Professional Documents

Culture Documents

Microeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474

Microeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474

Uploaded by

rifkaindiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474

Microeconomics. Pindyck, Robert S. - Rubinfeld, Daniel L. (2018) - 474

Uploaded by

rifkaindiCopyright:

Available Formats

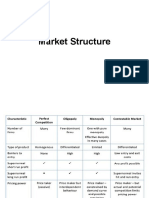

472 PART 3 Market structure and Competitive strategy

output will be in equilibrium—or whether there will even be an equilibrium?

To answer these questions, we need an underlying principle to describe an

equilibrium when firms make decisions that explicitly take each other’s behav-

ior into account.

In §8.7, we explain that in a Remember how we described an equilibrium in competitive and monopo-

competitive market, long- listic markets: When a market is in equilibrium, firms are doing the best they can

run equilibrium occurs when and have no reason to change their price or output. Thus a competitive market is in

no firm has an incentive to equilibrium when the quantity supplied equals the quantity demanded: Each

enter or exit because firms

are earning zero economic firm is doing the best it can—it is selling all that it produces and is maximiz-

profit and the quantity ing its profit. Likewise, a monopolist is in equilibrium when marginal revenue

demanded is equal to the equals marginal cost because it, too, is doing the best it can and is maximizing

quantity supplied.

its profit.

nAsh equilibriuM With some modification, we can apply this same princi-

ple to an oligopolistic market. Now, however, each firm will want to do the best

it can given what its competitors are doing. And what should the firm assume that

its competitors are doing? Because the firm will do the best it can given what its

competitors are doing, it is natural to assume that these competitors will do the best

they can given what that firm is doing. Each firm, then, takes its competitors into

account, and assumes that its competitors are doing likewise.

This may seem a bit abstract at first, but it is logical, and as we will see, it

gives us a basis for determining an equilibrium in an oligopolistic market. The

concept was first explained clearly by the mathematician John Nash in 1951, so

Nash equilibrium set of we call the equilibrium it describes a Nash equilibrium. It is an important con-

strategies or actions in which each cept that we will use repeatedly:

firm does the best it can given its

competitors’ actions.

Nash Equilibrium: Each firm is doing the best it can given what its competitors

are doing.

We discuss this equilibrium concept in more detail in Chapter 13, where we

show how it can be applied to a broad range of strategic problems. In this chap-

ter, we will apply it to the analysis of oligopolistic markets.

To keep things as uncomplicated as possible, this chapter will focus largely

on markets in which two firms are competing with each other. We call such a

duopoly Market in which two market a duopoly. Thus each firm has just one competitor to take into account

firms compete with each other. in making its decisions. Although we focus on duopolies, our basic results will

also apply to markets with more than two firms.

The Cournot Model

Recall from §8.8 that when We will begin with a simple model of duopoly first introduced by the French

firms produce homogeneous economist Augustin Cournot in 1838. Suppose the firms produce a homoge-

or identical goods, consum- neous good and know the market demand curve. Each firm must decide how much

ers consider only price when to produce, and the two firms make their decisions at the same time. When making its

making their purchasing

decisions. production decision, each firm takes its competitor into account. It knows that

its competitor is also deciding how much to produce, and the market price will

depend on the total output of both firms.

Cournot model oligopoly The essence of the Cournot model is that each firm treats the output level of

model in which firms produce a its competitor as fixed when deciding how much to produce. To see how this works,

homogeneous good, each firm

treats the output of its competitors

let’s consider the output decision of Firm 1. Suppose Firm 1 thinks that Firm 2

as fixed, and all firms decide will produce nothing. In that case, Firm 1’s demand curve is the market de-

simultaneously how much to mand curve. In Figure 12.3 this is shown as D1(0), which means the demand

produce. curve for Firm 1, assuming Firm 2 produces zero. Figure 12.3 also shows the

You might also like

- Technopreneurship 101: Module 4: Market Identification and AnalysisDocument60 pagesTechnopreneurship 101: Module 4: Market Identification and AnalysisTOLENTINO, Julius Mark VirayNo ratings yet

