Professional Documents

Culture Documents

Concept Map

Concept Map

Uploaded by

21800675Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concept Map

Concept Map

Uploaded by

21800675Copyright:

Available Formats

FEDERAL

BUDGET FISCAL POLICY

Balanced Budget

Government

GOVERNMENT SUPPLY-SIDE

Transfer

Payments EXPENDITURE DEMAND-SIDE

Changes in consumption, investment, government

purchases, and net exports can all affect aggregate

STATES OF demand, shifting the AD curve.

GOVERNMENT Budget Surplus

Fiscal Policy: Keynesian

Government BUDGET Shifting the Aggregate Perspective Marginal Tax Rates and

Purchases Demand Curve Aggregate Supply Marginal (Income) Tax

GOVERNMENT BUDGET

The economy is not self regulating Rate

TAX REVENUE PROJECTIONS Public Debt

Lags Change in person's tax

Subsidy VS Tax Deduction Budget Deficit Data payment

Change in taxable income

Structural

Crowding Out Effectiveness Laffer Curve

Impose Revenue-Generating

Taxes and Fees

Cyclical 0% or 100% Tax Rates

Transmission

Income Tax Structures Value-Added Tax

Direct Effect

Wait-and-see ? Tax Revenues are zero

Legislative Tax Revenue

Indirect Effect

Progressive Major points of the Laffer

Type of Crowding Curve Increase in Tax Rates

Income Tax Regressive Tax Part Value Added

Income Tax Part

? Increase in tax revenues

Proportional

Income Tax Tax Base

Zero Crowding Tax Rate

Incomplete

Decrease in Tax Rates

Out

Crowding Out

? Increase in tax revenues

Complete

Crowding Out

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Economics Knowledge Organisers Macroeconomics Year 1Document12 pagesEconomics Knowledge Organisers Macroeconomics Year 1Jhanvi ParekhNo ratings yet

- National Budget 2024 - EnglishDocument68 pagesNational Budget 2024 - EnglishAdaderana Online100% (1)

- Ifmis Erp System: Integrated Financial Makagements System & Enterprise Resource Planning SystemDocument34 pagesIfmis Erp System: Integrated Financial Makagements System & Enterprise Resource Planning SystemEmmanuel Shivina KhisaNo ratings yet

- Coke Vending Machine - Price DifferentiationDocument6 pagesCoke Vending Machine - Price DifferentiationSubrata Dass50% (2)

- Case Econ08 PPT 22Document48 pagesCase Econ08 PPT 22Satria Curry100% (1)

- J V M Sarma PDFDocument57 pagesJ V M Sarma PDFAnkit GiriNo ratings yet

- Another Clean-Up Job: Jallikattu: Ecological Roots CutDocument1 pageAnother Clean-Up Job: Jallikattu: Ecological Roots CutBibek BoxiNo ratings yet

- Dimensions of The BudgetDocument40 pagesDimensions of The BudgetlosangelesNo ratings yet

- Budget 2011-2012Document4 pagesBudget 2011-2012selvalntpNo ratings yet

- UnionBudgetPreview-Jan14 21Document13 pagesUnionBudgetPreview-Jan14 21Chirag prajapatiNo ratings yet

- Laws of Demand and Supply: 4 Phases of The Business CycleDocument3 pagesLaws of Demand and Supply: 4 Phases of The Business CyclejazNo ratings yet

- Lat 9Document1 pageLat 9aditya FransiskaNo ratings yet

- Budget Highlights FY 207980 V2Document12 pagesBudget Highlights FY 207980 V2Ganesh PoudelNo ratings yet

- Government Budgeting: Courses Offered: Rbi Grade B Sebi NabardDocument16 pagesGovernment Budgeting: Courses Offered: Rbi Grade B Sebi NabardSai harshaNo ratings yet

- Annual Report 2018-EnGDocument250 pagesAnnual Report 2018-EnGHenry DP SinagaNo ratings yet

- Q4 FY22 InfographicDocument1 pageQ4 FY22 InfographicawarialocksNo ratings yet

- 2008 - Budget SimplifiedDocument41 pages2008 - Budget SimplifiedVishal BhojaniNo ratings yet

- The Government and Fiscal Policy: Chapter OutlineDocument38 pagesThe Government and Fiscal Policy: Chapter OutlinecharlotteNo ratings yet

- DIFFERENT TYPES OF DEFICITS INFOGRAPHICS CompressedDocument1 pageDIFFERENT TYPES OF DEFICITS INFOGRAPHICS CompressedRaja SNo ratings yet

