Professional Documents

Culture Documents

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Uploaded by

pelusonietoaxelCopyright:

You might also like

- NURS 366 Exam 1 Study Guide and RubricDocument7 pagesNURS 366 Exam 1 Study Guide and RubriccmpNo ratings yet

- Twice-Weekly Watering Schedule: Kiestwood Community GardenDocument5 pagesTwice-Weekly Watering Schedule: Kiestwood Community GardenkiestwoodNo ratings yet

- Report On Housing in Sea Girt, NJDocument4 pagesReport On Housing in Sea Girt, NJSamuel HenryNo ratings yet

- 3243 Drew Street - OMDocument15 pages3243 Drew Street - OMAnonymous E717q54No ratings yet

- January 20, 2017 Strathmore Times PDFDocument32 pagesJanuary 20, 2017 Strathmore Times PDFStrathmore TimesNo ratings yet

- Full Brochure of InvestmentsDocument79 pagesFull Brochure of Investments081209No ratings yet

- New Vacant LandsDocument34 pagesNew Vacant Lands081209No ratings yet

- Agentmailings: Getting A Home Loan Watch... Ing The TVDocument2 pagesAgentmailings: Getting A Home Loan Watch... Ing The TVapi-115992645No ratings yet

- Gonzales Cannon 9-29-11 IssueDocument50 pagesGonzales Cannon 9-29-11 IssueNikki MaxwellNo ratings yet

- East Point: Tri-Cities Business BuzzDocument8 pagesEast Point: Tri-Cities Business BuzzAndrewNo ratings yet

- Times Review Classifieds: April 7, 2016Document8 pagesTimes Review Classifieds: April 7, 2016TimesreviewNo ratings yet

- Ooccl Newsletter June 2012Document2 pagesOoccl Newsletter June 2012raymond_crawfordNo ratings yet

- 2021 May Trading Post (Ver 1.1)Document3 pages2021 May Trading Post (Ver 1.1)WoodsNo ratings yet

- The903Residences4pgTeaserlow1 - Ppaul DonahueDocument4 pagesThe903Residences4pgTeaserlow1 - Ppaul Donahueashes_xNo ratings yet

- December 2013 / January 2014: Published & Distributed by 208.746.0483 800.473.4158Document28 pagesDecember 2013 / January 2014: Published & Distributed by 208.746.0483 800.473.4158David ArndtNo ratings yet

- Letter of Martin Levine Realtor For Neil GillespieDocument7 pagesLetter of Martin Levine Realtor For Neil GillespieNeil GillespieNo ratings yet

- 2021 June Trading Post (Ver 1.1)Document3 pages2021 June Trading Post (Ver 1.1)WoodsNo ratings yet

- Times Review Classifieds 1-3-13Document4 pagesTimes Review Classifieds 1-3-13TimesreviewNo ratings yet

- Hobe Sound Currents June 2013 Vol. 3 Issue #2Document24 pagesHobe Sound Currents June 2013 Vol. 3 Issue #2Barbara Clowdus100% (1)

- DH 0915Document12 pagesDH 0915The Delphos HeraldNo ratings yet

- Analyzing The Green Valley Mixed-Use II ProjectDocument10 pagesAnalyzing The Green Valley Mixed-Use II ProjectMadelyn GalalNo ratings yet

- Busi. Journal Oct. 2014Document12 pagesBusi. Journal Oct. 2014The Delphos HeraldNo ratings yet

- Palouse Homefinder - Jan/Feb 2011Document20 pagesPalouse Homefinder - Jan/Feb 2011David ArndtNo ratings yet

- The Dima Lysius TeamDocument2 pagesThe Dima Lysius TeamJoseph DimaNo ratings yet

- Anza CT, Victorville, CA 92392 MLS# 541773 RedfinDocument1 pageAnza CT, Victorville, CA 92392 MLS# 541773 Redfin4x59dnqmtwNo ratings yet

- Septembet 21, 2012 Strathmore TimesDocument28 pagesSeptembet 21, 2012 Strathmore TimesStrathmore TimesNo ratings yet

- The Roadrunner: Kern Kaweah Get-Together Sat. Nov 5Th, Reserve NowDocument11 pagesThe Roadrunner: Kern Kaweah Get-Together Sat. Nov 5Th, Reserve NowKern Kaweah Sierrra ClubNo ratings yet

- 03-10-12 Classified Display AdsDocument23 pages03-10-12 Classified Display AdsRegisterPublicationsNo ratings yet

- South Bay Digs 7.5.13Document107 pagesSouth Bay Digs 7.5.13South Bay Digs100% (1)

- Club CaribeDocument24 pagesClub CaribemariapinangoNo ratings yet

- 2023 Annual MarketReportDocument27 pages2023 Annual MarketReportSuyapa SaucedaNo ratings yet

- Elphos Erald: Lakeview Farms Adding 200 Jobs To DelphosDocument12 pagesElphos Erald: Lakeview Farms Adding 200 Jobs To DelphosNancy SpencerNo ratings yet

- BR Development - Hidden Vine ApartmentsDocument35 pagesBR Development - Hidden Vine ApartmentsSamuel SNo ratings yet

- January 6, 2017 Strathmore TimesDocument19 pagesJanuary 6, 2017 Strathmore TimesStrathmore TimesNo ratings yet

- Home Hunter - April 22, 2012Document16 pagesHome Hunter - April 22, 2012Stacey MosierNo ratings yet

- Times Review Classifieds: March 31, 2016Document8 pagesTimes Review Classifieds: March 31, 2016TimesreviewNo ratings yet

