Professional Documents

Culture Documents

ACC 113 - SAS - Day - 2

ACC 113 - SAS - Day - 2

Uploaded by

Joy QuitorianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 113 - SAS - Day - 2

ACC 113 - SAS - Day - 2

Uploaded by

Joy QuitorianoCopyright:

Available Formats

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

Lesson title: Business Combination (Part 1) Materials:

Lesson Targets: Columnar notebook; calculator;

At the end of the learning session, textbook

1. I can identify a business combination. References:

2. I can explain the essential elements of business Millan, Zeus Vernon B.; Accounting

combinations. for Business Combinations; 2019

3. I can compute goodwill or gain on bargain purchase. Edition; pp. 1-23

Dayag, Antonion J.; Advanced

Financial Accounting and

Reporting, 2016 Edition

Productivity Tip:

Keep away anything that might be a possible source of distraction. You can also go to a quiet and

comfortable place to keep our concentration focused.

A. LESSON PREVIEW/REVIEW

Introduction (5 min.)

Welcome to ACC 113 - Accounting for Business Combinations!

Let’s begin your 2nd day in Accounting for Business Combination by activating your prior knowledge

through answering the What I know Chart, part 1 in Activity 1. Do not worry if you answer the questions

incorrectly that only means you do not have prior knowledge of the subject.

1) Activity 1: What I Know Chart, Part 1

Before proceeding with our main lesson, let us first answer the first column of the chart below:

What I Know Questions: What I Learned (Activity 4)

1. What is a business

combination?

2 How do we account for business

combination?

3 How can a business combination

occur?

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

B.MAIN LESSON

1) Activity 2: Content Notes (15 mins)

Business Combination

A transaction or other event in which an acquirer obtains control of one or more businesses

Control

An investor controls an investee when the investor is exposed, or has rights, to variable returns

from its involvement with the investee and has the ability to affect those returns through its

power over the investee

Presumed to exist when ownership interest acquired in the voting rights of the acquiree is more

than 50% (51% or more).

Ma y still exist even if the acquirer holds less than 50% interest in the voting rights of the acquire

in the following cases:

o The acquirer has the power to appoint or remove the majority of the board of directors of

the acquiree; or

o The acquirer has the power to cast the majority of votes at board meetings or equivalent

bodies within the acquiree; or

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

o The acquirer has power over more than half of the voting rights of the acquiree because

of an agreement with other investors; or

o The acquirer has power to control the financial and operating policies of the acquiree

because of a law or an agreement.

Identifying an Acquirer

The acquirer is the entity that obtains control of the acquiree.

The acquiree is the business that the acquirer obtains control of in a business combination.

Determining the acquisition date

The acquisition date is the date on which the acquirer obtains control of the acquiree.

Pro-forma computation of Goodwill:

Consideration Transferred xxx

Non-controlling interest in the acquire (NCI) xxx

Previously held equity interest in the acquiree xxx

Total xxx

Less: FV of net identifiable assets acquired xxx

Goodwill/(Gain on bargain purchase) xxx

Consideration transferred

The consideration transferred in a business combination is measured at fair value.

Acquisition-related costs

Acquisition-related costs are costs the acquirer incurs to effect a business combination.

Acquisition-related costs are recognized as expenses in the periods in which they are incurred,

except for the following:

o Costs to issue debt securities measured at amortized cost – included in the initial

measurement of the resulting financial liability.

o Costs to issue equity securities – are accounted for as deduction from share premium. If

share premium is insufficient, the issue costs are deducted from retained earnings.

Non-controlling interest (NCI)

Non-controlling interest (NCI) is the equity in a subsidiary not attributable, directly or indirectly,

to a parent.

NCI is measured either at:

o Fair value, or

o The NCI’s proportionate share of the acquiree’s identifiable net assets.

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

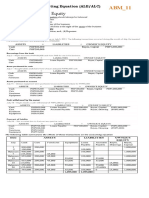

2) Activity 3: Skill-building Activities (35 mins)

Solve the following problems:

1. Entity A acquired all the assets and assumed all the liabilities of entity B for P1,800,000. Information

on entity B’s assets and liabilities as at the acquisition date is shown below:

Assets Carrying amounts Fair values

Receivables – net 200,000 100,000

Inventory 600,000 450,000

Building – net 1,200,000 1,800,000

Goodwill 100,000 20,000

Total assets 2,100,000 2,370,000

Liabilities

Payables 900,000 700,000

Requirement: Compute for the goodwill (gain on bargain purchase).

