Professional Documents

Culture Documents

Chapter 1 Quiz Practice Reference

Chapter 1 Quiz Practice Reference

Uploaded by

Trần Khánh VyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 Quiz Practice Reference

Chapter 1 Quiz Practice Reference

Uploaded by

Trần Khánh VyCopyright:

Available Formats

lOMoARcPSD|16255439

Chapter 1 QUIZ - Practice Reference

Bachelor of Science in Accountancy (Polytechnic University of the Philippines)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

REVIEW QUIZ BSA SRC 1-1

• T/F

1. The terms of bookkeeping and accounting are synonymous.

FALSE

*Bookkeeping is only one of the functions of accounting while accounting is a diversified profession.

2. Decreases in asset and decreases in revenue accounts should be entered on the left

side of a T account

TRUE (key to correction answer)

*False is my answer. The normal balance of Asset is debit which is on the left, so

when it decreases it will be entered on the right side (Credit) (opinion ko lang ito

hahaha, correct me if I’m wrong)

3. The bottom line of the trial balance indicates the profitability of the business

FALSE

* The preparation of the trial balance will mathematically prove the equality of the debit and credit

balances of each account but will not give the assurance that no errors have been made during the

journalizing and posting process in case the total debit and credit amounts are shown as equal.

4. Receiving payments on an account receivable increases only the assets.

FALSE

*Receiving payments on AR has no effect on assets. Ma de-decrease yung Ar then

increase yung Cash which is both asset accounts

5. Recording the expiration of a prepaid asset results in the reduction of the asset

account and an increase in the related expense account.

TRUE

6. The firm should use the same accounting method from period to period to achieve

comparability over time within a single enterprise

TRUE

7. Accounting is a service activity whose function is to provide quantitative

information about economic entities.

TRUE

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

8. The accounting process consists of the recording phase and the summarizing phase.

TRUE

9. Double entry bookkeeping means that the accountant should reflect the dual effects

of a business transaction

TRUE

10. A buyer who acquires merchandise under credit terms of 1/10, n/30 has 10

days after the invoice date to take advantage of the cash discount.

TRUE

11. Cash purchase is both a purchase transaction and a cash payment transaction.

Thus, requires two separate entries

FALSE

12. The term freight prepaid or freight collect will dictate who will pay the

transportation costs.

TRUE

13. All adjusting entries involve one entry to an income statement account and

another entry to a balance sheet account.

TRUE

14. Accumulated depreciation and allowance for bad debts are examples of

contra assets

TRUE

15. Closing entries result in the transfer of profit or loss in to the owner’s

capital account

TRUE

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

• Multiple Choice

16. Nina Ricci Company has just completed its first year of operation. Which

of the company’s financial statements cannot be prepared directly from the

adjusted trial balance?

D. ALL (Statement of Capital, SFS,SCI)

17. Which of the following complete description of a transaction is not

possible?

D. Increase asset; decrease equity

18. Adjusting entries are recorded because an entity

B. Uses the accrual basis of accounting

19. The bookkeeper of Benetton Company recorded the payment of a credit

customer as a debit to cash and credit to accounts payable. The erroneous

recording of transaction would result to

A. Overstatement of AR and AP

* Should be: Dr. Cash; Cr. AR

20. A trial balance is

D. A list of all accounts with their balances

21. Which of the following is not considered in computing net cost of

purchases?

B. Transportation cost paid on goods shipped to customers

Included: Transportation cost paid on purchased goods; purchase returns

and allowances; purchases

22. If revenues are greater than expenses, the income summary account will be

closed by

A. Debiting income summary and crediting capital account

23. Posting involves

A. The transferring of amounts from the journal to the appropriate accounts

in the ledger

24. Credit term expression 3/20; n/30 means

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

B. A 3% discount is given if the invoice is paid within 20 days, otherwise, the

total invoice is due in 30 days

25. If a company collected its outstanding trade accounts receivable within the

discount period, the entry upon collection will include

A. Dr. sales discount

26. Operating Income will result if gross profit exceeds

A. Operating Expense

27. A device used to facilitate the preparation of the adjusting entries and the

financial statements is the

B. Worksheet

28. The following are closed to income summary except

B.Drawing

Included: Sales; Expenses; Purchases

* Closed to Capital Acc

29. Net Sales less Cost of Goods Sold will equal

C. Gross Margin

30. The inventory of a merchandising entity consists of goods bought for resale.

Which is not part of the inventory of a grocery store?