- 1375282590moneysaver Shopping NewsDocument16 pages1375282590moneysaver Shopping NewsCoolerAdsNo ratings yet

- Robbinsville 1128Document12 pagesRobbinsville 1128elauwitNo ratings yet

- SouthBeachRealEstate 16c6c17e 5pawhss33wy 16c6c18c Tai0fvv4f4tDocument3 pagesSouthBeachRealEstate 16c6c17e 5pawhss33wy 16c6c18c Tai0fvv4f4tskrishatguruNo ratings yet

- Butner AptDocument11 pagesButner Aptapi-306448793No ratings yet

- Crossroads: Mississippi Chapter Sierra Club Golden Triangle Group Feb 2007 - July 2007Document5 pagesCrossroads: Mississippi Chapter Sierra Club Golden Triangle Group Feb 2007 - July 2007Mississippi Sierra ClubNo ratings yet

- South Central Kentucky Homes September 2011Document108 pagesSouth Central Kentucky Homes September 2011yourtownNo ratings yet

- Hawaii Moves Mag 1 ST QTR 2011Document56 pagesHawaii Moves Mag 1 ST QTR 2011Mathew NgoNo ratings yet

- Times Review Classifieds: Oct. 13, 2016Document7 pagesTimes Review Classifieds: Oct. 13, 2016TimesreviewNo ratings yet

- 2022 July Trading Post - Ver.1Document4 pages2022 July Trading Post - Ver.1WoodsNo ratings yet

- Nova Scotia Home Finder Annapolis Valley March 2015Document72 pagesNova Scotia Home Finder Annapolis Valley March 2015Nancy BainNo ratings yet

- Chicago Retail For LeaseDocument7 pagesChicago Retail For LeaseabrealtyNo ratings yet

- Dysart Appraisal Jan2013Document6 pagesDysart Appraisal Jan2013cbspgNo ratings yet

- Michael Joseph Listings - Issue 24Document5 pagesMichael Joseph Listings - Issue 24Frank VyralNo ratings yet

- Farmstead: Fate of TheDocument12 pagesFarmstead: Fate of TheelauwitNo ratings yet

- February / March 2014: Published & Distributed by 208.746.0483 800.473.4158Document28 pagesFebruary / March 2014: Published & Distributed by 208.746.0483 800.473.4158David ArndtNo ratings yet

- September 2015 Jacksonville ReviewDocument40 pagesSeptember 2015 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Call For ResearchDocument16 pagesCall For ResearchgonnaboyNo ratings yet

- Times Review Classifieds: Dec. 29, 2016Document5 pagesTimes Review Classifieds: Dec. 29, 2016TimesreviewNo ratings yet

- Fairfax Forum ClassifiedsDocument1 pageFairfax Forum ClassifiedsFarmer PublishingNo ratings yet

- APD Solutions and APD Solutions DeKalb LLC DocumentsDocument25 pagesAPD Solutions and APD Solutions DeKalb LLC DocumentsViola DavisNo ratings yet

- 9615 King Road, Loomis, CA 95650 ZeroDownDocument2 pages9615 King Road, Loomis, CA 95650 ZeroDownCraig PatersonNo ratings yet

- Hawaii Moves Mag 4 TH QTR 2010Document64 pagesHawaii Moves Mag 4 TH QTR 2010Mathew NgoNo ratings yet

- Hubertus Boy's National Award Honors His Care For The HungryDocument20 pagesHubertus Boy's National Award Honors His Care For The HungryHometown Publications - Express NewsNo ratings yet

- DS 113 Science Technology and Innovation For DevelopmentDocument50 pagesDS 113 Science Technology and Innovation For DevelopmentEldard KafulaNo ratings yet

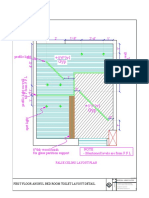

- Toilet False Ceiling PlanDocument1 pageToilet False Ceiling PlanPooja JabadeNo ratings yet

- Atlan, Henri - The Living Cell As A Paradigm For Complex Natural SystemsDocument3 pagesAtlan, Henri - The Living Cell As A Paradigm For Complex Natural SystemsKein BécilNo ratings yet

- Inctrykcija Po Zkcplyatacii YLCSDocument90 pagesInctrykcija Po Zkcplyatacii YLCSpredragstojicicNo ratings yet

- Damping Lab 1Document60 pagesDamping Lab 1Robert Lau Yik SiangNo ratings yet

- Krishna PDFCVDocument4 pagesKrishna PDFCVAVS InfraNo ratings yet

- Dolby Vision Generic 4.0 Studio SpecDocument3 pagesDolby Vision Generic 4.0 Studio Spectakeeasy5 takeeasy5No ratings yet

- Shoeb ResumeDocument4 pagesShoeb ResumeM-Shoeb ShaykNo ratings yet

- Summer Training Report On Shri Ram Piston and Rings LimitedDocument89 pagesSummer Training Report On Shri Ram Piston and Rings LimitedKevin Joy75% (4)

- PhysicsOfMusic PDFDocument288 pagesPhysicsOfMusic PDFcahes100% (1)

- Bisalloy 400 DatasheetDocument12 pagesBisalloy 400 DatasheetMohamed SeifNo ratings yet

- Insights Into Formulation Technologies and Novel Strategies For The Design of Orally Disintegrating Dosage Forms: A Comprehensive Industrial ReviewDocument13 pagesInsights Into Formulation Technologies and Novel Strategies For The Design of Orally Disintegrating Dosage Forms: A Comprehensive Industrial ReviewROBINNo ratings yet