Use the following information for the next two items:

Entity A acquired 75% of the outstanding voting shares of Entity Bfor P2,000,000. On acquisition date,

Entity B’s identifiable assets and liabilities have fair values of P4.000,000 and P1,600,000, respectively.

2. How much is the goodwill if Entity A opts to measure the controlling interest at the NCI’s

proportionate share in Entity B’s net identifiable assets?

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

3. Entity A opts to measure the non-controlling interest at fair value. An independent valuer assessed

the NVI’s fair value to be P540,000. How much is the goodwill?

3) Activity 4: What I Know Chart, Part 2

This time, let us go back to Activity 1 and fill out the third column for what we now know about the

lesson.

4) Activity 5: Check for Understanding (Summative Test, 5 mins)

To measure our understanding of today’s lesson, let us try answering the questions that follow. Write T

for if the statement if true. If not, write, F.

____1. The two important elements in the definition of business combination under PFRS 3 are

“business” and “combination”.

____2. PFRS 3 requires the use of the purchase method in accounting for business combination.

____3. The entity that obtains control in a business combination is called the acquiree.

____4. The acquisition date in a business combination is normally the closing date.

____5. Non-controlling interests are measured at fair value only.

____6. If the controlling interest is 80%, the non-controlling interest is 20%.

____7. A gain on bargain purchase (negative goodwill) is recognized as an allocated deduction to the

net identifiable assets acquired in the year of business combination.

____8. An intangible asset that is unrecorded by the acquiree may nevertheless be recognized by the

acquirer in a business combination.

____9. A noncurrent asset acquired in a business combination that is classified as held for sale is

measured at fair value.

____10. If the consideration transferred in a business combination is deferred, the consideration may

be measured at present value.

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

C. LESSON WRAP-UP

1) Activity 6: Thinking about Learning

Congratulations for finishing this module! You can now tract your progress by shading the number of

the module that you finished. It’s just the start but by being consistent, you’ll be shading Day 31 as

scheduled.

Did you have challenges learning the concepts in this module? If none, which parts of the module

helped you learn the concepts?

__________________________________________________________________________________

__________________________________________________________________________________

FAQs

1. What are common reasons for entering business combination?

There are various reasons for combining businesses. Such may include elimination of cutthroat

competition, economies of large-scale production, control of market, or technological factors.

2. How does goodwill increase company value?

Goodwill is the premium that is paid when a business is acquired. If a business is acquired for

more than its book value, the acquiring business is paying for intangible items such as

intellectual property, brand recognition, skilled labor, and customer loyalty.

KEY TO CORRECTIONS

Activity 3

1. Solution:

Consideration transferred 1,800,000

Non-controlling interest in the acquiree -

Previously held equity interest in the acquiree -

Total 1,800,000

Fair value of net identifiable assets acquired

(2.37M – 20K goodwill – 700K liabilities) (1,650,000)

Goodwill 150,000

2. Solution:

Consideration transferred 2,000,000

NCI [(4M –1.6M) x 25%] 600,000

Previously held equity interest in the acquiree -

Total 2,600,000

This document is the property of PHINMA EDUCATION

ACC 113: Accounting for Business Combinations

Student Activity Sheet #2

Name: ______________________________________________________ Class number: ______

Section: ____________ Schedule: ____________ ___________________ Date: _____________

Fair value of net identifiable assets acquired (4M –1.6M) (2,400,000)

Goodwill 200,000

3. Solution:

Consideration transferred 2,000,000

NCI 540,000

Previously held equity interest in the acquiree -

Total 2,540,000

Fair value of net identifiable assets acquired (4M –1.6M) (2,400,000)

Goodwill 140,000

This document is the property of PHINMA EDUCATION

You might also like

- ABB Electric SegmentationDocument4 pagesABB Electric SegmentationAjeeth0% (1)

- Lesson Plan - Forms of Business Organization - Statement of Comprehensive IncomeDocument5 pagesLesson Plan - Forms of Business Organization - Statement of Comprehensive IncomeBrenda SebandalNo ratings yet

