Professional Documents

Culture Documents

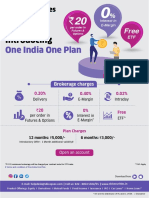

Taxes and Regulatory Charges

Taxes and Regulatory Charges

Uploaded by

utsav panwarCopyright:

Available Formats

You might also like

- Financial AnalysisDocument44 pagesFinancial AnalysisHeap Ke Xin100% (3)

- PresentationDocument15 pagesPresentationapi-241493839No ratings yet

- Taxes and Regulatory ChargesDocument1 pageTaxes and Regulatory ChargesmrksravikiranNo ratings yet

- Zerodha ChargesDocument4 pagesZerodha ChargesHancock willsmithNo ratings yet

- Costs Involved in Equity Investing and Estimation of ProfitDocument9 pagesCosts Involved in Equity Investing and Estimation of Profit483-ROHIT SURAPALLINo ratings yet

- 22nd March PDF 0fa7d6e944Document1 page22nd March PDF 0fa7d6e944eurostarimpex1No ratings yet

- List of All Fees, Charges, and Taxes On Trading and Investing - ZerodhaDocument5 pagesList of All Fees, Charges, and Taxes On Trading and Investing - Zerodhashah siddiqNo ratings yet

- Charge List: List of All Charges and TaxesDocument2 pagesCharge List: List of All Charges and TaxesNeeraj MandloiNo ratings yet

- Fit Diy 1hDocument1 pageFit Diy 1hRahul PatilNo ratings yet

- Trade Free Pro F0986013a8Document1 pageTrade Free Pro F0986013a8Deep NamataNo ratings yet

- Trad Free ChargesDocument1 pageTrad Free ChargesanimeshtechnosNo ratings yet

- Trade Free Pro Tariff SheetDocument1 pageTrade Free Pro Tariff Sheetmr.13sepNo ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- PlanDocument4 pagesPlanrajritesNo ratings yet

- Edelweiss Broking LTD.: V03/Feb/2020Document2 pagesEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNo ratings yet

- Plans Margins and Plan Information: Charges Currency Futures Currency OptionsDocument1 pagePlans Margins and Plan Information: Charges Currency Futures Currency OptionsManu ShrivastavaNo ratings yet

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableDocument2 pagesBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of ChargesChandhan ReddyNo ratings yet

- Schedule of ChargesDocument1 pageSchedule of Chargesnasir elahiNo ratings yet

- Stamp Duty As Per The State of Residence: Zerodha Charges Equity Delivery Equity Intraday Equity Futures Equity OptionsDocument2 pagesStamp Duty As Per The State of Residence: Zerodha Charges Equity Delivery Equity Intraday Equity Futures Equity OptionsRavi Teja Reddy VNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- TariffSheet YouthPlanDocument1 pageTariffSheet YouthPlanRahul PatilNo ratings yet

- Sl. No. Charge Head Charge Rate: (Includes First FY BO Account Opening Fee)Document1 pageSl. No. Charge Head Charge Rate: (Includes First FY BO Account Opening Fee)tareq mahmudNo ratings yet

- Rates and Charges - Fincare Small Finance BankDocument4 pagesRates and Charges - Fincare Small Finance BankkrishnabhasingikNo ratings yet

- Contract Note Cum Tax Invoice: RD1986 Deebak SDocument4 pagesContract Note Cum Tax Invoice: RD1986 Deebak SDeebak SNo ratings yet

- Tradewise Tax PNL ReportDocument47 pagesTradewise Tax PNL ReportSamir KumarNo ratings yet

- Trading Qty Decider Based On Money Management RuleDocument15 pagesTrading Qty Decider Based On Money Management RulexenonvideoNo ratings yet