- Oando For Jevlink2Document4 pagesOando For Jevlink2Steve Bassey100% (2)

- Griffin IB6e PPTDocument48 pagesGriffin IB6e PPTRoddureMeghlaNo ratings yet

- Micro paraDocument7 pagesMicro paraAj MillanNo ratings yet

- SJ Mepla Manual Program EngDocument57 pagesSJ Mepla Manual Program EngCuong HoNo ratings yet

- Mass Transfer DR AurobaDocument192 pagesMass Transfer DR Aurobaahmed ubeedNo ratings yet

- Butterfly CircusDocument2 pagesButterfly CircusSalma BenjellounNo ratings yet

- Presentation On Heineken BeerDocument13 pagesPresentation On Heineken BeerΣόλα ΚαρίμοβαNo ratings yet

- Sustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksDocument21 pagesSustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksWaqas HaroonNo ratings yet

- Authors BookDocument189 pagesAuthors Bookمحمد رضا رضوانیNo ratings yet

- KL 002.10 Eng Student Guide sp2 v1.0.1 PDFDocument414 pagesKL 002.10 Eng Student Guide sp2 v1.0.1 PDFalexusmatrixNo ratings yet

- San Miguel CorporationDocument8 pagesSan Miguel CorporationLeah BautistaNo ratings yet

- FAST PUBLICATION ListofSCOPUSandUGCCAREJournalsDocument3 pagesFAST PUBLICATION ListofSCOPUSandUGCCAREJournalsandrianidebrinaNo ratings yet

- Tarang Hearing Aids To MoH Thru DEIT - 3Document9 pagesTarang Hearing Aids To MoH Thru DEIT - 3Ravindra KumarNo ratings yet

- BCS RulesDocument40 pagesBCS RulesHKF1971No ratings yet

- Krishnan - Soliton Interview ExperienceDocument4 pagesKrishnan - Soliton Interview ExperiencePoorna Saai MNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- Full Metal Plate Mail 1.7Document100 pagesFull Metal Plate Mail 1.7Ezra Agnew100% (1)

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Uploaded by

pelusonietoaxelCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Commercial Real Estate Appraisal - 1114 S Dixie Hwy

Uploaded by

pelusonietoaxelCopyright:

PROPERTY DETAIL

1114 S Dixie Hwy is a two-tenant NNN strip center with an advantageous location. The

property is over the S Dixie Hwy, a highly trafficked highway in Coral Gables, and it is only a few

steps away from “University Metrorail Station. The property is located well across from the

University of Miami, home to more than 20,000 students, faculty, and staff. It is also surrounded

by residential single and multifamily, and many other retail properties. The two tenants on-site,

Starbucks and Moon Thai, have become very popular among students and local neighbors. As

land is a scarce commodity in this particular area, this is one of the remaining sites that offer

fifteen free parking lots to customers.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

Property Information The property is comprised of a

1114 S Dixie Hwy one-story building that sits over

Address

Coral Gables, FL 33146. 15,000 sq ft. of land or 0.34 acres.

Zoning MX1

Property Type Retail. Multi-Tenant, Net Leased The building total of 5,482 sq ft. of

Stores 2 developed retail space with 15

Stories 1 parking spaces (1 parking space per

Lot Size 15,000 sq ft. 365.46 sq ft. of leasable space).

Developed Space 5,482 sq ft.

Year built 1955 According to information gathered

Tenants Starbucks | Moon Thai Restaurant from Rockval, GEM PYRAMID LLC

Year 1 NOI* $307,473

acquired this property from GAZEBO

Cap Rate* 4.46%

Asked Price* $6,900,000

CORP. on October 1, 2017. It was

Selling Price** $6,400,000 transacted for $6,4 million

Selling Price/sq ft.** $1,167 ($1,167/sq ft.).

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

According to the Coral Gables

zoning code, the property is located in an

MX-1 Mixed Use Zone which allows

redevelopment of the property into a

mixed-use: commercial and residential1.

The purpose of the (MX) Mixed Use

Districts is to accommodate commercial

and residential to serve the needs of a

diverse community. The MX1 District

allows a low intensity of development

and is located along some of the City’s

primary corridors, and often has an

adjacency with single-family residential

areas.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

Located on the S Dixie Hwy,

connecting South Miami with

Coral Gables, Coral Way,

Coconut Grove, and Brickell.

The total daily traffic over the

S Dixie Hwy counts on average

77,500 Vehicles Per Day (VPD).

Nearby major shopping centers: Nearby commercial properties around include:

- Citi Bank

1. Brickell City Centre

- CVS

2. Mary Brickell Village

- WildFork Food

3. Miracle Mile

- UPS

4. The Shops at Merrick Park

among many popular fast-food chains such as:

5. CocoWalk

- McDonald’s

6. The Shops at Sunset Place

- Denny’s

- TGI Fridays

- Five Guys

- Shake Shack

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

The Underline is a public-private partnership that will transform Miami-Dade County land

below the existing Metrorail from the Miami River (Brickell area) to Dadeland South Metrorail

Station.

