Professional Documents

Culture Documents

Acvalco Q3

Acvalco Q3

Uploaded by

Angelo Gian Co0 ratings0% found this document useful (0 votes)

5 views4 pagesThis document discusses different valuation methods for companies across their life cycle. It covers:

1) Valuing young companies using survivability scenarios and relative valuation with adjustments due to lack of history and high mortality risk.

2) Valuing growth companies using discounted cash flows but with adjustments for unpredictable growth and changing risk over time. Relative valuation also requires adjustments.

3) The First Chicago Method which combines discounted cash flows and relative valuation to value start-ups and growth companies through developing scenarios with cash flows and exit multiples.

Original Description:

Original Title

ACVALCO Q3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses different valuation methods for companies across their life cycle. It covers:

1) Valuing young companies using survivability scenarios and relative valuation with adjustments due to lack of history and high mortality risk.

2) Valuing growth companies using discounted cash flows but with adjustments for unpredictable growth and changing risk over time. Relative valuation also requires adjustments.

3) The First Chicago Method which combines discounted cash flows and relative valuation to value start-ups and growth companies through developing scenarios with cash flows and exit multiples.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views4 pagesAcvalco Q3

Acvalco Q3

Uploaded by

Angelo Gian CoThis document discusses different valuation methods for companies across their life cycle. It covers:

1) Valuing young companies using survivability scenarios and relative valuation with adjustments due to lack of history and high mortality risk.

2) Valuing growth companies using discounted cash flows but with adjustments for unpredictable growth and changing risk over time. Relative valuation also requires adjustments.

3) The First Chicago Method which combines discounted cash flows and relative valuation to value start-ups and growth companies through developing scenarios with cash flows and exit multiples.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

ACVALCO Q3

Certainty Equivalent Approach

- is based on the assumption that individuals have different

levels of risk aversion.

- the concept of equivalence is commonly used in various

areas, including investment analysis, insurance, and

decision theory, to assess and compare options with varying

levels of risk and uncertainty

Risky = P120,000

Guaranteed = P111,110

Accounting For Risk

- higher risk = higher return

- increase the required rate of return (discount rate), add risk

premium to the risk-free rate

- alternatively, you can trim cash flows instead

Value of the project = P281,438

Firm Value

Enterprise Value Four Keys to Using Multiples

- we rely on multiples to scale stock prices to a common

denominator

1. Definitional Tests

Kinds of P/E ratio

a. Trailing P/E ratio - EPS of last 12 months

b. Forward P/E ratio - EPS of 12 months into the future

Relative Valuation note: ratios should be consistent

- also called valuation using multiples is the notion of

comparing the price of an asset to the market value of Consistency

similar assets P/E = Stock Price / EPS = Equity Value / Earnings

- uses the market value as the basis for the valuation (must EV/EBIT = Enterprise Value / EBIT

be similar in industry)

- can be used if you don’t want to undergo discounted cash Uniformity

flow techniques - what accounting policy is being used? (example:

depreciation method and useful life)

1. Look for comparables (same size, same industry)

2. Scale the prices to a common variable (through the use of 2. Descriptive Tests

multiples) - multiples can as low as 0 and can be as high as who

● Price to Earnings ratio (Stock Price / EPS), if EPS is knows high (no definite amount)

not given then you can calculate EPS (Net Income - - not a normal distribution but a skilled to the right

Preferred Dividends / Average Number of Common distribution (central tendency)

Shares Outstanding) - using median is more reliable

● Price to Book ratio (Stock Price / BVPS), if BVPS is

not given then you can calculate BVPS Common 3. Analytical Tests

Equity / Average Number of Common Shares - analyze why P/E ratios are high or low

Outstanding) - high P/E ratios = may be overvalued (can use the dividend

growth model as basis)

On average, the market is correct in pricing the stocks

3. Differences of a company to other similar companies

should be taken into consideration if it's significant. 4. Application Tests

- how are we going to use the P/E ratio as a multiple?

● compare with comparables - selection of comparable companies, most young

● control for differences companies are not publicly listed yet (use forward earnings

as an alternate)

How to control for differences?

