Professional Documents

Culture Documents

Book Summary - BSP - CA Ravi Mamodiya

Book Summary - BSP - CA Ravi Mamodiya

Uploaded by

miOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book Summary - BSP - CA Ravi Mamodiya

Book Summary - BSP - CA Ravi Mamodiya

Uploaded by

miCopyright:

Available Formats

Email Id: caravimamodiya@gmail.

com; Mobile No: +91-9828091785

About the Book

● This book talks about the approach to initiate succession planning in the business at an

early stage and help the business grow from generation to generation and maintain the

successful stage.

● It is aimed to assist the Professionals as well as the Business owners to understand the

criticality of succession planning and how to create the strategies for better business

continuity planning.

● This book has been prepared for easy understanding of the succession strategies and

step wise approach to understand the implementation of succession. To cater the most

complicated question about when & how to start planning for succession, the book is

divided into a 5 step approach which makes things easier to implement even for a

non-expert. It also contains the Checklists and Practical case studies to understand the

practical aspects to it. It also gives the basic Human Resource planning approach and

assessment tools.

● This book at the last of its part discusses Estate planning which includes The Indian

Succession Act, Hindu Succession Act, Shariat law, Private Trust and its laws, also

include the applicability of Income Tax Act in different situations. Creation of Hindu

Undivided family and taxation has also been incorporated in this part only. All the

relevant law has been explained with practical case studies for better understanding.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Book Structure

● The book has Eight Parts.

● The first Part provide the base of succession along with the kinds of succession planning

and way to understand the same. This part also consists of the myths and reality about

succession, challenges in the family business management and Lifecycle of the business.

● The second part talks about the Guiding principles and Strategies to handle succession

planning along with the approach to pursue the same. In this part the most important

● topic is 5 step approach to handle the succession and wheel of succession to plan,

manage and see the expectation of the same.

● Part three consist of the Vision of the owner which is the 1st step of the five step

approach. In this part the business owner/professional will take the clarity about the

Vision of the business internally as well as externally and create a better visualization of

the business for long term along with the benefits to all the stake holders.

● The fourth Part talks about the purpose and creation of the Family Constitution. This

part also deals in making the better understanding of the family council, creation of the

constitution, family Fund, Family board creation and their regular meetings. In this part

we have also talked about the tools for family governances.

● The fifth Part focuses on the alignment of the family vision with business and creating a

better bridge so that the values of the family can remain intact along with the growth of

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

the family business. The contingency planning is on important pat of this succession

journey which has been dealt in this part.

● The next part talks on the identification of the successor along with the grooming of the

successor. This consist of the HR strategies along with the readily available tools which

will help to make it happen. This also talks about the Assessment, Management and

Grooming of the successor.

● In the seventh part this book explains about the estate planning and applicability of the

different laws like, Indian Succession Act, Hindu Succession Act, Creation of Private

Trust and its structuring, along with the Income Tax Act and its provision applicable in

different situation. And at the end it is Checklist and formates

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

About the Author:

CA Ravi Mamodiya

Mr. Ravi Mamodiya is a fellow member of the Institute of

Chartered Accountants of India of 2011 Batch and did his

post-graduation form Rajasthan University. Currently he

is a managing Partner of M/s A R Mamodiya & Co.,

Chartered Accountant, Jaipur. In his long career with

Hindustan Zinc, Ernst & Young and later working closely

with many SMEs, he specialized in turnarounds by

providing ground-level solutions.

Through his unorthodox career, he has challenged and transformed the way organizations plan

the organization’s continuity. As you observe him communicate his view on the business

growth, Ravi has earned a reputation for straight talk, logical explanations and effective

organization design.

His book covers all the essential features of business successions. It is an output of interviews

with many prominent lawyers, consultants and business owners across the country. The book is

a result of his observations and learning about business succession, the business ecosystem, and

understanding the importance of creating awareness for a void that is succession beyond

success.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

BOOK SUMMARY

The term “succession” is either unknown or avoided by many people in business. Why? It

probably means that the business will have to run without them someday. It reminds you

of the fact that ”death” is inevitable. So, how do you ensure that your company is in the

best hands after your retirement or demise? The answer lies in succession planning.

