Professional Documents

Culture Documents

Income Tax Payment Challan: PSID #: 171610056

Income Tax Payment Challan: PSID #: 171610056

Uploaded by

nadeemuzairCopyright:

Available Formats

You might also like

- Essay On InnovationDocument2 pagesEssay On InnovationAshhar KNo ratings yet

- Income Tax Payment Challan: PSID #: 171894732Document1 pageIncome Tax Payment Challan: PSID #: 171894732moxykho109No ratings yet

- It 000152365852 2023 00Document1 pageIt 000152365852 2023 00nabeelshahzad0035dnbNo ratings yet

- It 000154543078 2023 00Document1 pageIt 000154543078 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000157128851 2023 00Document1 pageIt 000157128851 2023 00Nanak Pur GHSNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000157130050 2023 00Document1 pageIt 000157130050 2023 00xabimoviesNo ratings yet

- It 000144391613 2022 00Document1 pageIt 000144391613 2022 00Muhammad Aamir AbbasNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- Muhammad Jamil-Atl ChallanDocument1 pageMuhammad Jamil-Atl Challanmj0730435No ratings yet

- It 000156180476 2023 00Document1 pageIt 000156180476 2023 00xabimoviesNo ratings yet

- Mushtaq Ahmad-Atl ChallanDocument1 pageMushtaq Ahmad-Atl Challanmj0730435No ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- It 000153285706 2023 00Document1 pageIt 000153285706 2023 00Muhammad AneesNo ratings yet

- Income Tax Payment Challan: PSID #: 164638694Document1 pageIncome Tax Payment Challan: PSID #: 164638694Syed Tahir ImamNo ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- It 000155658731 2023 00Document1 pageIt 000155658731 2023 00Atif JaveadNo ratings yet

- It 000154735437 2023 00Document1 pageIt 000154735437 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- It 000156499945 2023 00Document1 pageIt 000156499945 2023 00xabimoviesNo ratings yet

- It 000137673641 2022 00Document1 pageIt 000137673641 2022 00ayanNo ratings yet

- eyecareDocument1 pageeyecareAbdul GhafoorNo ratings yet

- Nawaz Challan Tax Year 2022 It-000146079994-2022-00Document1 pageNawaz Challan Tax Year 2022 It-000146079994-2022-00Shahid AminNo ratings yet

- It 000145493451 2022 00Document1 pageIt 000145493451 2022 00Salman AhmedNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- Saeed KhanDocument1 pageSaeed Khanattock jadeedNo ratings yet

- It 000156493987 2023 00Document1 pageIt 000156493987 2023 00xabimoviesNo ratings yet

- Income Tax Payment Challan: PSID #: 172367834Document1 pageIncome Tax Payment Challan: PSID #: 172367834Atif JaveadNo ratings yet

- It 000156879363 2023 00Document1 pageIt 000156879363 2023 00xabimoviesNo ratings yet

- It 000146384671 2022 00Document1 pageIt 000146384671 2022 00zohaib hassan ShahNo ratings yet

- It 000155993978 2023 00Document1 pageIt 000155993978 2023 00maaz khanNo ratings yet

- It 000154735269 2023 00Document1 pageIt 000154735269 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154568930 2023 00Document1 pageIt 000154568930 2023 00xabimoviesNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000130702686 2021 00Document1 pageIt 000130702686 2021 00Qazi zubairNo ratings yet

- It 000136721186 2022 00Document1 pageIt 000136721186 2022 00wali khelNo ratings yet

- It 000152688444 2023 00Document1 pageIt 000152688444 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000150863456 2022 00Document1 pageIt 000150863456 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000154116473 2023 00Document1 pageIt 000154116473 2023 00sibghatullahmiranibNo ratings yet

- It 000154264298 2023 00Document1 pageIt 000154264298 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000156923859 2023 00Document1 pageIt 000156923859 2023 00xabimoviesNo ratings yet

- Income Tax Payment Challan: PSID #: 43568625Document1 pageIncome Tax Payment Challan: PSID #: 43568625GM B&GNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- Muhammad Afan Malik-IIDocument1 pageMuhammad Afan Malik-IIBabu AnsariNo ratings yet

