Professional Documents

Culture Documents

IAS 20 Basic Questions

IAS 20 Basic Questions

Uploaded by

tutorwarrior98Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 20 Basic Questions

IAS 20 Basic Questions

Uploaded by

tutorwarrior98Copyright:

Available Formats

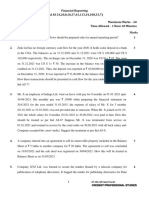

Practice Questions

Topic: IAS 20 (Government Grant)

Question: 1

On 1 January 2021 ABC Limited acquired a plant at a cost of Rs. 600 million and received a grant of Rs.

400 million on the same date. The plant is to be depreciated on straight line basis over its useful life of 10

years and Rs. 120 million residual values. There is reasonable assurance that conditions of the grant shall

be complied with.

Required: Pass journal entries for the year ended is 31 December 2021, 2022, and 2023.

Question: 2

On 1 July 2022 DEF Limited acquired a plant at a cost of Rs. 10 million and received a grant of Rs. 3

million on the same date. The plant is to be depreciated on straight line basis over its useful life of 8 years

and Rs. 120 million residual values. There is reasonable assurance that the conditions of the grant shall be

complied with.

Required: Pass journal entries for the year ended is 30 June 2023, 2024, and 2025.

Question: 3

On 1 July 2021 XYZ Limited acquired a plant at a cost of Rs. 880 million and received a grant of Rs. 300

million on 30th September 2022. The plant is to be depreciated on straight line basis over its useful life of 5

years. There is reasonable assurance that the conditions of the grant shall be complied with.

Required: Pass journal entries for the year ended is 30 June 2022, 2023, and 2024.

Question: 4

On 1st January 2020, Deep Water Limited installed a non-current asset with a cost of Rs. 500,000 and

received a grant of Rs. 100,000 in relation to that asset. The asset is being depreciated by the reducing

balance method. The rate of depreciation is 12%. There is a reasonable assurance that the company will

fulfill the relevant conditions.

Required: Pass Journal entries for the year ended 31st December 2020 to 2022.

Question: 5

On 1st July 2021, Shallow Water Limited installed a non-current asset with a cost of Rs. 1,000,000 and

received a grant of Rs. 300,000 in relation to that asset. The asset is being depreciated by the reducing

balance method. The rate of depreciation is 10%. There is a reasonable assurance that the company will

fulfill the relevant conditions.

Required: Pass Journal entries for the year ended 30 June 2022 to 2024

Question: 6

At the start of the year 2021, Pure Water Limited installed a plant with a cost of Rs. 75 million and received

a grant of Rs. 20 million in relation to that asset at 1st April 2021. The asset is being depreciated by the

reducing balance method. The rate of depreciation is 12.5%. There is a reasonable assurance that the

company will fulfill the relevant conditions.

Required: Pass Journal entries for the year ended 31st December 2021 to 2023

CAPS College M. Imran Gasura

You might also like

- Meridian Systems Case 3 1 PDFDocument5 pagesMeridian Systems Case 3 1 PDFPriyanka ReddyNo ratings yet

- Chase Sapphire: Creating A Millennial Cult Brand: Submitted By: Group 3Document10 pagesChase Sapphire: Creating A Millennial Cult Brand: Submitted By: Group 3jyoti100% (1)

- Chapter 3: Strategic Planning and MarketingDocument12 pagesChapter 3: Strategic Planning and MarketingAnthony ClemonsNo ratings yet

- Account PaperDocument1 pageAccount Paperseemabians cazmieNo ratings yet

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- International Taxation May 23 Suggested AnswersDocument37 pagesInternational Taxation May 23 Suggested AnswersNINTE THANDHANo ratings yet

- May 21 2024 Printable PDFDocument13 pagesMay 21 2024 Printable PDFDhruva DasNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- 6991 Note PayableDocument2 pages6991 Note PayableFREE MOVIESNo ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- Test 1 Question PaperDocument12 pagesTest 1 Question PaperNaveen R HegadeNo ratings yet

- Debentures 2024 SPCCDocument53 pagesDebentures 2024 SPCCdollpees01No ratings yet

- CA Inter Law Q MTP 2 May 2024 Castudynotes ComDocument11 pagesCA Inter Law Q MTP 2 May 2024 Castudynotes ComthegodslayyerNo ratings yet

- 6978 - Government Grant and Borrowing CostDocument2 pages6978 - Government Grant and Borrowing CostRaquel Villar DayaoNo ratings yet

