Professional Documents

Culture Documents

Pas 8

Pas 8

Uploaded by

Sacedon, Trishia Mae C.0 ratings0% found this document useful (0 votes)

40 views3 pagesThis document summarizes accounting policies and guidelines for changes in accounting policies, estimates, errors, and reporting entities according to PAS 8. Key points include:

- Changes in accounting policies are applied retrospectively with transitional provisions, while changes in estimates are applied prospectively.

- Prior period errors are corrected by restating comparative information presented to reflect the cumulative effect of correcting the error.

- Changes in reporting entities are treated as changes in accounting policies and prior periods are restated as if the new reporting entity had always existed.

- Disclosures are required for changes in estimates, policies, errors, and reporting entities.

Original Description:

REV

Original Title

PAS-8

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes accounting policies and guidelines for changes in accounting policies, estimates, errors, and reporting entities according to PAS 8. Key points include:

- Changes in accounting policies are applied retrospectively with transitional provisions, while changes in estimates are applied prospectively.

- Prior period errors are corrected by restating comparative information presented to reflect the cumulative effect of correcting the error.

- Changes in reporting entities are treated as changes in accounting policies and prior periods are restated as if the new reporting entity had always existed.

- Disclosures are required for changes in estimates, policies, errors, and reporting entities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

40 views3 pagesPas 8

Pas 8

Uploaded by

Sacedon, Trishia Mae C.This document summarizes accounting policies and guidelines for changes in accounting policies, estimates, errors, and reporting entities according to PAS 8. Key points include:

- Changes in accounting policies are applied retrospectively with transitional provisions, while changes in estimates are applied prospectively.

- Prior period errors are corrected by restating comparative information presented to reflect the cumulative effect of correcting the error.

- Changes in reporting entities are treated as changes in accounting policies and prior periods are restated as if the new reporting entity had always existed.

- Disclosures are required for changes in estimates, policies, errors, and reporting entities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

PAS 8 – CHANGES IN ACCOUNTING POLICIES, Accounting Treatment for a Change in

ESTIMATES AND ERROR Accounting Policy

Change in Accounting Estimate With transitional provision: A change in

accounting policy required by a standard or an

PAS 8 defines a change in accounting estimate

interpretation shall be applied in accordance

as “an adjustment of the carrying amount of an

with transitional provisions therein.

asset or a liability, or the amount of periodic

consumption of an asset that results from the Without transitional provision: If the standard or

assessment of the present status of and interpretation contains no transitional

expected future benefit and obligation provisions or if an accounting policy is changed

associated with the asset and liability.” voluntarily, the change shall be applied

retrospectively or retroactively.

Note: When it is difficult to determine whether

an adjustment is a change in accounting PAS 8, paragraph 22, provides that “an entity

estimate or a change in accounting policy, the shall adjust the opening balance of each

change shall be treated as a change in affected component of equity for the earliest

accounting estimate, with appropriate period presented and the comparative amounts

disclosure. disclosed for each prior period presented as if

the new policy had always been applied.”

Accounting Treatment for a Change in

Accounting Estimate

The effect of a change in accounting estimate Limitation of Retrospective Application

shall be recognized currently and prospectively

Retrospective application of a change in

by including it in profit or loss of:

accounting policy is not required if it is

a. The period of change if the change affects impractical to determine the cumulative effect

that period only. of change.

b. The period of change and future period if the For a particular prior period, it is impractical to

change affects both. apply a change in accounting policy when:

Prospective recognition of the effect of a a. The effects of the retrospective application

change in accounting estimate means that the are not determinable.

change is applied to transactions, other events

b. The retrospective application requires

and conditions from the date of change in

assumptions about what management’s

estimate.

intentions would have been at that time.

Note: a change in accounting estimate shall not

c. The retrospective application requires

result in restating the amounts presented in

significant estimate, and it is impossible to

financial statements of prior periods.

distinguish objectively information about the

estimate that:

Accounting Policies 1. Provides evidence of circumstances that

existed at that time, and

Accounting policies are the specific principles,

bases, conventions, rules and practices applied 2. Would have been available at that time

by an entity in preparing and presenting

financial statements.

