Professional Documents

Culture Documents

JAC 12th Accounts Syllabus 2024

JAC 12th Accounts Syllabus 2024

Uploaded by

ap82046760 ratings0% found this document useful (0 votes)

18 views6 pagesThis document outlines the syllabus for Class 12 Accounting for the academic year 2023-24. It includes:

1. Topics to be covered each month from June to September including chapters on partnerships, partnership reconstitution, dissolution, and companies.

2. Learning outcomes for each topic - students will develop skills in accounting for partnerships, understand partnership agreements and adjustments, and learn about company share capital.

3. A breakdown of subtopics, chapters, time periods, and learning objectives for each topic area. The syllabus aims to build students' conceptual understanding and accounting skills.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the syllabus for Class 12 Accounting for the academic year 2023-24. It includes:

1. Topics to be covered each month from June to September including chapters on partnerships, partnership reconstitution, dissolution, and companies.

2. Learning outcomes for each topic - students will develop skills in accounting for partnerships, understand partnership agreements and adjustments, and learn about company share capital.

3. A breakdown of subtopics, chapters, time periods, and learning objectives for each topic area. The syllabus aims to build students' conceptual understanding and accounting skills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views6 pagesJAC 12th Accounts Syllabus 2024

JAC 12th Accounts Syllabus 2024

Uploaded by

ap8204676This document outlines the syllabus for Class 12 Accounting for the academic year 2023-24. It includes:

1. Topics to be covered each month from June to September including chapters on partnerships, partnership reconstitution, dissolution, and companies.

2. Learning outcomes for each topic - students will develop skills in accounting for partnerships, understand partnership agreements and adjustments, and learn about company share capital.

3. A breakdown of subtopics, chapters, time periods, and learning objectives for each topic area. The syllabus aims to build students' conceptual understanding and accounting skills.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

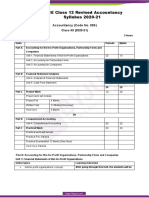

सा ािहक िव े िदत पा म 2023-24

CLASS - 12 SUBJECT - ACCOUNTS

Name of Peri Learning Outcomes

Month Week Subtopic of Chapter

Chapter od

1.1 Nature of Partnership 2 After going through this Unit, the students will be able to:

1.2 Partnership Deed 2 ● Capable to understand and explain the meaning of

2nd(6days) partnership, partnership firm and their features.

1.3 Special Aspects of

2 ● describe the meaning and need of partnership deed and its

Partnership Accounts

contents

1.4 Maintenance of Capital ● Capable to explain the significance of provision of

2

Chapter 1 Accounts of Partners Partnership Act in the absence of partnership deed.

3rd(5days) Accounting 1.5 Distribution of Profit ● Capable of making the difference between charge and

for 3

June among Partners appropriation.

Partnership : ● differentiate between fixed and fluctuating capital, outline

1.6 Guarantee of Profit to a

Basic 2 the process and develop the understanding and skill of

4th(5days) Partner

Concepts preparation of Profit and Loss Appropriation Account.

1.7 Past Adjustments 3 ● develop the understanding and skill of preparation profit

and loss appropriation account.

● develop the understanding and skill of making past

5th(3days) 3 adjustments.

1.8 Final Accounts

2.1 Modes of Reconstitution of ● state the meaning, nature and factors affecting goodwill

1st(1day) 1

a Partnership Firm ● develop the understanding and skill of valuation of goodwill

2.2 Admission of a New using different methods.

1 ● state the meaning of sacrificing ratio, gaining ratio and the

Partner

2nd(6days) change in profit sharing ratio among existing partners.

2.3 New Profit Sharing Ratio 3

● capable to calculate new profit sharing ratio and sacrificing

2.4 Sacrificing Ratio 2 ratio

3rd(5days) Chapter 2 2.5 Goodwill 5 ● develop the understanding of accounting treatment of

l ti f t d t f li biliti d

p

2.6 Adjustment for revaluation of assets and reassessment of liabilities and

Reconstitutio Accumulated Profits and 3 treatment of reserves and accumulated profits .

4th(6days) n of a Losses ● explain the effect of change in profit sharing ratio on

July Partnership 2.7 Revaluation of Assets and admission of a new partner.

