Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsAUSTRALIAN TAXATION - Parteng Apat

AUSTRALIAN TAXATION - Parteng Apat

Uploaded by

Vero EntertainmentThis document summarizes key aspects of Australian taxation law, including:

1) Types of non-assessable non-exempt income such as hobbies, gambling wins, gifts, and lottery or competition wins.

2) Tax treatment of employee share schemes which provide benefits like discounted company shares and options.

3) Rules around deductible expenses for individuals, including allowed deductions to increase taxable income and denied deductions for capital, private, or non-assessable income expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- LBUE Assignment 1 To SubmitDocument4 pagesLBUE Assignment 1 To SubmitmbizoliyemaNo ratings yet

- Accenture Performance AppraisalDocument30 pagesAccenture Performance AppraisalChanpreet Singh Grover25% (4)

- Philips C Pap SettlementDocument274 pagesPhilips C Pap SettlementKhristopher Brooks0% (1)

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- CFA PM, AA, Econ, FI, Trading, Perf EvalDocument42 pagesCFA PM, AA, Econ, FI, Trading, Perf EvalKnightspageNo ratings yet

- Grand Hyatt Melbourne Hotel Marketing PlanDocument19 pagesGrand Hyatt Melbourne Hotel Marketing PlankarenNo ratings yet

- 345272733-Accenture-Suman DasDocument6 pages345272733-Accenture-Suman DasSuman Das100% (1)

- Financial Accounting and Reporting A Global Perspective 4th Edition Stolowy Solutions ManualDocument20 pagesFinancial Accounting and Reporting A Global Perspective 4th Edition Stolowy Solutions ManualleuleuNo ratings yet

- AUSTRALIAN TAXATION - Parteng TatloDocument1 pageAUSTRALIAN TAXATION - Parteng TatloVero EntertainmentNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- Chapter 13Document9 pagesChapter 13Michael KemifieldNo ratings yet

- AUSTRALIAN TAXATION - Part 1Document1 pageAUSTRALIAN TAXATION - Part 1Vero EntertainmentNo ratings yet

- Business Tax SQE Notes HngortDocument9 pagesBusiness Tax SQE Notes HngortShalene ArudchelvanNo ratings yet

- GROSS INCOME DEDUCTIONS Advance NotesDocument13 pagesGROSS INCOME DEDUCTIONS Advance NotesMary Angeline SalvaneraNo ratings yet

- Benefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomeDocument10 pagesBenefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomejenicaNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- TAXXXDocument10 pagesTAXXXFirstYear OneBNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- Topic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBADocument3 pagesTopic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBAJhon Ariel JulatonNo ratings yet

- Logue Taxation of Individual Income OutlineDocument41 pagesLogue Taxation of Individual Income OutlinearthrodNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Gross Income TaxationDocument47 pagesGross Income TaxationJade Carlo ManuelNo ratings yet

- I. VAT: Zero Rated ExemptDocument6 pagesI. VAT: Zero Rated ExemptHiền nguyễn thuNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Chapter 7 Business IncomeDocument30 pagesChapter 7 Business IncomeKailing KhowNo ratings yet

- TAX 1 - Gross ProfitDocument3 pagesTAX 1 - Gross ProfitPacaña, Vincent Michael M.No ratings yet

- Economics of TaxationDocument21 pagesEconomics of TaxationNikka DelovergesNo ratings yet

- Direct and Indirect MethodDocument2 pagesDirect and Indirect MethodIan GolezNo ratings yet

- TAX.3407 Inclusions and Exclusions From Gross IncomeDocument14 pagesTAX.3407 Inclusions and Exclusions From Gross IncomeJUARE MaxineNo ratings yet

- TAX - Gross Income (Compensation)Document12 pagesTAX - Gross Income (Compensation)Von Andrei MedinaNo ratings yet

- Taxation HandoutDocument9 pagesTaxation HandoutTricia mae DingsitNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- ZMIDTAXDocument4 pagesZMIDTAXtaudvejNo ratings yet

- Imagine Accounting White Paper 30 Tax Minimisation Strategies For BusinessesDocument7 pagesImagine Accounting White Paper 30 Tax Minimisation Strategies For BusinessesJosh PygNo ratings yet