The Underline is expected to be completed by 2026. Once completed, it will serve

thousands of Miami residents. The 10-mile corridor will provide lighting, pedestrian and bicycle

paths, and access to public transportation. Additionally, it will include recreation features,

playgrounds, exercise equipment, basketball and volleyball courts, soccer fields, picnic areas, dog

parks, and more.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

MARKET ANALYSIS

Nearby Sale Comparables

Address Year Built Size (sq ft.) Dist (mi) Selling Date Selling Price Price/sq ft. Submarket Weights

* 1114 S Dixie Hwy 1955 5,482 n/a 1/10/2017 $6,400,000 $1,167 Coral Gables -

1 4700 S Le Jeune Road 1961 5,069 1.3 1/18/2005 $1,850,000 $365 Coral Gables 12.5%

2 475 S Dixie Hwy 1953 1,664 1.2 on-sale $4,175,000 $2,509 Coral Gables 30%

3 440 S Dixie Hwy 1964 1,879 1.2 6/6/2013 $1,300,000 $692 Coral Gables 12.5%

4 425 S Dixie Hwy 1954 12,428 1.2 6/4/2012 $4,320,000 $348 Coral Gables 20%

5 5877 Ponce De Leon Blvd 1969 4,196 0.9 3/31/2015 $3,900,000 $929 Coral Gables 25%

Weighted Average 1960 4902 1.1 - $3,485,250 $1,187 Coral Gables 100%

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

CoStar, RockVal, Loopnet, and Miami-Dade Gov. Property Appraiser websites were used

to collect property data on 1114 S Dixie Hwy and each one of the comparable properties. In the

absence of cap rates available data, comparable properties sales data was used instead to

appraise the subject property.

All the properties selected are other comparable retail properties located in the same

Coral Gables submarket. To be more precise, retail properties located between SW 57th Ave and

Le Jeune Road. Each one of the comparable properties is not further than 1.3 miles from the

subject property.

In this analysis, all the properties (including the subject) are of the same age, with an

average construction year of 1960. Additionally, all of them are 100% occupied as such as the

subject property. Properties size range widely varies from 1,664 sq ft. to 12,428 sq ft., with a

weighted average of 4,902 sq ft., being very close to the subject property.

In order to obtain an accurate appraisal, only properties with relatively recent available

sale data were used, with the oldest sale transaction being in 2005.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

The five properties featured in the table above are comparable with 1114 S Dixie Hwy.

They were chosen based on the following criteria: location, size, vacancy rate, property style,

tenants, and last selling date.

- 475 S Dixie Hwy has the highest weight compared to other properties. Despite it has

only one tenant, it shares the same tenant as the subject property. There is another Starbucks

leasing there. Additionally, both properties have similar styles, and they both include a parking

lot for their customers. Finally, this property is currently on sale which gives a current market

price condition.

On the contrary, 4700 S Le Jeune Road and 440 S Dixie Hwy have the lowest weight.

- In the case of 4700 S Le Jeune Road, it is located on another road different from the

subject property. It includes more tenants and different kinds of tenants compared to the subject

property. Despite both properties sharing that both have parking lots, their styles are quite

different.

- In the case of 440 S Dixie Hwy, it is smaller and looks older compared to the subject

property. Although it also has an Asian restaurant, it is just one not so desired tenant. Finally, it

doesn’t own a parking lot exclusively for its clients in an area in which is really hard to park

otherwise.

In between the two extremes, 425 S Dixie Hwy and 5877 Ponce De Leon Blvd hit high weights as

well.

- 5877 Ponce De Leon Blvd has two well-known tenants: “Domino’s” and “The Munch”.

Despite it is located on the other side of the US1, it virtually shares the same traffic as S Dixie

Hwy.

- 425 S Dixie Hwy instead is just only one big tenant that occupies a much bigger space

than the two tenants leasing the subject property. It is also important to notice that property

points out to other kinds of tenants. For instance, “Basset”, a home furniture manufacturer and

retailer, instead of a restaurant retailer as the case of the subject property.

Based on the analysis conducted above, it was determined that the weighted average

price/sq ft. in the area should be around $1,187. Considering that 1114 S Dixie Hwy is 5,482 sq ft.

big, the value of this property should be approximately $6,507,134.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

Valuation Scenarios

Address Year Built Size (sq ft.) Dist (mi) Selling Date Selling Price Price/sq ft. Submarket

1114 S Dixie Hwy (Worst Case) 1955 5,482 - 1/10/2017 $5,756,100 $1,050 Coral Gables

1114 S Dixie Hwy (Mid-Case) 1955 5,482 - 1/10/2017 $6,505,352 $1,187 Coral Gables

1114 S Dixie Hwy (Best Case) 1955 5,482 - 1/10/2017 $7,126,600 $1,300 Coral Gables

After having read the offering memorandum for the subject property and for different

properties in this area, I conclude that the market in this area is fastly recovering after the

pandemic. There is a very little vacancy for good retail stores despite the rise of e-commerce.

Based on this analysis, I will use $1,187 per sq ft. as the median case scenario, $1,050 per

sq ft. as the worst-case scenario, and $1,300 per sq ft. as the best-case scenario.

Nearby Rents Quotes

Address Year Built Size (sq ft.) Dist (mi) Lease Type Lease Ask Price Submarket Weight

* 1114 S Dixie Hwy 1955 5,482 n/a NNN - Coral Gables -

1 1250 S Dixie Hwy 1953 2,381 0.3 NNN $50 Coral Gables 35%

2 301 Altara Ave 2019 2,720 1.9 NNN $60 Coral Gables 10%

3 7200-7222 Red Rd 1955 1,673 1.2 NNN $37 Coral Gables 20%

4 6020-6030 S Dixie Hwy 2019 2,365 1.8 NNN $65 Coral Gables 15%

5 3850 Bird Rd 2007 5,222 1.9 NNN $30 Coral Gables 10%

6 3060 SW 37th Ave 2021 1,000 1.8 NNN $42 Coral Gables 10%

Weighted Average 1990 2417 1.2 NNN $48 Coral Gables 100%

In order to obtain an accurate current market price, only properties with relatively recent

available data were used. These six properties are other properties that are on lease now.

