Professional Documents

Culture Documents

KFS Full Freelancer Conventional

KFS Full Freelancer Conventional

Uploaded by

shaistarasheed9622Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KFS Full Freelancer Conventional

KFS Full Freelancer Conventional

Uploaded by

shaistarasheed9622Copyright:

Available Formats

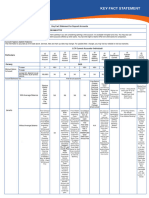

Key Fact Statement for Deposit Accounts

United Bank Limited Date xx-xx-xxxx

__________________ Branch

IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English. You may also use this document to

compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison.

City, ____________________

Account Types & Salient Features :

This information is accurate as of the date above. Services, fees and mark up rates may change on time to time basis i.e. monthly, semi annually etc. For updated fees/charges, you may visit our website or visit our branches.

Conventional

Particulars

UBL Freelancer Account

UBL Freelancer

Currency (PKR,

Account

US, EUR,

- Currency

etc.) (PKR, US, EUR, etc.) PKR

UBL Freelancer Account - Minimum Balance for Account - To open To open NIL

Minimum Balance for Account

UBL Freelancer Account - Minimum Balance for Account - To keep To keep NIL

UBL Freelancer

Account Maintenance

Account - Account

Fee Maintenance Fee NIL

UBL Freelancer Account

Is Profit Paid - Is Profit

on account PaidSubject

(Yes/No) on account (Yes/No)

to the applicable taxSubject

rate to the applicable tax rate No

UBL Freelancer

Indicative Profit

Account

Rate.

- Indicative

(%) Profit Rate. (%) N/A

UBL Freelancer

Profit Payment

Account

Frequency

- Profit(Daily,

Payment Frequency

Monthly, Quarterly,(Daily, Monthly,

Half yearly Quarterly, Half yearly and yearly)

and yearly) N/A

UBL Freelancer

Provide example:

Account - Provide

(On example:

each Rs.1000, you can(On

earneach Rs.1000,

Rs.------ on given you can earn Rs.------ on given periodicity)

periodicity) N/A

UBL Freelancer

Premature/Account

Early Encashment/Withdrawal

- Premature/ Early Encashment/Withdrawal

Fee (If any, provide amount/rate)

Fee (If any, provide amount/rate) N/A

Service Charges: IMPORTANT: This is a list of the main service charges for this account. It does not include all charges. You can find a full list at our branches, on our website at "www.ubldigital.com”. Please note that all bank charges are exclusive of

applicable taxes. * For Good Citizen Filer Customer, service charges will be free as per the product features. PS: For UBL Uniflex account Rs. 100/- pertransaction after 3 withdrawal in a month.

Services Modes Conventional

UBL Freelancer Account - Cash Transaction Deposit - Intercity Intercity 0.10% or Rs. 550/-or Max Rs. 3,000

Cash Transaction Deposit

UBL Freelancer Account - Cash Transaction Deposit - Intra-city Intra-city Free

UBL Freelancer Account - Cash Transaction Withdrawal - Intercity Intercity 0.20% or Min. Rs. 500/- or Max Rs. 3,000

UBL Freelancer Account - Cash Transaction Withdrawal - Intra-city Intra-city Free

Cash Transaction Withdrawal

UBL Freelancer Account - Cash Transaction Withdrawal - Own ATM withdrawal Own ATM withdrawal Free

UBL Freelancer Account - Cash Transaction Withdrawal - Other Bank ATM Other Bank ATM Free

UBL Freelancer Account - SMS - ADC/Digital ADC/Digital Free

SMS

UBL Freelancer Account - SMS - Clearing Clearing Free

UBL Freelancer Account - SMS - For other transactions For other transactions Free

UBL Freelancer Account - Debit Cards - UBL VISA Classic Issuance UBL VISA Classic Issuance Free

UBL Freelancer Account - Debit Cards - UBL VISA Classic Annual UBL VISA Classic Annual Free

UBL Freelancer Account - Debit Cards - UBL Premium Master Issuance UBL Premium Master Issuance Free

UBL Freelancer Account - Debit Cards - UBL Premium Master Annual UBL Premium Master Annual Free

UBL Freelancer Account - Debit Cards - Union Pay Debit Card Issuance Union Pay Debit Card Issuance Free

Debit Cards

UBL Freelancer Account - Debit Cards - Union Pay Debit Card Annual Union Pay Debit Card Annual Free

UBL Freelancer Account - Debit Cards - Paypak Debit Card Issuance Paypak Debit Card Issuance Free

