketsDocument6 pagesWhat Are The Recent Developments in Global Financial MarketsHari KrishnanNo ratings yet

- 305-Int Fin-NotesDocument6 pages305-Int Fin-NotesRutik PatilNo ratings yet

- Importance of International FinanceDocument4 pagesImportance of International FinanceNandini Jagan29% (7)

- Izbor Tekstova Iz The Economist 15 OktobarDocument11 pagesIzbor Tekstova Iz The Economist 15 OktobarNiksa KosuticNo ratings yet

- 9781557756350Document18 pages9781557756350Robert RoblesNo ratings yet

- 2839 Financial Globalization Chapter May30Document45 pages2839 Financial Globalization Chapter May30indiaholicNo ratings yet

- SPCFLCF36B29BDocument5 pagesSPCFLCF36B29BRao TvaraNo ratings yet

- The Financial Crisis and The Developing WorldDocument4 pagesThe Financial Crisis and The Developing WorldmustafeezNo ratings yet

- LKJH4A33C7AFFDocument12 pagesLKJH4A33C7AFFRao TvaraNo ratings yet

- Mod2 Global EconomyDocument36 pagesMod2 Global Economyclaire yowsNo ratings yet

- Ifm Assignment: - Babitha P Mba-B (121823602050)Document4 pagesIfm Assignment: - Babitha P Mba-B (121823602050)Hanuman PotluriNo ratings yet

- What Is GlobalizationDocument22 pagesWhat Is GlobalizationPrashant SharmaNo ratings yet

- 2021-7 Cleary Progress and ImprovementDocument26 pages2021-7 Cleary Progress and ImprovementSean ClearyNo ratings yet

- Globalization in Financial EnvironmentDocument3 pagesGlobalization in Financial EnvironmentabdakbarNo ratings yet

- Structural Adjustment - A Major Cause of PovertyDocument10 pagesStructural Adjustment - A Major Cause of PovertyBert M DronaNo ratings yet

- Multinational Finance Solutions Chapter 1Document3 pagesMultinational Finance Solutions Chapter 1fifi_yaoNo ratings yet

- Global Marketing: By: Aastha Uppal Aishani Vij Apoorwa Middha Avantika Gupta Deviyani Bhasin Nitiz Kaila Sneha KumarDocument73 pagesGlobal Marketing: By: Aastha Uppal Aishani Vij Apoorwa Middha Avantika Gupta Deviyani Bhasin Nitiz Kaila Sneha KumarDeepika AjayanNo ratings yet

- The Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichFrom EverandThe Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichNo ratings yet

- Invested Capital Profit Annual NET RORDocument7 pagesInvested Capital Profit Annual NET RORAnjo VasquezNo ratings yet

- DLP ElementsofstoryDocument33 pagesDLP ElementsofstoryKathlen Aiyanna Salvan BuhatNo ratings yet

- DescrepaniesDocument21 pagesDescrepaniesHoward boiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shashikant ChaturvediNo ratings yet

- W91Document4 pagesW91Patrick LongNo ratings yet

- Saudi Arabia Real Estate Market ReviewDocument4 pagesSaudi Arabia Real Estate Market ReviewDIVENIRENo ratings yet

- Economics of Social Issues 21E 21St Edition Charles A Register Full ChapterDocument51 pagesEconomics of Social Issues 21E 21St Edition Charles A Register Full Chapterjoseph.velazquez944100% (7)

- LG 2Document1 pageLG 2darrenNo ratings yet

- 1-Price Ceiling Examples Effectiveness (Short Run vs. Long Run) 2 - Price Floor Examples Effectiveness 3 - Price Setting ExamplesDocument6 pages1-Price Ceiling Examples Effectiveness (Short Run vs. Long Run) 2 - Price Floor Examples Effectiveness 3 - Price Setting ExamplesFioighlg BuhewofNo ratings yet

- ABCDE Consulting Inc.: Articles of Incorporation ofDocument5 pagesABCDE Consulting Inc.: Articles of Incorporation ofAl Cheeno AnonuevoNo ratings yet

- Vitting - Format.Document12 pagesVitting - Format.rbn_7225No ratings yet

- Directors Loan and Tax ImplicationsDocument2 pagesDirectors Loan and Tax ImplicationsMary SmithNo ratings yet

- Topic 1 Introduction To Quality: Learning ObjectivesDocument6 pagesTopic 1 Introduction To Quality: Learning ObjectivesSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- Dummy PortfolioDocument4 pagesDummy PortfolioManik KainthNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationKyla DizonNo ratings yet

- UntitledDocument420 pagesUntitledCristian MarinNo ratings yet

- Entrep DLP 6Document2 pagesEntrep DLP 6Jemel GepigaNo ratings yet

- UntitledDocument2 pagesUntitledRuss FajardoNo ratings yet

- BHN, HV, HRB and HRC Hardness Conversion Chart - Upmold LimitedDocument6 pagesBHN, HV, HRB and HRC Hardness Conversion Chart - Upmold Limitednikunjsingh04No ratings yet

- Micro4 - Price Floor and Ceilings - 2021Document35 pagesMicro4 - Price Floor and Ceilings - 2021Divya Deepika BobbiliNo ratings yet

- APT Satellite (1045 HK) Time To Revisit PDFDocument7 pagesAPT Satellite (1045 HK) Time To Revisit PDFJocelynNo ratings yet

- Bill of Sale (Motorcycle)Document2 pagesBill of Sale (Motorcycle)bradley omariNo ratings yet

- Iata Passenger Glossary of TermsDocument199 pagesIata Passenger Glossary of Termschan dannyNo ratings yet

- 8 Taxation of NRDocument8 pages8 Taxation of NRchandrakantchainani606No ratings yet

- 7-Year Asset Class Real Return Forecasts : As of January 31, 2021Document1 page7-Year Asset Class Real Return Forecasts : As of January 31, 2021Ericko Marvin KweknotoNo ratings yet

- 2.07 Social Problems and Solutions ChartDocument4 pages2.07 Social Problems and Solutions ChartAubrey HovanNo ratings yet