Professional Documents

Culture Documents

Exp - Imp Docu & Proce (Unit IV)

Exp - Imp Docu & Proce (Unit IV)

Uploaded by

ankushnayak9011Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exp - Imp Docu & Proce (Unit IV)

Exp - Imp Docu & Proce (Unit IV)

Uploaded by

ankushnayak9011Copyright:

Available Formats

Department of Commerce and Management

University of Kota, Kota

Export-Import Procedures, Documentation and Management

IB-203

Unit-IV

Export Assistance and Support measures: Import Finance, Preparing for Shipment, Cargo

Insurance, Shipment of Export Cargo, Custom Clearance of Import Cargo

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

1

IV)

Department of Commerce and Management

University of Kota, Kota

EXPORT ASSISTANCE AND SUPPORT MEASURES:

IMPORT FINANCE

Imports play an important role in the economy of every country, rich and poor alike. Rich

countries need to import capital goods, raw materials and technology to ensure an optimum

utilisation of their production capacity. They need to import a wide variety of consumer

goods to enable their people to enjoy a high standard of living. Poor countries need to import

technology and capital equipment and sometime strategic raw materials to develop industries

for accelerating pace of their development. In India, for example, the pace of industrialisation

level of exports and consequently the rate of economic growth is heavily dependent upon

imports. A low level of imports usually indicates low purchasing power of its people and also

emergence of recessionary trends in economy. At a firm's level efficient management of

import operations is a critical factor in determining the overall profitability of its imports.

Hence, all through understanding of import financing techniques and practices is necessary

for concerned managers. In this unit, you will learn the regulatory framework and related

exchange control mechanism of import financing and various methods of import financing.

India followed a restricted import policy till mid-eighties, nothing could be imported without

a licence involving cumbersome procedures alongwith intricate documentation. Although

some liberalisation measures were taken in second half of eighties, real breakthrough came

only in 1991.

Steady progress has been made in nineties in replacement of quantitative restrictions,

licensing and discretionary control over imports by deregulation, simplification of procedures

and protection through tariff and exchange rates. Export Import policies of 1992-97 and

1997- 2002 were the steps in this direction.

It is against the background of nature and significance of India's import trade, one has to

understand import financing methods and techniques. Import financing involves making

payment to foreign entities for the goods purchased from them. From the management

decision making viewpoint, it means making decision regarding terms of payment (i.e.

choosing one among several alternatives), arranging funds, involving choice of financial

institution and the instrument to be used for making payment and involving choice of

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

2

IV)

Department of Commerce and Management

University of Kota, Kota

intermediary through whom the payment is to be made.

THE REGULATORY FRAME WORK

The principal objectives of India's Export Import Policy is to accelerate the country's

transaction to an internationally oriented economy with a view to derive maximum benefit

from the expanding global market. Various policy objectives are achieved basically through

three legislations.

These are:

1. Foreign Trade (Development & Regulation) Act, 1993 administered by Director General,

Foreign Trade (DGFT) replacing the earlier legislation Import & Export (Control) Act, 1947,

administered by the Chief Controller of Imports & Exports (CCIE).

2. Foreign Exchange Management Act, 1999 administered by the Department of Economic

Affairs, Ministry of Finance and the Exchange Control Development of the Reserve bank of

India. FEMA has been brought is place of Foreign Exchange Regulation Act.

3, Indian Customs and Excise Act, 1962 administered by Central Board of Excise and

Customs.

The rules and operational procedures and changes relating to imports are framed by the

Foreign Exchange Dealers Association of India (FEDAI). In addition, Uniform Customs &

Practice for Documentary Credit (UPDC) formulated by lnternational Chamber of

Commerce, Paris which has a global acceptance, is indispensible to cover transactions under

documentary credits. '

India's import policy is formulated within the framework of obligations of the Membership of

World Trade Organisation (WTO). Hence, the policy does not have a discriminatory and

restrictive dimension. Whatever restrictions on imports continue are the ones which have

been allowed under the WTO regime. In line with WTO provisions for according preferential

treatment of imports from developing countries, India has signed several preferential treading

arrangement with some South Asian Countries and the products which will attract

concessional rate of duty are-also specified.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

3

IV)

Department of Commerce and Management

University of Kota, Kota

Physical control over imports is exercised by DGFT and the Customs Deptt. RBI exercise

financial controls through the guidelines provided to authorised dealers. Of late, tariffs rather

than quantitative restrictions are being used to regulate import trade.

Under the present policy, all goods, except those appearing on negative list can be freely

imported in India. For goods included in the restricted, or banned list, import licence may be

issued by the Director General of Foreign Trade. An import licence is an authorisation which

includes a customs clearance permit (CCP) indicating inter alia, quantity description and

value of the goods, actual user conditions if any, the minimum export value if any, export

obligation, if any, and value addition obligation, if any. Import licences which are issued on

C.I.F. basis, is given in duplicate viz. Customs Copy (for clearance from customs) and

Exchange Control copy for remittances.

For exporting units, certain special facilities have been provided under the present policy.

Under the Export Promotion Capital goods (EPCG) Scheme, capital goods can be imported

at a concessional rate of custom duty, subject to an export obligation to be fulfilled within a

specified period of 5-8 years. Under the Duty Exemption Scheme, the government permits

import of raw materials, intermediates, components, consumables, spare parts, accessories,

packing materials and computer software required for direct use in the product to be exported

duty free under different categories of licences. Advance licence is issued for inputs needed

for export production. It can be issued for physical exports, intermediate supply and deemed

exports.

EXCHANGE CONTROL REGULATIONS CONCERNING IMPORTS

Exchange control regulations refer to rules and regulations framed and administered by the

Reserve bank of India (RBI) under the provisions of Foreign Exchange Management Act,

1999. These regulations aim at pooling resources for national development in the best interest

of the country. Under the provisions of the Act, RBI regulates sale and purchase of foreign

currencies, Commercial banks with a licence to deal in foreign currencies, called authorised

dealers (ADS) buy and sell foreign currencies in accordance with the guidance provided by

the RBI. Let us learn various regulations regarding payment of imports.

Mode of Payment: Exchange control regulations govern sales of foreign currencies to non -

residents against import of goods from any country except - Nepal and Bhutan. It may be

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

4

IV)

Department of Commerce and Management

University of Kota, Kota

pointed out that residents of these two countries are residents for the purposes of exchange

control regulations, hence, ADS cannot sell any foreign exchange for financing imports from

these two countries.

Under the existing regulations, ADS provide foreign currencies to importers:

i) for remittance to foreign supplies as advance payments.

ii) Paying the foreign supplies in compliance of their undertaking under the letter of credit.

iii) discounting on purchasing except documents.

iv) advances against shipping documents.

Authorised dealers can open a letter of credit (L/C) to facilitate imports subject to following

regulations:

a) Letters of credit may be opened by banks only on behalf of their customers who maintain

account with them.

b) L/C should be opened in favour of overseas suppliers of shipper of goods.

c) Application for L/C must be accompanied by sale contract and other documentary

evidence relating to the order and its confirmation and import licence, if any.

Authorised dealers have been permitted to sell foreign currencies for making payment

towards imports into India. For this purpose, importers have to submit an application in form

A giving the necessary details including classification of goods based on Harmonized system.

It is also obligatory on the part of an importer to submit exchange control copy of customs

bill of entry to the authorised dealer through whom the relative remittance was made as

evidence that the relative goods for which the payment was made have actually been,

imported into India within three months from the date of remittance.

