Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

41 viewsFM Chart Book

FM Chart Book

Uploaded by

abhishekkapse654Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Taxation Sec B May 2024 1703584499Document8 pagesTaxation Sec B May 2024 1703584499abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703584210Document6 pagesTaxation Sec B May 2024 1703584210abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703584298Document6 pagesTaxation Sec B May 2024 1703584298abhishekkapse654No ratings yet

- Audit Chap-6 Short NotesDocument1 pageAudit Chap-6 Short Notesabhishekkapse654No ratings yet

- As 19Document8 pagesAs 19abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703583896Document15 pagesTaxation Sec B May 2024 1703583896abhishekkapse654No ratings yet

- Day 5Document7 pagesDay 5abhishekkapse654No ratings yet

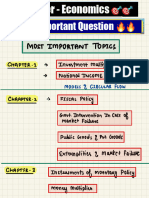

- Economics Important QuestionsDocument4 pagesEconomics Important Questionsabhishekkapse654No ratings yet

- PDF 167984100250523Document1 pagePDF 167984100250523abhishekkapse654No ratings yet

- Law120230912 13.6.41Document5 pagesLaw120230912 13.6.41abhishekkapse654No ratings yet

- EIS Mentor N23Document308 pagesEIS Mentor N23abhishekkapse654No ratings yet

- Dividend Short NotesDocument1 pageDividend Short Notesabhishekkapse654No ratings yet

FM Chart Book

FM Chart Book

Uploaded by

abhishekkapse6540 ratings0% found this document useful (0 votes)

41 views36 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

41 views36 pagesFM Chart Book

FM Chart Book

Uploaded by

abhishekkapse654Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 36

PREFACE

To all readers,

Tam proud to present this Book along with Team Expert. I have spent time writing this with a student

perspective in mind. Each chapter has broken down core concepts and expanded on them with diagrams and

tables, as and whien possible, It is my goal to help each and every folder of this book to be able to fight against

the ods and win. Victory presents itself with the backing of knowledge, practice and expertise.

This book provides a valuable window on the subject and covers the necessary components chapter By

chapter. The challenges in this subject are Goth difficult and interesting.

People are working on them with enthusiasm, tenacity, and dedication to develop new methods of analysis

and provide new solutions to Keep up with the ever-changing threats. In this new age of global interconnectivity

and interdependence, it is necessary to stay relevant, for both professionals and students,

This book is a good step in that direction and would not have been possible without my team, my colleagues, my

students and everyone that fias supported me in my journey as a CA professional. For any feedback or questions

based on the material covered within the book, please fee fre to contact me-via email,

(CA Prashant Sarda

© caprashantsarda@gmail.com

8007766008

About the Author:

FIRST in Nanded district and 10" in LATUR Board in XI commerce

45 AIR 11 at CA Foundation level

#5 “The Best Paper Award” for Economics at CA Foundation level

# Recipient of ‘Dhirubhai Ambani Scholarship “for 3 years

4 15+ years of teaching experience

Special Thanks

Rohini Bhosure, Divya Gandhi Ria Shah

Designed By : Jasmin Tamboli & Mayur Dhanwani

CAPITAL STRUCTURE

festa re

MANAGEMENT OF WORKING CAPITAL

CAPITAL BUDGETING

Congratulations to Stars of CA, Prashant Sarda's Intermediate FM:

Rekha Sutar ~ All India 1* Ranker

> Abhijeet Mutha — All India 14" Ranker

>Purva Katariya — Alll India 17" Ranker

Harsha Bhattad- All India 23" Ranker

» Ameya Vaze- 92 Marks

> Atul Pandit- 90 Marks

>Mayuri Katare-89 Marks

» Shipchandler Khuzema- 89 Marks

>Purva Darda- All India 32” Ranker

>Madhu Hiremath ~ All India 32% Ranker

>Harshada Bhatawdekar ~ Alll India 38” Ranker

>Sumit Agrawal — All India 38” Ranker

>Shraddha Somani ~ Alll India 39" Ranker

> Juhi Munot ~ All India 39” Ranker

>Kedar Kale ~ All India 49 Ranker

> Tamanna Mali- 87 Marks

Renu Mulay - 85 Marks

>Naman Oswal - 85 marks

> Akash Mehta — 84 Marks

>Tanveer Kaur- 82 Marks

> Aditya Mehta- 81 Marks

> Ameya Limaye- 81 Marks

>Hrishikesh Chauvan- 80 Marks

> Gurpreet Singh — All India 23 Ranker >& many more...

