Professional Documents

Culture Documents

Exam Taxation

Exam Taxation

Uploaded by

athena leila bordanCopyright:

Available Formats

You might also like

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Problem 1Document3 pagesProblem 1Shiene MedrianoNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PSDocument2 pagesFDNACCT - Quiz #1 - Solutions To PSIchi HasukiNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Chapter 17Document6 pagesChapter 17GONZALES, MICA ANGEL A.No ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- BAF/1/20/011/TZ BAF/1/20/027/TZ: Wakuhanga Manufacturing Statement As at 31 December 2020Document3 pagesBAF/1/20/011/TZ BAF/1/20/027/TZ: Wakuhanga Manufacturing Statement As at 31 December 2020elmudaaNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Team PRTC-10.21 FPB SOLUTION-TAXDocument8 pagesTeam PRTC-10.21 FPB SOLUTION-TAXViolet BaudelaireNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Spring 2024 - MGT401 - 1 - BC230204582Document4 pagesSpring 2024 - MGT401 - 1 - BC230204582Alisaad287No ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- FCF 12th Edition Chapter 02Document32 pagesFCF 12th Edition Chapter 02David ChungNo ratings yet

- Red Rose EnterpriseDocument3 pagesRed Rose Enterprisefatin batrisyiaNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- Chapter 9&11 - Income TaxationDocument4 pagesChapter 9&11 - Income TaxationAnika Gaudan PonoNo ratings yet

- Assignment On Statement of CashflowDocument1 pageAssignment On Statement of CashflowRight Karl-Maccoy HattohNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Prelim Exam-Boticario D. (AST)Document4 pagesPrelim Exam-Boticario D. (AST)Dominic E. BoticarioNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Spring 2024 Mgt401 1 SolDocument3 pagesSpring 2024 Mgt401 1 SolIrfan AhmedNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Answers TaxDocument6 pagesAnswers TaxDANICA DIVINANo ratings yet

- ACTIVITYDocument2 pagesACTIVITYathena leila bordanNo ratings yet

- Personal Dilemmas...Document1 pagePersonal Dilemmas...athena leila bordanNo ratings yet

- PPC - Prelim ExamDocument1 pagePPC - Prelim Examathena leila bordanNo ratings yet

- Workplace DiscriminationDocument3 pagesWorkplace Discriminationathena leila bordanNo ratings yet

- Advertising Semi Final ExamDocument2 pagesAdvertising Semi Final Examathena leila bordanNo ratings yet

- Task Performance On Global Production and Supply Chain ManagementDocument1 pageTask Performance On Global Production and Supply Chain Managementathena leila bordanNo ratings yet

- Case StudyDocument2 pagesCase Studyathena leila bordanNo ratings yet

- Task Performance On Global Human Resources ManagementDocument2 pagesTask Performance On Global Human Resources Managementathena leila bordanNo ratings yet

- Income Tax. ExerciseDocument2 pagesIncome Tax. Exerciseathena leila bordanNo ratings yet

- Final Exam-IbtDocument1 pageFinal Exam-Ibtathena leila bordanNo ratings yet

- Pre-Finals ExamDocument1 pagePre-Finals Examathena leila bordanNo ratings yet

- The Organization of International BusinessDocument1 pageThe Organization of International Businessathena leila bordanNo ratings yet

- Importing, Exporting and CountertradeDocument2 pagesImporting, Exporting and Countertradeathena leila bordanNo ratings yet

- Donghua Double Pitch ChainDocument611 pagesDonghua Double Pitch ChainErliana IndahNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- 30 Proggrsming ProblemsDocument21 pages30 Proggrsming ProblemsWarren GonzalesNo ratings yet

- A Level Accounting QuestionsDocument391 pagesA Level Accounting QuestionsALI HAMEEDNo ratings yet

- Btot 011.09.2022Document259 pagesBtot 011.09.2022Manas HemantNo ratings yet

- Converse SwotDocument5 pagesConverse SwotAsif FazlaniNo ratings yet

- PB BrE B1+ WB Answers U5 PDFDocument1 pagePB BrE B1+ WB Answers U5 PDFDaniel CostaNo ratings yet