C. Computer Equipment

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

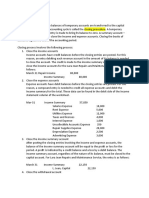

• Problem Solving

31. On December 1, 2017, a client advanced P 80,000 for services to be

rendered first quarter of 2018. The liability method was used to record the

collection of the said amount. What amount is recognized as revenue for the year

2017?

ANSWER: 0

* Because it will only be rendered by next year (2018), so no revenue is to be

recognized by December 31, 2017

32. The following data is available from the records of Spurs Merchandising

Company: Cost of Goods Available for Sale - P 3, 100,000; Gross Profit -P

900,000; Net Sales - P 3,000,000; Net Purchases - P 2,600,000; Operating

expenses - P 1,010,000; What is the company's ending inventory?

ANSWER: 1M

* Ending Inventory = Cost of Goods Sold (COGS) – Cost of Goods Available

for Sale/Total Goods Available for Sale (TGAS)

COGS = Net Sales - Gross Profit (Derived from Gross Profit = Net Sales –

COGS)

COGS = 3M – 900K = 2.1 M

Ending Inventory = 2.1 M – 3.1M = 1M

33. The company’s net income (loss) given the data in number 32 is

ANSWER: (110,000)

*Net Income (loss) = Gross Profit – Operating Expenses

Net Loss = 900,000 – 1,010,000 = (110,000)

34. Given: Sales P 1,800,000; Purchases P 684,000; Ending Inventory P

168,000; Operating expenses P 504,000; Net Income P 132,000. How much is the

cost of sales?

ANSWER: 1,164,000

*COGS/COS = Net Sales - Gross Profit

(Derived from Gross Profit = Net Sales – COGS)

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

Gross Profit = Net Income + Operation Exp (Derived from Net Income = Gross

Profit – Operating Expenses)

Gross Profit = 132K + 504K = 636K

COGS/COS = 1.8 – 636K = 1,164,000

35. L A Clippers Company started its business operation on June 1, 2016 and

showed the following data regarding the Fixed assets as of December 31, 2017.•

Office Equipment bought for P 120,000 on August 1, 2016, estimated useful life 5

years with no salvage value• Transportation equipment - depreciable cost of P

240,000, salvage value of P 30,000, with estimated useful life of 8 years. This was

purchased on May 31, 2017. The company has a calendar year accounting period

and uses the straight line method for depreciation to all its fixed assets. How much

is the adjusting entry for depreciation expense for the year ended December 31,

2017?

ANSWER: 41,500

*Annual Depreciation = Depreciable Asset Cost x Depreciation rate per year

Depreciable Asset Cost = Purchase cost – salvage value

Office Equipment = 120,000 x 20% (1/5 years = Depreciation rate per year) =

24,000 = 24,000

Transportation Equipment = (240,000/8) x 7/12 (7months incurred from May 31

– Dec 31) = 17500

24,000+17500 = 41,500

36. Celtics Company has P 40,000 in revenues, P 88,000 in expenses, P 24,000

in owner investment, P 6,000 in owner’s withdrawals, and P 30,000 in liabilities

paid off. Owner’s equity changes by:

ANSWER: (30,000)

*Changes in Owner’s Equity = Beg. Investment +/- Net Income/Net Loss +

Additional Investment – Withdrawals

Net Loss = 40K-88K = 48K

Changes in Owner’s Equity = 24,000 – (-48K-6,000) = (30,000)

37. The net income reported on the income statement is P 90,000. However,

adjusting entries have not been made at the end of the period for bad debts

expense of P 12,500 and accrued utilities of P 8,400. Net income, as corrected, is:

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

ANSWER: 69,100

*Bad Debts expense &Accrued Utilities are expense accounts, thus should be

deducted from Net Income.

