Professional Documents

Culture Documents

Anf VL

Anf VL

Uploaded by

John Aldridge ChewCopyright:

Available Formats

You might also like

- Citi - Auto ABS PrimerDocument44 pagesCiti - Auto ABS Primerjmlauner100% (1)

- NVRDocument125 pagesNVRJohn Aldridge Chew100% (1)

- Munger's Analysis To Build A Trillion Dollar Business From ScratchDocument11 pagesMunger's Analysis To Build A Trillion Dollar Business From ScratchJohn Aldridge Chew100% (4)

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Distressed Investment Banking - To the Abyss and Back - Second EditionFrom EverandDistressed Investment Banking - To the Abyss and Back - Second EditionNo ratings yet

- Ek VLDocument1 pageEk VLJohn Aldridge ChewNo ratings yet

- Global Crossing 1999 10-KDocument199 pagesGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- LPX 10K 2010 - Balance Sheet Case-StudyDocument116 pagesLPX 10K 2010 - Balance Sheet Case-StudyJohn Aldridge ChewNo ratings yet

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Eminence CapitalMen's WarehouseDocument0 pagesEminence CapitalMen's WarehouseCanadianValueNo ratings yet

- SGDE Example of A Clear Investment ThesisDocument10 pagesSGDE Example of A Clear Investment ThesisJohn Aldridge ChewNo ratings yet

- Hudsongeneralco10k405 1997Document149 pagesHudsongeneralco10k405 1997John Aldridge ChewNo ratings yet

- Idea VelocityDocument2 pagesIdea Velocitynirav87404100% (1)

- Complete Notes On Special Sit Class Joel Greenblatt 2Document311 pagesComplete Notes On Special Sit Class Joel Greenblatt 2eric_stNo ratings yet

- A Thorough Discussion of MCX - Case Study and Capital TheoryDocument38 pagesA Thorough Discussion of MCX - Case Study and Capital TheoryJohn Aldridge Chew100% (2)

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge Chew100% (4)

- WMT Case Study #1 AnalysisDocument8 pagesWMT Case Study #1 AnalysisJohn Aldridge Chew100% (1)

- Global Crossing 1999 10-KDocument199 pagesGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- SGDE Example of A Clear Investment ThesisDocument10 pagesSGDE Example of A Clear Investment ThesisJohn Aldridge ChewNo ratings yet

- Special Situation Net - Nets and Asset Based Investing by Ben Graham and OthersDocument28 pagesSpecial Situation Net - Nets and Asset Based Investing by Ben Graham and OthersJohn Aldridge Chew100% (4)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- Problem 3Document3 pagesProblem 3Joyce GijsenNo ratings yet

- Wet Seal - VLDocument1 pageWet Seal - VLJohn Aldridge ChewNo ratings yet

- Sealed Air Case Study - HandoutDocument17 pagesSealed Air Case Study - HandoutJohn Aldridge ChewNo ratings yet

- 50 Yr Kodak - SRCDocument1 page50 Yr Kodak - SRCJohn Aldridge ChewNo ratings yet

- Tupper Ware 25 Yr ChartDocument1 pageTupper Ware 25 Yr ChartJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Global Crossing CS by Univ of EdinburghDocument35 pagesGlobal Crossing CS by Univ of EdinburghJohn Aldridge ChewNo ratings yet

- Liz Claiborne 10-K Jan 1 2000Document205 pagesLiz Claiborne 10-K Jan 1 2000John Aldridge ChewNo ratings yet

- Cornell Students Research Story On Enron 1998Document4 pagesCornell Students Research Story On Enron 1998John Aldridge Chew100% (1)

- Enron Case Study - So What Is It WorthDocument20 pagesEnron Case Study - So What Is It WorthJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Quinsa Example of A Clear Investment Thesis - Case Study 3Document18 pagesQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewNo ratings yet

- Anon - Housing Thesis 09 12 2011Document22 pagesAnon - Housing Thesis 09 12 2011cnm3dNo ratings yet

- Lecture 9 A Great Investor Discusses Investing in Retailers and ANNDocument18 pagesLecture 9 A Great Investor Discusses Investing in Retailers and ANNJohn Aldridge Chew100% (3)

- A Study of Market History Through Graham Babson Buffett and OthersDocument88 pagesA Study of Market History Through Graham Babson Buffett and OthersJohn Aldridge Chew100% (2)

- Great Investor 2006 Lecture On Investment Philosophy and ProcessDocument25 pagesGreat Investor 2006 Lecture On Investment Philosophy and ProcessJohn Aldridge Chew100% (1)

- Dividend Policy, Strategy and Analysis - Value VaultDocument67 pagesDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Enron Moral Hazard Case StudyDocument32 pagesEnron Moral Hazard Case StudyJohn Aldridge Chew100% (1)

