Professional Documents

Culture Documents

Home Loan

Home Loan

Uploaded by

Sanyam0 ratings0% found this document useful (0 votes)

3 views18 pagesA home loan or mortgage allows individuals to borrow money from a lender to purchase a home, which is repaid over time including interest. Buying a home provides stability, a sense of ownership, and potential financial growth through building equity. Federal home loans offer benefits like financial stability backed by the government, competitive interest rates, flexible options, government backing that reduces risk, excellent customer service, digital banking solutions, risk mitigation strategies, and financial education resources. Eligibility includes NRIs and PIOs meeting certain conditions. Loans cover up to 85% of costs with repayment holiday options and repayment through various methods like EMI.

Original Description:

Original Title

HOME LOAN

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA home loan or mortgage allows individuals to borrow money from a lender to purchase a home, which is repaid over time including interest. Buying a home provides stability, a sense of ownership, and potential financial growth through building equity. Federal home loans offer benefits like financial stability backed by the government, competitive interest rates, flexible options, government backing that reduces risk, excellent customer service, digital banking solutions, risk mitigation strategies, and financial education resources. Eligibility includes NRIs and PIOs meeting certain conditions. Loans cover up to 85% of costs with repayment holiday options and repayment through various methods like EMI.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views18 pagesHome Loan

Home Loan

Uploaded by

SanyamA home loan or mortgage allows individuals to borrow money from a lender to purchase a home, which is repaid over time including interest. Buying a home provides stability, a sense of ownership, and potential financial growth through building equity. Federal home loans offer benefits like financial stability backed by the government, competitive interest rates, flexible options, government backing that reduces risk, excellent customer service, digital banking solutions, risk mitigation strategies, and financial education resources. Eligibility includes NRIs and PIOs meeting certain conditions. Loans cover up to 85% of costs with repayment holiday options and repayment through various methods like EMI.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 18

WHAT IS HOME LOAN?

A home loan, known as a mortgage, is

a financial tool that allows individuals

to borrow money from a lender in order

to purchase a home. Typically, the loan

is repaid over a specified period of

time and includes interest. Home loans

provide individuals with the

opportunity to become homeowners

without the need to pay the full

purchase price upfront.

THE SIGNIFICANCE OF BUYING A

HOME

Buying a home holds great significance

as it provides stability, a sense of

ownership, and potential financial growth.

It offers a place to create memories, build

equity, and establish roots in a

community. Additionally, homeownership

often comes with tax benefits and the

opportunity to customize and personalize

one's living space.

BUILD YOUR DREAM

HOME WITH FEDERAL

HOME LOAN

INTRODUCTION

Welcome to the presentation on the

Advantages of Choosing a Federal

Bank for your Home Loan. This

comprehensive analysis will highlight

the key benefits and reasons to

consider a federal bank for your home

financing needs.

FINANCIAL STABILITY

Federal banks offer financial stability backed

by the government, providing a secure

lending environment. This stability ensures

long-term confidence and peace of mind for

borrowers.

COMPETITIVE INTEREST RATES

Benefit from competitive interest rates

offered by federal banks, resulting in

potential savings over the life of the loan.

Lower rates can significantly reduce the

overall cost of borrowing.

FLEXIBLE LOAN OPTIONS

Federal banks provide flexible loan options

tailored to individual needs, including fixed

and adjustable-rate mortgages, as well as

various term lengths and down payment

requirements.

GOVERNMENT BACKING

The government backing of federal banks

instills confidence in both borrowers and

lenders, reducing risk and ensuring access

to funding even in challenging economic

conditions.

CUSTOMER SERVICE EXCELLENCE

Experience exceptional customer service

excellence from federal banks, with

dedicated support and guidance throughout

the loan application and approval process.

DIGITAL BANKING SOLUTIONS

Access convenient digital banking solutions

provided by federal banks, offering online

applications, account management, and

payment options for a seamless borrowing

experience.

COMMUNITY INVOLVEMENT

Federal banks actively engage in community

initiatives and support, demonstrating a

commitment to community involvement and

contributing to the welfare of local

neighborhoods.

RISK MITIGATION

Federal banks employ robust risk management

strategies, mitigating potential risks for both

borrowers and the institution. This ensures a

secure and reliable lending environment.

FINANCIAL EDUCATION RESOURCES

Access valuable financial education

resources offered by federal banks,

empowering borrowers with knowledge and

insights to make informed decisions about

their home loans.