Prospective Application

A change in accounting policy shall be made

only when: When it is impractical to apply a new accounting

policy retrospectively because it cannot

a. Required by an accounting standard or an

determine the cumulative effect of applying the

interpretation of the standard.

policy to all prior periods, the entity shall apply

b. The change will result in more relevant and the new policy prospectively from the earliest

faithfully represented information about the period practicable.

financial statements

Change in Reporting Entity

The following are not changes in accounting

A change in reporting entity is a change

policy:

whereby entities change their nature and report

a. The application of an accounting policy for their operations in such a way that the financial

events or transactions that differ in substance statements are in effect those of a different

from previously occurring events or reporting entity.

transactions

A change in reporting entity is actually a change

b. The application of a new accounting policy in accounting policy and therefore shall be

for events or transactions which did not occur treated retrospectively or retroactively to

previously or that was immaterial disclose what the statements would have

looked like if the current entity had been

existing in the prior year. Thus, the financial

statements of all prior periods presented shall If the error occurred before the earliest period

be restated to show financial information for the presented, the opening balances of assets,

new reporting entity. liabilities and equity for the earliest period

presented shall be restated.

Absence of Accounting Standard

When it is impractical to determine the

PAS 8, paragraph 10, provides that in the

cumulative effect at the beginning of the current

absence of an accounting standard that

period of an error on all prior periods, the entity

specifically applies to a transaction or event,

shall restate the comparative information to

management shall use its judgment in selecting

correct the error prospectively from the earliest

and applying an accounting policy that results

date practicable.

in information that is relevant to the economic

decision-making needs of users and faithfully

represented. Disclosures of Prior Period Errors

Paragraphs 11 and 12 specify the following An entity shall disclose the following:

hierarchy of guidance which management may

1. The nature of prior period error

use when selecting accounting policies in such

circumstances: 2. The amount of correction for each prior

period presented to the extent practicable:

a. Requirements of current standards dealing

with similar matters. a. For each financial statement line item

affected

b. Definition, recognition criteria and

measurement concepts for assets, liabilities, b. For basic and diluted earnings per share

income and expenses in the Conceptual

Framework for Financial Reporting 3. The amount of correction at the beginning of

the earliest prior period presented

c. Most recent pronouncements of other

standard-setting bodies that use similar 4. If retrospective restatement is impracticable

Conceptual Framework, other accounting for a particular prior period, the circumstances

literature and accepted industry practices. that led to the existence of that condition and a

description of how and from when the error has

been corrected.

Prior Period Errors

Prior period errors are omissions from and

misstatements in the financial statements for Example of prior period error:

one or more periods arising from a failure to use 1. Mathematical mistakes

or misuse of reliable information that: 2. Oversights or misinterpretation of facts

a. Was available when financial statements for 3. Mistake in applying accounting policies

those periods were authorized for issue. 4. Fraud

b. Could reasonably be expected to have been

obtained and taken into account in the Statement of financial statement errors

preparation and presentation of those financial

statements. Accounts Affected: Real accounts only

Example: improper classification of an asset,

liability and capital account

Accounting Treatment for Prior Period Errors

Correction: Reclassify the account balances

Prior period errors shall be corrected

retrospectively by adjusting the opening

balances of retained earnings and affected

Income statement errors

assets and liabilities.

Accounts Affected: Nominal accounts only

For comparative statements, financial

statements of the prior period shall be restated Example: improper classification of revenues

so as to reflect the retroactive application of the and expenses

prior period errors.

Correction: Reclassify the account if the error is

This is known as retrospective restatement discovered in the same year it is committed but

which is “correcting the recognition, if the discovery of error is in subsequent year,

measurement and disclosure of amounts of no need to reclassify accounts because the

elements of financial statements as if the prior nominal accounts for the current year are

period error had never occurred. correctly stated

In other words, the net income, its components,

retained earnings and other affected balances Combined statement errors

for the prior period presented shall be adjusted Accounts Affected: Both real and nominal

accordingly. accounts

Result in a misstatement of net income

Example: If accrued salaries payable is over meaning, if comparative statements are

looked, the effects are; presented, the prior year statements are

restated to correct the error.

a) Salaries expense is understated

(income statement error) Note: The correction of a prior period error is

b) Liability is understated (statement of excluded from profit or loss for the period in

financial position error) which the error is discovered. Instead, it should

c) Net income is overstated (income be adjusted to the beginning balance of

statement error) retained earnings of the earliest period

d) Retained earnings account is overstated presented.

