Professional Documents

Culture Documents

Project 2

Project 2

Uploaded by

Kumar GulshanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project 2

Project 2

Uploaded by

Kumar GulshanCopyright:

Available Formats

Quest Journals

Journal of Research in Business and Management

Volume 8 ~ Issue 11 (2020) pp: 61-63

ISSN(Online):2347-3002

www.questjournals.org

Comparative Analysis of Public and Private Sector Banks in

India

Rabindra Kumar

Assistant professor, Department of Commerce

SPY College, Gaya

ABSTRACT:

Public Sector Banks (PSBs) are a major type of bank in India, where a majority stake (i.e. more than 50%) is

held by the government. The shares of these banks are listed on stock exchanges. The private sector enterprise is

an organisation which is owned, managed & controlled by private individuals or a group of individuals or both.

This is also engaged in business activity but with the motive of profit maximisation rather than public service

like in case of public sector enterprise. The merger of the loss making New Bank of India with the profitable

Punjab National Bank was the first instance of merger of two public sector commercial banks. Corporate world

have been merging to gain synergies in their operations, derive economies of scale and offer one-stop facilities

to more demanding clientele. Hence, the desire to grow quickly through mergers, rather than through the slow

path of normal expansion in business it is important to improve the competitiveness and quality of the services

sector in order to enhance its efficiency. The present comparative study focuses on the merger of public and

private sector banks in India specially merger events relating to Bank of Baroda, Punjab National Bank, HDFC

Bank and ICICI Bank. It also examines the only aspect of such merger(s) in terms of valuation of banks before

and after merger and find out the result that which sector gained more value through merger in India.

KEYWORDS: Merger and Acquisition, Valuation of Banks, Public and private sector banks.

I. INTRODUCTION:

In India it was only in 20th century that the concept of takeover took birth but even then the concept of

antagonistic takeovers was not known to anybody. This concept emerged when Swaraj Paul started efforts to

takeover Escorts Ltd. and DCM Ltd. He was the first hostile raider among the raiders of Indian stock market.

During 1950 to 1960 there were instances of private sector banks, which had to be rescued or closed down due

to very low capital. In 1960, the failure of Palai Central Bank and Laxmi Bank, led to loss of confidence in the

banking system as a whole. In 1961, the Banking Companies (Amendment) Act empowered RBI to formulate

and carry out a scheme for the reconstitution and compulsory amalgamation of sub-standard banks with well-

managed ones. Consequently, out of 42 banks which were granted freeze, 22 were amalgamated with other

banks, one was allowed to go into voluntary liquidation, one to amalgamate voluntarily with another bank, three

were ordered to be wound up and the freeze on three was allowed to slide. In India, mergers have been used to

bail out weak banks till the Narasimham Committee-II discouraged this practice. Since the mid 1980s, several

private banks had to be rescued through mergers with public sector banks. The merger of the loss making New

Bank of India with the profitable Punjab National Bank was the first instance of merger of two public sector

commercial banks. As far as, the merger activity in banking sector is concerned, it is used to merger of sick and

weak banks with a healthy bank. The only purpose was to save the sick bank and its customers from the

liberalization problems and process. The merger of New Bank of India with Punjab National Bank was a bad

experience and has not served any purpose. As a result of this merger PNB had to face lot of court litigations

and also incurred a loss in the year 1996, which was unusual in the history of the Bank.

II. PUBLIC Vs PRIVATE SECTOR BANKS:

As far as, the merger activity in banking sector is concerned, it is used to merger of sick and weak

banks with a healthy bank. The only purpose was to save the sick bank and its customers from the liberalization

problems and process. The merger of New Bank of India with Punjab National Bank was a bad experience and

has not served any purpose. As a result of this merger PNB had to face lot of court litigations and also incurred a

loss in the year 1996, which was unusual in the history of the Bank. With the liberalization policies of the

government, many private banks came into existence. In 1995 the government also removed entry barriers in the

*Corresponding Author: Rabindra Kumar 61 | Page

Comparative Analysis of Public and Private Sector Banks in India

banking sector. As a result of this good number of technology savvy, customer friendly banks have started

operating in India. In order to survive in the competition and get a market share these new banks started offering

innovative and attractive products with the help of their technology. The public sector banks also realized the

need of the hour and started using technology in a big way. These banks are also collaborating with the new

generation banks in offering certain services and getting mutually benefited. Some of the new generation banks

like HDFC Bank and ICICI Bank have started looking for external growth by way of merger route. These banks

have started looking for healthy banks rather than sick and weak banks for acquisition. The main criteria while

selecting target banks was the synergy benefits like market growth, market presence, effect on profit etc.