In respect of imports by post parcel, postal wrappers are required to be submitted as

documentary evidence in support of imports into India.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

5

IV)

Department of Commerce and Management

University of Kota, Kota

Currency of Payment: According to exchange control regulations, payment for imports

should be made in a currency appropriate to the country or through an account appropriate to

the country of origin of goods irrespective of the country from where they are shipped or

supplied. RBI has given a list of permitted currencies and approved methods of payment for

imports in Exchange Control Manual for guidance of importers.

Time limit for settlement of imports bills: Time limit for settlement of import bill is 6 months

from the date of shipment, but authorised dealers can settle without reference to RBI even if

the period of six months has expired, provided the AD is satisfied about the bonafides of the

circumstances.

METHODS OF IMPORT FINANCE

The methods of import financing include: financing under L/C, financing against bills under

collection, financing against deferred payment, financing under foreign credit and finance by

EXIM Bank of India. Let us discuss them in detail.

Financing Import Under Letter of Credit

Letter of credit can be defined as a commitment of bank to pay the seller of goods or services

of certain amount provided he presents stipulated documents evidencing the shipment of or

the performance of services within a prescribed period of time. As a credit instrument and a

means of making and securing payment, the letter of credit is an essential instrument for

conducting world trade today. It fulfils all the requirements provided the regarding its use are

stated in clear and unambiguous terms.

Import letters of credit financing involves three principal stages:

i) Requesting bank to open a letter of credit

ii) Retiring documents under letter of credit

iii) Import Trust receipt facility.

Each time a LIC is opened, the importers has to file a formal stamped "Letter of credit

application and Agreement" in the prescribed form. The application should set forth the

precise terms and conditions under which the importer wishes his bank to establish the credit,

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

6

IV)

Department of Commerce and Management

University of Kota, Kota

and describe the documents covering the goods purchased which the bank is to receive in

exchange for payments.

As the correct opening of the credit is the first essential to the ultimate success of the

transaction and as the LIC will-be issued on the basis of information supplied by the importer

in the LIC application. It is absolutely necessary that the information supplied by him must be

complete arid precise. After due scrutiny of the application form, the relevant letters are

issued by the bankers subject to the Uniform Customs And Practice for Documentary Credits,

in order to guard against confusion and misunderstanding.

Letters of credit may be opened by mail or Fax depending upon the urgency of the situation.

It may be revocable or irrevocable. Irrevocable L/C implies that the terms and conditions of

the credit can be amended only with the consent of all the concerned parties, At times, the

importer may ask the issuing bank to get the credit confirmed by another bank. It means that

in addition to the issuing bank (the confirming bank) assumes the commitment to pay

provided the terms of the credit are fulfilled.

Financing against Bills under Collection

In the case of imports not covered by letters of credit, the documents are forwarded by a bank

in the supplier's country, known as the collecting bank, for collection if proceeds from the

importer and payment to the supplier through the remitting bank. In such cases, the collecting

bank would examine the documents and the instructions stated in the covering schedule to

ensure that all the stated documents have been received intact and the bill of lading and the

bill of exchange are endorsed in its favour or blank endorsed.to enable the bank to handle the

documents. The bank than presents the documents to the importer on payment (in case of

sight or DIP Bill) or against written acceptance (in case of usance or D/A bill). Where the

importer is eligible to receive the documents only on payment, he can avail an import loan or

a trust receipt facility, as discussed before. Obligations of various parties involved are

provided in Uniform Rules for Collection (URC) Publication NO. 322 issued by International

Chamber of Commerce, Paris.

Sometimes, shipping documents may be sent by the exporter directly to his importer. In such

a case, the bank may receive clean bills for collection of proceeds. In such cases, banks are

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

7

IV)

Department of Commerce and Management

University of Kota, Kota

required to call for documentary evidence of imports such as custom noted invoice, exchange

control copy of bill of entry and import licence, if any.

Payment for bills in respect of imports through post can also be arranged through a bank. In

such cases, tile relative postal receipts must be produced as evidence of shipment through

post and an undertaking to submit postal wrappers within three months from the date of

wrappers.

Financing Imports against Deferred Payment

Imports under deferred payment implies that the supplier has agreed to supply goods on

credit terms extending beyond six months. In such cases, authorised dealer has to refer each

deferred payment case to RBI for prior approval of advance payment, bank guarantee and

instalments (principal and interest) with documents viz. exchange control copy of import

licence, if any, contract copy arid statement of desired facilities.

Appraisal for issue of guarantees or loans is similar to term finance. For importing under

deferred payment, the importer should have sufficient cash generated to pay the due

instalments. He should arrange for payment of advance and down payments from his own

resources which would cover bank's margin requirement. Imported machinery has to be

hypothecated to the bank and the importer should counter guarantee the transaction.

Financing under Foreign Credit

Government of India gets assistance in the form of loans and development credits from

international financial institutions as also foreign governments. These loans are of two types:

tied loans and loans in free foreign currencies. Terms and conditions of each loan along with

detailed instructions regarding the procedure to be followed for opening letters of credit.

Submission of documents etc. are set out in public notices issued by DGFT. RBI also issues

circulars for each foreign credit giving important instructions relating to SLICII imports.

Payment under foreign credit may be made under (a) letter of commitment method (b)

reimbursement method. Under the letter of commitment procedure, remittances from India

for the relative imports are not permitted. The importer in India obtains a letter of

commitment from the Government of India after furnishing a bank guarantee for payment of

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

8

IV)

Department of Commerce and Management

University of Kota, Kota

rupee equivalent of the import value. The importer furnishes the letter of commitment to the

bank opening L/C. Then the usual procedure follows,

The shipping documents are delivered to the importer on payment / acceptance. Where no

L/C is opened at all and on receipt of document covering imports rupee deposits are made to

Government account by the importer through the bank.

Import Loans by Export-Import Bank of India

Bank finances imports from third countries required for executing projects overseas for which

contracts have been won by Indian exporters.

Regarding imports into India, Exim Bank finances such imports which are export-related, i.e.

imports by Export Oriented Units, import of computer systems for development and export of

software, import of plant, machinery, technology for upgradation / expansion of production

capability for export markets.

Exim Bank also finances bulk imports of consumable inputs and canalized items. Under this

scheme, promissory notes drawn in favour of commercial banks by their importer borrowers

are discounted, Exim bank will issue letter of commitment for finance on request from

commercial bank indicating its requirement. The quantum of finance depends on the

condition that import order should not be less than Rupees one Crore.

PREPARING FOR SHIPMENT

The first stage in the physical movement of goods from the factory/godown of the exporter to

the importer is to pack, mark and label the consignment in accordance with the requirements

of 'the buyers. The buyer also arranges the proper transport for the movement of goods to the

port of shipment. For this purpose, the exporter must be aware of different modes of

transport, especially for performing the overseas part of the journey. The choice of carrier,

whether an aircraft or a ship, will depend on many factors including product and marketing

characteristics as well as the cost and non-cost factors. In addition to commercial aspects of

movement of cargo to the port of shipment, the exporter is required to comply with an

important legal requirement. In this unit, you will learn about the features of liner and tramp

shipping services, various chartering practices, and methods of quality control and pre-

shipment inspection. You will also study the role of clearing and forwarding agents.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

9

IV)

Department of Commerce and Management

University of Kota, Kota

PACKING OF GOODS

Goods in transit are subject to many hazards. If these are not properly packed, they may be

damaged or lost due to rough handling, crushing weight, corrosion, pilferage, etc. Transport

usually subjects the cargo to mechanical forces such as shocks, vibrations, pressures, and

climatical forces including temperature and moisture. The packaging needs to be strong

enough to withstand the rigours of stowage and multiple handling. Goods, which are not

packed properly, may damage other goods in the same transit. Thus, it is essential that the

goods are properly -racked to protect them, to keep a consignment together, to protect the

goods from damaging the environment and be affected by it.

