Professional Documents

Culture Documents

Working Note

Working Note

Uploaded by

Damilare ElijahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Note

Working Note

Uploaded by

Damilare ElijahCopyright:

Available Formats

Working Note

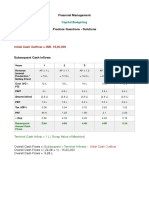

1. Sales Revenues

2018: $0 (No sale took place in 2018)

2019: (Number of Units Sold x Average Price) = 250 x $10,000 = $ 2,500,000

2. Cash

2018: Stock Sold + Bank Loan = $750,000 + $50,000 = $800,000

2019: Inventory Sold x Price per Whisky Barrel = 240 x 10,000 = $2,400,000

3. Inventory

2018: Exhibit 3: January 2018 + July 2018 = $300,000 + $325,000 = $625,000

2019: Exhibit 3: January 2019 + July 2019 = $700,000 + $750,000 = $1,450,000

4. Retained Earnings

2018: 2017 Retained Earnings + 2018 Net Income = $0 - $5,000 = $-5,000

2019: 2018 Retained Earnings + 2019 Net Income = -$5,000 + $50,000 = $45,000

5. Cost of goods sold (COGS)

2018: $0

2019: 250 barrels sold (Using FIFO approach: 50 sold in January 2018 @6,000 + 50 sold in June 2018 @

$6,500 + 100 sold in January 2019 @ $7,000 + 50 in July 2019 @ $7,500) = $300,000 + $325,000 +

$700,000 + $375,000 = $1,700,000

6. Operating Expenses

2018: $0

2019: Sum of disused shipyard lease per month + Second-hand equipment lease + Advertisement + and

other expenses in Exhibit 4= ($7,500 x 12) + $50,000 + $75,000 + $230,000 = $445,000

SG&A

2018 = $0

2019 = Sum of Sales Commission + Operating expenses + Salary expenses to Adger + Master distiller = (250

x $9,000) $250,000 + $445,000 + $50,000 = $745,000

Financial Ratio Formular 2018 Value 2019 Value

Analysis

Current Ratio Current 795,000/50,000 15.9 845,000/50,000 16.9

Assets/Current

Liabilities

Quick/Acid- (Current assets- (795,000- 3.4 (845,000- 9.4

test Ratio inventory)/ 625,000)/ 375,000)/50,000

current liabilities 50,000

The Debt-to- Total 50,000/[750,000 0.067 50,000/ [750,000 0,063

Equity Ratio Liabilities/Equity +(5000)] + 45,000]

Debt-to-Assets Total 50,000/795,000 0.063 50,000/845,000 0.059

ratio Liabilities/Asset

The Return on Net Income/Asset (5000)/795,000* 0.63 50,000/845,000*1 5.92

Assets ratio 100 00

The Return on Net Income/Total 5000)/[750,000 -0.67 50000/(750,000+ 6.29%

Equity Ratio Equity +(5000)]*100 45,000)*100

(ROE)

The Gross Gross N/A N/A (800,000/2,500,00 32%

Margin Income/Revenue 0) *100

The Net Net N/A N/A (50,000/2,500,00 2%

Margin Income/Revenue 0) *100

The Assets Revenue/Total N/A N/A 2,500,000/845,00 3.05

Turnover Ratio 0

Asset

The Inventory COGS/Average N/A N/A 1,700,000/(375,0 3.4

Turnover Ratio Inventory 00+625,000/2)

You might also like

- Accounting Project - Group #2Document5 pagesAccounting Project - Group #2Adedeji Adebowale Peter100% (2)

- Quantic MBA Accounting Project - Class of Sept 2024 Group 58Document7 pagesQuantic MBA Accounting Project - Class of Sept 2024 Group 58Eng Chee Liang100% (1)

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Chapter 1 InventoryDocument12 pagesChapter 1 InventoryDaniel AssefsNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocument27 pagesForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Corportae FinanceDocument10 pagesCorportae FinanceFarooqChaudhary100% (1)

- Chapter 13 SCMDocument12 pagesChapter 13 SCMAliyah Francine Gojo CruzNo ratings yet

- Chapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Document8 pagesChapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Ravena ReyesNo ratings yet

- Chapter 2Document3 pagesChapter 2Ikramul HaqueNo ratings yet

- Latihan Soal Analysis of Financial StatementDocument7 pagesLatihan Soal Analysis of Financial StatementCaroline H24No ratings yet

- Latihan Soal Analysis of Financial StatementDocument7 pagesLatihan Soal Analysis of Financial StatementCaroline H24No ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Fin Analysis Chap 3 PreciseDocument16 pagesFin Analysis Chap 3 PrecisebayezidNo ratings yet

- MS08 10 Working Capital Management Part 2 SolutionsDocument11 pagesMS08 10 Working Capital Management Part 2 SolutionsEarl EzekielNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- CFIN 3rd Edition by Besley Brigham ISBN Solution ManualDocument6 pagesCFIN 3rd Edition by Besley Brigham ISBN Solution Manualrussell100% (30)

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Management of CA 2Document2 pagesManagement of CA 2GA ZinNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- SM - ANSWERS To PROBLEM QUESTIONS - Chapter 13Document6 pagesSM - ANSWERS To PROBLEM QUESTIONS - Chapter 13Sufiyya HabeebNo ratings yet

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- Accounting 1 AssignmentsDocument3 pagesAccounting 1 AssignmentsbashirgisheNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Overall Profitability RatiosDocument20 pagesOverall Profitability RatiosShobika RNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- MobDocument4 pagesMobJun TdhNo ratings yet

- Cfin 2 2nd Edition Besley Test BankDocument5 pagesCfin 2 2nd Edition Besley Test BankBenjaminTaylorcbtgs100% (18)

- GoooooodDocument4 pagesGoooooodIan RelacionNo ratings yet

- Dwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 3 3rd Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (18)

- M4-WK2-HIA - SubmissionDocument7 pagesM4-WK2-HIA - Submissionbim269No ratings yet

- Cfin 3 3rd Edition Besley Solutions ManualDocument5 pagesCfin 3 3rd Edition Besley Solutions Manualjenniferdrakenxkzgroiyt100% (10)

- Financial ControlDocument6 pagesFinancial ControlAbdul MajidNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- Case 1 New Signal Cable CompanyDocument6 pagesCase 1 New Signal Cable Companymilk teaNo ratings yet

- McPhee Distillers Statements v03 CPDocument13 pagesMcPhee Distillers Statements v03 CPcmag10No ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- II Practice of Horizontal & Vertical Analysis Activity IIDocument9 pagesII Practice of Horizontal & Vertical Analysis Activity IIZarish AzharNo ratings yet

- Solutions of End-of-Chapter Four ProblemsDocument4 pagesSolutions of End-of-Chapter Four Problemsctyre34No ratings yet

- Upsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersDocument9 pagesUpsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersLaud ListowellNo ratings yet

- Online Lecture Material FR IMAGE 03Document28 pagesOnline Lecture Material FR IMAGE 03Dave ClintonNo ratings yet

- Capital Budgeting Return On Investment1Document2 pagesCapital Budgeting Return On Investment1Ariadi TjokrodiningratNo ratings yet

- ROI AnalysisDocument2 pagesROI Analysisapi-3809857100% (2)

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- Accounting and Financial ManagementDocument7 pagesAccounting and Financial ManagementMelokuhle MhlongoNo ratings yet

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Biruk Zewdie AFM AssignmentDocument3 pagesBiruk Zewdie AFM AssignmentBura ZeNo ratings yet

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- MRK - Fall 2023 - ACC501 - 1 - BC220417583 DdewwrDocument3 pagesMRK - Fall 2023 - ACC501 - 1 - BC220417583 Ddewwrsalzania01No ratings yet

- Cfin 3 3rd Edition Besley Solutions ManualDocument35 pagesCfin 3 3rd Edition Besley Solutions Manualghebre.comatula.75ew100% (17)

- Cost &MGT Solutions 2018-2023Document181 pagesCost &MGT Solutions 2018-2023ahmad.khalif9999No ratings yet