All the properties selected are other comparable retail properties located in the same

Coral Gables submarket, not further than 1.9 miles from the subject property. Information from

Loopnet was used to collect property data of each one of the properties in the table above.

In this analysis, not all the properties are strictly similar to the subject property.

Additionally, all of them are not occupied; some of them are empty now. Properties’ age widely

varies between properties as same as the size range that also varies from 1,000 sq ft. to 5,222

sq ft.

The six properties featured in the table above are other properties comparable with 1114

S Dixie Hwy. They were weighted based on the following criteria: location, distance, parking, and

property style.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

440 S Dixie Hwy has the highest weight compared to other properties. They both are close

to each other, sharing the same location characteristics. Moreover, both properties are of a

similar age. Finally, they both include a parking lot for their customers.

On the contrary, 301 Altara Ave, 3850 Bird Road, and 3060 SW 37th Ave have the lowest

weight. All of them share basically the same issues. They are far from the subject property in

other areas within Coral Gables but with different characteristics. The style of the properties is

not similar as well. Finally, all of them don’t own a parking lot to receive their customers.

Then, 7200-7222 Red Road and 6020-6030 S Dixie Hwy obtained weights in between the two

extremes.

- 7200-7222 Red Road is located over a highly trafficked street. Despite it is not over the

US1, it doesn’t share the same style and, it doesn’t have a parking lot, it still being within

the range of properties with available rent data comparable to the subject.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

- Although 6020-6030 S Dixie Hwy is a little bit far from the subject property, it is located

over the S Dixie Hwy, sharing the same traffic. Moreover, the property also has a parking

lot for customers and shares some style with the subject property.

Based on the analyses conducted above, it was determined that the weighted average

rent/sq ft. in the area should be around $48. Considering that 1114 S Dixie Hwy is 5,482 sq ft. big,

the gross market rent for the target building should be $263,136.

MARKET COMMENTS:

MMG Equity Partners released “South Florida Retail Real Estate Summary” report last

March 17th. In that report, MMG shares a snapshot of Miami-Dade County market conditions for

the 4Q2021. It looks like on average the asking rent was $40,66 per sq ft. during the last quarter

of 20212.

This number is approximate to others offered by CoStar. It indicates that the average

asking price for the overall market is $41.22 per sq. ft. In particular, CoStar reports that for the

submarket in which the subject property is located, the average asking price is $48.44 per sq ft.

CoStar also provided how much is asking for the subject property. It is asking $48.04 per sq ft.,

providing the exact number that we got from comparable asking rents.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

ANNUAL PRO FORMA RETAIL ASSUMPTIONS

TYPE PSF

GENERAL ASSUMPTIONS Operating Exp. $ 5.79

Vacancy 0% RE Taxes $ 8.52

Inflation 3% Insurance $ 1.01

Adjusting Rents 3% Management Fees $ 0.92

Adjusting Exp.Cost 3% TOTAL $ 16.24

PRO FORMA (Amounts in USD) 1114 S Dixie Hwy

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

For the Years Ending Apr-22 Apr-23 Apr-24 Apr-25 Apr-26 Apr-27

Total Square Footage 5,482 5,482 5,482 5,482 5,482 5,482

Vacant Square Footage 0 0 0 0 0 0

Rented Square Footage 5,482 5,482 5,482 5,482 5,482 5,482

Average Gross Lease

$48.00 $49.44 $50.92 $52.45 $54.02 $55.65

Rent Per Sqft

RENTAL REVENUE

Potential Gross Rent $263,136 $271,030 $279,161 $287,536 $296,162 $305,047

Vacancy $0 $0 $0 $0 $0 $0

Total Rental Revenue $263,136 $271,030 $279,161 $287,536 $296,162 $305,047

OTHER INCOME

Exp. Reimbursement $89,034 $91,705 $94,456 $97,289 $100,208 $103,214

Total Other Income $89,034 $91,705 $94,456 $97,289 $100,208 $103,214

Potential Gross Revenue $352,170 $362,735 $373,617 $384,825 $396,370 $408,261

OPERATING EXPENSES per sq ft.

Operating Exp. $5.79 $31,714 $32,665 $33,645 $34,655 $35,694 $36,765

RE Taxes $8.52 $46,707 $48,108 $49,552 $51,038 $52,569 $54,146

Insurance $1.01 $5,553 $5,720 $5,891 $6,068 $6,250 $6,437

Management Fees $0.92 $5,059 $5,211 $5,368 $5,529 $5,694 $5,865

Total Operating Expenses $16.24 $89,034 $91,705 $94,456 $97,289 $100,208 $103,214

Net Operating Income $263,136 $271,030 $279,161 $287,536 $296,162 $305,047

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

The Pro-forma for 1114 S Dixie Hwy was designed based on a couple of logical

assumptions. No vacancy was considered since the subject property is a two-tenant property

which both are not expected to leave the property. The long-term inflation rate for the US

economy was used, increasing prices at 3% per year. Based on different offering memorandums

for different retail properties in the area (including the subject property), it can be possible to

assume that the NOI of this property increases at 3% per year. To simplify, it was assumed that

operating costs also increase at the inflation rate. Nevertheless, if we consider the most recent

US inflation rate of around 8%, it may be seen that rent growth lags behind. This observation fits

into Greg MacKinnon’s explanation that retail properties are not a good hedge against inflation.