(statement of financial position error)

Correction: It depends whether the error is

counter balancing or non counter balancing Effects of Counterbalancing Error on year-end

Profit and Loss:

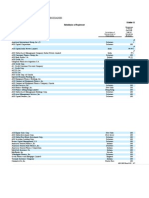

Counterbalancing Errors

Year 1 Year 2 Year 3

Effect of error: Overstatement Understatement None

1. The income statements for two

successive periods are incorrect. Financial Position:

2. The statement of financial position at the

end of the first period is incorrect. Year 1 Year 2 Year 3

3. The statement of financial position at the Erroneous None None

end of the second period is correct.

Effect in subsequent years: If not detected, they Effects of Non Counterbalancing Error on year-

are automatically counter balanced or end

corrected in the next accounting period.

Profit and Loss:

Example: Misstatement of the ff; Inventory,

Year 1 Year 2 Year 3

prepaid expense, accrued expense, deferred

Overstatement None None

income and accrued income

Financial Position:

Non Counterbalancing Errors

Year 1 Year 2 Year 3

Effect of error: Erroneous Erroneous Erroneous

1. The income statement of the period in

which the error is committed is incorrect Relationship between Accounts

but the succeeding income statement is Under Periodic Inventory System

not affected.

2. The statement of financial position of the • Direct Relationship

year of the error and succeeding

statements of financial position are Ending Inventory : Profit

incorrect until the error is corrected. Beginning Inventory & Purchases : COGS

Effect in subsequent years: They are not • Inverse Relationship

automatically counterbalance or corrected.

Ending Inventory : COGS

Example: Misstatement of depreciation and

doubtful accounts Beginning Inventory & Purchases : Profit

Under Perpetual Inventory System

Treatment of prior period errors • Direct Relationship

PAS 8 provides that an entity shall correct Asset-related Account : Profit

material prior period errors retrospectively in

• Inverse Relationship

the first set of financial statements authorized

for issue after their discovery by: Liability-related Account : Profit

a. Restating the comparative amounts for the

prior period presented in which the error

occurred. Special Note by me: In case you are having

trouble analyzing every situation and their

b. Restating the opening balances of assets, impact on one another, always remember the

liabilities and equity for the earliest prior period nature of the accounts and think of it carefully.

presented if the error occurred before the Do not be pressured, you already knew it,

earliest period presented. you’re just being confused. Take a breath

In other words, a prior period error shall be

corrected by retrospective restatement,

You might also like

- Estmt - 2019 06 20 PDFDocument10 pagesEstmt - 2019 06 20 PDFDiana Lynn100% (1)

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Aggregate Demand WorksheetDocument6 pagesAggregate Demand WorksheetDanaNo ratings yet

- Costing ModuleDocument7 pagesCosting ModuleJoneric RamosNo ratings yet

- Activity No. 1 - Cost, Concepts and ClassificationsDocument4 pagesActivity No. 1 - Cost, Concepts and ClassificationsDan RyanNo ratings yet

- A Study On Investor Behaviour On Investment AvenuesDocument11 pagesA Study On Investor Behaviour On Investment AvenuesLakshmiRengarajan100% (1)

- Chapter 01Document13 pagesChapter 01Asim NazirNo ratings yet

- 11 - M. PH Pharmaceutical Marketing & ManagementDocument23 pages11 - M. PH Pharmaceutical Marketing & Managementmonita aryaNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- (Diagnostic Exam) Advanced Studies in TaxationDocument25 pages(Diagnostic Exam) Advanced Studies in TaxationOjims Christjohn C CadungganNo ratings yet

- An Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsDocument38 pagesAn Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsPhrexilyn PajarilloNo ratings yet

- Pas 28Document6 pagesPas 28AnneNo ratings yet

- Universal Robina Corporation:: Holy Angel UniversityDocument5 pagesUniversal Robina Corporation:: Holy Angel UniversityRawr rawrNo ratings yet