- It 000154454559 2023 00Document1 pageIt 000154454559 2023 00xabimoviesNo ratings yet

- Musthtaq Azeem Atl Challan PDFDocument1 pageMusthtaq Azeem Atl Challan PDFFarhan AliNo ratings yet

- IT-000147932818-2023-00Document1 pageIT-000147932818-2023-00Abdul GhafoorNo ratings yet

- It 000154263018 2023 00Document1 pageIt 000154263018 2023 00MUHAMMAD TABRAIZNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- It 000153477861 2023 00Document1 pageIt 000153477861 2023 00Muhammad salman SalmanNo ratings yet

- It 000152669656 2023 00Document1 pageIt 000152669656 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000156478422 2023 00Document1 pageIt 000156478422 2023 00hizbullahjantankNo ratings yet

- Income Tax Payment Challan: PSID #: 162397225Document1 pageIncome Tax Payment Challan: PSID #: 162397225Muhammad Asif BashirNo ratings yet

- It 000156777531 2024 06Document1 pageIt 000156777531 2024 06Zeshan SajidNo ratings yet

- It 000157243994 2024 06Document1 pageIt 000157243994 2024 06Muhammad Umair FakharNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Difference Between GAAP and IFRSDocument7 pagesDifference Between GAAP and IFRSnadeemuzairNo ratings yet

- I3 - IT Operational Change ManagementDocument1 pageI3 - IT Operational Change ManagementnadeemuzairNo ratings yet

- PP Manuals - WatermarkDocument173 pagesPP Manuals - WatermarknadeemuzairNo ratings yet

- AudQuerry For IT AuditorsDocument13 pagesAudQuerry For IT AuditorsnadeemuzairNo ratings yet

- I7 - IT Service Request & Problem HandlingDocument1 pageI7 - IT Service Request & Problem HandlingnadeemuzairNo ratings yet

- EDP Internal Control Questionnaire-FinalDocument3 pagesEDP Internal Control Questionnaire-FinalnadeemuzairNo ratings yet

- Co Manual - WatermarkDocument103 pagesCo Manual - WatermarknadeemuzairNo ratings yet

- In Modern Banking EnvironmentDocument2 pagesIn Modern Banking EnvironmentnadeemuzairNo ratings yet

- IT Audit RDC Islamabad-2009Document55 pagesIT Audit RDC Islamabad-2009nadeemuzairNo ratings yet

- 01-ABAP Lesson One SAP Navigation - SAP ABAPDocument4 pages01-ABAP Lesson One SAP Navigation - SAP ABAPnadeemuzairNo ratings yet

- HandwritingresoucesDocument50 pagesHandwritingresoucesnadeemuzairNo ratings yet

- Chapter 12Document8 pagesChapter 12nadeemuzairNo ratings yet

- Khilafat MovementDocument11 pagesKhilafat MovementnadeemuzairNo ratings yet

- The City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)Document2 pagesThe City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)nadeemuzairNo ratings yet

- ForceDocument24 pagesForcenadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 1Document2 pagesClass 7 Reinforcement Worksheet Algebra 1nadeemuzairNo ratings yet

- Class 6 9 Reinforcement Worksheet Algebra 3Document2 pagesClass 6 9 Reinforcement Worksheet Algebra 3nadeemuzairNo ratings yet

- Sea Breeze - Causes, Diagram and Effects - JotscrollDocument5 pagesSea Breeze - Causes, Diagram and Effects - JotscrollnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Lecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document31 pagesLecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- Lecture 8: Requirements Analysis and NegotiationDocument20 pagesLecture 8: Requirements Analysis and NegotiationnadeemuzairNo ratings yet

- Lecture 6: Requirements Validation and VerificationDocument35 pagesLecture 6: Requirements Validation and VerificationnadeemuzairNo ratings yet

- Consultants Team ExperienceDocument7 pagesConsultants Team ExperiencenadeemuzairNo ratings yet