Moreover, retail assumptions to calculate operating expenses. These were obtained from

the Glades Plaza offering memorandum. Those assumptions were adjusted for inflation to

today’s values. It’s valuable to notice that our subject property is NNN, so the tenants reimburse

operating expenses to the landlord.

AKERSON CAP RATE

Akerson Cap Rate 1114 S Dixie Hwy

VARIABLES AKERSON ASSUMPTIONS

Mortgage (LTV) 65% M (LTV) 65%

Equity € 35% E (1 - M) 35%

RM = Mortgage Cnst. $0.055 Loan Rate 3.6%

PV = PV Remaining Loan $0.8976 Term (Years) 30

P = 1 - PV $0.1024 Holding Period (Years) 5

Ye (Required ROE) 15% Ye (Required ROE) 15%

1/Sn (Sinking Fund fact) $0.1483 Appreciation 3%

Delta (App. Over Hold) 0.159274074

Cap Rate (No appr.) 8.30%

Cap Rate (Appreciation) 5.93%

Akerson: No appreciation

NOI $ 263,136

Property Value $ 3,171,432.25

Akerson: Appreciation

NOI $ 263,136

Property Value $ 4,433,788.45

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

The LTV assumption of 65% was made in reference to one of the recent quotes named in

JLL Capital Markets Overview. A conservative interest rate of 3.6% was taken from JLL Capital

Markets Overview considering it is a Retail/Class B property which usually those loans are issued

for. It was considered a 30-year schedule amortized loan with a 5-year holding period. It was also

considered a 3% annual appreciation rate based on the long-term growth rate of the US

economy. It was considered a 15% required rate of return based on the type of property (value-

add). This number fits into what Matt Shores looks like to include a property in his portfolio. All

other values were calculated using Akerson Cap Rate formulas.

CONCLUSION

In this assignment, it was possible to appraise 1114 S Dixie Hwy in two very different ways:

using External Cap Rates (from comparable properties) and using Akerson Cap Rate. This last one

is the most accurate method under unsteady market conditions such as the one we are

experiencing now. Akerson is really useful when markets are volatile and there is no good data

available. Akerson, instead of looking at comparable properties, takes a macroeconomic

approach. Because Akerson considers income return, appreciation return, equity build-up, and

leverage, it may be considered the most comprehensive cap rate.

In a perfect world, both methods should have given the same property appraisal.

Nonetheless, I got two different values for this property. Using the comps approach, I arrived at

the mid property value of $6,507,134. While using the Akerson Cap Rate, I obtained a property

value of $3,171,432 (w/o appreciation), and a property value of $4,433,788 (w/ appreciation).

It is well-known that Miami real estate market is booming, and it is highly probable that

comparable properties’ prices are pushing up our comps valuation. Additionally, some of the

used properties were last transacted when the market was recovering from the 2008 financial

crisis which doesn’t reflect the best CRE pre-pandemic conditions. Bearing on that idea, I would

think that the Akerson with appreciation valuation may be more representative of the property’s

true value (considerably lower although). I’m more confident using Akerson since it was possible

to check the obtained weighted average asking rent with other sources such as CoStar and MMG

4Q 2021 reports.

Nevertheless, under the current Miami CRE’s market prices, if this property were listed

now, it might be possible to obtain the $6,507,134.

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

REFERENCES

1. https://www.coralgables.com/departments/DevelopmentServices/zoningcode

2. https://www.mmgequitypartners.com/south-florida-retail-summary/

Axel Adriel Peluso Nieto

USA | (786) 407 3639 | apelusonieto@miami.com

www.linkedin.com/in/apelusonieto

You might also like

- NURS 366 Exam 1 Study Guide and RubricDocument7 pagesNURS 366 Exam 1 Study Guide and RubriccmpNo ratings yet

- Twice-Weekly Watering Schedule: Kiestwood Community GardenDocument5 pagesTwice-Weekly Watering Schedule: Kiestwood Community GardenkiestwoodNo ratings yet

- Report On Housing in Sea Girt, NJDocument4 pagesReport On Housing in Sea Girt, NJSamuel HenryNo ratings yet

- 3243 Drew Street - OMDocument15 pages3243 Drew Street - OMAnonymous E717q54No ratings yet

- January 20, 2017 Strathmore Times PDFDocument32 pagesJanuary 20, 2017 Strathmore Times PDFStrathmore TimesNo ratings yet

- Full Brochure of InvestmentsDocument79 pagesFull Brochure of Investments081209No ratings yet

- New Vacant LandsDocument34 pagesNew Vacant Lands081209No ratings yet

- Agentmailings: Getting A Home Loan Watch... Ing The TVDocument2 pagesAgentmailings: Getting A Home Loan Watch... Ing The TVapi-115992645No ratings yet

- Gonzales Cannon 9-29-11 IssueDocument50 pagesGonzales Cannon 9-29-11 IssueNikki MaxwellNo ratings yet

- East Point: Tri-Cities Business BuzzDocument8 pagesEast Point: Tri-Cities Business BuzzAndrewNo ratings yet

- Times Review Classifieds: April 7, 2016Document8 pagesTimes Review Classifieds: April 7, 2016TimesreviewNo ratings yet

- Ooccl Newsletter June 2012Document2 pagesOoccl Newsletter June 2012raymond_crawfordNo ratings yet

- 2021 May Trading Post (Ver 1.1)Document3 pages2021 May Trading Post (Ver 1.1)WoodsNo ratings yet

