Professional Documents

Culture Documents

Analysis Vaibhav Deore (FM 202)

Analysis Vaibhav Deore (FM 202)

Uploaded by

sandy maliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis Vaibhav Deore (FM 202)

Analysis Vaibhav Deore (FM 202)

Uploaded by

sandy maliCopyright:

Available Formats

Name : Vaibhav Kailas Deore

Course: MBA Sem-II

Div : C

Subject: Financial Management 202

Submitted to : Dr. Priya Vasagadekar

Company - Tata Motors

Financial Performance Analysis (Standalone Ratios) (March 2019 – March 2023)

1. EPS (Earnings per Share):

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

7.27 -29.88 -36.99 -34.88 -84.89

• The trend of EPS over the five years increasing.

• There is increase in EPS due high demand and Supply for EV’s.

2. Return on Net Worth or Equity:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

12.14 -6.97 -12.57 -41.6 9.11

• The trend of Return on Net Worth or Equity over the four years is improving.

• Based Company's Return on Net Worth or Equity we can conclude that the company

performing better.

3. ROCE (Return on Capital Employed):

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

8.67 0.92 0.35 -6.72 11.07

• The trend of ROCE over the four years is increasing.

• Based on the company's ROCE the company is effectively utilizing its capital.

4. Net Profit Margin:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

4.14 -2.94 -7.93 -16.59 2.91

• The trend of Net Profit Margin over the five years is improving.

• Based on the company's Net Profit Margin the company maintaining decent

profitability.

5. ROA (Return on Assets):

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

58.67 52.07 49.77 48.7 65.26

• The trend of ROA over the four years is increasing.

• Based on the company's ROA the company is efficiently utilizing its assets?

6. Total Debt to Equity:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

0.84 1.17 1.14 1.19 0.79

• The trend of Total Debt to Equity over the five years decreasing.

• The company's debt structure and the level of risk associated with its capital structure is

effectively managed.

7. Current Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

0.37 0.36 0.51 0.46 0.54

• The trend of Current Ratio is declining.

• The company has short-term liquidity and has ability to meet current obligations.

8. Quick Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

0.46 0.49 0.55 0.53 0.51

• The trend of Quick Ratio is declining.

• The company has ability to use its near cash and has ability to meet current obligation.

9. Dividend Payout Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

0 -0.0134 -0.0117 -0.0292 -0.0122

• The trend of Dividend Payout Ratio is declining.

• The DPR numbers suggest the company is not distributing larger portion of its earning as

dividend whereas utilizing it for company growth.

10. Asset Turnover Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

1.56 1.13 0.75 1.11 1.82

• The trend of Asset turnover ratio is improving.

• The company is better at utilization of assets.

11. Inventory Turnover Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

21.72 12.71 6.63 11.46 14.84

• The trend of inventory turnover ratio is increasing.

• A higher inventory turnover ratio suggests efficient inventory management and faster

turnover.

12. Earning Yield Ratio:

Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

0.02 -0.01 -0.02 -0.29 0.03

• The trend of Earning Yield ratio is increasing.

• The increasing earning yield ratio indicates that investors in the company are getting

higher return on their investments.

You might also like

- BV - Assignement 2Document7 pagesBV - Assignement 2AkshatAgarwal50% (2)

- Case 1.4Document4 pagesCase 1.4Nam Hong Joo88% (8)

- The Protek Company Is A Large Manufacturer and Distributor ofDocument2 pagesThe Protek Company Is A Large Manufacturer and Distributor ofAmit PandeyNo ratings yet

- DATA ANALYSIS AND INTERPRETATIONDocument16 pagesDATA ANALYSIS AND INTERPRETATIONsomnathdike12No ratings yet

- Term Paper Assignment PPT FinalDocument26 pagesTerm Paper Assignment PPT FinalUday tejaNo ratings yet

- Analysis of Working Capital of Dabur India - VinayDocument4 pagesAnalysis of Working Capital of Dabur India - VinayPratap Kshitish RajNo ratings yet

- Financial Ratio Analysis (Apple)Document13 pagesFinancial Ratio Analysis (Apple)5562axyzNo ratings yet

- Accounts-Annual Report PPT-Group 7 - 20231105 - 104024 - 0000Document38 pagesAccounts-Annual Report PPT-Group 7 - 20231105 - 104024 - 0000Akshar VekariyaNo ratings yet

- Finance ProjectDocument48 pagesFinance ProjectFatima RizwanNo ratings yet

- FIN701 Finance and Accounting: Action Learning Project Group-14Document13 pagesFIN701 Finance and Accounting: Action Learning Project Group-14sunny bhardwajNo ratings yet

- Tài Chính Công TyDocument14 pagesTài Chính Công Typttd154No ratings yet

- Business Finance Ch3Document25 pagesBusiness Finance Ch3mahmoodafroz.shaik.aeNo ratings yet