- Lecture 5: Requirements Elicitation: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document37 pagesLecture 5: Requirements Elicitation: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- P6 Social Studies End of Term I Joint ExaminationsDocument13 pagesP6 Social Studies End of Term I Joint Examinationsemmanuelobiro51No ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- SociolinguisticsDocument21 pagesSociolinguisticsWella WilliamsNo ratings yet

- Mobilia Products, Inc. v. Umezawa, 452 SCRA 736Document15 pagesMobilia Products, Inc. v. Umezawa, 452 SCRA 736JNo ratings yet

- A Level Essay Questions by TopicsDocument11 pagesA Level Essay Questions by TopicsDD97No ratings yet

- VERNACULAR ARCHITECTURE (Mud)Document26 pagesVERNACULAR ARCHITECTURE (Mud)Ashina Gupta100% (1)

- Asian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromDocument3 pagesAsian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromHarsh AryaNo ratings yet

- Health and Physical Education ThesisDocument35 pagesHealth and Physical Education ThesisZia IslamNo ratings yet

- Assignment/ Tugasan - Principles of ManagementDocument11 pagesAssignment/ Tugasan - Principles of ManagementSuriya KumaraNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Netflix and Its InnovationDocument14 pagesNetflix and Its InnovationAkash yadavNo ratings yet

- 10 Sample Paper Chennai Region 2Document11 pages10 Sample Paper Chennai Region 2Illaya BharathiNo ratings yet

- Chiquita Motion To Dismiss For Forum Non ConveniensDocument59 pagesChiquita Motion To Dismiss For Forum Non ConveniensPaulWolfNo ratings yet

- ICICI Prudential Life Insurance CompanyDocument21 pagesICICI Prudential Life Insurance CompanySayantan ChoudhuryNo ratings yet

- Manual On Settlement of Land DisputesDocument120 pagesManual On Settlement of Land Disputescookbooks&lawbooks100% (1)

- Histtory and Importance of HadithDocument31 pagesHisttory and Importance of HadithAbdullah AhsanNo ratings yet

- Difference Between Ancient Medieval and Modern History 61Document2 pagesDifference Between Ancient Medieval and Modern History 61Blv manoharNo ratings yet

- Corpse Grinder Cult Lijst - 1.2Document4 pagesCorpse Grinder Cult Lijst - 1.2Jimmy CarterNo ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- Gulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsDocument20 pagesGulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsmurphygtNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Week 1 Origins of Hospitality and HousekeepingDocument12 pagesWeek 1 Origins of Hospitality and HousekeepingEmmanuel CherianNo ratings yet

- Analysis of Credit Risk Measurement UsinDocument6 pagesAnalysis of Credit Risk Measurement UsinDia-wiNo ratings yet

- Qazi Zahed IqbalDocument95 pagesQazi Zahed IqbalMus'ab AhnafNo ratings yet

- Topic: Student Politics in PakistanDocument7 pagesTopic: Student Politics in PakistanIrfan FarooqNo ratings yet

- Report On Rosemary Chiavetta in Harrisburg PA From NuwberDocument82 pagesReport On Rosemary Chiavetta in Harrisburg PA From Nuwbermaria-bellaNo ratings yet

- TED Taiye SelasiDocument4 pagesTED Taiye SelasiMinh ThuNo ratings yet

Income Tax Payment Challan: PSID #: 171610056

Income Tax Payment Challan: PSID #: 171610056

Uploaded by

nadeemuzairOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Payment Challan: PSID #: 171610056

Income Tax Payment Challan: PSID #: 171610056

Uploaded by

nadeemuzairCopyright:

Available Formats

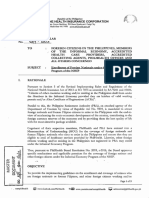

INCOME TAX PAYMENT CHALLAN

For 1-Bill Payment through member PSID # : 171610056

bank please add prefix 999999 with PSID

RTO-I KARACHI 6 6 2023

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 137 Admitted Income Tax Payment Section Code 9203

(Section) (Description of Payment Section) Account Head (NAM) B01131

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

CNIC/Reg./Inc. No. 42201-9423919-5

Taxpayer's Name MUHAMMAD NADEEM BHATTI Status INDIVIDUAL

Business Name

Address 31-A, BLOCK-2, P.E.C.H.S.

FOR WITHHOLDING TAXES ONLY

CNIC/Reg./Inc. No.

Name of withholding agent

Total no. of Taxpayers Total Tax Deducted

Amount of tax in words: Three Hundred Ninety Six Rupees And No Paisas Only Rs. 396

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 396 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor 42201-9423919-5

Name of Depositor MUHAMMAD NADEEM BHATTI

Date

Stamp & Signature

PSID-IT-000144106858-002023

Prepared By : 4220103391201 - MUHAMMAD AQUIL AHMAD Date: 25-Oct-2023 09:12 AM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- Essay On InnovationDocument2 pagesEssay On InnovationAshhar KNo ratings yet

- Income Tax Payment Challan: PSID #: 171894732Document1 pageIncome Tax Payment Challan: PSID #: 171894732moxykho109No ratings yet

- It 000152365852 2023 00Document1 pageIt 000152365852 2023 00nabeelshahzad0035dnbNo ratings yet

- It 000154543078 2023 00Document1 pageIt 000154543078 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000157128851 2023 00Document1 pageIt 000157128851 2023 00Nanak Pur GHSNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000157130050 2023 00Document1 pageIt 000157130050 2023 00xabimoviesNo ratings yet

- It 000144391613 2022 00Document1 pageIt 000144391613 2022 00Muhammad Aamir AbbasNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- Muhammad Jamil-Atl ChallanDocument1 pageMuhammad Jamil-Atl Challanmj0730435No ratings yet

- It 000156180476 2023 00Document1 pageIt 000156180476 2023 00xabimoviesNo ratings yet

- Mushtaq Ahmad-Atl ChallanDocument1 pageMushtaq Ahmad-Atl Challanmj0730435No ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- It 000153285706 2023 00Document1 pageIt 000153285706 2023 00Muhammad AneesNo ratings yet

- Income Tax Payment Challan: PSID #: 164638694Document1 pageIncome Tax Payment Challan: PSID #: 164638694Syed Tahir ImamNo ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- It 000155658731 2023 00Document1 pageIt 000155658731 2023 00Atif JaveadNo ratings yet

- It 000154735437 2023 00Document1 pageIt 000154735437 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- It 000156499945 2023 00Document1 pageIt 000156499945 2023 00xabimoviesNo ratings yet

- It 000137673641 2022 00Document1 pageIt 000137673641 2022 00ayanNo ratings yet

- eyecareDocument1 pageeyecareAbdul GhafoorNo ratings yet

- Nawaz Challan Tax Year 2022 It-000146079994-2022-00Document1 pageNawaz Challan Tax Year 2022 It-000146079994-2022-00Shahid AminNo ratings yet

- It 000145493451 2022 00Document1 pageIt 000145493451 2022 00Salman AhmedNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- Saeed KhanDocument1 pageSaeed Khanattock jadeedNo ratings yet

- It 000156493987 2023 00Document1 pageIt 000156493987 2023 00xabimoviesNo ratings yet

- Income Tax Payment Challan: PSID #: 172367834Document1 pageIncome Tax Payment Challan: PSID #: 172367834Atif JaveadNo ratings yet

- It 000156879363 2023 00Document1 pageIt 000156879363 2023 00xabimoviesNo ratings yet

- It 000146384671 2022 00Document1 pageIt 000146384671 2022 00zohaib hassan ShahNo ratings yet

- It 000155993978 2023 00Document1 pageIt 000155993978 2023 00maaz khanNo ratings yet

- It 000154735269 2023 00Document1 pageIt 000154735269 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154568930 2023 00Document1 pageIt 000154568930 2023 00xabimoviesNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000130702686 2021 00Document1 pageIt 000130702686 2021 00Qazi zubairNo ratings yet

- It 000136721186 2022 00Document1 pageIt 000136721186 2022 00wali khelNo ratings yet

- It 000152688444 2023 00Document1 pageIt 000152688444 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000150863456 2022 00Document1 pageIt 000150863456 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000154116473 2023 00Document1 pageIt 000154116473 2023 00sibghatullahmiranibNo ratings yet

- It 000154264298 2023 00Document1 pageIt 000154264298 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000156923859 2023 00Document1 pageIt 000156923859 2023 00xabimoviesNo ratings yet

- Income Tax Payment Challan: PSID #: 43568625Document1 pageIncome Tax Payment Challan: PSID #: 43568625GM B&GNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- Muhammad Afan Malik-IIDocument1 pageMuhammad Afan Malik-IIBabu AnsariNo ratings yet

- It 000154454559 2023 00Document1 pageIt 000154454559 2023 00xabimoviesNo ratings yet

- Musthtaq Azeem Atl Challan PDFDocument1 pageMusthtaq Azeem Atl Challan PDFFarhan AliNo ratings yet

- IT-000147932818-2023-00Document1 pageIT-000147932818-2023-00Abdul GhafoorNo ratings yet

- It 000154263018 2023 00Document1 pageIt 000154263018 2023 00MUHAMMAD TABRAIZNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- It 000153477861 2023 00Document1 pageIt 000153477861 2023 00Muhammad salman SalmanNo ratings yet

- It 000152669656 2023 00Document1 pageIt 000152669656 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000156478422 2023 00Document1 pageIt 000156478422 2023 00hizbullahjantankNo ratings yet

- Income Tax Payment Challan: PSID #: 162397225Document1 pageIncome Tax Payment Challan: PSID #: 162397225Muhammad Asif BashirNo ratings yet

- It 000156777531 2024 06Document1 pageIt 000156777531 2024 06Zeshan SajidNo ratings yet

- It 000157243994 2024 06Document1 pageIt 000157243994 2024 06Muhammad Umair FakharNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Difference Between GAAP and IFRSDocument7 pagesDifference Between GAAP and IFRSnadeemuzairNo ratings yet

- I3 - IT Operational Change ManagementDocument1 pageI3 - IT Operational Change ManagementnadeemuzairNo ratings yet

- PP Manuals - WatermarkDocument173 pagesPP Manuals - WatermarknadeemuzairNo ratings yet

- AudQuerry For IT AuditorsDocument13 pagesAudQuerry For IT AuditorsnadeemuzairNo ratings yet

- I7 - IT Service Request & Problem HandlingDocument1 pageI7 - IT Service Request & Problem HandlingnadeemuzairNo ratings yet

- EDP Internal Control Questionnaire-FinalDocument3 pagesEDP Internal Control Questionnaire-FinalnadeemuzairNo ratings yet

- Co Manual - WatermarkDocument103 pagesCo Manual - WatermarknadeemuzairNo ratings yet

- In Modern Banking EnvironmentDocument2 pagesIn Modern Banking EnvironmentnadeemuzairNo ratings yet

- IT Audit RDC Islamabad-2009Document55 pagesIT Audit RDC Islamabad-2009nadeemuzairNo ratings yet

- 01-ABAP Lesson One SAP Navigation - SAP ABAPDocument4 pages01-ABAP Lesson One SAP Navigation - SAP ABAPnadeemuzairNo ratings yet

- HandwritingresoucesDocument50 pagesHandwritingresoucesnadeemuzairNo ratings yet

- Chapter 12Document8 pagesChapter 12nadeemuzairNo ratings yet

- Khilafat MovementDocument11 pagesKhilafat MovementnadeemuzairNo ratings yet

- The City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)Document2 pagesThe City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)nadeemuzairNo ratings yet

- ForceDocument24 pagesForcenadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 1Document2 pagesClass 7 Reinforcement Worksheet Algebra 1nadeemuzairNo ratings yet

- Class 6 9 Reinforcement Worksheet Algebra 3Document2 pagesClass 6 9 Reinforcement Worksheet Algebra 3nadeemuzairNo ratings yet

- Sea Breeze - Causes, Diagram and Effects - JotscrollDocument5 pagesSea Breeze - Causes, Diagram and Effects - JotscrollnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Lecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document31 pagesLecture 3: Requirements Quality: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- Lecture 8: Requirements Analysis and NegotiationDocument20 pagesLecture 8: Requirements Analysis and NegotiationnadeemuzairNo ratings yet

- Lecture 6: Requirements Validation and VerificationDocument35 pagesLecture 6: Requirements Validation and VerificationnadeemuzairNo ratings yet

- Consultants Team ExperienceDocument7 pagesConsultants Team ExperiencenadeemuzairNo ratings yet

- Lecture 5: Requirements Elicitation: Requirements Management and Systems Engineering (ITKS451), Autumn 2008Document37 pagesLecture 5: Requirements Elicitation: Requirements Management and Systems Engineering (ITKS451), Autumn 2008nadeemuzairNo ratings yet

- P6 Social Studies End of Term I Joint ExaminationsDocument13 pagesP6 Social Studies End of Term I Joint Examinationsemmanuelobiro51No ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- SociolinguisticsDocument21 pagesSociolinguisticsWella WilliamsNo ratings yet

- Mobilia Products, Inc. v. Umezawa, 452 SCRA 736Document15 pagesMobilia Products, Inc. v. Umezawa, 452 SCRA 736JNo ratings yet

- A Level Essay Questions by TopicsDocument11 pagesA Level Essay Questions by TopicsDD97No ratings yet

- VERNACULAR ARCHITECTURE (Mud)Document26 pagesVERNACULAR ARCHITECTURE (Mud)Ashina Gupta100% (1)

- Asian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromDocument3 pagesAsian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromHarsh AryaNo ratings yet

- Health and Physical Education ThesisDocument35 pagesHealth and Physical Education ThesisZia IslamNo ratings yet

- Assignment/ Tugasan - Principles of ManagementDocument11 pagesAssignment/ Tugasan - Principles of ManagementSuriya KumaraNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Netflix and Its InnovationDocument14 pagesNetflix and Its InnovationAkash yadavNo ratings yet

- 10 Sample Paper Chennai Region 2Document11 pages10 Sample Paper Chennai Region 2Illaya BharathiNo ratings yet

- Chiquita Motion To Dismiss For Forum Non ConveniensDocument59 pagesChiquita Motion To Dismiss For Forum Non ConveniensPaulWolfNo ratings yet

- ICICI Prudential Life Insurance CompanyDocument21 pagesICICI Prudential Life Insurance CompanySayantan ChoudhuryNo ratings yet

- Manual On Settlement of Land DisputesDocument120 pagesManual On Settlement of Land Disputescookbooks&lawbooks100% (1)

- Histtory and Importance of HadithDocument31 pagesHisttory and Importance of HadithAbdullah AhsanNo ratings yet

- Difference Between Ancient Medieval and Modern History 61Document2 pagesDifference Between Ancient Medieval and Modern History 61Blv manoharNo ratings yet

- Corpse Grinder Cult Lijst - 1.2Document4 pagesCorpse Grinder Cult Lijst - 1.2Jimmy CarterNo ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- Gulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsDocument20 pagesGulf Times: HMC Providing State-Of-The-Art Treatment To All Covid-19 PatientsmurphygtNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Week 1 Origins of Hospitality and HousekeepingDocument12 pagesWeek 1 Origins of Hospitality and HousekeepingEmmanuel CherianNo ratings yet

- Analysis of Credit Risk Measurement UsinDocument6 pagesAnalysis of Credit Risk Measurement UsinDia-wiNo ratings yet

- Qazi Zahed IqbalDocument95 pagesQazi Zahed IqbalMus'ab AhnafNo ratings yet

- Topic: Student Politics in PakistanDocument7 pagesTopic: Student Politics in PakistanIrfan FarooqNo ratings yet

- Report On Rosemary Chiavetta in Harrisburg PA From NuwberDocument82 pagesReport On Rosemary Chiavetta in Harrisburg PA From Nuwbermaria-bellaNo ratings yet

- TED Taiye SelasiDocument4 pagesTED Taiye SelasiMinh ThuNo ratings yet