KEY FEATURES

Maximum funding for your dream

house -85% of the project cost.

Repayment holiday up to 36 months.

No pre closure charges

Easy top up loans in future.

Longer repayment period up to 360

months

Low processing fees

ELIGIBILITY

For NRIs: €45% > NRI individuals including salaried people, self- employed and

business persons are eligible for Housing Loan.

> Persons of Indian Origin (PIO) are also eligible for Housing Loan subject to

following conditions:

1. The loan is covered by primary / collateral security of immovable property in

India in the name of PIO.

2. The PIO should hold a valid PIO Card accompanied by a valid foreign

passport.

3. A close relative (as defined in Companies Act) residing in India should join as

co-obligant to the loan. Age of the borrower should not exceed 55 years at the end

of loan tenure. Monthly income should be not less than Rs. 50000/-.

REPAYMENT OPTIONS

Repayment of the loan is made as Equated

Monthly Installments (EMI).

You can use any one of the ways to repay the

loan:

Cheques

Standing instructions at your branch

FedNet - Internet Banking

Automated Payment through ECS

Mobile Banking

CONCLUSION

In conclusion, the advantages of choosing a federal bank for your home

loan are numerous and compelling. From financial stability to community

involvement, federal banks offer a comprehensive and reliable lending

experience.

Thanks!

Do you have any questions?

You might also like

- PEEC System Calibrating and AdjustingDocument21 pagesPEEC System Calibrating and AdjustingRichard Chua100% (1)

- Fyodor Dostoevsky - The Brothers KaramazovDocument1,631 pagesFyodor Dostoevsky - The Brothers KaramazovAditi GuptaNo ratings yet

- Home LoanDocument17 pagesHome LoanSanyamNo ratings yet

- Navigating The World of Housing FinanceDocument9 pagesNavigating The World of Housing FinanceTanu RathiNo ratings yet

- Retail Banking Products and ServicesDocument5 pagesRetail Banking Products and Servicesbeena antuNo ratings yet

- Compare Housing Loan Rates in The PhilippinesDocument6 pagesCompare Housing Loan Rates in The PhilippinesAppraiser PhilippinesNo ratings yet

- Sachin Black BookDocument81 pagesSachin Black Booksachinjuwatkar93No ratings yet

- Banking of BPMDocument20 pagesBanking of BPMSai DheerajNo ratings yet

- Print - AamirDocument19 pagesPrint - AamirAamir BasraiNo ratings yet

- Chapter - 3 Home LoanDocument65 pagesChapter - 3 Home LoanmotherfuckermonsterNo ratings yet

- Housing Loan ThesisDocument5 pagesHousing Loan Thesisheatherdionnemanchester100% (2)

- New Home LoanDocument65 pagesNew Home LoanROHITNo ratings yet

- Personal Loan Products: New Car LoansDocument18 pagesPersonal Loan Products: New Car LoanssuvarnarathodNo ratings yet

- Project Report On Convergence of Banking Sector To Housing FinanceDocument4 pagesProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadNo ratings yet

- Home LoansDocument26 pagesHome Loansneha aggarwalNo ratings yet

- Sip Project SBI HomeloanDocument45 pagesSip Project SBI HomeloanAkshay RautNo ratings yet

- Convergence of Bank To Housing FinanceDocument6 pagesConvergence of Bank To Housing FinancePritesh MaparaNo ratings yet

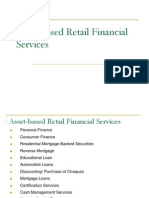

- Asset - Based Retail Financial ServicesDocument60 pagesAsset - Based Retail Financial ServicesAmit GuptaNo ratings yet

- Chapter - 1Document49 pagesChapter - 1KarunaNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- Dipali Project ReportDocument58 pagesDipali Project ReportAshish MOHARENo ratings yet

- Retail Banking and Wholesale BankingDocument6 pagesRetail Banking and Wholesale BankingNiharika Satyadev Jaiswal100% (2)

- A Study of Home Loan Schemes of Sbi: Indian Streams Research JournalDocument4 pagesA Study of Home Loan Schemes of Sbi: Indian Streams Research Journalsairushika0No ratings yet

- EasyloansolutionsDocument14 pagesEasyloansolutionsprajapatimanish806No ratings yet

- Commercial Banking: BBIT (Hons.) 5th SemesterDocument20 pagesCommercial Banking: BBIT (Hons.) 5th SemestershomoshoNo ratings yet