- Sec Code of Corporate Governance AnswerDocument3 pagesSec Code of Corporate Governance AnswerHechel DatinguinooNo ratings yet

- Byproduct AccountingDocument13 pagesByproduct AccountingAbu NaserNo ratings yet

- Bfar ReviewerDocument6 pagesBfar Reviewerraimefaye seduconNo ratings yet

- Repealed PD 692 Known As Revised Accountancy LawDocument8 pagesRepealed PD 692 Known As Revised Accountancy LawLian RamirezNo ratings yet

- Responsibility Accounting - With Special Reference To Tata Steel Ltd. IndiaDocument8 pagesResponsibility Accounting - With Special Reference To Tata Steel Ltd. IndiaAnkur Jyoti ChoudhuryNo ratings yet

- Module 5.2 - Sample ExercisesDocument8 pagesModule 5.2 - Sample ExercisesJaimell LimNo ratings yet

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Unit4 ActivityDocument11 pagesUnit4 ActivityJasper John NacuaNo ratings yet

- Chapter 5 - Intermediate Accounting Volume 1Document11 pagesChapter 5 - Intermediate Accounting Volume 1Buenaventura, Elijah B.No ratings yet

- ReSA Batch 46 ScheduleDocument1 pageReSA Batch 46 ScheduleMica TolentinoNo ratings yet

- NSTP 2 RiviewerDocument5 pagesNSTP 2 RiviewerZeny DalumpinesNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDale MartinNo ratings yet

- FAR REVIEWER Part 1Document7 pagesFAR REVIEWER Part 1jessamae gundanNo ratings yet

- Module 7 Process CostingDocument6 pagesModule 7 Process CostingAlexandra AbasNo ratings yet

- 6726 Revised Conceptual FrameworkDocument7 pages6726 Revised Conceptual FrameworkJane ValenciaNo ratings yet

- Davao - Eagle - Com JOSEPHDocument6 pagesDavao - Eagle - Com JOSEPHablay logeneNo ratings yet

- Liabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasDocument158 pagesLiabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasErika Mae LegaspiNo ratings yet

- INTGR TAX 005 Compensation IncomeDocument5 pagesINTGR TAX 005 Compensation IncomeZatsumono YamamotoNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Job Order Costing Activity 2Document7 pagesJob Order Costing Activity 2RJ MonsaludNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- FAR Qualifying Exam Review: Loan ReceivableDocument9 pagesFAR Qualifying Exam Review: Loan ReceivableRodelLaborNo ratings yet

- Ch28 Test Bank 4-5-10Document14 pagesCh28 Test Bank 4-5-10KarenNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- Cfas Chapter 2 Cfas ValixDocument8 pagesCfas Chapter 2 Cfas ValixNiro MadlusNo ratings yet

- Shareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' EquityDocument12 pagesShareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' Equitycriszel4sobejanaNo ratings yet

- The Simplex Minimization MethodDocument13 pagesThe Simplex Minimization MethodJean HipolitoNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Int Acc Answer Key Volume 1 by Valix 2019 1Document232 pagesInt Acc Answer Key Volume 1 by Valix 2019 1Mariela HanticNo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- Chapter 8Document5 pagesChapter 8Misherene MagpileNo ratings yet

- Par Cor Quizzes Soln Pca 2019Document27 pagesPar Cor Quizzes Soln Pca 2019mariellec907No ratings yet

- First Time Adoption of PFRSDocument5 pagesFirst Time Adoption of PFRSPia ArellanoNo ratings yet

- StalasaDocument23 pagesStalasajessa mae zerdaNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Standard Costing & Variance AnalysisDocument23 pagesStandard Costing & Variance AnalysisZehra LeeNo ratings yet

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaDocument32 pagesCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Review and Discussion Questions Chapter TenDocument5 pagesReview and Discussion Questions Chapter TenDaniel DialinoNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- The Simplex Method MaximizationDocument21 pagesThe Simplex Method MaximizationJohn Rovic GamanaNo ratings yet

- Cost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsDocument8 pagesCost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsXyne FernandezNo ratings yet

