Professional Documents

Culture Documents

Jeevan Utsav Leaflet

Jeevan Utsav Leaflet

Uploaded by

photonxcomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeevan Utsav Leaflet

Jeevan Utsav Leaflet

Uploaded by

photonxcomCopyright:

Available Formats

LIMITED PREMIUM PLAN WITH GUARANTEED ADDITION THROUGHOUT

2

PREMIUM PAYING TERM, WHOLE LIFE INSURANCE PLAN

SURVIVAL BENEFIT

1

Option 1(Income Benefit): 10% of

BSA @ End of each year.

Option 2(Flexi - Income Benefit):

10% of BSA @ End of each year with GURANTEED ADDITION

Flexibility to defer and accumulate

benefits @ 5.5% Compounding @ Rs. 40/- per 1000 BSA during

Yearly. PPT

Withdrawal: 75% of Accumulated

Benefit once in a Year

DEATH BENEFIT

Sum Assured on Death +

Guaranteed Addition

BENEFITS & FEATURES PAID UP

3

Min Age At Entry: 90 Days

All features continue in

Max Age At Entry: 65 Years

Proportionate values if Paid Up

Max Age at the end of PPT: 75 Yrs

Value is equal or More Than Rs.

PPT: 5-16 Yrs

2,00,000

Deferment Period:

5 Yrs PPT: 5 Yrs

6 Yrs PPT: 4 Yrs

7 Yrs PPT: 3 Yrs

8-16 Yrs PPT: 2 Yrs

Min SA: Rs. 5,00,000/-

USP

4

Guaranteed Benefits

5

Guaranteed Risk Cover for life

Guaranteed Income for Life from 18 Years

Flexibility to withdraw Income anytime of the year.

Additional Liquidity through loan upto 50%

Lowest Premium paying term.

Broader Age Range: 90 Days-65 Years

OTHER RIDERS AND BENEFITS

AB & ADDB

Critical Illness Rider

Term Assurance Rider

Premium Waiver Benefit

Modes Available: Monthly(Nach/ENach), Quarterly, Half-Yearly & Yearly

High Sum Assured Rebate

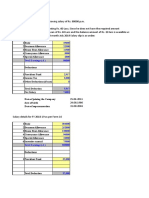

The Corporation shall pay interest on the AGE 25

Policyholder can

deferred and accumulated Flexi Income.

Prem. Paying Term 12 withdraw 75% of

Benefits at the rate of 5.5% p.a. compounding

the Fund Available

yearly for completed months from its due date Sum Assured 10,00,000/- anytime during the