- Coke 50 Year Chart - SRCDocument1 pageCoke 50 Year Chart - SRCJohn Aldridge ChewNo ratings yet

- Aig Best of Bernstein SlidesDocument50 pagesAig Best of Bernstein SlidesYA2301100% (1)

- Assessing Performance Records - A Case Study 02-15-12Document8 pagesAssessing Performance Records - A Case Study 02-15-12John Aldridge Chew0% (1)

- Value Investing (Greenwald) SP2018Document5 pagesValue Investing (Greenwald) SP2018YOG RAJANINo ratings yet

- The Future of Common Stocks Benjamin Graham PDFDocument8 pagesThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNo ratings yet

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Class Notes #2 Intro and Duff and Phelps Case StudyDocument27 pagesClass Notes #2 Intro and Duff and Phelps Case StudyJohn Aldridge Chew100% (1)

- ValueXVail 2013 - Chris KarlinDocument26 pagesValueXVail 2013 - Chris KarlinVitaliyKatsenelsonNo ratings yet

- Students Grilled On Their Presentations and Review of CourseDocument43 pagesStudents Grilled On Their Presentations and Review of CourseJohn Aldridge ChewNo ratings yet

- Rosenstein ValueInvestingCongress 100112Document42 pagesRosenstein ValueInvestingCongress 100112VALUEWALK LLCNo ratings yet

- A Comparison of Bubbles by John Chew - FinalDocument7 pagesA Comparison of Bubbles by John Chew - FinalJohn Aldridge Chew100% (1)

- Scion 2006 4q Rmbs Cds Primer and FaqDocument8 pagesScion 2006 4q Rmbs Cds Primer and FaqsabishiiNo ratings yet

- Coors Case StudyDocument3 pagesCoors Case StudyJohn Aldridge Chew0% (1)

- Arlington Value 2006 Annual Shareholder LetterDocument5 pagesArlington Value 2006 Annual Shareholder LetterSmitty WNo ratings yet

- Greenhaven+Q1 2015 FINALDocument15 pagesGreenhaven+Q1 2015 FINALPradeep RaghunathanNo ratings yet

- Arlington Value 2014 Annual Letter PDFDocument8 pagesArlington Value 2014 Annual Letter PDFChrisNo ratings yet

- Tobacco Stocks Buffett and BeyondDocument5 pagesTobacco Stocks Buffett and BeyondJohn Aldridge ChewNo ratings yet

- CA Network Economics MauboussinDocument16 pagesCA Network Economics MauboussinJohn Aldridge ChewNo ratings yet

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge ChewNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital ManagementscottleeyNo ratings yet

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementFrom EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementNo ratings yet

- Wall Street Research: Past, Present, and FutureFrom EverandWall Street Research: Past, Present, and FutureRating: 3 out of 5 stars3/5 (2)

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Competitive Advantage in Investing: Building Winning Professional PortfoliosFrom EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Chapter 20 - Margin of Safety Concept and More NotesDocument53 pagesChapter 20 - Margin of Safety Concept and More NotesJohn Aldridge Chew100% (1)

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Tow Times Miller IndustriesDocument32 pagesTow Times Miller IndustriesJohn Aldridge ChewNo ratings yet

- Coors Case StudyDocument3 pagesCoors Case StudyJohn Aldridge Chew0% (1)

- Niederhoffer Discusses Being WrongDocument7 pagesNiederhoffer Discusses Being WrongJohn Aldridge Chew100% (1)

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge ChewNo ratings yet

- Global Crossing CS by Univ of EdinburghDocument35 pagesGlobal Crossing CS by Univ of EdinburghJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- GLBC 20000317 10K 19991231Document333 pagesGLBC 20000317 10K 19991231John Aldridge ChewNo ratings yet

- CA Network Economics MauboussinDocument16 pagesCA Network Economics MauboussinJohn Aldridge ChewNo ratings yet

- Prof. Greenwald On StrategyDocument6 pagesProf. Greenwald On StrategyMarc F. DemshockNo ratings yet

- Five Forces Industry AnalysisDocument23 pagesFive Forces Industry AnalysisJohn Aldridge ChewNo ratings yet

- Tobacco Stocks Buffett and BeyondDocument5 pagesTobacco Stocks Buffett and BeyondJohn Aldridge ChewNo ratings yet

- Quinsa Example of A Clear Investment Thesis - Case Study 3Document18 pagesQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewNo ratings yet

- Burry WriteupsDocument15 pagesBurry WriteupseclecticvalueNo ratings yet

- Dividend Policy, Strategy and Analysis - Value VaultDocument67 pagesDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewNo ratings yet

- Capital Structure and Stock Repurchases - Value VaultDocument58 pagesCapital Structure and Stock Repurchases - Value VaultJohn Aldridge ChewNo ratings yet