Adjusting entry:

• Bad Debts Expense

Allowance for Bad Debts

• Utilities Expense

Utilities Payable

Net Income = Revenues – Expenses

Correct Net Income = 90,000 – 12,500 – 8,400

Correct Net Income = 69,100

38. The accounts in the ledger of Pacers Company are as follows: . All accounts

have normal balances. Accounts payable 300; Owner’s equity 2,800; Accounts

receivable 400; Prepaid Rent 400; Accrued utilities 100; Rent expense 150; Cash

1,500; Unearned fees 200; Drawings 200; Utilities expense 50; Fees earned 1,900;

Wages expense 350; Insurance expense 250; Land 2,000. In preparing the trial

balance, the total credit is

ANSWER: 5,300

*Accounts payable = 300

Owner’s Equity = 2,800

Accrued Utilities = 100

Unearned Fees (Liability acc) = 200

Fess Earned = 1,900

These accounts are normally credited. Total = 5,300

39. Using data in number 38, total liabilities would amount to:

ANSWER: 600

*Accounts Payable = 300

Accrued Utilities = 100

Unearned Fess = 200

Total = 600

40. Using data in number 38, Pacers Company’s net income is

ANSWER: 1,100

*Net Income = Rev – Exp

Revenue = 1,900

Expenses = 150 + 50 + 350 + 250

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

Net Income = 1,100

41. On June 1, 2019, Parker Company purchased a delivery equipment for P

250,000 with an estimated life of 20 years and a salvage value of P 10,000. Parker

Co. decided to use the straight line method of depreciation. How much will be the

depreciation expense on December 31, 2019?

ANSWER: 7,000

*Annual Depreciation = Purchased cost – salvage value/estimated useful life

Annual Depreciation = 250K-10K/20 yrs = 12,000

Accumulated Dep = 12K x 7/12 (7 months from June 1 – Dec 31) = 7,000

42. Using data in number 41, how much will be the accumulated depreciation

on December 31, 2028?

ANSWER: 115,000

*Annual dep = 12k x 9 yrs (2020-2028) = 108k

108K + 7K (2019 dep) = 115K

43. At the end of March 2017, the first quarter of operations, the following

selected data were taken from the financial records of Lacoste Company: First

Quarter profit P 39,750 ; Total Assets as of March 31, 2017 P 189,700 ; Total

liabilities as of March 31, 2017 P 20,200. In preparing the financial statements,

the following adjustments were overlooked: a) Supplies used during the first

quarter, P 1,750; b) Unbilled fees earned at March 31, 2017, P 2,900; c)

Depreciation of equipment for the quarter, P 2,500; d) Accrued salaries at March

31, 2017, P 1,500. How much is the adjusted amount of profit for the first quarter

ending March 31, 2017?

ANSWER: 36,900

*Profit = 39,750

Supplies Expense = (1,750)

Fees Earned = 2,900

Dep Exp = (2,500)

Salaries Exp = (1,500)

Profit = 36,900

44. As of May 31, 2019, Mr. Davis has a capital balance of P 470,000. During

the month of June, he withdrew P 50,000 to be used for his annual check-up. His

company's income statement revealed various expenses totalling P 89,000,

thereby a Net Loss of P 14,300. During the same period, he was unable to pay a

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

note amounting to P 20,000. How much would be the capital balance of Mr. Davis

at the end of June 2019

ANSWER: 405,700

*Capital end = Beg. Cap - Net Loss – Withdrawals

Capital end = 470K – 14,300 – 50K = 405,700

45. The balance sheet of Tala Company shows total liabilities of P 150,000

which is equal to 1/3 the amount of total assets. What is the amount of total

assets?

ANSWER: 450,000

*150K divided by 1/3 = 450k

46. Using data in number 45, what is the amount of the owner's equity?

ANSWER: 300,000

*A = L + OE

OE = A-L

OE = 450K – 150K = 300K

47. Isabel Company had assets of P 145,000 and liabilities of P 94,000 at the

beginning of the year. during the year, assets decreased by P 32,000 and total

liabilities decreased to P 72,000. Total expenses were P 40,000. There were no

additional investments nor withdrawals during the year. What is the amount of

revenues for the period?

ANSWER: 30,000

*Beginning

A=145K; L=94k; OE=51k

End

A=145-32k=113k

L=72K(“decrease to” means exact decreased amount)

OE = 41K

Formula: Beg OE + Revenue - Expenses – withdrawal = End OE

Reverse operation:

Revenue = 41k End Oe + 40k expenses – 51K beg OE = 30,000

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

lOMoARcPSD|16255439

48. The following information was taken from the bools of Annakel Trading

Company: Purchases P 127,500; Sales P 423,500; Purchase discount P 3,785;

Sales discount P 5,765; Beginning Inventory P 29,000; Ending Inventory P

17,400; Selling expenses P 78,575; Administrative expenses P 68,475. How much

is the gross profit of Annakel Trading Company?

