Professional Documents

Culture Documents

07 Receivable Financing 2 Solving

07 Receivable Financing 2 Solving

Uploaded by

kyle mandaresioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Receivable Financing 2 Solving

07 Receivable Financing 2 Solving

Uploaded by

kyle mandaresioCopyright:

Available Formats

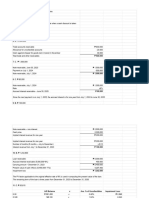

Problem Solving - Receivable Financing

1 Pittance Company

1-Mar Cash 2,000,000

Notes payable - bank 2,000,000

1-Apr Cash (1,000,000 x 98%) 980,000

Sales discount (1,000,000 x 2%) 20,000

Accounts receivable 1,000,000

1-Jun Cash 2,000,000

Accounts receivable 2,000,000

1-Sep Note payable - bank 2,000,000

Interest expense (2,000,000 x 12% x 6/12) 120,000

Cash 2,120,000

2 Idealist Company

a. Principal amount of loan 4,000,000

Less: Discount (4,000,000 x 10% x 1yr) 400,000

Cash proceeds 3,600,000

1-Oct-19 Cash 3,600,000

Discount on notes payable 400,000

Notes payable - bank 4,000,000

12/31/2019 To record the amortization of Discount on notes payable

Interest expense (400,000 x 3/12) 100,000

Discount on notes payable 100,000

10/1/2020 To record the payment bank loan

Notes payable 4,000,000

Cash 4,000,000

To record the amortization of Discount on notes payable

Interest expense (400,000 x 9/12) 300,000

Discount on notes payable 300,000

b. Principal of bank loan 4,000,000

Less: Discount on notes payable (400,000 - 100,000) 300,000

Carrying amount of bank loan 3,700,000

"The entity signed a note for the loan and pledged P5,000,000 of its accounts

receivable as collateral for the same."

3 Elegant Company

1-May Accounts receivable - assigned 800,000

Accounts receivable 800,000

Cash 620,000

Service charge 20,000

Notes payable - bank (800,000 x 80%) 640,000

5-May Sales return 30,000

Accounts receivale - assigned 30,000

10-May Cash (500,000 x 98% 490,000

Sales discount (500,000 x 2%) 10,000

Accounts receivable - assigned 500,000

1-Jun Notes payable - bank 490,000

Interest expense (640,000 x 2%) 12,800

Cash 502,800

7-Jun Allowance for doubtful accounts 10,000

Accounts receivable - assigned 10,000

20-Jun Cash 200,000

Accounts receivable - assigned 200,000

1-Jul Notes payable - bank (640,000 - 490,000) 150,000

Interest expense (150,000 x 2%) 3,000

Cash 153,000

Accounts receivable - assigned

1-May 800,000 5-May 30,000

10-May 500,000

7-Jun 10,000

20-Jun 200,000

End 60,000

800,000 800,000

Accounts receivable 60,000

Accounts receivale - assigned 60,000

4 Docile Company

1-Jul Accounts receivable - assigned 1,500,000

Accounts receivable 1,500,000

Cash 1,065,000

Service charge (1,500,000 x 4%) 60,000

Notes payable - bank (1,500,000 x 75%) 1,125,000

1-Aug notification basis

Notes payable - bank 800,000

Accounts receivable - assigned 800,000

Interest expense (1,125,000 x 2%) 22,500

Cash 22,500

1-Sep (Notification basis)

Notes payable - bank (1,125,000 - 800,000) 325,000

Interest expense (325,000 x 2%) 6,500

Cash 168,500

Accounts receivable - assigned 500,000

Accounts receivable - assigned

1-Jul 1,500,000 1-Aug 800,000

1-Sep 500,000

End 200,000

1,500,000 1,500,000

Accounts receivable 200,000

Accounts receivable - assigned 200,000

5 Grateful Company

1-Jul Accounts receivable - assigned 500,000

Accounts receivable 500,000

Cash 390,000

Service charge (500,000 x 2%) 10,000

Notes payable 400,000

1-Aug Cash 330,000

Accounts receivable - assigned 330,000

Interest expense (400,000 x 1%) 4,000

Notes payable - bank (330,000 - 4,000) 326,000

Cash 330,000

1-Sep Cash 170,000

Accounts receivable - assigned (500,000 - 330,000) 170,000

Notes payable - bank (400,000 - 326,000) 74,000

Interest expense (74,000 x 1%) 740

Cash 74,740

You might also like

- Sample Portfolio InvestmentDocument22 pagesSample Portfolio Investmentwshutop100% (2)

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- Problem 8-6 & 8-7 ReportDocument3 pagesProblem 8-6 & 8-7 Reportjessamae gundan100% (1)