- Assignment LDocument6 pagesAssignment Lphprcffj2rNo ratings yet

- Solution FM GMDocument11 pagesSolution FM GMDharmateja ChakriNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- RatiosDocument79 pagesRatiosKim Bales BlayNo ratings yet

- Section 4Document3 pagesSection 4com01156499073No ratings yet

- Final Ratio Analysis (2) - 2Document4 pagesFinal Ratio Analysis (2) - 2anjuNo ratings yet

- Business Monthly BudgetDocument4 pagesBusiness Monthly BudgetMohamed ElhousniNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Individual Assignment 12Document7 pagesIndividual Assignment 12bekele amenaNo ratings yet

- Difference Between GAAP and IFRSDocument3 pagesDifference Between GAAP and IFRSGoutam SoniNo ratings yet

- Securitization and The Credit Crisis of 2007: Practice QuestionsDocument5 pagesSecuritization and The Credit Crisis of 2007: Practice QuestionsVishal GoyalNo ratings yet

- Davis Edwards Trading and InvestingDocument10 pagesDavis Edwards Trading and InvestingMaksim PlebejacNo ratings yet

- Acca F7 Revision Notes PDFDocument65 pagesAcca F7 Revision Notes PDFSaurabh Kaushik71% (7)

- Applied Economics: Written Test #1 M1-4Document21 pagesApplied Economics: Written Test #1 M1-4MariaAngelaAdanEvangelistaNo ratings yet

- Geldwickx Assignment Session - 2Document5 pagesGeldwickx Assignment Session - 2Joseph JohnNo ratings yet

- Real Estate Investment and Finance Strategies Structures Key Decisions David Hartzell All ChapterDocument67 pagesReal Estate Investment and Finance Strategies Structures Key Decisions David Hartzell All Chapterdonna.chavis420100% (15)

- Appraising A Project by Discounting and Non-Discounting CriteriaDocument55 pagesAppraising A Project by Discounting and Non-Discounting CriteriaVaidyanathan Ravichandran100% (5)

- JV Valuation IssuesDocument7 pagesJV Valuation IssuesswapnilshethNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow StatementSriram BastolaNo ratings yet

- FMM-XI Jan22Document127 pagesFMM-XI Jan22Ankur100% (2)

- All Practice Set SolutionsDocument22 pagesAll Practice Set SolutionsJohn TomNo ratings yet

- Brokerlist 20141015135322Document1 pageBrokerlist 20141015135322abhaykatNo ratings yet

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- MAS Compilation of QuestionsDocument10 pagesMAS Compilation of QuestionsArianne LlorenteNo ratings yet

- IndivAssignNo2 MK331Document3 pagesIndivAssignNo2 MK331Sarah MitraNo ratings yet

- Research Model Canvas Interactive - HandoutDocument2 pagesResearch Model Canvas Interactive - HandoutArdin SupriadinNo ratings yet

- Product Management Chap. 1Document11 pagesProduct Management Chap. 1Sean CataliaNo ratings yet

- Kaplan Schweser Printable Quizzes - Quiz 6: Question 1 - #10432Document8 pagesKaplan Schweser Printable Quizzes - Quiz 6: Question 1 - #10432Kanak MishraNo ratings yet

- Formula For Ratio AnalysisDocument8 pagesFormula For Ratio AnalysiszainNo ratings yet

- Market For Depository ReceiptsDocument16 pagesMarket For Depository ReceiptsShivangi MahajanNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsSteffany RoqueNo ratings yet

- Far Inventories AssignmentDocument7 pagesFar Inventories AssignmentplenostheamickaelaNo ratings yet

- Market Segmenting Targeting and PositioningDocument45 pagesMarket Segmenting Targeting and PositioningJustine Elissa Arellano MarceloNo ratings yet

- Relevance of Dividend: I. Walter Valuation ModelDocument4 pagesRelevance of Dividend: I. Walter Valuation ModelArj SharmaNo ratings yet

- Solution Manual For Corporate Finance 4Th Edition by Berk Demarzo Isbn 013408327X 9780134083278 Full Chapter PDFDocument27 pagesSolution Manual For Corporate Finance 4Th Edition by Berk Demarzo Isbn 013408327X 9780134083278 Full Chapter PDFkatherine.serrano725100% (10)