Professional Documents

Culture Documents

Sas7 Acc118

Sas7 Acc118

Uploaded by

zariyahmin12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sas7 Acc118

Sas7 Acc118

Uploaded by

zariyahmin12Copyright:

Available Formats

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Lesson title: FINANCIAL PLANNING AND BUDGETING (CONT.) Materials:

N

Lesson Objectives: SAS

IO

At the end of this module, I should be able to: References:

1. prepare the ending finished goods inventory budget and cost Timbang, F. L. (2015). Financial

of goods sold budget Management, Part 1. Quezon City:

AT

2. accomplish the budgeted income statement C & E Publishing, Inc.

3. prepare the cash budget, budgeted balance sheet and budget

C

for capital expenditures Managerial Accounting: The

4. use budgets for performance evaluation Cornerstone of Business

U

Decisions, 4e. by Mowen, M. and

ED

Hansen D. (2012)

COC Teacher’s Guide

A

M

Productivity Tip: Schedule doing practice drills similar to the ones in this module two more times this week.

Spacing your practice time will help you master the process!

IN

A. LESSON PREVIEW/REVIEW

PH

1) Introduction

Based on your recollection of your Basic Accounting lessons, can you state the different items

that can be found in an income statement? What does the income statement tell us about?

F

O

In this module, we will learn about some of the components or supporting schedules of

operating budget and financial budget, such as the cash budget, budgeted balance sheet and

TY

other financial budget. Along with the other schedules previously discussed, we will be able to

accomplish the budgeted income statement.

R

2) Activity 1: What I Know Chart, part 1 (3 mins)

Do you know anything about operating budget? Try answering the questions below by writing

PE

your ideas under the first column What I Know. It’s okay if you write key words or phrases that

you think are related to the questions.

O

What I Know Questions: What I Learned (Activity 4)

PR

What is a budgeted income

statement?

What information do we get by

accomplishing a budgeted

income statement?

This document is the property of PHINMA EDUCATION

Page 1 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Are ending finished goods

inventory budget and cost of

N

goods sold budget related?

What is a financial budget?

IO

What are its components?

May we use budgets for

AT

performance evaluation?

C

B.MAIN LESSON

1) Activity 2: Content Notes

U

ED

⮚ supplies information needed for the balance sheet

⮚ serves as an important input for the preparation of the cost of

Ending finished goods sold budget

goods inventory

budget A

⮚ to prepare, the unit cost of producing finished goods must be

calculated by using information from the direct materials, direct

M

labor, and overhead budgets

IN

Cost of goods ⮚ reveals the expected cost of the goods to be sold

PH

sold budget

Budgeted Income ⮚ the ultimate outcome of the operating budgets

Statement

F

Cash budget ⮚ because cash flow is the lifeblood of an organization, the cash

budget is one of the most important budgets in the master

O

budget

TY

⮚ basic structure includes cash receipts, disbursements, any

excess or deficiency of cash, and financing as shown below:

R

PE

Expected beginning balance PXX

Add cash receipts XX

Cash available PXX

O

Less disbursements XX

Expected ending balance PXXX

PR

Cash budget: ⮚ consists of the beginning cash balance and the expected cash

Cash Available receipts

⮚ expected cash receipts include all sources of cash for the

period being considered

⮚ principal source is from sales

This document is the property of PHINMA EDUCATION

Page 2 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

⮚ since a large proportion of sales is usually on account, a major

task of an organization is to determine the pattern of collection

N

for its accounts receivable

IO

⮚ past experience can be used to determine what percentage of

credit sales are paid in the month of and months following sales,

AT

and create a schedule of cash collections on accounts

receivable

C

Cash budget: ⮚ lists all planned cash outlays for the period

U

Cash ⮚ all expenses that do not require a cash outlay are excluded

Disbursements

ED

⮚ may require care in handling payments on account

Cash budget: ⮚ Some companies expand the basic cash budget format by

Cash Excess or adding lines to show any borrowing or repayment necessary to

Deficiency

A

achieve a minimum desired cash amount.

M

⮚ the preliminary ending cash balance is called cash excess or

IN

deficiency

⮚ The cash excess or deficiency line is compared to the minimum

PH

cash balance (or lowest amount of cash acceptable as noted by

company policy).