> Devashish Kannawar — All India 49" Ranker

[Feo wan asrccrs or rimanciat wanacement

Etfectve Utlzation af Funds

‘CA Prashant Sarda

Long term

objective

Short term

objective

Maximizing profits

of firm

Pentel © Lene“ hue fA" keene

ALC uy Cen)

Sonne)

does not consider the affect of future Itrecognses effete ofall future cash

cash flows, dividend decisions, EPS ete low, dividends, EPS ete

prot 28 Afi with wealth maximisation

objective may pay regular dividends

tolte Sharonaters

1ognses time pattern of return

oc on shor dine Focus on Masham Long Tr Ssmaamenemnonbmrcoasts

ope ae recognises he riokroun Retort, |

Is comparatively easy o determine he offers no lear r specie relationship tar Sanna Nes att

taatonanp betean fal Tetveon trancisdeesion and Sect memete cee rtrs

decision and profits. ‘share market price. Ess Cae ee dos

Lads to systematics decisions using the Toso ura

tools and techniques of capital budgeting,

(@) postponing repacement expenditure Risk Return Trade-off, Leverage Effet ot,

Fee

‘Thr or varus foun the pic othe red see eran te snp 9. fw ote labore, heh tobe Hanapedby on rparaaien an acontmuns be es, the

Fisher dc agar hohe nse ond fib co eew et nearer alt of : ath rd rotor wi pute he

fem alte above oar are rt sl monogram reste usten wou ane nara ase 0 pon ce caus aa fry enasenue et al

‘rem sbigton

Stuer lang paral fray ave sat ve many ne pi ue thn ma peer shan eerie trav the sation,

fers be se oats and ay become alert hsouaney bay rs aly fae to peywato dabs ond ar coon hana ate

Join us - (G) iamprashantsarda| (J tme/caprashantsarda | @/@) carrashantsarda 2

Cee

comerinon

© caprashantsarda@am:

‘As the name suggest,

“worth of a rupee received today is different from

the worth of a rupee to be received in future.”

Reasons for time preference of money (Relevance of Time Value of Money)

> Risk © Preference of present consumption

“® Investment opportunities _-® Inflation

varies

Sa eres

“ aie

rian Rey os Grrr ncion

ei

ey

join us - (G) iamprashantsarda| (J tme/caprashantsarda | € / @) carrashantsarda

ec Gz

Operating Leverage or Degree

‘oF eperating Leverage (DOL)

‘Combined Leverage or Dagree

of combined Leverage (O81)

Taking advantage of both nant

BT iree

reonturerinenneny

Cee

king advantage of

pm ro

Pentel © Leni“ hur fA" keene

oan

Cece)

rooney

Cee

‘CA Prashant Sarda

CE CUCL DRACO

‘STANDPOINT FoR YOUR DESTINY

(Se oT Fa Sonne a

cs CA-G TE

Carts | DOL = impacie of steal by FLT

coast : CA GATE Test Series

Prato een For Test Syllabus & Other Details

Contact No. 7888066008

Email Id - info@cagate in

. For Video Lectures, Pendrives & Test Series visit

Follow us on : WWW.MYEDUNEEDS.COM

Youu } Expert Academy, Office No. SB, 2nd Floor,

Prestige Point, Bajirao Road, PUNE -

411002

CA PRASHANT SARDA

Join us - (G) iamprashantsarda| (J tme/caprashantsarda | @P/@) carrashantsarda 5

QD Rt a ty Caan oaetpie

Comer

Eee

eGo CA Prashant Sarda

TT

- Nature of Industry (small / large scale)

‘¢ Capital structure as the name says, itis the structure of,

capital chosen by a company.

— Gestation period (Time required to settle the business)

+ Certainty of profits (more - debt & less - equity)

‘= It refers to the mix of sources from where the long term

funds required in a business may be raised.

+ Quantum of Return on Investment

(ROI to be compared to cost of funds) «= In other words, it refers to proportion of debt, preference

— Lending policy of bank (liberal strict) capital and equity capital.

