Professional Documents

Culture Documents

Merchandising Problem 1 Periodic and Perpetual

Merchandising Problem 1 Periodic and Perpetual

Uploaded by

juls0 ratings0% found this document useful (0 votes)

9 views2 pagesThe document provides instructions to prepare journal entries, post to ledgers, prepare financial statements, and a post-closing trial balance under both a periodic and perpetual inventory system for a business called Pineapple Distributor owned by Juan Lopez. It includes 30 transactions from January 1 to April 30 including purchases and sales of merchandise, expenses, payments received and made, inventory amounts, and more.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides instructions to prepare journal entries, post to ledgers, prepare financial statements, and a post-closing trial balance under both a periodic and perpetual inventory system for a business called Pineapple Distributor owned by Juan Lopez. It includes 30 transactions from January 1 to April 30 including purchases and sales of merchandise, expenses, payments received and made, inventory amounts, and more.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesMerchandising Problem 1 Periodic and Perpetual

Merchandising Problem 1 Periodic and Perpetual

Uploaded by

julsThe document provides instructions to prepare journal entries, post to ledgers, prepare financial statements, and a post-closing trial balance under both a periodic and perpetual inventory system for a business called Pineapple Distributor owned by Juan Lopez. It includes 30 transactions from January 1 to April 30 including purchases and sales of merchandise, expenses, payments received and made, inventory amounts, and more.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

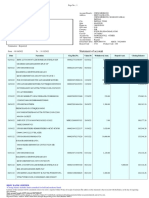

Prepare the Journal entries under the PERIODIC INVENTORY SYSTEM, post

the entries to their corresponding ledgers with proper post referencing, prepare

the trial balance, prepare the complete set of financial statements, and prepare

a post-closing trial balance

01 The business PINEAPPLE DISTRIBUTOR was registered as single proprietorship

with the Department of Trade and Industry, Juan Lo invested P39, 000

02 Bought computer equipment for P10,000 cash

02 Bought merchandise on account from UPTOWN Supply Co. P15, 900, Term, 2/10,

n/30

03 Bought office supplies on cash basis for P700

04 Sold merchandize on account P15,200 FOB Destination, terms 2/10, n/30

05 Paid P200 freight on April 4 sale

06 Received credit memo UPTOWN Supply Co. for merchandise return P300

11 Paid UPTOWN

13 Collected from April 4 customers

14 Bought merchandise on cash basis for P14,400

15 Salaries paid P1,500

16 Borrowed money from RCBC Bank, signed a promissory note for P12,000

17 Received refund from a supplier on cash purchase of April 14, P500

18 Bought merchandise from MESDA, P14,200 FOB Shipping, term, 2/10, n/30

20 Paid freight on April 18 purchase P700

23 Sold merchandise for P16, 400

26 Bought merchandise for cash P12,300

27 Paid MESDA on April 18 purchase, P9,000. No discount allowed on partial

payment

28 J. Lo got cash from the business, P2,008

29 Made refund to cash customer for defective merchandise, P900

30 Sold merchandise on account, P13,700 2/30

30 Paid the following: Advertising P1,000, Utilities P400, Rent P3,500, Salaries

P1,500

30 Inventory April 30, P25,000

Prepare the Journal entries under the PERPETUAL INVENTORY SYSTEM, post

the entries to their corresponding ledgers with proper post referencing, prepare

the trial balance, prepare the complete set of financial statements, and prepare

a post-closing trial balance

01 The business PINEAPPLE DISTRIBUTOR was registered as single proprietorship

with the Department of Trade and Industry, Juan Lopez invested P39, 000

02 Bought computer equipment for P10,000 cash

02 Bought merchandise on account from LOWTOWN Supply Co. P15, 900, Term,

2/10, n/30

03 Bought office supplies on cash basis for P700

04 Sold merchandize on account P15,200 FOB Destination, terms 2/10, n/30 (Cost of

Goods Sold P11,000)