- The903Residences4pgTeaserlow1 - Ppaul DonahueDocument4 pagesThe903Residences4pgTeaserlow1 - Ppaul Donahueashes_xNo ratings yet

- December 2013 / January 2014: Published & Distributed by 208.746.0483 800.473.4158Document28 pagesDecember 2013 / January 2014: Published & Distributed by 208.746.0483 800.473.4158David ArndtNo ratings yet

- Letter of Martin Levine Realtor For Neil GillespieDocument7 pagesLetter of Martin Levine Realtor For Neil GillespieNeil GillespieNo ratings yet

- 2021 June Trading Post (Ver 1.1)Document3 pages2021 June Trading Post (Ver 1.1)WoodsNo ratings yet

- Times Review Classifieds 1-3-13Document4 pagesTimes Review Classifieds 1-3-13TimesreviewNo ratings yet

- Hobe Sound Currents June 2013 Vol. 3 Issue #2Document24 pagesHobe Sound Currents June 2013 Vol. 3 Issue #2Barbara Clowdus100% (1)

- DH 0915Document12 pagesDH 0915The Delphos HeraldNo ratings yet

- Analyzing The Green Valley Mixed-Use II ProjectDocument10 pagesAnalyzing The Green Valley Mixed-Use II ProjectMadelyn GalalNo ratings yet

- Busi. Journal Oct. 2014Document12 pagesBusi. Journal Oct. 2014The Delphos HeraldNo ratings yet

- Palouse Homefinder - Jan/Feb 2011Document20 pagesPalouse Homefinder - Jan/Feb 2011David ArndtNo ratings yet

- The Dima Lysius TeamDocument2 pagesThe Dima Lysius TeamJoseph DimaNo ratings yet

- Anza CT, Victorville, CA 92392 MLS# 541773 RedfinDocument1 pageAnza CT, Victorville, CA 92392 MLS# 541773 Redfin4x59dnqmtwNo ratings yet

- Septembet 21, 2012 Strathmore TimesDocument28 pagesSeptembet 21, 2012 Strathmore TimesStrathmore TimesNo ratings yet

- The Roadrunner: Kern Kaweah Get-Together Sat. Nov 5Th, Reserve NowDocument11 pagesThe Roadrunner: Kern Kaweah Get-Together Sat. Nov 5Th, Reserve NowKern Kaweah Sierrra ClubNo ratings yet

- 03-10-12 Classified Display AdsDocument23 pages03-10-12 Classified Display AdsRegisterPublicationsNo ratings yet

- South Bay Digs 7.5.13Document107 pagesSouth Bay Digs 7.5.13South Bay Digs100% (1)

- Club CaribeDocument24 pagesClub CaribemariapinangoNo ratings yet

- 2023 Annual MarketReportDocument27 pages2023 Annual MarketReportSuyapa SaucedaNo ratings yet

- Elphos Erald: Lakeview Farms Adding 200 Jobs To DelphosDocument12 pagesElphos Erald: Lakeview Farms Adding 200 Jobs To DelphosNancy SpencerNo ratings yet

- BR Development - Hidden Vine ApartmentsDocument35 pagesBR Development - Hidden Vine ApartmentsSamuel SNo ratings yet

- January 6, 2017 Strathmore TimesDocument19 pagesJanuary 6, 2017 Strathmore TimesStrathmore TimesNo ratings yet

- Home Hunter - April 22, 2012Document16 pagesHome Hunter - April 22, 2012Stacey MosierNo ratings yet

- Times Review Classifieds: March 31, 2016Document8 pagesTimes Review Classifieds: March 31, 2016TimesreviewNo ratings yet

- 1375282590moneysaver Shopping NewsDocument16 pages1375282590moneysaver Shopping NewsCoolerAdsNo ratings yet

- Robbinsville 1128Document12 pagesRobbinsville 1128elauwitNo ratings yet

- SouthBeachRealEstate 16c6c17e 5pawhss33wy 16c6c18c Tai0fvv4f4tDocument3 pagesSouthBeachRealEstate 16c6c17e 5pawhss33wy 16c6c18c Tai0fvv4f4tskrishatguruNo ratings yet

- Butner AptDocument11 pagesButner Aptapi-306448793No ratings yet

- Crossroads: Mississippi Chapter Sierra Club Golden Triangle Group Feb 2007 - July 2007Document5 pagesCrossroads: Mississippi Chapter Sierra Club Golden Triangle Group Feb 2007 - July 2007Mississippi Sierra ClubNo ratings yet

- South Central Kentucky Homes September 2011Document108 pagesSouth Central Kentucky Homes September 2011yourtownNo ratings yet

- Hawaii Moves Mag 1 ST QTR 2011Document56 pagesHawaii Moves Mag 1 ST QTR 2011Mathew NgoNo ratings yet

- Times Review Classifieds: Oct. 13, 2016Document7 pagesTimes Review Classifieds: Oct. 13, 2016TimesreviewNo ratings yet

- 2022 July Trading Post - Ver.1Document4 pages2022 July Trading Post - Ver.1WoodsNo ratings yet

- Nova Scotia Home Finder Annapolis Valley March 2015Document72 pagesNova Scotia Home Finder Annapolis Valley March 2015Nancy BainNo ratings yet

- Chicago Retail For LeaseDocument7 pagesChicago Retail For LeaseabrealtyNo ratings yet

- Dysart Appraisal Jan2013Document6 pagesDysart Appraisal Jan2013cbspgNo ratings yet

- Michael Joseph Listings - Issue 24Document5 pagesMichael Joseph Listings - Issue 24Frank VyralNo ratings yet