III. THE MAJOR DIFFERENCES BETWEEN A PRIVATE AND PUBLIC SECTOR BANK

• Shareholders

a) In a public sector bank more than fifty percentage of the stake is held by the Government.

b) In a private sector majority of the stake owned to private shareholders, including corporations and

individuals.

• Interest Rate

Deposit interest rates offered by public sector banks are almost the same when compared to private sector banks.

However new-age banks such as the Bandhan Bank, Airtel Bank are offering marginally better interest rates

when compared with their counterparts In case of loans, interest rates are marginally lower as for example SBI

introduced a new home loan offering for its women customers with an interest rate of 8.35% for a ticket size of

upto Rs. 30 lakhs.

• Fees & Service

Private Sector Banks have made names in providing better service, however, they charge for the extra services

provided by them. Public sector banks fees and charges are less such as on balance maintenance. A lot of public

sector banks are still picking up in their service offerings.

• Customer Base:

Mostly public sector accounts are opened for government employees for their salaries, fixed deposits, lockers

etc. Their customer base is also relatively large when compared with their peers in the private sector as they

have been in the domain for long and have managed to gain customer's confidence. Whereas private sector bank

in India target company employees,for their salary accounts, credit cards and net banking.

List of Some Public Banks in India:

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Indian Bank

Indian Overseas Bank

Punjab National Bank

Punjab and Sindh Bank

Union Bank of India

Uco Bank

State Bank of India

List of Some Private Banks in India:

Axis Bank

Bandhan Bank

CSB Bank

City Union Bank

DCB Bank

Dhanlaxmi Bank

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

IDFC FIRST Bank

Jammu & Kashmir Bank

Karnataka Bank

*Corresponding Author: Rabindra Kumar 62 | Page

Comparative Analysis of Public and Private Sector Banks in India

Karur Vysya Bank

Kotak Mahindra Bank

Lakshmi Vilas Bank

Nainital bank

RBL Bank

YES Bank

IDBI Bank

IV. VALUATION OF BANKS:

The valuation of banks is resorted when the proposals are under consideration and the value of business

depends not just on assets it carries but determined mostly by the projects in hands, the risk profile of the

different classes of business. Business valuation is a process and a set of procedures used to estimate the

economic value of an owner’s interest in a business. Valuation is used by financial market participants to

determine the price they are willing to pay or receive to consummate a sale of a business. In addition to

estimating the selling price of a business, the same valuation tools are often used by business appraisers to

resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among

business assets, establish a formula for estimating the value of partners' ownership interest for buy-sell

agreements, and many other business and legal purposes Three different approaches are commonly used in

business valuation: the income approach, the asset-based approach, and the market approach. Within each of

these approaches, there are various techniques for determining the value of a business using the definition of

value appropriate for the appraisal assignment. Generally, the income approaches determine value by calculating

the net present value of the benefit stream generated by the business (discounted cash flow); the asset-based

approaches determine value by adding the sum of the parts of the business (net asset value); and the market

approaches determine value by comparing the subject company to other companies in the same industry, of the

same size, and/or within the same region. A number of business valuation models can be constructed that utilize

various methods under the three business valuation approaches. Venture Capitalists and Private Equity

professionals have long used the First Chicago method which essentially combines the income approach with

the market approach. In determining this of these approaches to use, the valuation professional must exercise

discretion. Each technique has advantages and drawbacks, which must be considered when applying those

techniques to a particular subject company. Most treatises and court decisions encourage the valuator to

consider more than one technique, which must be reconciled with each other to arrive at a value conclusion. A

measure of common sense and a good grasp of mathematics are helpful.

V. CONCLUSION:

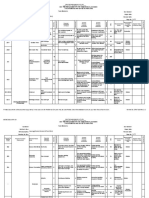

The overall analysis of table reveals the fact that the private sector banks provided positive returns

whereas Public Sector Bank (PSB) like State Bank of India, provided negative returns. The major reasons for

negative returns of PSB might be that PSBs are still conservative banks. But in the case of ICICI Bank, which

follows an aggressive policy, the event got discounted within a shorter duration and with positive returns. It is

important for Indian banks to improve competitiveness and quality of the banking system to bring efficiency in

the performance. Merger banks need to communicate or publicize about merger proposal with a view to getting

the consent of their shareholders.