1. Subjective Adjustments

- may lack objectivity

2. Modified Multiples

- using another multiple method

3. Statistical Techniques

Valuation Across The Life Cycle (Aswath Damodoran)

I. Young Companies

- refers to a company in the early stages of operations

● Idea companies

● Start-up companies

● Second-stage companies

Characteristics:

- absence of history

- little or zero revenues, operating losses

PV on year 5 @ 10% to reach the future value

- dependence on private equity (might not yet be publicly

listed)

II. Growth Companies

- high mortality rate (not expected to survive; will not become

- a company whose value that comes from assets that are

mature)

yet to be acquired rather than existing investments

- shares of stock lacks liquidity (founders may find it hard to

- any company whose business generates significant

sell stocks of the company due to lack of marketability)

positive cash flows or earnings, which increase at

significantly faster rates than the overall economy

Notable concerns in discounted cash flow techniques:

- organic growth rates

- we can’t predict cash flows due to absence of history

- company made effiecient decisions to grow their earnings

- we can not, most likely, calculate the beta (since young

- market measures (like P/E ratios but its not conclusive)

companies don’t have returns as it lacks history)

- most company’s value would come from the terminal value

Characteristics:

- dynamic financials (unstable, unpredictable growth)

Survivability’s two scenarios:

- high multiples

1. Probability of survival

- less debt (cash inflows are used for reinvestment)

2. Probability of bankruptcy

- short and shifting history

note: get the weighted average of the 2 probabilities to get a

rough estimate of a young company’s survivability

Notable concerns in discounted cash flow techniques:

- revenue grows initially at a faster pace before it converges

Notable concerns in relative valuation:

with the typical growth rate of mature companies

- the variable that will be scaled to (P/E ratio, P/B ratio)

- operating margin ratios need to be adjusted as the

company matures (to arrive in the free cash flows, operating

profits may not be sustainable)

- changing risk across time (discount rates are expected to

be different as required return also changes)

note: growth companies are riskier than matured companies

so discount rates in growth companies are higher

Notable concerns in relative valuation:

- should not use revenues multiples (as growth companies

may be incurring losses instead of profit or revenues don’t

translate to profit)

- forward earnings

- adjusting for growth

The First Chicago Method

- a valuation approach that uses both discounted cash flow

and relative valuation methods

- is generally used for start-up (young) or growth companies

- involves the development of three different scenarios, with

cash flows and an exit price (using a multiple)

- other inputs include required rate of returns and

probability of each scenario to happen

- expected value approach is used in arriving at the

business’ value

You might also like

- MB On PEDocument22 pagesMB On PEfinaarthikaNo ratings yet

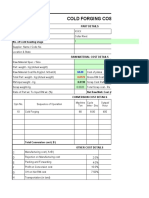

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- Chapter 11 Financial Statement AnalysisDocument3 pagesChapter 11 Financial Statement AnalysisgoerginamarquezNo ratings yet

- 250 High CPC Adsene Ad Network Lists-Technical24x7Document5 pages250 High CPC Adsene Ad Network Lists-Technical24x7Shubham Singh Mehra0% (1)

- Resumen FinancesDocument11 pagesResumen Financesfranchesca guillenNo ratings yet

- Financial Markets and Instruments 6Document33 pagesFinancial Markets and Instruments 6Zhichang ZhangNo ratings yet

- Absolute Vs Relative ValuationDocument3 pagesAbsolute Vs Relative ValuationLilliane EstrellaNo ratings yet

- Business 2 2023Document10 pagesBusiness 2 2023group0840No ratings yet

- Valcom D3Document4 pagesValcom D3Ivan Jay E. EsminoNo ratings yet

- Controllership REVIEWERDocument10 pagesControllership REVIEWERDanielle AndreiNo ratings yet

- Week 2 FINA2207Document31 pagesWeek 2 FINA2207blythe shengNo ratings yet

- Financial Ratios 4Document4 pagesFinancial Ratios 4Natasha Claire MangulabnanNo ratings yet

- Session 21 & 22 (CH 17,18,19 & 20 - RV)Document65 pagesSession 21 & 22 (CH 17,18,19 & 20 - RV)Arun KumarNo ratings yet

- Using Industry Average Multiples For ValuationDocument8 pagesUsing Industry Average Multiples For ValuationSaad AliNo ratings yet

- Valuation ModelsDocument22 pagesValuation Modelsshristy2026No ratings yet

- Chapter 14Document9 pagesChapter 14Kimberly LimNo ratings yet

- FIN-573 - Lecture 5 - Feb 18 2021Document41 pagesFIN-573 - Lecture 5 - Feb 18 2021Abdul BaigNo ratings yet

- 017 Strategy Chapter 9 Strategy Evaluation SlidesDocument32 pages017 Strategy Chapter 9 Strategy Evaluation SlidesNash AsanaNo ratings yet

- Chapter 8 Relative & Real Option Valuation BasicsDocument8 pagesChapter 8 Relative & Real Option Valuation Basics1954032027cucNo ratings yet

