Professional Documents

Culture Documents

MFIN705 Ass3

MFIN705 Ass3

Uploaded by

yichan0519Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MFIN705 Ass3

MFIN705 Ass3

Uploaded by

yichan0519Copyright:

Available Formats

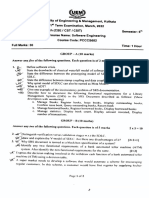

McMaster University

DeGroote School of Business

MFIN 705

Assignment 3

Due December 1.

Hand in a pdf copy of your: 1) computer output, 2) your R code in a plain text

file and 3) a separate write-up of the answers to the following questions on Avenue,

Assignment 3. Each student’s write-up should be done independently.

1. (15) Explain how the GARCH model and the stochastic volatility model are similar

and how they differ. Explain how the models can be estimated.

2. (55) This question will consider the single index model

rt = µ + βrm,t + ut ,

where rt is daily returns for WMT and rm,t is the daily return for SPY. The data

range is from 2005-01-01 2023-08-01.

(a) (10) Use OLS to compute the beta for WMT. Why is beta useful in finance?

(b) (20) If the second conditional moments of (rt , rm,t ) are time-varying define a

time-varying beta in this setting and estimate it using the model in the posted

bekk.r code. Report model estimates and any evidence of time variation in

beta.

(c) (5) Compare the constant beta with the time-varying beta with a plot.

(d) (20) Which beta captures more of the variation in rt ?

3. (30) This question requires you to download and compute daily returns for 15

stocks from yahoo.

(a) (10) Explain what principle component analysis is and why it is useful.

(b) (20) Perform principle component analysis on your selected stocks and report

your results. Use a scree plot to select the number of components you would

use.

You might also like

- Mca RevisedDocument130 pagesMca RevisedAmbalika SharmaNo ratings yet

- WWW Manaresults Co inDocument4 pagesWWW Manaresults Co insriniefsNo ratings yet

- It306 ADocument2 pagesIt306 ASANUNo ratings yet

- E3 A1116 Pages: 2: With A Suitable Example Explain How Does A Pointer Point To Another Pointer?Document2 pagesE3 A1116 Pages: 2: With A Suitable Example Explain How Does A Pointer Point To Another Pointer?Farzin FarooqNo ratings yet

- MCA (MGMT) 2020-Sample QuestionsDocument19 pagesMCA (MGMT) 2020-Sample QuestionsAnagha SawantNo ratings yet

- Thapar Institute of Engineering & Technology, Patiala: End Semester Examination (May 2019)Document4 pagesThapar Institute of Engineering & Technology, Patiala: End Semester Examination (May 2019)Forza HorizonNo ratings yet

- 1 Term Examination, March, 2022: Semester: 6thDocument4 pages1 Term Examination, March, 2022: Semester: 6thAnushree MondalNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/CSC580Document4 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/CSC580ainNo ratings yet

- 2020-11-05SupplementaryCS100CS100-I - Ktu QbankDocument2 pages2020-11-05SupplementaryCS100CS100-I - Ktu QbankSibin SamNo ratings yet

- PGDCA - NEW Semester I Assignments January and July 2023 SessionsDocument13 pagesPGDCA - NEW Semester I Assignments January and July 2023 SessionsYou Are Not Wasting TIME Here100% (1)

- csc313 356 139-CSC313Document6 pagescsc313 356 139-CSC313Aniket AmbekarNo ratings yet

- Data Base Management Systems r16 Oct 2018Document8 pagesData Base Management Systems r16 Oct 2018Lokesh ManikantaNo ratings yet

- BCT 2304 Database Management SystemDocument3 pagesBCT 2304 Database Management Systemben munjaruNo ratings yet

- Java MCQDocument10 pagesJava MCQsatyam sharmaNo ratings yet

- Dec - 2022 MCS-219Document4 pagesDec - 2022 MCS-219singhdeep258779No ratings yet

- End SemDocument8 pagesEnd SemSamaira SinghNo ratings yet

- E3 B192003 Pages: 2: Answer All Questions, Each Carries2 or 3 MarksDocument2 pagesE3 B192003 Pages: 2: Answer All Questions, Each Carries2 or 3 MarksFarzin FarooqNo ratings yet

- MCS 032 NotesDocument4 pagesMCS 032 NotesTECH IS FUNNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- 3Document4 pages3hohimof546No ratings yet

- CST202 QPDocument2 pagesCST202 QPSreedevi R KrishnanNo ratings yet

- Bit2201 Bbit308 Simulation and ModelingDocument3 pagesBit2201 Bbit308 Simulation and ModelingMark Joe AburNo ratings yet

- Class: XII Time: 3 Hrs. Jindal Vidya Mandir, Salav. Pre Board II Examination (2023-24) Subject: Informatics Practices (065) MM: 70Document5 pagesClass: XII Time: 3 Hrs. Jindal Vidya Mandir, Salav. Pre Board II Examination (2023-24) Subject: Informatics Practices (065) MM: 70srsecondarycomputerscienceteacher1No ratings yet