- MTP Law IiDocument11 pagesMTP Law IiAbhishant KapahiNo ratings yet

- IAS-23 Borrowing CostsDocument5 pagesIAS-23 Borrowing CostsAbdul SamiNo ratings yet

- Mixed IAS (ICAP) MCQsDocument9 pagesMixed IAS (ICAP) MCQsbebetterpls3No ratings yet

- Intermediate Accounting 3 Share Based PaymentDocument4 pagesIntermediate Accounting 3 Share Based PaymentdmangiginNo ratings yet

- IAS 20 Extra QuestionsDocument3 pagesIAS 20 Extra QuestionsNimra MerajNo ratings yet

- Ind AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLDocument9 pagesInd AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLjvbsdNo ratings yet

- Topic 6 - Lecture ExamplesDocument2 pagesTopic 6 - Lecture ExamplestrevorNo ratings yet

- Assignment No. 2 (Fall 2022)Document3 pagesAssignment No. 2 (Fall 2022)Bluewings Travel &ToursNo ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Questions and AnswersDocument24 pagesPaper 4: Taxation Section A: Income Tax Law: Questions and AnswersShivani KumariNo ratings yet

- ACT1106 - Bond ExercisesDocument4 pagesACT1106 - Bond ExercisesPj Dela VegaNo ratings yet

- Review QuestionsDocument3 pagesReview QuestionsAriaNo ratings yet

- CASESTUDY-Byju Raveendran Is Doing Whatever It Takes To Keep Employee Morale UpDocument2 pagesCASESTUDY-Byju Raveendran Is Doing Whatever It Takes To Keep Employee Morale UpAnshula KolheNo ratings yet

- Term Exam - PaperDocument11 pagesTerm Exam - Paperhamna wahabNo ratings yet

- June 1 2024 Printable PDFDocument17 pagesJune 1 2024 Printable PDFDhruva DasNo ratings yet

- MTP 3 15 Questions 1680696400Document7 pagesMTP 3 15 Questions 1680696400Umar MalikNo ratings yet

- International Accounting Standard 23Document4 pagesInternational Accounting Standard 23sami ullahNo ratings yet

- LAW Smart WorkDocument10 pagesLAW Smart WorkmaacmampadNo ratings yet

- Notes To Accounts Year EndDocument15 pagesNotes To Accounts Year EndSantosh AntonyNo ratings yet

- Issue of Debentures Collage SPCC Term 2Document4 pagesIssue of Debentures Collage SPCC Term 2Taaran ReddyNo ratings yet

- 10 Year Questions Issue of SharesDocument34 pages10 Year Questions Issue of Sharesoldtaxi9No ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- TaxationDocument24 pagesTaxation1088Anushka SharmaNo ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- 2.5 PRETEST - Borrowing CostsDocument4 pages2.5 PRETEST - Borrowing CostsShania Angela MoyaNo ratings yet

- Assessment (QP)Document2 pagesAssessment (QP)hasan ihtishamNo ratings yet

- May 23 Tax RTPDocument24 pagesMay 23 Tax RTPShailjaNo ratings yet

- Acctg 3B Activity On PAS 20 and 23Document1 pageAcctg 3B Activity On PAS 20 and 23Panda ErarNo ratings yet

- Notes and Loans Receivable Problem With AnswersDocument4 pagesNotes and Loans Receivable Problem With Answersella lazoNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- Sample Exercises On Prepayments Deferrals and AccrualsDocument11 pagesSample Exercises On Prepayments Deferrals and AccrualsCarl AvilaNo ratings yet

- FAR 1 3rd Mock - ComprehensiveDocument4 pagesFAR 1 3rd Mock - Comprehensiveahsanalipalipoto17No ratings yet

- Corporate Financing Decisions, Spring 2016Document4 pagesCorporate Financing Decisions, Spring 2016Ashok BistaNo ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Mock - Question v1Document5 pagesMock - Question v1Dawood ZahidNo ratings yet

- Module 8 - THEORIESDocument5 pagesModule 8 - THEORIESFiona MiralpesNo ratings yet

- Term Test 2 (QP)Document4 pagesTerm Test 2 (QP)Ali OptimisticNo ratings yet

- FR Phase 2 - TestDocument5 pagesFR Phase 2 - TestMayank GoyalNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- A.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesDocument1 pageA.) B.) C.) D.) E.) F.) : 2B Recording Transactions and Adjusting EntriesRyoma EchizenNo ratings yet