- Risk To SharekhanDocument8 pagesRisk To SharekhanprakashinduNo ratings yet

- Tariff Sheet Youth PlanDocument1 pageTariff Sheet Youth PlanDeebak Ashwin ViswanathanNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- Stocks: Interactive Brokers (India) Private LimitedDocument1 pageStocks: Interactive Brokers (India) Private LimitedHercules PhaetonNo ratings yet

- Emerchant Current Account RCSMS SOFDocument5 pagesEmerchant Current Account RCSMS SOFmajhi.deepashreeNo ratings yet

- Soc CFDDocument6 pagesSoc CFDindbatch2022No ratings yet

- DSE FeesDocument3 pagesDSE FeesNgari AmosNo ratings yet

- HSBCDocument2 pagesHSBCSoumyakanta SahaniNo ratings yet

- Price Bid: RFX Number:Cd-048/ 9000043426 Bid Number: 8000206324Document2 pagesPrice Bid: RFX Number:Cd-048/ 9000043426 Bid Number: 8000206324SOVENNo ratings yet

- OCBC ChargesDocument10 pagesOCBC ChargesAndrewHuiosNo ratings yet

- Statutory Charges W.E.F 01.07.2020Document2 pagesStatutory Charges W.E.F 01.07.2020tradingview9339No ratings yet

- Schedule of DP ChargesDocument2 pagesSchedule of DP ChargestraderescortNo ratings yet

- Lit. Review1Document1 pageLit. Review1Jalpesh BavishiNo ratings yet

- Commercial Bid Format: Bank of BarodaDocument1 pageCommercial Bid Format: Bank of BarodaVishal K CNo ratings yet

- Nps ChargesDocument1 pageNps Chargeschristopherphoenix65No ratings yet

- CDS - Schedule of Fees Deposits Updated July 2016Document4 pagesCDS - Schedule of Fees Deposits Updated July 2016fpaimranNo ratings yet

- Tariff Sheet Youth PlanDocument1 pageTariff Sheet Youth PlanVishvaraj ManeNo ratings yet

- Tradewise Tax PNL ReportDocument35 pagesTradewise Tax PNL ReportVadivel Kumar TNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Jaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionDocument1 pageJaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionSangwan ParveshNo ratings yet

- Brokerage in CashDocument7 pagesBrokerage in Cashrajp2099No ratings yet

- Minimum Brokerage Per Order (Subject To Ceiling of 2.5% of Total Traded Value) Resident NRIDocument4 pagesMinimum Brokerage Per Order (Subject To Ceiling of 2.5% of Total Traded Value) Resident NRIasdNo ratings yet

- IIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Document2 pagesIIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Piyush JainNo ratings yet

- Karvy Stock Broking LTDDocument2 pagesKarvy Stock Broking LTDMayank KumarNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- SBI Cap SecuritiesDocument2 pagesSBI Cap SecuritiesPooja maskeNo ratings yet

- Brokerage Structure - ABSL Multi Asset Allocation Fund NFODocument1 pageBrokerage Structure - ABSL Multi Asset Allocation Fund NFOSanjay GuptaNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- Tradewise Tax PNL ReportDocument38 pagesTradewise Tax PNL Reportuodal rajNo ratings yet

- Anil Gurjar: Units Value (INR) Units Value (INR)Document3 pagesAnil Gurjar: Units Value (INR) Units Value (INR)Prachi DubeyNo ratings yet

- New DP SchemeDocument1 pageNew DP SchemeMayank VashiNo ratings yet

- Final Product PPT - Aura EdgeDocument11 pagesFinal Product PPT - Aura EdgeNarendra KumarNo ratings yet

- Full Set - Investment AnalysisDocument17 pagesFull Set - Investment AnalysismaiNo ratings yet

- Roy II vs. Herbosa, G.R. No. 207946, November 22, 2016Document20 pagesRoy II vs. Herbosa, G.R. No. 207946, November 22, 2016Rina OlandoNo ratings yet

- Investment checklist - Phan Thị Mỹ DuyênDocument4 pagesInvestment checklist - Phan Thị Mỹ DuyênPhan My DuyenNo ratings yet