Firm – 3 ● develop the understanding and skill of treatment of

Reassessment of Liabilities

Admission goodwill as per AS-26,

5th(5days) 108 of a 2.8 Adjustment of Capitals 5 ● Develop the skill of treatment of revaluation of assets and

Partner reassessment of liabilities

● Capable to explain and need to treatment of reserves and

accumulated profits,

● Explain adjustment of capital accounts on the basis of new

6th(1days) 1 partners capital or new ratio and preparation of balance sheet

of the new firm.

2.9 Change in Profit Sharing

Ratio among the Existing

Partners

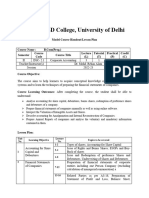

3.1 Ascertaining the Amount ● explain the effect of retirement / death of a partner on

Due to Retiring/Deceased 3 change in profit sharing ratio.

1st(5days Partner ● develop the understanding of accounting treatment of

3.2 New Profit Sharing Ratio 2 goodwill, revaluation of assets and re-assessment of liabilities

and adjustment of accumulated profits and reserves on

3.3 Gaining Ratio 2

2nd(5days) Chapter 3 retirement / death of a partner and capital adjustment.

3.4 Treatment of Goodwill 3 ● develop the skill of calculation of deceased partner's share

Reconstitutio 3.5 Adjustment for till the time of his death

n of a Revaluation of Assets and 2 and prepare deceased partner's executor's account.

Aug Partnership Liabilities ● discuss the preparation of the capital accounts of the

3rd(4days) Firm – remaining partners

3.6 Adjustment of

Retirement/ Accumulated Profits and 2 and the balance sheet of the firm after retirement / death of a

Death of a Losses partner.

Partner

3.7 Disposal of Amount Due to

2

Retiring Partner

4th(6days)

3.8 Adjustment of Partners’

4

Capitals

5th(3days) 3.9 Death of a Partner 3

4.1 Dissolution of Partnership 1 you will be able to :

1st(2days) • State the meaning of dissolution of partnership firm;

4.2 Dissolution of a Firm 1

• Differentiate between dissolution of partnership and

2nd(4days) 4.3 Settlement of Accounts 4

Chapter 4 dissolution of a partnership firm;

Dissolution

of • Describe the various modes of dissolution of the partnership

Partnership firm;

3rd(5days) Firm 5 • Explain the rules relating to the settlement of claims among

all partners

Sep

; • Prepare Realisation Account;

4.4 Accounting Treatment

1.1 Features of a Company 2 After studying this chapter, students will be able to :

4th(4days) Part B • explain the basic nature of a joint stock company as a form

Chapter 1 1.2 Kinds of Companies 2

Accounting of business organisation and the various kinds of companies

1.3 Share Capital of a Company 1

based on liability of their members;

5th(3days) for Share 1.4 Nature and Classes of • describe the types of shares issued by a company

Capital 2

Shares ; • explain the accounting treatment of shares issued at par, at

1st(5days) 1.5 Issue of Shares 5 premium and at discount including oversubsription;

2nd(5days 1.6 Accounting Treatment 5 • outline the accounting for forfeiture of shares and reissue of

Chapter 1 forfeited shares under varying situations;

Accounting • workout the amounts to be transferred to capital reserve

3rd(5days) for Share 5 when forfeited shares are reissued; and prepare share

Capital forfeited account ;

1.7 Forfeiture of Shares

2.1 Meaning of Debentures 1 After studying this chapter students will be able to :

Oct 2.2 Distinction between Shares • state the meaning of debenture and explain the difference

4th(3days) 1 between debentures and shares;

Chapter 2 and Debentures

• describe various types of debentures;

Issue and 2.3 Types of Debentures 1

• record the journal entries for the issue of debentures at par,

Redemption 2.4 Issue of Debentures 1 at a discount and at premium;

of

p ;

of

• explain the concept of debentures issued for consideration

Debentures

5th(2days) other than cash and the accounting thereof;

1

• explain the concept of issue of debentures as a collateral

2.5 Over Subscription security and the accounting thereof;

2.6 Issue of Debentures for • record the journal entries for issue of debentures with

2 various terms of issue, terms of redemption;

Consideration other than Cash

1st(4days) • show the items relating to issue of debentures in company’s

2.7 Issue of Debentures as a

2 balance sheet;