+ Monetary and fiscal policy of govt

CAPITAL STRUCTURE

‘Moderate | Moderate | Notdiluted Structure Structure

Highest | Lowest | Notailuted When cost of funds

Wafer rom company to company. neal ite)

te minimum and || appropriate capt structure more relevant.

eam || Major feature

Fees atzo || 1)Profitaitty 2)Flexibitty 3) Conservation

maximum. 4) Solvency 5) Control

join us - (Q) iamprashantsarda| €) t.melcaprashantsarda | €)/@ carrashantsarda 6

‘CA Prashant Sarda

een

Peat bananas

Renee

Flexibility

eeu)

Ce

Join us - (G) iamprashantsarda| (J t.meicaprashantsarda | @/@) carrashantsarda 7

CAPITAL STRUCTURE

ails}

Soe

Peery

Pernt

Petes

( (NI) approach

ar ome

|Miller (MM) approach

TRADITIONAL THEORY

1) Kd ig always

Hess than Ke

2) Kd and Ke vary with

change im debt equity

Cost of capital

2) Ke Is more steoper

y and higher: ‘than

increase inka

x

Debt / Equity Mix

General Assumpti

eran

Neer

Cee

Cee

4) Only two sources of fund i.e, debt and equity

2) No change in total capital employed

3) Capital structure can be changed

4) No retained earnings

5) No losses

66) No change in fixed cost of operations

7) No taxes.

8) No difference in investors expectations

Rane huaeo rnd

Assumptions Diagram Steps

© iamprashantsarda| J tmelcaprashantsarda | €)/@) carrashantsarda 8

Assumptions: Diagram

4) Kis always less than Ke

2) Kd remains constant at ll

cry

Coe

eee rae

Steps

Jt

(Veer

2) EBT = EBIT Interest

MODIGLIANI & MILLER APPROACH

yea: Cepmr¥.4

3) Value of Fem (V) =

4) Value of Debt (0)

5)S=V-D

4) Markt captaliss value of

firm a8 a whole without

lving any importance to

Gee

{__,,

Debt/Equity Mit

4) kis always less than Ke

2) Kd remains constant at all levels of debt-oquity mix

43)ke increases as debt content increases.

{4) Market capitalises value of frm as a whole without any importance to

debt-quity mix

‘5)Capital Market is perfect, investors are free to buy or sell securities, no

transaction cost, investors can personally borrow without restrictions on

‘same terms as the firms do,

66) Same risk class classification -if2 firms have same capital employed and

‘same EBIT.

<

Cost of capital

a

Debt/ Equity Mix

“this theory is a copy of

NO! Approach

~Adaltionally it states

‘that

{a} If2 firms belong to same

risk class ie, thoir

‘capital employed is same

‘and their EBIT is also

‘same, then thelr market

price per share should

also be the same.

(b) fat any moment, the

market price per share is

not same, arbitrage

process will make it

Fite © Lene “hue fA" heuer me

)DIGLIANI & MILLER Neer

FXO ON AU,

1) Value of levered company =

Value of an unievered company oes

PV of Interest Taxshield

or,

Vg=Vu+TB

{i) Cost of Equity in a levered

Financial Indifference

company (Keg) = BEP Point

Debt

Kou + (eu Ka) aay y

EDs eae ey

—> tis cost of raising an

additional rupee of capital.

—P> The word marginal means Let the EBIT be for plan A and Plan B,

additional. Lot the EBIT be" Plan A Plane

> We compute cost of only (Ke Intrest)(1=1)-PD _ | (X-tnorost)(1-1) PO. __(K- Interest (1 -1)-PD

additional / New capita. No. of equity shares ‘No. of equity share No. of equity shares

© iamprashantsarda| J t.melcaprashantsarda | P/Q carrashantsarda 10,

Itrefers to the idea that a company chooses how much debt financt

how much equity finance to use by balancing the costs and benefits,

Itprimarity deals withthe two concepts -cost of financial distross and

agency costs.

It states that there Is an advantage te financing with debt, the tax

benefits of debt and there is @ cost of financing with debt, the costs of

bankruptcy costs of debt and non-bankruptcy costs,

financial distress

smanding terms, bondholderistockholder

like staff leaving, supplier's

power struggle, etc),

Marginal benefit of further increase In debt declines as debt increases,

the marginal cost increases, $0 that afirm that is optimizing its

‘overall value will focus on this trade-off when choosing how much dé

and equity to use for financing.