till the date of withdrawal or surrender or death,

Year

whichever is earlier Annual Premium 86,800/-

Accrued Interest @

Regular Income Flexi Income Cumulative Flexi Withdrawal @ Age

Age 5.5% in Flexi Income

Benefit Benefit Income Benefit 60 Years

Benefit

38 ₹1,00,000.00 – –

39 ₹1,00,000.00 ₹1,00,000.00 ₹5,500.00 ₹105,500.00

40 ₹1,00,000.00 ₹2,00,000.00 ₹11,302.50 ₹216,802.50

41 ₹1,00,000.00 ₹3,00,000.00 ₹17,424.14 ₹334,226.64

42 ₹1,00,000.00 ₹4,00,000.00 ₹23,882.47 ₹458,109.10

43 ₹1,00,000.00 ₹5,00,000.00 ₹30,696.00 ₹588,805.10

44 ₹1,00,000.00 ₹6,00,000.00 ₹37,884.28 ₹7,26,689.38

45 ₹1,00,000.00 ₹7,00,000.00 ₹45,467.92 ₹8,72,157.30

46 ₹1,00,000.00 ₹8,00,000.00 ₹53,468.65 ₹10,25,625.95

47 ₹1,00,000.00 ₹9,00,000.00 ₹61,909.43 ₹11,87,535.38

48 ₹1,00,000.00 ₹10,00,000.00 ₹70,814.45 ₹13,58,349.82

49 ₹1,00,000.00 ₹11,00,000.00 ₹80,209.24 ₹15,38,559.07

50 ₹1,00,000.00 ₹12,00,000.00 ₹90,120.75 ₹17,28,679.81

51 ₹1,00,000.00 ₹13,00,000.00 ₹1,00,577.39 ₹19,29,257.20

52 ₹1,00,000.00 ₹14,00,000.00 ₹1,11,609.15 ₹21,40,866.35

53 ₹1,00,000.00 ₹15,00,000.00 ₹1,23,247.65 ₹23,64,114.00

54 ₹1,00,000.00 ₹16,00,000.00 ₹1,35,526.27 ₹25,99,640.27

55 ₹1,00,000.00 ₹17,00,000.00 ₹1,48,480.21 ₹28,48,120.48

56 ₹1,00,000.00 ₹18,00,000.00 ₹1,62,146.63 ₹31,10,267.11

57 ₹1,00,000.00 ₹19,00,000.00 ₹1,76,564.69 ₹33,86,831.80

58 ₹1,00,000.00 ₹20,00,000.00 ₹1,91,775.75 ₹36,78,607.55

59 ₹1,00,000.00 ₹21,00,000.00 ₹2,07,823.42 ₹39,86,430.97

60 ₹1,00,000.00 ₹22,00,000.00 ₹2,24,753.70 ₹43,11,184.67 ₹32,33,389

61 ₹1,00,000.00 ₹23,00,000.00 ₹59,278.00 ₹12,37,078.53

62 ₹1,00,000.00 ₹24,00,000.00 ₹1,27,318.99 ₹14,05,117.84

63 ₹1,00,000.00 ₹25,00,000.00 ₹2,04,599.78 ₹15,82,399.33

The fund accumulates till the Age of 100 Years.

You might also like

- Usaa Receipt ShareDocument10 pagesUsaa Receipt ShareRohan DuncanNo ratings yet

- Introduction To Banking and Financial Markets - Unit 5 - Mid Term QuizDocument5 pagesIntroduction To Banking and Financial Markets - Unit 5 - Mid Term Quizprithvirajdk7No ratings yet

- 40 Credit Repair SecretsDocument8 pages40 Credit Repair Secretswlingle11755% (20)

- MCQ Motor For PE Training 2018 VKA-1 PDFDocument7 pagesMCQ Motor For PE Training 2018 VKA-1 PDFJayalakshmi RajendranNo ratings yet

- Proof of AddressDocument9 pagesProof of AddressATIF ALINo ratings yet

- Navkar InstituteDocument16 pagesNavkar InstituteKunal JainNo ratings yet

- IC 90 Key NotesDocument47 pagesIC 90 Key NotesHari Jb50% (4)

- Medical Cards Comparison in MalaysiaDocument5 pagesMedical Cards Comparison in MalaysiaZulkifli Abdul MajidNo ratings yet

- Payslips JHB - NOV12Document12 pagesPayslips JHB - NOV12Winnie TemboNo ratings yet

- Best Ulip Plan: SMART POWER (Sample Illustration)Document1 pageBest Ulip Plan: SMART POWER (Sample Illustration)Tricolor C ANo ratings yet

- IC38 SushantDocument46 pagesIC38 SushantAyush BhardwajNo ratings yet

- IC 38 My NotesDocument51 pagesIC 38 My NotesShri RanjanNo ratings yet

- IIBF Test Question Bank With Answers - 2018Document41 pagesIIBF Test Question Bank With Answers - 2018serialchannel73No ratings yet

- Jaiib Made Simple Paper 1Document270 pagesJaiib Made Simple Paper 1Ashokkumar MadhaiyanNo ratings yet

- Government Sponsored SchemesDocument5 pagesGovernment Sponsored SchemesClassicaverNo ratings yet

- POS Goal Suraksha: Key Feature DocumentDocument6 pagesPOS Goal Suraksha: Key Feature DocumentPiyush VisputeNo ratings yet

- Vikas 2018 SBLC BhubaneswarDocument320 pagesVikas 2018 SBLC BhubaneswarTejaswiNo ratings yet

- FAQ of Insurance Institute of IndiaDocument8 pagesFAQ of Insurance Institute of IndiaSachin KumarNo ratings yet

- IC-24 - Legal Aspects of Life AssuranceDocument1 pageIC-24 - Legal Aspects of Life Assuranceaman vermaNo ratings yet

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Ethics in Insurance Sector of IndiaDocument43 pagesEthics in Insurance Sector of IndianandiniNo ratings yet

- Exam5 CaseStudy 2009Document248 pagesExam5 CaseStudy 2009Swetal ParmarNo ratings yet