⮚ If a cash deficiency exists with less cash on hand than is

F

needed, the company usually obtains a short-term loan.

O

⮚ A cash excess is usually used to repay loans or used to make

temporary investments.

TY

Cash Budget:

Borrowings and Borrowings and Repayments:

R

Repayments, ⮚ If a company converts its preliminary cash balance line to a cash

PE

Ending Cash excess (deficiency) line, it may be borrowing or repaying money.

Balance

⮚ If there is a deficiency, this section shows the necessary amount

O

to be borrowed.

⮚ When excess cash is available, this section shows planned

PR

repayments, including interest expense.

Ending Cash Balance:

⮚ last line of the cash budget

This document is the property of PHINMA EDUCATION

Page 3 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

⮚ the planned amount of cash to be on hand at the end of the

period after all receipts and disbursements, as well as

N

borrowings and repayments, are considered

IO

Budgeted ⮚ depends on information contained in the current balance sheet

Balance Sheet

AT

and in the other budgets in the master budget

⮚ explanations for the budgeted figures are typically provided in

the footnotes

C

U

Using Budgets for Performance Evaluation

ED

Budgets are often used to judge the performance of managers. Bonuses, salary

increases, and promotions are all affected by a manager’s ability to achieve or beat budgeted

goals.

A

Positive behaviour occurs when the goals of each manager are aligned with the goals

of the organization and each manager has the drive to achieve them.

M

The alignment of managerial and organizational goals is often referred to as goal

IN

congruence. If the budget is improperly administered, subordinate managers may subvert the

organization’s goals.

PH

Dysfunctional behaviour is individual behaviour that is in basic conflict with the goals of

the organization.

Key features that promote a reasonable degree of positive behaviour include:

F

O

Frequent Frequent, timely performance reports allow managers to know how

feedback on successful their efforts have been, to take corrective actions, and to change

performance plans as necessary

TY

Monetary and Incentives are the means an organization uses to influence a manager to

nonmonetary exert effort to achieve an organization’s goal.

R

incentives Traditional organizational theory assumes that employees are primarily

motivated by monetary rewards, they resist work, and they are inefficient

PE

and wasteful.

O

Monetary incentives are used to control a manager’s tendency to shirk and

waste resources by relating budgetary performance to salary increases,

PR

bonuses, and promotions.

Nonmonetary incentives, including job enrichment, increased responsibility

and autonomy, and recognition programs can be used to enhance a

budgetary control system.

Participative Allows subordinate managers considerable say in how the budgets are

budgeting established

This document is the property of PHINMA EDUCATION

Page 4 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Increased responsibility and challenge inherent in the process provide

N

nonmonetary incentives that lead to a higher level of performance

IO

Three potential problems:

● setting standards that are either too high or too low

AT

● building slack into the budget (often referred to as padding the

budget)

C

- exists when a manager deliberately underestimates revenues or

U

overestimates costs in an effort to make the future period appear

less attractive in the budget than they think it will be in reality

ED

● pseudoparticipation

- top management assumes total control of the budgeting process,

seeking only superficial participation from lower-level managers;

A

simply obtains formal acceptance of the budget from subordinate

M

managers, not seeking real input

IN

Realistic Budgets should reflect operating realities, including the following:

standards ● Actual Levels of Activity

PH

● Seasonal Variations

● Efficiencies

● General Economic Trends

F

O

Controllability Costs whose level a manager can influence

of costs

TY

If noncontrollable costs are put in the budgets of subordinate managers to

help them understand that these costs also need to be covered, then they

should be separated from controllable costs and labeled as noncontrollable.

R

Multiple While financial measures of performance are important, overemphasis can

PE

measures of lead to a form of dysfunctional behavior called milking the firm or myopia.

performance

Myopic behavior occurs when a manager takes actions that improve

O

budgetary performance in the short run but bring long-run harm to the firm.

PR

Budgetary measures alone cannot prevent myopic behavior.

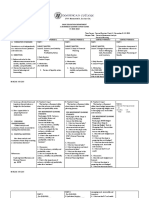

As follows are the format of the budgets mentioned above:

This document is the property of PHINMA EDUCATION

Page 5 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

N

IO

AT

C

U

ED

A

M

IN

PH

F

O

2) Activity 3: Skill-building Activities

TY

Let’s practice! After completing each exercise, you may refer to the Key to Corrections for

R

feedback. Try to complete each exercise before looking at the feedback.