- Lesson 4Document5 pagesLesson 4Apple Allyssah ComabigNo ratings yet

- Lean Manufacturing OverviewDocument252 pagesLean Manufacturing OverviewDebashishDolon100% (1)

- BudolDocument2 pagesBudolShaun GatdulaNo ratings yet

- SEA ShopeeDocument222 pagesSEA ShopeemikhaelNo ratings yet

- Gratuity Form-IDocument3 pagesGratuity Form-IanupamaNo ratings yet

- Table 1: Variance Analysis of Actual Vs Forecasted Results For Short Term Bank Debt On July 08Document6 pagesTable 1: Variance Analysis of Actual Vs Forecasted Results For Short Term Bank Debt On July 08PK LNo ratings yet

- file BBA Sem.6Document27 pagesfile BBA Sem.6Dr RamaniNo ratings yet

- AnnexureDocument3 pagesAnnexurejeetNo ratings yet

- CBRE Q410 HCMC Market Insights ENDocument11 pagesCBRE Q410 HCMC Market Insights ENTran BachNo ratings yet

- Efficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsDocument16 pagesEfficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsCông Long NguyễnNo ratings yet

- Portes Five AnalysisDocument7 pagesPortes Five AnalysisDotecho Jzo EyNo ratings yet

- Packing List: Ship-To PartyDocument7 pagesPacking List: Ship-To PartySeb EgnNo ratings yet

- Infosys Cobalt WhitePaper Contract-Manufacturing-ApproachDocument8 pagesInfosys Cobalt WhitePaper Contract-Manufacturing-ApproachSharma AkshayNo ratings yet

- Thesis On Automobile Industry in PakistanDocument8 pagesThesis On Automobile Industry in PakistanAndrew Parish100% (2)

- Sb025e INVOICE PACKSLIP 1632834873584Document1 pageSb025e INVOICE PACKSLIP 1632834873584RahulNo ratings yet

- PBL Session 2Document3 pagesPBL Session 2Muhammad ZulhisyamNo ratings yet

- Canon Sus 2019 eDocument136 pagesCanon Sus 2019 eSameer AdnanNo ratings yet

- 05-Determinants of Tax Avoidance - Evidence On Profit Tax-Paying Companies in RomaniaDocument22 pages05-Determinants of Tax Avoidance - Evidence On Profit Tax-Paying Companies in RomaniaatiaNo ratings yet

- Retail BankingDocument25 pagesRetail BankingTrusha Hodiwala80% (5)

- MR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleDocument2 pagesMR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleAubrien Fachi MusambakarumeNo ratings yet

- 06-Play Cc6 - Leveraging Wins To Attract Similar Clients - Sales DnaDocument1 page06-Play Cc6 - Leveraging Wins To Attract Similar Clients - Sales DnaIman Ragheb. PANo ratings yet

- Internship Report BankDocument28 pagesInternship Report BankHumera TariqNo ratings yet

- 01 PartnershipDocument27 pages01 PartnershipEarl ENo ratings yet

Exam Taxation

Exam Taxation

Uploaded by

athena leila bordanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam Taxation

Exam Taxation

Uploaded by

athena leila bordanCopyright:

Available Formats

ATHENA LEILA S.

BORDAN

1. C

2. A

3. D

4. D

5. A

6. D

7. D

8. C

9. A

10.C

11.C

12.D

13.B

14.B

Solution: Net Income per book P 220,000

Less dividend income (50,000)

Interest Income (5,000)

Add provision for bad debts 35,000

Taxable Income P200,000

15.C

Solution: Gross Income P895,250

Less: dividend from domestic corporation (42,000)

Dividend received from resident foreign corp (5,000)

Proceeds from sale of company sales (4,750)

Net Income P 828,000

Add : bad debts recovered 15,000

Income before tax 843,000

Income tax(30%) 251,900

Less: tax credit for 2010 (15,000)