- Charlie Munger - Art of Stock PickingDocument18 pagesCharlie Munger - Art of Stock PickingsuniltmNo ratings yet

- Greenwald Class Notes 6 - Sealed Air Case StudyDocument10 pagesGreenwald Class Notes 6 - Sealed Air Case StudyJohn Aldridge Chew100% (1)

- Ia Assignment 3Document3 pagesIa Assignment 3Resty VillaroelNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- The Financial Environment: Markets, Institutions, and Interest RatesDocument2 pagesThe Financial Environment: Markets, Institutions, and Interest RatesKristel SumabatNo ratings yet

- Indiabulls SC WritDocument180 pagesIndiabulls SC WritVignesh Faque JockeeyNo ratings yet

- Name of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)Document2 pagesName of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)pranab_nandaNo ratings yet

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangNo ratings yet

- BSE SENSEX - Wikipedia, The Free EncyclopediaDocument13 pagesBSE SENSEX - Wikipedia, The Free Encyclopediaviswadutt100% (1)

- Hhtfa8e ch01 SMDocument83 pagesHhtfa8e ch01 SMkbrooks323No ratings yet

- LMGT 2330-7426 Exam 2 12S1Document4 pagesLMGT 2330-7426 Exam 2 12S1Lisa NguyenNo ratings yet

- Olam Annual Report 2014 PDFDocument210 pagesOlam Annual Report 2014 PDFHimanshu KakkarNo ratings yet

- KLG Presentation Oct08Document26 pagesKLG Presentation Oct08Rizky RizNo ratings yet

- RM Gtu TheoryDocument4 pagesRM Gtu TheoryAtibAhmedNo ratings yet

- Stock Market Trends and Investment PatternDocument112 pagesStock Market Trends and Investment PatternArvind MahandhwalNo ratings yet

- Ogbeibu Samuel Accounting Assignt (1) AMENDEDDocument14 pagesOgbeibu Samuel Accounting Assignt (1) AMENDEDSammy OgbeibuNo ratings yet

- 7110 s11 QP 12Document12 pages7110 s11 QP 12mstudy123456No ratings yet

- Acct3102 Chapter 14Document11 pagesAcct3102 Chapter 14monikademonisiaNo ratings yet

- Elliott WaveDocument24 pagesElliott WavejrladduNo ratings yet

- Syllabus Economics CraigDocument13 pagesSyllabus Economics CraigPrashuk JainNo ratings yet

- Victoria Chemicals Part 1Document2 pagesVictoria Chemicals Part 1cesarvirataNo ratings yet

- Department of Management Secretarial Practice Class: II BBA Time: 3 Hours Sub Code: SABA41 Mark: 75 Part A (4x1 4 Marks) Choose The Correct AnswerDocument2 pagesDepartment of Management Secretarial Practice Class: II BBA Time: 3 Hours Sub Code: SABA41 Mark: 75 Part A (4x1 4 Marks) Choose The Correct AnswerpremNo ratings yet

- Unpaid Unclaimed Dividend IEPF 1Document46 pagesUnpaid Unclaimed Dividend IEPF 1kaminiNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- TWC LetterDocument2 pagesTWC LetterZerohedgeNo ratings yet

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Ch05 Bond Valuation SoluationsDocument6 pagesCh05 Bond Valuation SoluationsSeema Kiran50% (2)

Anf VL

Anf VL

Uploaded by

John Aldridge ChewOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anf VL

Anf VL

Uploaded by

John Aldridge ChewCopyright:

Available Formats

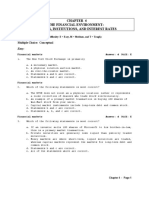

ABERCROMBIE NYSE-ANF

TIMELINESS

SAFETY

TECHNICAL

3

3

3

High:

Low:

Raised 10/2/09

31.3

8.0

RECENT

PRICE

47.5

16.2

33.8

15.0

33.7

20.7

36.9 RELATIVE

DIVD

Median: 16.0) P/E RATIO 1.58 YLD 0.9%

77.03 P/ERATIO 25.3(Trailing:

47.4

23.1

74.1

44.2

79.4

50.0

85.8

67.7

82.1

13.7

42.3

17.0

58.5

29.9

78.3

48.2

Target Price Range

2014 2015 2016

LEGENDS

8.5 x Cash Flow p sh

. . . . Relative Price Strength

2-for-1 split 6/99

Options: Yes

Shaded areas indicate recessions

New 11/20/98

Raised 7/29/11

BETA 1.15 (1.00 = Market)

2014-16 PROJECTIONS

VALUE

LINE

128

96

80

64

48

40

32

24

Annl Total

Price

Gain

Return

High 115 (+50%) 11%

Low

80

(+5%)

2%

Insider Decisions

to Buy

Options

to Sell

S

0

1

1

O

0

1

1

N

0

2

2

D

0

1

1

J

0

1

1

F

0

1

1

M

0

2

2

A

0

2

2

M

0

4

5

16

12

% TOT. RETURN 6/11

Institutional Decisions

3Q2010

129

to Buy

to Sell

135

Hlds(000) 93540

4Q2010

142

169

83979

1Q2011

141

175

85943

Percent

shares

traded

75

50

25

1 yr.