UBL Freelancer Account - Debit Cards - Paypak Debit Card Annual Paypak Debit Card Annual Free

UBL Freelancer Account - Debit Cards - Others Issuance Others Issuance As per SOC

UBL Freelancer Account - Debit Cards - Others Annual Others Annual As per SOC

UBL Freelancer Account - Cheque Book - Issuance Issuance Free

Cheque Book

UBL Freelancer Account - Cheque Book - Stop Payment Stop Payment Rs. 500/-

UBL Freelancer

RemittanceAccount

(Local) - Remittance (Local) - Banker Cheque/ Pay Order/ Cashier's

Banker Cheque

Cheque/ Pay Order/ Cashier's Cheque Rs. 450/-

UBL Freelancer Account - Remittance Foreign - Foreign Demand Draft Foreign Demand Draft 0.12% per USD 1000; Min USD 6, Max USD 30

Remittance Foreign

UBL Freelancer Account - Remittance Foreign - Wire Transfer Wire Transfer As per SOC

UBL Freelancer Account - Statement of Account - Annual Annual Free

Statement of Account

UBL Freelancer Account - Statement of Account - Half Yearly Half Yearly Free

UBL Freelancer Account - Statement of Account - Duplicate Duplicate Rs. 35/- Inc of Tax

UBL Freelancer Account - Fund Transfer - ADC/Digital Channels ADC/Digital Channels Free

Fund Transfer

UBL Freelancer Account - Fund Transfer - Others Others As Per SOC

N/A

UBL Freelancer Account - Digital Banking - Internet Banking subscription (one-time

Internet

& Banking

annual) subscription (one-time & annual)

Digital Banking

N/A

UBL Freelancer Account - Digital Banking - Mobile Banking subscription (one-Mobile

time &Banking

annual) subscription (one- time & annual)

UBL Freelancer Account - Clearing - Normal Normal Free

Clearing Account - Clearing - Intercity

UBL Freelancer Intercity Free

UBL Freelancer Account - Clearing - Same Day Same Day Rs. 525/-

Closure of Account

UBL Freelancer Account - Closure of Account - Customer request Customer request Free

You Must Know

Requirements to open an account: To open the account you will need to satisfy some identification requirements as per regulatory instructions and banks' internal

policies. These may include providing documents and information to verify your identity. Such information may be required on a periodic basis. Please ask us for

more details.

Cheque Bounce: Dishonoring of Cheque is subject to a criminal trial in Pakistan. Accordingly, you should be writing Cheque with utmost prudence. Issuing a cheque Unclaimed Deposits: In terms of Section 31 of Banking Companies Ordinance, 1962 all deposits

dishonestly which gets dishonored on presentation is a criminal offence and is punishable under the law. which have not been operated during the period of last ten years, except deposits in the name

of a minor or a Government or a court of law, are surrendered to State Bank of Pakistan (SBP) by

Safe Custody: Safe custody of access tools to your account like ATM cards, PINs, Cheques, e-banking usernames, passwords; other personal information, etc. is your the relevant banks, after meeting the conditions as per provisions of law. The surrendered

responsibility. Bank cannot be held responsible in case of a security lapse at the customer’s end. Please note that United Bank Limited never calls customers and ask deposits can be claimed through the respective banks. For further information, please contact

your personal details including but not limited to Password, Credit Card Pin, OTP etc. Please be cautious against such kind of messages. branch where your account resides.

Record updation: Always keep profiles/records updated with the bank to avoid missing any significant communication. You can contact your branch to update your

Closing this account: In order to close the account please visit your branch.

information.

How can you get assistance or make a complaint?

What happens if you do not use this account for a long period? United Bank Limited, Complaint Management Unit, 1st Floor, UBL Warehouse Building

If your account remains inoperative for 12 months exculding UBL Pensioner Account (Current Or Saving)**, it will be treated as dormant. If your account becomes Maikolachi MT Khan Road, Karachi

dormant/ inactive, you may request reactivation by personally visiting your UBL branch by completing the following formalities: a) Providing application for Tel : 021-32446949

reactivation of account b) Providing any one of the following valid identity document submitted at the time of account opening Helpline: 021-111-825-888

* Computerized National Identity Card ( CNIC) or Passport or * National Identity Card for Overseas Pakistanis (NICOP) c) Conduct any real time debit transaction at Email: customer.services@ubl.com.pk

branch to activate the account. d) For Pensioner Account - undergoing biometric verification / submission of life certificate or non-marriage declaration, as Website: www.ubldigital.com

applicable.e)However, customers residing overseas will require to visit nearest UBL International Branch or Branch of any correspondent Bank or Pakistani Embassy /

