Professional Documents

Culture Documents

Sep-22 453441

Sep-22 453441

Uploaded by

ShekharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sep-22 453441

Sep-22 453441

Uploaded by

ShekharCopyright:

Available Formats

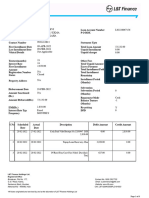

Saurabh .

Date As On 30-Sep-22

H.No-262, Gujarkheda Mhow CRN 427945066

. Account Number 2714987745

Mhow Period 01-Sep-22 to 30-Sep-22

Indore 453441 Currency Indian Rupees

Madhya Pradesh Home Branch JAWAHAR MARG ROAD

India Address KMBL,No.82,Jawahar Marg, Plot

No.628,Scheme No.3, Traffic Route

No.2,Indore,Madhya Pradesh-452007

Nominee Registered No

MICR Code 452485009

IFSC Code KKBK0005937

Statement of Banking Account

Date Narration Chq / Ref. No Withdrawal(Dr) Deposit(Cr) Balance

01-Sep-2022 OPENING BALANCE ... 13.00 13.00 (Cr)

30-Sep-2022 Int.Pd:2714987745:01-07-2022 to 30-09-2022 1.00 14.00 (Cr)

Closing Balance 14.00 (Cr)

Hold balance-Charges 0.00 (Cr)

Hold balance-Others 0.00 (Cr)

Average Monthly / Quarterly Balance 13.03 (Cr)

Closing Balance of Sweep TD 0.00 (Cr)

Bank deposit of up to Rs. 5,00,000 with respect to each depositor is fully protected by the Deposit Insurance and Credit Guarantee Corporation under the Deposit Insurance Scheme.

Effective July 1, 2017, GST has been levied on the charges at the prescribed rate of 18 %. Please note that this statement / advice should not be construed as a 'Tax Invoice' under the

Goods and Services Tax Act.

Dear Customer, as per Government's directive, if the PAN is not linked with the Aadhaar by Mar 31, 2023 then the PAN will become inoperative. Kindly visit the e-filing portal of the

Income Tax dept. & link your AADHAAR with PAN to avoid any adverse consequences and issues in future. Non-linking of PAN with Aadhaar will result in higher TDS (Tax

Deducted at Source)/TCS (Tax Collected at Source) and the Bank shall be constrained to restrict operations in the Account/s held by you.

RBI has advised Banks to make the facility of Positive Pay available to customers issuing high value cheques. Effective January 1, 2021, customers will be required to provide details

for all cheques issued by them via Net Banking/Mobile Banking/at the branch on the same day of the issuance or before it is handed over to the beneficiary. For more details, visit

www.kotak.com

Important: RBI vide its circular number RBI/2020-21/107 DPSS.CO.RPPD.No.SUO 21102/04.07.005/2020-21 dated March 15, 2021 had instructed banks for the Extension of

Cheque Truncation System (CTS) across all bank branches in the country. In view of this, with effect from October 01, 2021 Erstwhile Non-CTS Clearing Houses (ECCS clearing) have

been discontinued at all the locations and all these locations have moved to Cheque Truncation System (CTS).

This is system generated report and does not require signature and stamp

Any discrepancy in the statement should be brought to the notice of Kotak Mahindra Bank Ltd. within one month from date of statement

Commonly Used Narrations: AP-Autopay for Billpay , ATL-Other Bank ATM Withdrawal , ATW-Kotak ATM Withdrawal , BP-Bill Pay transaction , CDM-Kotak Cash Deposit Machine , CMS-Cash Management Service , IB-Internet

Digitally signedBanking

by DS transaction

KOTAK, MAHINDRA BANK(5)

IMPS-Immediate Payment Service , IMT-Instant Money Transfer , KB-Billpay transaction via Keya Chatbot , MB-Mobile Banking Transaction , NACH-National Automated Clearing House , NEFT-National Electronic Funds

Date: FriTransfer

Nov 04, Netcard-Netc@rd

12:50:12 GMT+05:30 2022

transaction , OS-Online Shopping transaction , OT -Online Trading transaction via Payment Gateway , PB-Phone Banking , PCI/PCD-POS transaction , RTGS-Real Time Gross Settlement , UPI-Unified Payment Interface , VISACCPAY-Visa Credit Card

Payment , VMT-VISA Money Transfer , WB-Billpay transaction via WhatsApp Banking

You might also like

- Health Insurance Policy SUBHRANILDocument1 pageHealth Insurance Policy SUBHRANILsubhranil1No ratings yet

- Sep-22 122050Document1 pageSep-22 122050rajneeshclic2No ratings yet

- Sagar Gautam: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageSagar Gautam: Date As On CRN Account Number Period Currency Home Branch AddressSagar GautamNo ratings yet