Collateral Security

• describe the methods of writing-off discount/loss on issue

2.8 Terms of Issue of of debentures

3

Debentures ; • explain the methods of redemption of debentures and the

2nd(6days) Chapter 2 2.9 Interest on Debentures 1 accounting thereof; and

Issue and 2.10 Writing off Discount/Loss • explain the concept of sinking fund, its use for redemption

2 of debentures and the accounting thereof

Nov Redemption on Issue of Debentures

of 2.11 Redemption of

3rd(2days) Debentures 2

Debentures

2.12 Redemption by Payment

1

in Lump Sum

2.13 Redemption by Purchase

4th(5days) 2

in Open Market

2.14 Redemption by

2

Conversion

3.1 Meaning of Financial After studying this chapter, students will be able to

Statements : • explain the nature and objectives of financial statements of

3.2 Nature of Financial a company;

Statements • describe the form and content of Statement of Profit and

Chapter 3 Loss of a company as per schedule III

3.3 Objectives of Financial

Financial ; • describe the form and content of balance sheet of a

Statements

1st(2days) Statements 2 company as per schedule III;

of a 3.4 Types of Financial • explain the significance and limitations of financial

Company Statements statements; and

Company ;

3.5 Uses and Importance of • prepare the financial statements.

Financial Statements

3.6 Limitations of Financial

Statements

4.1 Meaning of Analysis of After studying this chapter, studentswill be able to

2nd(6days)

Financial Statements : • explain the nature and significance of financial analysis;

4.2 Significance of Analysis of • identify the objectives of financial analysis;

Financial Statements • describe the various tools of financial analysis;

• state the limitations of financial analysis;

Chapter 4 4.3 Objectives of Analysis of

• prepare comparative and common size statements and

Analysis of Financial Statements

6 interpret the data given therein.

Dec Financial 4.4 Tools of Analysis of

Statements Financial Statements

4.5 Comparative Statements

4.6 Common Size Statement

4.7 Limitations of Financial

Analysis

5.1 Meaning of Accounting After studying this chapter, students will be able to :

1

Ratios • explain the meaning, objectives and limitations of

5.2 Objectives of Ratio accounting ratios;

1 • identify the various types of ratios commonly used ;

Analysis

• calculate various ratios to assess solvency, liquidity,

3rd(5days) 5.3 Advantages of Ratio

1 efficiency and profitability of the firm;

Chapter 5 Analysis

• interpret the various ratios calculated for intra-firm and

Accounting 5.4 Limitations of Ratio interfirm comparisons.

1

Ratios Analysis

5.5 Types of Ratios 1

5.6 Liquidity Ratios 2

5.7 Solvency Ratios 2

4th(6days)

5.8 Activity (or Turnover)

2

Ratio

Chapter 5

Accounting 3

Ratios 5.9 Profitability Ratios

6.1 Objectives of Cash Flow After going through this Unit, the students will be able to:

1st(5days) Statement ● capable to explain the meaning and objectives of cash flow

6.2 Benefits of Cash Flow statement.

Statement 2 ● develop the concept of differentiation between operating

activities investing activities and financing activities

6.3 Cash and Cash Equivalents

6.4 Cash Flows

Jan2024 6.5 Classification of Activities

Chapter 6

Cash Flow for the Preparation of Cash 2

Statement Flow Statement ● develop the understanding of preparation of Cash Flow

6.6 Ascertaining Cash Flow Statement using indirect method as per AS 3 with given

2nd(6days) 2 adjustments.

from Operating Activities

6.7 Ascertainment of Cash

Flow from Investing and 2

Financing Activities

6.8 Preparation of Cash Flow

3rd(5days) 5

Statement

Project work,

Jan 4th &5th Revision &

Test

You might also like

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualDocument87 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualEmilyJonesizjgp100% (17)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Management Accounting, 4th Edition (PG 225 253)Document29 pagesManagement Accounting, 4th Edition (PG 225 253)Uncle MattNo ratings yet

- GA Taxes Delinquent-IndividualsDocument1,082 pagesGA Taxes Delinquent-IndividualsMcMillan ConsultingNo ratings yet

- Financial and Managerial Accounting 16th Edition Williams Haka Bettner Carcello Solution ManualDocument14 pagesFinancial and Managerial Accounting 16th Edition Williams Haka Bettner Carcello Solution ManualMuhammad Arham25% (4)