- Problem 23-1, Page 650 Erica Company: Required: # Debit CreditDocument14 pagesProblem 23-1, Page 650 Erica Company: Required: # Debit CreditDeanne LumakangNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Promotion Wrap-Up With: For Rihanna's Perfume, A Video Meant For RewatchingDocument2 pagesPromotion Wrap-Up With: For Rihanna's Perfume, A Video Meant For RewatchingManan ShahNo ratings yet

- Himalaya's Marketing StrategyDocument22 pagesHimalaya's Marketing StrategyMayank100% (6)

- Receivable FinancingDocument8 pagesReceivable FinancingHannah Pearl Flores VillarNo ratings yet

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument23 pagesPittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- INTERMEDIATE ACCOUNTING 1 EditedDocument18 pagesINTERMEDIATE ACCOUNTING 1 EditedApril Mae LomboyNo ratings yet

- Problem 8-3Document1 pageProblem 8-3Gilbert MoralesNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Laudit - 8 1,8 2Document3 pagesLaudit - 8 1,8 2Gilbert MoralesNo ratings yet

- IA Chapter-8-10Document8 pagesIA Chapter-8-10Christine Joyce EnriquezNo ratings yet

- Chapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Document9 pagesChapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Lorence IbañezNo ratings yet

- Problem 8Document3 pagesProblem 8Coleen Lara SedillesNo ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Assignment 7 and Problem Solving - LA MADRID, Arianne Leah, V.Document10 pagesAssignment 7 and Problem Solving - LA MADRID, Arianne Leah, V.Leah La MadridNo ratings yet

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- Answers Part2Document1 pageAnswers Part2Jamaica DavidNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Acctg Lab 2.Document110 pagesAcctg Lab 2.AngieNo ratings yet

- Activity 3-IntAcc1Document2 pagesActivity 3-IntAcc10322-1975No ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- Chapter 8 & 9 AssignmentDocument8 pagesChapter 8 & 9 AssignmentSamantha Charlize Vizconde67% (3)

- Chapter 8 9 AssignmentDocument8 pagesChapter 8 9 AssignmentDax CruzNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- This Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsDocument2 pagesThis Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsKim TanNo ratings yet

- FAR 1 Chapter - 8Document8 pagesFAR 1 Chapter - 8Klaus DoNo ratings yet

- FAR 1 Chapter - 8Document8 pagesFAR 1 Chapter - 8Klaus DoNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Prelim Exercises Partnership Operation 28Document5 pagesPrelim Exercises Partnership Operation 28Garp BarrocaNo ratings yet

- Assignment On LiabilitiesDocument7 pagesAssignment On LiabilitiesVixen Aaron EnriquezNo ratings yet

- 4 Solution Exam Auditing 2Document5 pages4 Solution Exam Auditing 2Kristina KittyNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Jawaban Soal, Akuntansi Menengah 1Document7 pagesJawaban Soal, Akuntansi Menengah 1Mira OktaviaNo ratings yet

- Batch 95 FAR First Preboard SolutionDocument7 pagesBatch 95 FAR First Preboard Solutionssslll2No ratings yet

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- Bonds PayableDocument4 pagesBonds PayableyelzNo ratings yet

- Catibog, Marynissa M. (Intermediate Acctg 2) - ActivityDocument11 pagesCatibog, Marynissa M. (Intermediate Acctg 2) - ActivityMarynissa CatibogNo ratings yet

- Chapter5 IA Problems1 9Document16 pagesChapter5 IA Problems1 9Anonn100% (1)

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- FinAct ARDocument12 pagesFinAct ARNMCartNo ratings yet

- Name: Lecturer: Course Name: Course CodeDocument6 pagesName: Lecturer: Course Name: Course CodeJaredNo ratings yet

- Endngrsi - Akuntsi - Jurnal (2) NewDocument10 pagesEndngrsi - Akuntsi - Jurnal (2) NewMirzanun Nurul WakhidahNo ratings yet

- There Is No Transfer of Ownership Over The P3M Receivables.: Disclosure OnlyDocument8 pagesThere Is No Transfer of Ownership Over The P3M Receivables.: Disclosure OnlyCrizel DarioNo ratings yet

- Book 1Document14 pagesBook 1by ScribdNo ratings yet

- Solution Manual INTACC3 SUMMERDocument25 pagesSolution Manual INTACC3 SUMMERRaven SiaNo ratings yet

- Problem 9-1,9-2,9-3Document3 pagesProblem 9-1,9-2,9-3Annabeth ChaseNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- ACC106 Notes Receivable IllustrationsDocument23 pagesACC106 Notes Receivable IllustrationsJohn MaynardNo ratings yet

- Class Exercise Sheet FourDocument9 pagesClass Exercise Sheet Fourcarol mohasebNo ratings yet

- Auditing TheoryDocument60 pagesAuditing Theorykyle mandaresioNo ratings yet

- 14 Retail Inventory Method Section 2 MCPDocument3 pages14 Retail Inventory Method Section 2 MCPkyle mandaresioNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- 14 Retail InventoryMethod - Multiple Choice ProblemDocument2 pages14 Retail InventoryMethod - Multiple Choice Problemkyle mandaresioNo ratings yet

