Professional Documents

Culture Documents

2023 11 24 Manitoba-Beef-Producers E-Newsletter FINAL

2023 11 24 Manitoba-Beef-Producers E-Newsletter FINAL

Uploaded by

utamar319Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 11 24 Manitoba-Beef-Producers E-Newsletter FINAL

2023 11 24 Manitoba-Beef-Producers E-Newsletter FINAL

Uploaded by

utamar319Copyright:

Available Formats

E-Newsletter An update from MBP November 24, 2023 mbbeef.

ca

dsfsfa

Manitoba Government Making Agricultural Crown

Land Leases More Affordable for Producers

First Invoices Reflecting New Rent Reduction to Hit Mailboxes Today

(November 24, 2023 Province of Manitoba news release) The Manitoba government encourages sustainable use of

ERIKSDALE—Effective immediately, the Manitoba Crown land for multiple uses through a careful planning

government is increasing the temporary rent reduction process, noted the minister, including the intensity of use and

scheduled for agricultural Crown land (ACL) forage leases how different parcels may be developed. The ACL program

to 55 per cent from 33 per cent for the 2024 growing contributes to ecological goods and services, and provides

season in recognition of the hardships producers have mitigation and adaptation to climate change, added the

faced in recent years, Premier Wab Kinew and Agriculture minister.

Minister Ron Kostyshyn announced here today.

“This announcement is a lifeline for Crown leaseholders,” said

“When the previous government made these changes, it Dale Myhre, a veteran rancher with a cattle operation in the

hurt Manitoba producers in all aspects of their business Parkland region. “We are so grateful that this government is

including production and market costs, and made it harder listening to producers rather than announcing policies without

for them to recover,” said Kinew. “Our government is consultation. With this reduction in Crown lease rents, beef

committed to helping producers in the Parkland, Interlake producers have gone from feeling desperation to feeling hope

and across the province. This rent reduction will again.”

essentially freeze rates to the same as 2023 and will

provide producers with over $2 million in support.” For more information on agricultural Crown lands,

visit https://gov.mb.ca/agriculture/land-

Agricultural Crown lands are parcels of land leased to management/crown-land.

producers for agricultural use including grazing, haying or

annual cropping. These lands are important public assets

economically, environmentally and socially, essential to

supporting and growing the livestock industry in

Manitoba, noted the premier.

“Today’s announcement is part of our promise to ensure

affordability with ACL lease rates and begins to accomplish

the goals set out in the minister of agriculture mandate

letter,” said Kostyshyn. “We will continue to review the

ACL program to ensure it best serves Manitoba

producers.”

Manitoba Government Presents Throne Speech

Welcoming 'A New Day in Manitoba'

(November 21, 2023 Province of Manitoba News • reduce wait times for surgeries and MRIs by

Release) The Manitoba government, joined by bringing high-quality surgical care back to

community leaders from across the province, laid Manitoba’s public health-care system with

out its plan to work together, strengthen health new surgical slates and new diagnostic

care, lower costs for families and grow the services;

province’s low-carbon economy with a geothermal • reduce the backlog in hospitals by

home heating program in the speech from the expanding services at Grace Hospital,

throne, ‘A New Day in Manitoba,’ Premier Wab Health Sciences Centre Winnipeg,

Kinew announced. Concordia Hospital and Brandon Regional

Health Centre;

“Today is a new day in our province,” said Kinew. • provide immediate relief to families by

“Our government is resetting the relationship with freezing hydro rate increases for one year

Manitobans. We are ready to get to work for you, and cutting the gas tax;

alongside other levels of government, public • grow Manitoba’s economy and create good

servants, community leaders, health-care workers jobs by encouraging investments in

and families who are doing everything they can to Manitoba industries like value-added

build a better province. We know we can manufacturing, trade and natural

accomplish great things for Manitoba when we resources;

work together. Our plan will invest in the health • take action to bring needed relief to beef

care and supports you rely on, while being producers on Crown land leases;

responsible with the province’s books.” • work with front-line organizations, the

business community and all levels of

Manitobans were welcomed into the Legislative government to help Manitobans struggling

Building for the ceremonies surrounding the throne with homelessness; and

speech, which included performances from Métis • reset the relationship with Indigenous

fiddlers Morgan Grace and Keith Ginther. governments by working together on

priorities in health care, education and

“After two terms of cuts and closures, the new economic reconciliation.