3 yr.

5 yr.

The Abercrombie & Fitch brand was es- 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

tablished in 1892 as a supplier of rugged 13.80 16.41 18.05 23.49 31.74 37.58 43.52 40.40 33.29 39.76 47.15 54.00

outdoor gear. In 1992, through the ex- 2.12 2.59 2.87 3.99 5.32 6.44 7.65 5.68

3.61

4.35

5.85

7.35

change of 43 million shares of Class B 1.65 1.94 2.06 2.50 3.75 4.59 5.20 3.05

.89

1.67

3.05

4.50

stock, Limited, Inc. repositioned the compa---.50

.60

.70

.70

.70

.70

.70

.70

.70

ny as a more fashion-oriented apparel busi- 6.02 7.71 9.21 7.78 11.34 15.92 18.78 21.06 20.78 21.67 23.35 26.45

ness. On September 26, 1996, an IPO of 98.90 97.27 94.61 86.04 87.73 88.30 86.16 87.64 87.99 87.25 87.00 87.00

8.05 million shares of Class A stock was 18.5 12.8 14.0 14.6 15.8 14.1 14.9 16.9

33.0

25.1 Bold figures are

Value Line

sold resulting in an 84.2% ownership by The

.95

.70

.80

.77

.84

.76

.79

1.02

2.20

1.62

estimates

Limited. Goldman Sachs led the spinoff on

---1.4%

1.0%

1.1%

.9%

1.4%

2.4%

1.7%

May 29, 1998 issuing .01367 of an Aber- 1364.9 1595.8 1707.8 2021.3 2784.7 3318.2 3749.9 3540.3 2928.6 3468.8 4100 4700

crombie share for each Limited share.

43.9% 44.7% 45.9% 50.2% 70.9% 71.0% 71.9% 73.1% 72.5% 70.4% 70.5% 71.0%

CAPITAL STRUCTURE as of 4/30/11

Total Debt $69.9 mill. Due in 5 Yrs $69.9 mill.

LT Debt $69.9 mill.

LT Interest $5.0 mill.

(4% of Capl)

Leases, Uncapitalized Annual rentals $331.2 mill.

No Defined Benefit Pension Plan

Pfd Stock None

Common Stock 87,667,424 shs.

as of 6/3/11

MARKET CAP: $6.8 billion (Mid Cap)

CURRENT POSITION 2009

2010

($MILL.)

Cash Assets

712.5

826.4

Receivables

90.9

81.3

Inventory (FIFO)

310.7

385.9

Other

121.8

139.7

Current Assets

1235.9 1433.3

Accts Payable

110.2

137.2

Debt Due

--Other

339.2

421.7

Current Liab.

449.4

558.9

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Sales

14.0%

Cash Flow

11.0%

Earnings

3.5%

Dividends

-Book Value

21.5%

Fiscal

Year

Begins

2008

2009

2010

2011

2012

Fiscal

Year

Begins

2008

2009

2010

2011

2012

Calendar

2007

2008

2009

2010

2011

4/30/11

741.8

83.2

358.4

156.1

1339.5

151.4

-340.4

491.8

Past Estd 08-10

5 Yrs.

to 14-16

9.0% 13.0%

2.5% 16.0%

-7.5% 26.0%

14.0%

3.0%

17.5% 13.0%

Full

QUARTERLY SALES ($ mill.)A

Fiscal

Apr.Per Jul.Per Oct.Per Jan.Per Year

800.2 845.8 896.3 998.0 3540.3

601.7 637.2 753.7 936.0 2928.6

687.8 745.8 885.8 1149.4 3468.8

836.7 875 1040 1348.3 4100

965 1010 1170 1555

4700

Full

EARNINGS PER SHARE AB

Fiscal

Apr.Per Jul.Per Oct.Per Jan.Per Year

.69

.87

.72

.78

3.05

d.26

d.09

.55

.68

.89

d.13

.22

.56

1.03

1.67

.27

.23

.75

1.80

3.05

.40

.55

1.20

2.35

4.50

QUARTERLY DIVIDENDS PAID D

Full

Mar.31 Jun.30 Sep.30 Dec.31 Year

.175

.175

.175

.175

.70

.175

.175

.175

.175

.70

.175

.175

.175

.175

.70

.175

.175

.175

.175

.70

.175

.175

(A) Fiscal year ends Saturday closest to January 31st of the following year. (B) Diluted earnings. Quarterly figures may not add to total due