- 17 - Corporation TaxDocument7 pages17 - Corporation Taxayushagarwal23No ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- p1779 PDFDocument2 pagesp1779 PDFkNo ratings yet

- PAS 12 Income TaxesDocument12 pagesPAS 12 Income Taxeshjihjbj,iljNo ratings yet

- Becker REG - Chapter 1 OutlineDocument5 pagesBecker REG - Chapter 1 OutlineCassandra TangNo ratings yet

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Taxes Fact Sheet 2Document6 pagesTaxes Fact Sheet 2Kevin PerrineNo ratings yet

- TAX 06.1 - RIT Compensation IncomeDocument3 pagesTAX 06.1 - RIT Compensation Incomejonlisong976No ratings yet

- Gross IncomeDocument21 pagesGross IncomehjNo ratings yet

- Midterm Inctax ReviewerDocument18 pagesMidterm Inctax ReviewerngNo ratings yet

- ENTREP Business TermsDocument1 pageENTREP Business TermsSUASE GEMMALYNNo ratings yet

- Income Tax 11-14 PDFDocument1 pageIncome Tax 11-14 PDFJemna AryanaNo ratings yet

- Selling Government Property - Sources and Contributions of Other Government Agencies - DonationsDocument10 pagesSelling Government Property - Sources and Contributions of Other Government Agencies - Donationsela kikayNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- HA3042 Revision Slides T2 2019 PDFDocument21 pagesHA3042 Revision Slides T2 2019 PDFSahil Aryal Golay VaiNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- Taxation 1 - Lecture 1Document5 pagesTaxation 1 - Lecture 1Justin PandherNo ratings yet

- Deferred Tax Accounting - Lecture NotesDocument6 pagesDeferred Tax Accounting - Lecture Notesmax pNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Lecture 6-Investment Income-With Answer1 PDFDocument90 pagesLecture 6-Investment Income-With Answer1 PDFScott NickNo ratings yet

- Inclusion and Exclusion of Gross IncomeDocument70 pagesInclusion and Exclusion of Gross IncomeEnola HeitsgerNo ratings yet

- Comprehensive Income Tax Case StudyDocument7 pagesComprehensive Income Tax Case StudyPhilip MackioNo ratings yet

- TAXATION I - Income Tax (Word)Document24 pagesTAXATION I - Income Tax (Word)Jerald-Edz Tam AbonNo ratings yet

- Business Tax Environment: by Aliza Abid BhuttaDocument15 pagesBusiness Tax Environment: by Aliza Abid BhuttaAhmed zeeshanNo ratings yet

- The "Conceptual Framework" in Accounting and FinanceDocument41 pagesThe "Conceptual Framework" in Accounting and Financecynthia passNo ratings yet

- Final RevisionDocument18 pagesFinal RevisionWael chehataNo ratings yet

- TAX 667 Topic 8 Tax Planning For CompanyDocument63 pagesTAX 667 Topic 8 Tax Planning For Companyzarif nezukoNo ratings yet

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerJobelle Marie MahNo ratings yet

- 2018.01.15 TMSA 3 SubmissionDocument56 pages2018.01.15 TMSA 3 Submissionburak erbasNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- Probability CovarianceDocument7 pagesProbability CovarianceM sobrul IslamNo ratings yet

- CV PrudenceDocument3 pagesCV Prudencevintech computersNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- Economics Chap 2Document90 pagesEconomics Chap 2xhaviNo ratings yet

- Getting Started On Tmall GlobalDocument53 pagesGetting Started On Tmall GlobalJohanLaiNo ratings yet

- Lawhist Syllabus 1t 202122Document7 pagesLawhist Syllabus 1t 202122Jazmine ChingNo ratings yet

- How To Estimate The Cost of Mechanical DredgingDocument21 pagesHow To Estimate The Cost of Mechanical DredgingKaren LimNo ratings yet

- Lecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEDocument8 pagesLecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEMidhun ChowdaryNo ratings yet

- Change Management - Resistance To ChangeDocument9 pagesChange Management - Resistance To ChangeRosenna99No ratings yet