‘These disputes generally give birth to agency problems that in turn give

rise to the agency costs

1ey costs may affect the capital structure ofa firm. There may be

two types of conflicts -shareholders-manager conflict and

fobt holders contlict.

The:

shareholder

Pentel © Lene“ ure fA" keene

[oery

Cece)

Co

The introduction of a dynamic Trade- off theory of capital

structure makes the predictions of this theory alot more

accurate and thoughtful ofthat in practice,

ree oma

20d on Asymmetic Information, whieh

‘fore tos stuation In which ferent parse

have diferent information,

Pecking order theory suagests that managers

‘may une various sources for rising of fan in

‘he Yllowing order = intemal

=

4) Use internal financing first.

2) Issue debt next

23) Issue of now equity shares at last

14

Cee

Eee

QD CHAPTER-4- COST OF CAPITAL fl en aaa Poe

£ t

Cost of Debt (k,) Cost of Preference Share (K,) ‘CA Prashant Sarda

lrredeemabte Debt lredeamable Cost of External Equity

Praterence hi (hah iseue of Eeuiny Cost of Retained eaming (Kr)

Ke f + +

Keats

Ke (tp)

Rao Kena aemiahes

Redeemable Preference

‘Share ee

t

k,n HG9+ RV_NPI, D+ (RV NPB 199

. RV = NPVI2 With growth | without growth

(tap) ator personal tax

t + t + t

Dwain eponen Steines? gama ce Anosh) faring Pee, | Rae Apache rg

EES EPS, Der Fi,

p10 x FS sgh RR 0 K=R+ BIRR)

tedemable value Pie cument market price| _P,

PD, = Preference dividend BisDiidendintimet |

y= Dividend of Next year (ea.enaney * .

or) (ogee ae) R

(R= Maret Risk Premium

Fite © Lene“ hureae en fA" keue me>

WEIGHTED AVERAGE ren

COST OF CAPITAL (WACC) Coe)

Qa en

‘CA Prashant Sarda

Using Book value weights

“ua wit sad rs carved rom book || Twos ved ar ded rom

> usetintven aces cturaneee’ | [> yaa amen souesortnanes a

porbcote of account eee

“Aes cles wie erat vain) Lp Abays colt wis for waa

ae ataee| cece ene

See) Fcenteeet aerate eer

of WACC or K,

; Book value or|Proportion | Individual cost Product

Source of Finance | “Market Value (%) ofcapital | (Prop. x Individual Cost)

Equity capital wi ke kex W1

Preference Capital w2 kp kpx W2

Retained earning* w3 kr krx W3

Debt w4 kd kdx W4

Total Total of above K, = WACC

‘Note : In case of book value method, we consider retained earnings but in case of market value method,

retained earnings are considered only when Kr is not equal to Ke.

© iamprashantsarda| J t.melcaprashantsarda | P/Q carrashantsarda 13,

remy Cer

| + Notattectedby accounting poiies Market valves 3

Untstedtcompanies

not available for

Not reliable when shares are not

setvaly traded

| consistent with definition of cst of nd are afected by speculations.

capital Le, to manta market value

‘ot ahares, cot of eaptal rate of

fatum should be earned by company.

Lotrue reflection of firm's capital

aay Ono ey

Advantages Disadvantages,

Affected by accounting plies.

Firm sts thelr capital structure in tors of

book value

Does not truly reprsent the

‘opportunity cost of capital

Caleulations ar sim

Less uctuations in book value

Useful when markst prices are not

aval

Many investors uso book value walghts for

thelr analysis,

[ey

Cece)

Ce

‘CA Prashant Sarda

{@. WHAT DO YOU UNDERSTAND BY CAPITAL.

‘STRUCTURE? HOW DOES IT DIFFER FROM

FINANCIAL STRUCTURE?

‘Ans: Capital structure refers tothe combination of debt

‘equity which a company uses t finance Is long

term operations ts the lng term financing of the

‘company representing long term source of capital

‘owner's equity and fong term debts but

fxcludes current lables,

“Whereas nancial structure isthe entire lft hand

sid of Balance sheet representing all the long

{erm and short term sources of capital,

‘Thus we may say capital structure is only # part of

financial structure

Joinus - () iamprashantsarda| (J tme/caprashantsarda | @/@) carrashantsarda 14,

CHAPTER-S~ MANAGEMENT OF WORKING CAPITAL

== The Working Capital as the nam

forday today working of company.