Like a human life cycle, most business owners fail to understand a business life cycle. It

begins with the conception/ideation stage and ends with the exit or retirement phase.

Business owners make the most common mistake by not planning for the exit phase.

They have certain reservations about the entire process because it seems unnecessary

or not meant for them.

Here are the myths and facts around succession planning:

Sr. No. Myths Facts

1) It is meant only for rich It is essential for all

2) It should be thought of only in Life is quite unpredictable and hence, the

old age earlier you plan, the better it is.

3) It is about retirement, and I’m The owner’s retirement is an eventual

not ready to retire component, but more important is the

development of a timeline, identification

of the key successors, the role

development of those successors, and

how to finance the transition.

4) My legal heirs will handle it It is good to hope that they do, but

unfortunately, many disputes often

happen over money in today's world

5) I have registered my The nominee may not always be the

nominee(s) and they will be the owner of the assets. The owner will be the

beneficiaries of my assets legal heir as per a Will and in absence of a

Will, the transmission of assets happens

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

as per the succession laws

6) I don't need to seek a There is nothing wrong with seeking a

professional opinion professional opinion. Just like a doctor is

an expert in his, they can guide you to

ensure that estate and succession

planning is done legitimately considering

the nitty-gritty involved.

7) Giving up ownership means It is a long term process of 5-10 years.

giving up control and income Having a succession plan and preparing

will ensure you and your key stakeholders

(employees, clients, family, etc.) enjoy the

process and get the most value out of the

experience.

8) My Family will be integrated Unfortunately, change is constant in

even after my death everyone’s life and dynamics between

families are bound to change after the

death of the family leader.

9) Equal Distribution of Family If all successors are not actively involved

business wealth is fair in the business then an equal division will

not be considered right.

10) The business being taken over Only post-viewing the strengths and

by children will ensure success weaknesses of both the individual taking

over as well as that of the organisation,

one should decide how and what needs

to be passed on to the younger

generation.

11) A succession plan is as simple A will comes into effect primarily after the

as putting together a will death of the testator. While succession

planning helps in deciding what happens

to a person’s property, investments, and

business when the circumstance in life

changes.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Experts agree that succession planning should begin 10-15 years before retirement. Even

if you believe you will never retire, a succession plan is necessary in case of a

contingency. You can consider succession planning as a life insurance plan for your

business.

Succession planning at the individual, family and business levels include:

● Strategic Planning,

● Continuity Planning

● Human Resources Planning

● Financial Planning,

● Estate Planning, and

● Exit Planning

What does family succession planning include?

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

This form of succession planning includes five steps in detail are :

1. Vision

Do you have clarity over your passion, purpose and why?

2. Family Constitution

Does the next generation wish to own and/or operate the business?

3. Aligning the business & family strategies

Does the company’s strategic plan support the family’s vision and values and vice versa?

4. Identifying & Preparing successors and Leadership transition

Which family members will enter the business?

5. Estate Planning

Who will run the business?

What does business succession planning include?

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

What does Business Succession Planning include?

1. Vision

Are you clear about the direction you want internally within the organization and

where you want to head externally?

2. Identifying & Preparing Successors for Leadership

Do you want to hand over your business to someone known or to an outsider?

3. Estate Planning

Who will run the business, and how will you ease the transition?

These questions are a checklist of things to consider before the transition begins.

However, how do you know when you have succeeded in the succession

process? It starts with the wheel of succession.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Wheel of Succession

The Wheel of Succession which is based on the five points elaborated earlier

Before beginning to implement the succession planning process, you need to

know where you currently stand and which direction you need to go. The Wheel

of Succession is an important tool that clarifies these aspects and provides the

starting point of succession.