Manitoba government is presenting a responsible

“Together, we can build the future we want for this

and ambitious plan to strengthen public health

province, where every family can afford to build a

care, grow the economy and build a province where

good life, where you have quality health care close

all Manitobans can thrive,” said Kinew.

to home and a government that works for you,”

said Kinew.

The premier noted the speech from the throne sets

out a course to:

• make Manitoba a leader in the low-carbon

economy with an agreement from the

federal government to deliver funding for a

geothermal heat pump program that will

connect homes across Manitoba with low-

carbon, affordable energy and offer new

opportunities to train the next generation

of energy workers;

Manitoba Government Introduces Legislation to

Make Lives More Affordable for Manitobans by

Lowering Fuel Taxes

Changes would Introduce a Gas Tax Holiday for Six Months: Sala

(November 23, 2023 Province of Manitoba news There is no provincial sales tax on the purchase of

release) The Manitoba government is introducing fuel. Fuel taxes would continue to be collected on

amendments to the fuel tax act, which would aviation, locomotive and propane as these are not

temporarily pause the collection of the provincial included in the fuel tax holiday, the minister

tax on gasoline for at least six months starting added.

next year, Finance Minister Adrien Sala

announced today. The average Manitoba family with two cars is

expected to save approximately $250 during the

“We know there is an affordability crisis in six-month fuel tax holiday, the minister noted.

Manitoba and across Canada,” said Sala. “This

legislation would provide much-needed relief to MBP note: The proposed reduction would be in

Manitobans during these unprecedented times effect January 1 to June 30, 2024. The legislation

of high inflation. The bill would help everyone as drafted states that “No tax is payable during the

from the family rushing their kids off to different tax holiday by a buyer of gasoline, diesel or

activities, to the small business owner who relies natural gas if the fuel is purchased for use in

on their car for work.” operating: (a) a motor vehicle on a roadway; and

(b) a motor vehicle registered as a farm truck

Bill 3, the fuel tax amendment act (fuel tax

under The Drivers and Vehicles Act. In Manitoba a

holiday) would temporarily reduce the provincial

farm truck is defined as “a motor vehicle that is

fuel tax rate to zero cents per litre on gasoline,

owned by a farmer and designed primarily to

natural gas and diesel fuels for road use.

transport cargo and not passengers.” Under The

Highway Traffic Act, "roadway" means the portion

This tax pause would remain in place for six

of a highway that is improved, designed, or

months. During the fuel tax holiday, the 14-cent

ordinarily used for vehicular traffic, and includes

fuel tax rates on gasoline and diesel used to

that portion thereof that, but for the presence of a

operate motor vehicles will be eliminated, the

safety zone, would be ordinarily so used, but does

minister noted.

not include the shoulder; and where a highway

includes two or more separate roadways, the term

“This would provide direct relief to Manitoba

"roadway" refers to any one roadway separately

families struggling with rising costs and is a

and not all of the roadways collectively.”

crucial step in our government’s plan to make

life more affordable for all Manitobans,” said

Sala.

Industry Update

CCA welcomes new provisions and exemptions for

farmers in 2023 Fall Economic Statement

November 24, 2023

On Tuesday, November 21st, the Honourable Chrystia Freeland, Minister of Finance,

announced the Fall Economic Statement (FES). All signals pointed to a restrained FES and the

Canadian Cattle Association (CCA) was pleased to see a few provisions and exemptions

announced for producers. Particularly, we were pleased to see proposed changes to the

Underused Housing Tax (UHT), right to repair equipment, and expansion of eligibility for tax

credits that support using biomass for heat and electricity. While details were skim, CCA staff

are looking into the specifics to see how beef producers will be impacted.

Underused Housing Tax

The FES included a proposed exemption on the UHT for homeowners who use their property as

a place of residence for employees, such as a farm. CCA has advocated for this exemption with

Minister Bibeau at the Canadian Revenue Agency and worked closely with other stakeholders.

We are looking into details to ensure this exemption applies for housing for Temporary Foreign

Workers. This exemption would take place for the 2023 tax filing and future years—it does not

apply to 2022.

As background, the UHT imposes a 1 per cent tax on ownership of vacant or underused

housing in Canada. On October 31, 2023, Minister Bibeau announced a six-month extension to

homeowners affected by the UHT. Affected homeowners have until April 30, 2024, to file their

2022 returns and will not have to pay any penalties or interest provided that they file by that

date.

The proposed changes on UHT announced during FES will include a consultation on the

proposed legislation, with a deadline of January 3, 2024. Interested stakeholders can share their

feedback by emailing Consultation-Legislation@fin.gc.ca. CCA will make a submission in

response.

Right to Repair

The federal government announced amendments to the Competition Act that would prevent

manufacturers from behaving in an anti-competitive manner by refusing to provide the means of

repair of devices and products. This is good news for producers to be able to address any

challenges with tractors and vehicles in a timely manner with fair competition.

Tax Credits to Support Using Waste Biomass to Generate Heat and Electricity

Eligibility of these tax credits will be expanded for a 30-percent clean technology investment tax

credit to include systems that produce electricity, heat, or both from waste biomass, including

from agriculture such as food and animal waste, manure, etc.

There will also be a 15%-percent clean electricity investment tax credit to include systems that

produce electricity or both electricity and heat from waste biomass, which will be available after

Budget 2024 for those projects that did not begin construction before March 28, 2023.

The Canadian Cattle Association is the national voice for Canada’s

beef cattle industry representing 60,000 beef farms and feedlots.

www.cattle.ca

Industry Update

Employee Ownership Trusts

Following the announcement in Budget 2023, which introduced tax rules to facilitate the creation

of Employee Ownership Trusts, the provisions announced in the FES propose to exempt the

first $10 million in capital gains realized on the sale of a business to an Employee Ownership

Trust from taxation. This would be in effect in the 2024, 2025, and 2026 tax years. CCA will

work with Finance Canada and other stakeholders to assess the impact of this change on

producers.

Sustainable Finance

Finally, the federal government announced that the Departments of Finance, Innovation,

Science, and Economic Development, and Environment and Climate Change Canada will

develop options for making climate disclosures mandatory for private companies. The federal

government will also work with regulators, the financial sector, industry, and independent

experts to develop a taxonomy towards reaching net-zero by 2050. CCA will work with

stakeholders and bring our environmental story into these discussions to ensure that producers’

voices are heard.

The full text of the 2023 Fall Economic Statement can be found at

https://www.budget.canada.ca/fes-eea/2023/report-rapport/toc-tdm-en.html

For further information, contact:

Michelle McMullen

Communications Manager

Canadian Cattle Association

403-451-0931| mcmullenm@cattle.ca

The Canadian Cattle Association is the national voice for Canada’s

beef cattle industry representing 60,000 beef farms and feedlots.

www.cattle.ca

Resolutions Suggestion Form for 45th Manitoba Beef Producers AGM

MBP’s board of directors is now accepting in writing suggested resolutions for potential debate at its 45th Annual General Meeting

set for February 8-9, 2024, back at the Victoria Inn Hotel & Conference Centre at 3550 Victoria Avenue in Brandon.

If the resolution is deemed to be in order by MBP’s Resolutions Committee it will be considered for debate at the AGM. In

consultation with the resolution’s author, proposed resolutions may be subject to editing by MBP for clarity and to ensure

consistency of formatting across all resolutions.

Please note: If the resolution covers off matters on which MBP is already conducting advocacy work, it may be deemed to be

redundant and not taken forward for debate so as to ensure there is time to debate resolutions on emerging matters. As well, it is

also important that proposed resolutions deal with something that is potentially achievable and clearly state the actions you are

asking MBP to consider taking. The sample resolution format is below and two examples are on the second page.

Send the proposed resolution and your contact information to info@mbbeef.ca to the attention of General Manager Carson Callum

and Policy Analyst Maureen Cousins. Or, you may fax it to 1-204-774-3264 or mail it to 220-530 Century Street, Winnipeg MB

R3H 0Y4. Resolutions will be accepted for consideration until 9 a.m. Friday, January 26, 2024. All resolutions for debate will

be posted on MBP’s website.

Whereas

Whereas

Be it resolved to recommend that Manitoba Beef Producers

Your name:

Address: (include MBP District number if known)

Phone Number: Email Address:

Sample Resolutions Arising from Past Manitoba Beef Producers District Meetings

Example 1

Whereas blackbirds cause significant losses to producers’ crops.

Be it resolved to recommend that Manitoba Beef Producers lobby the Minister of Sustainable Development to include blackbird

damage as eligible for claims under the Wildlife Damage Compensation Program for Crop Damage.

Example 2

Whereas Manitoba Agriculture recognizes that bale grazing of beef cattle can save producers time, effort and money and help

distribute valuable nutrients to the soil to enhance future productivity; and

Whereas even though this practice is well utilized by Manitoba’s beef producers, they currently receive no compensation for

wildlife damage to bales left in fields or pastures for feeding purposes.