Consulate along with the following documents: a) Signed dormant activation request of the customer, ensuring contact details, phone number, e mail address and If you are not satisfied with our response, you may contact :

mailing address are filled in, or signed request on company’s letter head in case of company account, b) Valid copy of global ID, c) Signed Cheque. info@bankingmohtasib.gov.pk/ fax: 021-99217375/ Tel: 021-99217334-38

**If a UBL Pensioner Account (Current Or Saving) holder fails to submit a life certificate or fails to undergo biometric verification during March and September or a

pensioner does not draw a pension for consecutive six months, the account shall become dormant. Or fails to submit non - marriage certificate (in case of family

pension) on or before 30th September each year.

I ACKNOWLEDGE RECEIVING AND UNDERSTAND THIS KEY FACT STATEMENT

Customer Name:

Product Chosen: UBL Freelancer Account

Mandate of account: Single/Joint/Either or Survivor: * For UBL Pensioner Current Account or UBL Pensioner Saving Account can only be opened Singly

Address

Contact No.: Mobile No. Email Address

Customer's Signature (All account holders's signoffs are required) Signature Verified (Name, Employee # and Functional Title)

You might also like

- As 3566.2-2002 Self-Drilling Screws For The Building and Construction Industries Corrosion Resistance RequireDocument7 pagesAs 3566.2-2002 Self-Drilling Screws For The Building and Construction Industries Corrosion Resistance RequireSAI Global - APACNo ratings yet

- Value Added CourseDocument128 pagesValue Added CourseVignesh WaranNo ratings yet

- Asaan CONVENTIONAL KFSDocument1 pageAsaan CONVENTIONAL KFSnoorulhudaniazi02No ratings yet

- KFS UBL Ameen Asaan Digital Current AccountDocument1 pageKFS UBL Ameen Asaan Digital Current Accounthaniaamalik08No ratings yet

- Kfs For Rda 2023Document1 pageKfs For Rda 2023skhes946No ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- KFS LCY Saving Accounts Individuals and Entities 01Document3 pagesKFS LCY Saving Accounts Individuals and Entities 01Mysterious PerformerNo ratings yet

- KFS HBL Conventional Current AccountDocument6 pagesKFS HBL Conventional Current AccountMillat AfridiNo ratings yet

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Saving Accounts: Key Fact StatementDocument6 pagesSaving Accounts: Key Fact StatementAfaq YousafNo ratings yet

- KFS HBL Conventional Current Account - July 2023Document6 pagesKFS HBL Conventional Current Account - July 2023M. MUNEEB UR REHMANNo ratings yet

- KFS HBL@ Work Conventional AccountsDocument6 pagesKFS HBL@ Work Conventional AccountsArslan BaigNo ratings yet

- Key Fact Statement H1 2023Document8 pagesKey Fact Statement H1 2023H&H PRODUCTIONSNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- Schedule of Charges For Retail Customers (Effective From 1 JULY 2016)Document3 pagesSchedule of Charges For Retail Customers (Effective From 1 JULY 2016)atulNo ratings yet

- KFS HBL Conventional Saving Account-SeptemberDocument6 pagesKFS HBL Conventional Saving Account-Septembermaya aliNo ratings yet

- Allied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)Document3 pagesAllied Islamic Current A/C (Fcy) Allied Islamic Saving A/C (Fcy)Jerry RajputNo ratings yet

- Axis Direct PDFDocument2 pagesAxis Direct PDFMahesh KorrapatiNo ratings yet

- Feedback Demat Tariff For Retail Clients W e F 01-07-2016Document2 pagesFeedback Demat Tariff For Retail Clients W e F 01-07-2016vinay senNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Woman Savings Account KFSDocument2 pagesWoman Savings Account KFSQ Trade DistributorsNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- Updated Key Fact Sheet Indicative Rate July1st 2023Document4 pagesUpdated Key Fact Sheet Indicative Rate July1st 2023shahzebm222No ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Alhabib Woman Islamic Asaan Savings AccountDocument2 pagesAlhabib Woman Islamic Asaan Savings Accountseadeco1991No ratings yet

- K2 SCA, MEA 6 December 2023 English BDocument3 pagesK2 SCA, MEA 6 December 2023 English Baltaf.usmanNo ratings yet