- Learning From Michael BurryDocument20 pagesLearning From Michael Burrymchallis100% (7)

- CIM Sample Reflective Statements PDFDocument8 pagesCIM Sample Reflective Statements PDFOriginalo VersionaNo ratings yet

- Lesson Title: Revenue Recognition - Consignment AccountingDocument8 pagesLesson Title: Revenue Recognition - Consignment AccountingFeedback Or BawiNo ratings yet

- ACC 113 - SAS - Day - 19Document11 pagesACC 113 - SAS - Day - 19Joy QuitorianoNo ratings yet

- 2.1 Statement of Comprehensive IncomeDocument5 pages2.1 Statement of Comprehensive IncomeGraceila CalopeNo ratings yet

- ACC 113 - SAS - Day - 15Document11 pagesACC 113 - SAS - Day - 15Joy QuitorianoNo ratings yet

- Sas#23 Acc104Document6 pagesSas#23 Acc104Charisse April MaisoNo ratings yet

- ACC 113 - SAS - Day - 18Document12 pagesACC 113 - SAS - Day - 18Joy QuitorianoNo ratings yet

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- Nefas Silk Poly Technic College: Learning GuideDocument43 pagesNefas Silk Poly Technic College: Learning GuideNigussie BerhanuNo ratings yet

- Sas - Day 23 - Fin 004Document8 pagesSas - Day 23 - Fin 004Hazal DereNo ratings yet

- ACC 110 - Day 19 - 20 - SASDocument15 pagesACC 110 - Day 19 - 20 - SASFeedback Or BawiNo ratings yet

- TOPIC: A.) Conceptual Framework and Elements of Financial StatementsDocument6 pagesTOPIC: A.) Conceptual Framework and Elements of Financial StatementsADNo ratings yet

- FA Chapter 1Document19 pagesFA Chapter 1Jynilou PinoteNo ratings yet

- Quiz FabmDocument3 pagesQuiz FabmDEXTER GARRIDONo ratings yet

- Fabm Module4Document50 pagesFabm Module4Paulo VisitacionNo ratings yet

- Draft Fabm1 Module 5Document8 pagesDraft Fabm1 Module 5Abegail AlegreNo ratings yet

- BUSINESS FINANCE Week 10Document5 pagesBUSINESS FINANCE Week 10Ace San GabrielNo ratings yet

- Study Guide For Module 9 (Marketing)Document4 pagesStudy Guide For Module 9 (Marketing)mattheweberhard2No ratings yet

- SAS#2-ACC104 With AnswerDocument5 pagesSAS#2-ACC104 With AnswerartificerrrrNo ratings yet

- Week 10 (Learning Materials)Document8 pagesWeek 10 (Learning Materials)CHOI HunterNo ratings yet

- REVISION UNIT 5+6 - StudentDocument4 pagesREVISION UNIT 5+6 - StudentNhiên HạNo ratings yet

- Distance Education: Instructional ModuleDocument10 pagesDistance Education: Instructional ModuleRD Suarez100% (3)

- Definition of AccountingDocument2 pagesDefinition of AccountingAndrés AvilésNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- Acb3 02Document42 pagesAcb3 02gizachew alekaNo ratings yet

- Module in Fabm 1: Department of Education Schools Division of Pasay CityDocument6 pagesModule in Fabm 1: Department of Education Schools Division of Pasay CityAngelica Mae SuñasNo ratings yet

- ABM-FABM2 12 - Q1 - W2 - Mod2Document16 pagesABM-FABM2 12 - Q1 - W2 - Mod2Jose John Vocal83% (18)

- Business and Management 2: Fundamentals of AccountancyDocument11 pagesBusiness and Management 2: Fundamentals of AccountancyZed MercyNo ratings yet

- Infonet College: Learning GuideDocument19 pagesInfonet College: Learning Guidemac video teachingNo ratings yet

- Module 2 - The Accounting Equation and The Double-Entry SystemDocument41 pagesModule 2 - The Accounting Equation and The Double-Entry SystemJenny Paculaba100% (1)

- FABM2 Module 2. Statement of Comprehensive IncomeDocument13 pagesFABM2 Module 2. Statement of Comprehensive IncomeSITTIE RAYMAH ABDULLAHNo ratings yet