Containers have become the order of the day. Intermodal transportation is the movement of

cargo from one location to another location via more than one mode of transportation (i.e.

rail, road, river/ocean). Unitisation, in general terms, may be defined as consolidation of a

number of bags, boxes, packs, etc. in a single cargo unit, most important of which is the

container. The purpose of unitisation is to assist the process of cargo handling through

reducing the handling frequency of each cargo unit. Unitisation has particular relevance to the

making up of a number of 'small sized' items into one unit of standard size. .

In international trade, containerisation has become a predominant form of unitised transport.

It enables the transportation of cargo from the warehouse of the exporter to that of the

importers directly.

Containerisation offers many advantages including the following:

i) Speed and economy of handling

ii) Safety both with regard to breakage and pilferage

iii) Greater efficiency due to less re-handling of individual packages

iv) Less packaging cost

v) Less cost of insurance and handling

vi) Door-to-door transport service.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

10

IV)

Department of Commerce and Management

University of Kota, Kota

Marking and Labelling of Goods

Every export package must be properly marked and labelled. Marking, including handling

instructions, help quick and safe transportation of goods. Marking is of two types-marking of

origin and shipping marks. In addition to marking, handling instructions on export packs

must be clearly stated. Where these are given in the form of written language, these must be

in the language of exporting and importing countries. In case of goods requiring careful

handling and storage, the international practice is to give these instructions in the form of

symbols.

NATURE OF EXPORT CARGO

The demand for transport services is a derived demand and the nature of these services is

determined by the nature of goods traffic in international trade. The internationally traded

goods for which different types of transport services are needed may be categorised into three

broad groups on the basis pf their marketing requirements. These groups are: Rush Cargo,

Bulk Cargo and General or Non-Bulk Cargo. In satisfying the immediate marketing needs of

the Rush Cargo, speed is the most important consideration in the decision making process

and hence, such cargo is necessarily to be sent by air.

Bulk Cargo by its very nature, can be carried and stored in large quantities mainly because

their market demand does not frequently change since they are free from attacks of product

development, changes in design, obsolescence, deterioration and depreciation.

General Cargo comprises manufactured, semi-manufactured, processed and semi-processed

goods and materials moving in small quantities in cases, packages, parcels, bales, etc.

LINER AND TRAMP SHIPPING SERVICES

It is clear from the discussion so far that Bulk Cargo requires such kind of shipping services

in which large quantity of one type of cargo can be carried at low per unit cost.

These services are provided by carriers known as Tramps. Quite naturally, there are different

types of tramp ships to carry different kinds of bulk cargo. On the other hand, carriers which

provide regular and scheduled shipping services to carry heterogeneous forgo suiting the

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

11

IV)

Department of Commerce and Management

University of Kota, Kota

marketing requirements of General Cargo are known as Liners. A liner ship is built and rule

to satisfy the transport demand of a variety of cargos.

Liner Shipping Service

The liner ship has the following features:

i) It is designed to carry a variety of cargo, with spaces for bales, bundles, boxes,

barrels, drums, etc, as well as for reefer (refrigerated) cargo. The designs of the

holds and number of decks will be different from those of a tramp. With the

increased share of containerised cargo, specially designed container ships for

carrying different categories of containers operate.

ii) The cargo handling equipment on a liner will be varied and sophisticated for quick

loading and unloading of cargo to ensure quick turn-round. A quick turn-round

means that the ship spends the least possible time in the port and most of its time

in transit.

iii) It operates regularly between fixed ports and normally loads in several ports. It

serves a number of discharging ports along a predetermined route.

iv) In order to ensure speedier carriage, it is fitted with sophisticated and expensive

propelling machinery.

v) It provides pre-announced scheduled services on given terms and conditions of

carriage. These terms and conditions mostly relate to the responsibilities and

liabilities of the ship owners in receipt, carriage and delivery of cargo. Liners.

Thus provide services on terms and conditions, which are not negotiable.

vi) It generally offers carriage on fixed and stable freight rates.

Tramp Shipping Service

A tramp carrier has the following characteristic features;

i) It is primarily designed to carry the more simple and homogeneous cargo in large quantity.

It is, therefore, designed to fully utilise its carrying capacity for carriage of one type of cargo.

For example, a grain-carrying ship bvill be designed in such a way that a full cargo of grains

in bulk can be accommodated in the lower holds.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

12

IV)

Department of Commerce and Management

University of Kota, Kota

ii) Since one kind of homogeneous cargo is to be handled, a tramp will have comparatively

simple equipment. Bulk cargos are normality loaded and discharged by mechanical

equipment, elevators, pumps, etc.

iii) Because of the comparatively low unit value of commodities carried, a tramp will be

operated at the lowest possible cost. This objective can be achieved by operating ships having

relatively less speed by fitting less expensive propelling machinery.

iv) A tramp generally carries cargos of one or two ship users. Hence, loading and discharging

are confined to a few ports.

v) It does not have a fixed route and predetermined schedule of departure as it is to be

engaged by one/two users as and when their need arises.

vi) It offers services at terms and conditions, including freight/hire charges, which are not

fixed and given but are negotiable.

CARGO INSURANCE

Cargo insurance, commonly known as marine insurance, occupies an important position in

international business. It provides protection against unanticipated business to participate

more freely in the business and expands the scope of their operations. Cargo insurance

protects the traders and others against the risk of loss or damage to goods in transit from the

seller to the buyer. A trader engaged in international business can protect his interests by

taking an appropriate insurance policy from an insurance company.

NEED FOR CARGO INSURANCE

There are two reasons for securing the insurance cover. The first reason concerns the legal

dimension of limited liability of the carriers and other intermediaries: The second reason

concerns commercial considerations.

Legal Dimension'

When the goods are ill transit from the exporter to the importer, they are, at different stages in

the custody of different agencies and authorities including the clearing and forwarding

agents, carriers, port and customs authorities, etc. If there is any loss or damage to the goods,

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

13

IV)

Department of Commerce and Management

University of Kota, Kota

while in their custody of the concerned intermediary rnay be held liable to pay damages of

the cargo owners.

The nature and extent of liabilities of various intermediaries have been defined in the

respective laws enacted by the government all over the world. According to these laws, the

intermediaries cannot be liable for loss to the cargo, if it was caused by reasons or events

beyond their control.

Commercial Dimension

From the point of view of an exporter, a transaction is complete as soon as the importer either

pays for the Bill of Exchange on its presentation or he undertakes to make payment at a

future date by accepting the Bill. Sometimes even before the Bill of Exchange is presented to

the importer. He gets to know about the loss of goods in transit and does not accept the Bill

when presented. In such a situation, the exporter is cornpelled to bear the loss.

NATURE OF CARGO INSURANCE POLICY

A marine or cargo insurance policy has an international character and, therefore, a policy

taken in one country is acceptable in other country. This is because of the adoption of

universally acceptable uniform rules governing insurance in different countries. Marine

insurance in India is subject to the following legislations:

i) The Insurance Act, 1938; and Insurance Rules, 1939

ii) Marine Insurance Act. 1963,

In India, the cargo insurance cover is provided only by the Nationalised Insurance

Companies. These companies operate within the standard rules and regulations including

those, which are provided in the "All India Marine Cargo Tariff'.

Article 3 of the Indian Marine Insurance Act, I963 defines marine insurance contract as "It is

an agreement whereby the insurer undertakes to indemnify the assured in the manner and to

extent thereby agreed, against marine losses, that is to say, the losses incidental to marine

adventure". Before we explain different aspects of the marine insurance contract, it should be

clearly understood that the word "marine" used in the definition does not have any specific

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

14

IV)

Department of Commerce and Management

University of Kota, Kota

connotation. Despite the usage of this word, cargo insurance principles as stated in the

definition are equally applicable to all modes of transport used in the carriage of goods.

