Professional Documents

Culture Documents

Pas 7

Pas 7

Uploaded by

Sacedon, Trishia Mae C.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pas 7

Pas 7

Uploaded by

Sacedon, Trishia Mae C.Copyright:

Available Formats

PAS 7 – CASH FLOWS Cash payments for:

• Acquisition/Redemption of Own

Operating Activities (From principal revenue • Shares

producing activities) • Short or long-term borrowings

Cash receipts from: • Finance lease liability

• Sale of goods and services • Interest expense (alternative)

• Royalties, rental, fee, commissions and • Dividends

other revenue

• Interest Income Cash flows shall be classified in a consistent

• Dividends manner from period to period as either

Cash payments for: operating, investing or financing.

• Purchase of goods and services

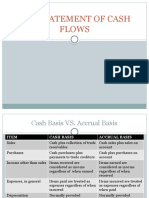

• Selling, Administrative and Other ACCRUAL

ITEMS CASH BASIS

Expenses BASIS

• Interest Expense XXXXX Income is Income is

• Dividends (alternative) recognized when recognized when

Cash receipts and payments for: received earned

• Premiums and claims, annuities and regardless of regardless of

other policy benefits by an insurance when earned, when received,

company and expense is and expense is

recognized when recognized when

• Income Taxes (unless specifically

paid regardless incurred

specified with Investing and Financing)

of when incurred. regardless of

• Securities held for trading

when paid.

• Advances, loans and interest income and

Cash sales plus Cash sales plus

expense of a financial institution

Sales collection of sales on account.

trade receivable.

Investing Activities (From acquisition and

Cash purchases Cash purchases

disposal of long-term assets including long- Purchases plus payment to plus purchase on

term investments) trade creditors account

Cash receipts from: Items received Items earned are

• Sale of PPE, Intangibles and Other long- are considered as considered as

Income

term assets other than income income

• Sale of Equity and Debt Instruments sales regardless of regardless of

• Sale of Interest in Joint Ventures when earned. when received.

• Advances and loans to other parties Items paid are Items incurred

• Derivative contracts treated as are treated as

Expense,

• Interest Income (alternative) in general

expense expense

• Dividends (alternative) regardless of regardless of

Cash payments for: when incurred. when paid.

• Purchase of PPE, Intangibles and Other No bad debts are Doubtful

long-term assets recorded accounts are

• Purchase of Equity and Debt Instruments Bad Debts because trade treated as bad

• Purchase of Interest in Joint Ventures receivables are debts.

• Derivative contracts not recognized.

Financing Activities (From equity and

borrowings)

Cash receipts from:

• Issuance of equity instruments

• Issuance of short or long-term

• borrowings

Conversion of Cash Basis to Accrual Basis

Direct Method Computations:

Collection from customers = Sales + A/R Beg.

Bal. - A/R End. Bal.

Payments to suppliers = Cost of Goods Sold +

End. Inventory - Beg. Inventory + Beg.

A/P - End. A/P

Payments for operating expenses = Operating

Expenses + End. Prepaid Exp. Bal. - Beg.

Statement of Cash Flows formats:

Prepaid Exp. Bal. + Beg. Accrued Liab. Bal. -

Direct Method – Format of the operating section

End. Accrued Liab. Bal.

of the statement of cash flows lists the major

Receipt of interest = Interest Revenue + Beg.

categories of cash receipts and disbursements.

Interest Receivable Bal. - End. Interest

Indirect Method – Format of the operating

Receivable Bal.

section of the statement of cash flows starts

Receipt of dividends = Dividend Revenue + Beg.

with the net income and then shows the

Dividend Receivable Bal. - End.

adjustments needed to reconcile the net

Dividend Receivable Bal.

income with the cash flows from operating

Payments to employees = Wages Expense +

activities.

Beg. Wages Payable Bal. - End. Wages

Special Note by me: Remember that this two

Payable Bal.

only differ in Operating Activities. Thus, the

Payments for interest = Interest Expense + Beg.

computation for Investing Activities and

Interest Payable Bal. - End. Interest

Financing Activities in Indirect Method is the

Payable Bal.

same as Direct Method and will not be shown.

Payments for income taxes = Income Tax

Expense + Beg. Income Tax Payable Bal. - End.

Income Tax Payable Bal.