PE

Use the given budgets below to answer Exercises 1-3.

O

Exercise 1: Prepare an ending finished goods inventory budget assuming that the company

plans to have 200 units of finished goods at period end. The company uses 5 ounces of ink for

PR

each unit of its finished product.

This document is the property of PHINMA EDUCATION

Page 6 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Exercise 2: Prepare the cost of goods sold budget assuming the company has direct materials

N

used of P22,880 and beginning finished goods inventory of P1,251.

IO

AT

C

U

Exercise 3: Prepare the budgeted income statement of the company. Assume that the tax rate is

ED

40%.

A

M

IN

PH

F

O

TY

R

PE

O

PR

This document is the property of PHINMA EDUCATION

Page 7 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

N

IO

AT

C

U

ED

A

M

IN

PH

F

O

TY

R

PE

O

PR

This document is the property of PHINMA EDUCATION

Page 8 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

N

IO

AT

C

U

ED

A

M

IN

PH

F

O

Exercise 4: From past experience, Texas Rex expects that, on average, 25 percent of total sales

TY

are on cash and 75 percent of total sales are on credit. Of the credit sales, Texas Rex expects

that 90 percent will be paid in cash during the quarter of sale, and the remaining 10 percent will

be paid in the following quarter. Texas Rex Inc. expects the following total sales:

R

Quarter 1 P10,000

Quarter 2 P12,000

PE

Quarter 3 P15,000

Quarter 4 P20,000

O

The balance in accounts receivable as of the last quarter of 2011 was P1,350. This will be

collected in cash during the first quarter of 2012. Prepare a schedule showing cash receipts

PR

from sales expected in each quarter of 2012.

This document is the property of PHINMA EDUCATION

Page 9 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

N

Exercise 5: Tierro Company budgeted the following information for 2020:

IO

May June July August

Budgeted Purchases P104,000 p110,000 P102,000 P100,000

AT

● Cost of goods sold is 40% of sales. Accounts payable is used only for inventory

acquisitions.

C

● Tierro Co purchases and pays for merchandise 60% in the month of acquisition and 40%

U

in the following month.

● Selling and administrative expenses are budgeted at P40,000 for May and are expected

ED

to increase at 5% per month. They are paid during the month of acquisition. In addition,

budgeted depreciation is P10,000 per month.

● Tierro Co pays P4,500 per month for its 6% note payable and interest.

●

A

Income taxes are P38,400 for July and are paid in the month incurred.

M

How much are the budgeted cash disbursements for July?

IN

PH

F

O

TY

Exercise 6: Visual Inc. has asked Allan and Maebeth for a budgeted balance sheet for the year

ended December 31, 2020. The following information is available:

a. The cash budget shows an expected cash balance of P26,000 at December 31, 2020.

R

b. The 2020 sales budget shows total annual sales of P500,000. All sales are made on

PE

account and accounts receivable at December 2020 are expected to be 8%of annual

sales.

c. The merchandise purchases budget shows budgeted cost of goods sold for2020 of

O

P210,000 and ending merchandise inventory of P21,000. 20% of the ending inventory is

expected to have not yet been paid at December 31, 2020.

PR

d. The December 31, 2020 balance sheet includes the following balances: Equipment

P127,000, Accumulated Depreciation P52,000, Common Stock P68,000, and Retained

Earnings P21,000.

e. The budgeted income statement for 2020 includes the following: depreciation on

equipment P6,000, federal income taxes P21,000, and net income P41,800. The income

taxes will not be paid until 2024.

This document is the property of PHINMA EDUCATION

Page 10 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

f. In 2020, management does not expect to purchase additional equipment or to declare

any dividends. It does expect to pay all operating expenses, other than depreciation, in

N

cash.

IO

Prepare an unclassified budgeted balance sheet at December 31, 2020.

AT

C

U

ED

3) Activity 4: What I Know Chart, part 2

A

It’s time to answer the questions in the What I Know chart in Activity 1. Log in your answers in

M

the table.