- Jaiib PPT Downloaded From IibfDocument42 pagesJaiib PPT Downloaded From IibfSuranjit BaralNo ratings yet

- Retail Loan in BankingDocument27 pagesRetail Loan in Banking...ADITYA… JAINNo ratings yet

- SBI CRA - Regular Non-Trade ModelDocument24 pagesSBI CRA - Regular Non-Trade Modelaruntce_kumar9286No ratings yet

- Non Medical ChartsDocument1 pageNon Medical ChartsAyush BhardwajNo ratings yet

- Product Features - Swarna Ganga - SBG PDFDocument7 pagesProduct Features - Swarna Ganga - SBG PDFps12hayNo ratings yet

- BFM Numericals .10Document10 pagesBFM Numericals .10Sribharath SekarNo ratings yet

- Business Maths by JK Thukral - Chapter 2Document65 pagesBusiness Maths by JK Thukral - Chapter 2Shaina ShainaNo ratings yet

- MF Sample Paper 01Document69 pagesMF Sample Paper 01mirza_ajmalNo ratings yet

- Nism MFD Notes Dec 2014Document26 pagesNism MFD Notes Dec 2014philo21No ratings yet

- Ic 2Document30 pagesIc 2Radhie NoahNo ratings yet

- Pmgdisha Affidavit PDFDocument7 pagesPmgdisha Affidavit PDFMojesh ChouhanNo ratings yet

- 1.NISM Mutual Fund V (A) Question BankDocument61 pages1.NISM Mutual Fund V (A) Question BankNikhil JaiswalNo ratings yet

- Geography Ranganth Book PDF DownloadDocument73 pagesGeography Ranganth Book PDF Downloadತತ್ವ ಸಹಿಷ್ಣುNo ratings yet

- Chapter:-1 Introduction of Insurance: Introduction To Service SectorDocument56 pagesChapter:-1 Introduction of Insurance: Introduction To Service SectorDinesh RominaNo ratings yet

- IRDA - Insurance RegulatorDocument52 pagesIRDA - Insurance RegulatorShubham PatilNo ratings yet

- SAPM by Syam Kerala University s3 MbaDocument88 pagesSAPM by Syam Kerala University s3 Mbasyam kumar sNo ratings yet

- IC27 p6Document10 pagesIC27 p6Samba SivaNo ratings yet

- Harshad Jaju Vouching For IpccDocument80 pagesHarshad Jaju Vouching For IpccvishnuvermaNo ratings yet

- Project ReportDocument15 pagesProject ReportMichael AdonikarNo ratings yet

- 3 - PRobabilityDocument17 pages3 - PRobabilityAnonymous UP5RC6JpGNo ratings yet

- LIC All Plans AvailableDocument40 pagesLIC All Plans AvailableAjit SinhaNo ratings yet

- NISM V-A Sample 500 QuestionsDocument30 pagesNISM V-A Sample 500 QuestionsANIKET DATKHILENo ratings yet

- Credit Point SystemDocument3 pagesCredit Point Systemshanmuga89No ratings yet

- As 19 LeasesDocument20 pagesAs 19 LeasesNishant Jha Mcom 2No ratings yet

- Star Health InsuranceDocument21 pagesStar Health InsuranceShubham Chaudhari100% (1)

- Cost & FMDocument4 pagesCost & FMSurajNo ratings yet

- POS Goal Suraksha - Detailed BrouchreDocument2 pagesPOS Goal Suraksha - Detailed BrouchreSuraj Shenoy NagarNo ratings yet

- Guide For Motor Insurance: Key For Associateship ExaminationDocument18 pagesGuide For Motor Insurance: Key For Associateship ExaminationRocky Green0% (1)

- Composite Ic38 PDFDocument631 pagesComposite Ic38 PDFPraveena.TNo ratings yet

- Legal Aspects of Indian BusinessDocument124 pagesLegal Aspects of Indian BusinessGuruKPO100% (3)

- 68-10th Tamil - One Mark Questions With Answers - DownloadDocument15 pages68-10th Tamil - One Mark Questions With Answers - DownloadId Watch4No ratings yet

- Quiz 1 - Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzDocument27 pagesQuiz 1 - Prepared by Baroda Academy, AHMEDABAD - Print - QuizizzShilpa JhaNo ratings yet

- Sample Paper Irda ExamDocument19 pagesSample Paper Irda ExamPrateek GargNo ratings yet