When to add or subtract in the Indirect Method:

Items What to do Why do it

Depreciation,

Depletion, or Non-Cash

Add

Amortization Expenses

of assets

Non-Cash

Gains Subtract

Income

Non-Cash

Losses Add

Expenses

Increase in

current Assets Deducted

Subtract

(except cash from Accrual

and cash Basis Profit

equivalents)

Decrease in Added to

Add

Accrual Basis

current Assets

Profit

Increase in Added to

current Add Accrual Basis

Liabilities Profit

Decrease in Deducted

current Subtract from Accrual

Liabilities Basis Profit

Only those transactions that affected cash and

cash equivalents are reported in the statement

of cash flows. Non-cash transactions are

excluded and disclosed only.

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Short Notes Financial AccountigDocument9 pagesShort Notes Financial AccountigNajihah AbNo ratings yet

- Class 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeDocument4 pagesClass 3 Statement of Cash Flows Learning Objectives: Financial Reporting and Analysis - Dr. Michael LeeKevin ChengNo ratings yet

- 2.2 Financial StatementsDocument38 pages2.2 Financial StatementsNefarioDMNo ratings yet

- Unit Ii Cash Flow Analysis: Noncash Revenues and ExpensesDocument6 pagesUnit Ii Cash Flow Analysis: Noncash Revenues and Expensesaniket yadav0006No ratings yet

- Use of Financial StatementsDocument14 pagesUse of Financial Statementsimandimahawatte2008No ratings yet

- The Statement of Cash FlowsDocument12 pagesThe Statement of Cash Flowshamida saripNo ratings yet

- 7 Elements of FS-specific AccountsDocument28 pages7 Elements of FS-specific Accountsivygem saanNo ratings yet

- Financial StatementsDocument13 pagesFinancial Statementsme_chNo ratings yet

- Business MathDocument4 pagesBusiness MathPamela MarieNo ratings yet

- 1 LiabilitiesDocument39 pages1 LiabilitiesDiana Faith TaycoNo ratings yet

- Activities - Cash Payments To Acquire PropertyDocument2 pagesActivities - Cash Payments To Acquire PropertyPrecious ViterboNo ratings yet

- Accounting Slides Topic 6Document21 pagesAccounting Slides Topic 6Edouard Rivet-BonjeanNo ratings yet

- Topic 3 Acc2013Document22 pagesTopic 3 Acc2013yellowcat91No ratings yet

- Finance ShortcourseDocument46 pagesFinance Shortcoursemahendra ega higuittaNo ratings yet

- Assets, Liabilities, Equity, Incomes and Expenses: Session # 2Document9 pagesAssets, Liabilities, Equity, Incomes and Expenses: Session # 2Akash DhimanNo ratings yet

- Corporate Financial Reporting: Session 2: PGP 2018-19 Introduction and Accounting EquationDocument30 pagesCorporate Financial Reporting: Session 2: PGP 2018-19 Introduction and Accounting EquationArty DrillNo ratings yet

- Statement of Cash Flows (CA5106)Document17 pagesStatement of Cash Flows (CA5106)rhbqztqbzyNo ratings yet

- Basics of Accounting 3 Double Entry Book Keeping RulesDocument44 pagesBasics of Accounting 3 Double Entry Book Keeping Rulesjiten zopeNo ratings yet

- Conceptual Framework Module 9Document5 pagesConceptual Framework Module 9Jaime LaronaNo ratings yet

- Introduction To Financial Reporting: Assets Liabilities + Owner's EquityDocument7 pagesIntroduction To Financial Reporting: Assets Liabilities + Owner's EquityKothari InvestmentsNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- Property, Plant & EquipmentDocument19 pagesProperty, Plant & EquipmentErika Mae LegaspiNo ratings yet

- Financial Statements - Basis of AnalysisDocument44 pagesFinancial Statements - Basis of AnalysisJasmine ActaNo ratings yet

- Chapter 10PPTBBDocument49 pagesChapter 10PPTBBAnihaNo ratings yet

- Accounting NotesDocument6 pagesAccounting NotesD AngelaNo ratings yet

- Mas 3Document4 pagesMas 3Sophia LampaNo ratings yet

- 3.4 Final AccountsDocument6 pages3.4 Final AccountsDeepshika ReddyNo ratings yet

- Fs Cashflows Nov 20211Document21 pagesFs Cashflows Nov 20211MikhailNo ratings yet

- Cash Flow Statement: Vishesh SinghDocument20 pagesCash Flow Statement: Vishesh SinghVishesh SinghNo ratings yet