Suggests is the capital required

‘= We estimate the working capital so that required working capital in

company shouldbe sufficient for coming period,

= Theworking capital can be estimated as:

oan

cry

Cee

Ce eee

‘CA Prashant Sarda

Particulars:

‘Computation.

[current Assets

Raw matria stock

WAP, Stock

Finished good stock

Sundry debtors

Cash Bank balance

Raw material

ater

Sub-Total A

‘Curent Liabilties

“Trade Creditors

‘outstanding wag

Outstanding overheads

Net Working Capital 3)

Note: tf nothing is given always assume WIP is complate 100% w.8 raw material & 50%

Wirt conversion cost Le, wages and overheads

Deak ka

Based on concept

‘Time with growah in sales

Joinus - () iamprashantsarda| (J tme/caprashantsarda | P/Q carrashantsarda 15,

WORKING

Conservative

‘Approach

Higher level of

Investment in CA,

Le. more liquidity,

lesserrisk

and lessor profits

ee

ITO

ITAL

loderate

Approach

Moderate or

reasonable investment

In Ale, moderate

liquidity, moderate risk

and moderate profs.

Lesser level of

investment in C.A.

‘ee lesser liquidity,

higher risk and

higher profs.

UA ota

Level of Investment

Conservative)

policy

psu

we + |, Literest

Profit)

Moderat

Liquiait

Policy 4

Moderate

We Loan|

Moderate

Profit

Moder

‘Aggressive

Poliey [> Hawley)

we

Loan:

Profit?

Anite © Lene “Lurene tPA" keene

ere

Cec

Cer

<

Moderate

inca.

‘Aggressive

‘Output

‘APPROACHES FOR WC ESTIMATION

Total Gross Approach

Consider al costs ie, casi

and'non eash expenses also)

Cash Cost Approach

ust chango in approach only 3 components will change

Yor working capital estimation viz, WP stock, finished

(oeds stock and debtors,

sororities aunty tr

7

CONCEPT OF OPERATIN

‘materials, WP, finished goods, debtors and thereat

1 ano oxplainedthrough tho following dagram:»

(Gross operating =RM storage period +

Cea I ods

Lerner

Pen ry

eee

Net Operating Cycle = Gross oporating cycle

+ Creditors payment period

365 Days

Wet Operating Cycle Period

@ wf

X Net Operating Cycle Period

Sates

Working capital required

(Ged of normal approseh! — 365

Working capital required Cash Costof Sales

{Dine on cn coo apron

x Net Operating Cycle Period

Cash Cost of Sales

No, of eperating cycles per annum

Components of operating cycle canbe calcul

‘Avg. stock of Raw Marais

‘Reg cost of RW consumed day

‘vg stock of WIP

Rag cost of Production aay

3) FG. storage pevod= Ava stock of 6

" 1 Pero cost of goods sold aay

‘Avg. Accounts Racevable

‘Avg. Credit Sales [aay

‘Avg. Accounts Paya

‘aug. Creat Purchases day

1) Raw material storage period =

2) WLP storage period

4) Debtors collection period

Cine

Cece

Coe

Pe

arse

w

Gouna

Production policy (Production? = WC")

reduction process (Labour intens

Length of manufacturing process (Length t= WC")

[Nature of business (Manufacturing = WC)

Credit potcy towards Debtors (Liberal! = WC")

Market standing (Newly stated = WC")

Inventory policy (High storage = WC)

Market conditions (Buyer's market = WCT)

Inflationary conditions hifaionary condition = WC")

Business Cycle (Peak or boom conditions = WC1)

FUNCTIONS OF TREASURY MANAGEMENT

‘cash management (by forecasting cash requirements)

‘Currency management (mainly for imports & exports)

Financing management. (capital structure)

Bank Liston (for borrowing at cheapest possible cos)

Corporate Finance (for raising of funds)

CO OT)

the maximum amount of ance given from banker’ side fr financing

working capital of company.

‘Thar are 3 methods for computing MPBF given by tandon committee are:

75% of (CA-CL)

(73% ofca) «cL.