IN

PH

4) Activity 5: Check for Understanding

1. Encircle the letter of your choice. Which of the following is an operating budget?

a. budgeted statement of cash flows

F

b. capital expenditures budget

O

c. budgeted income statement

d. cash budget

TY

2. Describe some problems with participative budgeting.

R

PE

O

PR

C. LESSON WRAP-UP

Activity 6: Thinking about Learning

Congratulations for finishing this module! Shade the number of the module that you finished.

This document is the property of PHINMA EDUCATION

Page 11 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

N

IO

Did you have challenges learning the concepts in this module? If none, which parts of the module

AT

helped you learn the concepts?

__________________________________________________________________________________

C

___________________________

U

Some question/s I want to ask my teacher about this module is/are:

ED

__________________________________________________________________________________

_________________________

FAQs

A

1. Is the ending inventory related to the amount of profit for a certain period?

M

⮚ Yes, ending inventory and profit have direct relationship. In the computation of the Cost of

Goods Sold, high ending inventory results to low cost of goods sold, which in effect, results to

IN

high gross income.

PH

Homework:

Study in advance:

● Financial budget

F

O

KEY TO CORRECTIONS

Answers to Skill-Building Exercises

Exercise 1: Ending finished goods inventory budget

TY

R

PE

O

PR

Quarter

Source 1 2 3 4

Received on account from: P2,500 P3,000 P3,750 P5,000

Quarter 4, 2011 1,350

This document is the property of PHINMA EDUCATION

Page 12 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Quarter 1, 2012 6750a 750b

N

Quarter 2, 2012 8,100c 900d

Quarter 3, 2012 10,125e 1,125f

IO

Quarter 4, 2012 13,500g

AT

P10,600 P11,850 P14,775 P19,625

C

a d g

(P10,000 x 0.75)(0.9) (P12,000 x 0.75)(0.1) (P20,000 x 0.75)(0.9)

U

b e

(P10,000 x 0.75)(0.1) (P15,000 x 0.75)(0.9)

c f

ED

(P12,000 x 0.75)(0.9) (P15,000 x 0.75)(0.1)

Exercise 2: Cost of goods sold budget

A

M

IN

PH

F

O

TY

Answer: Cash disbursements:

Cash paid for July purchases (60% x P102,000) P 61,200

Cash paid for June purchases (40% x P110,000) 44,000

R

Cash paid for July selling and admin (P40,000 x 1.05 x 1.05) 44,100

PE

Cash paid for note payment and interest 4,500

Cash paid for income taxes 38,400

Total cash disbursements P192,200

O

PR

This document is the property of PHINMA EDUCATION

Page 13 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Exercise 3: Budgeted Income Statement

N

IO

AT

C

U

ED

A

M

IN

Allan and Maebeth

Budgeted Balance Sheet

PH

December 31, 2020

Assets

F

Cash P26,000

O

Accounts Receivable (8% x P500,000) 40,000

Merchandise Inventory 21,000

TY

Equipment P127,000

Less: Accumulated Depreciation 58,000 69,000

Total assets P156,000

R

PE

Liabilities and Stockholder’s Equity

Accounts Payable (20% x P21,000) P 4,200

O

Income taxes payable 21,000

Common stock 68,000

PR

Retained earnings (P21,000 + P41,800) 62,800

Total liabilities and stockholder’s equity P156,000

Activity 5: Check for Understanding

1. C

This document is the property of PHINMA EDUCATION

Page 14 | 15

ACC 118 Strategic Business Analysis

Module #7

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

2. Answers may slightly vary

N

1. Standards may be set too high. This can discourage managers/employees from even trying to

meet the standards. Alternatively, standards can be set too low. This will not encourage workers to

IO

stretch to meet achievable (yet higher) standards.

AT

2. Managers may pad the budget. Managers know that the budget sets the standards against which

their work will be measures. Not surprisingly, managers may prefer an easier standard, with

budgetary slack built in.

C

U

3. Pseudoparticipation may be more the rule than participation. Here, top management sets the

budget and does not seek or use input from lower level managers. The so-called participation is

ED

simply the opportunity for lower level managers to formally acknowledge the budget.