- AEC11, Line Items Statement of Cash FlowsDocument3 pagesAEC11, Line Items Statement of Cash FlowsKYLE CASSANDRA DUNAY BABAELNo ratings yet

- Chapter 11 Lecture 2018Document62 pagesChapter 11 Lecture 2018Johnny Sins100% (1)

- Statement of Cash Flows Ca5106Document57 pagesStatement of Cash Flows Ca5106Bon juric Jr.No ratings yet

- Cash Flow AnalysisDocument2 pagesCash Flow AnalysisJoey WassigNo ratings yet

- Sofp NotesDocument4 pagesSofp NotesLyka MillorNo ratings yet

- Cfas - ReceivablesDocument9 pagesCfas - ReceivablesYna SarrondoNo ratings yet

- Acct 018 Chapter 4 5Document4 pagesAcct 018 Chapter 4 5rivera.roshelleNo ratings yet

- Understanding Financial Statements, Taxes, and Cash Flows: Chapter 2Document49 pagesUnderstanding Financial Statements, Taxes, and Cash Flows: Chapter 2Cherry BlasoomNo ratings yet

- Presentation 250524Document26 pagesPresentation 250524Muhammad shahNo ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- Topic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Document15 pagesTopic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Sakshi koulNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementJeftonNo ratings yet

- 4types of Major Accounts-For Observation2Document13 pages4types of Major Accounts-For Observation2Marilyn Nelmida TamayoNo ratings yet

- Statement of Cash FlowsDocument16 pagesStatement of Cash FlowsJmaseNo ratings yet

- IAS 7 Statement of Cash Flows-1Document27 pagesIAS 7 Statement of Cash Flows-1machabelanosiphoNo ratings yet

- Accounting TerminologyDocument37 pagesAccounting Terminologyjhj01No ratings yet

- Fabm Week 4 Study GuideDocument3 pagesFabm Week 4 Study GuideFERNANDO TAMZ2003No ratings yet

- Types of Major AccountsDocument25 pagesTypes of Major AccountsRain Sofia LoquinteNo ratings yet

- Chapter 2. The Accounting EquationDocument46 pagesChapter 2. The Accounting Equationtrlinh15072004No ratings yet

- FinAcc_11Document34 pagesFinAcc_11Roger CastroNo ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsZance Jordaan100% (1)

- Lecture 6Document64 pagesLecture 6Zixin Gu100% (1)

- Fabm 1 - Week 4Document3 pagesFabm 1 - Week 4FERNANDO TAMZ2003No ratings yet

- Reading Balance SheetDocument25 pagesReading Balance SheetbajrangkaswanNo ratings yet

- Cash Flows Chap-13Document52 pagesCash Flows Chap-13nina0301100% (1)

- Cash Flow Statement: Presented By: Monojit Roy Punit Baiya Shasank Smita Sachhan VigneshDocument13 pagesCash Flow Statement: Presented By: Monojit Roy Punit Baiya Shasank Smita Sachhan VigneshZeet RoyNo ratings yet

- Chapter 2Document22 pagesChapter 2John Edwinson JaraNo ratings yet

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- Week 3 SlidesDocument38 pagesWeek 3 SlidesRogelio ParanNo ratings yet

- List SurnamesDocument1 pageList SurnamesSacedon, Trishia Mae C.No ratings yet

- FAMISANDocument4 pagesFAMISANSacedon, Trishia Mae C.No ratings yet

- Artist and ArtisanDocument7 pagesArtist and ArtisanSacedon, Trishia Mae C.No ratings yet

- Audit PlanningDocument24 pagesAudit PlanningSacedon, Trishia Mae C.No ratings yet

- Pas 8Document3 pagesPas 8Sacedon, Trishia Mae C.No ratings yet

- Group Discussion ExercisesDocument15 pagesGroup Discussion ExercisesDuyên HồngNo ratings yet

- Operario, Gabrielle Mae - MODULE3 - ASSIGNMENT - BOND MARKET SECURITIESDocument5 pagesOperario, Gabrielle Mae - MODULE3 - ASSIGNMENT - BOND MARKET SECURITIESGabby OperarioNo ratings yet

- Credit Risk Analyst Interview Questions and Answers 1904Document13 pagesCredit Risk Analyst Interview Questions and Answers 1904MD ABDULLAH AL BAQUINo ratings yet

- Ch.13 Graded Assignment PDFDocument11 pagesCh.13 Graded Assignment PDFShehry VibesNo ratings yet