- Mahana MunafaDocument2 pagesMahana Munafaalimurtaza6582No ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Retail Customers: Schedule of Charges ForDocument1 pageRetail Customers: Schedule of Charges ForGaurav MishraNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Website Notice Revision in Tariff Effective April 2023 - Non MSFDocument3 pagesWebsite Notice Revision in Tariff Effective April 2023 - Non MSFbackupvipul2304No ratings yet

- Demat SOA RetailDocument1 pageDemat SOA Retailamol.harshpalNo ratings yet

- Announced by The Bank From Time To Time. Current Accounts Will Be Based On Qard. Saving Accounts and Islamic Term Deposits Will Be Based On MudarabahDocument2 pagesAnnounced by The Bank From Time To Time. Current Accounts Will Be Based On Qard. Saving Accounts and Islamic Term Deposits Will Be Based On Mudarabahhussainchotto75No ratings yet

- Key Fact Statement For Deposit Accounts: To OpenDocument4 pagesKey Fact Statement For Deposit Accounts: To OpenMaqsood akhtarNo ratings yet

- Income Distribution - Month Ended June 30, 2019Document1 pageIncome Distribution - Month Ended June 30, 2019Prince KhalilNo ratings yet

- Important FormulasDocument6 pagesImportant FormulasJagadees KrishnanNo ratings yet

- KFS HBL Conventional Term Deposit Accounts - Dec 2022Document6 pagesKFS HBL Conventional Term Deposit Accounts - Dec 2022Abeer KhanNo ratings yet

- Savings Bank Products-1207202307Document1 pageSavings Bank Products-1207202307Bruh YooinkNo ratings yet

- Meezan Bank Profit RatesDocument1 pageMeezan Bank Profit RatesNazim KhanNo ratings yet

- CDRD Revised Tariff Guide 2020Document11 pagesCDRD Revised Tariff Guide 2020Atlas Microfinance LtdNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- KFS Deutsche Bank AG - PakistanDocument3 pagesKFS Deutsche Bank AG - PakistanPrijin UnnunnyNo ratings yet

- K4 BBA, CUR, LIF, BUR 6 December 2023 English BDocument3 pagesK4 BBA, CUR, LIF, BUR 6 December 2023 English Baltaf.usmanNo ratings yet

- NRV Faq PDFDocument2 pagesNRV Faq PDFKhushbu ShahNo ratings yet

- AL Habib Mahana Munafa Key FactDocument2 pagesAL Habib Mahana Munafa Key FactAmir Mehmood AbbasiNo ratings yet

- Service ChargeDocument13 pagesService Chargevalipimahesh339No ratings yet

- Effective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlyDocument2 pagesEffective From 1st January, 2022: AMB (Average Monthly Balance) Non Maintenance Charges (NMC) - MonthlySavitha ENo ratings yet

- Savings Account - Revision in Service ChargesDocument2 pagesSavings Account - Revision in Service ChargesPradeep MishraNo ratings yet

- Website Notice Revision in Tariff - April 2025 - CARO - V1 - 290224Document2 pagesWebsite Notice Revision in Tariff - April 2025 - CARO - V1 - 290224arunveluNo ratings yet

- Subledger Accounting: Account Analysis ReportDocument14 pagesSubledger Accounting: Account Analysis ReportOsmanMehmoodNo ratings yet

- Ch-9A-PAYROLL ASSIGNMENTDocument7 pagesCh-9A-PAYROLL ASSIGNMENTkrishnajhaNo ratings yet

- Banking Assignment On State Bank of HyderabadDocument36 pagesBanking Assignment On State Bank of HyderabadsankadheerajNo ratings yet

- Revision in General Schedule of Fees and Charges W e F 1st June 2022finalDocument2 pagesRevision in General Schedule of Fees and Charges W e F 1st June 2022finalpbhawsar3687No ratings yet

- KFS WB enDocument2 pagesKFS WB enRameez Ali FaridiNo ratings yet

- KFS Fcy enDocument2 pagesKFS Fcy enra5848273No ratings yet

- Financial Model OBT 13STB FM T1!11!12 3Document21 pagesFinancial Model OBT 13STB FM T1!11!12 3Zaini AhNo ratings yet

- Meezan Bank Income DistributionDocument1 pageMeezan Bank Income DistributionMuhammad SalmanNo ratings yet

- Effective From 1st December, 2019: AMB (Average Monthly Balance)Document2 pagesEffective From 1st December, 2019: AMB (Average Monthly Balance)akibNo ratings yet

- 3 FinProcess 11 PostJE TemplateDocument8 pages3 FinProcess 11 PostJE Templateaseem siddiqueNo ratings yet