In the wheel of succession, the circle’s centre starts with “0%”, and the outermost

circle leads to ‘100%’. This circle is divided into different steps/areas for

succession. Take one area at a time, rate yourself from “0 to 100” and see where

you stand in that area.

The wheel below is like the wheel of a car. If some steps remain incomplete, it

wouldn’t form a tyre and your business car would not run. To ensure business

continuity planning, it’s crucial to take the ride in each area from “0 to 100” and

complete the wheel of succession.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Steps for Succession Planning

Once you’re aware of your position, it’s time to put the succession plan in action. This

5-step journey begins with defining the vision and creating a business plan.

(I) The owner’s vision

This step includes defining the following aspects of the business:

1. Vision

2. Mission

3. Goals

4. The ‘Why’

5. Passion

6. Purpose

7. GPS

8. Clarity, Focus & Results

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

(II) Family Constitution

More than 90% of the businesses in India are family-owned. Many of them do not remain

together beyond three generations.

Just as the Indian Constitution lays down the framework that demarcates fundamental

political code, structure, procedures, and duties of government institutions, the Family

Constitution is the framework of governance that perpetuates the growth of the family

business across multiple generations. It enumerates the purpose, core values and goals

of the family and the business.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Creating a family constitution requires following a step-by-step approach to ensure you

do not miss out on the important details. It necessitates the presence of an internal driver

or champion who passionately leads the process. The steps below can be considered a

checklist that provides much-needed clarity to the members involved in the process.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

(III) Business and Family Alignment

This step is guided by the Three Circle Model (outlined below) which illustrates the

interaction/impact of the family component on the management and ownership of family

businesses. This model determines the interaction and how all three circles meet in the

middle. It includes the following:

The Management circle: It represents the interaction/impact that the management has

on the family and the ownership of the business.

The family circle: This circle determines the interaction/impact that the family has on the

management and ownership of the business.

The ownership circle: This is similar to the management circle and represents the

interaction/impact that the owners have on the family and management of the business.

(IV) Successor Identification and Grooming

Leaders must develop future visions and motivate the organizational members achieve

them. They need to induce their members with confidence and zeal. A classic example of

true leadership can be found in the pages of the Ramayana.

Lord Rama was known for his ability to lead by example and groom many leaders.

However, even after being chosen as the king of Ayodhya, he patiently left kingship for

14 years. He showed true leadership by taking the kingdom towards better growth and

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

success of the people. This is represented through the three-step model as illustrated

below:

Assessment” uses instruments and measures by the individual, co-workers, supervisors,

and subordinates for better clarity of the individual’s and others’ perceptions of their

strengths and weaknesses.

Once the assessment is complete, “management” calls for the organization or individual

to create developmental experiences that provide opportunities to learn and apply the

new skills identified in the assessment phase.

The final phase, “grooming,” requires the individual’s organization, supervisor, and

colleagues to provide the tools, resources, and time necessary to devote to the

developmental experiences.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

(V) Ownership Transfer and estate planning

Estate Planning and Succession Planning are often used interchangeably. While

succession planning focuses on the smooth transition of business and management to

the next generation, Estate Planning ensures tax and regulatory efficient generational

transfer of business and wealth ownership

The two types typically include:

1. Intestate succession – one without a will; or

2. Testamentary succession – one with a will

In cases where there is No Will, i.e. Intestate or Non - Testamentary Succession, The

Hindu Succession Act, 1956 prescribes the rules relating to succession applicable to

Hindus, Sikhs, Buddhists, Jains and related communities. It extends to the majority of the

Indians. The Shariat law applies to Muslims specifically for succession within their family.

Then follows the Indian Succession Act 1925 which applies to Christians and other

persons not covered by the Hindu Succession Act 1956 and the Shariat Law.