Income tax payable 236,900

Add: Surcharge (2%) 4, 738

Interest (20% of P236,000) 47,380

Total income tax payable 288,018

Less: Tax paid in 2010 (50,000)

Income Tax Payable in 2022 P 35,763.50

16.A

17.D

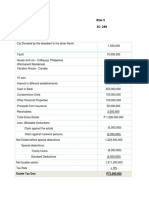

Solution: Un Adjacent taxable income P520,240

Less: Cash Dividend (122,8000)

Stock dividend (73,500)

Property dividend (27.000)

Gambling Winnings (23,100)

Donation Received (16,000)

Gain on sale of capital asset (15 months)

(800,000x50%) (4,000)

Gain on sale of his vacant lot (120,000)

Total P133,840

Add: surcharge on late filling 12,000

Interest on personal loan 24,000

Gambling losses 32,000

Personal and living expenses 50,000

Loss on sale of capitol assets 5,000

Adjustable Taxable Income P 256,840

18.D

19.C

20.A

21.D

22.A

23.A

24.D

25.D

26.C

You might also like

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Problem 1Document3 pagesProblem 1Shiene MedrianoNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PSDocument2 pagesFDNACCT - Quiz #1 - Solutions To PSIchi HasukiNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Chapter 17Document6 pagesChapter 17GONZALES, MICA ANGEL A.No ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- BUSITAX (Final Output)Document5 pagesBUSITAX (Final Output)Ivan AnaboNo ratings yet

- BAF/1/20/011/TZ BAF/1/20/027/TZ: Wakuhanga Manufacturing Statement As at 31 December 2020Document3 pagesBAF/1/20/011/TZ BAF/1/20/027/TZ: Wakuhanga Manufacturing Statement As at 31 December 2020elmudaaNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Team PRTC-10.21 FPB SOLUTION-TAXDocument8 pagesTeam PRTC-10.21 FPB SOLUTION-TAXViolet BaudelaireNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Spring 2024 - MGT401 - 1 - BC230204582Document4 pagesSpring 2024 - MGT401 - 1 - BC230204582Alisaad287No ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- FCF 12th Edition Chapter 02Document32 pagesFCF 12th Edition Chapter 02David ChungNo ratings yet

- Red Rose EnterpriseDocument3 pagesRed Rose Enterprisefatin batrisyiaNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- Chapter 9&11 - Income TaxationDocument4 pagesChapter 9&11 - Income TaxationAnika Gaudan PonoNo ratings yet

- Assignment On Statement of CashflowDocument1 pageAssignment On Statement of CashflowRight Karl-Maccoy HattohNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Prelim Exam-Boticario D. (AST)Document4 pagesPrelim Exam-Boticario D. (AST)Dominic E. BoticarioNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Spring 2024 Mgt401 1 SolDocument3 pagesSpring 2024 Mgt401 1 SolIrfan AhmedNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Answers TaxDocument6 pagesAnswers TaxDANICA DIVINANo ratings yet

- ACTIVITYDocument2 pagesACTIVITYathena leila bordanNo ratings yet

- Personal Dilemmas...Document1 pagePersonal Dilemmas...athena leila bordanNo ratings yet

- PPC - Prelim ExamDocument1 pagePPC - Prelim Examathena leila bordanNo ratings yet

- Workplace DiscriminationDocument3 pagesWorkplace Discriminationathena leila bordanNo ratings yet

- Advertising Semi Final ExamDocument2 pagesAdvertising Semi Final Examathena leila bordanNo ratings yet

- Task Performance On Global Production and Supply Chain ManagementDocument1 pageTask Performance On Global Production and Supply Chain Managementathena leila bordanNo ratings yet

- Case StudyDocument2 pagesCase Studyathena leila bordanNo ratings yet

- Task Performance On Global Human Resources ManagementDocument2 pagesTask Performance On Global Human Resources Managementathena leila bordanNo ratings yet

- Income Tax. ExerciseDocument2 pagesIncome Tax. Exerciseathena leila bordanNo ratings yet