- Farmstead: Fate of TheDocument12 pagesFarmstead: Fate of TheelauwitNo ratings yet

- February / March 2014: Published & Distributed by 208.746.0483 800.473.4158Document28 pagesFebruary / March 2014: Published & Distributed by 208.746.0483 800.473.4158David ArndtNo ratings yet

- September 2015 Jacksonville ReviewDocument40 pagesSeptember 2015 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Call For ResearchDocument16 pagesCall For ResearchgonnaboyNo ratings yet

- Times Review Classifieds: Dec. 29, 2016Document5 pagesTimes Review Classifieds: Dec. 29, 2016TimesreviewNo ratings yet

- Fairfax Forum ClassifiedsDocument1 pageFairfax Forum ClassifiedsFarmer PublishingNo ratings yet

- APD Solutions and APD Solutions DeKalb LLC DocumentsDocument25 pagesAPD Solutions and APD Solutions DeKalb LLC DocumentsViola DavisNo ratings yet

- 9615 King Road, Loomis, CA 95650 ZeroDownDocument2 pages9615 King Road, Loomis, CA 95650 ZeroDownCraig PatersonNo ratings yet

- Hawaii Moves Mag 4 TH QTR 2010Document64 pagesHawaii Moves Mag 4 TH QTR 2010Mathew NgoNo ratings yet

- Hubertus Boy's National Award Honors His Care For The HungryDocument20 pagesHubertus Boy's National Award Honors His Care For The HungryHometown Publications - Express NewsNo ratings yet

- DS 113 Science Technology and Innovation For DevelopmentDocument50 pagesDS 113 Science Technology and Innovation For DevelopmentEldard KafulaNo ratings yet

- Toilet False Ceiling PlanDocument1 pageToilet False Ceiling PlanPooja JabadeNo ratings yet

- Atlan, Henri - The Living Cell As A Paradigm For Complex Natural SystemsDocument3 pagesAtlan, Henri - The Living Cell As A Paradigm For Complex Natural SystemsKein BécilNo ratings yet

- Inctrykcija Po Zkcplyatacii YLCSDocument90 pagesInctrykcija Po Zkcplyatacii YLCSpredragstojicicNo ratings yet

- Damping Lab 1Document60 pagesDamping Lab 1Robert Lau Yik SiangNo ratings yet

- Krishna PDFCVDocument4 pagesKrishna PDFCVAVS InfraNo ratings yet

- Dolby Vision Generic 4.0 Studio SpecDocument3 pagesDolby Vision Generic 4.0 Studio Spectakeeasy5 takeeasy5No ratings yet

- Shoeb ResumeDocument4 pagesShoeb ResumeM-Shoeb ShaykNo ratings yet

- Summer Training Report On Shri Ram Piston and Rings LimitedDocument89 pagesSummer Training Report On Shri Ram Piston and Rings LimitedKevin Joy75% (4)

- PhysicsOfMusic PDFDocument288 pagesPhysicsOfMusic PDFcahes100% (1)

- Bisalloy 400 DatasheetDocument12 pagesBisalloy 400 DatasheetMohamed SeifNo ratings yet

- Insights Into Formulation Technologies and Novel Strategies For The Design of Orally Disintegrating Dosage Forms: A Comprehensive Industrial ReviewDocument13 pagesInsights Into Formulation Technologies and Novel Strategies For The Design of Orally Disintegrating Dosage Forms: A Comprehensive Industrial ReviewROBINNo ratings yet

- Oando For Jevlink2Document4 pagesOando For Jevlink2Steve Bassey100% (2)

- Griffin IB6e PPTDocument48 pagesGriffin IB6e PPTRoddureMeghlaNo ratings yet

- Micro paraDocument7 pagesMicro paraAj MillanNo ratings yet

- SJ Mepla Manual Program EngDocument57 pagesSJ Mepla Manual Program EngCuong HoNo ratings yet

- Mass Transfer DR AurobaDocument192 pagesMass Transfer DR Aurobaahmed ubeedNo ratings yet

- Butterfly CircusDocument2 pagesButterfly CircusSalma BenjellounNo ratings yet

- Presentation On Heineken BeerDocument13 pagesPresentation On Heineken BeerΣόλα ΚαρίμοβαNo ratings yet

- Sustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksDocument21 pagesSustainable Incorporation of Lime-Bentonite Clay Composite For Production of Ecofriendly BricksWaqas HaroonNo ratings yet

- Authors BookDocument189 pagesAuthors Bookمحمد رضا رضوانیNo ratings yet

- KL 002.10 Eng Student Guide sp2 v1.0.1 PDFDocument414 pagesKL 002.10 Eng Student Guide sp2 v1.0.1 PDFalexusmatrixNo ratings yet

- San Miguel CorporationDocument8 pagesSan Miguel CorporationLeah BautistaNo ratings yet

- FAST PUBLICATION ListofSCOPUSandUGCCAREJournalsDocument3 pagesFAST PUBLICATION ListofSCOPUSandUGCCAREJournalsandrianidebrinaNo ratings yet

- Tarang Hearing Aids To MoH Thru DEIT - 3Document9 pagesTarang Hearing Aids To MoH Thru DEIT - 3Ravindra KumarNo ratings yet

- BCS RulesDocument40 pagesBCS RulesHKF1971No ratings yet

- Krishnan - Soliton Interview ExperienceDocument4 pagesKrishnan - Soliton Interview ExperiencePoorna Saai MNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- Full Metal Plate Mail 1.7Document100 pagesFull Metal Plate Mail 1.7Ezra Agnew100% (1)