- Astron Paper & Board - RHPDocument468 pagesAstron Paper & Board - RHPsubham agrawalNo ratings yet

- Partnership & Corporation Accounting NotesDocument16 pagesPartnership & Corporation Accounting NotesJACQUELYN PABLITONo ratings yet

- Legal Aspects of Finance and Security LawsDocument60 pagesLegal Aspects of Finance and Security LawsPhalit Gupta100% (1)

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- REAL ESTATE INVESTMENT TRUSTS-Advantages and Disadvantages.Document7 pagesREAL ESTATE INVESTMENT TRUSTS-Advantages and Disadvantages.Ken BiiNo ratings yet

- Dept. A Dept.BDocument14 pagesDept. A Dept.BB. Srini VasanNo ratings yet

- 20200210jby522 PDFDocument33 pages20200210jby522 PDFZhi_Ming_Cheah_8136No ratings yet

- TB Chapter08Document79 pagesTB Chapter08CGNo ratings yet

- p4 LSBF Notes Afm Advanced Financial Management PDFDocument158 pagesp4 LSBF Notes Afm Advanced Financial Management PDFVeer Pratab SinghNo ratings yet

- Chap 010Document20 pagesChap 010Anonymous sZLcBAgNo ratings yet

- aRIA WhitePaper PartIII Myth Vs Reality PDFDocument14 pagesaRIA WhitePaper PartIII Myth Vs Reality PDFNeculaesei AndreiNo ratings yet

- Nism CH 10Document13 pagesNism CH 10Darshan JainNo ratings yet

- Financial AnalysisDocument23 pagesFinancial AnalysisRead BukuNo ratings yet

- Public Shariah MFR November 2017Document42 pagesPublic Shariah MFR November 2017Azrul AzimNo ratings yet

- The Underlying Effect of Risk Management On Banks' Financial Performance: An Analytical Study On Commercial and Investment Banking in BahrainDocument12 pagesThe Underlying Effect of Risk Management On Banks' Financial Performance: An Analytical Study On Commercial and Investment Banking in Bahrainrochdi.keffalaNo ratings yet

- Summer Internship Project ReportDocument75 pagesSummer Internship Project ReportAKKY JAINNo ratings yet

- A. Vocabulary: Financial Terms: Unit 6: Money (Hp3)Document4 pagesA. Vocabulary: Financial Terms: Unit 6: Money (Hp3)Phu TaNo ratings yet

- Summer Internship Report On Indian Stock MarketsDocument18 pagesSummer Internship Report On Indian Stock Marketssujayphatak070% (1)

- NCSM Earnings WF May 2018Document5 pagesNCSM Earnings WF May 2018minurkashNo ratings yet

- KVSS 2022 Financial StatementDocument36 pagesKVSS 2022 Financial StatementKristofer PlonaNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Sharekhan Internship ProjectDocument74 pagesSharekhan Internship Projectayush goyalNo ratings yet

- Investment in Equity SecuritiesDocument23 pagesInvestment in Equity SecuritiesJay-L TanNo ratings yet

- Pa I Chapter 1Document16 pagesPa I Chapter 1Hussen Abdulkadir100% (1)

Taxes and Regulatory Charges

Taxes and Regulatory Charges

Uploaded by

utsav panwarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxes and Regulatory Charges

Taxes and Regulatory Charges

Uploaded by

utsav panwarCopyright:

Available Formats

Details of Statutory/Regulatory charges

Charges Equity Intraday/Delivery Equity Futures/Options Currency Commodity

Futures/Options Futures/Options

GST 18% on total value of brokerage + transaction charges + SEBI fees

Securities Transaction 0.025% (sell side)/0.1% 0.0125% (sell Nil 0.01% (sell-side)/0.05%

Tax/Commodity (both-sides) side)/0.0625%(sell- (sell-side)

Transaction tax side on premium)