ANSWER: 282,420

*Gross Profit = Net Sales – COGS

COGS = Beg. Inventory + (Purchases – purchase discount) – Ending Inventory

Net Sales = Sales – Sales Discount

Net Sales = 423,500 – 5,765 = 417,735

COGS = 29K + (127,500 – 3,785) – 17,400 = 135,315

Gross Profit = 417,735 – 135,315 = 282,420

49. Using the data in number 48, how much is the net income (net loss)?

ANSWER: 135,370

*Net Income = Gross Profit – Operating Expenses

NI = 282 420 – (78,575 + 68,475) = 135,370

50. The unadjusted trial balance of Butler Company on December 31, 2019

showed the Accounts Receivable with a debit balance of P 150,000 and a credit

balance of P 3,000 for the Allowance for Bad debts. The management estimated

that bad debts will 8% of the outstanding accounts receivable. How much is the

bad debts expense for 2019?

ANSWER: 9,000

*

Required ending balance of Allowance for Doubtful Accounts P12,000

(8% x P 150,000)

less credit balance of allowance before adjustment 3,000

Doubtful Accounts Expense for the period P 9,000

==============

Downloaded by Tr?n Khánh Vy (trankhanhvy.weii@gmail.com)

You might also like

- Group Statements Volume 1 (Sixteenth Edition) - 1-1-1Document555 pagesGroup Statements Volume 1 (Sixteenth Edition) - 1-1-1Thapelo kgwale100% (8)

- Chapter 7Document19 pagesChapter 7nimnim85% (13)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Fundamentals of Accounting 1 and 2Document4 pagesFundamentals of Accounting 1 and 2Mia100% (1)

- Dmp3e Ch03 Solutions 02.17.10 FinalDocument83 pagesDmp3e Ch03 Solutions 02.17.10 Finalmichaelkwok1No ratings yet

- 3tay1112 Jpia Finals E-Review - Actbas1Document3 pages3tay1112 Jpia Finals E-Review - Actbas1CGNo ratings yet

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- Accounting Prodigy BasicAcc1 Instructors Manual PDFDocument5 pagesAccounting Prodigy BasicAcc1 Instructors Manual PDFPrecious Vercaza Del RosarioNo ratings yet

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- Accounting ProcessDocument7 pagesAccounting ProcessLeenNo ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Fabm Week 11 20fabm 121 Week 11 20Document3 pagesFabm Week 11 20fabm 121 Week 11 20Criscel SantiagoNo ratings yet

- Set A Review Quiz QuestionsDocument7 pagesSet A Review Quiz QuestionsJan Allyson BiagNo ratings yet

- 123doc Questions and Answers For Financial Accounting 1 3Document16 pages123doc Questions and Answers For Financial Accounting 1 3Mỹ AnhNo ratings yet

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Document185 pagesFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- KTTC1Document22 pagesKTTC1Trần Khánh VyNo ratings yet

- Pre Final Quiz 4Document8 pagesPre Final Quiz 4MARC JOHN ILANONo ratings yet

- Chapter 3 Acctng ProcessDocument46 pagesChapter 3 Acctng ProcessMary BNo ratings yet

- Q3 - Acctba1 2012-13 2TDocument10 pagesQ3 - Acctba1 2012-13 2TDarwyn MendozaNo ratings yet

- Long Test For Final Examination in Conceptual Framewor... (BSA 2-1 STA. MARIA: 1ST SEM AY 2020-2021)Document26 pagesLong Test For Final Examination in Conceptual Framewor... (BSA 2-1 STA. MARIA: 1ST SEM AY 2020-2021)Mia CruzNo ratings yet

- Posting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessDocument18 pagesPosting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessRalphjoseph Tuazon100% (1)

- Fac511s - Financial Accounting - 1st Opp - June 2019Document8 pagesFac511s - Financial Accounting - 1st Opp - June 2019FrancoNo ratings yet

- Arrangement - Sample QuestionDocument7 pagesArrangement - Sample QuestionJonh Paul SantosNo ratings yet

- Assignment 1Document11 pagesAssignment 1imamibrahim726No ratings yet

- Far 04 Accounting Cycle - Service BusinessDocument18 pagesFar 04 Accounting Cycle - Service Businessyna kyleneNo ratings yet