- Chapter 1 Direct Reading GuideDocument10 pagesChapter 1 Direct Reading GuideOsiris HernandezNo ratings yet

- Prepare Financial Statements 2. Describe Accountancy As A Profession 3. Describe Career OpportunitiesDocument4 pagesPrepare Financial Statements 2. Describe Accountancy As A Profession 3. Describe Career OpportunitiesRevise PastralisNo ratings yet

- Manage Overdue Customer AccountsDocument15 pagesManage Overdue Customer Accountsmulehabesha.mhNo ratings yet

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- Financial AccountancyDocument25 pagesFinancial AccountancyRAVI SHEKARNo ratings yet

- Module #11Document7 pagesModule #11Joy RadaNo ratings yet

- Administer Subsidiary Accounts and LedgersDocument43 pagesAdminister Subsidiary Accounts and LedgersrameNo ratings yet

- Sas21 Acc115Document7 pagesSas21 Acc115crpa.lina.cocNo ratings yet

- Tanauan Institute, Inc.: PurchasesDocument9 pagesTanauan Institute, Inc.: PurchasesHanna CaraigNo ratings yet

- Cost Accounting I - 1. Accounting SystemDocument31 pagesCost Accounting I - 1. Accounting SystemYusuf B'aşaranNo ratings yet

- FABM1TGhandouts L7 Accounting-EquationDocument4 pagesFABM1TGhandouts L7 Accounting-EquationKarl Vincent DulayNo ratings yet

- Entrep 10 SLHT Q4 Week 1 3Document7 pagesEntrep 10 SLHT Q4 Week 1 3ABIGAIL ROSACEÑANo ratings yet

- CP Accounting MIdterm Review 15-16Document11 pagesCP Accounting MIdterm Review 15-16jhouvanNo ratings yet

- Abm 12 Fabm2 q1 Clas1 Elements of Sci v8 - Rhea Ann NavillaDocument13 pagesAbm 12 Fabm2 q1 Clas1 Elements of Sci v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Acb3 02Document42 pagesAcb3 02rameNo ratings yet

- Bca 4040 - Principles of Financial Accounting and ManagementDocument14 pagesBca 4040 - Principles of Financial Accounting and ManagementabhishekNo ratings yet

- Classification: PublicDocument16 pagesClassification: PublicKyla Renz de LeonNo ratings yet

- PrE7 MODULE 1Document17 pagesPrE7 MODULE 1Caisy Anne B. CalibotNo ratings yet

- Module #8Document7 pagesModule #8Joy RadaNo ratings yet

- SAS#4-ACC104 With AnswerDocument5 pagesSAS#4-ACC104 With AnswerartificerrrrNo ratings yet

- FABM2 Supp - Mat 1 AquinoDocument11 pagesFABM2 Supp - Mat 1 AquinoryzajarabejoNo ratings yet

- Temegnu GizawfinanDocument11 pagesTemegnu GizawfinanTemegnugizawNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- 5038 - Assignment 1 Front SheetDocument26 pages5038 - Assignment 1 Front Sheetlong truongNo ratings yet

- Learning Activity Sheet Business FinanceDocument9 pagesLearning Activity Sheet Business FinanceVon Violo BuenavidesNo ratings yet

- Fabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Document16 pagesFabm2: Quarter 1 Module 2 New Normal ABM For Grade 12Nonilon RoblesNo ratings yet

- ACC 113 - SAS - Day - 19Document11 pagesACC 113 - SAS - Day - 19Joy QuitorianoNo ratings yet

- ACC 113 - SAS - Day - 15Document11 pagesACC 113 - SAS - Day - 15Joy QuitorianoNo ratings yet

- Sample Data 040834Document3 pagesSample Data 040834Joy QuitorianoNo ratings yet

- DataAnalysis-RUILES, CHRISTINE JOYDocument11 pagesDataAnalysis-RUILES, CHRISTINE JOYJoy QuitorianoNo ratings yet

- ACC 113 - SAS - Day - 3Document5 pagesACC 113 - SAS - Day - 3Joy QuitorianoNo ratings yet

- Acc 148 - Sas 14-16 - Ruiles - 021816Document8 pagesAcc 148 - Sas 14-16 - Ruiles - 021816Joy QuitorianoNo ratings yet