Transaction charges* NSE: 0.00335%/ BSE NSE: NSE: 0.00095% BSE: MCX (for Agri &Non

0.00375% 0.002% /0.0505% on 0.00022% /NSE: 0.037% Agri): 0.0026%

premium BSE: 0.001% NCDEX: 0.006%/

0.05% for MCX &0 for

NCDEX

Stamp charges 0.003% or Rs.300 0.002% or Rs.200 0.0001% or Rs.10 0.002% or Rs.200

per crore on buy-side per crore on buy-side per crore on buy-side per crore on buy-side

/0.015%or Rs.1500 /0.003% or Rs.300 on /0.003% or Rs.300

per crore on buy-side buy- side per crore on buy-side

SEBI charges Rs.10/crore Rs.10/crore Rs.10/crore Agri:

Rs.1/crore

Non Agri:

Rs.10/crore/ Commodity

options : Rs.10 per crore

*Transaction charges - The transaction charges are inclusive of NSE IPFT charges (Investor Protection Fund Trust).

You might also like

- Financial AnalysisDocument44 pagesFinancial AnalysisHeap Ke Xin100% (3)

- PresentationDocument15 pagesPresentationapi-241493839No ratings yet

- Taxes and Regulatory ChargesDocument1 pageTaxes and Regulatory ChargesmrksravikiranNo ratings yet

- Zerodha ChargesDocument4 pagesZerodha ChargesHancock willsmithNo ratings yet

- Costs Involved in Equity Investing and Estimation of ProfitDocument9 pagesCosts Involved in Equity Investing and Estimation of Profit483-ROHIT SURAPALLINo ratings yet

- 22nd March PDF 0fa7d6e944Document1 page22nd March PDF 0fa7d6e944eurostarimpex1No ratings yet

- List of All Fees, Charges, and Taxes On Trading and Investing - ZerodhaDocument5 pagesList of All Fees, Charges, and Taxes On Trading and Investing - Zerodhashah siddiqNo ratings yet

- Charge List: List of All Charges and TaxesDocument2 pagesCharge List: List of All Charges and TaxesNeeraj MandloiNo ratings yet

- Fit Diy 1hDocument1 pageFit Diy 1hRahul PatilNo ratings yet

- Trade Free Pro F0986013a8Document1 pageTrade Free Pro F0986013a8Deep NamataNo ratings yet

- Trad Free ChargesDocument1 pageTrad Free ChargesanimeshtechnosNo ratings yet

- Trade Free Pro Tariff SheetDocument1 pageTrade Free Pro Tariff Sheetmr.13sepNo ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- PlanDocument4 pagesPlanrajritesNo ratings yet

- Edelweiss Broking LTD.: V03/Feb/2020Document2 pagesEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNo ratings yet

- Plans Margins and Plan Information: Charges Currency Futures Currency OptionsDocument1 pagePlans Margins and Plan Information: Charges Currency Futures Currency OptionsManu ShrivastavaNo ratings yet

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableDocument2 pagesBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of ChargesChandhan ReddyNo ratings yet

- Schedule of ChargesDocument1 pageSchedule of Chargesnasir elahiNo ratings yet

- Stamp Duty As Per The State of Residence: Zerodha Charges Equity Delivery Equity Intraday Equity Futures Equity OptionsDocument2 pagesStamp Duty As Per The State of Residence: Zerodha Charges Equity Delivery Equity Intraday Equity Futures Equity OptionsRavi Teja Reddy VNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- TariffSheet YouthPlanDocument1 pageTariffSheet YouthPlanRahul PatilNo ratings yet

- Sl. No. Charge Head Charge Rate: (Includes First FY BO Account Opening Fee)Document1 pageSl. No. Charge Head Charge Rate: (Includes First FY BO Account Opening Fee)tareq mahmudNo ratings yet

- Rates and Charges - Fincare Small Finance BankDocument4 pagesRates and Charges - Fincare Small Finance BankkrishnabhasingikNo ratings yet