- Vat and Completion of Acc Cycle For MerchandisingDocument7 pagesVat and Completion of Acc Cycle For MerchandisingLouie De La TorreNo ratings yet

- Bbap18011159 Fin 2013 (WM) Financial ManagementDocument8 pagesBbap18011159 Fin 2013 (WM) Financial ManagementRaynold RaphaelNo ratings yet

- A122 Exercises QDocument30 pagesA122 Exercises QBryan Jackson100% (1)

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloNo ratings yet

- Revenue RecognitionDocument49 pagesRevenue RecognitionKevin Smith0% (1)

- Lecture Notes Chapters 1-4Document32 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesDocument8 pagesDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaNo ratings yet

- Module 9 - The WorksheetDocument13 pagesModule 9 - The WorksheetNina AlexineNo ratings yet

- Abm 1 AdjustingDocument19 pagesAbm 1 AdjustingCarmina DongcayanNo ratings yet

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Chap 9 NotesDocument15 pagesChap 9 Notes乙คckคrψ YTNo ratings yet

- FAR Quizzes and Practical ExerciseDocument23 pagesFAR Quizzes and Practical ExerciseCarla EspirituNo ratings yet

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- Accounting ExamDocument2 pagesAccounting ExamMichelle JohnsonNo ratings yet

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- Topic 2 Accounting EquationDocument27 pagesTopic 2 Accounting EquationHazmanRamleNo ratings yet

- Accounts TestDocument6 pagesAccounts Testwaqas malikNo ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- FABM 2nd Quarter Exam 41 PtsDocument6 pagesFABM 2nd Quarter Exam 41 PtsMa Rk100% (3)

- Revenue IAS 18Document7 pagesRevenue IAS 18Chota H MpukuNo ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- Part DDocument20 pagesPart DAra Bianca InofreNo ratings yet

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDocument16 pagesGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakNo ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- Sample Mid Semester Exam With AnswersDocument15 pagesSample Mid Semester Exam With AnswersjojoinnitNo ratings yet

- AAT ITAX LRP Assessment FA2015 - Questions 2015-16Document8 pagesAAT ITAX LRP Assessment FA2015 - Questions 2015-16LindaBakóNo ratings yet

- Preparing Adjusting Entries Q2 Lesson 1Document65 pagesPreparing Adjusting Entries Q2 Lesson 1reviraclouiejoy21No ratings yet

- Birla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IDocument2 pagesBirla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IArjun Jaideep BhatnagarNo ratings yet

- Check List For Yearly ClosingDocument4 pagesCheck List For Yearly Closingvaishaliak2008No ratings yet

- ACCOUNTINGDocument19 pagesACCOUNTINGaaaaNo ratings yet

- Tutorial 2 CompAccCycle221012 1Document5 pagesTutorial 2 CompAccCycle221012 1revaty18No ratings yet

- Lesson 2 Adjusting The Accounts Service TypeDocument33 pagesLesson 2 Adjusting The Accounts Service TypeSofia Naraine OnilongoNo ratings yet

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Chương 2-3 10đ - 2Document4 pagesChương 2-3 10đ - 2Trần Khánh VyNo ratings yet

- Trần Khánh Vy - 31211022051 - Problem 1.8Document1 pageTrần Khánh Vy - 31211022051 - Problem 1.8Trần Khánh VyNo ratings yet

- Example Chapter 5Document2 pagesExample Chapter 5Trần Khánh VyNo ratings yet

- 52 -Trần Khánh Vy - Written quizDocument2 pages52 -Trần Khánh Vy - Written quizTrần Khánh VyNo ratings yet

- Gallo HBR Regression 2015Document8 pagesGallo HBR Regression 2015Trần Khánh VyNo ratings yet

- KTTC1Document22 pagesKTTC1Trần Khánh VyNo ratings yet

- FormulasDocument17 pagesFormulasTrần Khánh VyNo ratings yet

- CHƯƠNG 6 - Quality Management - 2Document75 pagesCHƯƠNG 6 - Quality Management - 2Trần Khánh VyNo ratings yet

- KTVMDocument12 pagesKTVMTrần Khánh VyNo ratings yet

- Budgeting-For Students 2Document9 pagesBudgeting-For Students 2Trần Khánh VyNo ratings yet

- 676fund Flow Statement Solved ProblemsDocument3 pages676fund Flow Statement Solved ProblemsGovind SinghNo ratings yet