I) (75% of uctuating CA) - CL (where fluctuating CA= Total CA-Core CA)

ent el © Lemieeen “ hurieeeenn fA" kere ane

CU (Cline

Cece)

FACTORS TO BE ANALYSED BEFORE Ceo

CREDIT IS GRANTED TO A CUSTOMER eee ee

‘CA Prashant Sarda

BNC noch

VARIOUS SOURCES OF CREDIT

RATING ee

> Trade refrences

| Bank references

| creat nuteau reports (Specialised agency to provide creat information)

Past experiences in dealing

Published nancial statment, (in case of puble Ra. companies)

Salesman’ interview and report.

EEUEEVE E)EE (EE

EEUEEVE EU EE IEE

COST OF MAINTAINING RECEIVABLES

> interest on investment nance cost (or Vc, and FC Le, Total cost)

[> aaministraton cost (Keeping records, ete) ‘Select the policy with higher net benefit

[+ betinquency cost raminders, phone, calls, te)

{> collection cost (contacting customers, cheque collection)

L-+ detauiting cost (ad Debs, Legal Charges et)

inus - () iamprashantsarda| (J tme/caprashantsarda | € / @) carrashantsarda

Pe cry

reonturerinenneny

‘The cash shouldbe managed such that we should carry sufficlent eash balance for business cotinine ee

ley cash should not be exces cash has oppertunity cost and cash should net be in shortage

good fui wil be hampered payment arent made cnn Ths, ane manager | yaa Baum E68 model oF eptmom

Cash elas

hesimptone

Intows and outlows ee forcatd Rime eo eonore

{2 Pied Tnanedon cor per taeacton

FORMAT OF CASH BUDGET IS AS UNDER {3 Fa urn cou per opeo

{eeemancanay PS

ia eee eee

foe a

Cash sales were, pet

“Catecton tom Debtors ese ea eer

creases eae ‘oontpertaneacion”” B

«Issue of shares ! Debenture / Preference Shares | \n mtarest rete perrupes/p.a® | nvestment

should ensure sulficiency of cash. Houses cash budget for management of cash wherein future cash

Subsctal A) Millor Or Cash Management Model

ees ‘Assumption: Stochastic (uneven) cashout flow.

Cash Purchases ve

Payment to eredtors ‘|

“Taxes paid

‘Subsota ()

a + lovestnent excess cash cash balance touches upper

‘Surplus (Defic AB) lik

lt

«+ trennuas atime inves and gt ine witha

‘Opening balance of cash bank

‘Closing balance ofeash/ bank (©+D)

Joinus - (G) iamprashantsarda| (J tme/caprashantsarda | P/Q) carrashantsarda 19)

GeO

tin Matin creat) Ma cheque Bening

Tat ) rw poved iow) proceesing Yost) processing fe

comin Sa ah, aa

7 aw]

4) Concentration Banking and

2} Lock box ayetem

imate

ee

‘sn each ety where we have

erry tection agent how

Pim

Infoeal bank ofthat ey.

“+ We can thon transfer the

‘smount tH

‘and manage

‘cheque deposit

joinus - (Q) iamprashantsarda| J t.meicaprashantsarda | J / QD caprashantsarda 20,

ORE

CHAPTER-6- CAPITAL BUDGETING = —

‘are used to evaluate capital expenditure decision,

> The capital expenditure declsions are very

Important for fnanel! manager mainly Becauss

{i)They are reversible in nature

Jo section evtaria: Lesser the pay beck pris bet

the projec. =a)

ORE a Poet

2 hounds sre a

wc tne nay Sia WO ca HOV

Oar or

"> Aa thename nuggets, ts exactly oppose ot |] Onginalinvestmant-Scrap Value, tens wetng

3 payback nse + cones

‘Average Annual Cash FIOWS 59 Selection etarla Higher the ARR, better the project