Indemnity and Insurable Value

-The insurance contract is in the nature of indemnity. The literal meaning of indemnity is

protection against loss. The object of an insurance contract is to place the insured, after a loss,

in the same relative position in which he would have stood had no loss occurred. In other

words, an insured can claim only that much that he has suffered (or lost). If cargo has beer1

damaged by 10 per cent of the insured value, the insured will be paid only that much amount,

even though he has paid premium on the total insured value. But it must also be understood

that the indemnity undertaking of the insurance company is only a "commercial" indemnity

KINDS OF PERILS

The cargo insurance policy can be as wide as to cover all possible kinds of risk and losses to

which cargo could be exposed in transit. The events, which lead to loss or damage to the

cargo, are the perils against which insurance cover can be obtained. Those perils may be

categorised into four groups.

Maritime Perils

These perils are the ones to which cargo is exposed in transit and caused by either an Act of

God (i.e., a natural calamity) or an Act of Man (man-made event, either through negligence

or through connivance), The perils may occur while the cargo is in transit either on land,

inland water, and sea or in air. An act of God may also be described as "extraordinary and

violent action of waves and winds"

Extraneous Perils

These are the incidental perils to which the cargo is exposed. These are caused mainly on

account of the faults in loading, keeping, carrying and unloading of cargo. Examples of such

Perils are: improper storage, rough handling, breakage and leakage, hook and sling damage,

contract with mud oils and acids and theft, pilferage and non-delivery.

War Perils

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

15

IV)

Department of Commerce and Management

University of Kota, Kota

War perils covered by the Institute War Clauses refer to following events:

i) War, civil war, revolution, rebellion, insurrection or civil strike or any hostile act by or

against a belligerent power;

ii) Capture, seizure, arrest, restraint or detainment of carrier or craft arising from event

mentioned in (i) above. Thus, confiscation by the customs authorities of goods being

smuggled cannot be insured; and

iii) Derelict (abandoned) mines, torpedoes, bombs or other derelict weapons of war. It is clear

from the above that war risk insurance is not only against hostile warlike acts but also for

perils which continue to exist after war is over.

Strike Perils

In marine insurance, strike perils mean events, which lead to loss or damage to cargo caused

by:

i) Strikes, lock-out workmen or persons taking part in labour disturbances, riots or civil

commissions; and

ii) A terrorist or any person acting from a political motive.

It is clear from the above that strike perils are not only the ones which are caused by the

striking workmen. These also include perils caused by the political activities, which

participate or lead to the strike.

TYPES OF POLICIES

Specific Voyage Policy

A Voyage policy covers the risks that may arise during a journey from specific place to

another.

The terms and conditions of the insurance are set out in the appropriate I.L.U. (Institute of

London Underwrites) and other clauses. The clauses cover mainly the perils and risk covered

under the policy as well as conditions related to the insurable value and claims.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

16

IV)

Department of Commerce and Management

University of Kota, Kota

Open Cover

Open cover is an insurance arrangement designed specifically to the need of those firms,

which have substantial import export turnover, frequent transactions. Such firms are spared

the inconvenience of negotiating insurance contracts every time the transaction is to be made.

Main features of an open cover arrangement are as follows:

i) Unlike an insurance policy, open cover is not an enforceable contract.

ii) Under all open cover arrangement, agreement between the insured and the insurer is

reached about the subject matter (e.g., goods) insured, packing conditions, voyages, risks

covered, rates and other conditions of the cover.

iii) No premium is charged when an open cover is issued, but the insurance companies

usually require the insured to furnish either a bank guarantee or cash deposits towards

payment of premium against each declaration, as declarations are made.

iv) 'The validity period of an open cover is twelve months.

v) It is customary to make an open cover agreement subject to two limitation clauses as Par

Place clauses. The effect of these clauses is to limit the liability of the insurance company to

an agreed amount.

vi) An open cover may be cancelled by either party by giving 30 days notice in writing.

vii) When the loss takes place, claim will be awarded with reference to insurable value

calculated on the basis of c.i.f. plus 10 per cert.

viii) The duty of the insured is to declare each and every segment as soon as known.

Unintentional failure to report shipment will be condoned by the insurance company.

Open Policy

Also known as Floating policy, it has much in a common with the open cover. 'This policy

benefits clients with substantial turnover and a large number of despatches. Thus it covers a

series of consignments with all stipulations of the open cover, except that:

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

17

IV)

Department of Commerce and Management

University of Kota, Kota

i) ' Open policy is an enforceable contract of insurance and is hence, duly stamped; and

ii) Open policy is for an agreed amount against which a series of consignments may be

despatched and declared as a result of which the sum insured will gradually diminish by the

amount of each declaration until it is finally exhausted.

iii) Even though the open policy ceases on expiry of one year from the date of its issue, the

sum insured is of paramount importance. Therefore, the sum insured may exhaust prior to the

expiry of the policy.

iv) Open policy is subject to cancellation by either party after giving 15 days notice of

cancellation in writing.

INSURANCE CLAIMS

Responsibilities of the Insured

It is the duty of the insured or his agents, in all cases, to take such measures as may be

reasonable to avert or minimise a loss, Further, it is also his duty to protect rights of the

insurer of recovery from the carriers, port authority and others. In particular, the duties of the

insured or his agent are:

i) Lodge claim on the carriers, port authorities and other intermediaries for any missing

packages;

ii) If the loss or damage is apparent or visible, make an application to the agents of the

carriers, port authority, customs authority and the insurer (or agent) to arrange joint survey

within 3 days of discharge of cargo from the vessel (7 days in case of air consignment);

iii) If the loss was not apparent at the time of taking delivery of cargo, give notice in writing

to the carriers and other parties within 3 days of delivery of cargo (7 days in case of air

consignment);

iv) Lodge a proper monetary claim on carriers, port authority and customs authority;

v) In case of any missing package, get a log entry made with the' port authority and lodge a

claim on carrier and port authority;

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

18

IV)

Department of Commerce and Management

University of Kota, Kota

vi) If missing packages are traced subsequently, clearance may be made only after a joint

survey;

vii) The claims on carriers, customs and port authorities should be filed within the time,

limits prescribed under the relevant laws.

Filing Claims

The insured will file claim with the insurance company after meeting the aforementioned

requirements. The insurance company is generally contacted immediately on discovery of

loss to the cargo which will assist the insured in carrying out the responsibilities.

It is quite natural that there is disagreement between the insured and the insurers regarding

insurance claims. In such a case, the insured can take legal recourse against the insurers and

file a legal suit. However, under the Indian Limitation Act, no suit can be filed against the

insurers in respect of a claim under an insurance policy after a lapse of three years.

a) The date of occurrence causing the losses; or

b) The date when the claim is repudiated either partly or wholly.

Documents for Claims

The claims on the insurers should be submitted duly supported by the following documents:

i) Original insurance policy or certificate of insurance duly endorsed by the insured;

ii) ' Full set of Bill of Lading in respect of total loss claims. Otherwise non-negotiating copy

of the Bill of Lading, Airway Bill, Railway, etc., as applicable;

iii) Copy of invoice with packing/weight list;

iv) Insurance survey Report or other documentary evidence to substantiate cause and extent

of lots;

v) Joint ship survey Discrepancy certificate issued by the carriers;

vi) Port authority Landing Remarks certificate;

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

19

IV)

Department of Commerce and Management

University of Kota, Kota

vii) Casualty report when a vessel is missing or lost;

viii) Ship Master's protest or an authenticated copy of extract from ship's Log book in case

vessel encountered heavy weather or other casualty during the voyage;

ix) In case of short landing claims, a Short Landing Certificate issued by the carrier or import

authority

x) A landed but Missing Certificate from port authority. In case where package has landed

but is missing;

xi) In the event of General Average claim for refund of GA Deposit; the GA Deposit Receipt

and GA Counter-Guarantee;

xii) 'I'riplicate copy of Bill of Entry (in case of India).

xiii) Copies of Letter lodging claims on the carriers, port authority, etc;

xiv) Copies of correspondence exchanged with carriers to examine whether the claimant has

taken necessary measures;

xv) Letter of subrogation duly stamped and signed; and

xvi) Any other document as may be asked for by the insurers.