- 2023 12 21 19 16 47sep 22 - 110033Document1 page2023 12 21 19 16 47sep 22 - 110033lochin200kNo ratings yet

- XXXXXX940 Aug-22Document1 pageXXXXXX940 Aug-22AmplifierNo ratings yet

- Sep-22 500018Document1 pageSep-22 500018ak4784449No ratings yet

- Aug 2Document1 pageAug 2ak4784449No ratings yet

- Deepak Kumar: Date As On CRN Account Number Period Currency Home Branch AddressDocument2 pagesDeepak Kumar: Date As On CRN Account Number Period Currency Home Branch AddressDeepak KumarNo ratings yet

- Kaustav Basu: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageKaustav Basu: Date As On CRN Account Number Period Currency Home Branch AddressANIL MANDINo ratings yet

- 2023 11 13 20 55 57sep 23 - 641008Document2 pages2023 11 13 20 55 57sep 23 - 641008Saravanan DevasagayamNo ratings yet

- Mo Fazal Khan: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageMo Fazal Khan: Date As On CRN Account Number Period Currency Home Branch AddressFazalNo ratings yet

- Mohit Kumar: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageMohit Kumar: Date As On CRN Account Number Period Currency Home Branch Addressmohit kumarNo ratings yet

- Nov-22 570017Document2 pagesNov-22 570017Lakshmi LakshmiNo ratings yet

- Saravanan T: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageSaravanan T: Date As On CRN Account Number Period Currency Home Branch AddressSaravanan DevasagayamNo ratings yet

- 2023 11 13 20 56 09aug 23 - 641008Document1 page2023 11 13 20 56 09aug 23 - 641008Saravanan DevasagayamNo ratings yet

- 2023 04 11 10 44 58feb 23 - 302033Document2 pages2023 04 11 10 44 58feb 23 - 302033Kunal SharmaNo ratings yet

- 2023 11 08 18 20 03sep 23 - 244001Document2 pages2023 11 08 18 20 03sep 23 - 244001ernavedaliNo ratings yet

- Pankaj .: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pagePankaj .: Date As On CRN Account Number Period Currency Home Branch AddressMohd Shakib AñsãrîNo ratings yet

- 2024 04 07 15 21 15apr 23 - 641602Document3 pages2024 04 07 15 21 15apr 23 - 641602Pratap PratapNo ratings yet

- STMT Acct 2722024192243Document1 pageSTMT Acct 2722024192243ANAND SAHUKARINo ratings yet

- 2023 08 11 17 31 40jul 23 - 500072Document1 page2023 08 11 17 31 40jul 23 - 500072Tallapureddy SarweswarareddyNo ratings yet

- WFL JN8757 20240106 FonDocument1 pageWFL JN8757 20240106 FonDUX Durgesh YadavNo ratings yet

- STMNT PLF KPMDocument6 pagesSTMNT PLF KPMKUMAR AUNo ratings yet

- 2024 02 21 15 28 30oct 23 - 475110Document7 pages2024 02 21 15 28 30oct 23 - 475110pirates1No ratings yet

- Wa0024.Document2 pagesWa0024.vineethrv1822No ratings yet

- 2024 03 08 18 51 23jan 24 - 250002Document1 page2024 03 08 18 51 23jan 24 - 250002dsssbdonotreplyNo ratings yet

- Current & Saving Account Statement: Arefa C/O Mohd Nadeem, 161, Ginnori Sirsi Sirsi, Sambhal, Sambhal Sirsi DehatDocument2 pagesCurrent & Saving Account Statement: Arefa C/O Mohd Nadeem, 161, Ginnori Sirsi Sirsi, Sambhal, Sambhal Sirsi DehatShajir KhanNo ratings yet

- 2024-03-28-22-30-56fy 21-22 - 380015Document6 pages2024-03-28-22-30-56fy 21-22 - 380015pateldrash2498No ratings yet

- 2023 12 31 12 04 45oct 23 - 208007Document1 page2023 12 31 12 04 45oct 23 - 208007ayush singhNo ratings yet

- 2024 02 02 19 10 06apr 23 - 754028Document2 pages2024 02 02 19 10 06apr 23 - 754028SR CREATIONNo ratings yet

- 2023 11 13 20 55 29oct 23 - 641008Document1 page2023 11 13 20 55 29oct 23 - 641008Saravanan DevasagayamNo ratings yet

- Larsen & Toubro Limited, ConstructionDocument1 pageLarsen & Toubro Limited, ConstructionNitesh KumarNo ratings yet

- 2023 12 31 12 04 56nov 23 - 208007Document1 page2023 12 31 12 04 56nov 23 - 208007ayush singhNo ratings yet