- Final Exam-IbtDocument1 pageFinal Exam-Ibtathena leila bordanNo ratings yet

- Pre-Finals ExamDocument1 pagePre-Finals Examathena leila bordanNo ratings yet

- The Organization of International BusinessDocument1 pageThe Organization of International Businessathena leila bordanNo ratings yet

- Importing, Exporting and CountertradeDocument2 pagesImporting, Exporting and Countertradeathena leila bordanNo ratings yet

- Donghua Double Pitch ChainDocument611 pagesDonghua Double Pitch ChainErliana IndahNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- 30 Proggrsming ProblemsDocument21 pages30 Proggrsming ProblemsWarren GonzalesNo ratings yet

- A Level Accounting QuestionsDocument391 pagesA Level Accounting QuestionsALI HAMEEDNo ratings yet

- Btot 011.09.2022Document259 pagesBtot 011.09.2022Manas HemantNo ratings yet

- Converse SwotDocument5 pagesConverse SwotAsif FazlaniNo ratings yet

- PB BrE B1+ WB Answers U5 PDFDocument1 pagePB BrE B1+ WB Answers U5 PDFDaniel CostaNo ratings yet

- Lesson 4Document5 pagesLesson 4Apple Allyssah ComabigNo ratings yet

- Lean Manufacturing OverviewDocument252 pagesLean Manufacturing OverviewDebashishDolon100% (1)

- BudolDocument2 pagesBudolShaun GatdulaNo ratings yet

- SEA ShopeeDocument222 pagesSEA ShopeemikhaelNo ratings yet

- Gratuity Form-IDocument3 pagesGratuity Form-IanupamaNo ratings yet

- Table 1: Variance Analysis of Actual Vs Forecasted Results For Short Term Bank Debt On July 08Document6 pagesTable 1: Variance Analysis of Actual Vs Forecasted Results For Short Term Bank Debt On July 08PK LNo ratings yet

- file BBA Sem.6Document27 pagesfile BBA Sem.6Dr RamaniNo ratings yet

- AnnexureDocument3 pagesAnnexurejeetNo ratings yet

- CBRE Q410 HCMC Market Insights ENDocument11 pagesCBRE Q410 HCMC Market Insights ENTran BachNo ratings yet

- Efficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsDocument16 pagesEfficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsCông Long NguyễnNo ratings yet

- Portes Five AnalysisDocument7 pagesPortes Five AnalysisDotecho Jzo EyNo ratings yet

- Packing List: Ship-To PartyDocument7 pagesPacking List: Ship-To PartySeb EgnNo ratings yet

- Infosys Cobalt WhitePaper Contract-Manufacturing-ApproachDocument8 pagesInfosys Cobalt WhitePaper Contract-Manufacturing-ApproachSharma AkshayNo ratings yet

- Thesis On Automobile Industry in PakistanDocument8 pagesThesis On Automobile Industry in PakistanAndrew Parish100% (2)

- Sb025e INVOICE PACKSLIP 1632834873584Document1 pageSb025e INVOICE PACKSLIP 1632834873584RahulNo ratings yet

- PBL Session 2Document3 pagesPBL Session 2Muhammad ZulhisyamNo ratings yet

- Canon Sus 2019 eDocument136 pagesCanon Sus 2019 eSameer AdnanNo ratings yet

- 05-Determinants of Tax Avoidance - Evidence On Profit Tax-Paying Companies in RomaniaDocument22 pages05-Determinants of Tax Avoidance - Evidence On Profit Tax-Paying Companies in RomaniaatiaNo ratings yet

- Retail BankingDocument25 pagesRetail BankingTrusha Hodiwala80% (5)

- MR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleDocument2 pagesMR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleAubrien Fachi MusambakarumeNo ratings yet

- 06-Play Cc6 - Leveraging Wins To Attract Similar Clients - Sales DnaDocument1 page06-Play Cc6 - Leveraging Wins To Attract Similar Clients - Sales DnaIman Ragheb. PANo ratings yet

- Internship Report BankDocument28 pagesInternship Report BankHumera TariqNo ratings yet

- 01 PartnershipDocument27 pages01 PartnershipEarl ENo ratings yet