to difference in share count. Excl. n.r. chg.: 04,

22.9%

491

168.7

39.0%

12.4%

241.6

-595.4

28.3%

28.3%

28.3%

--

23.2%

597

194.9

38.4%

12.2%

389.7

-749.5

26.0%

26.0%

26.0%

--

23.3%

700

205.1

38.8%

12.0%

472.7

-871.3

23.5%

23.5%

23.5%

--

24.1%

788

237.4

38.5%

11.7%

238.4

-669.3

35.5%

35.5%

28.5%

20%

24.4% 24.2% 24.6% 18.8%

851

944

1035

1125

342.2 422.2 475.7 272.3

39.2% 37.2% 37.4% 39.6%

12.3% 12.7% 12.7%

7.7%

455.5 581.5 597.2 635.0

--- - 100.0

995.1 1405.3 1618.3 1845.6

34.4% 30.0% 29.4% 14.1%

34.4% 30.0% 29.4% 14.8%

29.1% 25.7% 25.6% 11.5%

15%

15%

13%

22%

12.2% 13.3%

1096

1069

79.0 150.3

33.9% 34.3%

2.7%

4.3%

786.5 874.4

71.2

68.6

1827.9 1890.8

4.3%

7.9%

4.3%

8.0%

1.0%

4.7%

78%

41%

16.0%

1065

275

35.0%

6.7%

850

70.0

2030

13.0%

13.5%

10.5%

22%

18.0%

1080

400

35.0%

8.5%

950

70.0

2300

17.0%

17.5%

15.0%

15%

THIS

STOCK

VL ARITH.*

INDEX

121.1

13.4

30.7

35.8

51.3

50.6

VALUE LINE PUB. LLC

14-16

Sales per sh A

Cash Flowper sh

Earnings per sh AB

Divds Decld per sh D

Book Value per sh

Common Shs Outstg C

Avg Annl P/E Ratio

Relative P/E Ratio

Avg Annl Divd Yield

76.45

10.85

7.50

.84

42.35

85.00

13.0

.85

.9%

Sales ($mill) A

Gross Margin E

Operating Margin

Number of Stores

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Capl ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Capl

Return on Shr. Equity

Retained to Com Eq

All Divds to Net Prof

6500

72.0%

20.0%

1160

650

37.0%

10.0%

1700

Nil

3600

18.0%

18.0%

16.0%

11%

BUSINESS: Abercrombie & Fitch Company retails lines of mens,

womens, and childrens clothing. Operates under the names Abercrombie & Fitch, abercrombie, Hollister, and Gilly Hicks. Originally

established in 1892 to supply apparel for the rugged outdoors. Now,

the company is better known for its youthful, fashion-oriented

casual apparel. Basic apparel line includes jeans, T-shirts, knits,

and button-downs. Has 1,069 stores located in North America,

Europe, and Japan as of 1/29/11. RUEHL discontd in 2009. Has

about 85,000 empls. (incl. 9,000 full-time). Chrmn. & CEO: Michael

Jeffries owns 3.0% of common; other officers and directors, .7%

(5/11 proxy). Inc.: Delaware. Addr.: 6301 Fitch Path, New Albany,

Ohio 43054. Tel.: 614-283-6500. Internet: www.abercrombie.com.

Fiscal 2011 (began January 30th)

should be an excellent year for Abercrombie & Fitch. Share profit in the

opening quarter eclipsed our estimate of

$0.03 and the year-earlier loss of $0.13, on

a 22% sales advance. Comps were up

across all three major chainsAbercrombie

& Fitch, abercrombie kids, and Hollister.

International-based and online sales were

especially strong. Meanwhile, good expense leverage led to healthy margin performance. Except for the July period, prospects for the balance of the year should be

fairly positive, too. Thus, weve upped our

annual share-net target from $2.75.

Margins ought to pick up, despite

pressure from increasing product

costs and some other expenses. Higher

sourcing costs probably hurt the gross

margin in the second quarter. That, along

with store opening expenses associated

with the retailers global expansion strategy (more below), likely took a toll on the

operating margin. But the picture should

be rosier in the back half, as ANF raises

its prices to offset higher product costs,

though caution is needed to avoid pushing

customers away. Too, sales generated from

new stores and lower expenses from the

closure of 50 underperforming domestic

shops ought to help improve leverage.

International expansion remains a

key theme for this retailer, mostly to

compensate for the maturing domestic

business, where the store base is being

reduced. ANF continues to focus on expanding in markets throughout Europe

and Asia, where its brand is gaining

ground and growth opportunities are vast.

Five A&F flagship stores are on track to

debut

in

France,

Spain,

Belgium,

Germany, and Singapore; up to 40 Hollister shops are slated to open in Europe

and Asia. Latin America is another region

likely to be tapped a few years from now.