SHIPMENT OF EXPORT CARGO

At the port of loading, two main formalities are involved: i) Getting permission from the

customs authorities to ship the goods; and ii) Getting permission from the port authorities to

bring the cargo into the shipment shed where the goods will have to be brought for loading

into the carrier. After the goods have been loaded, the exporter, through [he clearing and

forwarding agent, will proceed to obtain "fact of shipment" certification on different

documents.

STAGES OF SHIPMENT

For effecting shipment from ports in India, the exporter, generally through his clearing and

forwarding agent, has to comply with procedural formalities of the customs and port

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

20

IV)

Department of Commerce and Management

University of Kota, Kota

authorities separately. In addition, he has also to obtain permission from the shipping

companies (or their agents) for bringing the cargo into the shipment shed according to the

"loading plan" of the ship. SpecificaIIy, the stages of the shipment process are:

I) Filing of documents with the customs authorities for checking genuineness of the

transaction and for obtaining examination order;

2) Payment of the port charges;

3) Obtaining permission of the shipping company to bring cargo into the shipment shed;

4) Obtaining permission from the shed superintendent for bringing the cargo into the

shipment shed;

5) Arranging for transport of cargo to move into the shipment shed through Port Gate;

6) Permission of the Gate Inspector to move cargo into the port area;

7) Unloading of cargo in the shipment shed;

8) Examination of cargo by the Customs Authorities and obtaining "Let Export" Order;

9) Obtaining "Let Ship" Order from the customs preventive officer prior to loading;

10) Issuance of Mate's Receipt by the Master of the vessel.

11) Obtaining "fact of shipment" certificate from the Customs Preventive Officer.

CENTRAL EXCISE FORMALITIES

It is common practice all over the world that the exports are not to bear the burden of indirect

taxes. Export goods are either exempted from such taxes or these taxes are refunded, if

exemption is not possible.

The Government of India has laid down procedure for either getting the duty refunded or

exemption from payment of duty.

Excise Rebate Policy

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

21

IV)

Department of Commerce and Management

University of Kota, Kota

The scheme under which the Central Excise exemption or refund is provided is popularly

describe port procedures involved in the shipment of export cargo. , known as Rebate of

Central Excise. This scheme operates under section 37 of the Central Excise and Salt Act,

1944; as amended from time to time as well as the relevant Excise Rules. According to the

recent amendment in lieu of the Rules 12, 12A and 191A of the Central Excise Rules, only

one Rule 12 operates for exports under claim for rebate of duty.

Procedural Formalities

Refund Procedure under Rule 12: The authorities involved in the Rule are: i) Jurisdictions /

Central Excise Authority known as Central Excise Range Superintendent under whose

jurisdiction the manufacturing unit is located; ii) Maritime Central Excise Authority located

at the port. Rebate may be either claimed from Jurisdictional Assistant Collector of Central

Excise or Maritime collector.

The documents required under Rule 12 are:

i) lnvoices to be filled in four copies.

ii) AR 41AR 5 Form to be filled in six copies.

The procedure followed is as under:

i) The exporters prepare four copies of Invoices giving all detail of the consignment.

ii) The excisable goods which are to be imported under claim for rebate, are be

marked as export cargo in individual packages

iii) These marks and numbers are to be specified on AR4/AR5 Forms. All the 6

copies.

iv) Personal Ledger Account (PLA) is to be filled in specifying the amount of duty

applicable to the export consignment as debit. In PLA the credit balance of the

deposit account spent by the individual manufacturer with the central excise

authority is shown Each time when goods are cleared, the amount of duty

applicable to the goods to be cleared is debited and the balance is shown in the

balance column.

v) 6 copies of AR41 AR5 For usage to be presented to the Range Superintendent

before clearance of the cargo. Under the Self-Removal Procedure (SRP) Presence

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

22

IV)

Department of Commerce and Management

University of Kota, Kota

of the central excise officer at the factory at the time of clearance is not necessary.

But in those cases where physical examination by the central excise officer is

solicited before the clearance of the cargo, 6 copies of AR4/AR5 Forms should be

presented to the Range Superintendent at least 24 hours before the goods are to be

removed from the factory.

vi) After verifying the details given in the aforementioned documents, tile Range

superintendent allows clearance of the cargo from tile factory for onward

transmission to the Port of shipment.

vii) The original and duplicate copies of AR4/ ARS Forrns are handed over to the

exporter; the triplicate copy is sent to the Maritime Certificate Excise Collectorate

Refund section, having jurisdiction over the port where from the goods are to be

shipped.

viii) The original, duplicate and six tuplicate copies of AR4/AR5 Forms are to be

submitted to the Export Department of Customs House alongwith other shipping

documents to prove that formal central excise clearance has been obtained from

the jurisdictional Central Excise Authority.

ix) If custom officer is satisfied, he would make endorsements in the original,

duplicate and six triplicate copies of AP4/ARS Forms. The officer returns original

and six triplicate copies to the exporter and sends duplicate copy to the Rebate

sanctioning Authority.

x) Rebate claim may be filed either from Maritime Collector or Jurisdictional

Assistant Collector of Central Excise.

xi) Following documents should be filed for claiming rebate:

a) Application in prescribed form.

b) Original copy of AR4/ARS Form.

c) Duplicate copy of AR4 in sealed cover received from customs officer, if

required

d) Duly attested copy of Bill of lading

e) Duly attested copy of shipping Bill (Export promotion copy)

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

23

IV)

Department of Commerce and Management

University of Kota, Kota

f ) Disclaimer certificate in case where claimants other than exporter

CUSTOM CLEARANCE OF IMPORT CARGO

The concept of customs operation is as old as the trade itself, in the olden days. There was a

tradition followed by traders of offering gifts, etc. to kings to be able to sell their merchandise

in different territories. The same practice has been formalized in the modern economic and

political systems. Goods are subjected to levy of duties, whenever they cross the national

frontiers/boundaries of a country. Despite all efforts in favour of free trade, collection of

revenue is still on priority of the Commissioner in charge of a Customhouse. In this unit, you

will learn the objectives, legal framework, basic information, documents and duties related to

custom clearance of import cargo.

OBJECTIVES OF CUSTOM CLEARANCE

Apart from being a source of revenue, the major objectives of customs clearance are as

follows:

Check smuggling: Those transactions which do not take place in accordance with provisions

of different laws in force in India amounts to smuggling. It is the duty of customs

administration to check such transactions.

Regulate trade: Customs clearance help in regulating trade in accordance with national

objectives and policies. Violation of any provision of the Exim policy as decided by the

Ministry of Commerce ipso-facto is a violation under the Customs Act with regard to various

prohibition and restrictions imposed by the Government.

Agency function: To undertake agency functions i.e. functions performed on behalf of other

agencies. For example, it is the customs responsibility to ascertain that the requirements

emanating from different acts in force are complied with or not. It may be requirements of the

Foreign Exchange Management Act or Quality Control and Pre-Shipment inspection Act.