- All LIC PlansDocument4 pagesAll LIC Planslicvivek100% (1)

- ASSESSMENT OF VARIOUS ENTITIES - TaxDocument20 pagesASSESSMENT OF VARIOUS ENTITIES - TaxKhushi MultaniNo ratings yet

- Capital Gain AY 2022-23 With SolutionsDocument15 pagesCapital Gain AY 2022-23 With SolutionsKrish Goel100% (1)

- Guide To TransUnion CIBIL Commercial Bureau - Version 3.6Document58 pagesGuide To TransUnion CIBIL Commercial Bureau - Version 3.6Amit SinghNo ratings yet

- Agents AnandaDocument9 pagesAgents AnandaPrasanthNo ratings yet

- Plan DetailDocument4 pagesPlan DetailB GANAPATHYNo ratings yet

- Exide Life Guaranteed Wealth Plus Flier 1Document6 pagesExide Life Guaranteed Wealth Plus Flier 1vickyNo ratings yet

- GS One Pager FinalDocument191 pagesGS One Pager FinalEarl Justine FerrerNo ratings yet

- Employee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsFrom EverandEmployee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsRating: 5 out of 5 stars5/5 (1)

- Amaia Pampanga Sample CompDocument1 pageAmaia Pampanga Sample CompdusteezapedaNo ratings yet

- Iobbank Structure SUO Moto DisclosureDocument2 pagesIobbank Structure SUO Moto DisclosureCHANDAN CHANDUNo ratings yet

- SSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineDocument1 pageSSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineIvy ValcarcelNo ratings yet

- Pension Calculation at 23-9-2028Document1 pagePension Calculation at 23-9-2028Qamar JamilNo ratings yet

- Debt Management ServicesDocument9 pagesDebt Management ServicesMaimai DuranoNo ratings yet

- Finanacial Performance Analysis of HDFC BankDocument54 pagesFinanacial Performance Analysis of HDFC BankSharuk KhanNo ratings yet

- Caiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiousDocument223 pagesCaiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiouselliaCruzNo ratings yet

- Swift Go ExportDocument18 pagesSwift Go ExportMasoud DastgerdiNo ratings yet

- IRDA AgentsDocument26 pagesIRDA AgentsRavi VermaNo ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- ADIB Bank - AEDDocument4 pagesADIB Bank - AEDTehseenNo ratings yet

- Ajsw 2 GD Ws Dee UZk 9Document7 pagesAjsw 2 GD Ws Dee UZk 9ram7.upworkNo ratings yet

- mPassBook 20230531 20230830 5002Document11 pagesmPassBook 20230531 20230830 5002Vishal BawaneNo ratings yet

- Cardholder Request FormDocument1 pageCardholder Request FormMarissa Gallenero-CalabinesNo ratings yet

- Service Report 10.05.2023Document12 pagesService Report 10.05.2023PCL PNINo ratings yet

- Bank Lending EnvironmentDocument7 pagesBank Lending EnvironmentMoses OlabodeNo ratings yet

- Navigating Instant Personal Loans in India I Capital NowDocument6 pagesNavigating Instant Personal Loans in India I Capital NowkayajmagamingNo ratings yet

- IGL, General Banking Law (Riguera Lec)Document12 pagesIGL, General Banking Law (Riguera Lec)Ivan LeeNo ratings yet

- CERSAIDocument5 pagesCERSAIKaruppiah ARNo ratings yet

- Engineering Economy: Annuity Due, Deferred Annuity and PerpetuityDocument8 pagesEngineering Economy: Annuity Due, Deferred Annuity and PerpetuityHENRICK IGLENo ratings yet

- When Should You Take Social SecurityDocument9 pagesWhen Should You Take Social SecurityShahid AliNo ratings yet

- Arroyo Housing ProjectDocument20 pagesArroyo Housing ProjectJELLAH MAY LORENONo ratings yet

- Present Value - Extra Topic Chapt 9 12 AdvDocument5 pagesPresent Value - Extra Topic Chapt 9 12 AdvlokNo ratings yet

- MunicipalBank E-Passbook13-05-2024 195315Document3 pagesMunicipalBank E-Passbook13-05-2024 195315RudhviNo ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- Acct Statement XX1039 07062024Document35 pagesAcct Statement XX1039 07062024Soyab SuriyaNo ratings yet