- Completing The AuditDocument49 pagesCompleting The AuditHanna BayotNo ratings yet

- Financial Statement Analysis MCQs - Financial Statements MCQsDocument22 pagesFinancial Statement Analysis MCQs - Financial Statements MCQsMudassir ShaikhNo ratings yet

- DLF LIMITED Auditors ReportDocument6 pagesDLF LIMITED Auditors ReportAvinash MulikNo ratings yet

- ICAI EAC Opinion October-2021-Accounting Treatment of Government GrantsDocument12 pagesICAI EAC Opinion October-2021-Accounting Treatment of Government GrantschandraNo ratings yet

- Auditing Theory 1st PBDocument6 pagesAuditing Theory 1st PBRalph Adian TolentinoNo ratings yet

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraNo ratings yet

- Summative-Test - Louise Peralta - 11 - FairnessDocument3 pagesSummative-Test - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- ACCOUNTING 104 (Government Accounting)Document6 pagesACCOUNTING 104 (Government Accounting)Lagunilla, Mariah Anne E.No ratings yet

- Ar21 22Document164 pagesAr21 22abdulraheem18822No ratings yet

- AcF308 Exam Prep NotesDocument5 pagesAcF308 Exam Prep Notesaryanrao098No ratings yet

- Kendriya Vidyalaya Sangathan Jaipur Region: Last Minutes Revision Material Subject: AccountancyDocument20 pagesKendriya Vidyalaya Sangathan Jaipur Region: Last Minutes Revision Material Subject: AccountancyMohd AyazNo ratings yet

- General Shareholder Meeting Minutes TemplateDocument6 pagesGeneral Shareholder Meeting Minutes TemplatewhatevernameNo ratings yet

- OUTLINE of Business PlanDocument2 pagesOUTLINE of Business PlanHaydeehh BaldinoNo ratings yet

- NTPC Cor - 23690 - 1 - 1Document8 pagesNTPC Cor - 23690 - 1 - 1rajfabNo ratings yet

- CV Kelvin Ndoro CCDocument2 pagesCV Kelvin Ndoro CCKevin MaekaNo ratings yet

- Financial Accounting As Per Cbcs Syllabus 2014 15 As Revised in March 2017 For B Com Semester I Bangalore University Ruqsana Anjum Full ChapterDocument68 pagesFinancial Accounting As Per Cbcs Syllabus 2014 15 As Revised in March 2017 For B Com Semester I Bangalore University Ruqsana Anjum Full Chaptercarol.germann781100% (20)

- 19, International Financial Reporting Standards-I Paper: 02, Accounting & Financial AnalysisDocument13 pages19, International Financial Reporting Standards-I Paper: 02, Accounting & Financial AnalysisMohit RanaNo ratings yet

- JGLE-GAP Report Desember 2021Document93 pagesJGLE-GAP Report Desember 2021Yuari AdeNo ratings yet

- Intermediate Finacial Accounting and Reporting: (ACC406) 20 OCTOBER 2020Document4 pagesIntermediate Finacial Accounting and Reporting: (ACC406) 20 OCTOBER 2020Aliya GhazaliNo ratings yet

- Quiz Number 2 BuscombDocument12 pagesQuiz Number 2 BuscombRyan CapistranoNo ratings yet

- Chapter 5 in Class NoteDocument6 pagesChapter 5 in Class NoteAn TrịnhNo ratings yet

- Accounting Problems 2234Document3 pagesAccounting Problems 2234Camille G.No ratings yet

- Financial Accounting (FA/FFA) : Syllabus and Study GuideDocument16 pagesFinancial Accounting (FA/FFA) : Syllabus and Study GuideAwais MehmoodNo ratings yet

- Annamalai University: Directorate of Distance EducationDocument314 pagesAnnamalai University: Directorate of Distance EducationMALU_BOBBYNo ratings yet

- CH 04Document71 pagesCH 04Khánh Ngọc NguyễnNo ratings yet

- LUSPE - AC54 - Unit V - Summary NotesDocument5 pagesLUSPE - AC54 - Unit V - Summary NotesEDMARK LUSPENo ratings yet

- AccountingDocument95 pagesAccountingSimran KaurNo ratings yet

- Recording Financial TransactionsDocument13 pagesRecording Financial Transactionssewmini.abilashi01No ratings yet