- Mr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Document7 pagesMr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Bhanu Pratap Simgh YadavNo ratings yet

- KMB May 15 PDFDocument4 pagesKMB May 15 PDFVinod SinghNo ratings yet

- Soa L02228067156Document6 pagesSoa L02228067156nitishNo ratings yet

- Sunita Wadehra: Date As On CRN Account Number Period Currency Home Branch AddressDocument1 pageSunita Wadehra: Date As On CRN Account Number Period Currency Home Branch AddressVineet WadehraNo ratings yet

- 2024 05 20 21 42 49apr 24 - 110085Document1 page2024 05 20 21 42 49apr 24 - 110085gauravgupta8899kNo ratings yet

- 2024 02 09 14 48 23aug 23 - 226010Document5 pages2024 02 09 14 48 23aug 23 - 226010thegolu946No ratings yet

- Aug-23 141401Document7 pagesAug-23 141401sauravsharmachate5No ratings yet

- 2023 03 15 08 46 40feb 23 - 508207Document4 pages2023 03 15 08 46 40feb 23 - 508207Vinod DwivediNo ratings yet

- Summary of Accounts Held Under Customer Id 84996 4710: Relationship Summary As On 30st June 2021Document3 pagesSummary of Accounts Held Under Customer Id 84996 4710: Relationship Summary As On 30st June 2021Hùng NguyễnNo ratings yet

- LD 4gbaxn 20220405 FonDocument1 pageLD 4gbaxn 20220405 Fonabdurrehman217217No ratings yet

- Sep-21 524004Document2 pagesSep-21 524004nayeemshaik.129No ratings yet

- 2023 10 02 11 03 31aug 23 - 605009Document5 pages2023 10 02 11 03 31aug 23 - 605009prasannapharaohNo ratings yet

- BilledStatements 5978 01-07-23 20.38Document2 pagesBilledStatements 5978 01-07-23 20.38vatsal3576No ratings yet

- 2024 03 16 09 15 32feb 24 - 431136Document6 pages2024 03 16 09 15 32feb 24 - 431136MSEB WalujNo ratings yet

- Shanvi 8109Document1 pageShanvi 8109dharamp45873No ratings yet

- Deeksha Ledger JanDocument1 pageDeeksha Ledger Jannarayank.guptaNo ratings yet

- 2024-03-01to - 30-Mar-24 - 143521Document6 pages2024-03-01to - 30-Mar-24 - 143521Ashish MasihNo ratings yet

- SDVSDDocument2 pagesSDVSDhecap99816No ratings yet

- Screenshot 2023-11-16 at 11.45.49 PMDocument27 pagesScreenshot 2023-11-16 at 11.45.49 PMmimienordin4No ratings yet

- Jul-23 141401Document5 pagesJul-23 141401sauravsharmachate5No ratings yet

- General LedgerDocument322 pagesGeneral LedgerMario CungkringNo ratings yet

- Nimish - Saving & DepositsDocument2 pagesNimish - Saving & DepositsKaranNo ratings yet

- Jai 2020-2021Document1,050 pagesJai 2020-2021jaycee fertilisersNo ratings yet

- Iphone 15 Pro Max NDCDocument2 pagesIphone 15 Pro Max NDCrajadurai931997No ratings yet

- Account Statement 010223 300423 PDFDocument34 pagesAccount Statement 010223 300423 PDFGamer SinghNo ratings yet

- 2024 02 10 15 44 11dec 23 - 201301Document4 pages2024 02 10 15 44 11dec 23 - 201301socialmedia.manager.incNo ratings yet

- 2024 05 09 13 07 31aug 23 - 313802Document5 pages2024 05 09 13 07 31aug 23 - 313802himanshutatawat9No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

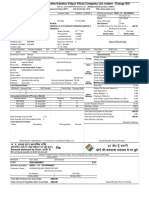

- RECEIPTDocument1 pageRECEIPTShekharNo ratings yet

- Save Electricity: N3614005647 HRS1 - 21 - 3614005647 LV1Document1 pageSave Electricity: N3614005647 HRS1 - 21 - 3614005647 LV1ShekharNo ratings yet

- Save Electricity: Amount Deferred by Govt. of M. PDocument1 pageSave Electricity: Amount Deferred by Govt. of M. PShekharNo ratings yet

- Provisional Letter CommDocument1 pageProvisional Letter CommShekharNo ratings yet

- Loan Account StatementDocument2 pagesLoan Account StatementShekharNo ratings yet

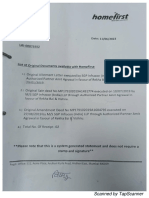

- Home First Finance Company India PVT LTD Mail - FWD - Complaint About One of My Customer Vishnu ChauhanDocument1 pageHome First Finance Company India PVT LTD Mail - FWD - Complaint About One of My Customer Vishnu ChauhanShekharNo ratings yet