- Retail 3Document27 pagesRetail 3Pravali SaraswatNo ratings yet

- Icici Bank Home LoansDocument2 pagesIcici Bank Home LoansMohtashim KhanNo ratings yet

- Assignment-4: Building EconomicsDocument5 pagesAssignment-4: Building EconomicspriyaNo ratings yet

- Blackbook 121Document2 pagesBlackbook 121Tanvi PawarNo ratings yet

- Compared To Corporate BankingDocument4 pagesCompared To Corporate BankingArunita SadhukhanNo ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Retail Banking and Wholesale BankingDocument6 pagesRetail Banking and Wholesale BankingManas ChoudharyNo ratings yet

- A Project ReportDocument77 pagesA Project Reportadityamhashilkar2No ratings yet

- DURGADocument21 pagesDURGAMohmmed KhayyumNo ratings yet

- Types of Housing LoanDocument20 pagesTypes of Housing LoanIzzuddin ZulkefliNo ratings yet

- Real EstateDocument9 pagesReal EstateAmanuel EristuNo ratings yet

- List of Investment Banks in PakistanDocument8 pagesList of Investment Banks in PakistanAhmad KhanNo ratings yet

- ARJUNDocument37 pagesARJUNarjun krNo ratings yet

- Home LoanDocument78 pagesHome LoanSohel Bangi100% (2)

- DHFL Home LoanDocument74 pagesDHFL Home LoanKeleti SanthoshNo ratings yet

- "The Most Preferred Home Loan Provider" Voted Inawaaz ConsumerDocument10 pages"The Most Preferred Home Loan Provider" Voted Inawaaz ConsumerPrachi JainNo ratings yet

- An Analytical Study On Home Loan: TitleDocument9 pagesAn Analytical Study On Home Loan: TitleomkarNo ratings yet

- Comparative Study of Home Loans of PNB and Sbi Bank Final ProjectDocument11 pagesComparative Study of Home Loans of PNB and Sbi Bank Final ProjectManish KumarNo ratings yet

- Consumer FinanceDocument24 pagesConsumer FinanceAdityaNo ratings yet

- Housing Loan of PNBDocument38 pagesHousing Loan of PNBgunpriyaNo ratings yet

- T.Y.Bbi Personal LoanDocument49 pagesT.Y.Bbi Personal LoanCh TarunNo ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- A Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksDocument12 pagesA Comparative Study of Home Loan Schemes of Private Sector Banks Public Sector BanksKapil KumarNo ratings yet

- Asset Based Retail Financial ServicesDocument37 pagesAsset Based Retail Financial Servicesjimi02100% (1)

- Dissertation On Home LoanDocument6 pagesDissertation On Home LoanHelpWritingAPaperCanada100% (1)

- A Report On Bank Loan Product HDFC (Personal Loan)Document11 pagesA Report On Bank Loan Product HDFC (Personal Loan)Kunal YadavNo ratings yet

- MFS Unit3Document13 pagesMFS Unit3tarunbhardwaj526No ratings yet

- Project HDFCDocument35 pagesProject HDFCBalraj RandhawaNo ratings yet

- Assignment On Housing Development Finance Corporation LTDDocument27 pagesAssignment On Housing Development Finance Corporation LTDShubhra Agarwal100% (2)

- Personal Loan ProjectDocument7 pagesPersonal Loan ProjectSudhakar GuntukaNo ratings yet

- FinalDocument17 pagesFinalRamakrishna BalijepalliNo ratings yet

- Federal Bank of India - LoansDocument11 pagesFederal Bank of India - LoansAbhishekNo ratings yet

- Infinite Banking Secrets for Tax-Free Retirement: A Beginner's Guide: How to invest in Real Estate with Infinite BankingFrom EverandInfinite Banking Secrets for Tax-Free Retirement: A Beginner's Guide: How to invest in Real Estate with Infinite BankingNo ratings yet

- Reverse Mortgage 2024: Unlock Your Home Equity for a Flourishing Retirement: The Essential Guidebook to Understanding Reverse Mortgages, Enhancing Retirement Planning, and Achieving Financial FreedomFrom EverandReverse Mortgage 2024: Unlock Your Home Equity for a Flourishing Retirement: The Essential Guidebook to Understanding Reverse Mortgages, Enhancing Retirement Planning, and Achieving Financial FreedomNo ratings yet