- Legal Framework Public Debt Management-1 PDFDocument32 pagesLegal Framework Public Debt Management-1 PDFZambwe ShingweleNo ratings yet

- National: BudgetDocument68 pagesNational: BudgetChamika Nuwan ObeyesekeraNo ratings yet

- Far 09 Government GrantsDocument9 pagesFar 09 Government GrantsJoshua UmaliNo ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- Amendments in Tax Laws FY0798011Document40 pagesAmendments in Tax Laws FY0798011Ganesh PoudelNo ratings yet

- Lec 2 & 3 Fiscal Policy of PakistanDocument66 pagesLec 2 & 3 Fiscal Policy of PakistanGhulam HaiderNo ratings yet

- UNION BUDGET 2023 - Graphs, Trends & Detailed AnalysisDocument16 pagesUNION BUDGET 2023 - Graphs, Trends & Detailed AnalysisappuNo ratings yet

- Budget - Eco AssignmentDocument21 pagesBudget - Eco AssignmentRaghav BharadwajNo ratings yet

- Session 7Document17 pagesSession 7samal.arabinda25No ratings yet

- Mac 4Document6 pagesMac 4Thảo Nguyễn Thị ThuNo ratings yet

- NtungamoDocument2 pagesNtungamoJulius MuhimboNo ratings yet

- Inflation: The Macroeconomic EnvironmentDocument1 pageInflation: The Macroeconomic EnvironmentMinhh KhanggNo ratings yet

- Public Finance-1 - Delhi-Evening (Jan. 2024)Document84 pagesPublic Finance-1 - Delhi-Evening (Jan. 2024)Ashish RanjanNo ratings yet

- Form 2dcDocument3 pagesForm 2dcЛіцей 'Синергія'No ratings yet

- Fiscal Policy - Extra HandoutDocument13 pagesFiscal Policy - Extra HandoutPradeep Kr.No ratings yet

- Annex A-2: Sample Conceptual Framework of Information SystemsDocument1 pageAnnex A-2: Sample Conceptual Framework of Information SystemspetiepanNo ratings yet

- For The Period NOVEMBER 2020: (With Year End Bonus & Cash Gift 2020)Document8 pagesFor The Period NOVEMBER 2020: (With Year End Bonus & Cash Gift 2020)Allen Rey YeclaNo ratings yet

- Agkilo Financial ReportsDocument116 pagesAgkilo Financial ReportsJaya Mariela DuranNo ratings yet

- Financial Budget: Reporter: Katherine MiclatDocument57 pagesFinancial Budget: Reporter: Katherine MiclatMavis LunaNo ratings yet

- Caf GST Booster m1 m20Document94 pagesCaf GST Booster m1 m20thotasravani 1997No ratings yet

- Jinja District ProfileDocument2 pagesJinja District ProfileJohn KimutaiNo ratings yet

- Annex E Changes in Equity 2020Document1 pageAnnex E Changes in Equity 2020EunicaNo ratings yet

- Mar 5 2021 - NASBODocument31 pagesMar 5 2021 - NASBONational Press FoundationNo ratings yet

- Federal Budget 2011Document1 pageFederal Budget 2011The London Free PressNo ratings yet

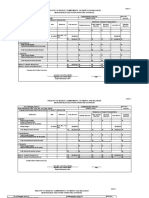

- Nepal Budget Highlights: Financial Year 2020-21Document18 pagesNepal Budget Highlights: Financial Year 2020-21samit shresthaNo ratings yet

- Government GrantsDocument3 pagesGovernment GrantsAruxi YoshiNo ratings yet

- ADs ProformaDocument10 pagesADs ProformaMohit AroraNo ratings yet

- Chicago Park District 2021 Bond Issuance Statement (Preliminary)Document290 pagesChicago Park District 2021 Bond Issuance Statement (Preliminary)jrNo ratings yet

- Budget and Financial Management OverviewDocument34 pagesBudget and Financial Management OverviewOwoicho OmachiNo ratings yet

- The Parliamentary Budget Office's Fiscal Sustainability Report 2017Document125 pagesThe Parliamentary Budget Office's Fiscal Sustainability Report 2017caleyramsayNo ratings yet

- Egypt Economic ReformDocument29 pagesEgypt Economic ReformAmr AhmedNo ratings yet

- Metro Budget Presentation Sept. 2020Document14 pagesMetro Budget Presentation Sept. 2020Metro Los AngelesNo ratings yet