- SNAP 2018 - Question Paper & Answer Key (Memory Based) : Section 1 - General EnglishDocument11 pagesSNAP 2018 - Question Paper & Answer Key (Memory Based) : Section 1 - General EnglishPrajakta KharoseNo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument7 pagesBajaj Allianz General Insurance Company LimitedRavi GoyalNo ratings yet

- New Asset Less Than 180 Days (India Tax Purpose) Half of DepreciationDocument9 pagesNew Asset Less Than 180 Days (India Tax Purpose) Half of DepreciationAnanthakumar ANo ratings yet

- Specifications and Bills of Quantities FOR The Proposed Construction and Completion OF Masinde Muliro Stadium AT Kanduyi Bungoma County - Phase IDocument169 pagesSpecifications and Bills of Quantities FOR The Proposed Construction and Completion OF Masinde Muliro Stadium AT Kanduyi Bungoma County - Phase ICornerstone ArchitectsNo ratings yet

- Note Sheet Registration (Autosaved) 1Document1,307 pagesNote Sheet Registration (Autosaved) 1MJ MoonwalkerNo ratings yet

- Spotlight Initiative Guidelines For Logo Use by Non-UN Entities 0Document12 pagesSpotlight Initiative Guidelines For Logo Use by Non-UN Entities 0Claudia DoroteoNo ratings yet

- Case CASE 4-1 4-1 PC PC Depot DepotDocument7 pagesCase CASE 4-1 4-1 PC PC Depot DepotJourast LadzuardyNo ratings yet

- Consumer Perception Toward Online Travel AgenciesDocument38 pagesConsumer Perception Toward Online Travel AgenciesnaveenNo ratings yet

- Swot Analysis 123Document15 pagesSwot Analysis 123Roif SamsulNo ratings yet

- Whitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainDocument25 pagesWhitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainIsroqi FarisNo ratings yet

- University of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureDocument4 pagesUniversity of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureMatthias LeuthardNo ratings yet

- Exchange Rate TheoriesDocument21 pagesExchange Rate Theoriesalekya.nyalapelli03No ratings yet

AUSTRALIAN TAXATION - Parteng Apat

AUSTRALIAN TAXATION - Parteng Apat

Uploaded by

Vero Entertainment0 ratings0% found this document useful (0 votes)

4 views1 pageThis document summarizes key aspects of Australian taxation law, including:

1) Types of non-assessable non-exempt income such as hobbies, gambling wins, gifts, and lottery or competition wins.

2) Tax treatment of employee share schemes which provide benefits like discounted company shares and options.

3) Rules around deductible expenses for individuals, including allowed deductions to increase taxable income and denied deductions for capital, private, or non-assessable income expenses.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key aspects of Australian taxation law, including:

1) Types of non-assessable non-exempt income such as hobbies, gambling wins, gifts, and lottery or competition wins.

2) Tax treatment of employee share schemes which provide benefits like discounted company shares and options.

3) Rules around deductible expenses for individuals, including allowed deductions to increase taxable income and denied deductions for capital, private, or non-assessable income expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageAUSTRALIAN TAXATION - Parteng Apat

AUSTRALIAN TAXATION - Parteng Apat

Uploaded by

Vero EntertainmentThis document summarizes key aspects of Australian taxation law, including:

1) Types of non-assessable non-exempt income such as hobbies, gambling wins, gifts, and lottery or competition wins.

2) Tax treatment of employee share schemes which provide benefits like discounted company shares and options.

3) Rules around deductible expenses for individuals, including allowed deductions to increase taxable income and denied deductions for capital, private, or non-assessable income expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

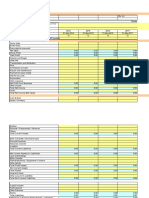

AUSTRALIAN TAXATION NON-ASSESSABLE NON-EXEMPT INCOME (NANE)

- Income from hobbies

: Employee Share Schemes - Gambling wins

- Employee share schemes provide employees with - Gifts unrelated to services rendered (e.g. birthday

benefits such as: gifts)

o Shares in the company for which they work - Lottery wins ( unless investment related lottery)

at a discount - Bequest under a will

o The opportunity to buy shares in the - Repayment of loan

company in the future (this is called a right - Increases in the value of property, without any

or option) realization through conversion into money or other

o In most cases, employees will be eligible for property (excluding trading stocks)

special tax treatment, known as tax

concessions. NOTE:

NOTE: Competition Prizes is not an income unless:

Exemption Concessions - The price is directly related to the taxpayer’s

- Provides for tax-free discounts of up to $1000to be business

given to an employee or service provider per income - Directly related to the taxpayer’s employment

year - Extensive personal exertion and skills are involved

o Under employee share scheme

o Ordinary shares NOTE:

o At least 75% employees are entitled - Pension for Seniors is not part of the assessable

o Employee must not be in a position to income.

control 5% of the votes

INDIVIDUAL INCOME TAX – DEDUCTIBLE EXPENSES

Deferral Concession Any item or expenditure deducted from assessable

- Provides for the deferral of tax on the discount for income in order to minimize the amount of income

up to ten years tax payable.

: Deferred Non-commercial business losses POSITIVE LIMBS (ALLOWED DEDUCTIONS)

- This item is losses incurred while carrying on a - The goal is to increase or produce your taxable

business (as a sole proprietor or as an individual revenue

partner in partnership)

NEGATIVE LIMBS (DENIED DEDUCTIONS)

STATUTORY INCOME (SPECIFIC TAX LEGISLATION) - Capital in nature

- Net Capital Gains - Private or domestic

- Trust Income - Incurred in relation to exempt or NANE income

- Partnership Income - Law prevents you from deducting it

- Dividends

- Employment Allowance (e.g, car) 3 GOLDEN RULES AS TO DEDUCTIBILLITY

- Leave Payment (e.g. holiday) - Not reimbursable by the employer

- Directly related to earning the income (not including

EXEMPT INCOME private expenses)

- Government superannuation co-contribution - Substantiated (>$300)

- Family Tax Assistance, Childcare benefits

- Some overseas employment income

- Payment to ADF personnel in war zones

- Exempt fringe benefits

- Payments to part time ADF member

- Some social security payments (e.g. disability, carers)

- Welfare (e.g, rent assistance and maintenance

payments)

You might also like

- LBUE Assignment 1 To SubmitDocument4 pagesLBUE Assignment 1 To SubmitmbizoliyemaNo ratings yet

- Accenture Performance AppraisalDocument30 pagesAccenture Performance AppraisalChanpreet Singh Grover25% (4)

- Philips C Pap SettlementDocument274 pagesPhilips C Pap SettlementKhristopher Brooks0% (1)

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- CFA PM, AA, Econ, FI, Trading, Perf EvalDocument42 pagesCFA PM, AA, Econ, FI, Trading, Perf EvalKnightspageNo ratings yet

- Grand Hyatt Melbourne Hotel Marketing PlanDocument19 pagesGrand Hyatt Melbourne Hotel Marketing PlankarenNo ratings yet

- 345272733-Accenture-Suman DasDocument6 pages345272733-Accenture-Suman DasSuman Das100% (1)

- Financial Accounting and Reporting A Global Perspective 4th Edition Stolowy Solutions ManualDocument20 pagesFinancial Accounting and Reporting A Global Perspective 4th Edition Stolowy Solutions ManualleuleuNo ratings yet

- AUSTRALIAN TAXATION - Parteng TatloDocument1 pageAUSTRALIAN TAXATION - Parteng TatloVero EntertainmentNo ratings yet

- ACTAX-3153-N002-Intro To Income Taxation PDFDocument5 pagesACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNo ratings yet

- Chapter 13Document9 pagesChapter 13Michael KemifieldNo ratings yet

- AUSTRALIAN TAXATION - Part 1Document1 pageAUSTRALIAN TAXATION - Part 1Vero EntertainmentNo ratings yet

- Business Tax SQE Notes HngortDocument9 pagesBusiness Tax SQE Notes HngortShalene ArudchelvanNo ratings yet

- GROSS INCOME DEDUCTIONS Advance NotesDocument13 pagesGROSS INCOME DEDUCTIONS Advance NotesMary Angeline SalvaneraNo ratings yet

- Benefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomeDocument10 pagesBenefits Amounting To Php90,000: Taxable Income: Individuals Earning Purely Compensation IncomejenicaNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- TAXXXDocument10 pagesTAXXXFirstYear OneBNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- Topic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBADocument3 pagesTopic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBAJhon Ariel JulatonNo ratings yet

- Logue Taxation of Individual Income OutlineDocument41 pagesLogue Taxation of Individual Income OutlinearthrodNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Gross Income TaxationDocument47 pagesGross Income TaxationJade Carlo ManuelNo ratings yet

- I. VAT: Zero Rated ExemptDocument6 pagesI. VAT: Zero Rated ExemptHiền nguyễn thuNo ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Chapter 7 Business IncomeDocument30 pagesChapter 7 Business IncomeKailing KhowNo ratings yet

- TAX 1 - Gross ProfitDocument3 pagesTAX 1 - Gross ProfitPacaña, Vincent Michael M.No ratings yet

- Economics of TaxationDocument21 pagesEconomics of TaxationNikka DelovergesNo ratings yet

- Direct and Indirect MethodDocument2 pagesDirect and Indirect MethodIan GolezNo ratings yet

- TAX.3407 Inclusions and Exclusions From Gross IncomeDocument14 pagesTAX.3407 Inclusions and Exclusions From Gross IncomeJUARE MaxineNo ratings yet

- TAX - Gross Income (Compensation)Document12 pagesTAX - Gross Income (Compensation)Von Andrei MedinaNo ratings yet

- Taxation HandoutDocument9 pagesTaxation HandoutTricia mae DingsitNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- ZMIDTAXDocument4 pagesZMIDTAXtaudvejNo ratings yet

- Imagine Accounting White Paper 30 Tax Minimisation Strategies For BusinessesDocument7 pagesImagine Accounting White Paper 30 Tax Minimisation Strategies For BusinessesJosh PygNo ratings yet

- 17 - Corporation TaxDocument7 pages17 - Corporation Taxayushagarwal23No ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- p1779 PDFDocument2 pagesp1779 PDFkNo ratings yet

- PAS 12 Income TaxesDocument12 pagesPAS 12 Income Taxeshjihjbj,iljNo ratings yet

- Becker REG - Chapter 1 OutlineDocument5 pagesBecker REG - Chapter 1 OutlineCassandra TangNo ratings yet

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Taxes Fact Sheet 2Document6 pagesTaxes Fact Sheet 2Kevin PerrineNo ratings yet

- TAX 06.1 - RIT Compensation IncomeDocument3 pagesTAX 06.1 - RIT Compensation Incomejonlisong976No ratings yet

- Gross IncomeDocument21 pagesGross IncomehjNo ratings yet

- Midterm Inctax ReviewerDocument18 pagesMidterm Inctax ReviewerngNo ratings yet

- ENTREP Business TermsDocument1 pageENTREP Business TermsSUASE GEMMALYNNo ratings yet

- Income Tax 11-14 PDFDocument1 pageIncome Tax 11-14 PDFJemna AryanaNo ratings yet

- Selling Government Property - Sources and Contributions of Other Government Agencies - DonationsDocument10 pagesSelling Government Property - Sources and Contributions of Other Government Agencies - Donationsela kikayNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- HA3042 Revision Slides T2 2019 PDFDocument21 pagesHA3042 Revision Slides T2 2019 PDFSahil Aryal Golay VaiNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- Taxation 1 - Lecture 1Document5 pagesTaxation 1 - Lecture 1Justin PandherNo ratings yet

- Deferred Tax Accounting - Lecture NotesDocument6 pagesDeferred Tax Accounting - Lecture Notesmax pNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Lecture 6-Investment Income-With Answer1 PDFDocument90 pagesLecture 6-Investment Income-With Answer1 PDFScott NickNo ratings yet

- Inclusion and Exclusion of Gross IncomeDocument70 pagesInclusion and Exclusion of Gross IncomeEnola HeitsgerNo ratings yet

- Comprehensive Income Tax Case StudyDocument7 pagesComprehensive Income Tax Case StudyPhilip MackioNo ratings yet