- Tata Motors AnalysisDocument9 pagesTata Motors AnalysisrastehertaNo ratings yet

- South Indian BankDocument4 pagesSouth Indian BankMohak PalNo ratings yet

- Managerial Finance - Case StudyDocument7 pagesManagerial Finance - Case StudyAhmed NasrNo ratings yet

- Safkopsnin Fin201 PresentatiomDocument15 pagesSafkopsnin Fin201 PresentatiomjakioulhasanomiNo ratings yet

- Boat FinicialDocument4 pagesBoat Finicialchirag raoNo ratings yet

- Cash FlowDocument3 pagesCash FlowYucheng ZhuNo ratings yet

- G1 Group5 DBSDocument14 pagesG1 Group5 DBSRohit BNo ratings yet

- Financial Ratio GSKDocument3 pagesFinancial Ratio GSKNirajan SharmaNo ratings yet

- On Study of Cash Management at Axis BankDocument18 pagesOn Study of Cash Management at Axis BankHimanshu0% (1)

- Clevergroup DigitalmarketingDocument18 pagesClevergroup DigitalmarketingKim HoaNo ratings yet

- Almarai Company - H1Document20 pagesAlmarai Company - H1amjadNo ratings yet

- Financial Analysis presentaTIONDocument18 pagesFinancial Analysis presentaTIONRaj MishraNo ratings yet

- Financial Analysis of Pharmaceuticals IndustryDocument12 pagesFinancial Analysis of Pharmaceuticals Industrymahmudhasan5051No ratings yet

- TERM PAPER- BamburiDocument17 pagesTERM PAPER- BamburiJulianNo ratings yet

- SecB Group09Document26 pagesSecB Group09Sayantika MondalNo ratings yet

- Vіvеk MіshraDocument16 pagesVіvеk Mіshraproject wordNo ratings yet

- Whirlpool India Finance AssignmentDocument25 pagesWhirlpool India Finance AssignmentAkshat GuptaNo ratings yet

- Chapter-4: AnalysisDocument9 pagesChapter-4: AnalysisBusra HaqueNo ratings yet

- SFM MarathonDocument87 pagesSFM MarathonCharmi KotechaNo ratings yet

- Fundamental Analysis of Fertilizer SectorDocument13 pagesFundamental Analysis of Fertilizer SectorAmit SinghNo ratings yet

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaNo ratings yet

- LadderforLeaders2023 273 PDFDocument699 pagesLadderforLeaders2023 273 PDFsantosh kumarNo ratings yet

- BBF201 041220233 Ca1Document9 pagesBBF201 041220233 Ca1SO CreativeNo ratings yet

- Banking Sector Roundup Q1fy24 BCGDocument52 pagesBanking Sector Roundup Q1fy24 BCGSumiran BansalNo ratings yet

- Specific Project 1 and 2 On HeromotocorpDocument7 pagesSpecific Project 1 and 2 On Heromotocorpchokeplayer15No ratings yet

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaNo ratings yet

- Computer Age Management Services LTD (CAMS) : Mittal School of BusinessDocument25 pagesComputer Age Management Services LTD (CAMS) : Mittal School of BusinessVaishnavi KandukuriNo ratings yet

- Ba 2.2 OfssDocument33 pagesBa 2.2 OfssakashNo ratings yet

- Arman F L: Inancial Services TDDocument10 pagesArman F L: Inancial Services TDJatin SoniNo ratings yet

- Group Information: Dien Quang Lamp Joint Stock Company Công ty Cổ phần Bóng đèn Điện Quang (DQC)Document8 pagesGroup Information: Dien Quang Lamp Joint Stock Company Công ty Cổ phần Bóng đèn Điện Quang (DQC)BonBonNo ratings yet

- FIM PresentationDocument14 pagesFIM Presentationsomeone specialNo ratings yet

- Liquidity RatiosDocument4 pagesLiquidity Ratiosacademic527No ratings yet

- Franchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDocument3 pagesFranchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDonna BatoNo ratings yet

- Assignment Fin420 - Individual & Group EditDocument58 pagesAssignment Fin420 - Individual & Group EditHakim SantiagoNo ratings yet

- FM101 2505B Ratio-AnalysisDocument6 pagesFM101 2505B Ratio-Analysisjhonnelsios-eNo ratings yet

- Ratio Analysis: Mari Perolum Company LimitiedDocument5 pagesRatio Analysis: Mari Perolum Company LimitiedNuman AhmedNo ratings yet

- STOCKS TO WATCH 2023-10-6 v1Document9 pagesSTOCKS TO WATCH 2023-10-6 v1Solomon MainaNo ratings yet

- Working Capital Management atDocument29 pagesWorking Capital Management atNavkesh GautamNo ratings yet

- Finan Asig 1Document29 pagesFinan Asig 1puyen241004No ratings yet

- Murree Brewery Company LTDDocument7 pagesMurree Brewery Company LTDkinza bashirNo ratings yet