- Contract Note Cum Tax Invoice: RD1986 Deebak SDocument4 pagesContract Note Cum Tax Invoice: RD1986 Deebak SDeebak SNo ratings yet

- Tradewise Tax PNL ReportDocument47 pagesTradewise Tax PNL ReportSamir KumarNo ratings yet

- Trading Qty Decider Based On Money Management RuleDocument15 pagesTrading Qty Decider Based On Money Management RulexenonvideoNo ratings yet

- Risk To SharekhanDocument8 pagesRisk To SharekhanprakashinduNo ratings yet

- Tariff Sheet Youth PlanDocument1 pageTariff Sheet Youth PlanDeebak Ashwin ViswanathanNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- Stocks: Interactive Brokers (India) Private LimitedDocument1 pageStocks: Interactive Brokers (India) Private LimitedHercules PhaetonNo ratings yet

- Emerchant Current Account RCSMS SOFDocument5 pagesEmerchant Current Account RCSMS SOFmajhi.deepashreeNo ratings yet

- Soc CFDDocument6 pagesSoc CFDindbatch2022No ratings yet

- DSE FeesDocument3 pagesDSE FeesNgari AmosNo ratings yet

- HSBCDocument2 pagesHSBCSoumyakanta SahaniNo ratings yet

- Price Bid: RFX Number:Cd-048/ 9000043426 Bid Number: 8000206324Document2 pagesPrice Bid: RFX Number:Cd-048/ 9000043426 Bid Number: 8000206324SOVENNo ratings yet

- OCBC ChargesDocument10 pagesOCBC ChargesAndrewHuiosNo ratings yet

- Statutory Charges W.E.F 01.07.2020Document2 pagesStatutory Charges W.E.F 01.07.2020tradingview9339No ratings yet

- Schedule of DP ChargesDocument2 pagesSchedule of DP ChargestraderescortNo ratings yet

- Lit. Review1Document1 pageLit. Review1Jalpesh BavishiNo ratings yet

- Commercial Bid Format: Bank of BarodaDocument1 pageCommercial Bid Format: Bank of BarodaVishal K CNo ratings yet

- Nps ChargesDocument1 pageNps Chargeschristopherphoenix65No ratings yet

- CDS - Schedule of Fees Deposits Updated July 2016Document4 pagesCDS - Schedule of Fees Deposits Updated July 2016fpaimranNo ratings yet

- Tariff Sheet Youth PlanDocument1 pageTariff Sheet Youth PlanVishvaraj ManeNo ratings yet

- Tradewise Tax PNL ReportDocument35 pagesTradewise Tax PNL ReportVadivel Kumar TNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Jaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionDocument1 pageJaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionSangwan ParveshNo ratings yet

- Brokerage in CashDocument7 pagesBrokerage in Cashrajp2099No ratings yet

- Minimum Brokerage Per Order (Subject To Ceiling of 2.5% of Total Traded Value) Resident NRIDocument4 pagesMinimum Brokerage Per Order (Subject To Ceiling of 2.5% of Total Traded Value) Resident NRIasdNo ratings yet

- IIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Document2 pagesIIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Piyush JainNo ratings yet

- Karvy Stock Broking LTDDocument2 pagesKarvy Stock Broking LTDMayank KumarNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- SBI Cap SecuritiesDocument2 pagesSBI Cap SecuritiesPooja maskeNo ratings yet

- Brokerage Structure - ABSL Multi Asset Allocation Fund NFODocument1 pageBrokerage Structure - ABSL Multi Asset Allocation Fund NFOSanjay GuptaNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- Tradewise Tax PNL ReportDocument38 pagesTradewise Tax PNL Reportuodal rajNo ratings yet

- Anil Gurjar: Units Value (INR) Units Value (INR)Document3 pagesAnil Gurjar: Units Value (INR) Units Value (INR)Prachi DubeyNo ratings yet