- Amtrak PPT SolutionsDocument32 pagesAmtrak PPT SolutionsAngela Thornton67% (3)

- Appendix FDocument17 pagesAppendix FD3 Pajak 315No ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- Ubs - DCF PDFDocument36 pagesUbs - DCF PDFPaola VerdiNo ratings yet

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinNo ratings yet

- Accountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Document9 pagesAccountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Parthiv PattaNo ratings yet

- CBSE Class 12 Term Wise Accountancy Syllabus 2021 22Document9 pagesCBSE Class 12 Term Wise Accountancy Syllabus 2021 22ILMA UROOJNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership FirmsDocument5 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firmsbhumilimbadiya09_216No ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument11 pagesACCOUNTANCY (Code No. 055) : RationaleIshan MittalNo ratings yet

- National Colllege of Business and Arts Cubao Fairview TaytayDocument6 pagesNational Colllege of Business and Arts Cubao Fairview TaytayKristine Salvador CayetanoNo ratings yet

- STD Xii Accountancy Syllabus 2023 - 24Document4 pagesSTD Xii Accountancy Syllabus 2023 - 24anayaNo ratings yet

- Accountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Document7 pagesAccountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Sarthak PithoriyaNo ratings yet

- Accountancy XII Syllabus 1234Document5 pagesAccountancy XII Syllabus 1234Moheet KumarNo ratings yet

- Accountancy Part IDocument197 pagesAccountancy Part ISweta BhattacharyaNo ratings yet

- BBA 5th TermDocument16 pagesBBA 5th TermhurmazNo ratings yet

- SM 12 Accountancy Eng 201617 PDFDocument424 pagesSM 12 Accountancy Eng 201617 PDFUdit100% (1)

- Course Outline ACC 212Document3 pagesCourse Outline ACC 212fbicia218No ratings yet

- ACCT201 Accounting For Special TransactionsDocument7 pagesACCT201 Accounting For Special TransactionsMiles SantosNo ratings yet

- Afar 2 Module CH 3 PDFDocument24 pagesAfar 2 Module CH 3 PDFRazmen Ramirez PintoNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- Account SyllabusDocument5 pagesAccount Syllabusadityasinghania.gtsNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- 2022 23 Accountancy 12-MinDocument8 pages2022 23 Accountancy 12-MinShajila AnvarNo ratings yet

- Reduced SyllabusDocument333 pagesReduced SyllabusRaj Rajeshwer Gupta100% (1)

- Accountancy (Code No. 055) : Class-XII (2019-20)Document6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- Must Do Content Accountancy Class XiiDocument45 pagesMust Do Content Accountancy Class XiiPratham Malhotra0% (1)

- CBSE Class 12 Accountancy Syllabus 2022 23Document8 pagesCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNo ratings yet

- ACCT202 Accounting For Business CombinationsDocument8 pagesACCT202 Accounting For Business CombinationsMiles SantosNo ratings yet

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Razmen Ramirez PintoNo ratings yet

- 7.-ISC-Accounts 040424 2025Document20 pages7.-ISC-Accounts 040424 2025jiyadugar037No ratings yet

- Course Syllabus in Accounting For Special Transactions: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Accounting For Special Transactions: Course Intended Learning Outcomes (Cilo) and Time AllotmentMelanie SamsonaNo ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFfrances.langley893100% (12)

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution ManualDocument91 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution Manuallaurel100% (31)

- Solutions - Chapter 2Document29 pagesSolutions - Chapter 2Dre ThathipNo ratings yet

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- Kolehiyo NG Subic: Accounting For Special TransactionsDocument9 pagesKolehiyo NG Subic: Accounting For Special TransactionsTulio JeremyNo ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFfrances.langley893100% (11)

- Corporate-Accounting-bk GoelDocument3 pagesCorporate-Accounting-bk Goeltanisha kochharNo ratings yet

- Afar 2 Module CH 3Document24 pagesAfar 2 Module CH 3Ella Mae TuratoNo ratings yet

- Afar 2 Module CH 3Document24 pagesAfar 2 Module CH 3Ella Mae TuratoNo ratings yet

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocument240 pagesAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY75% (8)

- Financial Accounting PracticesDocument6 pagesFinancial Accounting PracticesdimazNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Afar 2 Module CH 4 PDFDocument20 pagesAfar 2 Module CH 4 PDFRazmen Ramirez PintoNo ratings yet

- Dwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFDocument35 pagesDwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFmargrave.mackinaw.2121r100% (16)

- ANS 2017 SEP Financial - Accounting - and - Reporting - Fundamentals - September - 2017 - English - MediumDocument17 pagesANS 2017 SEP Financial - Accounting - and - Reporting - Fundamentals - September - 2017 - English - MediumJahanzaib ButtNo ratings yet

- JAC 11th Accountancy Syllabus 2023-24Document6 pagesJAC 11th Accountancy Syllabus 2023-24Kusum singhNo ratings yet

- Ap7 Presentation of Contractual InterestDocument38 pagesAp7 Presentation of Contractual InterestvalcilonNo ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- Afar 2 Module CH 1Document13 pagesAfar 2 Module CH 1Razmen Ramirez PintoNo ratings yet

- Accounting A Level Overview 2022-24Document5 pagesAccounting A Level Overview 2022-24RIYA AMIT MAHATONo ratings yet

- Note Topic 3.Document4 pagesNote Topic 3.ModraNo ratings yet

- PDF DocumentDocument267 pagesPDF DocumentsdfkjgskfNo ratings yet

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Ella Mae TuratoNo ratings yet

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- Note Topic 3Document8 pagesNote Topic 3ModraNo ratings yet

- Grade 12 CommerceDocument17 pagesGrade 12 CommerceNiqabi NextdoorNo ratings yet

- Balance Sheet StructuresFrom EverandBalance Sheet StructuresAnthony N BirtsNo ratings yet

- Nimbus Communications Ltd.Document452 pagesNimbus Communications Ltd.adhavvikasNo ratings yet

- Classification of Financial RatiosDocument2 pagesClassification of Financial RatiosЯoнiт ЯagнavaиNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- Mock Departmental Part 1Document7 pagesMock Departmental Part 1Mikee RizonNo ratings yet

- Project ReportDocument86 pagesProject ReportavnishNo ratings yet

- Group Project 0011D - Bus5111Document4 pagesGroup Project 0011D - Bus5111Franklyn Doh-NaniNo ratings yet

- Business Valuation MethodsDocument10 pagesBusiness Valuation Methodsraj28_999No ratings yet

- ACC 3003 - Final Exam RevisionDocument19 pagesACC 3003 - Final Exam Revisionfalnuaimi001100% (1)

- MTH Parcor Semifinal ExamDocument3 pagesMTH Parcor Semifinal ExamAngelica N. EscañoNo ratings yet

- Rous's Notes Finance CanDocument116 pagesRous's Notes Finance CanMoatasemMadianNo ratings yet

- Practice Exam 24Document29 pagesPractice Exam 24Go MongkoltornNo ratings yet

- Mid-Sem Exam NotesDocument21 pagesMid-Sem Exam Notesdaksh.aggarwal26No ratings yet

- Allen Stanford Criminal Trial Transcript Volume 6 Jan. 30, 2012Document358 pagesAllen Stanford Criminal Trial Transcript Volume 6 Jan. 30, 2012Stanford Victims CoalitionNo ratings yet

- AFA Worksheet IIDocument7 pagesAFA Worksheet IIAbebeNo ratings yet

- What Is A Cash Flow StatementDocument4 pagesWhat Is A Cash Flow StatementDaniel GarciaNo ratings yet

- Corporate Restructuring - Merger, Amalgamation, EtcDocument124 pagesCorporate Restructuring - Merger, Amalgamation, Etcudoshi_1No ratings yet

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- RNL Newipo Ipo PDFDocument482 pagesRNL Newipo Ipo PDFvikashNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceChristine Marie ViscaynoNo ratings yet

- Daftar Akun Bengkel Fajar MotorDocument4 pagesDaftar Akun Bengkel Fajar MotorNazwar SadilahNo ratings yet

- Part I Financial StatementDocument18 pagesPart I Financial Statementbebe143No ratings yet

- Non Ver - Football Player IAS38 or IFRS 15Document2 pagesNon Ver - Football Player IAS38 or IFRS 15Buvanendran SanjeevanNo ratings yet

- Newinc 2022-05-07Document13 pagesNewinc 2022-05-07dr.f.talashanNo ratings yet

- ExerciseDocument4 pagesExerciseMae RxNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet