Professional Documents

Culture Documents

Advanced Accounting 2nd Yr Q.P

Advanced Accounting 2nd Yr Q.P

Uploaded by

btsa1262013Copyright:

Available Formats

You might also like

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- Chapter 12-Capital Structure: Multiple ChoiceDocument26 pagesChapter 12-Capital Structure: Multiple ChoiceadssdasdsadNo ratings yet

- Interest Rate Lock AgreementDocument2 pagesInterest Rate Lock AgreementSarahi AlvarengaNo ratings yet

- Banking VocabularyDocument3 pagesBanking Vocabularytahar benattiaNo ratings yet

- Cash Basis Accrual Basis Exercises With AnswersDocument6 pagesCash Basis Accrual Basis Exercises With AnswersRNo ratings yet

- Corporate Law MCQsDocument33 pagesCorporate Law MCQsSalman AliNo ratings yet

- 5846SP 2Document10 pages5846SP 2grramyarajaNo ratings yet

- Ii Puc Accountancy Theory Package For 2022-23Document11 pagesIi Puc Accountancy Theory Package For 2022-23ngveeresh551No ratings yet

- Account: 5. in Case of Fixed Capitals, Partners Will HaveDocument3 pagesAccount: 5. in Case of Fixed Capitals, Partners Will HaveNavin PatidarNo ratings yet

- AccountsDocument12 pagesAccountsSandeep KumarNo ratings yet

- Advanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoiceDocument15 pagesAdvanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoicepallaviNo ratings yet

- Class 12th Accounts Mock 2Document8 pagesClass 12th Accounts Mock 2Tushar AswaniNo ratings yet

- CPT - December - 2010 - Session 1 1: Master MindsDocument6 pagesCPT - December - 2010 - Session 1 1: Master MindsViseshSatyannNo ratings yet

- Set 2Document41 pagesSet 2zainab.xf77No ratings yet

- Partnership Accounting - QuizizzDocument4 pagesPartnership Accounting - QuizizzramirezericahNo ratings yet

- Bi 17ubi305 - Corporate AccountingDocument18 pagesBi 17ubi305 - Corporate AccountingJmzkx SjxxkNo ratings yet

- Issue of Debenture QuestionsDocument9 pagesIssue of Debenture QuestionsSailesh GoenkkaNo ratings yet

- 12 Accountancy PDFDocument7 pages12 Accountancy PDFGaurang AgarwalNo ratings yet

- Reg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksDocument12 pagesReg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksMuhammad ThanveerNo ratings yet

- Ballb 6 Sem Company Law p2 Winter 2018Document2 pagesBallb 6 Sem Company Law p2 Winter 2018Shashank BhoseNo ratings yet

- Chapter 15 McqsDocument3 pagesChapter 15 McqsAbeera AhmedNo ratings yet

- RKG Fundamentals Partnership Test 60 MarksDocument6 pagesRKG Fundamentals Partnership Test 60 MarksSaumya SharmaNo ratings yet

- Class 12 Term 1 AccountancyDocument7 pagesClass 12 Term 1 AccountancyTûshar ThakúrNo ratings yet

- KVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9Document9 pagesKVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9im subbing to everyone subbing to meNo ratings yet

- Share Capital MCQDocument18 pagesShare Capital MCQPriyanshu GehlotNo ratings yet

- MCQS Chapter 5 Company Law 2017Document6 pagesMCQS Chapter 5 Company Law 2017BablooNo ratings yet

- 10 CPT Model Papers - With AnswersDocument558 pages10 CPT Model Papers - With AnswersRajesh DorbalaNo ratings yet

- TYBFM - CORPORATE ACCOUNTING IV MCQs Q BankDocument16 pagesTYBFM - CORPORATE ACCOUNTING IV MCQs Q Bankrachit mishraNo ratings yet

- Accountancy Exam Booster 0.2 Educom Achievers 9875305902-1Document11 pagesAccountancy Exam Booster 0.2 Educom Achievers 9875305902-1das662039No ratings yet

- 2 Inter - Law - 100A - Que - PaperDocument9 pages2 Inter - Law - 100A - Que - PaperDarshita JainNo ratings yet

- KVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9Document9 pagesKVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9im subbing to everyone subbing to meNo ratings yet

- Question 929893Document9 pagesQuestion 929893umangchh2306No ratings yet

- MCQS Chapter 9 Company Law 2017Document5 pagesMCQS Chapter 9 Company Law 2017BablooNo ratings yet

- FundamentalsarihantDocument11 pagesFundamentalsarihantSparsh SalujaNo ratings yet

- Aklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateDocument4 pagesAklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateArjay Datoon VillanuevaNo ratings yet

- Tybfm Ca Sem VDocument17 pagesTybfm Ca Sem VAkash KamathNo ratings yet

- REDEMPTION OF SHARES & DEBENTURES MCQsDocument7 pagesREDEMPTION OF SHARES & DEBENTURES MCQsChetan StoresNo ratings yet

- Fa 5Document14 pagesFa 5divyayella024No ratings yet

- Cma Inter G2 Account & Audit MTP SolutionDocument30 pagesCma Inter G2 Account & Audit MTP SolutionGeethika KesavarapuNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsDocument5 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsvijaykumartaxNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set1: Paper 6-Laws and EthicsDocument4 pagesMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set1: Paper 6-Laws and Ethicsvikash guptaNo ratings yet

- 12 Acc SP 03Document32 pages12 Acc SP 03ठाकुर रुद्र प्रताप सिंहNo ratings yet

- 10065CBSE Guess Paper 2022-23Document8 pages10065CBSE Guess Paper 2022-23Dhriti KarnaniNo ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- UT I Acc. Sample PaperDocument4 pagesUT I Acc. Sample Paperyvs12311No ratings yet

- 79 Law TestDocument3 pages79 Law TestKrushna MateNo ratings yet

- Issue of Shares 12 BKDocument1 pageIssue of Shares 12 BKObaid KhanNo ratings yet

- 12 Acc SP 04aDocument26 pages12 Acc SP 04aठाकुर रुद्र प्रताप सिंहNo ratings yet

- Ross12e Chapter30 TBDocument8 pagesRoss12e Chapter30 TBhi babyNo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- Acct Q 20 Marks BSSDocument2 pagesAcct Q 20 Marks BSSPapia SenNo ratings yet

- MCQ Comp LawDocument39 pagesMCQ Comp LawplannernarNo ratings yet

- SQP 09 AccountancyDocument8 pagesSQP 09 AccountancyacguptaclassesNo ratings yet

- Of 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250Document3 pagesOf 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250abhishekNo ratings yet

- Company Law CS Inter MCQsDocument19 pagesCompany Law CS Inter MCQsbitupon.sa108No ratings yet

- PRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsDocument8 pagesPRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsKaustav DasNo ratings yet

- Issue of Debentures (H.W)Document8 pagesIssue of Debentures (H.W)krisshlohia5No ratings yet

- Question 1288284Document11 pagesQuestion 1288284groverpankaj04No ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- Class Xii CH 1 MCQ AccountancyDocument27 pagesClass Xii CH 1 MCQ Accountancyscammer9901No ratings yet

- MBD SS Q. Bank ACC - G12 - Ch01Document26 pagesMBD SS Q. Bank ACC - G12 - Ch01Muskan KheraNo ratings yet

- AC Sample Paper 13 UnsolvedDocument10 pagesAC Sample Paper 13 UnsolvedAnwesh AsmitNo ratings yet

- Partnership Imp QDocument5 pagesPartnership Imp Qa4603488No ratings yet

- FM QuizDocument4 pagesFM QuizM Ahsan KhanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- AML Red Flag IndicatorsDocument7 pagesAML Red Flag Indicators9840665940No ratings yet

- Accounts Receivable MaterialDocument4 pagesAccounts Receivable Materialkookie bunnyNo ratings yet

- 9404 - Partnership LiquidationDocument4 pages9404 - Partnership LiquidationLuzviminda SaspaNo ratings yet

- Chapter 1 - Partnership FormationDocument3 pagesChapter 1 - Partnership FormationMelody ManadongNo ratings yet

- Intermediate Accounting 2 Topic 1Document3 pagesIntermediate Accounting 2 Topic 1John Anjelo MoraldeNo ratings yet

- Management Accounting Assignment 1Document3 pagesManagement Accounting Assignment 1saurabhma23.pumbaNo ratings yet

- Application For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenDocument2 pagesApplication For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenRAJENDRA BHANDARI50% (2)

- Cibil Score Fetched On 2022-03-11Document4 pagesCibil Score Fetched On 2022-03-11Gaurav PandeyNo ratings yet

- Quiz 3 - AccountingDocument8 pagesQuiz 3 - AccountingUzma KhanNo ratings yet

- Caso 2 Royal MailDocument12 pagesCaso 2 Royal Mailjuanito perezNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Financial Accounting in Practice PracticDocument117 pagesFinancial Accounting in Practice Practicshahadattuhin72No ratings yet

- Ratio Analysis Uttara Bank VS City BankDocument70 pagesRatio Analysis Uttara Bank VS City BankTaznina Nur MuntahaNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Factoring and Forfaiting: Shyam Prakash UDocument18 pagesFactoring and Forfaiting: Shyam Prakash Uus_prakashNo ratings yet

- Foundations of Macroeconomics 8Th Edition Bade Test Bank Full Chapter PDFDocument67 pagesFoundations of Macroeconomics 8Th Edition Bade Test Bank Full Chapter PDFwilliamvanrqg100% (15)

- Adjustment and Closing Entry-SolutionDocument3 pagesAdjustment and Closing Entry-SolutionSerazul Arafin MrinmoyNo ratings yet

- Accounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDocument3 pagesAccounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDail Xymere YamioNo ratings yet

- ACC101 T222 FinalExam MarkingGuideDocument18 pagesACC101 T222 FinalExam MarkingGuideTan IrisNo ratings yet

- Veterinary Services Payment Plan AgreementDocument3 pagesVeterinary Services Payment Plan AgreementRia KudoNo ratings yet

- Pmmy Medical StoreDocument12 pagesPmmy Medical StoreARIF0% (1)

- The Cormier Corporation Sells Office Equipment and Supplies To Many PDFDocument2 pagesThe Cormier Corporation Sells Office Equipment and Supplies To Many PDFFreelance WorkerNo ratings yet

- Money Vocabulary QuizDocument1 pageMoney Vocabulary QuizdiogofffNo ratings yet

- Test Acc406 - Dec 2018 QQDocument8 pagesTest Acc406 - Dec 2018 QQtakoyaki papadomNo ratings yet

Advanced Accounting 2nd Yr Q.P

Advanced Accounting 2nd Yr Q.P

Uploaded by

btsa1262013Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting 2nd Yr Q.P

Advanced Accounting 2nd Yr Q.P

Uploaded by

btsa1262013Copyright:

Available Formats

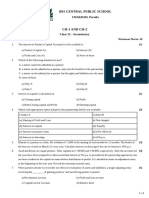

Section – I (10 X ½ = 5 Marks)

Multiple choice questions

1. In the absence of an agreement interest on partner's loan is pain in the ratio of [ ]

a) 4% b) 6% c) 5% d) 10%

2. When dates of withdrawals are not given, interest on drawings is charge for [ ]

a) 51/2 months b) 5 Months c) 6 Months d) 12 Months

3. The current account of a partner will always have [ ]

a) Credit balance b) Debit balance c) No Balance

d) May have debit or credit balance

4. Treatment of goodwill will be done as per [ ]

a) Para 16 of As10 b) Para 15 of As13 c) Para 14 of As11 d) Para 13 of As12

5. If new partner brings the amount of goodwill in cash it is transferred to old partner's capital accounts in

[ ]

a) Sacrificing ratio b) Old ratio c) New ratio d) Gaining ratio

6. A company is formed [ ]

a) Buy special act of parliament b) Under companies Act

c) General Agreement among potential investors d) None of these

7. Public Limited companies should have a minimum paid up capital of [ ]

a) 5 Lakhs b) 10 Lakhs c) 20 Lakhs d) 50 Lakhs

8. The liability of equity shareholders is [ ]

a) Unlimited b) Limited up to c) Guarantee given by them d) None of the above

9. In case of private companies [ ]

a) Shares can be transferred without restrictions b) There is restriction on transfer of

c) Can transfer 200 shares without consent of other shareholders.

d) Can transfer 500 shares with other

10. Preferences share have priority over equity shares [ ]

a) Payment of dividend and repayment b) Voting in annual general meeting

c) Subscribe for new issue of shares and debentures d) Interest on money invested in company

Section – II ( 10X ½ = 5 Marks)

Fill in the blanks

11. In the absence of an agreement, partners are _____________ entitled to receive salary.

12. In the balance sheet prepared after admission of a partner assets and liabilities are recorded at _________

13. If at the time of admission, profit & loss account appears in the books, it will be transferred to _________

14. A and B are partners sharing profit in the ratio of 3:2. C is admitted with 1/5 the shares in the profit

sharing ratio will be ________________

15. Interest on capital is calculated on the _________________

16. A Private company is prohibited form _________________

17. According to see 53 of the companies Act. 2013 a company cannot issued shares at _____________

18. A Company cannot allot shares unless _____________________ stated in the prospectus is received.

19. When shares are issued to promoters for services rendered by them _____________ is debited and share

capital is credited.

20. To write off preliminary expenses ________________ can be used.

Section – III ( 5 X 1 = 5 Marks)

Answer the following questions

21. What is sacrificing ratio?

Ans:

22. What are difference between sacrificing ratio and gaining ratio?

Ans:

23. What are different kinds of preference shares?

Ans:

24. Calls in Arrears and calls in Advance.

Ans:

25. What is Authorized Capital?

Ans:

You might also like

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- Chapter 12-Capital Structure: Multiple ChoiceDocument26 pagesChapter 12-Capital Structure: Multiple ChoiceadssdasdsadNo ratings yet

- Interest Rate Lock AgreementDocument2 pagesInterest Rate Lock AgreementSarahi AlvarengaNo ratings yet

- Banking VocabularyDocument3 pagesBanking Vocabularytahar benattiaNo ratings yet

- Cash Basis Accrual Basis Exercises With AnswersDocument6 pagesCash Basis Accrual Basis Exercises With AnswersRNo ratings yet

- Corporate Law MCQsDocument33 pagesCorporate Law MCQsSalman AliNo ratings yet

- 5846SP 2Document10 pages5846SP 2grramyarajaNo ratings yet

- Ii Puc Accountancy Theory Package For 2022-23Document11 pagesIi Puc Accountancy Theory Package For 2022-23ngveeresh551No ratings yet

- Account: 5. in Case of Fixed Capitals, Partners Will HaveDocument3 pagesAccount: 5. in Case of Fixed Capitals, Partners Will HaveNavin PatidarNo ratings yet

- AccountsDocument12 pagesAccountsSandeep KumarNo ratings yet

- Advanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoiceDocument15 pagesAdvanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoicepallaviNo ratings yet

- Class 12th Accounts Mock 2Document8 pagesClass 12th Accounts Mock 2Tushar AswaniNo ratings yet

- CPT - December - 2010 - Session 1 1: Master MindsDocument6 pagesCPT - December - 2010 - Session 1 1: Master MindsViseshSatyannNo ratings yet

- Set 2Document41 pagesSet 2zainab.xf77No ratings yet

- Partnership Accounting - QuizizzDocument4 pagesPartnership Accounting - QuizizzramirezericahNo ratings yet

- Bi 17ubi305 - Corporate AccountingDocument18 pagesBi 17ubi305 - Corporate AccountingJmzkx SjxxkNo ratings yet

- Issue of Debenture QuestionsDocument9 pagesIssue of Debenture QuestionsSailesh GoenkkaNo ratings yet

- 12 Accountancy PDFDocument7 pages12 Accountancy PDFGaurang AgarwalNo ratings yet

- Reg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksDocument12 pagesReg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksMuhammad ThanveerNo ratings yet

- Ballb 6 Sem Company Law p2 Winter 2018Document2 pagesBallb 6 Sem Company Law p2 Winter 2018Shashank BhoseNo ratings yet

- Chapter 15 McqsDocument3 pagesChapter 15 McqsAbeera AhmedNo ratings yet

- RKG Fundamentals Partnership Test 60 MarksDocument6 pagesRKG Fundamentals Partnership Test 60 MarksSaumya SharmaNo ratings yet

- Class 12 Term 1 AccountancyDocument7 pagesClass 12 Term 1 AccountancyTûshar ThakúrNo ratings yet

- KVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9Document9 pagesKVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9im subbing to everyone subbing to meNo ratings yet

- Share Capital MCQDocument18 pagesShare Capital MCQPriyanshu GehlotNo ratings yet

- MCQS Chapter 5 Company Law 2017Document6 pagesMCQS Chapter 5 Company Law 2017BablooNo ratings yet

- 10 CPT Model Papers - With AnswersDocument558 pages10 CPT Model Papers - With AnswersRajesh DorbalaNo ratings yet

- TYBFM - CORPORATE ACCOUNTING IV MCQs Q BankDocument16 pagesTYBFM - CORPORATE ACCOUNTING IV MCQs Q Bankrachit mishraNo ratings yet

- Accountancy Exam Booster 0.2 Educom Achievers 9875305902-1Document11 pagesAccountancy Exam Booster 0.2 Educom Achievers 9875305902-1das662039No ratings yet

- 2 Inter - Law - 100A - Que - PaperDocument9 pages2 Inter - Law - 100A - Que - PaperDarshita JainNo ratings yet

- KVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9Document9 pagesKVS Jaipur XII ACC QP & MS (2nd PB) 23-24 (SET-3) - 1-9im subbing to everyone subbing to meNo ratings yet

- Question 929893Document9 pagesQuestion 929893umangchh2306No ratings yet

- MCQS Chapter 9 Company Law 2017Document5 pagesMCQS Chapter 9 Company Law 2017BablooNo ratings yet

- FundamentalsarihantDocument11 pagesFundamentalsarihantSparsh SalujaNo ratings yet

- Aklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateDocument4 pagesAklan State University School of Management Sciences Banga, Aklan Final Examination in BEC 1/ BCC 2 Name: Course: DateArjay Datoon VillanuevaNo ratings yet

- Tybfm Ca Sem VDocument17 pagesTybfm Ca Sem VAkash KamathNo ratings yet

- REDEMPTION OF SHARES & DEBENTURES MCQsDocument7 pagesREDEMPTION OF SHARES & DEBENTURES MCQsChetan StoresNo ratings yet

- Fa 5Document14 pagesFa 5divyayella024No ratings yet

- Cma Inter G2 Account & Audit MTP SolutionDocument30 pagesCma Inter G2 Account & Audit MTP SolutionGeethika KesavarapuNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsDocument5 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsvijaykumartaxNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set1: Paper 6-Laws and EthicsDocument4 pagesMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set1: Paper 6-Laws and Ethicsvikash guptaNo ratings yet

- 12 Acc SP 03Document32 pages12 Acc SP 03ठाकुर रुद्र प्रताप सिंहNo ratings yet

- 10065CBSE Guess Paper 2022-23Document8 pages10065CBSE Guess Paper 2022-23Dhriti KarnaniNo ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- UT I Acc. Sample PaperDocument4 pagesUT I Acc. Sample Paperyvs12311No ratings yet

- 79 Law TestDocument3 pages79 Law TestKrushna MateNo ratings yet

- Issue of Shares 12 BKDocument1 pageIssue of Shares 12 BKObaid KhanNo ratings yet

- 12 Acc SP 04aDocument26 pages12 Acc SP 04aठाकुर रुद्र प्रताप सिंहNo ratings yet

- Ross12e Chapter30 TBDocument8 pagesRoss12e Chapter30 TBhi babyNo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- Acct Q 20 Marks BSSDocument2 pagesAcct Q 20 Marks BSSPapia SenNo ratings yet

- MCQ Comp LawDocument39 pagesMCQ Comp LawplannernarNo ratings yet

- SQP 09 AccountancyDocument8 pagesSQP 09 AccountancyacguptaclassesNo ratings yet

- Of 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250Document3 pagesOf 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250abhishekNo ratings yet

- Company Law CS Inter MCQsDocument19 pagesCompany Law CS Inter MCQsbitupon.sa108No ratings yet

- PRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsDocument8 pagesPRE-BOARD - 2 (2023-2024) : Grade: XII Marks: 80 Subject: Accountancy Time: 3 HrsKaustav DasNo ratings yet