- New DP SchemeDocument1 pageNew DP SchemeMayank VashiNo ratings yet

- Final Product PPT - Aura EdgeDocument11 pagesFinal Product PPT - Aura EdgeNarendra KumarNo ratings yet

- Full Set - Investment AnalysisDocument17 pagesFull Set - Investment AnalysismaiNo ratings yet

- Roy II vs. Herbosa, G.R. No. 207946, November 22, 2016Document20 pagesRoy II vs. Herbosa, G.R. No. 207946, November 22, 2016Rina OlandoNo ratings yet

- Investment checklist - Phan Thị Mỹ DuyênDocument4 pagesInvestment checklist - Phan Thị Mỹ DuyênPhan My DuyenNo ratings yet

- Astron Paper & Board - RHPDocument468 pagesAstron Paper & Board - RHPsubham agrawalNo ratings yet

- Partnership & Corporation Accounting NotesDocument16 pagesPartnership & Corporation Accounting NotesJACQUELYN PABLITONo ratings yet

- Legal Aspects of Finance and Security LawsDocument60 pagesLegal Aspects of Finance and Security LawsPhalit Gupta100% (1)

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- REAL ESTATE INVESTMENT TRUSTS-Advantages and Disadvantages.Document7 pagesREAL ESTATE INVESTMENT TRUSTS-Advantages and Disadvantages.Ken BiiNo ratings yet

- Dept. A Dept.BDocument14 pagesDept. A Dept.BB. Srini VasanNo ratings yet

- 20200210jby522 PDFDocument33 pages20200210jby522 PDFZhi_Ming_Cheah_8136No ratings yet

- TB Chapter08Document79 pagesTB Chapter08CGNo ratings yet

- p4 LSBF Notes Afm Advanced Financial Management PDFDocument158 pagesp4 LSBF Notes Afm Advanced Financial Management PDFVeer Pratab SinghNo ratings yet

- Chap 010Document20 pagesChap 010Anonymous sZLcBAgNo ratings yet

- aRIA WhitePaper PartIII Myth Vs Reality PDFDocument14 pagesaRIA WhitePaper PartIII Myth Vs Reality PDFNeculaesei AndreiNo ratings yet

- Nism CH 10Document13 pagesNism CH 10Darshan JainNo ratings yet

- Financial AnalysisDocument23 pagesFinancial AnalysisRead BukuNo ratings yet

- Public Shariah MFR November 2017Document42 pagesPublic Shariah MFR November 2017Azrul AzimNo ratings yet

- The Underlying Effect of Risk Management On Banks' Financial Performance: An Analytical Study On Commercial and Investment Banking in BahrainDocument12 pagesThe Underlying Effect of Risk Management On Banks' Financial Performance: An Analytical Study On Commercial and Investment Banking in Bahrainrochdi.keffalaNo ratings yet

- Summer Internship Project ReportDocument75 pagesSummer Internship Project ReportAKKY JAINNo ratings yet

- A. Vocabulary: Financial Terms: Unit 6: Money (Hp3)Document4 pagesA. Vocabulary: Financial Terms: Unit 6: Money (Hp3)Phu TaNo ratings yet

- Summer Internship Report On Indian Stock MarketsDocument18 pagesSummer Internship Report On Indian Stock Marketssujayphatak070% (1)

- NCSM Earnings WF May 2018Document5 pagesNCSM Earnings WF May 2018minurkashNo ratings yet

- KVSS 2022 Financial StatementDocument36 pagesKVSS 2022 Financial StatementKristofer PlonaNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Sharekhan Internship ProjectDocument74 pagesSharekhan Internship Projectayush goyalNo ratings yet

- Investment in Equity SecuritiesDocument23 pagesInvestment in Equity SecuritiesJay-L TanNo ratings yet

- Pa I Chapter 1Document16 pagesPa I Chapter 1Hussen Abdulkadir100% (1)