Consequently, where there is a Will, i.e. Testamentary Succession, The Indian Succession

Act 1925 applies to Hindus, Sikhs, Buddhists, Jains, Christians, Parsis, etc. Again, the

Shariat Law is distinct here for Muslims.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Similar to the taboo behind succession planning, a likewise trend is evident with drafting

a will. It is often considered a document that should be discussed only after a certain old

age. Furthermore, the mechanics to draft the same is rooted in this belief and used as a

reason not to draft a will. Some of the myths and facts around this are listed below:

Myths Reality

A Will must be drafted on a Stamp It can be handwritten on a Plain Paper

Paper

There is a Legal Format for a Will There is No Legal Format

A Will once made cannot be changed A Will can be changed any number of

or altered times

A Will effective during a person’s Will takes effect only after a person’s

lifetime death

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Will cannot exclude near relatives Can bequeath everything to Charity/

Servants/Friends excluding the spouse,

kids, etc.

Does not require to be Dated Last Will prevails. Hence, specifying a

date is mandatory.

Nomination prevails over Will Will prevails over the nomination

Married Women cannot make Wills All Women can make Wills

No Witnesses are Required At Least Two Witnesses are required

Additionally, estate planning through the settlement of a Private Trust is a relatively

feasible alternative to address the shortcomings of a Will. It enables a transition of assets

for intended beneficiaries with adequate checks and balances. Further the said Trust is

typically registered with the Registrar and Assurance Department of State.

Unlike a Will, Trust registration does not require a probate process, thereby leaving no

room for dispute with any aggrieved party. However, the creation of Trust under the

current scenario needs careful evaluation to avoid unintended tax and regulatory

implications.

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

To conclude:

The fastest way to kill a business is through a lack of succession planning. The

company that began as your dream deserves to continue for generations.

However, that is possible only by planning ahead of time.

If you’re wondering, “where do I begin?” the answer is by acknowledging the

need for succession planning and acting on it. This book, Succession Beyond

Success, is a guiding light or a blueprint for you, a business owner, to continue

your legacy. It answers the most common question about this process and leads

you on the path to success.

Keep Reading, Keep Learning, Keep Sharing!!!

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

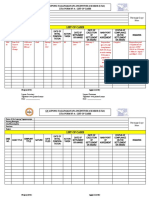

CHECKLISTS

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

Email Id: caravimamodiya@gmail.com; Mobile No: +91-9828091785

You might also like

- Family Constitution, Borne Family of LG Investments, LLC.Document14 pagesFamily Constitution, Borne Family of LG Investments, LLC.MinakshiMangalNo ratings yet

- The Private Equity Playbook: Management’s Guide to Working With Private EquityFrom EverandThe Private Equity Playbook: Management’s Guide to Working With Private EquityRating: 3.5 out of 5 stars3.5/5 (13)

- Ethics For Amador PDFDocument2 pagesEthics For Amador PDFPatrick0% (3)

- Organizational Case StudyDocument39 pagesOrganizational Case StudyHelen Grace Avila0% (1)

- KPMG - Family Business Succession PlanningDocument76 pagesKPMG - Family Business Succession PlanningEquicapita Income TrustNo ratings yet

- Family Business Agreement V1.0Document13 pagesFamily Business Agreement V1.0mohammed waliullah siddiqui100% (2)

- Building Your LegacyDocument8 pagesBuilding Your LegacyJesse CarmichaelNo ratings yet

- 2ed Fambiz - Basics 01Document9 pages2ed Fambiz - Basics 01Johannes Kevin FortunaNo ratings yet

- 7 - Family BusinessDocument15 pages7 - Family BusinessagkovfcwhafuwksdzaNo ratings yet

- Enter NshipDocument26 pagesEnter NshipTushar SatheNo ratings yet

- EditedDocument11 pagesEditedAniket ChatterjeeNo ratings yet

- 9 Must Qualities For EverybodyDocument37 pages9 Must Qualities For Everybodysheelkumar_pal429No ratings yet