Be it resolved to recommend that Manitoba Beef Producers lobby the provincial government for changes to the Wildlife Damage

Compensation Program for Crop Damage to ensure that baled hay that remains on fields for use as part of an extended feeding

regime becomes eligible for compensation related to wildlife damage.

You might also like

- National ACT AgreementDocument13 pagesNational ACT AgreementKelly Dennett81% (21)

- Reservation Agreement 132 SQM LoremarDocument1 pageReservation Agreement 132 SQM LoremarsherryannNo ratings yet

- No Ashes in The Fire Coming of Age Black and Free in America (Moore, Darnell L)Document164 pagesNo Ashes in The Fire Coming of Age Black and Free in America (Moore, Darnell L)Ebele AbrahamNo ratings yet

- Coalition Talking PointsDocument18 pagesCoalition Talking PointsMax Koslowski100% (2)

- 2016-May 25 MKO Economic Development Strategy DRAFTDocument4 pages2016-May 25 MKO Economic Development Strategy DRAFTctvcameronNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- 2022 Backgrounder 2 EnvironmentDocument4 pages2022 Backgrounder 2 EnvironmentPatrick D HayesNo ratings yet

- The Families First Agenda For ChangeDocument19 pagesThe Families First Agenda For ChangeDave TeixeiraNo ratings yet

- Alternative Budget Malaysia 2017 (Pakatan)Document40 pagesAlternative Budget Malaysia 2017 (Pakatan)Anonymous W3lzrKNo ratings yet

- 12-11-26 Postcard On Throne SpeechDocument5 pages12-11-26 Postcard On Throne SpeechRob AltemeyerNo ratings yet

- 28first SONA of Pres Marcos 2022Document8 pages28first SONA of Pres Marcos 2022yna garcesNo ratings yet

- Mandate Letter: British Columbia Ministry of Environment and Climate Change StrategyDocument3 pagesMandate Letter: British Columbia Ministry of Environment and Climate Change StrategyBC New DemocratsNo ratings yet

- Press Statement by Communication Secretary and State House Spokesperson On Cabinet Meeting Held 25 July 2013Document3 pagesPress Statement by Communication Secretary and State House Spokesperson On Cabinet Meeting Held 25 July 2013State House Kenya0% (1)

- 2007 DAR Accomplishment ReportDocument48 pages2007 DAR Accomplishment ReportGVaper QcphNo ratings yet

- Major Initiatives of Ministry of Cooperation-EnglishDocument14 pagesMajor Initiatives of Ministry of Cooperation-EnglishHarsh VirNo ratings yet

- Agriculture and FarmingDocument2 pagesAgriculture and FarmingparliamentaryyearNo ratings yet

- Mandate Letter: British Columbia Ministry of FinanceDocument3 pagesMandate Letter: British Columbia Ministry of FinanceBC New DemocratsNo ratings yet

- Mandate Letter: British Columbia Ministry of Energy, Mine and Petroleum ResourcesDocument4 pagesMandate Letter: British Columbia Ministry of Energy, Mine and Petroleum ResourcesBC New DemocratsNo ratings yet

- Feb 2023Document55 pagesFeb 2023TirunamalaPhanimohanNo ratings yet

- Manitoba Government Invests Additional $15 Million For Municipalities To Support Road RepairsDocument3 pagesManitoba Government Invests Additional $15 Million For Municipalities To Support Road RepairsOcelNo ratings yet

- Budget23 24Document9 pagesBudget23 24maheshNo ratings yet

- 1206purl Weekly-6868Document17 pages1206purl Weekly-6868Harish SatyaNo ratings yet

- New York State Senate GOP Inflation Report: July 2022Document14 pagesNew York State Senate GOP Inflation Report: July 2022Josh DursoNo ratings yet

- Atmanirbhar Bharat Abhiyan - COVID-19 Relief PackageDocument5 pagesAtmanirbhar Bharat Abhiyan - COVID-19 Relief PackageAnish AnishNo ratings yet

- Climate Emergency Urban Opportunity Priorities For National Governments FINALDocument3 pagesClimate Emergency Urban Opportunity Priorities For National Governments FINALLina Rocio RodriguezNo ratings yet

- 2022 News ReleaseDocument3 pages2022 News ReleasePatrick D HayesNo ratings yet

- Accomplishments and Frequently Asked Questions: Ramped-Up EnergyDocument2 pagesAccomplishments and Frequently Asked Questions: Ramped-Up Energyapi-26167156No ratings yet