- Stock ValuationDocument7 pagesStock ValuationBrenner BolasocNo ratings yet

- Corporate Valuation Mod IDocument29 pagesCorporate Valuation Mod IRavichandran RamadassNo ratings yet

- Module 11-13 (April 26-27, 2023)Document10 pagesModule 11-13 (April 26-27, 2023)Paulo Emmanuel SantosNo ratings yet

- Proprietary Trading - Truth and FictionDocument3 pagesProprietary Trading - Truth and Fictionclmagnaye100% (4)

- 3 Company AnalysisDocument23 pages3 Company AnalysisRasesh ShahNo ratings yet

- Security ValuationDocument10 pagesSecurity ValuationShilpi GuptaNo ratings yet

- 2018 03 10 Screening Jaclyn McclellanDocument52 pages2018 03 10 Screening Jaclyn McclellanYudhi GendutNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- PrelimDocument8 pagesPrelimEllah MaeNo ratings yet

- Valuation Final ReviewerDocument43 pagesValuation Final ReviewercamilleNo ratings yet

- Technical Interview Questions - MenakaDocument15 pagesTechnical Interview Questions - Menakajohnathan_alexande_1No ratings yet

- CVP Analysis. Profit AnalysisDocument40 pagesCVP Analysis. Profit AnalysisCherry Mae Nillas CastilloNo ratings yet

- Equity AnalysisDocument6 pagesEquity AnalysisVarsha Sukhramani100% (1)

- AFM NotesDocument4 pagesAFM NotesPhotos Back up 2No ratings yet

- Financial Accounting and ReportingDocument10 pagesFinancial Accounting and ReportingHoneylyn V. ChavitNo ratings yet

- PrelimsDocument6 pagesPrelimsJanna Grace Dela CruzNo ratings yet

- Basic Long Term Financial ConceptsDocument8 pagesBasic Long Term Financial ConceptsJohnpaul FloranzaNo ratings yet

- Dividend Discount ModelDocument17 pagesDividend Discount ModelNirmal ShresthaNo ratings yet

- Presented by - Snibdhatambe, 11 Shreeti Daddha, 09 (Bvimsr)Document39 pagesPresented by - Snibdhatambe, 11 Shreeti Daddha, 09 (Bvimsr)Daddha ShreetiNo ratings yet

- Classification of Financial Ratios On The Basis of FunctionDocument8 pagesClassification of Financial Ratios On The Basis of FunctionRagav AnNo ratings yet

- 06 Econ 118 ValuationDocument19 pages06 Econ 118 ValuationPaul KimNo ratings yet

- Market-Based Valuation: Price MultiplesDocument47 pagesMarket-Based Valuation: Price MultiplesSuci Putri LNo ratings yet

- Gprmo 0003Document1 pageGprmo 0003ApNo ratings yet

- Interpretation of Fin StatementsDocument22 pagesInterpretation of Fin StatementstinashekuzangaNo ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- UntitledDocument12 pagesUntitledDanielle AndreiNo ratings yet

- READING 7 Dividend Discount Model (Equity Valuation)Document28 pagesREADING 7 Dividend Discount Model (Equity Valuation)DandyNo ratings yet

- Mauboussin Jan 2014Document22 pagesMauboussin Jan 2014clemloh100% (1)

- 4-Limitations of Valuation Models PDFDocument41 pages4-Limitations of Valuation Models PDFFlovgrNo ratings yet

- Stock ValuationDocument7 pagesStock ValuationYapKJNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisremmymariethaNo ratings yet

- Valuing Companies in M&A TransactionsDocument24 pagesValuing Companies in M&A TransactionsParth SunejaNo ratings yet

- Equity Vs EVDocument9 pagesEquity Vs EVSudipta ChatterjeeNo ratings yet

- Rosenbaum and Pearl Investment Banking Summary Chps 1 To 3Document18 pagesRosenbaum and Pearl Investment Banking Summary Chps 1 To 3sgyn6cb4thNo ratings yet

- Valuation Theory M& ADocument6 pagesValuation Theory M& AbharatNo ratings yet

- Reading Material-Relative ValuationDocument4 pagesReading Material-Relative ValuationDheia BinoyaNo ratings yet

- Valuation AcquisitionDocument4 pagesValuation AcquisitionKnt Nallasamy GounderNo ratings yet

- Valuations (For Students)Document31 pagesValuations (For Students)Luyanda MhlongoNo ratings yet