REFERENCES:

[1]. www.google.com

[2]. www.wikipedia.org

[3]. www.indianmoney.com

[4]. Taxmann’s, “Companies Act”, Taxmann allied sevices(P) Ltd., New Delhi, 2007.

*Corresponding Author: Rabindra Kumar 63 | Page

You might also like

- CBS 2021Document333 pagesCBS 2021Drew Johnson100% (1)

- Capstone Project On Banking.Document120 pagesCapstone Project On Banking.Keyur Rajpara33% (3)

- Restructuring at CitibankDocument10 pagesRestructuring at CitibankUdayalakshmi RamachandranNo ratings yet

- Fundamental Analysis of Banking SectorsDocument63 pagesFundamental Analysis of Banking SectorsDeepak Kashyap75% (4)

- Project Appraisal SystemDocument75 pagesProject Appraisal Systempoo22187No ratings yet

- Quality Statement of SpacexDocument3 pagesQuality Statement of SpacexFaisal AyazNo ratings yet

- Ashish Udawant Summer ProjectDocument48 pagesAshish Udawant Summer ProjectAshishNo ratings yet

- Pre Merger and Post Merger Financial Analysis of Indian BankDocument12 pagesPre Merger and Post Merger Financial Analysis of Indian BankKRISHNA PRASAD SAMUDRALANo ratings yet

- Project Report On "Credit Risk Management in State Bank of India"Document65 pagesProject Report On "Credit Risk Management in State Bank of India"Sandeep YadavNo ratings yet

- Pt. D.D.U.M.C: Customer Preference Towards Private Sector Banks and Public Sector BanksDocument105 pagesPt. D.D.U.M.C: Customer Preference Towards Private Sector Banks and Public Sector BankssknagarNo ratings yet

- Yat HarthDocument51 pagesYat HarthAnil BatraNo ratings yet

- A Study On Financial Analysis of Punjab National BankDocument11 pagesA Study On Financial Analysis of Punjab National BankJitesh LadgeNo ratings yet

- CCI SynopsisDocument11 pagesCCI SynopsisAshish SinghNo ratings yet

- A Comparative Study On The Performance oDocument11 pagesA Comparative Study On The Performance omuskansingh66126No ratings yet

- Private Banks: Entry of New Banks in The Private SectorDocument6 pagesPrivate Banks: Entry of New Banks in The Private SectorRabinarayan MandalNo ratings yet

- BFSI Skills Requirements by Me FINALDocument76 pagesBFSI Skills Requirements by Me FINALTusharNo ratings yet

- Publicprvtbanks 25 M 22Document29 pagesPublicprvtbanks 25 M 22CHITHRANo ratings yet

- Multidisciplinary Action Project ReportDocument30 pagesMultidisciplinary Action Project Reportsallu RanajiNo ratings yet

- Winter Project Report NilojjalDocument26 pagesWinter Project Report NilojjalAbhijit PhoenixNo ratings yet

- Profitability and Productivity in Indian BanksDocument16 pagesProfitability and Productivity in Indian BanksRajneesh Deshmukh0% (1)

- Synopsis ON Credit Risk Management IN: Pooja Arora 140423533Document6 pagesSynopsis ON Credit Risk Management IN: Pooja Arora 140423533Pooja AroraNo ratings yet

- Project Report HDFCDocument54 pagesProject Report HDFCBhaskar ShuklaNo ratings yet

- Indian Banking Industry - CHALLENGES DTDocument8 pagesIndian Banking Industry - CHALLENGES DTShadab AshfaqNo ratings yet

- Kotak Mahindra Bank 121121123739 Phpapp02Document112 pagesKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNo ratings yet

- Finance Major ProjectDocument16 pagesFinance Major ProjectVarshini KrishnaNo ratings yet

- Preface: of Public Sector and Private Sector Banks"Document47 pagesPreface: of Public Sector and Private Sector Banks"madhuri100% (1)

- 1 .4 Limitations of The StudyDocument10 pages1 .4 Limitations of The Studychinmay ajgaonkarNo ratings yet

- Main DataDocument59 pagesMain Datachinmay parsekarNo ratings yet

- Banking System 1Document52 pagesBanking System 1Banshul KumarNo ratings yet

- A Comparative Study On Public & Private Sector Banks: A Special Reference To Financial Performance, Non-Performing Assets and Employee MoraleDocument11 pagesA Comparative Study On Public & Private Sector Banks: A Special Reference To Financial Performance, Non-Performing Assets and Employee Moralevansham malikNo ratings yet