- Budget PPT Group 6 (1) - 1Document17 pagesBudget PPT Group 6 (1) - 17336 Vikas MouryaNo ratings yet

- Backing Hard-Working Australians: Sticking To Our PlanDocument28 pagesBacking Hard-Working Australians: Sticking To Our PlanDivyashishNo ratings yet

- Draft 2023 Budget Policy StatementDocument87 pagesDraft 2023 Budget Policy StatementChadwick BirongaNo ratings yet

- 2018 BC Budget News ReleaseDocument3 pages2018 BC Budget News ReleaseMortgage ResourcesNo ratings yet

- Key Features of Budget 2010-2011: ChallengesDocument12 pagesKey Features of Budget 2010-2011: ChallengescoolbkNo ratings yet

- SonaDocument5 pagesSonaApple StarkNo ratings yet

- FIN (Budget)Document19 pagesFIN (Budget)SumitChaturvediNo ratings yet

- Zambia Weekly - Week 38, Volume 1, 24 September 2010Document7 pagesZambia Weekly - Week 38, Volume 1, 24 September 2010Chola MukangaNo ratings yet

- Budget 2010Document12 pagesBudget 2010nnletterNo ratings yet

- Key Features of Budget 2009-2010: ChallengesDocument15 pagesKey Features of Budget 2009-2010: ChallengesmukhunthanNo ratings yet

- Union Budget 2016 HighlightsDocument4 pagesUnion Budget 2016 HighlightsArpit NaruNo ratings yet

- Bugdet Highlights AK4Document2 pagesBugdet Highlights AK4Utsav Srikant MishraNo ratings yet

- Union Budget 2024 - 25Document11 pagesUnion Budget 2024 - 25VrkNo ratings yet

- Tax Reform For Acceleration and Inclusion ActDocument6 pagesTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadNo ratings yet

- Manitoba Hydro Annual Report 2015-16Document116 pagesManitoba Hydro Annual Report 2015-16ChrisDcaNo ratings yet

- Ey JM Budget Analysis 2023 2024 10032023Document14 pagesEy JM Budget Analysis 2023 2024 10032023Gellet ManchenellaNo ratings yet

- Ey Namibia Proposes Compensation Scheme For Businesses Due To Covid 19Document4 pagesEy Namibia Proposes Compensation Scheme For Businesses Due To Covid 19harryNo ratings yet

- Budget 2002-2003 Speech ofDocument34 pagesBudget 2002-2003 Speech ofBabita YadavNo ratings yet

- Budget 2016: A Comprehensive Sector Specific Analysis March 2016Document28 pagesBudget 2016: A Comprehensive Sector Specific Analysis March 2016Honey VashishthaNo ratings yet

- Americans For Prosperity FY 2017 Taxpayers' Budget - Executive SummaryDocument2 pagesAmericans For Prosperity FY 2017 Taxpayers' Budget - Executive SummaryAFPHQ_NewJerseyNo ratings yet

- President Uhuru Kenyatta's Speech During The Official Launch of The Second Medium Term Plan and Signing of Performance Contracts For Cabinet SecretariesDocument5 pagesPresident Uhuru Kenyatta's Speech During The Official Launch of The Second Medium Term Plan and Signing of Performance Contracts For Cabinet SecretariesState House KenyaNo ratings yet

- A21 - MAGBANUA, Andrea M. (Compilation of News)Document20 pagesA21 - MAGBANUA, Andrea M. (Compilation of News)dreaammmNo ratings yet

- Fall 2013 HouseholderDocument4 pagesFall 2013 HouseholdermrybachaNo ratings yet

- A Vision For Hope & Prosperity For The Next Decade and BeyondDocument12 pagesA Vision For Hope & Prosperity For The Next Decade and BeyondcherylmorrisNo ratings yet

- Maine Maine Maine: Executive SummaryDocument20 pagesMaine Maine Maine: Executive SummaryNEWS CENTER MaineNo ratings yet

- ED 2022-09 Lowering Costs For Families (220905) (Signed)Document2 pagesED 2022-09 Lowering Costs For Families (220905) (Signed)WXMINo ratings yet

- Key Features of Budget 2016-2017Document15 pagesKey Features of Budget 2016-2017DikshaNo ratings yet

- Overview of The Union Financial Budget 2010-11: 1 ForewordDocument35 pagesOverview of The Union Financial Budget 2010-11: 1 ForewordCyril HopkinsNo ratings yet