Collection of trade data: To collect trade data and submit the same to Directorate General of

Commercial Intelligence & Statistics (DGCI & S) Calcutta, Ministry of Commerce, which

brings out trade data in different formats for the use of a) Various Government

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

24

IV)

Department of Commerce and Management

University of Kota, Kota

Departments/Ministries, b) Trade and Industry, c) Researchers, and others concerned with

international trade.

Data is essential to review the past performance and plan for the features as well as to know

the trends of our trade or unit/value realisation of a particular item etc.

LEGAL FRAMEWORK

To achieve the above mentioned objectives, there is R need to have a suitable legal

framework.

At present, Customs department and Trade & Industry have been provided with guidelines

for smooth functioning based upon the following Acts passed by the Parliament, Foreign

Trade (Development and Regulation) Act, 1992

This Act of 1992 has repealed the Imports and Exports (Control) Act, 1947. Under the Act, of

1947 imports of all goods was prohibited or controlled except those that were specifically

permitted to be imported. Under the Act of 1992, import of all goods is free except to the

extent that some items are regulated by the policy or any other law for the time being in

force. In exercise of the power conferred by section 5 of this Act, the Central Government

formulated the first five year Export Import Policy (1992-97). With positive outcomes of this

policy, now the Central Government has notified the second five year Export Import policy (

1 997-2002).

Under section 3 and 5 of this Act, Central Government i.e. Ministry of Commerce is

authorised to make provisions relating to imports and exports and to formulate export and

import policy. Under the present policy there is a list of items which are completely banned

or restricted (can be imported against a licence) and canalised items (can only be imported

through canalising agency).

The Customs Act, 1962

The customs Act, 1962 governs customs operations. This Act comprises seventeen chapters

spread over 161 sections. These sections empower the Government to decide about the

suitable legal framework to provide guidelines to the Customs Administration and trade &

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

25

IV)

Department of Commerce and Management

University of Kota, Kota

industry covering all situations connected with export/import transactions. The Customs

Administration functions through two wings:

Appraisement: It deals with authorised transactions which move in accordance with the law,

for which prior permission is granted by the competent authority on the basis of

examination/appraisement of documents submitted by the importer/exporter followed by

physical verification of goods in a prescribed manner. The various sections of the CA, 1962

empower the Government to decide matters such as:

a) The type of ogranisational setup;

b) Approved places for loading and unloading of goods:

c) Responsibilities and formalities of the incharge of the vehicle carrying imported cargo, rate

of duty, nature of duty, date of duty and exchange rate, assessment guidelines, exemptions,

documentary requirements and warehousing procedure etc.

There are also provisions for the aggrieved party to go for appeal against anything done

wrong by one party against another party.

Prevention: Preventive wing keeps watch on the movement of goods involved in

unauthorized transactions which amount to smuggling. Action against such movements is

taken as per laid down procedures under the Customs Act. 'The prevention wing keeps a

watch over the unlawful movements, collects information, investigates, conducts raid, make

seizures and confiscate the goods. Penal action is taken against the defaulter.

Customs Tariff Act, 1975

Details about the rate and nature of customs duty levied on any item, as decided by the

Central Government are specified in the first schedule for imports and in the second schedule

for exports, of the Customs Tariff Act, 1975. This is for the purpose of streamlining the

Customs functioning. The Customs Tariff Act is based on a classification known as

Harmonised System of Nomenclature (HSN). 'There are 21 sections spread over 99 chapters,

covering different commodity groups. Each chapter is further divided in headings and

headings are divided in sub-headings. Onus to establish tariff classification of goods lies with

the department. However, it is advisable that importer must ensure that the classification is

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

26

IV)

Department of Commerce and Management

University of Kota, Kota

correct. To help understanding and determining of correct classification interpretative rules

and explanatory notes (HSN) can be referred to. It is pertinent to mention here that Customs

Tariff, Excise Tariff, Exill1 Policy, Duty Drawback schedule and Export/Import data are

based on the Harmonised System of Nomenclature (HSN).

Other Acts

You have learnt that it is the responsibility of the customs to ascertain that requirements

emanating from different laws in force are complied with or not. This function is performed

by customs on behalf of other agencies and hence called agency function. Some of these Acts

on whose behalf customs perform agency functions are:

Foreign Exchange Management Act, Tea Act, Coffee Act, Tobacco Act, Arms Act, Textiles

Act, The Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, The

Spices Cess Act, etc.

STAGES OF CUSTOM CLEARANCE

Let us now learn the stages of custom clearance. They are as follows:

1. Presentation of bill of entry along with the relevant documents to the import

document of the Custom House i.e. the concerned group.

2. The bill of entry is checked by the concerned official with the IGM submitted by the

carrier and it is notified.

3. Documents and the information are checked and scrutinised.

4. The bill of entry is marked for assessment and appraisement to the concerned

appraiser.

5. The appraiser makes an assessment on the basis of information given in the

documents and with reference to the classification and value of the goods. The

Examination Order is given.

6. The custom; assessed bill of entry is returned to the Importer ICHA for depositing

duty within a period of 7 days.

7. Duty is deposited with the cash department and at this stage the original COPY of the

bill of entry is detached and sent for record purposes.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

27

IV)

Department of Commerce and Management

University of Kota, Kota

8. The documents given to the Importer ICHA for presentation to the Dock

Superintendent for physical examination of goods as per Examination Order.

9. The Dock Superintendent marks the documents to one of the Examiner Inspector

physical examination. The Examiner after examination writes the report and signs on

the reverse of the bill of entry, sends it back to the superintendent for counter

signature and the "out of charge" order is given.

10. The CHA presents the documents to the Port Manager who ensures about any charges

to be paid by the Importer. The same is deposited with the cash department.

PROCEDURE OF CUSTOM CLEARANCE

The procedural formalities for getting imported goods cleared from customs are as per

requirements of section 45-49 of the CA, 1962. Let us learn them.

A. Unloading at Imported Goods: The in-charge of the carrier having custody over imported

goods is under obligation to unlosd the goods in a Customs approved area. The goods after

unloading are not handed over to the actual owner of the goods but are transferred into the

custody of the Port Trust Authority or any other competent agency / person as approved by

the Commissioner. Goods listed in the IOM are allowed to be unloaded in the presence of the

officer of customs. The custodian of the imported gods is under obligation to:

i) keep it record of imported goods and also send a copy of the list of goods to the proper

officer of Customs

ii) hand over the goods to the actual claimant on presentation of documents granting

permission by the Customs.

B. Presentation and Noting of B/E: The importer can present bill of entry in a prescribed form

to the proper officer in the import department either for their clearance for home consumption

(to take the goods at the place where they are needed) or can transfer then) in an approved

public warehouse. Capital goods intended for we in any 100% export oriented unit can be

deposited in a warehouse for a period of 5 years. The period for purpose of warehousing for

other categories of goods is one year. The warehousing period is subject to extension on the

merit of the case as considered necessary by the commissioner.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

28

IV)

Department of Commerce and Management

University of Kota, Kota

The bill of entry must contain all goods mentioned in the B/E or any other document as

issued by the carrier to the consigner of goods after taking custody of goods on board the

carrier. The B/E can be presented after the deliverly of the IGM/IR by the incharge of the

carrier. However, it can be submitted before the submission of IGM provided the carrier by

which the imported goods have been shipped for importation into India is expected to arrive

within 30 days from the date of presentation of IGMIIR.