05 Paid P200 freight on April 4 sale

06 Received credit memo LOWTOWN Supply Co. for merchandise return P300

11 Paid LOWTOWN

13 Collected from April 4 customers

14 Bought merchandise on cash basis for P14,400

15 Salaries paid P1,500

16 Borrowed money from RCBC Bank, signed a promissory note for P12,000

17 Received refund from a supplier on cash purchase of April 14, P500

18 Bought merchandize from MESDA, P14,200 FOB Shipping, term, 2/10, n/30

20 Paid freight on April 18 purchase P700

23 Sold merchandise for P16, 400 (Cost of Goods Sold P12,000)

26 Bought merchandise for cash P12,300

27 Paid MESDA on April 18 purchase, P9,000. No discount allowed on partial

payment

28 J. Lopez get cash from the business, P2,008

29 Made refund to cash customer for defective merchandise, P900

30 Sold merchandise on account, P13,700 2/30 (Cost of Goods Sold P9,000) ; Paid

the following: Advertising P1,000, Utilities P400, Rent P3,500, Salaries P1,500

You might also like

- Problem Solving: Merchandising Problem (Perpetual Inventory System)Document1 pageProblem Solving: Merchandising Problem (Perpetual Inventory System)Vincent Madrid83% (6)

- Itim Na SusoDocument6 pagesItim Na SusoEdmar Lerin25% (4)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Assignment Number 2 Financial Accounting Reporting 1Document8 pagesAssignment Number 2 Financial Accounting Reporting 1Sheina Jane AbarquezNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- NC-3REVISED ExampleDocument2 pagesNC-3REVISED ExampleStephanie Cruz100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Periodic TransactionDocument2 pagesPeriodic TransactionMoon BinnNo ratings yet

- Fabm Perf TaskDocument2 pagesFabm Perf TaskJohn Wayne LaynesaNo ratings yet

- Periodic Inventory SystemDocument1 pagePeriodic Inventory SystemLawrence CuraNo ratings yet

- ACC 100 EXERCISES Topic 1 - 2024Document4 pagesACC 100 EXERCISES Topic 1 - 2024angeladimekuNo ratings yet

- NC 3 Bookkeeping Problem. PerpetualDocument2 pagesNC 3 Bookkeeping Problem. PerpetualShane QuintoNo ratings yet

- Revised Canvas - Exercises For MerchandisingDocument5 pagesRevised Canvas - Exercises For MerchandisingMaryrose Sumulong0% (1)

- Problem Solving: Merchandising Problem (Periodic Inventory System)Document1 pageProblem Solving: Merchandising Problem (Periodic Inventory System)Vincent Madrid100% (6)

- Perpetual Inventory SystemDocument4 pagesPerpetual Inventory SystemJoe Honey Cañas CarbajosaNo ratings yet

- Tesda Perpetual GuidelinesDocument12 pagesTesda Perpetual GuidelinesMichael Angelo Laguna Dela FuenteNo ratings yet

- Lesson 3 Exercises Recording Transactions of A Service EnterpriseDocument3 pagesLesson 3 Exercises Recording Transactions of A Service Enterprisemark.anthony.mantes08No ratings yet

- Merch 2023 1Document2 pagesMerch 2023 1quinn valdezNo ratings yet

- COMPREHENSIVE-ILLUSTRATION MerchandisingDocument2 pagesCOMPREHENSIVE-ILLUSTRATION MerchandisingWhisky Lutan BadgerNo ratings yet

- Unit 4 Part 2 Merchandising Transactions Class Exercise Titan QuestionnaireDocument2 pagesUnit 4 Part 2 Merchandising Transactions Class Exercise Titan QuestionnaireElsa MendozaNo ratings yet

- Accounting ActivityDocument2 pagesAccounting ActivityRoberta Gonzales Sison80% (5)

- Accounting Fundamentals Part 1Document2 pagesAccounting Fundamentals Part 1lunaaaserna16No ratings yet