Neutrally ranked Abercrombie stock

has risen substantially since our May

review, reflecting investor enthusiasm

with the companys expansion plans. Indeed, international-based sales and a

growing online business should help the

retailer prosper over to mid-decade. But

wed defer commitments for now, as the

recent price discounts much of the growth

we foresee.

J. Susan Ferrara

August 5, 2011

$0.22; 05, $0.09. Excl. inc. (loss) from disc. Dividends historically paid mid- or late March,

ops.: 09, ($0.89); Q111, $0.01. Next egs. rpt. June, Sept., Dec. (E) Beginning FY05, data redue mid-Aug. (C) In millions, adjusted for stock flect new classification of cost of goods sold.

split. (D) Began paying dividends in 04.

2011, Value Line Publishing LLC. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscribers own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Companys Financial Strength

Stocks Price Stability

Price Growth Persistence

Earnings Predictability

A

40

55

45

To subscribe call 1-800-833-0046.

You might also like

- Citi - Auto ABS PrimerDocument44 pagesCiti - Auto ABS Primerjmlauner100% (1)

- NVRDocument125 pagesNVRJohn Aldridge Chew100% (1)

- Munger's Analysis To Build A Trillion Dollar Business From ScratchDocument11 pagesMunger's Analysis To Build A Trillion Dollar Business From ScratchJohn Aldridge Chew100% (4)

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Distressed Investment Banking - To the Abyss and Back - Second EditionFrom EverandDistressed Investment Banking - To the Abyss and Back - Second EditionNo ratings yet

- Ek VLDocument1 pageEk VLJohn Aldridge ChewNo ratings yet

- Global Crossing 1999 10-KDocument199 pagesGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- LPX 10K 2010 - Balance Sheet Case-StudyDocument116 pagesLPX 10K 2010 - Balance Sheet Case-StudyJohn Aldridge ChewNo ratings yet

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Eminence CapitalMen's WarehouseDocument0 pagesEminence CapitalMen's WarehouseCanadianValueNo ratings yet

- SGDE Example of A Clear Investment ThesisDocument10 pagesSGDE Example of A Clear Investment ThesisJohn Aldridge ChewNo ratings yet

- Hudsongeneralco10k405 1997Document149 pagesHudsongeneralco10k405 1997John Aldridge ChewNo ratings yet

- Idea VelocityDocument2 pagesIdea Velocitynirav87404100% (1)

- Complete Notes On Special Sit Class Joel Greenblatt 2Document311 pagesComplete Notes On Special Sit Class Joel Greenblatt 2eric_stNo ratings yet

- A Thorough Discussion of MCX - Case Study and Capital TheoryDocument38 pagesA Thorough Discussion of MCX - Case Study and Capital TheoryJohn Aldridge Chew100% (2)

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge Chew100% (4)

- WMT Case Study #1 AnalysisDocument8 pagesWMT Case Study #1 AnalysisJohn Aldridge Chew100% (1)

- Global Crossing 1999 10-KDocument199 pagesGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocument69 pagesCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- SGDE Example of A Clear Investment ThesisDocument10 pagesSGDE Example of A Clear Investment ThesisJohn Aldridge ChewNo ratings yet

- Special Situation Net - Nets and Asset Based Investing by Ben Graham and OthersDocument28 pagesSpecial Situation Net - Nets and Asset Based Investing by Ben Graham and OthersJohn Aldridge Chew100% (4)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- Problem 3Document3 pagesProblem 3Joyce GijsenNo ratings yet

- Wet Seal - VLDocument1 pageWet Seal - VLJohn Aldridge ChewNo ratings yet

- Sealed Air Case Study - HandoutDocument17 pagesSealed Air Case Study - HandoutJohn Aldridge ChewNo ratings yet

- 50 Yr Kodak - SRCDocument1 page50 Yr Kodak - SRCJohn Aldridge ChewNo ratings yet

- Tupper Ware 25 Yr ChartDocument1 pageTupper Ware 25 Yr ChartJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Global Crossing CS by Univ of EdinburghDocument35 pagesGlobal Crossing CS by Univ of EdinburghJohn Aldridge ChewNo ratings yet

- Liz Claiborne 10-K Jan 1 2000Document205 pagesLiz Claiborne 10-K Jan 1 2000John Aldridge ChewNo ratings yet

- Cornell Students Research Story On Enron 1998Document4 pagesCornell Students Research Story On Enron 1998John Aldridge Chew100% (1)

- Enron Case Study - So What Is It WorthDocument20 pagesEnron Case Study - So What Is It WorthJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Quinsa Example of A Clear Investment Thesis - Case Study 3Document18 pagesQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewNo ratings yet