C. Processing of B/E: As soon as bill of entry is presented along with other documents and

the same is notified by the customs with reference the IGM, the customs is under obligation

to process it, make scrutiny of the documents information and declaration given by the

importer and appraise the gods to duty. For this purpose, there are different group appraisal

supported by their staff. The document pass through different hands for necessary action)

endorsement/record. The concerned appraiser her to ensure that goods are not prohibited

goods, the classification and the valuation is correct, the transaction is in accordance with the

requirements of the provisions of different Acts, the party is not on the caution list and the

documents and other requirements have been complied with.

D. Physical Examination of Goods: The Dock Superintendent marks the paper to One of the

inspector or physical examination of goods on random basis, as per Examination Order by the

Appraisal officer (AIO). The contents of the packet are checked as per description and

information given in the bill of entry.

i. Check Second: The above procedure is known as check second i.e documents are first

examined goods are presented to duty and physical examination of goods is done thereafter.

Over 95% of the consignments are subject to check second system.

ii. Check First: where the AIO is not able to identify to goods properly or there is not

sufficient information about the composition/functions/classification of goods in question the

AIO marks the papers to the Dock Superintendent for their physical examination. This is

known as check first system.

iii. Confiscation of Goods: At any of the stage mentioned above, it is notified that the goods

are goods or the Importer has intended to import in violation and contravention of the

provisions of the relevant Acts in operation, penal proceedings may have to be listed and the

goods are liable to confiscation in terms of section III (d). The discretion lies with the

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

29

IV)

Department of Commerce and Management

University of Kota, Kota

adjudication authority to allow their release to the importer on payment of a fine or to

confiscate them.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

30

IV)

Department of Commerce and Management

University of Kota, Kota

SELF ASSESSMENT

State whether the following statements are True or False

i) Time limit for settlement of import bill is 6 months from the date of shipment.

ii) Uniform Customs and Practice for Documentary Credit is not indispensible to cover

transactions under documentary credit.

iii) Import licences are issued on CIF basis.

iv) Authorised dealers can sell foreign exchange for financing imports from Bhutan.

v) Payment of import should be made in a currency appropriate to the country.

vi) Letter of credit cannot be opened by mail.

vii) After paying the negotiating bankers, the issuing bankers release documents of title to the

importer on executing a stamped letter of Trust.

viii) When shipping documents are directly sent to importer by exporter, the bank receives

clean bills for collection of proceeds.

ix) For importing under deferred payment, the importer need not generate cash for advance

and down payments.

x) Government of lndia gets assistance in the form of loans and development credits from

international Financial Institutions.

xi) Speed is the most important consideration in case of Rush Cargo.

xii) Shipping conference helps in minimising losses or maximising profits by combating

competition among ship owners.

xiii) It operates regularly between fixed ports and normally loads in several ports. It serves a

number of discharging ports along a predetermined route.

xiv) Line shipping service is suitable for carrying homogeneous cargo.

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

31

IV)

Department of Commerce and Management

University of Kota, Kota

xv) l'he demand of bulk cargo frequently changes

xvi) Cargo insurance policy gives protection against loss of goods.

xvii). The cargo insurance contract is meant for the replacement of lost or damaged goods.

xviii) Insurance value for export consignment is calculated on the basis of C& F plus some

percentage.

xix) Maritime perils refer perils when cargo is in the ship.

xx) War perils occur during war and peacetime.

xxi) Particular average refers the partial loss caused accidentally by an insured peril.

xxii) Institute cargo clause B is the most superior cover.

xxiii) The exclusion clause covers those perils, which are not covered under the cargo

insurance contract.

xxiv) The validity period of open cover is 6 months.

xxv) Open policy is subject to cancellation by either party after giving 15 days notice of

cancellation in writing.

Answer: i) True ii) False iii) True iv) False v) True vi) False vii) True viii) True ix) False x)

True xi) True xii) True xiii) False xiv) False xv) False xvi) True xvii) False xviii) True xix)

False xx) True xxi) True xxii) False xxiii) True xxiv) False xxv) True

EXPORT IMPORT PROCEDURES, DOCUMENTATION & MANAGEMENT (UNIT

32

IV)

You might also like

- Import Export Documentation and ProceduresDocument107 pagesImport Export Documentation and ProceduresDr. Rakesh BhatiNo ratings yet

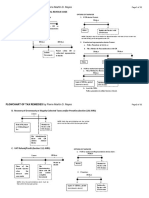

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Bir Ruling (Da-031-07)Document2 pagesBir Ruling (Da-031-07)Stacy Liong BloggerAccountNo ratings yet

- Custom Clearance Procedure PDFDocument70 pagesCustom Clearance Procedure PDFManish Chaurasia91% (23)

- Import FinanceDocument6 pagesImport FinanceSammir Malhotra0% (1)

- The Regulatory Frame WorkDocument3 pagesThe Regulatory Frame WorkRishabh JainNo ratings yet

- IEPPDocument14 pagesIEPPGleny SequiraNo ratings yet

- Foreign Exchange1Document84 pagesForeign Exchange1Ashwin WasnikNo ratings yet

- Export Procedure - KohimaDocument22 pagesExport Procedure - KohimavarshatolasariyaNo ratings yet

- Foreign Trade Policy May19Document22 pagesForeign Trade Policy May19H JNo ratings yet

- 06 IB Unit 4 Export and Import Procedures SEM 5Document28 pages06 IB Unit 4 Export and Import Procedures SEM 5godlistengideon7No ratings yet

- Export & Import Trade OperationsDocument46 pagesExport & Import Trade Operationsvandana1306No ratings yet

- Brief PolicyDocument9 pagesBrief PolicysanjchandanNo ratings yet

- Introduction To FTPDocument18 pagesIntroduction To FTPdipesh shahNo ratings yet

- FTP Icai MaterialDocument61 pagesFTP Icai MaterialsubbuNo ratings yet

- Exim Policy or Indian Foreign Trade PolicyDocument3 pagesExim Policy or Indian Foreign Trade PolicylapogkNo ratings yet

- Process of Import-ExportDocument11 pagesProcess of Import-ExportparekhtejalnNo ratings yet

- 1) Establishing An Organisation: Click HereDocument6 pages1) Establishing An Organisation: Click HerePraWin KharateNo ratings yet

- How To Export: 1) Establishing An OrganisationDocument5 pagesHow To Export: 1) Establishing An OrganisationRahul TilekarNo ratings yet

- Export and Import TradingDocument7 pagesExport and Import TradingNaina DhamechaNo ratings yet

- Export Potentials of Small Scale IndustriesDocument29 pagesExport Potentials of Small Scale IndustriesTanveer Singh Rainu60% (10)

- Assignment of FTPDocument9 pagesAssignment of FTPKrati GuptaNo ratings yet

- EXIM PolicyDocument65 pagesEXIM PolicyJasleen DuttaNo ratings yet

- Chapter 5 - Foreign Trade Policy & Procedure: 1. Process Re-Engineering and AutomationDocument53 pagesChapter 5 - Foreign Trade Policy & Procedure: 1. Process Re-Engineering and AutomationDhanpati GuptaNo ratings yet

- Finance (MBA) 163Document88 pagesFinance (MBA) 163Ganesh GaniNo ratings yet

- Foreign Trade End SemDocument21 pagesForeign Trade End SemUTKARSH GOSWAMINo ratings yet

- Investment Law Module 3Document10 pagesInvestment Law Module 3Abhin BehlNo ratings yet

- Ibmr, Ips Academy: SESSION-2018-2019 International Marketing Topic-Foreign Trade Policy 2002-2007Document10 pagesIbmr, Ips Academy: SESSION-2018-2019 International Marketing Topic-Foreign Trade Policy 2002-2007Rachi JainNo ratings yet

- India-Bangladesh Trade at A GlanceDocument12 pagesIndia-Bangladesh Trade at A GlanceakshitNo ratings yet

- How To Export: 1) Establishing An OrganisationDocument5 pagesHow To Export: 1) Establishing An Organisationarpit85No ratings yet

- Foreign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromDocument9 pagesForeign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromShubham SinghNo ratings yet

- Export Procedure and Documentation in India-1Document25 pagesExport Procedure and Documentation in India-1Sajja JyothiNo ratings yet

- EIP Export Market Organisation 18319Document56 pagesEIP Export Market Organisation 18319Kumar AdityaNo ratings yet

- How To ImportDocument30 pagesHow To ImportRiyaz ShaikhNo ratings yet

- Export Procedure and DocumentationDocument22 pagesExport Procedure and DocumentationnandiniNo ratings yet

- FTP 2015 2020-2Document9 pagesFTP 2015 2020-2Izhan ANo ratings yet

- How To Export: 1) Establishing An OrganisationDocument2 pagesHow To Export: 1) Establishing An Organisationkaran singhNo ratings yet

- DGFT ppt2Document24 pagesDGFT ppt2Aashi LuniaNo ratings yet

- Module-2 Export-Import Trade - Regulatory FrameworkDocument12 pagesModule-2 Export-Import Trade - Regulatory Frameworksudhir.kochhar3530100% (2)

- DGFT Guidelines and Checklist by KP 062d11c5ae37924 55650887Document50 pagesDGFT Guidelines and Checklist by KP 062d11c5ae37924 55650887Anupam BaliNo ratings yet

- Export & Import Trade OperationsDocument45 pagesExport & Import Trade Operationscarlos_wolffNo ratings yet

- Foreign Trade Policy Q&ADocument12 pagesForeign Trade Policy Q&Aphilia.newNo ratings yet

- Import Export ManagementDocument130 pagesImport Export ManagementNishita ShahNo ratings yet

- UnitDocument11 pagesUnitRohanNo ratings yet

- SM-II-Import and ExportDocument17 pagesSM-II-Import and ExportPrakhar LaddhaNo ratings yet

- SIMS Exim ManagementDocument56 pagesSIMS Exim ManagementRounaq DharNo ratings yet

- State Control Over Import and Export of GoodsDocument5 pagesState Control Over Import and Export of GoodsSumit DashNo ratings yet

- Foreign Trade Policy FTP 2023 Concepts Notes Questions With MCQsDocument27 pagesForeign Trade Policy FTP 2023 Concepts Notes Questions With MCQscadkmarwah0% (1)

- Export ManagementDocument33 pagesExport ManagementTanmoy ChakrabortyNo ratings yet

- Unit 4Document12 pagesUnit 4Abhinav RanjanNo ratings yet

- Credit Managemant Project: Export FinanceDocument67 pagesCredit Managemant Project: Export Finance✬ SHANZA MALIK ✬No ratings yet

- FTP 2015-20Document30 pagesFTP 2015-20chandrajeet yadavNo ratings yet

- A Report On IB FinalDocument5 pagesA Report On IB FinalManash Protim BoruahNo ratings yet

- Balance of TradeDocument9 pagesBalance of TradeBhumil ParikhNo ratings yet

- Export ManagementDocument302 pagesExport ManagementKaran WasanNo ratings yet

- Steps To Setup An Export BusinessDocument7 pagesSteps To Setup An Export Businesssrinath.vjNo ratings yet

- State Control On Export and Import of GoodsDocument10 pagesState Control On Export and Import of GoodsAmudha MonyNo ratings yet

- Amendment CustomsDocument50 pagesAmendment Customsamithamp20No ratings yet

- Import Export of IndiaDocument10 pagesImport Export of IndiaTanya KholiNo ratings yet

- Role of DGFT in Foreign Trade Policy: BY Gaurav Chandra Dev Sahoo Bhoomi Solanki Yashopriya Bhartiya Omkar BhosleDocument13 pagesRole of DGFT in Foreign Trade Policy: BY Gaurav Chandra Dev Sahoo Bhoomi Solanki Yashopriya Bhartiya Omkar BhosleDuma DumaiNo ratings yet

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshFrom EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshNo ratings yet

- The Shipbuilding Industry in TurkeyDocument52 pagesThe Shipbuilding Industry in TurkeygamronNo ratings yet

- Jurisprudence On Misdeclaration of Imported Goods in Word FormatDocument63 pagesJurisprudence On Misdeclaration of Imported Goods in Word FormatKrisNo ratings yet

- Commissioner of Customs vs. Hypermix Feeds CorpDocument7 pagesCommissioner of Customs vs. Hypermix Feeds CorpJonjon BeeNo ratings yet

- Ra 7560Document3 pagesRa 7560Joseph Santos GacayanNo ratings yet

- Principles of Customs: Administratio NDocument46 pagesPrinciples of Customs: Administratio NAlfredo III SantianesNo ratings yet

- The Role of Customs Brokers in Facilitating International TradeDocument8 pagesThe Role of Customs Brokers in Facilitating International TradelordNo ratings yet

- Iofe U2 A2 WRQDocument9 pagesIofe U2 A2 WRQapi-404111666No ratings yet

- What Is A Bill of LadingDocument29 pagesWhat Is A Bill of LadingRicardo PirelaNo ratings yet

- YaokasinDocument6 pagesYaokasinEdward Marc P. JovellanosNo ratings yet

- High Seas Sale of Goods Under GSTDocument3 pagesHigh Seas Sale of Goods Under GSTSATYANARAYANA MOTAMARRINo ratings yet

- Bank Management P 52Document62 pagesBank Management P 52revathykchettyNo ratings yet

- Tax 1 ReviewerDocument66 pagesTax 1 ReviewerTricia MontoyaNo ratings yet

- IDT AmendementsDocument20 pagesIDT AmendementstharunhimNo ratings yet

- Ibo 4Document15 pagesIbo 4vinodh kNo ratings yet

- Tax IshritaDocument15 pagesTax IshritaManeesh ReddyNo ratings yet

- Cir v. Puregold (Full Text)Document13 pagesCir v. Puregold (Full Text)Jeng PionNo ratings yet

- Myanmar Procedures For Export and Import and Customs ClearanceDocument5 pagesMyanmar Procedures For Export and Import and Customs ClearanceAye Kywe100% (2)

- Ethiopia Customs Guide v3Document160 pagesEthiopia Customs Guide v3Sarah سارةNo ratings yet

- International EnvironmentDocument29 pagesInternational Environmentallu saiNo ratings yet

- Papa vs. Mago (Article 130, in Relation To SEC 2209 TCCP) PDFDocument2 pagesPapa vs. Mago (Article 130, in Relation To SEC 2209 TCCP) PDFtink echivereNo ratings yet

- CAO 10 2020 Seizure and ForfeitureDocument17 pagesCAO 10 2020 Seizure and ForfeitureALAJID, KIM EMMANUELNo ratings yet

- How To Prepare Your Cleared Goods For Mailbag Products: Customer ManualDocument25 pagesHow To Prepare Your Cleared Goods For Mailbag Products: Customer ManualFarbod SayehNo ratings yet

- Aep Import Trader GuideDocument28 pagesAep Import Trader GuideNagrani PuttaNo ratings yet

- Economic Crime of SMUGGLING WordDocument5 pagesEconomic Crime of SMUGGLING WordFREDERICK REYES100% (1)

- New Ex Im Policies 1Document34 pagesNew Ex Im Policies 1Omar SiddiquiNo ratings yet

- Discord For Questions: MANTRO#8719: The All in 1 Replica Money Making EbookDocument39 pagesDiscord For Questions: MANTRO#8719: The All in 1 Replica Money Making EbookOluwadareNo ratings yet

- 5th ScheduleDocument5 pages5th ScheduleWaseem ParchaNo ratings yet