- Tax May 22 RTPDocument26 pagesTax May 22 RTPShailjaNo ratings yet

- Law MCQDocument8 pagesLaw MCQpriyalNo ratings yet

- FAC2A FASSET Lecture 2 Question - Final With SolutionsDocument7 pagesFAC2A FASSET Lecture 2 Question - Final With SolutionsNDza La Ma ARNo ratings yet

- Cfap-2-Cls - PPDocument6 pagesCfap-2-Cls - PPFurqan HanifNo ratings yet

- Quiz - (Evening Class)Document4 pagesQuiz - (Evening Class)JeonNo ratings yet

- Accounting - Answer Key Quiz - Investments in Associates and Additional ConceptsDocument2 pagesAccounting - Answer Key Quiz - Investments in Associates and Additional ConceptsNavsNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- A Corporate Governance Assessment of Ukraine's State-Owned Aviation SectorDocument79 pagesA Corporate Governance Assessment of Ukraine's State-Owned Aviation SectorOECD Global RelationsNo ratings yet

- Tender Manager - Architectural and Multi-Disciplinary Firm in Johannesburg!Document6 pagesTender Manager - Architectural and Multi-Disciplinary Firm in Johannesburg!Cassandra StapelbergNo ratings yet

- Anushthan Review of LiteratureDocument4 pagesAnushthan Review of LiteraturevineetNo ratings yet

- CASH MANAGEMENT at Escort LTDDocument88 pagesCASH MANAGEMENT at Escort LTDnikita50% (2)

- Mumbai - Amritsar - Dharamshala - Kasol - Manali - Kullu - Delhi - Mumbai - 11 DaysDocument17 pagesMumbai - Amritsar - Dharamshala - Kasol - Manali - Kullu - Delhi - Mumbai - 11 DaysShaurya BajajNo ratings yet

- 2222 Management SystemDocument5 pages2222 Management SystemUnokhogie EmmanuelNo ratings yet

- ConferDocument16 pagesConferOdhenk KhanNo ratings yet

- Dwnload Full Corporate Finance Asia Global 1st Edition Ross Solutions Manual PDFDocument35 pagesDwnload Full Corporate Finance Asia Global 1st Edition Ross Solutions Manual PDFmiltongoodwin2490i100% (16)

- 10th Latin American Conference On Process Safety 1694623902Document9 pages10th Latin American Conference On Process Safety 1694623902Julian CeronNo ratings yet

- Registry Guaranteed in StockDocument24 pagesRegistry Guaranteed in StockAmerican Hotel Register Company100% (1)

- Inventory Management STCDocument26 pagesInventory Management STCNabeel KhanNo ratings yet

- BUSINESS DEVELOPMENT at LAKME LEVER PRIVATE LIMITEDDocument18 pagesBUSINESS DEVELOPMENT at LAKME LEVER PRIVATE LIMITEDjagdish kaleNo ratings yet

- 13 Dela Cruz - Discussion Questions and Problems PDFDocument15 pages13 Dela Cruz - Discussion Questions and Problems PDFMau Dela CruzNo ratings yet

- Principles of Bank LendingDocument42 pagesPrinciples of Bank LendingTeja RaviNo ratings yet

- Mike Coleman Resume 8.13Document1 pageMike Coleman Resume 8.13Mike ColemanNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisJulie Ann CanlasNo ratings yet

- Strategic ManagementDocument17 pagesStrategic Managementfuture tradeNo ratings yet

- Residential Construction ContractfinalDocument9 pagesResidential Construction ContractfinalLora Van KootenNo ratings yet

- Cab - BLR Airport To Schneider PDFDocument3 pagesCab - BLR Airport To Schneider PDFVinil KumarNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- Moya, UgandaDocument17 pagesMoya, UgandaBenjamin Agyeman-Duah OtiNo ratings yet

- A/C ProjectDocument27 pagesA/C ProjectAshish TiwariNo ratings yet

- 2006 ProficiencyDocument7 pages2006 ProficiencydeeptimanneyNo ratings yet

- PF Withdrawal Application (CGBSIL PF Trust)Document2 pagesPF Withdrawal Application (CGBSIL PF Trust)anand chawanNo ratings yet

- ThermoLife International v. Hi-Tech PharmaceuticalsDocument12 pagesThermoLife International v. Hi-Tech PharmaceuticalsPriorSmartNo ratings yet

- Six Sigma For Medical Device Design PDFDocument129 pagesSix Sigma For Medical Device Design PDFstylish eagle100% (3)

- Introduction: The Impact of The Digital Revolution On Consumer BehaviorDocument16 pagesIntroduction: The Impact of The Digital Revolution On Consumer BehaviorFu JunNo ratings yet