- Real World Econ Examples From MehdiDocument10 pagesReal World Econ Examples From MehdiToviel KiokoNo ratings yet

- Budget 2019 Notes Made From Budget WebsiteDocument10 pagesBudget 2019 Notes Made From Budget Websitelaxmi bhattNo ratings yet

- Highlights of The Interim Budget 2009Document54 pagesHighlights of The Interim Budget 2009Bindhu KutiNo ratings yet

- Sector ImpactDocument6 pagesSector ImpactBhanu KumarNo ratings yet

- Incidence Analysis of Minnesota Governor Budget 2019Document11 pagesIncidence Analysis of Minnesota Governor Budget 2019FluenceMediaNo ratings yet

- CTA Case No. 8918 PDFDocument27 pagesCTA Case No. 8918 PDFSaint AliaNo ratings yet

- Heads of IncomeDocument7 pagesHeads of IncomerockyrrNo ratings yet

- Analysis of Financial Statement Bank Alfalah ReportDocument14 pagesAnalysis of Financial Statement Bank Alfalah ReportIjaz Hussain BajwaNo ratings yet

- Service Invoice For October 2020Document1 pageService Invoice For October 2020YasirTajNo ratings yet

- Mercy Business PlanDocument11 pagesMercy Business PlanMercy L. CooperNo ratings yet

- H LoanDocument136 pagesH LoanElango PaulchamyNo ratings yet

- Palm Gardens-Application FormDocument10 pagesPalm Gardens-Application FormSudhakar GanjikuntaNo ratings yet

- Review of Indian Tax SystemDocument9 pagesReview of Indian Tax Systembcomh01097 UJJWAL SINGHNo ratings yet

- MGT 101 San Mig BreweryDocument9 pagesMGT 101 San Mig BreweryFelix Michael Toothless100% (1)

- 2 Mark QuestionsDocument18 pages2 Mark Questionspreeti chhatwalNo ratings yet

- New Method of National Income Accounting: Courses Offered: Rbi Grade B Sebi NabardDocument6 pagesNew Method of National Income Accounting: Courses Offered: Rbi Grade B Sebi NabardSai harshaNo ratings yet

- Ostrogorsky 1966 Byzantine AgrarianDocument38 pagesOstrogorsky 1966 Byzantine AgrariantheodorrNo ratings yet

- 7 Finalnew Sugg June09Document17 pages7 Finalnew Sugg June09mknatoo1963No ratings yet

- Public RevenueDocument17 pagesPublic RevenueNamrata More100% (1)

- TradeDocument12 pagesTradeQarsam IlyasNo ratings yet

- Liberlisation, Privatisation and GlobalisationDocument5 pagesLiberlisation, Privatisation and GlobalisationKailashNo ratings yet

- Graduate Studies in Public and International AffairsDocument12 pagesGraduate Studies in Public and International Affairsusada_hikkiNo ratings yet

- Accounting VoucherDocument9 pagesAccounting VoucherShivam PrajapatiNo ratings yet

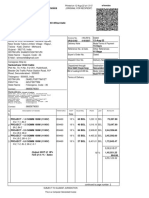

- Tax Invoice: Invoice Address Invoice Details Delivery AddressDocument2 pagesTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneNo ratings yet

- SALES TAX WORKBOOK - Prepared by - Sir Tariq TunioDocument11 pagesSALES TAX WORKBOOK - Prepared by - Sir Tariq TunioM.umairNo ratings yet

- TDS ChallanDocument2 pagesTDS ChallanRamachandran Mahendran60% (5)

- Dist AgreementDocument45 pagesDist AgreementknowsauravNo ratings yet

- Ent 600 FinanceDocument3 pagesEnt 600 FinanceDanial FahimNo ratings yet

- US v. Navarro, G.R. No. 6160 Full TextDocument3 pagesUS v. Navarro, G.R. No. 6160 Full TextThe Money FAQsNo ratings yet

- Budget Speech 2017-18 EnglishDocument148 pagesBudget Speech 2017-18 EnglishAston MartinNo ratings yet

- AEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Document2 pagesAEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Daisy TañoteNo ratings yet

- (Download PDF) Management Accounting Strategic Decision Making Performance and Risk 2nd Edition Hunt Solutions Manual Full ChapterDocument39 pages(Download PDF) Management Accounting Strategic Decision Making Performance and Risk 2nd Edition Hunt Solutions Manual Full Chapteryukawavovcic100% (6)