- Perpetual Transactions: Journal EntriesDocument71 pagesPerpetual Transactions: Journal EntriesRona Mae AnteroNo ratings yet

- Pick - Up Medical Supplies & Services Trial Balance As of November 30, 2012Document2 pagesPick - Up Medical Supplies & Services Trial Balance As of November 30, 2012JT GalNo ratings yet

- Midterm 1st Meeting Problem SolvingDocument1 pageMidterm 1st Meeting Problem SolvingChristopher CristobalNo ratings yet

- Transactions For Final RequirementDocument5 pagesTransactions For Final Requirementyvon claire regisNo ratings yet

- Merchandising ExercisesDocument4 pagesMerchandising ExercisesDanica CatalanNo ratings yet

- FABMDocument2 pagesFABMANDREA OLIVASNo ratings yet

- Cash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Document3 pagesCash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Christine BNo ratings yet

- Perpetual Inventory SystemDocument1 pagePerpetual Inventory SystemMAKINo ratings yet

- Assessment TestDocument3 pagesAssessment TestDaniel HunksNo ratings yet

- Accounting ExercisesDocument6 pagesAccounting ExercisesMichaella EsparesNo ratings yet

- NCIIDocument2 pagesNCIIRichardDinongPascualNo ratings yet

- EXAMPLE - Merchandising CompaniesDocument1 pageEXAMPLE - Merchandising CompaniesCristina QuiranteNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationMylene Salvador100% (1)

- Financial Accounting AssesmentDocument5 pagesFinancial Accounting AssesmentAnn Calabdan100% (1)

- Afna Natl Assignment For Day 6 Discusion Special JournalsDocument4 pagesAfna Natl Assignment For Day 6 Discusion Special JournalsMichelle Gay Palasan100% (1)

- BASIC2Document1 pageBASIC2GinTraballoNo ratings yet

- Takehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionDocument3 pagesTakehome Quiz On Cash Basis Accrual Basis Single Entry Error CorrectionYour MaterialsNo ratings yet

- Lecture : Day 1: Adjusting Entries & Chart of Accounts (Periodic & Perpetual)Document7 pagesLecture : Day 1: Adjusting Entries & Chart of Accounts (Periodic & Perpetual)khrysna ayra villanuevaNo ratings yet

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- Activity 1-NotesDocument2 pagesActivity 1-NotesChandria FordNo ratings yet

- MerchandisingDocument20 pagesMerchandisingDave PeraltaNo ratings yet

- Practice Set 3Document7 pagesPractice Set 3argie pelanteNo ratings yet

- File 1069803342Document31 pagesFile 1069803342Angelica TolinNo ratings yet

- Project No. 3: Special Journals: Debit Credit Debit CreditDocument2 pagesProject No. 3: Special Journals: Debit Credit Debit CreditjiiNo ratings yet

- ProblemsDocument1 pageProblemsMA RI AHNo ratings yet

- AssignmentDocument8 pagesAssignmentEdna MingNo ratings yet

- Transactions List - Service and MerchandisingDocument7 pagesTransactions List - Service and MerchandisingRavann Codera NañolaNo ratings yet

- HW6 BDocument2 pagesHW6 BBenicel Lane M. D. V.No ratings yet

- Merchandising Inventory System ComparisonDocument5 pagesMerchandising Inventory System Comparisonmama's cornerNo ratings yet

- 9 Final Quiz 2 Comprehensive Prob SpecialjournalDocument3 pages9 Final Quiz 2 Comprehensive Prob SpecialjournalPalma, Dalton John A.No ratings yet

- Kristina Sangupan - FABM 2 ExamDocument2 pagesKristina Sangupan - FABM 2 ExamAngelo ReyesNo ratings yet

- Accounting 2Document28 pagesAccounting 2cherryannNo ratings yet

- Business Transactions MerchandisingDocument5 pagesBusiness Transactions MerchandisingAnne de GuzmanNo ratings yet