- Issue of Debentures (H.W)Document8 pagesIssue of Debentures (H.W)krisshlohia5No ratings yet

- Question 1288284Document11 pagesQuestion 1288284groverpankaj04No ratings yet

- CH 2 MCQ Acc.Document13 pagesCH 2 MCQ Acc.Amit GuptaNo ratings yet

- Class Xii CH 1 MCQ AccountancyDocument27 pagesClass Xii CH 1 MCQ Accountancyscammer9901No ratings yet

- MBD SS Q. Bank ACC - G12 - Ch01Document26 pagesMBD SS Q. Bank ACC - G12 - Ch01Muskan KheraNo ratings yet

- AC Sample Paper 13 UnsolvedDocument10 pagesAC Sample Paper 13 UnsolvedAnwesh AsmitNo ratings yet

- Partnership Imp QDocument5 pagesPartnership Imp Qa4603488No ratings yet

- FM QuizDocument4 pagesFM QuizM Ahsan KhanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- AML Red Flag IndicatorsDocument7 pagesAML Red Flag Indicators9840665940No ratings yet

- Accounts Receivable MaterialDocument4 pagesAccounts Receivable Materialkookie bunnyNo ratings yet

- 9404 - Partnership LiquidationDocument4 pages9404 - Partnership LiquidationLuzviminda SaspaNo ratings yet

- Chapter 1 - Partnership FormationDocument3 pagesChapter 1 - Partnership FormationMelody ManadongNo ratings yet

- Intermediate Accounting 2 Topic 1Document3 pagesIntermediate Accounting 2 Topic 1John Anjelo MoraldeNo ratings yet

- Management Accounting Assignment 1Document3 pagesManagement Accounting Assignment 1saurabhma23.pumbaNo ratings yet

- Application For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenDocument2 pagesApplication For Withdrawal Upto 90 Percent of Maturity Benefit On Completion of 15 Yrs of Service For Education of ChildrenRAJENDRA BHANDARI50% (2)

- Cibil Score Fetched On 2022-03-11Document4 pagesCibil Score Fetched On 2022-03-11Gaurav PandeyNo ratings yet

- Quiz 3 - AccountingDocument8 pagesQuiz 3 - AccountingUzma KhanNo ratings yet

- Caso 2 Royal MailDocument12 pagesCaso 2 Royal Mailjuanito perezNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Financial Accounting in Practice PracticDocument117 pagesFinancial Accounting in Practice Practicshahadattuhin72No ratings yet

- Ratio Analysis Uttara Bank VS City BankDocument70 pagesRatio Analysis Uttara Bank VS City BankTaznina Nur MuntahaNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Factoring and Forfaiting: Shyam Prakash UDocument18 pagesFactoring and Forfaiting: Shyam Prakash Uus_prakashNo ratings yet

- Foundations of Macroeconomics 8Th Edition Bade Test Bank Full Chapter PDFDocument67 pagesFoundations of Macroeconomics 8Th Edition Bade Test Bank Full Chapter PDFwilliamvanrqg100% (15)

- Adjustment and Closing Entry-SolutionDocument3 pagesAdjustment and Closing Entry-SolutionSerazul Arafin MrinmoyNo ratings yet

- Accounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDocument3 pagesAccounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDail Xymere YamioNo ratings yet

- ACC101 T222 FinalExam MarkingGuideDocument18 pagesACC101 T222 FinalExam MarkingGuideTan IrisNo ratings yet

- Veterinary Services Payment Plan AgreementDocument3 pagesVeterinary Services Payment Plan AgreementRia KudoNo ratings yet

- Pmmy Medical StoreDocument12 pagesPmmy Medical StoreARIF0% (1)

- The Cormier Corporation Sells Office Equipment and Supplies To Many PDFDocument2 pagesThe Cormier Corporation Sells Office Equipment and Supplies To Many PDFFreelance WorkerNo ratings yet

- Money Vocabulary QuizDocument1 pageMoney Vocabulary QuizdiogofffNo ratings yet

- Test Acc406 - Dec 2018 QQDocument8 pagesTest Acc406 - Dec 2018 QQtakoyaki papadomNo ratings yet