- Standard Schedule of ChargesDocument4 pagesStandard Schedule of ChargesAliya MalhotraNo ratings yet

- Ives - Stilwell Experiment Fundamentally FlawedDocument22 pagesIves - Stilwell Experiment Fundamentally FlawedAymeric FerecNo ratings yet

- Experimental Optimization of Radiological Markers For Artificial Disk Implants With Imaging/Geometrical ApplicationsDocument11 pagesExperimental Optimization of Radiological Markers For Artificial Disk Implants With Imaging/Geometrical ApplicationsSEP-PublisherNo ratings yet

- BTX From FCC PDFDocument7 pagesBTX From FCC PDFjosealvaroNo ratings yet

- Cobb Douglas ProductionDocument4 pagesCobb Douglas ProductionMim ShakilNo ratings yet

- Indonesian Society 'S Sentiment Analysis Against The COVID-19 Booster VaccineDocument6 pagesIndonesian Society 'S Sentiment Analysis Against The COVID-19 Booster VaccineKasiyemNo ratings yet

- Prof. Alberto Berizzi: Dipartimento Di Energia Ph. 02 2399 3728 Email: Alberto - Berizzi@polimi - ItDocument32 pagesProf. Alberto Berizzi: Dipartimento Di Energia Ph. 02 2399 3728 Email: Alberto - Berizzi@polimi - ItMohammed OsmanNo ratings yet

- GSA Chipset Report PDFDocument12 pagesGSA Chipset Report PDFHimanshu GondNo ratings yet

- Jurnal AnakDocument6 pagesJurnal AnakWidhi SanglahNo ratings yet

- Kingspan Jindal Ext. Wall Panel SystemDocument32 pagesKingspan Jindal Ext. Wall Panel Systemabhay kumarNo ratings yet

- Bio 50Document28 pagesBio 50Mohammad Shahidullah ChowdhuryNo ratings yet

- 9.08 Solving Systems With Cramer's RuleDocument10 pages9.08 Solving Systems With Cramer's RuleRhea Jane DugadugaNo ratings yet

- Ehv Ac & DC Transmission MCQ Unit - 5 - Math TradersDocument3 pagesEhv Ac & DC Transmission MCQ Unit - 5 - Math TradersRitNo ratings yet

- Advantages & Disadvantages of Dictation As Writing ExercisesDocument6 pagesAdvantages & Disadvantages of Dictation As Writing ExercisesAfiq AzmanNo ratings yet

- Film TV Treatment TemplateDocument6 pagesFilm TV Treatment TemplateYaram BambaNo ratings yet

- Introduction To Criminology and PsycholoDocument10 pagesIntroduction To Criminology and PsycholoSkier MishNo ratings yet

- Burley StoryboardDocument15 pagesBurley Storyboardapi-361443938No ratings yet

- Holbright Hb-8212Document1 pageHolbright Hb-8212Eliana Cristina100% (1)

- Belzona 1311Document2 pagesBelzona 1311Bobby SatheesanNo ratings yet

- ICDBME2022 - Book of AbstractsDocument341 pagesICDBME2022 - Book of AbstractsAlev TaskınNo ratings yet

- FAR FR2805 Operators ManualDocument169 pagesFAR FR2805 Operators ManualJack NguyenNo ratings yet

- Mnemonics FinalDocument10 pagesMnemonics Finalapi-285415466No ratings yet

- Ray OpyicsDocument56 pagesRay OpyicsDhruv JainNo ratings yet

- Vertiv Aisle Containment SystemDocument46 pagesVertiv Aisle Containment SystemOscar Lendechy MendezNo ratings yet

- Kagramian Report 2Document12 pagesKagramian Report 2api-700030358No ratings yet

- 30ra 040 240 ManualDocument31 pages30ra 040 240 Manualmichel correa de limaNo ratings yet

- Complexe Scolaire Et Universitaire Cle de La Reussite 2022-2023 Composition 2e TrimestreDocument6 pagesComplexe Scolaire Et Universitaire Cle de La Reussite 2022-2023 Composition 2e TrimestreBruno HOLONOUNo ratings yet

- Jurnal Dinamika Ekonomi Pembangunan (JDEP) : Sektor Pariwisata Indonesia Di Tengah Pandemi Covid 19Document7 pagesJurnal Dinamika Ekonomi Pembangunan (JDEP) : Sektor Pariwisata Indonesia Di Tengah Pandemi Covid 19Nanda SyafiraNo ratings yet

- Technical Drawing ToolsDocument11 pagesTechnical Drawing Toolsdaphne brown-mundleNo ratings yet