- 13 Gross Profit Method Section 2 MCPDocument7 pages13 Gross Profit Method Section 2 MCPkyle mandaresioNo ratings yet

- 15 Biological Asset Section 2 Problem SolvingDocument3 pages15 Biological Asset Section 2 Problem Solvingkyle mandaresioNo ratings yet

- 15 Biological Asset Section 2 MCPDocument2 pages15 Biological Asset Section 2 MCPkyle mandaresioNo ratings yet

- C 12 LCNRV - Problem SolvingDocument1 pageC 12 LCNRV - Problem Solvingkyle mandaresioNo ratings yet

- 15 Biological Assets - Problem SolvingDocument1 page15 Biological Assets - Problem Solvingkyle mandaresioNo ratings yet

- 01.cash and Cash Equivalents - (Multiple Choice)Document5 pages01.cash and Cash Equivalents - (Multiple Choice)kyle mandaresioNo ratings yet

- 01 Cash and Cash Equivalents Problem SolviDocument4 pages01 Cash and Cash Equivalents Problem Solvikyle mandaresioNo ratings yet

- Competency Result (Yes) MeanDocument2 pagesCompetency Result (Yes) Meankyle mandaresioNo ratings yet

- Lecture 6 - ABC Costing RevisedDocument22 pagesLecture 6 - ABC Costing RevisedMJ jNo ratings yet

- Prudential RegulationsDocument11 pagesPrudential RegulationsBishnu DhamalaNo ratings yet

- Learning Curve NotesDocument3 pagesLearning Curve NotesFellOut XNo ratings yet

- Emem Samuel Cassava Business PlanDocument19 pagesEmem Samuel Cassava Business PlanMAVERICK MONROENo ratings yet

- Lesson One: Nature and Purpose of Cost AccountingDocument285 pagesLesson One: Nature and Purpose of Cost AccountingKevin WasongaNo ratings yet

- Importance of Human Resource Accounting in The Era of Economic RecessionDocument2 pagesImportance of Human Resource Accounting in The Era of Economic RecessionHitesh ShahNo ratings yet

- Capital StructureDocument8 pagesCapital StructureKalpit JainNo ratings yet

- Philip CVDocument4 pagesPhilip CVPhilip Arvin LacsonNo ratings yet

- Grade 11 ACC Session 4 LN PDFDocument4 pagesGrade 11 ACC Session 4 LN PDFrealbutterfly100% (1)

- Design Options For E-Distribution NetworkDocument6 pagesDesign Options For E-Distribution NetworkJohn PangNo ratings yet

- 508Document46 pages508swutea100% (1)

- LeviDocument8 pagesLeviabhishekniiftNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument42 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionRehab AlhajiNo ratings yet

- EPIC HY Report 2023Document54 pagesEPIC HY Report 2023Uday KiranNo ratings yet

- Whole Foods Opt 1Document27 pagesWhole Foods Opt 1Kumail ZaidiNo ratings yet

- CH-1 The Accounting Equation2Document47 pagesCH-1 The Accounting Equation2Yasin Arafat ShuvoNo ratings yet

- Industry and Marketplace Analysis: Stephen Lawrence and Frank MoyesDocument20 pagesIndustry and Marketplace Analysis: Stephen Lawrence and Frank MoyesAjit ShindeNo ratings yet

- Ediware: Edible Cutlery and CrockeryDocument11 pagesEdiware: Edible Cutlery and CrockerykavindriNo ratings yet

- 36 - Problems On Cost Sheet1Document5 pages36 - Problems On Cost Sheet1pat_poonam0% (1)

- Applied Auditing 2Document11 pagesApplied Auditing 2Leny Joy DupoNo ratings yet

- Phase 1 MKTG3004 UploadDocument10 pagesPhase 1 MKTG3004 Uploadrayanne.zreikaxxNo ratings yet

- 10 Capital Adequacy NormsDocument23 pages10 Capital Adequacy NormsBindal HeenaNo ratings yet

- Dong Zhe: E-Commerce Trend and E-Customer AnalyzingDocument41 pagesDong Zhe: E-Commerce Trend and E-Customer AnalyzingRADHIKA V HNo ratings yet

- Tata Starbucks 1Document9 pagesTata Starbucks 1Divine CastroNo ratings yet

- PDF 6Document349 pagesPDF 6Aexisse OrchessaNo ratings yet

- Finance 3010 Test 1 Version A Spring 2006Document13 pagesFinance 3010 Test 1 Version A Spring 2006HuyNguyễnQuangHuỳnhNo ratings yet

- Pricing and CVP Acc720Document14 pagesPricing and CVP Acc720Alea AzmiNo ratings yet