A

M

IN

PH

F

O

TY

R

PE

O

PR

This document is the property of PHINMA EDUCATION

Page 15 | 15

You might also like

- SITXFIN004 Assessment 2 - AssignmentDocument10 pagesSITXFIN004 Assessment 2 - Assignmentlux tamg0% (2)

- Chapter 9 ProblemsDocument55 pagesChapter 9 Problemsashibhallau0% (2)

- Budgetary Planning and Control: 7.1 Nature and Purposes of BudgetsDocument18 pagesBudgetary Planning and Control: 7.1 Nature and Purposes of Budgetsserge folegweNo ratings yet

- AFAR8720 - Government Accounting Manual PDFDocument8 pagesAFAR8720 - Government Accounting Manual PDFSid Tuazon100% (2)

- Sas6 Acc118Document8 pagesSas6 Acc118zariyahmin12No ratings yet

- FIN 004 Module #6 SASDocument6 pagesFIN 004 Module #6 SASPD MagsanocNo ratings yet

- Acc 118 Mod 3Document8 pagesAcc 118 Mod 3Rona Amor MundaNo ratings yet

- Las-Business-Finance-Q1 Week 4Document22 pagesLas-Business-Finance-Q1 Week 4Kinn JayNo ratings yet

- MAS 5 - Module 1Document11 pagesMAS 5 - Module 1Razmen Ramirez PintoNo ratings yet

- Module A For MAS 5 Aug 2022 5Document11 pagesModule A For MAS 5 Aug 2022 5Angela Miles DizonNo ratings yet

- Session 3 - Lecture SlidesDocument14 pagesSession 3 - Lecture Slideshaddaoui zahraNo ratings yet

- FIN 004 Module #7 SASDocument4 pagesFIN 004 Module #7 SASPD MagsanocNo ratings yet

- Prepare Operational Budget ModuleDocument22 pagesPrepare Operational Budget Modulehundelamesa2023No ratings yet

- AE 24 Module 1 BudgetingDocument14 pagesAE 24 Module 1 BudgetingShamae Duma-anNo ratings yet

- CH7 BudgetingDocument51 pagesCH7 BudgetingYMNo ratings yet

- Module 006 BudgetingDocument12 pagesModule 006 BudgetinggagahejuniorNo ratings yet

- Test Bank For Principles of Cost Accounting 17th Edition DownloadDocument38 pagesTest Bank For Principles of Cost Accounting 17th Edition Downloadbradleypetersonbqnsyzaegm100% (25)

- Budgeting Case Study SIR Final 1hrDocument6 pagesBudgeting Case Study SIR Final 1hrRalucaGeorgianaNo ratings yet

- HanduotDocument20 pagesHanduotTegene TesfayeNo ratings yet

- TM03 04 - Akman - Planningctrl Budgeting GJL 23 24Document91 pagesTM03 04 - Akman - Planningctrl Budgeting GJL 23 24Ramdonidoni doniNo ratings yet

- Take Test - Tutorial 3A Budgeting and Costing - BE8319 - ..Document7 pagesTake Test - Tutorial 3A Budgeting and Costing - BE8319 - ..Xiuming ChenNo ratings yet

- Budgeting For Planning and ControlDocument25 pagesBudgeting For Planning and ControlCiara Angily Abad GinetaNo ratings yet

- Prepare Operational BudgetsDocument25 pagesPrepare Operational Budgetsnahu a din100% (1)

- Budgeting For Planning and ControlDocument23 pagesBudgeting For Planning and ControlMuhammad AbrarNo ratings yet

- Pma3143 Chapter 4 Budgeting 0422Document23 pagesPma3143 Chapter 4 Budgeting 0422SYIMINNo ratings yet

- Budgeting For Planning and Control: Learning ObjectivesDocument23 pagesBudgeting For Planning and Control: Learning Objectives7100507No ratings yet

- Chapter 8 Budgeting For Planning and Control PDF FreeDocument19 pagesChapter 8 Budgeting For Planning and Control PDF FreeRashel Keith BadolNo ratings yet

- Lecture 11 BIS ManagerialDocument25 pagesLecture 11 BIS Managerialnada ahmedNo ratings yet

- A. Course Code - Title: B. Module No - Title: C. Time Frame: D. Materials: 1Document15 pagesA. Course Code - Title: B. Module No - Title: C. Time Frame: D. Materials: 1firestorm riveraNo ratings yet