- Econ SG Chap08Document20 pagesEcon SG Chap08CLNo ratings yet

- Bbe A2Document18 pagesBbe A2Nguyễn Hương QuỳnhNo ratings yet

- CH 13 Ans 4 eDocument33 pagesCH 13 Ans 4 ecoffeedanceNo ratings yet

- NTN MRP Oct 10Document57 pagesNTN MRP Oct 10Mahesh Daxini Thakker0% (1)

- ECO 5341 Cournot Competition and Collusion: Saltuk Ozerturk (SMU)Document11 pagesECO 5341 Cournot Competition and Collusion: Saltuk Ozerturk (SMU)Chin Yee LooNo ratings yet

- Sticky Prices Notes For Macroeconomics by Carlin & SoskiceDocument13 pagesSticky Prices Notes For Macroeconomics by Carlin & SoskiceSiddharthSardaNo ratings yet

- 9 - Basic Oligopoly ModelsDocument5 pages9 - Basic Oligopoly ModelsMikkoNo ratings yet

- Unit 9 Monopolistic CompetitionDocument20 pagesUnit 9 Monopolistic CompetitionRanjeet KumarNo ratings yet

- Chapter 12 FunalDocument9 pagesChapter 12 FunalQamar VirkNo ratings yet

- L1031 Microeconomics 2 EssayDocument8 pagesL1031 Microeconomics 2 Essayiqra khanNo ratings yet

- Part B: Question 3 The demand curve of a product is to be estimated to given by the expression: Q=200 - πDocument8 pagesPart B: Question 3 The demand curve of a product is to be estimated to given by the expression: Q=200 - πAjitYadavNo ratings yet

- T5. CompetitionDocument4 pagesT5. CompetitionNothing ThereNo ratings yet

- Principles of Economics Chapter 09Document28 pagesPrinciples of Economics Chapter 09Lu CheNo ratings yet

- Market Structure: E5 Managerial EconomicsDocument34 pagesMarket Structure: E5 Managerial EconomicsprabodhNo ratings yet

- Topic 4 and 5 Market Structures Pricing and Output DecisionsDocument8 pagesTopic 4 and 5 Market Structures Pricing and Output Decisionspatrickchiyangi6No ratings yet

- ECON Chapter 6Document12 pagesECON Chapter 6rorNo ratings yet

- MARKETSTRUCTUREDocument14 pagesMARKETSTRUCTUREjh342703No ratings yet

- Game Theory in OligopolyDocument6 pagesGame Theory in OligopolyIJASCSE100% (1)

- (Edit) Description: Market Form Market Industry Monopoly GreekDocument12 pages(Edit) Description: Market Form Market Industry Monopoly GreekAnurag SrivastavaNo ratings yet

- Market StructureDocument19 pagesMarket StructureSri HarshaNo ratings yet

- Solution Manual For Managerial Economics 6th Edition For KeatDocument11 pagesSolution Manual For Managerial Economics 6th Edition For KeatMariahAndersonjerfn100% (33)

- PG Semester I Micro Economics Shika RameshDocument21 pagesPG Semester I Micro Economics Shika RameshFinmonkey. InNo ratings yet

- OligopolyDocument7 pagesOligopolyaarudharshanNo ratings yet

- Chapter 17 - MicroeconomicsDocument5 pagesChapter 17 - MicroeconomicsFidan MehdizadəNo ratings yet

- 13sg Monopoly OligopolyDocument16 pages13sg Monopoly OligopolyAaron Carter Kennedy100% (1)

- Survey of Econ 3Rd Edition Sexton Solutions Manual Full Chapter PDFDocument33 pagesSurvey of Econ 3Rd Edition Sexton Solutions Manual Full Chapter PDFedward.goodwin761100% (12)

- Solution Manualch13Document33 pagesSolution Manualch13StoneCold Alex Mochan80% (5)

- The Four Types of Market Structures: Perfect CompetitionDocument26 pagesThe Four Types of Market Structures: Perfect CompetitionAnnNo ratings yet

- Scott Morton FT 11 08 99Document5 pagesScott Morton FT 11 08 99lifetechnologiesNo ratings yet

- First Fundamental Theorem of Welfare EconomicsDocument9 pagesFirst Fundamental Theorem of Welfare EconomicsChander VeerNo ratings yet