- Task 3 - Investment AppraisalDocument12 pagesTask 3 - Investment AppraisalYashmi BhanderiNo ratings yet

- Accounting Ratios: Which Could Be CalculatedDocument9 pagesAccounting Ratios: Which Could Be CalculatedBaher WilliamNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Control-M Agent InstallationDocument5 pagesControl-M Agent Installationrkruck100% (1)

- Study On Advertising Agency and Tourism Industry in NepalDocument5 pagesStudy On Advertising Agency and Tourism Industry in NepalSocial Science Journal for Advanced ResearchNo ratings yet

- 06.17.2021-2021-List of ClientDocument14 pages06.17.2021-2021-List of ClientAntonio NoblezaNo ratings yet

- Learnovate Ecommerce - Finance InternDocument9 pagesLearnovate Ecommerce - Finance Internyash kumar nayakNo ratings yet

- Mchpfsusb Library HelpDocument883 pagesMchpfsusb Library Helpgem1144aaNo ratings yet

- The Dow Chemical Company: Concrete Details Detail 101 Detail 101Document1 pageThe Dow Chemical Company: Concrete Details Detail 101 Detail 101Non Etabas GadnatamNo ratings yet

- Reserve Bank of IndiaDocument10 pagesReserve Bank of IndiasardeepanwitaNo ratings yet

- Annapurna ReportDocument31 pagesAnnapurna ReportPritish KumarNo ratings yet

- Beximco Textile LimitedDocument102 pagesBeximco Textile LimitedFahim100% (1)

- State Bank of India - Parivartan: Case StudyDocument4 pagesState Bank of India - Parivartan: Case StudyKunal BagdeNo ratings yet

- Canadian Business and Society Ethics Responsibilities and Sustainability Canadian 4th Edition Sexty Test BankDocument36 pagesCanadian Business and Society Ethics Responsibilities and Sustainability Canadian 4th Edition Sexty Test Banksyntaxmutuary.urqn100% (32)

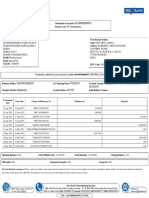

- Account Statement Last 10 TransactionsDocument2 pagesAccount Statement Last 10 TransactionsAshish kumarNo ratings yet

- IGCSE & OL Accounting Worksheets AnswersDocument53 pagesIGCSE & OL Accounting Worksheets Answerssana.ibrahimNo ratings yet

- DBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Document4 pagesDBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Isana SatishNo ratings yet

- Concrete Construction Practical Problems and Solutions Akhtar H. Surahyo 9780195797770 Amazon - Com Books PDFDocument3 pagesConcrete Construction Practical Problems and Solutions Akhtar H. Surahyo 9780195797770 Amazon - Com Books PDFJiabin LiNo ratings yet

- Scaling Your Business For Success: Overnight Successes Are Not Always "Overnight"Document6 pagesScaling Your Business For Success: Overnight Successes Are Not Always "Overnight"Invoice Out 2No ratings yet

- Application Form - 88Document2 pagesApplication Form - 88vanessanaobuNo ratings yet

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaNo ratings yet

- DIGEST-5. Bank of America v. American Realty Corp.Document3 pagesDIGEST-5. Bank of America v. American Realty Corp.Karl EstavillaNo ratings yet

- 86 Inches Quotation For SmartboardDocument1 page86 Inches Quotation For SmartboardJohnson OnuigboNo ratings yet

- Media LiteracyDocument28 pagesMedia LiteracyMa. Shantel CamposanoNo ratings yet

- R Ates For Hiring Auditorium / Lecture Hall of The Convention CentreDocument2 pagesR Ates For Hiring Auditorium / Lecture Hall of The Convention CentreRaj ChouhanNo ratings yet

- Activity Template - Risk Management PlanDocument3 pagesActivity Template - Risk Management PlanSyeda AmeenaNo ratings yet

- Gay7e Irm Ch04Document18 pagesGay7e Irm Ch04Thùy Linh Lê ThịNo ratings yet

- Verdejo VDocument15 pagesVerdejo VCleinJonTiuNo ratings yet

- Industrial Growth in India PDFDocument66 pagesIndustrial Growth in India PDFatipriya choudhary100% (2)

- Tess Zero Accident Program For ZAP Conf 09Document29 pagesTess Zero Accident Program For ZAP Conf 09Armin GomezNo ratings yet

- Oracle Financials Functional Foundation Release 11 Volume 1 Instructor GuideDocument274 pagesOracle Financials Functional Foundation Release 11 Volume 1 Instructor GuideSrinivas GirnalaNo ratings yet