Professional Documents

Culture Documents

Financial Management 1

Financial Management 1

Uploaded by

aniloveish09010 ratings0% found this document useful (0 votes)

2 views2 pagesThis document contains a balance sheet for Star Ltd. as of March 31, 2013 and other financial details regarding sales, costs, debtors, stock, and creditors for the year. The student was asked to calculate three ratios: debtors turnover ratio, creditors turnover ratio, and stock turnover ratio. The student provided the calculations. The debtors turnover ratio was 8 times, creditors turnover ratio was 4 times, and stock turnover ratio was 5 times.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a balance sheet for Star Ltd. as of March 31, 2013 and other financial details regarding sales, costs, debtors, stock, and creditors for the year. The student was asked to calculate three ratios: debtors turnover ratio, creditors turnover ratio, and stock turnover ratio. The student provided the calculations. The debtors turnover ratio was 8 times, creditors turnover ratio was 4 times, and stock turnover ratio was 5 times.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesFinancial Management 1

Financial Management 1

Uploaded by

aniloveish0901This document contains a balance sheet for Star Ltd. as of March 31, 2013 and other financial details regarding sales, costs, debtors, stock, and creditors for the year. The student was asked to calculate three ratios: debtors turnover ratio, creditors turnover ratio, and stock turnover ratio. The student provided the calculations. The debtors turnover ratio was 8 times, creditors turnover ratio was 4 times, and stock turnover ratio was 5 times.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

UPES

UNIVERSITY OF PETROLEUM AND ENERGY STUDIES ,

DEHRADUN

Academic Year 2023-25

Department: MBA, OPERATIONS

Name of Assignment: Ratio Analysis

Full Name: Aniket Kumar Tiwary

Roll No.: Jul-23.2YMBA-OPM10

Subject: Financial Management Date of Submission: 05-12-2023

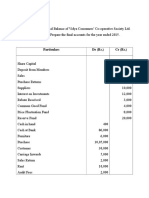

The Balance Sheet of Star Ltd. as at 31 st March, 2013 is given below:

Liabilities Amount Assets Amount

Equity Shares Capital 6,00,000 Plant & Machinery 4,50,000

Reserves 1,80,000 Furniture 50,000

Creditors 1,20,000 Stock 1,80,000

Debtors 1,20,000

Cash at bank 1,00,00

Total 9,00,000 Total 9,00,000

The other details are as follows:

1. Total sales during the year have been Rs. 10,00,000 out of which cash

sales amounted to Rs. 2,00,000.

2. The Gross Profit has been earned @ 20%

3. Amounts as on 1.4.2012

Debtors Rs. 80,000

Stock Rs. 1,40,000

Creditors Rs. 30,000

4. Cash paid to creditors during the year Rs.

2,10,000. You are required to calculate the following

ratios:

[a] Debtors Turnover Ratio; [b] Creditors Turnover Ratio; [c] Stock Turnover Ratio.

Answer

Net credit sales 8,00,000

Debtor Turnover ratio = = =

8 times Avg Receivables 1,00,000

Creditors a/c

To Cash a/c (payments) 2,10,000 By bal b/d 30,000

To Balance c/d 1,20,000 By purchases 3,00,000

3,30,000 (b/f) 3,30,000

Net credit purchases 3,00,000 (2,70,000 + 30,000)

Creditors Turnover ratio = =

Avg payable 75,000

CTR = 4 times

COGS 8,00,000 (10,00,000 - 20%)

Stock Turnover Ratio = =

Avg Stock 1,60,000

STR = 5 times

You might also like

- Morgan Stanley ModelwareDocument60 pagesMorgan Stanley Modelwareusikpa100% (2)

- Ratio Analysis Questions & AnswersDocument10 pagesRatio Analysis Questions & AnswersNaveen ReddyNo ratings yet

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- Intermediate Accounting Quiz BeeDocument8 pagesIntermediate Accounting Quiz BeeAndy SimbreNo ratings yet

- GCE O Level Principles of Accounts GlossaryDocument6 pagesGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- Unit-5 Mefa.Document12 pagesUnit-5 Mefa.Perumalla AkhilNo ratings yet

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDocument5 pages6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6No ratings yet

- Accounting System 0Document24 pagesAccounting System 0ramyaa baluNo ratings yet

- Unit II - Fund Flow & Cash FlowDocument71 pagesUnit II - Fund Flow & Cash FlowParag PardeshiNo ratings yet

- AccountsDocument5 pagesAccountsvenessaNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Aakash RamakrishnanNo ratings yet

- Vertical Financial StatementsDocument3 pagesVertical Financial StatementsMANAN MEHTANo ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Suggested - FM Eco - Test 1Document8 pagesSuggested - FM Eco - Test 1Ritam chaturvediNo ratings yet

- FM Practice Booklet For May 2023Document80 pagesFM Practice Booklet For May 2023Dainika ShettyNo ratings yet

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Practice Problems On Ratio AnalysisDocument6 pagesPractice Problems On Ratio AnalysisRahul SethiNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- 135 Accounting Managers RepeatersDocument4 pages135 Accounting Managers RepeatersThe DreamerNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Test29th AugustDocument2 pagesTest29th Augustemraan_aazamNo ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- Ratio Problems 1Document6 pagesRatio Problems 1Vivek MathiNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- COGS CasesDocument24 pagesCOGS CasesPrabhat KharelNo ratings yet