Intl Investment

gs a a V) Discounted Cash Flow methods

No, of years

Join us - (G) iamprashantsarda| (J tme/caprashantsarda | P/Q carashantsarda 24

(PO) aa ows oath tons

Iinaeats by investing the project ost today how much

a Zpojects he projects ith higher NPV wil be

> indicates that for every 1 rapes invested in the project

ion itera Higher the Ber the profect

Sup

Spi Det

iis tne rat ot atm sven bythe projet

IRR ~ Stat te + sDifensinnte

Important points to remember

———,

Arta gen

Prot income

(0 hoy otereome

1 Sxmss

15 Deprecten

(9 Tovea0vonPar

rate

(w Dapecaten

Lilet labled lal

expose at gan

Eten

(Ay oa epee ae

(9 Oars

lelegl eels €l

[oar]

cry

Cee

Ce eee

‘CA Prashant Sarda

nie © Lem “hue fA" keene meee

1. LIQUIDITY RATIOS *

ake ning anor det servis = Net Profit ater txton = Non Cash operating opens

eatonandotersmorsatone Non-operating austen ere on gems

Join us - (G) iamprashantsarda| (J tme/caprashantsarda | @/@ carrashantsarda 23,

5, PROFITABILITY RATIO BASED ON SALES

ory

Neer

Coy

Cee

eee sted ‘CA Prashant Sarda

set oS Ratios red in general

—m [Reysrvaronetoknm oo] Eortyparshon es) and

fey [Pehstigndaentstne'") seatat tot Pex anes,

uit een Eteieetias

ero To Sod etcteaererray

cae mea Prati loay Hered iene

Ermer? i REL

=—— Se

OTHER RATIOS

ra

So

oe ee

ou Ear a

real Absences

hus =e

Join us - (©) iamprashantsarda| € tmelcaprashantsarda | €)/@) carrashantsarda_ 25,

CA Prashant Sarda

COWRA Oy ae ECE

‘Tocalelte the return on equty using the DuPont model, simply multiply te

te componeats net prot mara

Pires

7. Financial data ae badly dlatrtedby nfo,

9 Timely rato analyse provide clues but not conclusions, These ars tools inthe hands of experts

Cece)

reontuneriennen

POTS Ge Eerie

‘CA Prashant Sarda

Return on investment (ROI) represents the earning power of the company.

PT Wa TATU OPIUB LIC)

Itis a process of determining, interpreting and presenting

int

po

cra

Eo

SS -

rs

for Evaluating

Sod

joinus - (Q) iamprashantsarda| J t.melcaprashantsarda | P/Q carrashantsarda 27,

min

1. General State of Economy

(Depression & Prosperity» Dividend)

2. tate of capital markat

(Easy access Dividend?)

3. Legal restrictions (Bylaw 8 order)

4, Contractual restietions (By lenders)

5 Tax Polley (Corporate Tex & DDT)

oa

4, Desire of sharoholders

(Goneraly dividend expectationst because of

‘Strength Indication.

) Uncertainty)

6) Need for curent income

2. Financial needs of company

(Most important amongst all

3: Nature of earnings (Stable income = Dividend *)

4. Desire of control (Control desir = Dividend)

5, Liquidity Postion (Liquiciys= Dividends)

[ey

Neer

Cee

Cee

“Dividend Rate

‘¢0ividend Payout

‘Dividend Yel

“¢Eaming Vil + BS

‘Captalieation Rate Ke)" MPS

Whore, DPS= Dividend per share

FV = Face value

[EPS = Eaming per share

[MPS =Market price per share

PIE = Price Earning

Alternative to Dividend

‘= Stock Split

‘= Reverse Stock Split

= Bonus Shares

‘= Buy Back of Shares

‘= Right Shares

Join us - ©) iamprashantsarda| J tmelcaprashantsarda | €) / @) carrashantsarda

Pricing of buy- back

Buy back Price = SXF

Uere,S =o of shares outstanding

before brack

= oman hart ce

Nn of share ova back

Right Shares :- p- Manes

Net

were, M = Cumatght markt pice

N= Nov of oa snare ened t purchase one ght hare

5 F'Stiscrpon price of naw share

Value of right alone = Ex-ight price (-) Subscription Price

Value of right alone

oF old share ent

‘io purchase right

Value of right por share = Cumight Price (2) Exigh Price

Value of right per sh or

28)

oan

cry

a lend Pol ey eee

reo)

D, = D,+{(EPS x Target Payout) -D] xAf

Ko= Cost of Equity capital (1-b)= Dividend Payout ratio

R =Internal rate of return Ke= Cost of equity capital jw ee Ohm Ceviaend cc Rerto

br =Growth Rate

Condon: If > Ke + Payout of dividend shouldbe minimum

I1R.< Ke-» Payout of dividend shouldbe maximum &

R= Ke » Dividend Payaut can be ary where between 0-100%

Whore, Py=Prevaling Markst price of share

5, Traditional or Graham & Dodd Model

1, =Dividend of next period

al ond of period one

Where, P= Market Price

‘mz multiplier

E = Eaming per share ,an =No. of shares tobe issued

1 Elnvestment amount required

numberof shares

Joinus - ()iamprashantsarda| (J tme/caprashantsarda | P/Q carrashantsarda 29

CHAPTEI rT ok cecal

erences

‘© Application of various possible probabilities to cash flows:

Stops:

1) Multiply cash flows with the probabilities to got expected cash flows,

2) Use expected cash flows to calculate NPV or IRR.