- III B.Tech. II Semester Regular Examinations Nov/Dec 2020: Code: 7G16DDocument7 pagesIII B.Tech. II Semester Regular Examinations Nov/Dec 2020: Code: 7G16DrameshNo ratings yet

- Merged Paper WTDocument11 pagesMerged Paper WTFACashishkumar singhNo ratings yet

- (CSC415) Final Assessment July 2022Document9 pages(CSC415) Final Assessment July 2022zuewaNo ratings yet

- Campusexpress - Co.in: Set No. 1Document8 pagesCampusexpress - Co.in: Set No. 1skssushNo ratings yet

- EC206 CO Modelqn2 Ktustudents - inDocument3 pagesEC206 CO Modelqn2 Ktustudents - ingpuonlineNo ratings yet

- M. Tech. Semester - I: Distributed Computing (MCSCS 101/1MCS1)Document20 pagesM. Tech. Semester - I: Distributed Computing (MCSCS 101/1MCS1)saurabh1116No ratings yet

- B.Tech Dec2022 Comp CSPC-27 Sem3Document2 pagesB.Tech Dec2022 Comp CSPC-27 Sem3ankit12012064No ratings yet

- Pps (Cse101c)Document12 pagesPps (Cse101c)Bhavya VermaNo ratings yet

- Digital Nov 07Document6 pagesDigital Nov 07skssushNo ratings yet

- CS222 1Document2 pagesCS222 1Riyaz ShaikNo ratings yet

- WWW Manaresults Co inDocument4 pagesWWW Manaresults Co insriniefsNo ratings yet

- Software Engineering May18Document2 pagesSoftware Engineering May18Tanisha PoojariNo ratings yet

- New Scheme Fifth Semester B.E. Degree Exalnillation, July 2006 Cs / IsDocument2 pagesNew Scheme Fifth Semester B.E. Degree Exalnillation, July 2006 Cs / IsAyushi BoliaNo ratings yet

- PythonDocument4 pagesPythonG Harish HariNo ratings yet

- Software Testing Methodologies Aug 2021Document2 pagesSoftware Testing Methodologies Aug 2021Nageswara Rao PulaNo ratings yet

- ADA Assignment - Final - 2022Document6 pagesADA Assignment - Final - 2022Olwethu N Mahlathini (Lethu)No ratings yet

- Zeal Polytechnic, Pune.: Second Year (Sy) Diploma in Computer Engineering Scheme: I Semester: IiiDocument82 pagesZeal Polytechnic, Pune.: Second Year (Sy) Diploma in Computer Engineering Scheme: I Semester: Iiixae778899No ratings yet

- PGDCA I Semester Jan 2020Document19 pagesPGDCA I Semester Jan 2020sayal96amritNo ratings yet

- Basic Parallel Computing (10 Points)Document5 pagesBasic Parallel Computing (10 Points)john carmackNo ratings yet

- DSC Cie-2Document2 pagesDSC Cie-2learn somethingNo ratings yet

- O RDocument11 pagesO Rwixiwe9843No ratings yet

- Question Paper Code:: (10×2 20 Marks)Document3 pagesQuestion Paper Code:: (10×2 20 Marks)Bala venniNo ratings yet

- Mca MGTDocument105 pagesMca MGTAkshansh Pal SinghNo ratings yet

- Ucs614 3 PDFDocument2 pagesUcs614 3 PDFsukruthNo ratings yet

- 3464Document4 pages3464Muhammad ShakoorNo ratings yet

- Tutorials - Software EngineeringDocument5 pagesTutorials - Software EngineeringNEELAM RAWATNo ratings yet

- M. Tech II Semester Q.P Oct 2015 Day 1Document5 pagesM. Tech II Semester Q.P Oct 2015 Day 1Prabhath DarlingNo ratings yet

- BE368 - Coursework 2022Document3 pagesBE368 - Coursework 2022Muhammad AfzaalNo ratings yet

- Questions 4 1Document95 pagesQuestions 4 1Anik PaulNo ratings yet

- RT 22022042017Document8 pagesRT 22022042017YasyrNo ratings yet

- B.Tech. (Semester: "Total O.Ofquestions:09) Paper Id (Cs324)Document2 pagesB.Tech. (Semester: "Total O.Ofquestions:09) Paper Id (Cs324)gurusodhiiNo ratings yet

- Master of Computer Applications: Assignments (July, 2008 & January, 2009) (2 Semester)Document12 pagesMaster of Computer Applications: Assignments (July, 2008 & January, 2009) (2 Semester)amritanshuuNo ratings yet

- CSIT2040 - Database SystemsDocument5 pagesCSIT2040 - Database Systemsms21900518No ratings yet

- Cao Previous QNDocument9 pagesCao Previous QNanusha deviNo ratings yet

- MCS-014-J14 - CompressedDocument3 pagesMCS-014-J14 - CompressedLukundo SichalweNo ratings yet

- Barani Institute of Management Sciences: BS (CS) - 5B & 5D Computer Architecture CS-532Document1 pageBarani Institute of Management Sciences: BS (CS) - 5B & 5D Computer Architecture CS-532Yaseen ShahidNo ratings yet