- Anon - Housing Thesis 09 12 2011Document22 pagesAnon - Housing Thesis 09 12 2011cnm3dNo ratings yet

- Lecture 9 A Great Investor Discusses Investing in Retailers and ANNDocument18 pagesLecture 9 A Great Investor Discusses Investing in Retailers and ANNJohn Aldridge Chew100% (3)

- A Study of Market History Through Graham Babson Buffett and OthersDocument88 pagesA Study of Market History Through Graham Babson Buffett and OthersJohn Aldridge Chew100% (2)

- Great Investor 2006 Lecture On Investment Philosophy and ProcessDocument25 pagesGreat Investor 2006 Lecture On Investment Philosophy and ProcessJohn Aldridge Chew100% (1)

- Dividend Policy, Strategy and Analysis - Value VaultDocument67 pagesDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Enron Moral Hazard Case StudyDocument32 pagesEnron Moral Hazard Case StudyJohn Aldridge Chew100% (1)

- Coke 50 Year Chart - SRCDocument1 pageCoke 50 Year Chart - SRCJohn Aldridge ChewNo ratings yet

- Aig Best of Bernstein SlidesDocument50 pagesAig Best of Bernstein SlidesYA2301100% (1)

- Assessing Performance Records - A Case Study 02-15-12Document8 pagesAssessing Performance Records - A Case Study 02-15-12John Aldridge Chew0% (1)

- Value Investing (Greenwald) SP2018Document5 pagesValue Investing (Greenwald) SP2018YOG RAJANINo ratings yet

- The Future of Common Stocks Benjamin Graham PDFDocument8 pagesThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNo ratings yet

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Class Notes #2 Intro and Duff and Phelps Case StudyDocument27 pagesClass Notes #2 Intro and Duff and Phelps Case StudyJohn Aldridge Chew100% (1)

- ValueXVail 2013 - Chris KarlinDocument26 pagesValueXVail 2013 - Chris KarlinVitaliyKatsenelsonNo ratings yet

- Students Grilled On Their Presentations and Review of CourseDocument43 pagesStudents Grilled On Their Presentations and Review of CourseJohn Aldridge ChewNo ratings yet

- Rosenstein ValueInvestingCongress 100112Document42 pagesRosenstein ValueInvestingCongress 100112VALUEWALK LLCNo ratings yet

- A Comparison of Bubbles by John Chew - FinalDocument7 pagesA Comparison of Bubbles by John Chew - FinalJohn Aldridge Chew100% (1)

- Scion 2006 4q Rmbs Cds Primer and FaqDocument8 pagesScion 2006 4q Rmbs Cds Primer and FaqsabishiiNo ratings yet

- Coors Case StudyDocument3 pagesCoors Case StudyJohn Aldridge Chew0% (1)

- Arlington Value 2006 Annual Shareholder LetterDocument5 pagesArlington Value 2006 Annual Shareholder LetterSmitty WNo ratings yet

- Greenhaven+Q1 2015 FINALDocument15 pagesGreenhaven+Q1 2015 FINALPradeep RaghunathanNo ratings yet

- Arlington Value 2014 Annual Letter PDFDocument8 pagesArlington Value 2014 Annual Letter PDFChrisNo ratings yet

- Tobacco Stocks Buffett and BeyondDocument5 pagesTobacco Stocks Buffett and BeyondJohn Aldridge ChewNo ratings yet

- CA Network Economics MauboussinDocument16 pagesCA Network Economics MauboussinJohn Aldridge ChewNo ratings yet

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge ChewNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital ManagementscottleeyNo ratings yet

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementFrom EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementNo ratings yet

- Wall Street Research: Past, Present, and FutureFrom EverandWall Street Research: Past, Present, and FutureRating: 3 out of 5 stars3/5 (2)

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Competitive Advantage in Investing: Building Winning Professional PortfoliosFrom EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Chapter 20 - Margin of Safety Concept and More NotesDocument53 pagesChapter 20 - Margin of Safety Concept and More NotesJohn Aldridge Chew100% (1)

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- Tow Times Miller IndustriesDocument32 pagesTow Times Miller IndustriesJohn Aldridge ChewNo ratings yet

- Coors Case StudyDocument3 pagesCoors Case StudyJohn Aldridge Chew0% (1)

- Niederhoffer Discusses Being WrongDocument7 pagesNiederhoffer Discusses Being WrongJohn Aldridge Chew100% (1)

- SNPK FinancialsDocument123 pagesSNPK FinancialsJohn Aldridge Chew100% (1)

- Sees Candy SchroederDocument15 pagesSees Candy SchroederJohn Aldridge ChewNo ratings yet

- Economies of Scale StudiesDocument27 pagesEconomies of Scale StudiesJohn Aldridge ChewNo ratings yet