- Name: Hira Saqib Rehman Submitted To: Sir Nasir Rasool Section:03 Date: 11 December 2023 Subject: Financial Statement AnalysisDocument18 pagesName: Hira Saqib Rehman Submitted To: Sir Nasir Rasool Section:03 Date: 11 December 2023 Subject: Financial Statement Analysishira saqibNo ratings yet

- Industry Ratio Final Na Final 1 With InterpretationDocument3 pagesIndustry Ratio Final Na Final 1 With InterpretationClaudine Anne AguiatanNo ratings yet

- Army IbaDocument34 pagesArmy IbaZayed Islam SabitNo ratings yet

- CF K C ChandanDocument10 pagesCF K C ChandanChandan K CNo ratings yet

- Small Steps Big ShiftsDocument117 pagesSmall Steps Big ShiftsRounak AgarwalNo ratings yet

- Naveen's ProjectDocument28 pagesNaveen's Projectbest video of every timeNo ratings yet

- Interview Special-2016Document36 pagesInterview Special-2016Sneha Abhash SinghNo ratings yet

- Gas PetronasDocument33 pagesGas PetronasNour FaizahNo ratings yet

- Introduction To DerivatiesDocument37 pagesIntroduction To DerivatiesyopoNo ratings yet

- Momentum Trading Strategies Free PDFDocument11 pagesMomentum Trading Strategies Free PDFHtet Oo0% (1)

- Brijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaDocument2 pagesBrijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaFaltu AccntNo ratings yet

- Chapter 5Document46 pagesChapter 5vaman kambleNo ratings yet

- Foundations of Esg Investing: Part 1: How ESG Affects Equity Valuation, Risk and PerformanceDocument41 pagesFoundations of Esg Investing: Part 1: How ESG Affects Equity Valuation, Risk and PerformanceMônica PatricioNo ratings yet

- Business FinanceDocument1 pageBusiness FinancePro NdebeleNo ratings yet

- Bonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument49 pagesBonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessCOURAGEOUSNo ratings yet

- FRA Course Outline - PGDM 2021-23Document6 pagesFRA Course Outline - PGDM 2021-23Chetan SaxenaNo ratings yet

- Principles of Corporate Finance: 6th EditionDocument4 pagesPrinciples of Corporate Finance: 6th EditionParin MaruNo ratings yet

- P1-2B 6081901141Document3 pagesP1-2B 6081901141Mentari Anggari67% (3)

- Daftar PustakaDocument4 pagesDaftar Pustakagpibpetrus001No ratings yet

- Order Fulfillment Process:: 1.customer Demand PlanningDocument10 pagesOrder Fulfillment Process:: 1.customer Demand PlanningFarhan TasleemNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- ISDA Equities Derivatives 2011 DefinitionsDocument333 pagesISDA Equities Derivatives 2011 Definitionsdafoozz100% (2)

- Mid Year Outlook Report 2023Document83 pagesMid Year Outlook Report 2023Aa XhrjNo ratings yet

- Financial ManagementDocument48 pagesFinancial ManagementAishu SathyaNo ratings yet

- The Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and NiederhofferDocument3 pagesThe Insider Trading Anomaly Endures 50 Years After It Was First Identified by Lorie and Niederhoffertidomam303No ratings yet

- Harshad Mehta ScamDocument16 pagesHarshad Mehta ScamAshu JainNo ratings yet

- CA Final FEMA Amendment Vfinal May'23 OnwardsDocument14 pagesCA Final FEMA Amendment Vfinal May'23 Onwardsfkaam024No ratings yet

- Ias in Square PharmaDocument7 pagesIas in Square Pharmaarif9870% (1)

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Week 08 - 01 - Module 18 - Accounting For InventoriesDocument10 pagesWeek 08 - 01 - Module 18 - Accounting For Inventories지마리No ratings yet

- DCF AAPL Course Manual PDFDocument175 pagesDCF AAPL Course Manual PDFShivam Kapoor100% (1)

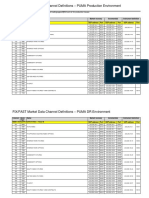

- FIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentDocument3 pagesFIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentVaibhav PoddarNo ratings yet

- Chap 019Document36 pagesChap 019Jesus Anthony QuiambaoNo ratings yet

- FundaTech 7Document111 pagesFundaTech 7Foru FormeNo ratings yet

- Time Value of MoneyDocument53 pagesTime Value of MoneyKritika BhattNo ratings yet

- Sample Experience LetterDocument3 pagesSample Experience LetterSubscription 126No ratings yet

- PT Jayatama - Dhiwa - Neraca Saldo (Klasik)Document2 pagesPT Jayatama - Dhiwa - Neraca Saldo (Klasik)Dhiwa RafiantoNo ratings yet