- Dissertation Report ON Indian Banking Industry: Prachi Janapitha, Adaspur, Cuttack - 754011, OdishaDocument6 pagesDissertation Report ON Indian Banking Industry: Prachi Janapitha, Adaspur, Cuttack - 754011, OdishaAbhijit MohantyNo ratings yet

- Fundamental Analysis of Private and Public Sector - 230131 - 103604Document57 pagesFundamental Analysis of Private and Public Sector - 230131 - 103604Abirami ThevarNo ratings yet

- Economy Banking System in IndiaDocument21 pagesEconomy Banking System in Indiakrishan palNo ratings yet

- Post and Pre Merger of Iob and BobDocument29 pagesPost and Pre Merger of Iob and BobShivam SomaniNo ratings yet

- Project Praful-1Document46 pagesProject Praful-1Rajendra GawateNo ratings yet

- Mergers Indian Banking Sector AluminiDocument72 pagesMergers Indian Banking Sector AluminiAvinash Pal SuryavanshiNo ratings yet

- Ing Vysya Bank ProjectDocument65 pagesIng Vysya Bank ProjectSakshi BehlNo ratings yet

- Thesis On Cooperative BanksDocument8 pagesThesis On Cooperative Bankscristinafranklinnewark100% (2)

- Comparative Analysis of Private Sector BankDocument66 pagesComparative Analysis of Private Sector BankRashmita Bhatt50% (4)

- Ing Vysya Bank ProjectDocument65 pagesIng Vysya Bank ProjectSakshi BehlNo ratings yet

- An Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Document15 pagesAn Assignment On "Case Study of Merger of Bank of Baroda With Vijaya Bank and Dena Bank"Shubham DeshmukhNo ratings yet

- Export Banking (1) ShubhamDocument54 pagesExport Banking (1) ShubhamShivanshu MittalNo ratings yet

- Commercial BAnk in IndiaDocument8 pagesCommercial BAnk in IndiasouvikNo ratings yet

- Corporation Bank Report FinalDocument61 pagesCorporation Bank Report FinalJasmandeep brarNo ratings yet

- A Comparative Study of Public and Private Sector Banks in IndiaDocument10 pagesA Comparative Study of Public and Private Sector Banks in IndiaEditor IJRITCC100% (1)

- 2015 - OctDocument20 pages2015 - OctDeepika ENo ratings yet

- 3IJISMRDJUN20193Document12 pages3IJISMRDJUN20193TJPRC Publications100% (1)

- Performace Evaluation of Selected Banking Companies in India: A StudyDocument25 pagesPerformace Evaluation of Selected Banking Companies in India: A StudyVinayak BhalbarNo ratings yet

- Priyanshi GaurDocument36 pagesPriyanshi Gaurstarkol.c2023112971No ratings yet

- Introduction About The Organization and Banking Industry: Chapter - 1Document41 pagesIntroduction About The Organization and Banking Industry: Chapter - 1Keerthy RajNo ratings yet

- E Banking ServicesDocument90 pagesE Banking ServicesManjunath Leo100% (2)

- Mergers Aquisitions3Document21 pagesMergers Aquisitions3Brijesh TrivediNo ratings yet

- Research Methodology: Introduction To Credit AppraisalDocument123 pagesResearch Methodology: Introduction To Credit AppraisalAstute ReportNo ratings yet

- Assessment of Service Quality in Indian Retailbanks For Icici Bank, HDFC Bank, Sbi and PNBDocument76 pagesAssessment of Service Quality in Indian Retailbanks For Icici Bank, HDFC Bank, Sbi and PNBParthesh Pandey100% (1)

- Project Report: Executive SummaryDocument32 pagesProject Report: Executive SummaryAbhijit PhoenixNo ratings yet

- AXIS ProjectDocument59 pagesAXIS ProjectSalim KhanNo ratings yet

- Summer Training Project ReportDocument66 pagesSummer Training Project ReportJimmy GoelNo ratings yet

- Abn-Ambro Bank Final 2007Document60 pagesAbn-Ambro Bank Final 2007Ajay PawarNo ratings yet

- Understanding The Role of Private Sector Banks in India: Mrs.M.NarmadhaDocument8 pagesUnderstanding The Role of Private Sector Banks in India: Mrs.M.NarmadhagayaNo ratings yet