- EntrepreneurshipDocument11 pagesEntrepreneurshipjanerodadoNo ratings yet

- Family Business Quarter 2 Week 14 Expectations: Functional Areas of ManagementDocument4 pagesFamily Business Quarter 2 Week 14 Expectations: Functional Areas of ManagementRemar Jhon PaineNo ratings yet

- The Business of a Successful Marriage: Treating Your Marriage Like a BusinessFrom EverandThe Business of a Successful Marriage: Treating Your Marriage Like a BusinessNo ratings yet

- Family Business 2.0Document9 pagesFamily Business 2.0Saddam HussainNo ratings yet

- Entrepreneurial Family Business: and Succession ManagementDocument31 pagesEntrepreneurial Family Business: and Succession ManagementRejean MagbanuaNo ratings yet

- Family Business TransitionsDocument7 pagesFamily Business TransitionsSudhakar BhushanNo ratings yet

- Build It and the Money Will Come: Master The 5 Secrets to a Successful Building and Property Development BusinessFrom EverandBuild It and the Money Will Come: Master The 5 Secrets to a Successful Building and Property Development BusinessNo ratings yet

- A Critical Analysis of Succession Planning in Selected Family Based Enterprises in IndiaDocument30 pagesA Critical Analysis of Succession Planning in Selected Family Based Enterprises in IndiaKavan HkNo ratings yet

- Unit 2: Forms of Entrepreneurship 2.1 Family Business EntrepreneurshipDocument24 pagesUnit 2: Forms of Entrepreneurship 2.1 Family Business EntrepreneurshipAnonymous 0zM5ZzZXCNo ratings yet

- Q4 - Objection - Scripts For Insurance SalesDocument100 pagesQ4 - Objection - Scripts For Insurance SalesSanthy Subra100% (2)

- EppDocument6 pagesEppReeya MehtaNo ratings yet

- Dr. Adukia - Entrepreneurship - Key To Eternal Happiness of SocietyDocument180 pagesDr. Adukia - Entrepreneurship - Key To Eternal Happiness of Society5k SUBSCRIBERS With 0 VideosNo ratings yet

- ACC Newsline Wrapper Aug Issue Version 3 - RemovedDocument21 pagesACC Newsline Wrapper Aug Issue Version 3 - RemovedpadmaniaNo ratings yet

- Professor InterviewDocument6 pagesProfessor Interviewchintan1806No ratings yet

- Family BusinessDocument18 pagesFamily BusinessMutum Amarjeet100% (1)

- Ede Chapter 1 PDFDocument25 pagesEde Chapter 1 PDFKunal AhiwaleNo ratings yet

- Task and SolutionDocument8 pagesTask and Solutionammad ahmadNo ratings yet

- Entrepreneurship Skills.Document5 pagesEntrepreneurship Skills.Cheelo Maitwa MaitwaNo ratings yet

- Presentation FOR Viva: Jaiprakash SenDocument48 pagesPresentation FOR Viva: Jaiprakash SenJaiNo ratings yet

- Preface: What Is Financial Intelligence?Document4 pagesPreface: What Is Financial Intelligence?Iuliana GondosNo ratings yet

- TII Estate Planning (Fresh) - FarmersDocument24 pagesTII Estate Planning (Fresh) - FarmerspriscillajacobNo ratings yet

- 30 Family Business TruthsDocument8 pages30 Family Business TruthshardikNo ratings yet

- Engineering MGT 3 - Business - Lecture Notes - FINAL (5) - 1Document49 pagesEngineering MGT 3 - Business - Lecture Notes - FINAL (5) - 1nyanzi arthur victor wNo ratings yet

- Go Start Up: Your Best Guide to Unlocking the Values and Culture of SuccessFrom EverandGo Start Up: Your Best Guide to Unlocking the Values and Culture of SuccessNo ratings yet

- DR Sanjay S Q4 Objection Script - EbookDocument108 pagesDR Sanjay S Q4 Objection Script - Ebookjw lau100% (1)