- Global Crossing CS by Univ of EdinburghDocument35 pagesGlobal Crossing CS by Univ of EdinburghJohn Aldridge ChewNo ratings yet

- WalMart Competitive Analysis Post 1985 - EOSDocument3 pagesWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewNo ratings yet

- GLBC 20000317 10K 19991231Document333 pagesGLBC 20000317 10K 19991231John Aldridge ChewNo ratings yet

- CA Network Economics MauboussinDocument16 pagesCA Network Economics MauboussinJohn Aldridge ChewNo ratings yet

- Prof. Greenwald On StrategyDocument6 pagesProf. Greenwald On StrategyMarc F. DemshockNo ratings yet

- Five Forces Industry AnalysisDocument23 pagesFive Forces Industry AnalysisJohn Aldridge ChewNo ratings yet

- Tobacco Stocks Buffett and BeyondDocument5 pagesTobacco Stocks Buffett and BeyondJohn Aldridge ChewNo ratings yet

- Quinsa Example of A Clear Investment Thesis - Case Study 3Document18 pagesQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewNo ratings yet

- Burry WriteupsDocument15 pagesBurry WriteupseclecticvalueNo ratings yet

- Dividend Policy, Strategy and Analysis - Value VaultDocument67 pagesDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewNo ratings yet

- Capital Structure and Stock Repurchases - Value VaultDocument58 pagesCapital Structure and Stock Repurchases - Value VaultJohn Aldridge ChewNo ratings yet

- Charlie Munger - Art of Stock PickingDocument18 pagesCharlie Munger - Art of Stock PickingsuniltmNo ratings yet

- Greenwald Class Notes 6 - Sealed Air Case StudyDocument10 pagesGreenwald Class Notes 6 - Sealed Air Case StudyJohn Aldridge Chew100% (1)

- Ia Assignment 3Document3 pagesIa Assignment 3Resty VillaroelNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- The Financial Environment: Markets, Institutions, and Interest RatesDocument2 pagesThe Financial Environment: Markets, Institutions, and Interest RatesKristel SumabatNo ratings yet

- Indiabulls SC WritDocument180 pagesIndiabulls SC WritVignesh Faque JockeeyNo ratings yet

- Name of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)Document2 pagesName of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)pranab_nandaNo ratings yet

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangNo ratings yet

- BSE SENSEX - Wikipedia, The Free EncyclopediaDocument13 pagesBSE SENSEX - Wikipedia, The Free Encyclopediaviswadutt100% (1)

- Hhtfa8e ch01 SMDocument83 pagesHhtfa8e ch01 SMkbrooks323No ratings yet

- LMGT 2330-7426 Exam 2 12S1Document4 pagesLMGT 2330-7426 Exam 2 12S1Lisa NguyenNo ratings yet

- Olam Annual Report 2014 PDFDocument210 pagesOlam Annual Report 2014 PDFHimanshu KakkarNo ratings yet

- KLG Presentation Oct08Document26 pagesKLG Presentation Oct08Rizky RizNo ratings yet

- RM Gtu TheoryDocument4 pagesRM Gtu TheoryAtibAhmedNo ratings yet

- Stock Market Trends and Investment PatternDocument112 pagesStock Market Trends and Investment PatternArvind MahandhwalNo ratings yet

- Ogbeibu Samuel Accounting Assignt (1) AMENDEDDocument14 pagesOgbeibu Samuel Accounting Assignt (1) AMENDEDSammy OgbeibuNo ratings yet

- 7110 s11 QP 12Document12 pages7110 s11 QP 12mstudy123456No ratings yet

- Acct3102 Chapter 14Document11 pagesAcct3102 Chapter 14monikademonisiaNo ratings yet

- Elliott WaveDocument24 pagesElliott WavejrladduNo ratings yet

- Syllabus Economics CraigDocument13 pagesSyllabus Economics CraigPrashuk JainNo ratings yet

- Victoria Chemicals Part 1Document2 pagesVictoria Chemicals Part 1cesarvirataNo ratings yet

- Department of Management Secretarial Practice Class: II BBA Time: 3 Hours Sub Code: SABA41 Mark: 75 Part A (4x1 4 Marks) Choose The Correct AnswerDocument2 pagesDepartment of Management Secretarial Practice Class: II BBA Time: 3 Hours Sub Code: SABA41 Mark: 75 Part A (4x1 4 Marks) Choose The Correct AnswerpremNo ratings yet

- Unpaid Unclaimed Dividend IEPF 1Document46 pagesUnpaid Unclaimed Dividend IEPF 1kaminiNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- TWC LetterDocument2 pagesTWC LetterZerohedgeNo ratings yet

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Ch05 Bond Valuation SoluationsDocument6 pagesCh05 Bond Valuation SoluationsSeema Kiran50% (2)