- Expected Cash Receipts Classified by Source Expected Cash DisbursementsDocument6 pagesExpected Cash Receipts Classified by Source Expected Cash DisbursementsRimuru Tempest100% (1)

- LezgawDocument20 pagesLezgawisha NeveraNo ratings yet

- MAS 06 Budgeting With Probability AnalysisDocument10 pagesMAS 06 Budgeting With Probability AnalysisJericho G. BariringNo ratings yet

- BudgetsDocument35 pagesBudgetsMayank Pande100% (1)

- Busfin 6 Budget-PlanDocument16 pagesBusfin 6 Budget-PlanHazel CabreraNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2Tin CabosNo ratings yet

- IWB Chapter 6 - BudgetingDocument38 pagesIWB Chapter 6 - Budgetingjulioruiz891No ratings yet

- CH - 2 For TeacherDocument11 pagesCH - 2 For TeacherEbsa AdemeNo ratings yet

- Module 5 ACCT2121Document39 pagesModule 5 ACCT21214211290No ratings yet

- K11.ipb Macb Vandoanhong Assignment2Document31 pagesK11.ipb Macb Vandoanhong Assignment2Nhân ThànhNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2JOSHUA GABATERONo ratings yet

- Midterm Topic 4.1 - Notes - Sales Budgets and Production BudgetsDocument2 pagesMidterm Topic 4.1 - Notes - Sales Budgets and Production BudgetslanoyjessicaellahNo ratings yet

- Abm 12 Finance q1 Clas4 Preparation-Of-budgets-And-projected-financial-statement v1 - Rhea Ann NavillaDocument23 pagesAbm 12 Finance q1 Clas4 Preparation-Of-budgets-And-projected-financial-statement v1 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Budgeting Planning and ControlDocument31 pagesBudgeting Planning and Controlintan agustina100% (1)

- 1st Quarter Module 5 Continuation Financial Planing Tools and Concept 2Document14 pages1st Quarter Module 5 Continuation Financial Planing Tools and Concept 2Gustler James Javier PunoNo ratings yet

- Hilton 11e Chap009PPTDocument51 pagesHilton 11e Chap009PPTNgọc ĐỗNo ratings yet

- Chapter 4 - BudgetingDocument9 pagesChapter 4 - BudgetingVuong PhamNo ratings yet

- Module in BudgetingDocument5 pagesModule in BudgetingJade TanNo ratings yet

- CH 07 ImaimDocument22 pagesCH 07 Imaimkevin echiverriNo ratings yet

- Workshop 4 Financial EducationDocument10 pagesWorkshop 4 Financial EducationAdriana RonderosNo ratings yet

- Slide MI2 - Students 2Document165 pagesSlide MI2 - Students 2Bryan NguyễnNo ratings yet

- Preparing Financial Reports For Single ProprietorshipDocument22 pagesPreparing Financial Reports For Single Proprietorshipandrea.begulbuilderscorpNo ratings yet

- 01 Handout 1Document16 pages01 Handout 1phillip quimenNo ratings yet

- Business Finance Lesson-Exemplar - Module 2Document7 pagesBusiness Finance Lesson-Exemplar - Module 2Divina Grace Rodriguez - LibreaNo ratings yet

- BUDGETS - Management Control SystemsDocument20 pagesBUDGETS - Management Control SystemsPUTTU GURU PRASAD SENGUNTHA MUDALIAR67% (3)

- Learning Goals Contact Period 1 Contact Period 2 Contact Period 3 Contact Period 4Document4 pagesLearning Goals Contact Period 1 Contact Period 2 Contact Period 3 Contact Period 4Chai Samonte TejadaNo ratings yet

- Lecture Note Part IIDocument29 pagesLecture Note Part IIErit AhmedNo ratings yet

- Prof Sunny Sabharwal JgbsDocument28 pagesProf Sunny Sabharwal JgbsVaibhav AgarwalNo ratings yet

- Budget (!Document6 pagesBudget (!Timilehin GbengaNo ratings yet

- Capital Budgeting IIDocument37 pagesCapital Budgeting IISelahi YılmazNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Bi Weekly Budget TrackerDocument22 pagesBi Weekly Budget TrackeranamarieNo ratings yet