- Definition of 'Oligopoly'Document15 pagesDefinition of 'Oligopoly'Joanna HarrisNo ratings yet

- Industrial Eco 1Document12 pagesIndustrial Eco 1Rajesh GargNo ratings yet

- MicroeconomicsDocument15 pagesMicroeconomicsDar SartajNo ratings yet

- Real World Examples of OligopolyDocument8 pagesReal World Examples of OligopolySanjana KrishnakumarNo ratings yet

- Ch. 7 Firm Competition andDocument25 pagesCh. 7 Firm Competition ands130220073No ratings yet

- Oligopoly 131201152729 Phpapp02Document20 pagesOligopoly 131201152729 Phpapp02Elsa CherianNo ratings yet

- Summary of Chapter 11 & 12 ME g9 ReportDocument7 pagesSummary of Chapter 11 & 12 ME g9 ReportAiza Bernadette NahialNo ratings yet

- Econ2011 - Chapter 11Document9 pagesEcon2011 - Chapter 11RosemaryTanNo ratings yet

- Chapter 9Document16 pagesChapter 9BenjaNo ratings yet

- Industrial Eco 4Document12 pagesIndustrial Eco 4Rajesh GargNo ratings yet

- OLIGOPOLYDocument31 pagesOLIGOPOLYSenam DzakpasuNo ratings yet

- Chapter FourDocument32 pagesChapter Fouretebark h/michaleNo ratings yet

- Oligopoly - MicroeconomicsDocument13 pagesOligopoly - MicroeconomicsSmarika NiraulaNo ratings yet

- Marketstructure PDFDocument15 pagesMarketstructure PDFmihir kumarNo ratings yet

- Managerial Economics: Rijan DhakalDocument117 pagesManagerial Economics: Rijan DhakalKhanal NilambarNo ratings yet

- The BSC Game TheoryDocument11 pagesThe BSC Game TheorypsathopoulosNo ratings yet

- Positive Normative EconomicsDocument4 pagesPositive Normative EconomicslulughoshNo ratings yet

- Topic 1: Market Structure and Market Power 1.1. CompetitorsDocument27 pagesTopic 1: Market Structure and Market Power 1.1. CompetitorsAntónio SoeiroNo ratings yet

- OligopolyDocument2 pagesOligopolyShane Angela PajaberaNo ratings yet

- Oligopoly II WPS OfficeDocument18 pagesOligopoly II WPS OfficeVen ClariseNo ratings yet

- Study Guide For Module No. 7Document5 pagesStudy Guide For Module No. 7ambitchous19No ratings yet

- Oligopoly and Strategic BehaviorDocument4 pagesOligopoly and Strategic BehaviorJaninelaraNo ratings yet

- Eco 2nd Sem Unit 2Document3 pagesEco 2nd Sem Unit 2Mr BeastNo ratings yet

- Monopolistic and OligopolyDocument47 pagesMonopolistic and Oligopolybhasker4uNo ratings yet

- MANAGERIAL ECONOMICS - FinalsDocument5 pagesMANAGERIAL ECONOMICS - FinalsFrancheskalane ValenciaNo ratings yet

- AE11 Chapter 6 Summary Group1 BSAIS 1ADocument14 pagesAE11 Chapter 6 Summary Group1 BSAIS 1AMiles CastilloNo ratings yet

- Capitulo 6 Baye PDFDocument34 pagesCapitulo 6 Baye PDFDiego Vigueras Quijada100% (1)

- Rivera Claire Polscie 2Document3 pagesRivera Claire Polscie 2Paula PaulyNo ratings yet

- Group6report Market Structure and PricingDocument73 pagesGroup6report Market Structure and PricingMichael SantosNo ratings yet

- OligopolyDocument29 pagesOligopolyAkshitha RaoNo ratings yet

- Parkin 13ge Econ IMDocument12 pagesParkin 13ge Econ IMDina SamirNo ratings yet

- OligopolyDocument32 pagesOligopolyAnj SelardaNo ratings yet

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3From EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3No ratings yet

- Mixed Data Sampling (MIDAS) Regression ModelsDocument37 pagesMixed Data Sampling (MIDAS) Regression ModelsrifkaindiNo ratings yet