- Subsequent Measurement Accounting Property Plant and EquipmentDocument60 pagesSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- LS 1.30 - PSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSADocument5 pagesLS 1.30 - PSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSASkye LeeNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Accounting 404BDocument2 pagesAccounting 404BMelicah Chantel SantosNo ratings yet

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalDocument3 pagesUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette LampitocNo ratings yet

- List SurnamesDocument1 pageList SurnamesSacedon, Trishia Mae C.No ratings yet

- FAMISANDocument4 pagesFAMISANSacedon, Trishia Mae C.No ratings yet

- Audit PlanningDocument24 pagesAudit PlanningSacedon, Trishia Mae C.No ratings yet

- Artist and ArtisanDocument7 pagesArtist and ArtisanSacedon, Trishia Mae C.No ratings yet

- Amazing Intraday Strategy - GUNTU RAMARAODocument25 pagesAmazing Intraday Strategy - GUNTU RAMARAOwadatkar.amit104No ratings yet

- Republic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005Document9 pagesRepublic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005dingNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- 19Document3 pages19Kristine Arsolon100% (2)

- GST 106 Conceptual Issues On Entrepreneurship and Entrepreneur 2Document6 pagesGST 106 Conceptual Issues On Entrepreneurship and Entrepreneur 2carenNo ratings yet

- Semana 10 Ingles NI EXAMENDocument31 pagesSemana 10 Ingles NI EXAMENSOLANO VIDAL RIJKAARD MAINNo ratings yet

- Empirical Asset Pricing: Classes 5 & 6: The Cross-Section of Expected Stock ReturnsDocument24 pagesEmpirical Asset Pricing: Classes 5 & 6: The Cross-Section of Expected Stock ReturnsJoe23232232No ratings yet

- Statement Oct 22 XXXXXXXX5308Document8 pagesStatement Oct 22 XXXXXXXX5308TECH 9tvNo ratings yet

- Roles & Functions of Reserve Bank of India: Useful LinksDocument7 pagesRoles & Functions of Reserve Bank of India: Useful LinksJaldeep MangawaNo ratings yet

- American International Group Inc and SubsidiariesDocument14 pagesAmerican International Group Inc and SubsidiariesFOXBusiness.com50% (2)

- Alexandria Public Schools Tax LevyDocument74 pagesAlexandria Public Schools Tax LevyinforumdocsNo ratings yet

- CRM RBCDocument14 pagesCRM RBCKarthik ArumughamNo ratings yet

- Aud ProbDocument9 pagesAud ProbKulet AkoNo ratings yet

- Government Bonds Bond - IN0020190362 Bond - IN0020170026Document4 pagesGovernment Bonds Bond - IN0020190362 Bond - IN0020170026Arif AhmedNo ratings yet

- Updated ResumeDocument3 pagesUpdated ResumeBhasker RamachandraNo ratings yet

- Tax Card For Tax Year 2019Document1 pageTax Card For Tax Year 2019Kinglovefriend100% (1)

- Financial Math TestDocument172 pagesFinancial Math TestCP Mario Pérez López100% (2)

- Hedge Fund StrategiesDocument2 pagesHedge Fund StrategiesPradnya Kulal0% (1)

- Bank Final AccountDocument11 pagesBank Final AccountKadam KartikeshNo ratings yet

- Statements Jan-23. 12Document3 pagesStatements Jan-23. 12Basmma EidNo ratings yet

- Why Worlds Largest AMCs Not Present in India - August 2023Document12 pagesWhy Worlds Largest AMCs Not Present in India - August 2023manindrag00No ratings yet

- Project Financial ServicesDocument71 pagesProject Financial ServicesPardeep YadavNo ratings yet

- 7.1 What Are Firms?: Chapter 7 Producers in The Short RunDocument55 pages7.1 What Are Firms?: Chapter 7 Producers in The Short RunraiNo ratings yet

- Derivative IBBL Stress Testing 2012-16 AatiqDocument56 pagesDerivative IBBL Stress Testing 2012-16 AatiqMD ATIQULLAH KHANNo ratings yet

- 5C of LoanDocument1 page5C of Loana.tanuNo ratings yet