- Sanyam 2Document8 pagesSanyam 2SanyamNo ratings yet

- COK DEL: Goyal / Sanyam MR AI0831Document1 pageCOK DEL: Goyal / Sanyam MR AI0831SanyamNo ratings yet

- Screenshot 2022-12-30 at 4.09.13 PMDocument414 pagesScreenshot 2022-12-30 at 4.09.13 PMSanyamNo ratings yet

- Cluster Sampling Definition, Method and ExamplesDocument1 pageCluster Sampling Definition, Method and ExamplesSanyamNo ratings yet

- GEM2xxxManualEN RevD1Document73 pagesGEM2xxxManualEN RevD1Aldo Germán Pavez MoraNo ratings yet

- Engine ClasificationDocument13 pagesEngine Clasificationvasanth9046No ratings yet

- BTW Sor (Fy10)Document236 pagesBTW Sor (Fy10)Tan AnthonyNo ratings yet

- Unit 8 Earth, Space and BeyondDocument19 pagesUnit 8 Earth, Space and Beyondulianavasylivna2022No ratings yet

- Argumentative Essay Conclusion ExampleDocument6 pagesArgumentative Essay Conclusion Exampleglzhcoaeg100% (2)

- Introduction To AlgorithmsDocument6 pagesIntroduction To Algorithmsavi05raj0% (1)

- Sketchy/ Physeo / Pixorize: Boards & BeyondDocument18 pagesSketchy/ Physeo / Pixorize: Boards & BeyondSaransh GhimireNo ratings yet

- Question2 p2 Aqa Combined Jun 2019Document5 pagesQuestion2 p2 Aqa Combined Jun 2019Justin Lloyd CasilaganNo ratings yet

- Jubiliant MSDSDocument12 pagesJubiliant MSDShimanshushah871006No ratings yet

- PD Lesson 5 Coping With Stress in Middle and Late AdolescenceDocument16 pagesPD Lesson 5 Coping With Stress in Middle and Late AdolescenceEL FuentesNo ratings yet

- API 6A Type 6BX 10000 Psi Flange Dimensions (Metric)Document3 pagesAPI 6A Type 6BX 10000 Psi Flange Dimensions (Metric)Riyan Esapermana100% (1)

- The Theory of EverythingDocument4 pagesThe Theory of EverythingAfrin HasanNo ratings yet

- GX Developer Version 8 Operating Manual (Startup) Sh080372elDocument52 pagesGX Developer Version 8 Operating Manual (Startup) Sh080372elJhonney JorgeNo ratings yet

- Fecky F Ichsan - Wound HealingDocument60 pagesFecky F Ichsan - Wound HealingFecky Fihayatul IchsanNo ratings yet

- Physics Exam ss2 2nd TermDocument14 pagesPhysics Exam ss2 2nd TermchrizyboyziNo ratings yet

- Visa Rules PublicDocument891 pagesVisa Rules PublicmasNo ratings yet

- ReleaseNotes 5.11.02.217Document5 pagesReleaseNotes 5.11.02.217bartusdarNo ratings yet

- Seminar Report On AutomationDocument32 pagesSeminar Report On AutomationDusmanta moharanaNo ratings yet

- 9th Class Pairing Scheme 2024Document6 pages9th Class Pairing Scheme 2024Zahid RoyNo ratings yet

- Course - Design - Policy - 2018 - TrainingDocument23 pagesCourse - Design - Policy - 2018 - TraininggarimagaurNo ratings yet

- Certificate-20-5627620017 4Document1 pageCertificate-20-5627620017 4قيصر محمدNo ratings yet

- Mechanical Material2Document15 pagesMechanical Material2engineerNo ratings yet

- Discrete Mathematics Solved MCQsDocument8 pagesDiscrete Mathematics Solved MCQsamna_shifaNo ratings yet

- Pharmacology of The GITDocument31 pagesPharmacology of The GITmarviecute22No ratings yet

- The Nature of Philosophical AnthropologyDocument8 pagesThe Nature of Philosophical AnthropologyPaul HorriganNo ratings yet

- 3.4.6 Excretory System H 3.4.8Document9 pages3.4.6 Excretory System H 3.4.8Joy FernandezNo ratings yet

- Three Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemDocument36 pagesThree Stages Sediment Filter and Uv Light Purifier: A Water Treatment SystemMark Allen Tupaz MendozaNo ratings yet

- Triangles - Class 10 - Notes - PANTOMATHDocument8 pagesTriangles - Class 10 - Notes - PANTOMATHsourav9823100% (1)