- PDF SaaS FinMod GIGADocument14 pagesPDF SaaS FinMod GIGArifkaindiNo ratings yet

- Hadi IsmantoDocument13 pagesHadi IsmantorifkaindiNo ratings yet

- The Comparison of Value at Risk On Sharia Based Stock and Non-Sharia Based StockDocument13 pagesThe Comparison of Value at Risk On Sharia Based Stock and Non-Sharia Based StockrifkaindiNo ratings yet

- BIE201 Handout02Document19 pagesBIE201 Handout02andersonmapfirakupaNo ratings yet

- Figure 6-2: Refer To Figure 6-2. The Price CeilingDocument5 pagesFigure 6-2: Refer To Figure 6-2. The Price Ceiling刘佳煊No ratings yet

- BBCE1013 Microeconomic Group One Assignment 1 (30-June-2023)Document17 pagesBBCE1013 Microeconomic Group One Assignment 1 (30-June-2023)Angelyn ChanNo ratings yet

- Unit 10 Labour Market Mind Maps - 231103 - 102231Document19 pagesUnit 10 Labour Market Mind Maps - 231103 - 102231mansi singhNo ratings yet

- Reading Guide Economics of Competitive Advantage' GSBS 6410 Weeks 1 - 6Document1 pageReading Guide Economics of Competitive Advantage' GSBS 6410 Weeks 1 - 6Dewi Maharani Zainul HarrisNo ratings yet

- 5-Keseimbangan Barang Dan Analisis Perubahan KeseimbanganDocument24 pages5-Keseimbangan Barang Dan Analisis Perubahan KeseimbanganRinaldy BobbyNo ratings yet

- Monopolistic CompetitionDocument5 pagesMonopolistic CompetitionSyed BabrakNo ratings yet

- Topic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Document5 pagesTopic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Mijwad AhmedNo ratings yet

- Jis B 1196Document19 pagesJis B 1196indeceNo ratings yet

- Monopolistic CompetitionDocument13 pagesMonopolistic CompetitionMohit MalhotraNo ratings yet

- Economics PPT SAHIL..Document25 pagesEconomics PPT SAHIL..Yash GoyalNo ratings yet

- Excel Calculation (Monopoly 3.0)Document9 pagesExcel Calculation (Monopoly 3.0)maneNo ratings yet

- Economics Chapter 9 & 10 SummaryDocument15 pagesEconomics Chapter 9 & 10 SummaryAlex HdzNo ratings yet

- BBA 1st Sem Syllabus (GU)Document10 pagesBBA 1st Sem Syllabus (GU)Geeta UnivNo ratings yet

- Chapter 12Document100 pagesChapter 12cutiee cookieyNo ratings yet

- Applied Economic ModuleDocument13 pagesApplied Economic ModuleMark Laurence FernandoNo ratings yet

- Ba Eco 201 2021Document6 pagesBa Eco 201 2021Subhajyoti DasNo ratings yet

- 9160261Document19 pages9160261Celine YapNo ratings yet

- Market StructureDocument101 pagesMarket StructureManu C PillaiNo ratings yet

- Price DeterminationDocument10 pagesPrice DeterminationRekha BeniwalNo ratings yet

- Managerial Economics 8th Edition Samuelson Test BankDocument22 pagesManagerial Economics 8th Edition Samuelson Test Bankstarfishcomposero5cglt100% (30)

- Game Theory Extra QuestionsDocument3 pagesGame Theory Extra Questionsjainamnshah7No ratings yet

- Monopoly: Monopoly and The Economic Analysis of Market StructuresDocument15 pagesMonopoly: Monopoly and The Economic Analysis of Market StructuresYvonneNo ratings yet

- N.B. N.B. N.B. N.B. I All II IIIDocument2 pagesN.B. N.B. N.B. N.B. I All II IIIGeetanjaliNo ratings yet

- Applied Economics Q3 Module 15Document13 pagesApplied Economics Q3 Module 15trek boi0% (1)

- ECON1268 Price Theory - Lecture 9-1Document79 pagesECON1268 Price Theory - Lecture 9-1Giang HoangNo ratings yet