- Transaction HistoryDocument1 pageTransaction HistoryShekharNo ratings yet

- List of DocumentsDocument1 pageList of DocumentsShekharNo ratings yet

- Lai 00073552Document1 pageLai 00073552ShekharNo ratings yet

- National Health Card 1669172871854Document1 pageNational Health Card 1669172871854ShekharNo ratings yet

- PumpletDocument2 pagesPumpletShekharNo ratings yet

- Lod Sanju BaiDocument1 pageLod Sanju BaiShekharNo ratings yet

- Bank Secrecy Law, Unclaimed Balances, Truth in Lending Act, Maximum Deposit Insurance Act QuizDocument4 pagesBank Secrecy Law, Unclaimed Balances, Truth in Lending Act, Maximum Deposit Insurance Act QuizJornel MandiaNo ratings yet

- Philhealth Identification Number (Pin) Important Reminders:: PurposeDocument3 pagesPhilhealth Identification Number (Pin) Important Reminders:: PurposeMhelaril AnneNo ratings yet

- GHD Superannuation Plan: Product Disclosure StatementDocument32 pagesGHD Superannuation Plan: Product Disclosure StatementNick KNo ratings yet

- 001 - Complaint - Filed 7-13-2022 (06572035xA9B4D)Document27 pages001 - Complaint - Filed 7-13-2022 (06572035xA9B4D)Jakob EmersonNo ratings yet

- M SC MathematicsDocument52 pagesM SC MathematicsVrindaNo ratings yet

- AGREEMENT Care Takers Cantonment Board FaisalDocument24 pagesAGREEMENT Care Takers Cantonment Board Faisalaashir aliNo ratings yet

- China's Frustrated Middle Class ROCCADocument5 pagesChina's Frustrated Middle Class ROCCARose AyacuchoNo ratings yet

- Aba - 17A - 2020Document158 pagesAba - 17A - 2020stan iKONNo ratings yet

- Disadvantages of Corporate Cover Personal Cover Vs Corporate CoverDocument1 pageDisadvantages of Corporate Cover Personal Cover Vs Corporate Cover3Sigma Financial Services 3SigmaNo ratings yet

- C. FIG Analyst Training - Partie IIDocument136 pagesC. FIG Analyst Training - Partie IIFabrizioNo ratings yet

- Gloria Macapagal ArroyoDocument4 pagesGloria Macapagal Arroyo2001094No ratings yet

- Summer Training Report On Mas FinanceDocument73 pagesSummer Training Report On Mas FinanceHimanshu Singh TanwarNo ratings yet

- Ch03 Taxation of IndividualsDocument13 pagesCh03 Taxation of IndividualsKyla ArcillaNo ratings yet

- Report Income TaxDocument6 pagesReport Income TaxLudmila DorojanNo ratings yet

- Adani Project SipDocument43 pagesAdani Project Sipkundan nishad50% (2)

- MODULE 1 Understanding Personal FinanceDocument43 pagesMODULE 1 Understanding Personal FinanceAnore, Anton NikolaiNo ratings yet

- Fill-In - License Application FormDocument9 pagesFill-In - License Application FormWesley James ViejoNo ratings yet

- Ceqtys42E-Quantity SurveyingDocument26 pagesCeqtys42E-Quantity SurveyingJeannieMayDelfinNo ratings yet

- On Egsismo: Frequently Asked QuestionsDocument2 pagesOn Egsismo: Frequently Asked QuestionsAlfie Arabejo Masong LaperaNo ratings yet

- Form For Withdrawal by Claimant Due To Death of SubscriberDocument6 pagesForm For Withdrawal by Claimant Due To Death of SubscriberAkash MalikNo ratings yet

- NBFC Full NotesDocument69 pagesNBFC Full NotesJumana haseena SNo ratings yet

- Rating Methodologies - List-of-Rating-Methodologies - 07mar23Document29 pagesRating Methodologies - List-of-Rating-Methodologies - 07mar23david kusumaNo ratings yet

- Property Management AgreementDocument4 pagesProperty Management AgreementCandy ValentineNo ratings yet

- Wa0015.Document2 pagesWa0015.svnbhattarNo ratings yet

- Aig ScriptDocument3 pagesAig Scriptbhaitotal310No ratings yet

- For ExaminerDocument74 pagesFor Examinerዳግማዊ ጌታነህ ግዛው ባይህNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- Commerical Insurance - Cyber Risk InsuranceDocument5 pagesCommerical Insurance - Cyber Risk InsuranceRobert SerenaNo ratings yet

- Motor Third Party ClaimDocument3 pagesMotor Third Party ClaimShantanuNo ratings yet