- Finance Assignment File 1 SolvedDocument5 pagesFinance Assignment File 1 SolvedIQRAsummers 2021No ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- Balance Sheet 1st Year 2nd Year Rs. RsDocument1 pageBalance Sheet 1st Year 2nd Year Rs. Rsjayesh janiNo ratings yet

- Years': PreviousDocument25 pagesYears': PreviousHarsahib SinghNo ratings yet

- Capital AdjustmentDocument13 pagesCapital Adjustmentsvasti2780No ratings yet

- Balance Sheet As On Equity and LiabilitiesDocument8 pagesBalance Sheet As On Equity and LiabilitiesChris TonNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Financial Statement Analysis Live ProjectDocument6 pagesFinancial Statement Analysis Live ProjectAnand Shekhar MishraNo ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- Section_B_Solved_Question Paper-1_BCom_VI_SemDocument13 pagesSection_B_Solved_Question Paper-1_BCom_VI_Semmanoj royNo ratings yet

- Financial Analysis - Ratio IllustrationsDocument10 pagesFinancial Analysis - Ratio IllustrationsDarshana RNo ratings yet

- RatioanalysisanswersDocument5 pagesRatioanalysisanswersAnu PriyaNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Exam PapersDocument8 pagesExam PapersTASH TASHNANo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Ratio Analysis Problems and SolutionsDocument11 pagesRatio Analysis Problems and SolutionsAira Nhaire Cortez MecateNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Table 1Document2 pagesTable 1linkin soyNo ratings yet

- Business Combination ExerciseDocument5 pagesBusiness Combination Exercise수지No ratings yet

- Charts For An Income StatementDocument4 pagesCharts For An Income Statementapi-354584521No ratings yet

- Feroze1888 Mills Limited Swot Analysis BacDocument13 pagesFeroze1888 Mills Limited Swot Analysis BacHasaan Bin ArifNo ratings yet

- ACC 101 - Module 4Document12 pagesACC 101 - Module 4Kyla Renz de LeonNo ratings yet

- Assignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyDocument22 pagesAssignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyAn NguyenthenamNo ratings yet

- Kunci Jawaban PT Alkindi Akuntansi Dagan PDFDocument15 pagesKunci Jawaban PT Alkindi Akuntansi Dagan PDFGunawan Wahyu FaqihNo ratings yet

- IPF Annual Report 2011Document116 pagesIPF Annual Report 2011Dragoș TuțăNo ratings yet

- Jollibee Foods Corporation: Consolidated Statements of IncomeDocument9 pagesJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinNo ratings yet

- Form mgt777Document46 pagesForm mgt777fdfladdNo ratings yet

- 2023 Industry ReportDocument72 pages2023 Industry ReportJeremy Burns100% (1)

- Idx Company Fact Sheet lq45 2022 01 PDFDocument183 pagesIdx Company Fact Sheet lq45 2022 01 PDFRAIHAN HAZIMNo ratings yet

- Block 2: Question Block Created by Wizard 1 of 6Document5 pagesBlock 2: Question Block Created by Wizard 1 of 6wcatNo ratings yet

- Home Office Branch and Agency AccountingDocument32 pagesHome Office Branch and Agency AccountingEspregante RoselleNo ratings yet

- Presentation of FS & Its' AuditingDocument27 pagesPresentation of FS & Its' AuditingTeamAudit Runner GroupNo ratings yet

- Evaluation and Inference of Financial PerformanceDocument82 pagesEvaluation and Inference of Financial PerformanceIlakkiya ManiNo ratings yet

- Integration SAPDocument6 pagesIntegration SAPMuhammad Afzal100% (2)

- Business Plan Final - 96739341 - 181269220201Document20 pagesBusiness Plan Final - 96739341 - 181269220201Abo Mi100% (2)

- Year 12 A Level Business Unit 1 and 2 Checklist How Well Do You Know/understand Each Topic?Document2 pagesYear 12 A Level Business Unit 1 and 2 Checklist How Well Do You Know/understand Each Topic?x SwxyxM xNo ratings yet

- Answers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDocument7 pagesAnswers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDina AlfawalNo ratings yet

- The List of 75 KPIs Includes The Metrics I Consider The Most Important and Informative and They Make A Good Starting Point For The Development of A Performance Management SystemDocument4 pagesThe List of 75 KPIs Includes The Metrics I Consider The Most Important and Informative and They Make A Good Starting Point For The Development of A Performance Management SystemEdward Ebb Bonno50% (2)

- Unit 2 Accounting Concepts, Principles, Bases, and Policies: StructureDocument24 pagesUnit 2 Accounting Concepts, Principles, Bases, and Policies: StructureShekhar MandalNo ratings yet

- Annual Report 2012 of Agrani Bank Limited PDFDocument325 pagesAnnual Report 2012 of Agrani Bank Limited PDFtanjina akhter meemNo ratings yet

- Annual-Report-2017-18 ZomatoDocument26 pagesAnnual-Report-2017-18 ZomatoMs Pillai Renuka Devi IPENo ratings yet

- Kamus AkuntansiDocument9 pagesKamus Akuntansiardityo uriyaniNo ratings yet

- Analysis of Advanced Information July 2023 v4Document18 pagesAnalysis of Advanced Information July 2023 v4Jack LeitchNo ratings yet

- Hons. With ResearchDocument70 pagesHons. With ResearchSusmitaRoyNo ratings yet