- TAXATION I - Income Tax (Word)Document24 pagesTAXATION I - Income Tax (Word)Jerald-Edz Tam AbonNo ratings yet

- Business Tax Environment: by Aliza Abid BhuttaDocument15 pagesBusiness Tax Environment: by Aliza Abid BhuttaAhmed zeeshanNo ratings yet

- The "Conceptual Framework" in Accounting and FinanceDocument41 pagesThe "Conceptual Framework" in Accounting and Financecynthia passNo ratings yet

- Final RevisionDocument18 pagesFinal RevisionWael chehataNo ratings yet

- TAX 667 Topic 8 Tax Planning For CompanyDocument63 pagesTAX 667 Topic 8 Tax Planning For Companyzarif nezukoNo ratings yet

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerJobelle Marie MahNo ratings yet

- 2018.01.15 TMSA 3 SubmissionDocument56 pages2018.01.15 TMSA 3 Submissionburak erbasNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- Probability CovarianceDocument7 pagesProbability CovarianceM sobrul IslamNo ratings yet

- CV PrudenceDocument3 pagesCV Prudencevintech computersNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- Economics Chap 2Document90 pagesEconomics Chap 2xhaviNo ratings yet

- Getting Started On Tmall GlobalDocument53 pagesGetting Started On Tmall GlobalJohanLaiNo ratings yet

- Lawhist Syllabus 1t 202122Document7 pagesLawhist Syllabus 1t 202122Jazmine ChingNo ratings yet

- How To Estimate The Cost of Mechanical DredgingDocument21 pagesHow To Estimate The Cost of Mechanical DredgingKaren LimNo ratings yet

- Lecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEDocument8 pagesLecture7-8 - 18527 - URBANIZATION AND SOCIAL CHANGEMidhun ChowdaryNo ratings yet

- Change Management - Resistance To ChangeDocument9 pagesChange Management - Resistance To ChangeRosenna99No ratings yet

- SNAP 2018 - Question Paper & Answer Key (Memory Based) : Section 1 - General EnglishDocument11 pagesSNAP 2018 - Question Paper & Answer Key (Memory Based) : Section 1 - General EnglishPrajakta KharoseNo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument7 pagesBajaj Allianz General Insurance Company LimitedRavi GoyalNo ratings yet

- New Asset Less Than 180 Days (India Tax Purpose) Half of DepreciationDocument9 pagesNew Asset Less Than 180 Days (India Tax Purpose) Half of DepreciationAnanthakumar ANo ratings yet

- Specifications and Bills of Quantities FOR The Proposed Construction and Completion OF Masinde Muliro Stadium AT Kanduyi Bungoma County - Phase IDocument169 pagesSpecifications and Bills of Quantities FOR The Proposed Construction and Completion OF Masinde Muliro Stadium AT Kanduyi Bungoma County - Phase ICornerstone ArchitectsNo ratings yet

- Note Sheet Registration (Autosaved) 1Document1,307 pagesNote Sheet Registration (Autosaved) 1MJ MoonwalkerNo ratings yet

- Spotlight Initiative Guidelines For Logo Use by Non-UN Entities 0Document12 pagesSpotlight Initiative Guidelines For Logo Use by Non-UN Entities 0Claudia DoroteoNo ratings yet

- Case CASE 4-1 4-1 PC PC Depot DepotDocument7 pagesCase CASE 4-1 4-1 PC PC Depot DepotJourast LadzuardyNo ratings yet

- Consumer Perception Toward Online Travel AgenciesDocument38 pagesConsumer Perception Toward Online Travel AgenciesnaveenNo ratings yet

- Swot Analysis 123Document15 pagesSwot Analysis 123Roif SamsulNo ratings yet

- Whitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainDocument25 pagesWhitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainIsroqi FarisNo ratings yet

- University of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureDocument4 pagesUniversity of Zurich, Dept. of Economics Prof. Dr. Mathias Hoffmann Exam For Spring 2015 LectureMatthias LeuthardNo ratings yet

- Exchange Rate TheoriesDocument21 pagesExchange Rate Theoriesalekya.nyalapelli03No ratings yet