- The Role of Accounting: Financial Accounting Vs Management AccountingDocument1 pageThe Role of Accounting: Financial Accounting Vs Management AccountingMinhh KhanggNo ratings yet

- Giz2022 en Strengthening Good Financil Governance in SambiaDocument2 pagesGiz2022 en Strengthening Good Financil Governance in SambiarefyhaduNo ratings yet

- Daily US Treasury Statement 4/12/11Document2 pagesDaily US Treasury Statement 4/12/11Darla DawaldNo ratings yet

- Finance Bill 2023 AnalysisDocument78 pagesFinance Bill 2023 AnalysisNdung'u NdiranguNo ratings yet

- Budget Procedure in India": A Presentation byDocument58 pagesBudget Procedure in India": A Presentation bykunalNo ratings yet

- Executie Angajamente BugetareDocument2 pagesExecutie Angajamente BugetareDumitru LeuletuNo ratings yet

- Brown Pushing For Taxes: Denied ReleaseDocument28 pagesBrown Pushing For Taxes: Denied ReleaseSan Mateo Daily JournalNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Managerial Economics Working of Telecom ServicesDocument19 pagesManagerial Economics Working of Telecom Servicessunnysandeep4uNo ratings yet

- Structured WarrantsDocument12 pagesStructured WarrantsezzaneeNo ratings yet

- Module 1 - Lecture 2: Marketing ManagementDocument8 pagesModule 1 - Lecture 2: Marketing ManagementChirag SabhayaNo ratings yet

- CapmDocument43 pagesCapmrocky bayasNo ratings yet

- Elements of Demand and SupplyDocument15 pagesElements of Demand and SupplyDolly Lyn ReyesNo ratings yet

- Learning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingDocument6 pagesLearning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingAira AbigailNo ratings yet

- Walmart VRIODocument6 pagesWalmart VRIOgouravNo ratings yet

- Marketing Channels Chapter 2Document24 pagesMarketing Channels Chapter 2Yesfoo Al RiffaayNo ratings yet

- Financial MarketsDocument19 pagesFinancial MarketsRubeenaNo ratings yet

- Introduction To Algo TradingDocument50 pagesIntroduction To Algo TradingMark Luther100% (4)

- Capital MarketsDocument2 pagesCapital MarketsAzzi SabaniNo ratings yet

- IST3005-Lec-04 - Social Media and The Marketing Objectives-Feb21Document22 pagesIST3005-Lec-04 - Social Media and The Marketing Objectives-Feb21KyleNo ratings yet

- LUX SOAP PLC and Strategies by Azhar AliDocument11 pagesLUX SOAP PLC and Strategies by Azhar AliAzhar AliNo ratings yet

- McqsDocument27 pagesMcqsNawab AhmedNo ratings yet

- Principle 6 of EconomicsDocument2 pagesPrinciple 6 of EconomicsAdrian Joseph AlvarezNo ratings yet

- ConsumerDocument5 pagesConsumerSourya MitraNo ratings yet

- FIN 439 Fall 17Document4 pagesFIN 439 Fall 17samenNo ratings yet

- Dcom510 Financial DerivativesDocument238 pagesDcom510 Financial DerivativesRavi Kant sfs 1No ratings yet

- Week 6 Handout PDFDocument7 pagesWeek 6 Handout PDFkiks fernsNo ratings yet

- Analisis Game Theory Pada Strategi Pemasaran Platform Pembelajaran Online X Dan yDocument6 pagesAnalisis Game Theory Pada Strategi Pemasaran Platform Pembelajaran Online X Dan yadhinaNo ratings yet

- Econ 12 PaperDocument11 pagesEcon 12 PaperKKNo ratings yet

- A Pain in The Supply Chain PDFDocument10 pagesA Pain in The Supply Chain PDFLinggar Amanda KamaNo ratings yet

- This Study Resource WasDocument7 pagesThis Study Resource WasAryan LeeNo ratings yet

- Question Nair ReDocument6 pagesQuestion Nair ReMariden Danna BarbosaNo ratings yet

- ECON Homework PDFDocument5 pagesECON Homework PDFNamanNo ratings yet

- CH5 Solution 9eDocument20 pagesCH5 Solution 9eAizhan Maldybayeva0% (1)

- Naked Economics Chapter Study GuideDocument2 pagesNaked Economics Chapter Study GuideXXX100% (1)

- Decision Theory - Sheet1Document2 pagesDecision Theory - Sheet1studentoneNo ratings yet

- Market ModelsDocument14 pagesMarket ModelsAnonymous CH1RGj6hNo ratings yet