- Reflection Paper (Ruiles)Document1 pageReflection Paper (Ruiles)Joy QuitorianoNo ratings yet

- SAS#9-ACC 100 1st Periodical ExamDocument5 pagesSAS#9-ACC 100 1st Periodical ExamJoy QuitorianoNo ratings yet

- ACC 113 - SAS - Day - 7Document9 pagesACC 113 - SAS - Day - 7Joy QuitorianoNo ratings yet

- Birung Group Research Chapter 1 3 2Document70 pagesBirung Group Research Chapter 1 3 2Joy QuitorianoNo ratings yet

- Acc 117 ExcercisesDocument3 pagesAcc 117 ExcercisesJoy QuitorianoNo ratings yet

- Sas#9 Fin073Document6 pagesSas#9 Fin073Joy QuitorianoNo ratings yet

- Dairy PakDocument9 pagesDairy PakaryagowdaNo ratings yet

- HP Case RevisedDocument6 pagesHP Case RevisedKenneth ChuaNo ratings yet

- Enhancing Customer Loyalty Through Quality of Service: Effective Strategies To Improve Customer Satisfaction, Experience, Relationship, and EngagementDocument26 pagesEnhancing Customer Loyalty Through Quality of Service: Effective Strategies To Improve Customer Satisfaction, Experience, Relationship, and EngagementnitinNo ratings yet

- Sales and Distribution Management ProjectDocument10 pagesSales and Distribution Management ProjectAtish PradhanNo ratings yet

- Accounting TermDocument8 pagesAccounting TermErick Danilo Salguero EscalanteNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document8 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Seminart in FSDocument30 pagesSeminart in FSbelleNo ratings yet

- TM BseDocument4 pagesTM BseVansh GoelNo ratings yet

- Markestrated - Manual Del ProfesorDocument66 pagesMarkestrated - Manual Del ProfesorKARACHITANo ratings yet

- W03 Reflection: Segmentation, Targeting, and Brand PositioningDocument1 pageW03 Reflection: Segmentation, Targeting, and Brand PositioningCédric DuhamelNo ratings yet

- Userbased ValueDocument18 pagesUserbased ValueNovariNo ratings yet

- APPLIED Entrepreneurship Quarter 3 Week 4Document10 pagesAPPLIED Entrepreneurship Quarter 3 Week 4Eunel PeñarandaNo ratings yet

- Functions and Roles in Operations Management: Foundations of OMDocument1 pageFunctions and Roles in Operations Management: Foundations of OMKristine Mae SampuangNo ratings yet

- Driving Traffic and CustDocument251 pagesDriving Traffic and CustsupergauchoNo ratings yet

- LufthansaDocument26 pagesLufthansaJuan Carlos Escajadillo100% (1)

- Accounting Manager Controller Software in Boston MA Resume Randall ShawDocument2 pagesAccounting Manager Controller Software in Boston MA Resume Randall ShawRandallShawNo ratings yet

- Wm. Wrigley Jr. Company: Securities and Exchange Commission FORM 10-KDocument34 pagesWm. Wrigley Jr. Company: Securities and Exchange Commission FORM 10-KSteveMastersNo ratings yet

- Summer Internship Program AmanDocument26 pagesSummer Internship Program Amanamanraj.mba22No ratings yet

- OPM ReportDocument7 pagesOPM ReportMazhar AliNo ratings yet

- Fmea Unit2Document78 pagesFmea Unit2aschandrawat357No ratings yet

- Class 11 Business Studies 1009 2019Document15 pagesClass 11 Business Studies 1009 2019Suraj RajputNo ratings yet

- List of IFRS & IASDocument6 pagesList of IFRS & IASKhurram IqbalNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Profit-Calculator (Update)Document3 pagesProfit-Calculator (Update)Emmanuel AginamNo ratings yet

- Independent University, Bangladesh: Assignment ACN 202 SEC-05Document7 pagesIndependent University, Bangladesh: Assignment ACN 202 SEC-05Murad HasanNo ratings yet

- Cost SegregationDocument2 pagesCost SegregationMeghan Kaye LiwenNo ratings yet

- A3 - Venture Capital Readiness ChecklistDocument1 pageA3 - Venture Capital Readiness ChecklistPedro DuarteNo ratings yet