- JIN's News 7 March 2012Document7 pagesJIN's News 7 March 2012bensunriseNo ratings yet

- Family Business SuccessionDocument76 pagesFamily Business SuccessionJesse Carmichael80% (5)

- LESSON 1 - ManagementDocument10 pagesLESSON 1 - ManagementalyricsNo ratings yet

- Entrepreneurial Skills The Skills You Need To Build A Great BusinessDocument9 pagesEntrepreneurial Skills The Skills You Need To Build A Great BusinessKapsogut Boys High SchoolNo ratings yet

- Interview Questions.Document39 pagesInterview Questions.sagar meshramNo ratings yet

- 7AC002 Accounting and Finance - Cohort 12 - Session Day 1 - 17th July 2017 - CochinDocument31 pages7AC002 Accounting and Finance - Cohort 12 - Session Day 1 - 17th July 2017 - Cochinعبد الجبارNo ratings yet

- Plans Are Useless, But Planning Is IndispensableDocument14 pagesPlans Are Useless, But Planning Is IndispensableSoorajKrishnanNo ratings yet

- QuickStartGuide RookieReadiness Interior D1 FinalDocument20 pagesQuickStartGuide RookieReadiness Interior D1 FinalHansipansiNo ratings yet

- WE SCHOOL - 1st Year ProjectDocument49 pagesWE SCHOOL - 1st Year ProjectPradip KumbharNo ratings yet

- Siddharth VivaDocument49 pagesSiddharth Vivamerugu manojNo ratings yet

- Management Articles: Business, Finance and ManagementDocument6 pagesManagement Articles: Business, Finance and ManagementSivasankaran KannanNo ratings yet

- Bryfry Entrep Guide MweheheDocument2 pagesBryfry Entrep Guide MweheheAlthea RaymundoNo ratings yet

- Family Business - EntrepreneurshipDocument16 pagesFamily Business - EntrepreneurshipHitesh JoshiNo ratings yet

- HR ManagementDocument11 pagesHR ManagementJayan PrajapatiNo ratings yet

- MBA ProjectDocument34 pagesMBA ProjectSayali kharatNo ratings yet

- StrategicDocument12 pagesStrategic1812.smriteesah.ia.21.24No ratings yet

- Creating A $40 Million Company Based On Dispersion ModellingDocument5 pagesCreating A $40 Million Company Based On Dispersion ModellingArcangelo Di TanoNo ratings yet

- 4b4ca7f0280a3 FAMILY BUSINESS LEADERSHIPDocument6 pages4b4ca7f0280a3 FAMILY BUSINESS LEADERSHIPBeatrice GramaNo ratings yet

- Family Business Article For Skit Week 5Document10 pagesFamily Business Article For Skit Week 5Elena SanduNo ratings yet

- MS Single Family Office Best Practices ReportDocument72 pagesMS Single Family Office Best Practices ReportFrancis MejiaNo ratings yet

- Succession Plan: Succession Planning Is A Process For Identifying and Developing Internal Personnel With TheDocument4 pagesSuccession Plan: Succession Planning Is A Process For Identifying and Developing Internal Personnel With TheKishore KunalNo ratings yet

- Companies That Do Capital Allocation RightDocument13 pagesCompanies That Do Capital Allocation Rightborjain_276249278No ratings yet

- Final Exam AnswersDocument8 pagesFinal Exam AnswersLance Eleazar BersalesNo ratings yet

- Bequilla, Jey Ann A., Et Al.Document2 pagesBequilla, Jey Ann A., Et Al.Kwin KonicNo ratings yet

- Virginia Laws Effective Jan 1Document7 pagesVirginia Laws Effective Jan 1ABC7News100% (3)

- Data Sharing Agreement: BackgroundDocument3 pagesData Sharing Agreement: BackgroundAttalah MohamedNo ratings yet

- .. NHRC Bangladesh .Document3 pages.. NHRC Bangladesh .Siddhartha BaraiNo ratings yet