- FINMAN 1 RevDocument2 pagesFINMAN 1 RevPrincess Ann FranciscoNo ratings yet

- النسب المالية - إنجليزىDocument5 pagesالنسب المالية - إنجليزىMohamed Ahmed YassinNo ratings yet

- Questions: Currency Lending Rate Borrowing RateDocument2 pagesQuestions: Currency Lending Rate Borrowing Ratehamba allahNo ratings yet

- Corporate Reporting Study Manual pt2 2020Document672 pagesCorporate Reporting Study Manual pt2 2020Learning PointNo ratings yet

- Capital StructureDocument8 pagesCapital StructureVarun MudaliarNo ratings yet

- Chase Bank Account Statement 2021Document3 pagesChase Bank Account Statement 2021quannbui950% (1)

- Static Banking by StudynitiDocument80 pagesStatic Banking by StudynitiSaurabh SinghNo ratings yet

- V1 Exam 1 AfternoonDocument31 pagesV1 Exam 1 AfternoonajnigelNo ratings yet

- CH 4Document21 pagesCH 49pxxp7pp6sNo ratings yet

- Rania Final Math Term 1 1Document8 pagesRania Final Math Term 1 1api-436869436No ratings yet

- Idfc First Bank: Fim Assignment - Bank ValuationDocument7 pagesIdfc First Bank: Fim Assignment - Bank ValuationRutuja NagpureNo ratings yet

- Practice Problems On Yield To MaturityDocument2 pagesPractice Problems On Yield To MaturityCharl PontillaNo ratings yet

- Money Banking and Financial Markets 5Th Edition Cecchetti Solutions Manual Full Chapter PDFDocument39 pagesMoney Banking and Financial Markets 5Th Edition Cecchetti Solutions Manual Full Chapter PDFKatherineJohnsonDVMinwp100% (8)

- Unsecured Sources of Short Term Loans, Madronero, Lorainne AnneDocument13 pagesUnsecured Sources of Short Term Loans, Madronero, Lorainne AnneAldrin Jon Madamba, MAED-ELMNo ratings yet

- Icici Prudential Value Discovery FunbDocument145 pagesIcici Prudential Value Discovery FunbAnuj RanaNo ratings yet

- Balance Sheets and Income Statements For Costco Wholesale Corporation FollowDocument2 pagesBalance Sheets and Income Statements For Costco Wholesale Corporation FollowDavid Rolando García OpazoNo ratings yet

- Macroeconomics A European Perspective 3Th by Olivier Full ChapterDocument41 pagesMacroeconomics A European Perspective 3Th by Olivier Full Chapteropal.wells168100% (23)

- Ind AS 109 FI - Material 5 (Revisied) Compound Financial Instruments - With AnswersDocument2 pagesInd AS 109 FI - Material 5 (Revisied) Compound Financial Instruments - With AnswersjvbsdNo ratings yet

- FIN 072 - SAS - Day 17 - IN - Second Period Exam OriginalDocument16 pagesFIN 072 - SAS - Day 17 - IN - Second Period Exam OriginalCharles AbulagNo ratings yet

- Ishares Tips Bond Etf: Fact Sheet As of 12/31/2014Document2 pagesIshares Tips Bond Etf: Fact Sheet As of 12/31/2014sigurddemizarNo ratings yet

- SSRN-id3308766.pdf - Quants Prespective On IBOR Fallback PDFDocument46 pagesSSRN-id3308766.pdf - Quants Prespective On IBOR Fallback PDFNikhilesh ShegokarNo ratings yet

- LAS 1 Quarter 4 BFDocument4 pagesLAS 1 Quarter 4 BFAnna Jessica NallaNo ratings yet

- Bonus MCQs Mostly C5Document5 pagesBonus MCQs Mostly C5Lê HiếuNo ratings yet

- Monetary and Credit Policy Operations: Part Two: The Working and Operations of The Reserve Bank of IndiaDocument17 pagesMonetary and Credit Policy Operations: Part Two: The Working and Operations of The Reserve Bank of IndiaUttamveer Singh GhalotNo ratings yet

- Chapter 2 Measuring The Cost of LivingDocument25 pagesChapter 2 Measuring The Cost of LivingHSE19 EconhinduNo ratings yet

- Ce 215 Engineering Econ Module CompilationDocument129 pagesCe 215 Engineering Econ Module CompilationClaudette Lindsay LabagnoyNo ratings yet