- A Comparative Study On Personal Banking Service of Sbi and IciciDocument7 pagesA Comparative Study On Personal Banking Service of Sbi and IciciPraveen NamdeoNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- System Design Implementation and Operation - Chapter 22Document14 pagesSystem Design Implementation and Operation - Chapter 22Chantal DeLarenta100% (1)

- User'S Guide: Using Position Manager Biss-C Library On Iddk HardwareDocument19 pagesUser'S Guide: Using Position Manager Biss-C Library On Iddk HardwareMi HoangNo ratings yet

- Fmea Sfe47.005 WeldingDocument8 pagesFmea Sfe47.005 Weldingkumaraswamy.kNo ratings yet

- Organization and Regulation of Rail Industry in JapanDocument23 pagesOrganization and Regulation of Rail Industry in JapanWilliam LauNo ratings yet

- The Best of Tyre RecyclingDocument4 pagesThe Best of Tyre RecyclingMihai Basarab100% (1)

- Himel Productos 20 1Document8 pagesHimel Productos 20 1eng.ahmed.radwanNo ratings yet

- Nfpa 12 2018 14Document1 pageNfpa 12 2018 14Sundar RzNo ratings yet

- Rescission Camp John Vs Charter ChemicalDocument3 pagesRescission Camp John Vs Charter ChemicalDeej JayNo ratings yet

- AIKO - Datasheet For Mono 182-10BB-160F Bifacial PERCDocument4 pagesAIKO - Datasheet For Mono 182-10BB-160F Bifacial PERCShashwata ChattopadhyayNo ratings yet

- The Graduate Institute International Trade Law 2020Document22 pagesThe Graduate Institute International Trade Law 2020Anthea J KamalnathNo ratings yet

- Corpus Journal of Dairy and Veterinary Science (CJDVS)Document2 pagesCorpus Journal of Dairy and Veterinary Science (CJDVS)Lady CabreraNo ratings yet

- Airbnb in India Comparison With Hotels, and Factors Affecting Purchase IntentionsDocument13 pagesAirbnb in India Comparison With Hotels, and Factors Affecting Purchase Intentionsfadli adninNo ratings yet

- Web Development Quotation: What About It?Document4 pagesWeb Development Quotation: What About It?Gathy BrayohNo ratings yet

- Form 3520-A (Rev. December 2023)Document5 pagesForm 3520-A (Rev. December 2023)Jeff LouisNo ratings yet

- Schedule 2023 First YrDocument87 pagesSchedule 2023 First Yrashaanandh0101No ratings yet

- 1 BR - All Seasons Terrace Apartments - Damac Hills - Golf Terrace - Inr 2.99 CR - ReadyDocument4 pages1 BR - All Seasons Terrace Apartments - Damac Hills - Golf Terrace - Inr 2.99 CR - ReadyFahad Farooq FareedNo ratings yet

- Quarter 2 - Module 13 Settings, Processes, Methods and Tools in CommunicationDocument15 pagesQuarter 2 - Module 13 Settings, Processes, Methods and Tools in CommunicationGlenda GloriaNo ratings yet

- Auditing 1 TYBBI SEM VDocument3 pagesAuditing 1 TYBBI SEM VPrasad WarikNo ratings yet

- Management Lessons by Chankya NitiDocument18 pagesManagement Lessons by Chankya NitiKaran VitekarNo ratings yet

- Circuit Board Case Operations ManagementDocument5 pagesCircuit Board Case Operations ManagementdonmathewsgeorgNo ratings yet

- Inc., Process Costing. The For Department For: Brooks, Uses Costs 2Document3 pagesInc., Process Costing. The For Department For: Brooks, Uses Costs 2zain khalidNo ratings yet

- 2018 Nogiar 1Document112 pages2018 Nogiar 1Dear Lakes AyoNo ratings yet

- Strategic Marketing - Paragon Ceramics: Summer 2020 Course Code: MKT460 Section: 07Document59 pagesStrategic Marketing - Paragon Ceramics: Summer 2020 Course Code: MKT460 Section: 07Promi GoswamiNo ratings yet

- COMPLETE-Garver LLC Contract-ApolloParkDocument22 pagesCOMPLETE-Garver LLC Contract-ApolloParkKayode CrownNo ratings yet

- A07 008 SBCDatacommAuditReport03 16 2007Document14 pagesA07 008 SBCDatacommAuditReport03 16 2007fadhlinaaNo ratings yet

- Benefits of MRP 001Document4 pagesBenefits of MRP 001lynnthuNo ratings yet

- JD HR InternDocument7 pagesJD HR Internanonymous machineNo ratings yet