- Financial Nindot PDFDocument104 pagesFinancial Nindot PDFbernieNo ratings yet

- Concept Note FormatDocument3 pagesConcept Note FormatAli PaquiraNo ratings yet

- Financial Management EssentialsDocument167 pagesFinancial Management EssentialsmissaveneNo ratings yet

- SDM Case AssignmentDocument15 pagesSDM Case Assignmentcharith sai t 122013601002No ratings yet

- Guidelines On The Appropriation, Release, PlanningDocument20 pagesGuidelines On The Appropriation, Release, PlanningCamila Anne GambanNo ratings yet

- Executive Report Vol 1 FinalDocument51 pagesExecutive Report Vol 1 FinalSolomon BalemeziNo ratings yet

- Budgeting and ForecastingDocument11 pagesBudgeting and ForecastingGrace XYZNo ratings yet

- SPPTChap 008Document17 pagesSPPTChap 008Farhan RabbehNo ratings yet

- Philippine Constitution Association vs. Enriquez, 235 SCRA 506, G.R. No. 113105, G.R. No. 113174, G.R. No. 113766, G.R. No. 113888 August 19, 1994 PDFDocument46 pagesPhilippine Constitution Association vs. Enriquez, 235 SCRA 506, G.R. No. 113105, G.R. No. 113174, G.R. No. 113766, G.R. No. 113888 August 19, 1994 PDFMarl Dela ROsaNo ratings yet

- 8414-2nd Assignment Autumn 2023Document23 pages8414-2nd Assignment Autumn 2023bysnowonlineNo ratings yet

- Budgetary Planning and ControlDocument32 pagesBudgetary Planning and ControlSaurabh SinghNo ratings yet

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument26 pagesFlexible Budgets, Direct-Cost Variances, and Management ControlAnis WidiasiwiNo ratings yet

- Setting Financial Goals Nagin SadiqzadahDocument5 pagesSetting Financial Goals Nagin Sadiqzadahapi-397287437No ratings yet

- Rail Transportation Manager in Chicago IL Resume David MongeDocument2 pagesRail Transportation Manager in Chicago IL Resume David MongeDavidMonge2No ratings yet

- Kelompok 3 APBN Dan Peran PemerintahDocument34 pagesKelompok 3 APBN Dan Peran PemerintahYorda Satrio A WNo ratings yet

- Budgeting ChapterDocument17 pagesBudgeting ChapteraasNo ratings yet

- He6 Module 2 Efficient Management of Family Resources Version 3bDocument20 pagesHe6 Module 2 Efficient Management of Family Resources Version 3bChristine JanellaNo ratings yet

- Website Competency Dictionary 1Document50 pagesWebsite Competency Dictionary 1Vahmi Brian Owen D'sullivansevenfoldimerzNo ratings yet

- City of Yorba Linda, CaliforniaDocument17 pagesCity of Yorba Linda, Californianajua arasNo ratings yet

- Job Descriptions and Competencies of District Education Office (Female) PDFDocument53 pagesJob Descriptions and Competencies of District Education Office (Female) PDFHaris KhanNo ratings yet

- Project Financial Reporting ChecklistDocument4 pagesProject Financial Reporting ChecklistSamuel Franklin Mendizabal GamezNo ratings yet

- Q1: A Company Engaged in Producing Tinned Food Has 300 Trained Employee On The Rolls Each of WhonDocument24 pagesQ1: A Company Engaged in Producing Tinned Food Has 300 Trained Employee On The Rolls Each of WhonsjthankiNo ratings yet

- MMB November 2022 ForecastDocument102 pagesMMB November 2022 ForecastMichael AchterlingNo ratings yet

- Budgt Adminisn CasDocument55 pagesBudgt Adminisn Casayele eshete100% (4)

- Financial PlanningDocument14 pagesFinancial PlanningAnh PhanNo ratings yet

- Public Sector Performance BudgetingDocument27 pagesPublic Sector Performance BudgetingTatenda ChigwedereNo ratings yet

- Organization Study Scoobee Day.Document65 pagesOrganization Study Scoobee Day.Eldhose Abraham100% (1)