- Excercises MerchandisingDocument4 pagesExcercises MerchandisingRenz AbadNo ratings yet

- Economic TransactionDocument2 pagesEconomic TransactionAnthony Koko R. Carlobos100% (1)

- Act 1Document4 pagesAct 1Jane DizonNo ratings yet

- ht80x Administration GuideDocument76 pagesht80x Administration Guideed bordNo ratings yet

- DicgcDocument11 pagesDicgcPranav ShahNo ratings yet

- Week 11 In-Class Exercise (Topic 9) - WORKSHEETDocument4 pagesWeek 11 In-Class Exercise (Topic 9) - WORKSHEETDương LêNo ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account Statementbrainroach15No ratings yet

- Datasheet 5W - 07.04.22Document7 pagesDatasheet 5W - 07.04.22Sijomon ParakkalNo ratings yet

- Ad HackDocument3 pagesAd HackFidence HackNo ratings yet

- Business Studies Project - Aarav BhardwajaDocument18 pagesBusiness Studies Project - Aarav BhardwajaAarav Bhardwaja100% (1)

- GF 74 A Form For Cash Count With SampleDocument4 pagesGF 74 A Form For Cash Count With Samplecomelec tarlaccityNo ratings yet

- BITS MBA FMA Paper-1Document2 pagesBITS MBA FMA Paper-1Raja Mohan RaviNo ratings yet

- Solving 8 Financial PuzzlesDocument7 pagesSolving 8 Financial PuzzlesDjimmy BoyjonauthNo ratings yet

- ENGLISH Potential Fraud and Suspicious Activity Flyer - InternationalDocument1 pageENGLISH Potential Fraud and Suspicious Activity Flyer - InternationalChristine Joy RiveraNo ratings yet

- AnnexureDocument2 pagesAnnexureNILESH_373100% (1)

- C Tfin52 66Document1 pageC Tfin52 66karamanan0% (1)

- FixedDepositsDocument1 pageFixedDepositsTiso Blackstar GroupNo ratings yet

- Acct Statement - XX7822 - 26012023Document4 pagesAcct Statement - XX7822 - 26012023STENLIN LEICHOMBAMNo ratings yet

- Essay Sample For TOEFLDocument2 pagesEssay Sample For TOEFLEkaNo ratings yet

- CXO CXW: Step 1Document4 pagesCXO CXW: Step 1Kae SalvadorNo ratings yet

- Bangalore Traffic Solution - PDF VersionDocument22 pagesBangalore Traffic Solution - PDF Versiondas_gv0% (1)

- MA5600T Product IntroductionDocument65 pagesMA5600T Product IntroductionkmalNo ratings yet

- Zurich Financial Services Australia Limited Dec 2014Document17 pagesZurich Financial Services Australia Limited Dec 2014Daniel ManNo ratings yet

- Customer Preference and Satisfaction Towards Information Technology Based Products and Services in Banking IndustryDocument45 pagesCustomer Preference and Satisfaction Towards Information Technology Based Products and Services in Banking IndustryPreethi GopalanNo ratings yet

- Resume 040110Document2 pagesResume 040110beautiful_bmaNo ratings yet

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- 603 TimetableDocument8 pages603 Timetablegiudittaa_No ratings yet

- IAccess FAQs 05.15.24Document20 pagesIAccess FAQs 05.15.24LGUNo ratings yet

- SAPFICOOnline TrainingDocument8 pagesSAPFICOOnline TrainingvijaykrjhaNo ratings yet

- RRW 0004 20190725 (1) - 1Document18 pagesRRW 0004 20190725 (1) - 1Ali WaliNo ratings yet

- OSS019300 BSC6910 GU V100R021 Product Description ISSUE1.0Document119 pagesOSS019300 BSC6910 GU V100R021 Product Description ISSUE1.0Mohamed GhuneimNo ratings yet

- 2-5int 2001 Dec QDocument11 pages2-5int 2001 Dec Qapi-3728790100% (3)