{@ Varying the discounting rate or Risk adjusted discount rate:

‘Important Points-

4 Asituation were actual

measured by assigning

2 Joint probably Is proba

13, Standard dovistion measures how much the actual data var

tof two events happening together

95 from expected data,

Standard Devistion J X-K)° when Probabity isnt given

7

ils a mean or expected value

‘ils no of yeare

Standard Deviations /Sip(yax)e_ When Probably is gen

4. Square of Standard deviation is called a variance.

5. Coefficient of variance (CV Isa relative measure of devition useful for

‘comparison of isk oftwo projects, with diferent expacted NPVs.

cys Sander Devaton

Higher the CV, higher the relative riskiness.

{2 Howto incorporate risk in capital budgeting?

‘Ans:-Higher the rg, higher the discounting rate.

Rishy Projects = Discounting Rats

Less ky Projects = Discounting Rate,

Pentel © Lene“ hue fA" keene

ere

Cee)

Ce ee

© Adjusting the cash flows or certainty equivalent

approach (CEC)

1) Risky cash flow x Certainty equivalent factor to arrive a iskless

cash flows

2) Rishoss cash flow are than discounted at ak ree rate (RF) to

{get the present value

3) NPVs then ealeutated

PV of cash inflows -PV of Gash outiows

Bi

Certainty equivalent co-ticient = Risens cash Hos

© Sensitivity Analysis:

Stops =

1 Senay analysis computes a the rato of downward change in input

avameter othe value of ital parameter.

2 Each input vari is considered separately & alter are arsumed 35

constr

2. The extent of change nan input parameter that would result in aro NPV

Is computed

4 The extn of change so determined is exorossed as percentage.

5:This process repeate oral eis varies to eat hl seni.

ita variably to undergo a change beyond the levels std the

rolect i reviewed afresh

Mos (y= SEARS® x00

‘¢tmportant Points:

The lower the change in MOS, higher isthe seni ofthe project to

that nut parameter.

2.This le beeause a small change in input parameter may en to 2 reversal

of projet.

Eg HMY wore to bacon zo wth 1% chang in ied cos relive to 10%

ange insy sen, taproot insadio bore seat a faed ont

30,

Cece

Coc

Eerie

Cas

Potential

Value

Low Capital Be

Output Pe

Ratio employed

er] er

concn Comet

Reo Cy

join us - (O) iamprashantsarda| J t.meicaprashantsarda | P/Q carrashantsarda 31

My Notes:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Taxation Sec B May 2024 1703584499Document8 pagesTaxation Sec B May 2024 1703584499abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703584210Document6 pagesTaxation Sec B May 2024 1703584210abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703584298Document6 pagesTaxation Sec B May 2024 1703584298abhishekkapse654No ratings yet

- Audit Chap-6 Short NotesDocument1 pageAudit Chap-6 Short Notesabhishekkapse654No ratings yet

- As 19Document8 pagesAs 19abhishekkapse654No ratings yet

- Taxation Sec B May 2024 1703583896Document15 pagesTaxation Sec B May 2024 1703583896abhishekkapse654No ratings yet

- Day 5Document7 pagesDay 5abhishekkapse654No ratings yet

- Economics Important QuestionsDocument4 pagesEconomics Important Questionsabhishekkapse654No ratings yet

- PDF 167984100250523Document1 pagePDF 167984100250523abhishekkapse654No ratings yet

- Law120230912 13.6.41Document5 pagesLaw120230912 13.6.41abhishekkapse654No ratings yet

- EIS Mentor N23Document308 pagesEIS Mentor N23abhishekkapse654No ratings yet

- Dividend Short NotesDocument1 pageDividend Short Notesabhishekkapse654No ratings yet