- SPOUSES FORTUNA v. REPUBLIC OF THE PHILIPPINES (G.R. No. 173423, March 05, 2014)Document2 pagesSPOUSES FORTUNA v. REPUBLIC OF THE PHILIPPINES (G.R. No. 173423, March 05, 2014)HazelNo ratings yet

- Housing and Land Use Regulatory Board: BatasDocument4 pagesHousing and Land Use Regulatory Board: BatasGwen TemporosaNo ratings yet

- A Critical Analysis of Section 2 (C) (I) of The Contempt of Courts Act 1971Document6 pagesA Critical Analysis of Section 2 (C) (I) of The Contempt of Courts Act 1971Nameeta PathakNo ratings yet

- Legal Rights and Obligations To A CorpseDocument6 pagesLegal Rights and Obligations To A CorpseSyed HassanNo ratings yet

- Casemine Judgment 89996Document3 pagesCasemine Judgment 89996Imbisaat LiyaqatNo ratings yet

- Jaswant Singh VSDocument2 pagesJaswant Singh VSAnant SinghNo ratings yet

- Tribunal Arbitral Du Sport Court of Arbitration For SportDocument26 pagesTribunal Arbitral Du Sport Court of Arbitration For Sportsantiago palaciosNo ratings yet

- GFPSDocument19 pagesGFPSEppie PalanasNo ratings yet

- 2007 S C M R 1446Document7 pages2007 S C M R 1446m. Hashim IqbalNo ratings yet

- Cases Amparo and Habeas DataDocument4 pagesCases Amparo and Habeas DataDave Jonathan MorenteNo ratings yet

- Article 352Document7 pagesArticle 352sai kiran gudisevaNo ratings yet

- Appointment Obtained by Fraud Is Void Ab Initio (2021)Document11 pagesAppointment Obtained by Fraud Is Void Ab Initio (2021)Divyanshu SinghNo ratings yet

- Motion For Partial Reconsideration - March 4, 2022Document42 pagesMotion For Partial Reconsideration - March 4, 2022VERA FilesNo ratings yet

- Film Development Council of The Philippines vs. Colon Heritage Realty Corporation, G.R. No. 204418, 15Document7 pagesFilm Development Council of The Philippines vs. Colon Heritage Realty Corporation, G.R. No. 204418, 15Sergio ConjugalNo ratings yet

- The "Ivanovo" (2000) 1 SLR (R) 263 (2000) SGHC 22Document12 pagesThe "Ivanovo" (2000) 1 SLR (R) 263 (2000) SGHC 22SiddharthNo ratings yet

- Tort Project of Jatin MeenaDocument24 pagesTort Project of Jatin MeenaJatin MeenaNo ratings yet

- United Nations and Global ConflictsDocument6 pagesUnited Nations and Global ConflictsTanica NgangbamNo ratings yet

- UN Security Council-6Document10 pagesUN Security Council-6sikander ranaNo ratings yet

- Personal Non-Disclosure AgreementDocument1 pagePersonal Non-Disclosure AgreementYouth ZoomNo ratings yet

- Law of Torts Sem IiDocument14 pagesLaw of Torts Sem IiRishabh BhandariNo ratings yet

- Civil Code of The Philippines:: Section 6, Obligations With A Penal ClauseDocument2 pagesCivil Code of The Philippines:: Section 6, Obligations With A Penal ClauseAnastasha GreyNo ratings yet

- s00-001 Index of Drawings 1Document1 pages00-001 Index of Drawings 1Sereyponleu KhunNo ratings yet

- Jurisprudence Course OutlineDocument12 pagesJurisprudence Course OutlineSHIVAM BHATTACHARYANo ratings yet

- APA Letter From Carolyn SharetteDocument2 pagesAPA Letter From Carolyn SharetteJennifer WeaverNo ratings yet

- FORM 7 A List of CasesDocument2 pagesFORM 7 A List of CasesGianNo ratings yet