Professional Documents

Culture Documents

5&6

5&6

Uploaded by

syraCopyright:

Available Formats

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Activity 1Document5 pagesActivity 1Jules AguilarNo ratings yet

- Practice Problem 11.0: Name Date Course/Year ScoreDocument5 pagesPractice Problem 11.0: Name Date Course/Year ScoreCatherine GonzalesNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Assess II Act CreatingDocument15 pagesAssess II Act CreatingBrian GoNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- 4Q Week 2 BK Group ActDocument11 pages4Q Week 2 BK Group ActReymsoNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Sample Worksheet K204050266 P3.5Document16 pagesSample Worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Entries 1Document1 pageEntries 1DreahNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument3 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Exercises On Accounting CycleDocument7 pagesExercises On Accounting CycleXyriene RocoNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Acctg Assginment 4 Adjusting EntriesDocument3 pagesAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Midterms Solutions - Pre-Test, SW, Assignment, DiscussionDocument12 pagesMidterms Solutions - Pre-Test, SW, Assignment, DiscussionGianna ReyesNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Date Account Titles and Explanation PR Debit Credit: Quiz Module 6Document16 pagesDate Account Titles and Explanation PR Debit Credit: Quiz Module 6fabyunaaaNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Assignment # 2Document8 pagesAssignment # 2Usman KhanNo ratings yet

- CH 2 Answers PDFDocument5 pagesCH 2 Answers PDFLian Blakely CousinNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewUyenNo ratings yet

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjianneNo ratings yet

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyNo ratings yet

- Dormitory Locators Journal Entries Date Accounts and Explanation Debit CreditDocument3 pagesDormitory Locators Journal Entries Date Accounts and Explanation Debit CreditEunice FulgencioNo ratings yet

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- Journal EntriesDocument3 pagesJournal EntriesAbigail RososNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Kertas Kerja SeptaDocument6 pagesKertas Kerja Septasafrudin250574No ratings yet

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Document9 pagesAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Maketh.ManNo ratings yet

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- Seminar3 Accrual Accounting and IncomeDocument4 pagesSeminar3 Accrual Accounting and IncomeThomas ShelbyNo ratings yet

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Estefanie Calamba 2Document13 pagesEstefanie Calamba 220 Ceralde Claire AlexaNo ratings yet

- ACC311 November 2018Document5 pagesACC311 November 2018Sunday NgbokiNo ratings yet

- Chapter 4, Accounting CycleDocument23 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- Mock 1 Mid-Term Exam (Answers and Explanations)Document8 pagesMock 1 Mid-Term Exam (Answers and Explanations)100519554No ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Long Exam Part 1Document11 pagesLong Exam Part 1yuwimiko27No ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- The Accounting ProcessDocument5 pagesThe Accounting ProcessXienaNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Your Financial Action Plan: 12 Simple Steps to Achieve Money SuccessFrom EverandYour Financial Action Plan: 12 Simple Steps to Achieve Money SuccessNo ratings yet

- The Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRAFrom EverandThe Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRANo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

5&6

5&6

Uploaded by

syraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5&6

5&6

Uploaded by

syraCopyright:

Available Formats

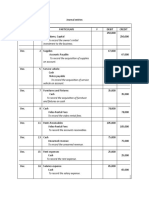

EXERCISE 5

Dec. 31

a. Interest Receivable 25.33

Interest Income 25.33

To record receivable from customers

b. Interest Expense 1,875

Interest Payable 1,875

To record interest due to BPI

c. Lease Income 566,666.67

Unearned Lease Income 566,666.67

To record for the unearned lease income

d. Insurance Expense 4,000

Prepaid Insurance 4,000

To record the expired insurance

e. Merchandise Inventory, ending 90,000

Income Summary 90,000

To record goods on hand

EXERCISE 6

a.

Dec. 31 Rent Expense 15,000

Rent Payable 15,000

b. RENT EXPENSE

Dec-31 15,000

RENT PAYABLE

Dec-31 15,000

c.

Jan. 5 Rent Payable 15,000

Cash 15,000

d. RENT EXPENSE

Dec. 31 15,000

RENT PAYABLE

Jan. 5 15,000 Dec. 31 15,000

CASH

Jan. 5 15,000

e. The rent expense in the income statement and the accrued rent in the statement

of financial position will now be zero (0) or non

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Activity 1Document5 pagesActivity 1Jules AguilarNo ratings yet

- Practice Problem 11.0: Name Date Course/Year ScoreDocument5 pagesPractice Problem 11.0: Name Date Course/Year ScoreCatherine GonzalesNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Assess II Act CreatingDocument15 pagesAssess II Act CreatingBrian GoNo ratings yet

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- 4Q Week 2 BK Group ActDocument11 pages4Q Week 2 BK Group ActReymsoNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Sample Worksheet K204050266 P3.5Document16 pagesSample Worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Entries 1Document1 pageEntries 1DreahNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument3 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Exercises On Accounting CycleDocument7 pagesExercises On Accounting CycleXyriene RocoNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Classwork 1Document4 pagesClasswork 1Shana VillamorNo ratings yet

- Acctg Assginment 4 Adjusting EntriesDocument3 pagesAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Midterms Solutions - Pre-Test, SW, Assignment, DiscussionDocument12 pagesMidterms Solutions - Pre-Test, SW, Assignment, DiscussionGianna ReyesNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Date Account Titles and Explanation PR Debit Credit: Quiz Module 6Document16 pagesDate Account Titles and Explanation PR Debit Credit: Quiz Module 6fabyunaaaNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Assignment # 2Document8 pagesAssignment # 2Usman KhanNo ratings yet

- CH 2 Answers PDFDocument5 pagesCH 2 Answers PDFLian Blakely CousinNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewUyenNo ratings yet

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjianneNo ratings yet

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyNo ratings yet

- Dormitory Locators Journal Entries Date Accounts and Explanation Debit CreditDocument3 pagesDormitory Locators Journal Entries Date Accounts and Explanation Debit CreditEunice FulgencioNo ratings yet

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- Journal EntriesDocument3 pagesJournal EntriesAbigail RososNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Kertas Kerja SeptaDocument6 pagesKertas Kerja Septasafrudin250574No ratings yet

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Document9 pagesAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 2Maketh.ManNo ratings yet

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- Seminar3 Accrual Accounting and IncomeDocument4 pagesSeminar3 Accrual Accounting and IncomeThomas ShelbyNo ratings yet

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Estefanie Calamba 2Document13 pagesEstefanie Calamba 220 Ceralde Claire AlexaNo ratings yet

- ACC311 November 2018Document5 pagesACC311 November 2018Sunday NgbokiNo ratings yet

- Chapter 4, Accounting CycleDocument23 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- Mock 1 Mid-Term Exam (Answers and Explanations)Document8 pagesMock 1 Mid-Term Exam (Answers and Explanations)100519554No ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Long Exam Part 1Document11 pagesLong Exam Part 1yuwimiko27No ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- The Accounting ProcessDocument5 pagesThe Accounting ProcessXienaNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Your Financial Action Plan: 12 Simple Steps to Achieve Money SuccessFrom EverandYour Financial Action Plan: 12 Simple Steps to Achieve Money SuccessNo ratings yet

- The Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRAFrom EverandThe Insider's Guide to Tax-Free Real Estate Investments: Retire Rich Using Your IRANo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet